What is the Recyclable Waste Market Size?

The recyclable waste market is driven by environmental regulations and growing awareness about sustainability. Advanced recycling technologies are improving efficiency and reducing landfill dependency.The recyclable waste market is growing due to rising environmental concerns, government regulations encouraging waste recycling, corporate sustainability initiatives, and a growing consumer demand for eco-friendly products and services.

Recyclable Waste Market Key Takeaways

- North America dominated the recyclable waste market with the largest share of 32.80% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 7.2% during the forecast period.

- By material, the paper and cardboard segment held the biggest market share of 34.60% in 2024.

- By material, the plastics segment is expected to grow at the fastest CAGR of 7.80% during the forecast period.

- By source, the back-of-house operations segment contributed the highest market share of 42.10% in 2024.

- By source, the retail floor segment will expand rapidly with a CAGR of 6.90% in the coming years.

- By recycled material, the recycled paper products segment generated the major market share of 33.40% in 2024.

- By recycled material, the recycled e-waste components segment will expand rapidly with CAGR of 8.60% in the coming years.

Impact of AI on the Recyclable Waste Market

Artificial intelligence is significantly transforming the recyclable waste market by enhancing sorting accuracy, optimizing logistics, and increasing profitability through better price predictions and decreased contamination, contributing to a more efficient and sustainable recycling industry and a stronger circular economy. AI enhances waste collection routes, reducing fuel consumption and emissions, and can accurately analyze market data to predict price fluctuations, enabling recycling firms to make informed decisions and improve profitability. AI can program biodegradable and recyclable options to traditional plastics by forecasting material properties, contributing to the advancement of new sustainable materials.

Market overview

The recyclable waste market is significant because it drives economic expansion by creating jobs and decreasing production expenses for businesses, while simultaneously encouraging environmental sustainability via resource conservation, reduced landfill waste, and decreased energy consumption together with greenhouse gas emissions. Recycling reduces the need to extract and process virgin raw materials, such as water, timber, and minerals, thereby preserving finite natural resources. By decreasing resource extraction, recycling aids protect ecosystems and natural habitats from disruption and supports biodiversity. Recycling programs teach the public the importance of protecting the environment and equip future generations with the knowledge to reduce pollution.

Recyclable Waste Market Growth Factors

- Increasing awareness about the detrimental impacts of waste on the environment is a significant driver, pushing businesses, governments, and individuals to accept more sustainable waste management practices.

- A shift towards a circular economy, where materials are reused as well as recycled to minimize waste, is fostering the expansion of the recyclable waste market.

- Innovations in mechanical as well as chemical recycling processes improve efficiency, increase the kinds of materials that can be recycled, and also create new market opportunities.

- The requirement for recycled wastepaper is also rising, with the printing together with writing paper segment anticipated to have a significant market share.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

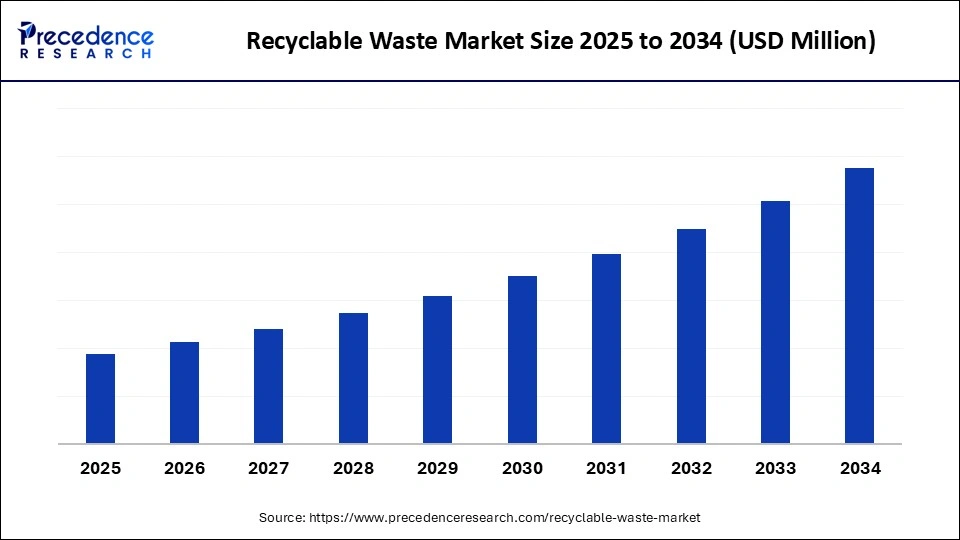

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Source, Recycled Material, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is Awareness About Plastic Pollution the Driver for the Recyclable Waste Market?

Growing awareness of the negative environmental and health impacts of plastic pollution is a key driver for the recyclable waste market because it increases requirement for plastic recycling services and makes a stronger incentive for businesses, governments, and consumers to support and participate in a circular economy. Governments respond to public concern by implementing policies such as bans on single-use plastics, which in turn increase the need for recycling infrastructure and create more business opportunities in the waste management sector. As the market expands, there is increased investment in research and development to enhance recycling efficiency and discover new pathways for utilizing recycled plastic, contributing to a virtuous cycle of knowledge, action, and market growth.

Restraint

How Are Operational Costs for Labor and Energy the Restraint for the Recyclable Waste Market?

High labor and energy costs restrain the recyclable waste market by increasing the cost of sorting, processing, and transporting recyclables, necessitating the use of customized and skilled workers, and consuming significant power in automated systems. Recycling needs significant manual labor along with skilled technicians for sorting materials into numerous categories and operating complex machinery. Automated sorting systems, along with other large-scale recycling equipment, consume a substantial amount of energy to function efficiently.

Opportunity

Why Does Developing and Providing Specialized Machinery and IT Solutions for Waste Recycling Processes Act as an Opportunity for the Recyclable Waste Market?

Specialized machinery and IT solutions create market opportunities by increasing recycling efficiency, improving material quality through advanced sorting (utilizing AI and sensors), decreasing operational costs, and enabling better waste tracking along with data analysis for smarter management. Technologies such as AI and optical sensors can accurately determine and sort different types of recyclables (paper, plastic, and metals), thereby decreasing contamination and producing higher-quality material feedstock. More efficient and profitable recycling operations stimulate the economy by creating jobs and fostering a robust circular economy, where materials are reused and repurposed to minimize waste.

Material Insights

Why Did the Paper and Cardboard Segment Dominate the Recyclable Waste Market in 2024?

The paper and cardboard segment dominates the recyclable waste market due to its high recycling rates, economic viability, established collection systems, and inherent sustainability. Paper and paperboard are among the most common materials in municipal solid waste (MSW), resulting in a substantial volume of recyclable material available. Technologies like pulping and even deinking are highly effective in converting wastepaper as well as cardboard into reusable fiber, creating a solid circular economy for these materials.

The plastics segment is witnessing the fastest growth due to escalating consumer as well as government demand for sustainable practices, rising investments in advanced recycling technologies, and the widespread usage of plastic in key industries such as automotive, packaging, and construction. Improvements in sorting along with recycling technologies are increasing the quality as well as consistency of recycled plastics. Innovations in both mechanical and chemical recycling processes are making it possible to convert waste plastic into virgin-grade raw materials, thereby improving the competitiveness of recycled plastics.

Source Insights

Why Did the Back-of-House Operations Segment Dominate the Recyclable Waste Market in 2024?

The "back-of-house" segment does not dominate the recyclable waste market; rather, municipal solid waste (MSW) as well as plastic waste are the most significant segments, driven by rising urban populations, consumption, together with government policies promoting source segregation and recycling. Urbanization and even growing consumption patterns contribute to a remarkable volume of MSW, making it the largest segment by waste type.

The retail floor segment is growing rapidly, fueled by retail environments, which include stores and malls, generating a substantial volume of waste and making them a significant source of recyclable materials. The growing e-commerce industry leads to a substantial rise in packaging waste, with retail as a primary source, creating a greater demand for its recycling and management. A shift in consumer perception towards environmental responsibility, mainly among younger generations such as millennials and Gen Z, creates a need for businesses to use recyclable materials and practices.

Recycled material Insights

Why Did the Recycled Paper Products Segment Dominate the Recyclable Waste Market in 2024?

The recycled paper segment dominates the recyclable waste market due to its high recyclability rates, widespread industrial usage, especially in packaging, and cost-effectiveness compared to virgin materials. Paper has a high recycling rate and is broadly accepted, mainly in the packaging industry (corrugated boxes, cartons). Consumers as well as businesses are increasingly choosing eco-friendly packaging options, driving the transition to recycled paper-based solutions.

The recycled e-waste components segment is growing rapidly due to the exponential rise in consumer electronics and their increasingly shorter lifespans, which generate huge amounts of e-waste, and the presence of valuable, high-value materials such as precious metals within these devices. Advances in technology and even a growing middle class with high disposable incomes contribute to shorter product lifecycles as well as a constant replacement of old electronics, generating a huge volume of e-waste.

Regional Insights

Why Did North America Dominate the Recyclable Waste Market in 2024?

The region, mainly the United States and Canada, benefits from an advanced waste management infrastructure, including well-known collection and distribution networks for solid waste. Strong government initiatives, as well as regulations such as those by the U.S. Environmental Protection Agency (EPA) and numerous state-level programs, promote and encourage structured recycling programs.

This is due to the rapid industrialization and urbanization contributing to increased waste generation, combined with government support for circular economy initiatives, growing environmental awareness, and an increasing acceptance of advanced recycling technologies and infrastructure. Growing public awareness, along with concern about the environmental damage caused by waste, mainly plastic and electronic waste, is driving the adoption of sustainable waste management solutions.

Recyclable Waste Market Companies

- Veolia Environnement S.A.

- SUEZ S.A., and Remondis SE & Co. KG

- Waste Management Inc.

- Republic Services Inc.

- Clean Harbors Inc.

Recent Developments

- In July 2025, Toyota Tsusho America finished its acquisition of Radius Recycling. The deal will permit Radius to keep its current branding as well as headquarters, along with its management, employees, and existing facilities. (Source: https://www.wastedive.com)

- In November 2024, Neste, Alterra, and Technip Energies signed a partnership agreement to advance the circularity of plastics by offering the industry a standardized technology solution for chemical recycling. The partners aim to globally provide a standardized, modular solution, derived from Alterra's proprietary liquefaction technology, to parties interested in building capacity for chemical recycling. (Source: https://www.neste.com)

- In October 2024, Fortum Recycling & Waste successfully manufactured biodegradable plastic from carbon dioxide (CO2) emissions resulting from waste incineration at its Riihimäki, Finland, plant. This breakthrough, derived from carbon capture and utilization (CCU), is a significant step towards reducing and utilizing industrial carbon dioxide emissions. (Source: https://www.fortum.com)

Segments Covered in the Report

By Material

- Paper and Cardboard

- Corrugated cardboard boxes (used for shipping products)

- Paper packaging (e.g. cereal boxes, snack boxes)

- Receipt rolls (non-thermal types)

- Paper bags

- Office paper (from in-store administration)

- Plastics

- Plastic wrap and shrink film (used for pallet wrapping)

- Plastic containers (e.g., yogurt, margarine tubs)

- PET bottles (soft drinks, water)

- HDPE bottles (milk, detergents)

- Plastic bags (customer returns or packaging waste)

Clamshell containers (fruit, baked goods packaging) - Plastic strapping and ties

- Glass

- Glass bottles (juice, sauces, condiments)

- Broken glass from damaged inventory

- Metals

- Aluminum cans (beverages)

- Tin/steel cans (canned goods)

- Foil wrappers/trays (ready-to-eat meals, baked goods)

- Metal bottle caps and lids

- Organics (Compostable but occasionally recyclable through industrial methods)

- Spoiled fruits and vegetables

- Bakery waste

- Dairy and meat waste (may be diverted to rendering/recycling in some jurisdictions)

- Coffee grounds and filters

By Source

- Retail Floor

- Damaged or expired products with recyclable packaging

- Plastic bags from customers or damaged stock

- Promotional materials and packaging

- Back-of-House Operations

- Shipping boxes and crates

- Pallet wrap and straps

- Storage containers and shelving waste

- Administrative/Office Waste

- Office paper

- Ink and toner cartridges (special recycling)

- Cardboard from supplies

By Recycled Material

- Recycled Plastics

- PET (Polyethylene Terephthalate)

- HDPE (High-Density Polyethylene)

- LDPE (Low-Density Polyethylene)

- PP (Polypropylene)

- Recycled Glass

- Recycled Metals

- Aluminum

- Steel/Tin

- Recycled E-Waste Components

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting