What is the Recycled ABS Resins Market Size?

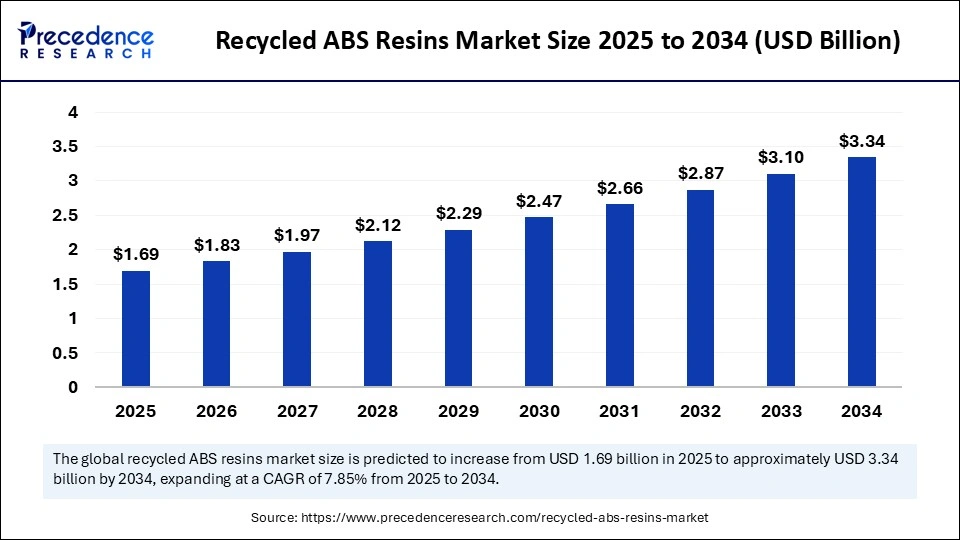

The global recycled ABS resins market size is valued at USD 1.69 billion in 2025 and is predicted to increase from USD 1.83 billion in 2026 to approximately USD 3.34 billion by 2034, expanding at a CAGR of 7.85% from 2025 to 2034. The market for recycled ABS resins is experiencing significant growth, driven by increasing demand for sustainable materials. Projected to reach new heights by 2034, it reflects a strong shift towards environmentally conscious manufacturing practices.

Recycled ABS Resins Market Key Takeaways

- Asia Pacific dominated the recycled ABS resins market in 2024.

- North America is expected to expand at the fastest CAGR between 2025 and 2034.

- By source, the Post-industrial recycled ABS segment held the largest market share in 2024,

- By source, advanced post-consumer recycled ABS is expected to grow at a remarkable CAGR between 2025 and 2034,

- By recycling method type, the mechanical recycling segment captured highest market share in 2024,

- By recycling method type, chemical recycling is expected to grow at a remarkable CAGR between 2025 and 2034.

- By grade type, the standard recycled ABS segments contributed the biggest market share in 2024.

- By grade type, flame-retardant & specialty recycled ABS is expected to grow at a remarkable CAGR between 2025 and 2034,

- By application type, the automotive & transportation segment led the market in 2024,

- By application type, electrical & electronics is expected to grow at a remarkable CAGR between 2025 and 2034,

- By end-user industry type, the automotive & transportation segment held the maximum market share in 2024,

- By end-user industry type, electrical & electronics is expected to grow at a remarkable CAGR between 2025 and 2034,

- By distribution channel type, the direct sales segment generated the major market share in 2024,

- By distribution channel type, online sales platforms are expected to grow at a remarkable CAGR between 2025 and 2034,

Market Overview

The recycled ABS resins market encompasses the recovery and processing of post-consumer and post-industrial ABS waste into usable resins for manufacturing purposes. ABS is a widely used thermoplastic valued for impact resistance, toughness, and ease of processing, making recycling an essential sustainability step for industries reliant on high-performance plastics. Recycled ABS resins are increasingly used in automotive components, consumer electronics housings, appliances, construction materials, and packaging. Advances in mechanical and chemical recycling technologies, coupled with circular economy initiatives, drive adoption. Growing regulatory pressures, brand commitments to recycled content, and rising cost competitiveness of recycled versus virgin ABS are further accelerating market expansion across automotive, electronics, and industrial applications.

The recycled ABS Acrylonitrile Butadiene Styrene resins market is gaining momentum as industries increasingly adopt circular economy principles. ABS, widely used in automotive components, consumer electronics, and construction, is now being recovered from post-consumer and post-industrial waste streams to reduce dependence on virgin plastics. Growing regulatory pressure on sustainable manufacturing, combined with consumer preference for eco-friendly products, is fueling demand. The market benefits from a dual advantage: cost-effectiveness compared to virgin ABS and the ability to reduce greenhouse gas emissions associated with plastic production. Advances in mechanical and chemical recycling are also enhancing material quality, making recycled ABS suitable for high-performance applications. Overall, the market is moving from a niche to a mainstream materials solution in global supply chains.

What Is the Impact of AI on the Recycled ABS Resins Market?

Artificial intelligence is reshaping the recycled ABS resins value chain by optimizing collection, sorting, and processing systems. AI-driven vision technologies enable precise separation of ABS from mixed plastic waste, significantly reducing contamination and improving recycling yields. Machine learning algorithms help recyclers forecast material demand, streamline logistics, and minimize operational costs. In manufacturing, AI is being used to monitor polymer quality in real time, ensuring recycled ABS meets the stringent requirements of automotive and electronics applications. Predictive analytics further supports price stability by forecasting supply fluctuations in waste streams. By enhancing efficiency, AI not only improves profitability but also strengthens confidence in recycled ABS as a reliable alternative to virgin resins.

Recycled ABS Resins Market Outlook

- Industry Growth Overview: The market for recycled ABS resins is projected to grow substantially between 2025 and 2034, driven by the increasing adoption of circular economy practices, rising demand for sustainable plastics in the automotive and electronics sectors, and improved recycling technologies.

- Rise of High-Performance ABS Grades:There is a strong focus on developing specialized, high-performance grades. R&D efforts are producing materials with enhanced properties to meet stringent automotive and electronics industry demands for improved durability, safety, and functionality, expanding ABS applications into new areas, such as 3D printing.

- Global Expansion: Leading players are expanding their recycling and production capacities in high-growth regions, particularly Asia-Pacific, due to the region's massive electronics and automotive manufacturing ecosystem. North America and Europe are focusing on developing advanced recycling infrastructure and meeting stringent regional environmental mandates to ensure a stable feedstock supply.

- Major Investors:Significant investment from major chemical producers and investment firms is flowing into the recycled ABS market. Key players like LG Chem, INEOS Styrolution, Trinseo, and SABIC are strategically investing in advanced mechanical and chemical recycling technologies. These investments aim to secure a competitive edge by offering sustainable, high-quality alternatives.

- Startup Ecosystem: The startup ecosystem is maturing, with innovation focused on advanced separation techniques and technologies to maintain material properties over multiple use cycles. Emerging firms and research institutes are attracting funding to develop cost-effective, scalable solutions for processing complex or contaminated waste streams, thereby overcoming traditional recycling challenges.

Market Key Trends

- Recycled ABS demand is rising in automotive, electronics, and construction due to sustainability mandates.

- AI is enhancing material recovery efficiency, quality consistency, and supply chain predictability.

- Asia Pacific leads the market, driven by manufacturing hubs and circular economy adoption.

- North America is the fastest-growing region, supported by stringent environmental regulations and corporate ESG commitments.

- High energy costs and quality consistency remain key challenges for recyclers.

- Strategic partnerships between recyclers, OEMs, and tech providers are shaping the competitive landscape.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.34 Billion |

| Market Size in 2026 | USD 1.83 Billion |

| Market Size in 2025 | USD 1.69 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.85% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Recycling Method, Grade, Application, End-User Industry, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

A powerful convergence of sustainability imperatives, regulatory push, and industrial demand propels the recycled ABS resins market. Governments across the globe are tightening mandates around the use of recycled plastics in consumer goods, packaging, and automotive components, compelling manufacturers to seek eco-friendly alternatives to virgin resins. At the same time, consumer awareness of plastic waste and environmental footprints is steadily increasing, strengthening demand for recycled materials. Cost competitiveness is another factor that recycled ABS often provides savings over virgin ABS, particularly when crude oil prices fluctuate. The growth of automotive, electronics, and construction industries in both developed and emerging economies ensures a steady downstream pull, while advancements in recycling technologies, including AI-driven sorting and chemical recycling, are improving material quality and expanding end-use applications. Together, these forces create a robust foundation for the long-term expansion of the recycled ABS market.

Restraint

Despite its strong momentum, the recycled ABS resins market faces several challenges that could slow adoption. Chief among these is the issue of quality consistency; recycled ABS can sometimes fall short of the stringent performance standards required in high-precision applications such as automotive interiors or advanced electronics. Recycling infrastructure also remains uneven across regions, with emerging economies often lacking the systems necessary for efficient collection, segregation, and processing of ABS waste. Chemical recycling, while promising, is capital-intensive and energy-demanding, which can erode its cost advantage. Inconsistent supply chains further complicate matters, as fluctuations in the availability of suitable plastic waste can disrupt production cycles. Moreover, entrenched reliance on low-cost virgin ABS in many industries continues to pose resistance, particularly in price-sensitive markets. These restraints highlight the importance of innovation, investment, and regulatory alignment to unlock the sector's full potential.

Opportunity

The future of the recycled ABS resins market is rich with opportunity, shaped by the global transition toward circular economies. One of the most promising avenues lies in the expansion of closed-loop recycling partnerships, where OEMs, recyclers, and technology providers collaborate to ensure a steady supply and consistent quality of recycled materials. AI and robotics are poised to revolutionize the recycling ecosystem, driving higher yields and lowering costs by improving waste sorting and material recovery. At the same time, emerging applications in sustainable packaging, consumer electronics, and green automotive solutions are widening the scope for recycled ABS. Governments offering subsidies, incentives, and favorable policies provide further tailwinds for adoption, particularly in regions targeting aggressive decarbonization goals. Additionally, the development of high-purity, engineering-grade recycled ABS opens doors to premium applications that were once reserved exclusively for virgin resins. For companies willing to invest in technology and partnerships, the market presents not just a compliance opportunity but a pathway to competitive advantage in the sustainability-driven economy.

Segment Insights

Source Insights

Why Is Post-industrial Recycled Material Dominating the Recycled ABS Resins Market?

The post-industrial recycled ABS accounts for the largest share of the market for recycled ABS resins, as it is sourced directly from manufacturing scrap and therefore offers consistent quality. The material is easier to process compared to post-consumer waste, since it is free from contaminants and color variations. Automotive and electronics manufacturers often recycle their own scrap streams into high-grade ABS feedstock, reducing both costs and waste footprints. This practice not only supports circularity but also ensures reliable mechanical properties in the final material. Many large OEMs prefer post-industrial ABS because it reduces dependency on virgin resin while maintaining product performance. Consequently, it remains the backbone of the recycled ABS industry.

In addition, the economics of post-industrial recycling are more favorable, as collection and sorting costs are minimal compared to consumer waste recycling. The material can be directly integrated into production processes without extensive reprocessing. Regulatory mandates encouraging in-house recycling further strengthen this segment. The dominance of industrial hubs in the Asia Pacific, where electronics and automotive factories generate abundant ABS scrap, provides a steady supply of post-industrial feedstock. These advantages make post-industrial ABS the most practical option for large-scale adoption today. While other sources are gaining traction, this segment's combination of quality, cost efficiency, and scalability secures its leading role.

Post-consumer recycled ABS is experiencing the fastest growth in the recycled ABS resins market, driven by increasing pressure to reduce plastic waste from discarded electronics, appliances, and household goods. Governments and NGOs are driving consumer take-back and extended producer responsibility programs, ensuring a rising supply of ABS waste. This stream is more complex to process due to contamination, mixed polymers, and variable properties. However, advances in AI-driven sorting and chemical recycling are unlocking its true potential. Post-consumer ABS recycling is becoming a cornerstone of the circular economy, addressing both environmental concerns and material scarcity. As sustainable consumption gains traction, this segment is poised for rapid acceleration.

The attractiveness of post-consumer ABS lies in its ability to demonstrate a visible sustainability impact by diverting plastic from landfills. Consumer brands in electronics and appliances are increasingly marketing products made with recycled plastics, boosting demand for this material. While quality remains a challenge, growing investment in purification and additive technologies is improving outcomes. International regulations, such as recycled content mandates in packaging and electronics, are also boosting growth. With rising environmental awareness, consumer willingness to pay for sustainable products is increasing, further stimulating market expansion. This positions post-consumer recycled ABS as the fastest-growing source segment globally.

Recycling Method Insights

Mechanical recycling continues to dominate the recycled ABS market because it is cost-effective and widely established. The process involves shredding, washing, and re-extruding ABS waste into usable granules, retaining much of its structural integrity. Industrial recyclers prefer this method due to its lower capital intensity compared to chemical recycling. For post-industrial scrap, mechanical recycling delivers consistent quality at scale, making it ideal for automotive and construction applications. The technology is mature, commercially proven, and supported by a robust infrastructure. As a result, mechanical recycling remains the dominant approach.

Furthermore, mechanical recycling benefits from shorter processing times and lower energy requirements. Its well-developed supply chains in the Asia Pacific and Europe ensure steady throughput. While some performance degradation may occur, blending with virgin resin often resolves quality concerns. For many manufacturers, this method offers the best balance between economics and sustainability. Continuous innovation in additives and processing techniques is helping improve material properties and extend applications. This entrenched ecosystem ensures that mechanical recycling remains the market leader.

Chemical recycling, though still emerging, is the fastest-growing method for ABS recovery. By breaking polymers back into monomers, it delivers higher-purity recycled resin that is nearly indistinguishable from virgin ABS. This makes it suitable for demanding applications such as automotive interiors and high-end electronics. The method also enables the processing of contaminated or mixed waste streams that mechanical recycling cannot handle. Although energy-intensive, advances in catalytic depolymerization and solvent-based recovery are improving efficiency. As industries demand higher-quality recycled materials, chemical recycling is gaining ground rapidly.

Investment in chemical recycling infrastructure is accelerating, particularly in developed markets. Partnerships between recyclers and OEMs are ensuring commercial viability and a guaranteed offtake. The technology aligns with circular economy ambitions, offering closed-loop solutions for challenging waste streams. While high costs remain a barrier, scaling production is expected to reduce expenses over time. Policy support in the form of subsidies and R&D funding is further propelling this segment. As a result, chemical recycling is projected to outpace all other methods in growth rate.

Grade Insights

Standard recycled ABS remains the dominant grade in the recycled ABS resins market due to its widespread use in various general applications across the automotive, construction, and appliance industries. It offers a balance of mechanical strength, durability, and cost that makes it suitable for a broad range of industries. Recyclers find it easier to produce standard grades from both post-industrial and post-consumer streams. Manufacturers adopt this grade for products where ultra-high performance is not critical. Its affordability compared to virgin resin ensures steady demand. Consequently, standard recycled ABS continues to hold the majority market share.

Additionally, the scalability of standard ABS recycling makes it attractive to industries operating at high volumes. It serves as an effective substitute for virgin resin in non-critical applications, such as housings, enclosures, and furniture. Continuous improvements in additive technology are helping recyclers maintain consistent quality. Standard ABS grades are also widely accepted by regulators as fulfilling recycled content obligations. The balance of availability, cost, and versatility ensures its dominance in the market. This trend is expected to persist as industries integrate sustainability into their mainstream manufacturing practices.

Flame-retardant and specialty recycled ABS is the fastest-growing grade segment, driven by safety and performance requirements in electronics, electrical components, and automotive interiors. These applications demand high standards of heat resistance, flame retardancy, and dimensional stability. Specialty grades are increasingly being developed to match the performance of virgin high-end ABS while offering sustainability benefits. Growth in electric vehicles and 5G electronics is particularly boosting demand for flame-retardant recycled ABS. The ability to deliver both compliance and environmental benefits makes this segment highly attractive. Manufacturers are investing in R&D to expand specialty offerings.

The rise of premium consumer electronics also fuels growth in the recycled ABS resins market. Brands are eager to showcase products that meet stringent safety standards while incorporating recycled materials. Specialty grades also align with regulatory frameworks mandating flame-retardant features in certain electronics and building products. Although production is more complex and costly, OEM partnerships are ensuring adoption. As recycling technologies advance, producing high-purity specialty ABS is becoming more feasible. This positions flame-retardant and specialty recycled ABS as the most dynamic grade in the years ahead.

Application Insights

Automotive and transportation applications dominate the recycled ABS resins market due to the sector's significant material consumption and increasing focus on sustainability. ABS is widely used in dashboards, trims, seat structures, and lightweight components. OEMs are increasingly incorporating recycled ABS to reduce lifecycle emissions and meet regulatory requirements. Post-industrial ABS scrap from automotive manufacturing provides a ready supply of material. The weight reduction benefits of ABS also complement the industry's shift toward electric vehicles. Thus, the automotive sector remains the largest consumer of recycled ABS.

The sector also benefits from strong policy support mandating recycled plastics in vehicles. Major automakers are adopting circular economy principles, investing in closed-loop recycling systems with suppliers. Recycled ABS delivers cost savings while meeting safety and performance standards. Asia Pacific's booming automotive sector provides additional momentum, while North America's EV market is creating new opportunities. Continuous innovation in specialty grades ensures compatibility with high-end automotive applications. This entrenches transportation as the leading segment by application.

Electrical and electronics applications represent the fastest-growing segment for recycled ABS. ABS is a staple material for housings, enclosures, and structural parts in appliances, laptops, and smartphones. With growing e-waste recycling initiatives, post-consumer ABS from electronics is becoming more readily available. Consumer brands are under intense pressure to meet sustainability goals, driving the adoption of recycled plastics. Specialty flame-retardant ABS is in particularly high demand for compliance with electrical safety standards. These trends collectively position electronics as the fastest-expanding end-use sector.

The surge in demand for consumer electronics and appliances further strengthens growth prospects. Manufacturers are actively promoting the use of recycled ABS as part of their ESG strategies to appeal to environmentally conscious consumers. Regulatory mandates requiring recycled content in electronics add to the momentum. The integration of chemical recycling ensures the production of higher-quality materials suitable for demanding electronic applications. Collaborations between recyclers and electronics giants are accelerating adoption rates. This makes the segment the most dynamic growth driver in the recycled ABS market.

End User Insights

Direct sales dominate the recycled ABS resins market, as distribution of bulk orders from automotive OEMs and electronics giants is negotiated directly with recyclers, ensuring a stable supply and consistent quality. This provides a higher degree of customization, better quality control, and greater assurance of supply consistency, which is critical for large-scale OEMs. Many companies prefer bulk procurement through direct contracts to secure stable pricing and guaranteed availability, especially in markets where raw materials are subject to fluctuations.

Online sales platforms are emerging as the fastest-growing distribution channel, driven by the digital transformation of supply chains and the rising acceptance of e-commerce in industrial procurement. These platforms provide access to a wide range of recycled ABS grades, enabling small and medium enterprises (SMEs) to procure materials with greater convenience and flexibility. The transparency of pricing, combined with competitive comparisons across suppliers, is fostering higher adoption of online channels. In addition, the ability to place smaller-volume orders online makes this model highly attractive for niche manufacturers and startups experimenting with sustainable materials.

Regional Insights

Why Is Asia Pacific Dominating the Recycled ABS Resins Market?

Asia Pacific holds the largest share of the recycled ABS resins market, supported by its role as the global hub for electronics and automotive manufacturing. China, Japan, South Korea, and India are at the forefront of recycled ABS consumption, driven by their strong industrial bases and government initiatives that promote the use of sustainable materials. Regulatory mandates in China and Japan are creating demand for recycled plastics in both domestic production and export goods. Furthermore, the rapid rise of consumer electronics recycling programs in countries like South Korea is fuelling a steady supply of ABS waste streams. Overall, Asia Pacific's dominance is underpinned by both supply-side advantages and strong downstream demand.

The region also benefits from large-scale recycling infrastructure investments, particularly in China and Southeast Asia, where governments are working to curb plastic waste imports while promoting domestic recycling industries. Low-cost labor and high waste availability strengthen the cost efficiency of recycling operations. Additionally, collaborations between local recyclers and multinational corporations are fostering quality improvements and expanding the applications of recycled ABS into higher-value segments. Increasing adoption of AI-enabled recycling facilities in urban centers is enhancing efficiency and supporting the growth of circular material flows across industries.

Looking ahead, the Asia Pacific is likely to maintain its lead due to its unparalleled manufacturing capacity and accelerating policy frameworks. Consumer demand for eco-friendly electronics and automotive products is rising, further boosting the integration of recycled ABS. The region's ability to balance high-volume recycling with quality improvements will be critical in sustaining growth. As global supply chains shift toward greener materials, Asia Pacific's recycled ABS industry is expected to play a central role in meeting international sustainability benchmarks and shaping competitive dynamics.

Why Is North America the Fastest-Growing Region in the Recycled ABS Resins Market?

North America is emerging as the fastest-growing region for the recycled ABS resins market, propelled by stringent environmental regulations and strong corporate ESG commitments. The United States and Canada are leading the push toward recycled plastics in consumer goods, automotive interiors, and construction materials. Federal and state-level policies mandating recycled content in packaging and durable goods are creating a strong pull for recycled ABS. Large OEMs in electronics and automotive are actively sourcing recycled materials to meet sustainability pledges, strengthening demand consistency.

Technological innovation is another major driver of growth in North America. The region is witnessing the rapid deployment of AI-powered recycling facilities, which improve waste separation, enhance resin quality, and boost recovery rates. Strong venture capital activity is funding start-ups focused on chemical recycling and polymer purification technologies, which are crucial to scaling high-performance recycled ABS. Partnerships between recyclers and automotive giants are accelerating closed-loop systems, ensuring steady feedstock availability. These collaborations are positioning North America as a key innovation hub for recycled plastics.

The region's future trajectory looks highly promising as both industry and consumers shift toward sustainable choices. The growing emphasis on circular economy practices, combined with a high willingness to pay for quality recycled materials, gives North America an edge in expanding market share. Moreover, collaborations between recyclers, research institutions, and manufacturers are expected to drive efficiency and material performance further. With policy support, advanced infrastructure, and innovation leadership, North America is well-positioned to become a global benchmark for growth in recycled ABS resins.

What Makes Europe a Significant Market for Recycled ABS Resins?

Europe is a mature and significant market for recycled ABS resins, with growth primarily driven by stringent environmental regulations aimed at reducing plastic waste and advancing a circular economy. The automotive and electronics industries are key users of recycled ABS, employing it in parts like dashboards, computer housing, and battery components in EVs. They focus on advanced mechanical and chemical recycling methods to address quality issues and meet high performance standards.

Germany is a key player in the European market, supported by strong manufacturing capabilities and a focus on sustainability. The country hosts major global companies, including INEOS Styrolution, which leads innovation across the virgin and recycled ABS value chain. Government rules and a public push for environmental responsibility are encouraging manufacturers to implement integrated waste management systems and use high-quality recycled materials, utilizing advanced sorting and processing technologies.

How is the Opportunistic Rise of Latin America in the Recycled ABS Resins Market?

Latin America is experiencing an opportunistic rise in the market, driven by increasing consumer environmental awareness and supportive government initiatives such as Brazil's National Solid Waste Policy (PNRS) and Chile's Extended Producer Responsibility law. The region's growth is bolstered by the need to reduce reliance on landfills and meet international sustainability standards. Additionally, opportunities are emerging in the packaging and consumer electronics sectors, attracting growing investment in recycling technologies to improve quality and reduce reliance on virgin materials.

Brazil leads the market in Latin America, fueled by strong government policies that mandate recycling and foster a circular economy. This has spurred investment in domestic recycling infrastructure and encouraged the use of recycled resins in various industries, including packaging and household goods. The market is driven by the demand for cost-effective, long-lasting materials in the growing automotive and electronics sectors to reduce reliance on volatile-priced virgin raw materials.

What Factors Contribute to the Growth of the Middle East and Africa Recycled ABS Resins Market?

The market in the Middle East and Africa is primarily driven by increasing environmental concerns, government regulations promoting sustainable practices, and rising industrial demand from the packaging, construction, and automotive sectors. Though the region has a smaller share of the global market compared to Asia-Pacific and Europe, countries like the UAE and Saudi Arabia are implementing national strategies and investing in advanced recycling technologies to reduce plastic waste and adopt a circular economy model.

Saudi Arabia is a key player in the market in the Middle East and Africa due to its rapid urbanization, significant investments in large-scale construction projects that incorporate green infrastructure practices, and an increasing government focus on recycling initiatives. The country is diversifying beyond traditional oil exports, and major companies like SABIC are introducing certified circular polymers produced through advanced recycling. This shift, along with rising demand in the automotive and electronics sectors, positions Saudi Arabia for substantial growth.

Value Chain Analysis

- Waste Collection and Sourcing

ABS plastic waste is collected from diverse sources, including post-industrial and post-consumer waste, often through manufacturer take-back programs.

Key Players: Republic Services, Waste Management, and manufacturers like HP, Dell, and Lenovo. - Sorting, Pre-processing, and Washing

The collected plastic is sorted, shredded, and washed to remove contaminants, especially for post-consumer waste.

Key Players: Specialized recycling facilities and technology providers for sorting and washing machinery. - Reprocessing and Compounding

Prepared ABS is melted, extruded, and often compounded with additives or virgin material to create recycled ABS pellets.

Key Players: CHIMEI Corporation, INEOS Styrolution, and SABIC. - Distribution and Supply Chain Management

This ensures efficient delivery of recycled ABS resins to manufacturers, with a focus on traceability.

Key Players: Chemical distributors, B2B e-commerce platforms like Cirplus, and logistics providers. - Product Manufacturing and Application

Recycled ABS is used to manufacture new products through injection molding, extrusion, or 3D printing.

Key Players: HP, Dell, Lenovo, Apple. - End-User/Consumer and Regulatory Framework

This is influenced by consumer demand for sustainable products and regulations promoting a circular economy.

Key Players: Consumers, governmental bodies (FDA, EPA), and NGOs promoting sustainability.

Top Companies in the Recycled ABS Resins Market

- MBA Polymers Inc.: Specializes in high-purity, post-consumer recycled ABS from WEEE and ELV waste streams.

- Veolia Environnement S.A.:Processes large volumes of mixed plastic waste to provide recycled polymers, including ABS, through its global waste management operations.

- SUEZ Recycling and Recovery:Provides recycled ABS resins through extensive sorting and large-scale recovery facilities as a global leader in waste management.

- Ravago Group: A major distributor and compounder offering a broad portfolio of standard and customized recycled ABS grades.

- Trinseo PLC: Offers ABS and SAN resins with certified recycled content for mobility and consumer goods applications, matching virgin material performance.

Other Key Players

- Envision Plastics

- Kuusakoski Recycling

- Green Ant Plastics

- Luxus Ltd.

- Covestro AG

- BASF SE

- LyondellBasell Industries

- Toray Industries, Inc.

- ELIX Polymers

- WIS Plastics

- Alpek SAB de CV

- Plastic Recycling Inc.

- Inteplast Group

- Plastic Energy Ltd.

- Avient Corporation

Recent Developments

- In September 2025, Andreas Mäurer, head of process development for polymer recycling, explained that his team's approach surpasses the limits of traditional solvent-based recycling methods. Unlike mechanical separation, the Fraunhofer process enables the selective dissolution and recovery of the desired polymer at exceptionally high purity. In contrast, unwanted polymers and solid residues remain undissolved and are efficiently removed. Moreover, impurities such as flame retardants, plasticisers, degradation byproducts, and even odours are eliminated through the use of tailored solvents, ultimately yielding recycled plastics of superior quality.

(Source: https://www.plasteurope.com)

Segment Covered in this Report

By Source

- Post-consumer recycled ABS

- Post-industrial recycled ABS

- Mixed recycling streams

- Others

By Recycling Method

- Mechanical recycling

- Chemical recycling (depolymerization, solvent-based recovery)

- Hybrid/advanced recycling

By Grade

- Standard recycled ABS

- High-impact recycled ABS

- Flame-retardant recycled ABS

- Specialty grades

By Application

- Automotive & transportation (interior trims, panels, components)

- Electrical & electronics (housings, casings, connectors)

- Appliances (refrigerators, vacuum cleaners, small appliances)

- Construction materials (pipes, fittings, panels)

- Packaging products

- Consumer goods (toys, furniture, accessories)

- Others

By End-User Industry

- Automotive OEMs

- Electronics & appliance manufacturers

- Packaging converters

- Construction companies

- Consumer goods manufacturers

- Others

By Distribution Channel

- Direct sales (manufacturers to OEMs)

- Distributors & suppliers

- Online sales platforms

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting