Regulatory Affairs Outsourcing Market Size and Forecast 2025 to 2034

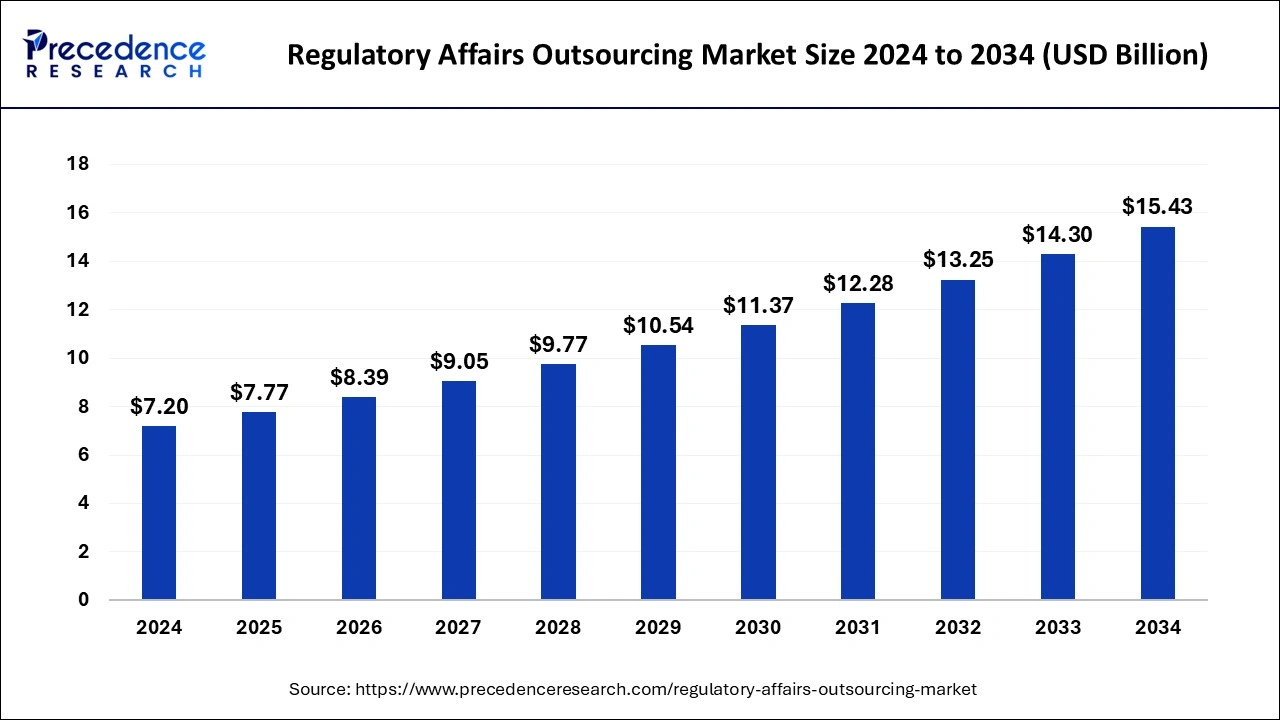

The global regulatory affairs outsourcing market size was estimated at USD 7.2 billion in 2024 and is anticipated to reach around USD 15.43 billion by 2034, expanding at a CAGR of 7.92% from 2025 to 2034. Rising clinical trial applications, an increase in the R&D activities, and increase in geographical expansion activities by companies which help the growth of the regulatory affairs outsourcing market.

Regulatory Affairs Outsourcing Market Key Takeaways

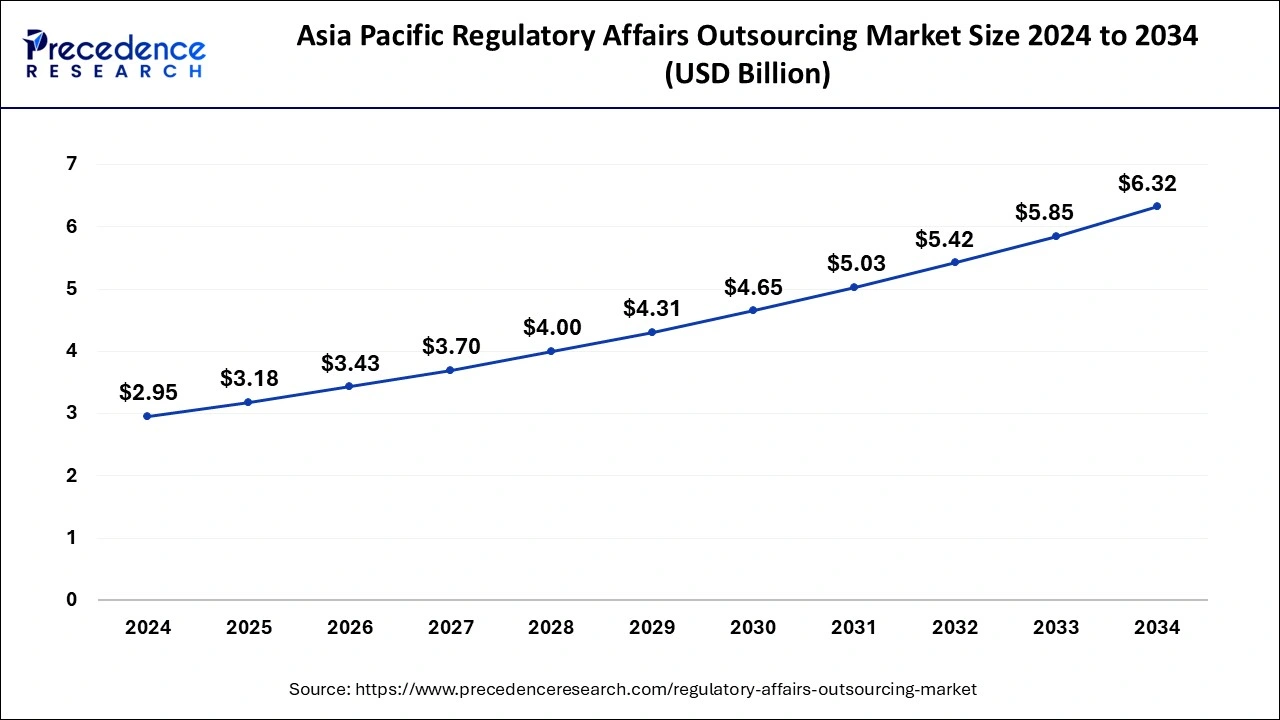

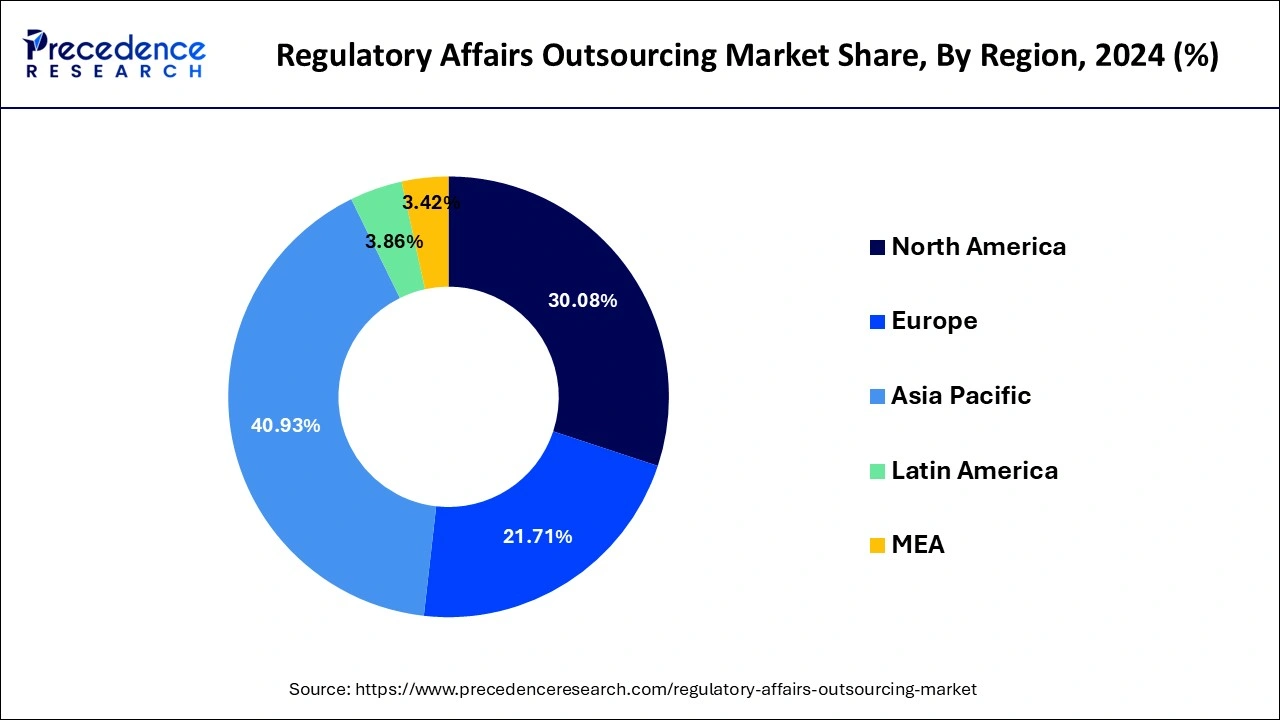

- Asia Pacific dominated the global regulatory affairs outsourcing market with the largest market share of 40.93% in 2024.

- North America is expected to expand at a solid CAGR of 7.9% during the forecast period.

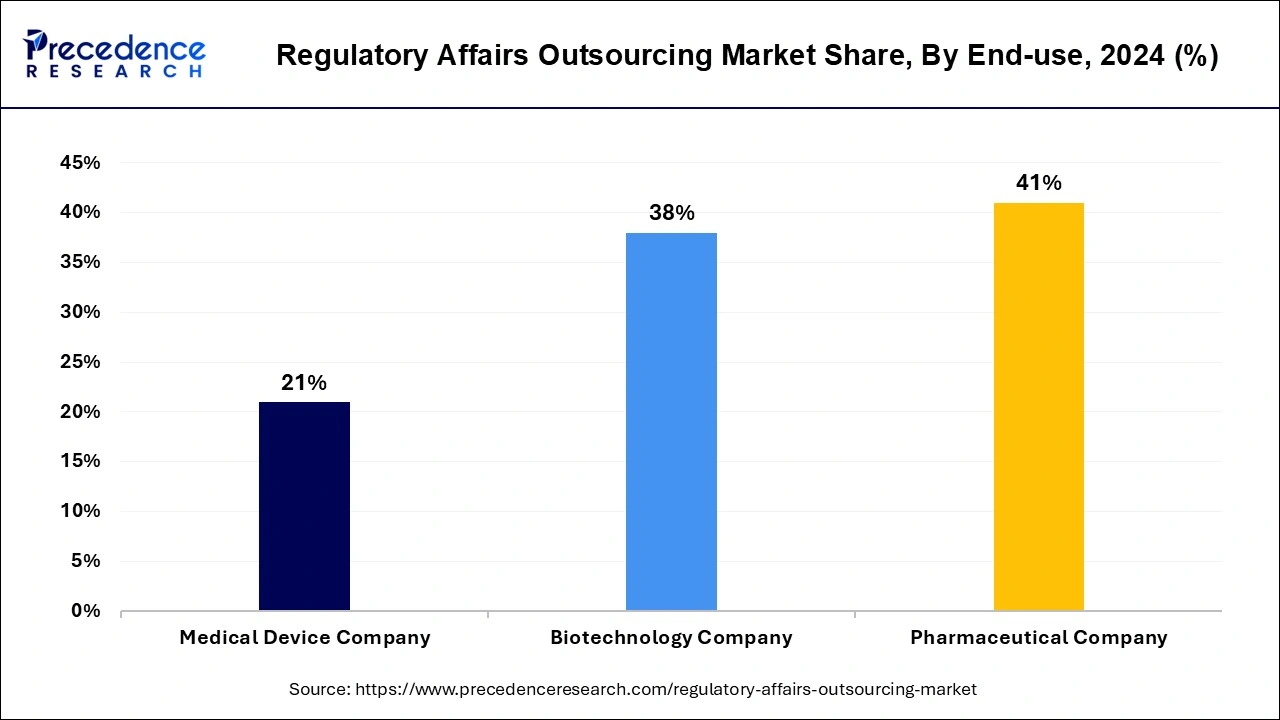

- By end-use, the pharmaceutical company segment contributed the highest market share of 41% in 2024.

- By service, the product registration and clinical trial segment accounted for the highest market share of 27% in 2024.

- By service, the legal representation services segment is projected to grow at a healthy CAGR of 9.1% during the forecast period.

- By category, the drugs segment has held a major market share of 41% in 2024.

- By category, the medical device segment is expected to expand at the fastest CAGR of 8% during the forecast period.

- By indication, the oncology segments contributed the biggest market share of 35% in 2024.

- By indication, the immunology segment is expanding at a solid CAGR of 9.83% over the forecast period.

- By stage, the clinical segment recorded the biggest market share of 48% in 2024.

- By stage, the Preclinical segment is projected to grow at a CAGR of 9.02% during the forecast period.

How is AI Changing Regulatory Affairs Outsourcing?

Artificial intelligence (AI) can analyze high amount of data quickly and accurately, identifying trends and patterns, that may be missed by a person. This can also help in predicting regulatory changes and assessing their potential impact in the organization. AI tools can be applied to automate regulatory processes like quality management, the implementation of regulations, auding, data extraction, dossier filling, and administrative work. These factors help the growth of the regulatory affairs outsourcing market.

Asia Pacific Regulatory Affairs Outsourcing Market Size and Growth 2025 to 2034

The Asia Pacific regulatory affairs outsourcing market size was evaluated at USD 2.95 billion in 2024 and is predicted to be worth around USD 6.32 billion by 2034, rising at a CAGR of 7.94% from 2025 to 2034.

Asia Pacific region dominated the growth of the regulatory affairs outsourcing market. The growing presence of numerous pharmaceutical and medical device companies in the region owing to the easy and cheap availability of raw materials for drugs and electronic medical devices has boosted the growth of this region.

China Regulatory Affairs Outsourcing Market Trends

China is a major contributor to the regulatory affairs outsourcing market. The rapidly growing pharmaceutical industry and strong investment in the healthcare sector help in the market growth. The growing number of clinical trials increases demand for regulatory affairs outsourcing services. The rising adoption of international standards & regulations helps in the market growth.

The growing middle-income population and the rising geriatric population increase demand for regulatory affairs outsourcing. The rising disposable incomes, growing population, and rising number of international medical device companies drive the overall growth of the market.

India Regulatory Affairs Outsourcing Market Trends

India is significantly growing in the regulatory affairs outsourcing market. The growing pharmaceutical and biotechnology industry helps in the market growth. The growing clinical trials and product registrations increase demand for regulatory affairs outsourcing. The presence of a skilled and experienced workforce in regulatory affairs drives the overall growth of the market.

The rising investments by the government to attract FDIs are further expected to drive the growth of the market in the Asia Pacific. The countries like China, India, Indonesia, and South Korea are expected to attract investments from numerous healthcare companies that is anticipated to drive the growth of the regulatory affairs outsourcing market in the region.

North America experiences the fastest growth in the regulatory affairs outsourcing market. The strong presence of pharmaceutical & biotechnology companies in the region helps in the market growth. The growing product development and complex regulatory frameworks increase demand for regulatory affairs outsourcing. The growing number of clinical trials and

stringent regulations by the FDA help in the market growth. The growing advancements in drug development and manufacturing processes increase demand for regulatory affairs outsourcing. The growing demand for personalized medicine and biologics drives the overall growth of the market.

United States Regulatory Affairs Outsourcing Market Trends

The United States is a key contributor to the regulatory affairs outsourcing market. The well-established biotechnology and pharmaceutical companies increase demand for regulatory affairs outsourcing. The strong presence of the US Food and Drug Administration in the healthcare, pharmaceuticals, and medical devices industry helps in the market growth. The high number of clinical trials in the country increases demand for regulatory affairs outsourcing. The rising demand for biologics and increasing international clinical trials drive the overall growth of the market.

Market Overview

Regulatory affairs outsourcing is the process of hiring an external party to handle submission processes and regulatory compliance for products like biotechnology, pharmaceuticals, and medical devices. The regulatory affairs outsourcing tasks include obtaining marketing authorization, managing product life cycle, reviewing product mockups, and ensuring compliance with regulations.

Regulatory Affairs Outsourcing Market Growth Factors

The high costs associated with the operations of regulatory affairs are significant factors that drive the demand for regulatory affairs outsourcing.

Complying with the various regulatory norms of the local regulatory authorities in the major markets like North America, Asia Pacific, and Europe is a challenging task for the companies especially the multinationals.

There are various companies like medical device manufacturers, pharmaceutical developers, and biotechnology companies that have increased demand for outsourcing regulatory affairs. The outsourcing of regulatory affairs has become more important owing to the expansion activities and development of new devices and drugs by the numerous companies operating in the healthcare sector.

The regular efforts for the development of new drugs and equipment result in an increased number of approvals regarding the preclinical and clinical trials. Therefore, in order to focus on the core activities and efficiently handle the regulatory affairs at low cost, the companies are increasingly adopting for the regulator affairs service providers, thereby boosting the demands for the services across the globe.

- Ever-greater operational costs in regulatory affairs push private firms towards outsourcing so that they may reduce such costs and improve operational efficiency.

- Regard to large and complex regulatory requirements across major markets in North America, Asia Pacific, and Europe, these companies tend to outsource regulatory activities to a greater extent.

- From a regulatory and compliance perspective, manufacturers of medical devices, pharmaceutical companies, and biotech firms seek regulatory affairs outsourcing.

- As new drugs and devices expand and develop, the increased number of approvals and regulatory submissions bottlenecks the service providers emerging in the outsourcing sector.

- With the outsourcing of regulatory affairs, companies get the advantage of keeping themselves engaged in their core activities while the regulations are looked into at the right time and in the most cost-effective manner; from here, the market is rising worldwide.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 7.77 Billion |

| Market Size by 2034 | USD 15.43 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.92% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, Category, End User, Indication, Stage |

| Regional Scope |

North America, Europe, Asia Pacific, LAMEA |

Market Dynamics

Drivers

Cost Efficiency

The existence and upkeep of an in-house regulatory affairs team will sometimes cost money, especially for small and medium enterprises. Outsourcing regulatory affairs accounts for a cheaper option, wherein companies get the required specialized know-how without incurring long-term fixed costs related to hiring, training, and retaining a full team. It also gives companies the flexibility to scale services based on actual needs, thereby improving working flexibility and better resource allocation. Thus, outsourcing becomes an attractive option for businesses seeking a device to cut overhead costs while keeping pace with regulatory changes.

Restraint

Quality Control

Establishing uniform quality control is among the greatest challenges of regulatory affairs outsourcing. It is necessary to require absolute compliance from the outsourced providers concerning regulatory standards, along with precise, timely documentation latter constitutes a critical factor in achieving product approvals without any delays or rejections. Since disparities in quality among service providers affect compliance and undermine the company's goodwill, they should, therefore, be avoided. Consequently, companies should look into the selection of vendors, audit practices, and othercommunications as a means to ensure outsourcing partners reach the quality and regulatory standards demanded by the healthcare and pharmaceutical industries.

Opportunity

Adoption of New Technologies

As the acceptance of AI, machine learning, and big data analytics permeates the processes in regulatory affairs, tremendous growth opportunities arise for outsourcing companies. It analyzes the data better, automates routine tasks, and improves regulatory intelligence capabilities, all of which enable companies to provide faster, more accurate, and more cost-effective solutions. Those outsourcing providers embracing the new technology will have the ability to provide predictive insight, streamline submissions, and manage compliance risk more effectively. This move towards technology-enabled regulatory services provides a competitive advantage and offers new growth opportunities in the regulatory affairs outsourcing market.

Service Insights

The product registration and clinical trial segment accounted for the highest market share of 27% in 2024and is projected to sustain its dominance during the forecast period. Regulatory writing and publishing is considered to be an integral part of the research. A wide variety of documents are produced throughout the clinical trial phases. Further, the regulatory writers are considered to be an essential communicator between the drug developers and the approving regulatory authorities such as FDA and EMA. The regulatory writers also play an important role in the advertising of any new drug or medical device. Hence, the significance of the regulatory writing and publication activities has made this the leading segment across the globe.

The legal representation services segment is projected to grow at a healthy CAGR of 9.1% during the forecast period. The legal representation segment is expected to be the most opportunistic segment owing to the rising penetration and expansion activities of the numerous biopharmaceutical and medical device companies across various nations of the globe. For instance, a biopharmaceutical company, based in the US, may require legal representation in order to get the market authorization and sell its products in India. Globalization is the major driver of this segment.

Category Insights

The drugs segment has held a major market share of 41% in 2024.and is expected to sustain its dominance during the forecast period. The rising demand for innovative medical devices across the hospitals and clinics has led the medical devices companies to focus on their core activities and outsource the regulatory affairs activities. The medical devices companies are constantly engaged in the development of the latest and innovative diagnostic and medical devices and hence are increasingly adopting the regulatory affairs services to increase its operational efficiencies.

The medical device segment is expected to expand at the fastest CAGR of 8% during the forecast period. This is attributed to the rapid growth of the biologics industry across the globe, owing to its rising popularity of various life-saving drugs. The increasing investments on the research & development of the various new biologic drugs require frequent preclinical and clinical approvals and regulatory writing services in order to get approval and market authorization across various countries.

End Use Insights

The pharmaceutical company segment contributed the highest market share of 41% in 2024 and is expected to sustain its dominance during the forecast period. This can be attributed to the rapid growth and popularity of biopharmaceuticals and the rising adoption of biosimilar, personalized drugs, and orphan drugs among the population. The rapidly expanding biopharmaceutical industry is expected to further drive the growth of this segment in the upcoming future.

The medical device company is expected to register the highest CAGR during the forecast period. The rising investments in the growth of the medical devices companies are fueling the growth of this segment. The rising research and development activities of the medical device companies is expected to drive the growth of this segment owing to the increasing need for regulatory writing and publication activities, in the forthcoming years.

Indication Insights

The oncology segments contributed the biggest market share of 35% in 2024 and is predicted to sustain its dominance during the forecast period. The development of the various therapeutics and drugs for the treatment of cancer in the past years has had significantly impacted the growth of this segment. Moreover, the surging popularity of personalized medicines is expected to drive the demand for regulatory affairs outsourcing in the upcoming years.

On the other hand, neurology is estimated to be the fastest-growing segment. The rising prevalence of neurological disorders among the population has attracted increased investments in the development of new neurological medicines and medical equipment, which will increase the regulatory affairs related activities such as product registration, regulatory writing, and legal representation. This factor may propel the growth of this segment during the forecast period.

Stage Insights

The clinical segment recorded the biggest market share of 48% in 2024 and is predicted to sustain its dominance during the forecast period. This can be attributed to the increasing number of clinical trials. According to ClinicalTrials.gov, around 326,000 clinical trials were registered in 2019 in the US which increased to more than 347,000 clinical trials in 2020. Therefore, the rising number of clinical trials is expected to retain the dominance of this segment throughout the forecast period.

The preclinical segment is projected to grow at a CAGR of 9.02% during the forecast period. The rising activities relating to the new product developments by the pharmaceutical and medical device companies are the primary factors that are expected to drive the growth of this segment in the foreseeable future.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

In 2019, Accell and Syntax collaborated to expand their client reach in Europe. The various developmental strategies like collaborations, mergers, acquisitions and partnerships foster market growth and offers lucrative growth opportunities to the market players.

Regulatory Affairs Outsourcing Market Companies

- Medpace

- ICON Plc

- WuXiAppTec, Inc.

- Covance

- Genpact Ltd.

- Pharmaceutical Product Development LLC.

- Freyr

- PRA Health Sciences

- Criterium, Inc.

- Accell Clinical Research, LLC.

Latest Announcement by Industry Leaders

- In May 2024, the launch of Regulatory Affairs & Policy Advocacy division was announced by Biotechnology Industry Research Assistance Council (BIRAC) to strengthen India's regulatory and policy milieu.

Recent Developments

- In August 2025, Larry Roth rebrands his wealth management consulting firm, Ascentix Partners, to Ascentix Partners, launching a network of elite consultancies to accelerate growth for wealth management enterprises. (Source: https://www.thinkadvisor.com)

- In July 2024, the launch of new clinical research services was announced by a Med-Tech ecosystem, DocMode Health Technologies. This expansion aims to provide a comprehensive solution that include regulatory compliance, data analysis, clinical trial management, and more.

- In November 2024, to unravel the regulatory challenges in emerging technologies like AI, space systems, and dual use innovations ‘webinar series' was launched by Satcom Industry Association-India (SIA-India) and IndUS Tech Council in collaboration

Segment Covered in the Report

By Service

- Legal Representation

- Regulatory Consulting

- Product Registration & Clinical Trial Application

- Regulatory Writing & Publication

- Others

By Category

- Biologics

- Drugs

- Medical Devices

By End User

- Medical Device Company

- Biotechnology Company

- Pharmaceutical Company

By Indication

- Neurology

- Oncology

- Immunology

- Cardiology

- Others

By Stage

- Clinical

- Preclinical

- Post Market Authorization

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting