What is the Regulatory Compliance Advisory Services for Utilities Market Size?

The global regulatory compliance advisory services for utilities market analyzes market trends, service models, and regulatory demands driving compliance consulting adoption across utility sectors.The market is driven by the rising demand for regulatory compliance and the need for compliance risk management in utility operations.

Market Highlights

- Europe dominated the market, holding the largest market share of approximately 35% in 2025.

- Asia-Pacific is expected to expand at the fastest CAGR of approximately 13% in the market between 2026 and 2035.

- By service type, the audit & assessment services segment held the largest regulatory compliance advisory services for utilities market share of approximately 30% in 2025.

- By service type, the technology advisory (GRC tools, compliance monitoring) segment is expected to grow at a remarkable CAGR of approximately 12% between 2026 and 2035.

- By utility type/end-user, the electricity utilities segment held the largest market share of approximately 45% in 2025.

- By utility type/end-user, the water & waste-water utilities segment is expected to grow at a remarkable CAGR of approximately 13% between 2026 and 2035.

- By compliance domain/focus area, the emissions & environmental compliance segment held the largest revenue share of approximately 34% in the market in 2025.

- By compliance domain/focus area, the data privacy & cybersecurity compliance segment is set to grow at a remarkable CAGR of approximately 14% between 2026 and 2035.

- By delivery model, the on-site consulting & field services segment held the largest regulatory compliance advisory services for utilities market share of approximately 50% in 2025.

- By delivery model, the remote/digital advisory & monitoring segment is expected to expand at a remarkable growth with a CAGR of approximately 15% between 2026 and 2035.

- By client size, the large national/multi-national utilities segment held the largest revenue share of approximately 60% in the market in 2025.

- By client size, the mid-sized regional utilities segment is expected to grow at a remarkable CAGR of approximately 11% between 2026 and 2035.

How Advisory Services Are Transforming the Utilities Regulatory Landscape?

The regulatory compliance advisory services for utilities market offer a wide scope of professional services that are offered to help electric, gas, and water utilities comply with their regulatory requirements and obligations. This includes consulting, audits, verification, compliance program development, risk and governance advisory, licensing and permitting support, and training. The increase in the complexity of regulations applied by the utilities, e.g., decarbonization of the grid, emissions, tariff reforms, data privacy, etc., makes special counselling services essential. The market also helps utilities align operations with the policy and legislative requirements, create transparency and accountability, and meet the international and regional compliance standards.

Governments and regulatory authorities are also increasing environmental, safety, and data control rules, and utilities are trying to get expert advisory services to reduce compliance risk and penalties. It is because more attention is paid to sustainability, more enforcement, and live policy restructuring, according to which the utilities begin to invest more in long-term compliance planning and technology-related advisory services.

Key AI Integration in the Regulatory Compliance Advisory Services for Utilities Market

The market is revolutionizing with the use of artificial intelligence (AI) by automating the compliance monitoring process, data management, and risk assessment. AI-based analytics is now being increasingly employed by utilities to discover regulatory loopholes, anticipate compliance risk, and automate reporting in complex operational systems. Machine learning (ML) models are used to improve decision-making by examining real-time energy grid, emissions, and financial data and operations to ensure that they comply with the changing environmental and data privacy requirements.

In addition, AI chatbots and digital assistants are implemented to train the staff, update regulations, and resolve queries. With the processes of decarbonization and digital transformation of global utilities underway, the integration of AI into compliance is emerging as a center-focused area, resulting in price reduction and human error minimization, as well as responsiveness to changing regulatory conditions.

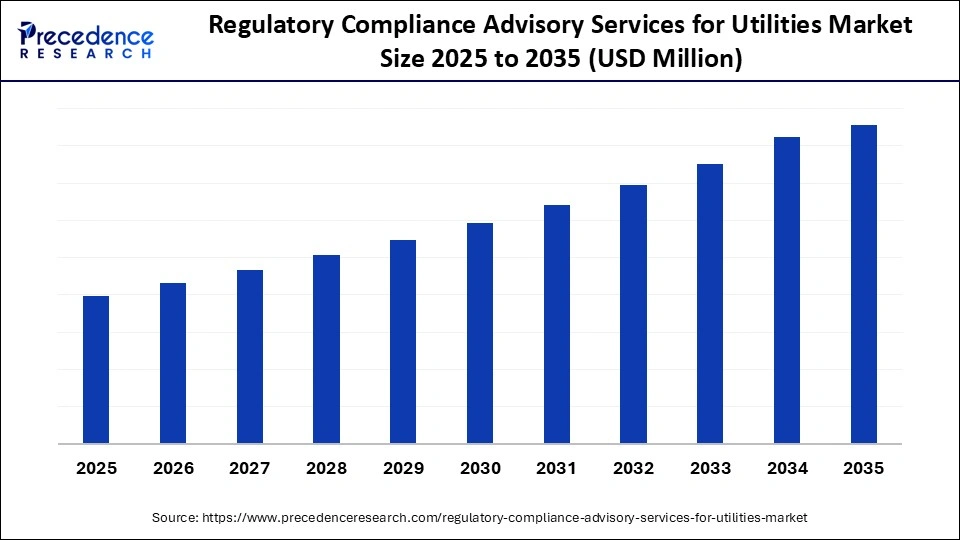

Regulatory Compliance Advisory Services for Utilities Market Outlook

- Industry Growth Overview: The market is showing growth because of heavier environmental and governance regulations that have increased. The growing digitalization and renewable integration are also making utilities invest in expert advisory and compliance management decisions.

- Global Expansion: The compliance advisory service is rapidly gaining global adherence through the tightening of rules in North America, Europe, and the Asia-Pacific. Developing economies are converging on the sustainability and decarbonization goals, fueling the need to have organized compliance mechanisms.

- Major Investors: Among the top investors are the international consultancies like Deloitte, PwC, EY, and KPMG, as well as the large tech companies that provide compliance software. The focus of their investments is on the increased overlap of professional advisory and digital compliance technologies.

- Startup Ecosystem: Innovators of AI compliance automation and risk analytics are emerging. Such startups are assisting utilities to confront complex regulations in a flexible, accurate, and cost-effective way.

Market Scope

| Report Coverage | Details |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service Type, Utility Type/End-User, Compliance Domain/Focus Area, Delivery Model, Client Size, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Service Type Insights

Why Did the Audit & Assessment Services Segment Hold a 30% Share in 2024?

The audit & assessment services segment held a major revenue share of approximately 30% in the regulatory compliance advisory services for utilities market in 2025, owing to the growing demand to establish utilities with regulatory transparency and operating responsibility. The trend is towards using third-party audits to determine compliance lapses, conformity of risk management systems, and compliance with environmental, safety, and data protection laws and regulations. With the changes in the global regulatory standards, the need to have independent audit and assessment services continues to be high in electric, gas, and water utilities.

The technology advisory (GRC tools, compliance monitoring) segment is expected to grow at the fastest CAGR of approximately 12% in the market between 2026 and 2035, due to the increasing digital transformation campaigns in utilities, the advent of AI, automation, and data analytics in compliance management. Technologies are effective and accurate since they can be applied to monitor in real-time, automate reporting, and predict future risks. This potentiates the need for GRC-based advisory services, as the utilities will continue with the operations and implement cloud-based compliance systems to assist in creating sustainable, technology-enabled compliance strategies.

Utility Type/End-User Insights

Why Did the Electricity Utilities Segment Dominate the Market?

The electricity utilities segment accounted for the highest revenue share of approximately 45% in the regulatory compliance advisory services for utilities market in 2025, because of regulatory complexities aimed to modernize the grid, integrate renewable energy, and decarbonize, inspired by these goals. The requirement of electricity utilities in the advisory services is increasing in relation to regulatory alignment, emissions management, and data management with the change to smart grids and clean energy systems.

The water & waste-water utilities segment is expected to grow with the highest CAGR of approximately 13% in the market during the studied years. Utilities are seeking professional advisory services to help them comply with discharge permits, pollution control, and sustainability structures. The segmental growth is also attributed to increasing investments in the modernization of wastewater treatment and digital water management systems. Advisory firms help these utilities attain ISO and environmental certification, good governance, and a risk-based compliance program.

Compliance Domain/Focus Area Insights

Which Compliance Domain/Focus Area Segment Dominated the Market?

The emissions & environmental compliance segment contributed the biggest revenue share of approximately 34% in the regulatory compliance advisory services for utilities market in 2025, due to the demanding global climate policies and decarbonization policies. Companies are under pressure to reduce greenhouse gas emissions, switch to renewable energy sources, and comply with environmental reporting frameworks, e.g., ESG and carbon disclosure standards. Advisory companies possess skills in monitoring emissions, regulatory manuals, sustainability audits, and environmental impact assessment.

The data privacy & cybersecurity compliance segment is expected to expand rapidly in the market with a CAGR of approximately 14% in the coming years, as utilities use smart meters, IoT systems, and cloud-based solutions, emerging cyber threats, and increased data protection legislation become a thorn. Advisory firms help in the implementation of cybersecurity architecture, compliance with GDPR and data privacy, and a real-time threat monitoring system. The rising number of cyberattacks on critical infrastructure and the growing number of requirements of data governance laws around the world augment the segment's growth.

Delivery Model Insights

Why Did the On-site Consulting & Field Services Segment Dominate the Market?

The on-site consulting & field services segment held the largest revenue share of approximately 50% in the regulatory compliance advisory services for utilities market in 2025, because direct, hands-on, and compliance verification, auditing, and infrastructure inspection were necessary. Utilities are dependent on on-site specialists who evaluate the operational risks, documentation, and compliance with the safety, emission, and environmental regulations. The world is becoming increasingly digitalized, and face-to-face consulting is still indispensable to confirm compliance frameworks, which demand field-level expertise and compliance certification.

The remote/digital advisory & monitoring segment is expected to witness the fastest growth in the market with a CAGR of approximately 15% over the forecast period, as utilities embrace digital transformation and automation in processes of compliance processes. The model uses AI, cloud services, and IoT-based monitoring systems to facilitate the use of constant compliance tracking and risk alerts. Remote advisory decreases the operation cost and increases efficiency, enabling centralized operations of various utility locations.

Client Size Insights

How the Large National/Multi-National Utilities Segment Dominated the Market?

The large national/multi-national utilities segment dominated the regulatory compliance advisory services for utilities market with a market share of approximately 60% in 2025, because of their well-established infrastructure, transacting in multi-jurisdictional settings, and operating in the complex regulatory environments. They spend a lot on advisory partnerships, audits, and technology-based compliance systems as a way of dealing with big risks and have clarity in governance.

The mid-sized regional utilities segment is expected to show the fastest growth with a CAGR of approximately 11% over the forecast period, due to the rising number of regulatory reforms and the modernization of utility infrastructure. These utilities are in need of advisory services in the implementation of cost-effective compliance programs, integration of renewables, and management of safety. As data governance and emissions regulation develop, local utilities are moving to flexible online compliance solutions and hybrid advisory models.

Regional Insights

Which Factors Drive the Market in Europe?

Europe led the global market with the highest regulatory compliance advisory services for utilities market share of 35% in 2025, due to the strict environmental, energy, and data governance rules. The utilities of the region are constantly under pressure to reach the requirements of the EU Green Deal, carbon neutrality, and new frameworks like the Emissions Trading System (ETS) and GDPR.

Germany, France, and other countries, such as the UK, are spending heavily on compliance advisory to overcome compliance with renewables, energy transition, and digital grid modernization. The increased applications of ESG reports and sustainability reporting further contribute to the increased demand for expert service providers to ensure the transparency of operations and adherence to the regulations.

UK Market Trends

The regulatory compliance advisory services currently have a strong demand in the UK with energy decarbonization objectives and policy changes as part of the Net Zero 2050 strategy. The advisory firms are getting more work to perform the obligations in the Ofgem framework, emissions reporting, and cybersecurity standards as mandated by utilities. The growth of renewable energy production and the use of intelligent grids have increased compliance requirements in the area of data management and environmental control. Further, regulatory divergence in the post-Brexit world is also pushing UK utilities to use professional consulting services to align their policies with new risks and changes in domestic and international compliance needs.

How is Asia-Pacific Estimated to Have the Fastest Growth in the Market?

Asia-Pacific is expected to achieve the highest CAGR in the regulatory compliance advisory services for utilities market throughout the forecast period. The direct cause of the increased compliance infrastructure requirements in China, India, Japan, and Southeast Asia is rapid industrialization, urbanization, and increased sustainability requirements. Governments are restricting environmental and safety policies and encouraging the adoption of renewable energy and smart grids. Advisory firms are cashing in on this change, offering customized compliance, digital surveillance, and risk management services. Carbon neutrality and energy security remain a recent trend in the region that contributes to market growth.

China Market Trends

The Chinese market is developing at a high rate, which can be explained by active decarbonization policies of the government and energy transition targets within the framework of the "Dual Carbon" program. Utilities are under increased pressure to meet the demands of emission caps, renewable energy requirements, and digital governance policies. Chinese utilities are increasingly seeking the services of more advisory firms to help them with carbon accounting, ESG reporting, and environmental audits. Both state and privately owned utilities are facing the trend of having to comply with energy efficiency laws, waste management policies, and cybersecurity laws, which are being tightened by China.

Why is North America Experiencing Notable Growth in the Market?

North America is considered to be a significantly growing area in the regulatory compliance advisory services for utilities market, due to changes in the environmental, safety, and data privacy regulations in the U.S and Canada. Advisory partnerships are costing utility companies a lot of money in a bid to meet the EPA's high emissions and comply with NERC regulations on reliability.

The increased adoption of digital surveillance frameworks, along with the development of cyber-resilience policies, is another factor in the increased need for professional advisory services. In addition, the emphasis on modernization of grid infrastructure and the enhancement of renewable energy potential in the region support the necessity of constant compliance checks, management regimes, and sophisticated risk management strategies.

U.S Market Analysis

The U.S. leads the market in North America, with the support of dynamic energy reforms, decarbonization, and data protection regulations, satisfying the need for ESG reporting, federal emissions, and cybersecurity requirements that are required by agencies such as FERC and NIST. The rapid adoption of smart grids, digital metering, and renewable infrastructure requires new operations and safety expectations to be followed. Advisory companies are crucial in assisting the utilities to curb risk, increase transparency, accept intricate federal and state-level policy modifications, and maintain regulatory consistency and sustainability of operations throughout the utility value chain.

Who are the Major Players in the Global Regulatory Compliance advisory Services for Utilities Market?

The major players in the regulatory compliance advisory services for utilities market include Deloitte, PricewaterhouseCoopers (PwC), Ernst & Young (EY), KPMG, Accenture, HCLTech, WG Consulting, S&W Group, Ricoh USA, Protiviti, NMS Consulting, Harbinger Land, Bain & Company, FTI Consulting, Oliver Wyman, Roland Berger, Arthur D. Little, PA Consulting, and ICF International, Inc.

Recent Developments

- In September 2025, Accenture announced the acquisition of French Orlade Group, an advisory and project management service provider, to help clients optimize their investments in large-scale, long-term projects, such as nuclear power plants, power grids, rolling stock, defense systems, and space launch systems.(Source: https://newsroom.accenture.com)

- In January 2025, IBM collaborated with a UAE-based technology group, e&, to deploy an advanced AI governance solution on its WatsonX.governance platform. The governance framework aims to improve compliance, monitoring, and ethical AI practices across e&'s growing AI ecosystem, allowing the company to establish robust governance, risk management, and regulatory oversight.(Source: https://newsroom.ibm.com)

Segments Covered in the Report

By Service Type

- Regulatory Gap & Readiness Assessments

- Licensing, Permitting & Regulatory Filing Support

- Compliance Programme Implementation & Advisory

- Audit & Assessment Services

- Risk & Governance Advisory (policy, tariff, emissions)

- Technology Advisory (GRC tools, compliance monitoring)

- Training & Certification Services

By Utility Type/End-User

- Electricity Utilities

- Transmission System Operators (TSOs)

- Distribution System Operators (DSOs)

- Gas Utilities

- Water & Waste-water Utilities

- Multi-Utility Operators (Electric + Gas + Water)

By Compliance Domain/Focus Area

- Emissions & Environmental Compliance (carbon, air, water)

- Safety & Operational Compliance (EHS, grid safety)

- Tariff & Market-Regulation Compliance

- Data Privacy & Cyber-Security Compliance

- Licensing & Permitting Compliance

By Delivery Model

- On-site Consulting & Field Services

- Remote/Digital Advisory & Monitoring

- Hybrid Model (Controller + Platform)

- Outcome-Based/Performance-Linked Advisory Contracts

By Client Size

- Large National/Multi-National Utilities

- Mid-Sized Regional Utilities

- Small/Municipal Utilities

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting