What is the Robotic Nurses Market Size in 2026?

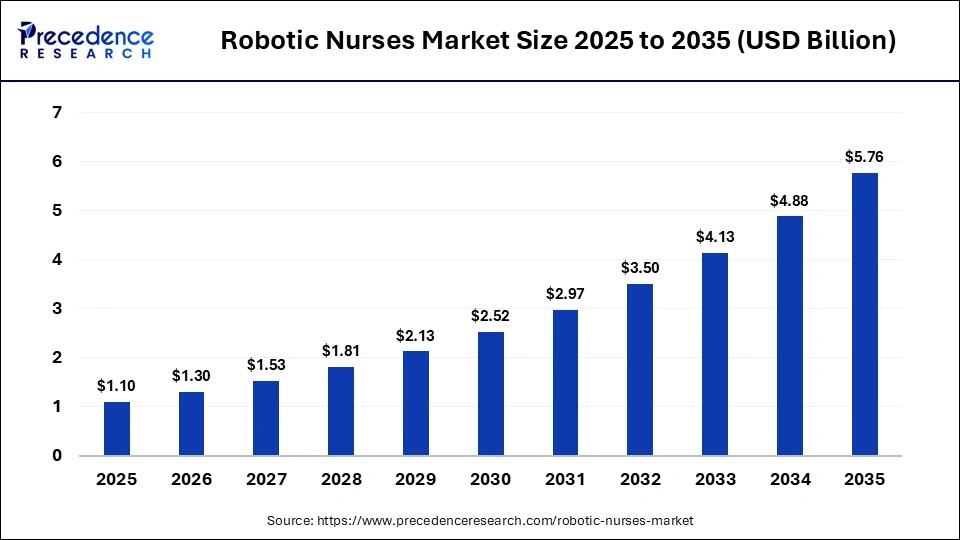

The global robotic nurses market size was calculated at USD 1.10 billion in 2025 and is predicted to increase from USD 1.30 billion in 2026 to approximately USD 5.76 billion by 2035, expanding at a CAGR of 18.00% from 2026 to 2035. The robotic nurses market is fueled by healthcare workforce shortage, the need for automation in hospitals, the growing geriatric population, and technological advancements in AI-based patient observation and assistance robotics.

Key Takeaways

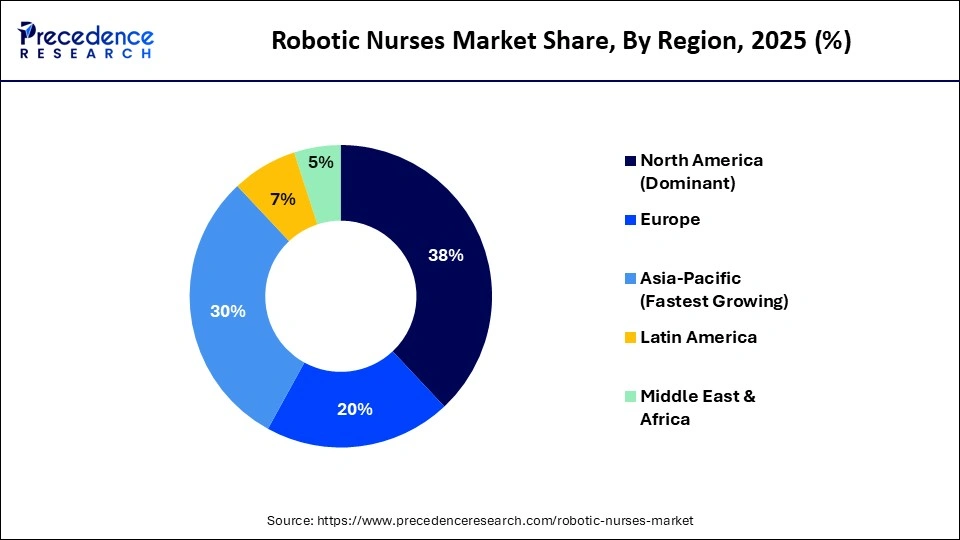

- North America led the robotic nurses market with the largest share of approximately 38% in the global market in 2025.

- Asia-Pacific is expected to grow at the highest CAGR of 18.2% during the forecast period.

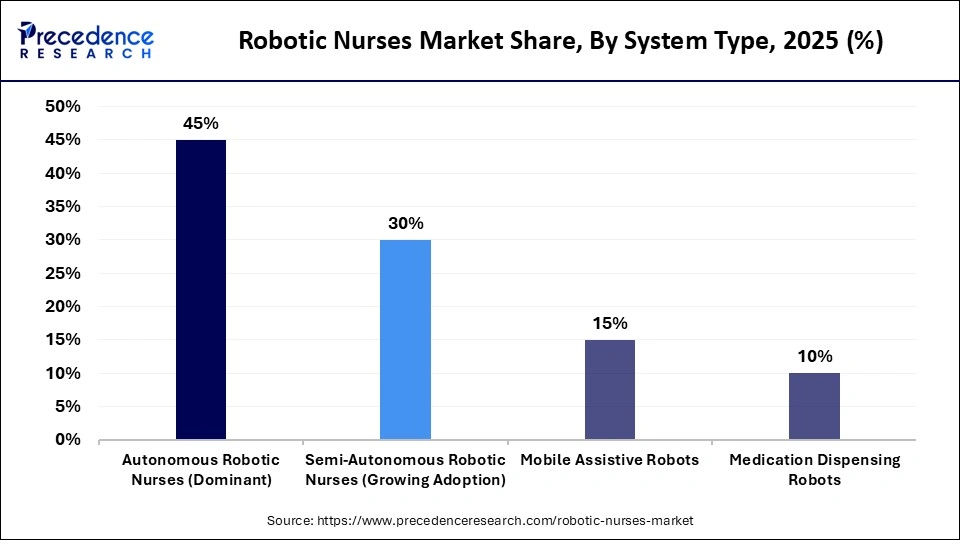

- By system type, the autonomous robotic nurses segment led the robotic nurses market and held approximately 45% share in 2025.

- By system type, the semi-autonomous robotic nurses segment is expected to grow at a notable CAGR of 16.2% during the forecast period.

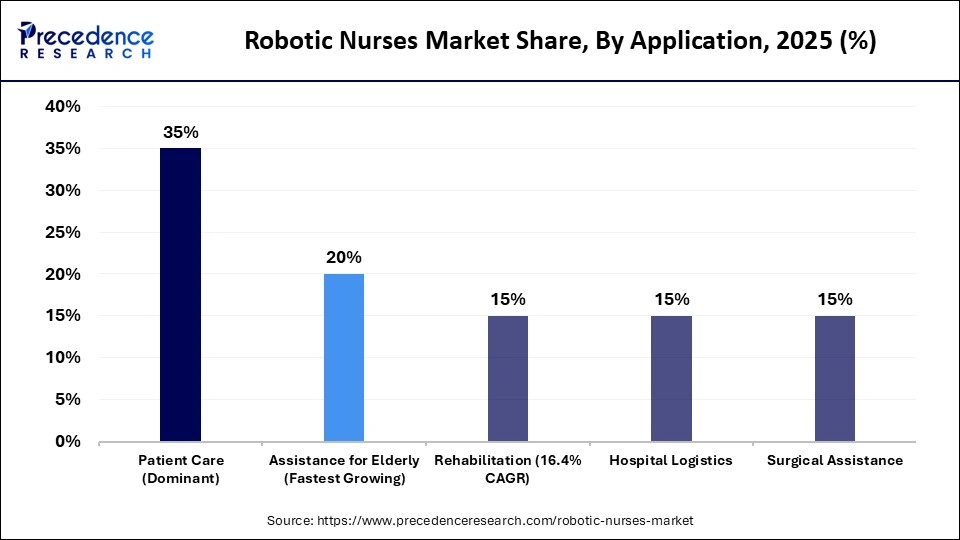

- By application type, the patient care segment dominated the market with approximately 35% share in 2025.

- By application type, the rehabilitation segment is expected to grow at the highest CAGR of 16.4% between 2026 and 2035.

- By end user type, the hospitals segment led the market with approximately 55% share in 2025.

- By end user type, the home care services segment is expected to grow at the fastest CAGR of 16.7% from 2026 to 2035.

What is the Robotic Nurses Market?

The market includes advanced robotic systems designed to assist healthcare professionals and support patient care through automation, logistics, monitoring, and interaction functions. These robots, ranging from autonomous mobile assistants to semi-autonomous and humanoid units, enhance care quality, reduce staff workload, and improve operational efficiency in hospitals and long term care settings. Rising healthcare automation, labor shortages, aging populations, and AI integration are key growth drivers, with adoption increasing across developed and emerging markets.

The robotic nurses market is driven by the use of sophisticated technologies such as autonomous mobile robotics (AMR), artificial intelligence, c, and sensor fusion systems.

These robots employ SLAM technology with LiDAR, depth cameras, and ultrasonic sensors to ensure safe movement in a dynamic hospital setting. AI-powered decision engines are used to control task prioritization, and natural language processing is used to enable communication with patients. Edge computing is used for real-time processing, and robotic arms with precision actuators are used for assisted mobility and support.

Technology Shifts in the Robotic Nurses Market?

The market is evolving from a state of basic programmed robots to smart and highly sophisticated AI-powered robots that have the capacity for decision-making and medical support with minimal human interference. The smart robotic nurses currently being developed can operate independently and navigate through crowded corridors without any human assistance. The recent trend is a shift from robots that perform single operations to those that offer multilateral services. For instance, modern robots can perform various functions such as deliveries, telepresence, and patient interaction.

Robotic Nurses Market Trends

- Collaborations & Partnerships: Robot development companies are collaborating with healthcare institutions to deploy AI-enabled robotic nurses in real hospital environments. These partnerships focus on automating medication delivery, patient monitoring, and logistics within the hospital. For instance, Diligent Robotics has partnered with several hospitals in the U.S for the deployment of its Moxi robot to assist the nursing staff in routine tasks and supply logistics.

- Government Initiatives: Governments are promoting the adoption of robotic technologies in healthcare to address workforce shortages and aging populations. Public health systems are funding pilot programs in hospitals and elderly care facilities. For example, Japan's Government has invested in the deployment of robotic nursing assistants in elderly care centers to improve long-term care efficiency.

- Business Expansions: Robotics companies are expanding their portfolio by adding AI interaction and telepresence capabilities in their robots. Companies are enhancing features such as mobility, patient engagement, and system integration. For instance, SoftBank Robotics extended the healthcare applications of its Pepper robot to support patient engagement and assistance in a clinical environment.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.10 Billion |

| Market Size in 2026 | USD 1.30 Billion |

| Market Size by 2035 | USD 5.76 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 18.00% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | System Type , Application,End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

System Type Insights

Why Did the Autonomous Robotic Nurses Segment Dominate the Robotic Nurses Market?

The autonomous robotic nurses segment led the market and held approximately 45% share in 2025. The market growth of this segment can be attributed to its capabilities of independent operations with minimal human interaction, thereby efficiently executing routine clinical and non-clinical operations. Robotic nursing solutions assist with operations such as medication administration, patient monitoring, and navigating through different areas of the hospital. The market growth of this segment is further driven by continued enhancement in AI, machine vision, and sensors, which result in safer and more reliable robotic solutions.

The semi-autonomous robotic nurses segment is expected to grow at the highest CAGR of 16.2% during the forecast period.The market growth of this segment is due to the balance it provides between human control and robotic efficiency. This segment supports healthcare workers with repetitive and time-consuming tasks. Many health facilities are adopting semi-autonomous systems because they are easier to integrate into clinical workflows and require lower regulatory complexity.

Application Type Insights

Why Did the Patient Care Segment Dominate the Robotic Nurses Market?

The patient care segment dominated the market with approximately 35% share in 2025. The market growth of this segment can be attributed to its direct clinical value in patient monitoring, medication administration, mobility assistance, and patient interaction. This segment boosts efficiency and reduces the workload on nursing staff. Also, an increased influx of patients and the need for constant monitoring of their health helped this segment gain more importance. The market growth of this segment is further driven by a rising focus on improving the quality of service and patient satisfaction.

The rehabilitation segment is expected to grow at the highest CAGR of 16.4% between 2026 and 2035. The market growth of this segment is due to rising demand for assisted rehabilitation programs and long-term therapy solutions. Physical rehabilitation is assisted by robotic nurses, as they help patients perform movements and provide therapy sessions. The increasing population share of the elderly and the rise in the number of patients suffering from strokes, spinal cord injuries, and orthopedic problems are responsible for the market growth of this segment. Robotic nursing solutions help improve the precision of therapy sessions and eliminate the need to continuously supervise patients during therapy sessions.

End User Type Insights

Why Did the Hospitals Segment Dominate the Robotic Nurses Market?

The hospitals  segment led the market and captured approximately 55% share in 2025. The market growth of this segment can be attributed to the rising need for workflow efficiency due to increasing patient influx. In hospitals, patients require continuous monitoring, medication administration, and mobility assistance, where a robotic nurse offers operational value. Hospitals have better financial capabilities to invest in advanced robots and the necessary infrastructure. The integration of hospital IT systems is also a key factor that supports the use of robots in hospitals.

The home care services segment is expected to expand at the highest CAGR of 16.7% from 2026 to 2035. The market growth of this segment is due to increasing preference for home-based treatment. The elderly population and patients with chronic diseases are growing, and this creates a need to continuously monitor them outside hospital settings. The robotic nurses in home care help with medication reminders, mobility assistance, and health monitoring. These robotic nurses help to minimize dependence on live-in caregivers and optimize healthcare costs.

Regional Insights

How Big is the North America Robotic Nurses Market Size?

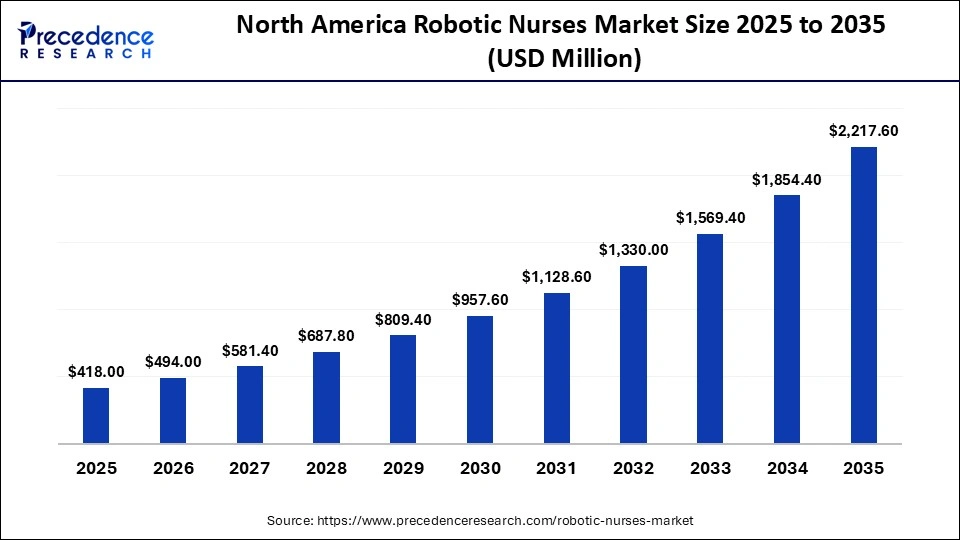

The North America robotic nurses market size is estimated at USD 418.00 million in 2025 and is projected to reach approximately USD 2,217.00 million by 2035, with a 2% CAGR from 2026 to 2035.

What Made North America the Leading Region in the Robotic Nurses Market?

North America led the robotic nurses market with the largest share of approximately 38% in the global market in 2025 due to well established healthcare infrastructure and the adoption of advanced medical technologies. This region has significant investments in healthcare robotics, AI, anddigital health technologies. Nursing shortages and high healthcare costs have compelled hospitals to adopt robotic nursing. Favorable regulatory norms and approval processes have helped the market growth in North America.

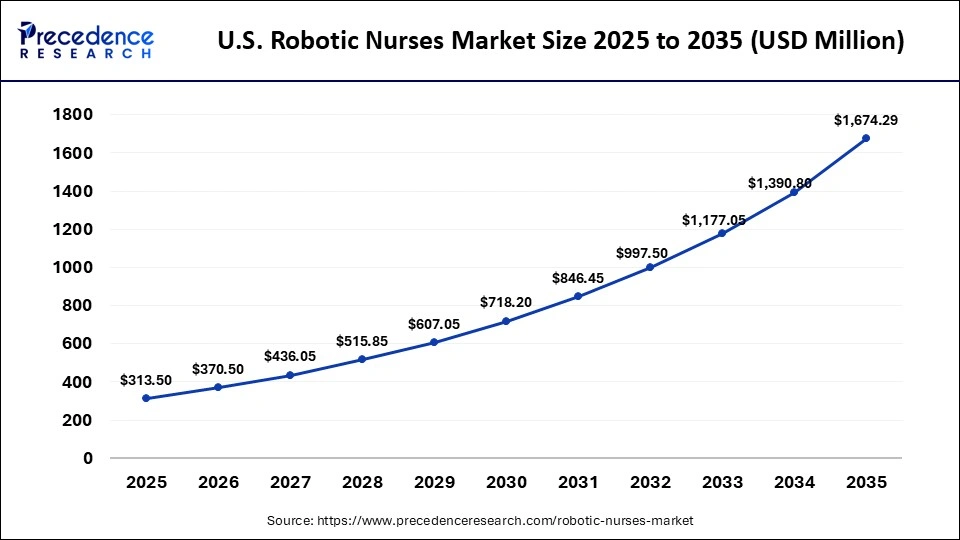

What is the Size of the U.S. Robotic Nurses Market?

The U.S. robotic nurses market size is calculated at USD 313.50 million in 2025 and is expected to reach nearly USD 1,674.29 million in 2035, accelerating at a strong CAGR of 2% between 2026 and 2035.

U.S Robotic Nursing Market Analysis

The U.S. led the market in North America due to its advanced healthcare infrastructure and high rate of technology adoption. Government, as well as private companies, have significantly invested in the development of healthcare automation, AI, and robotics technologies. This country has a significant presence of prominent medical device and robotics companies, which provide a strong platform for the development and launch of robotic technologies. Hospitals in the U.S are embracing robotic technologies to overcome nursing shortages and enhance operational efficiency.

Why is Asia Pacific the Fastest Growing Region in the Robotic Nurses Market?

Asia-Pacific is expected to grow at the highest CAGR of 18.2% during the forecast period due to the rapid expansion of healthcare infrastructure and increased investments in medical automation. The need to address the growing elderly population and the prevalence of chronic diseases is fueling the adoption of robotic care assistance. The governments of various nations in the Asia Pacific are focusing on the adoption of digital health technologies and AI-based technologies. The expansion of robotic manufacturing capacity in the region is another factor contributing to the growth of the market.

China Robotic Nursing Market Trends

China led the market growth in the Asia Pacific due to significant investments by the government in integrating robotics and AI technologies in healthcare. This country is highly invested in smart hospitals and medical robotics to cater to its rising aging population. Rapid growth in healthcare infrastructure and hospital modernization are the key factors driving market growth in China. This country has a high level of domestic manufacturing capacity in robotics, which makes it cheaper and more conducive to large-scale adoption.

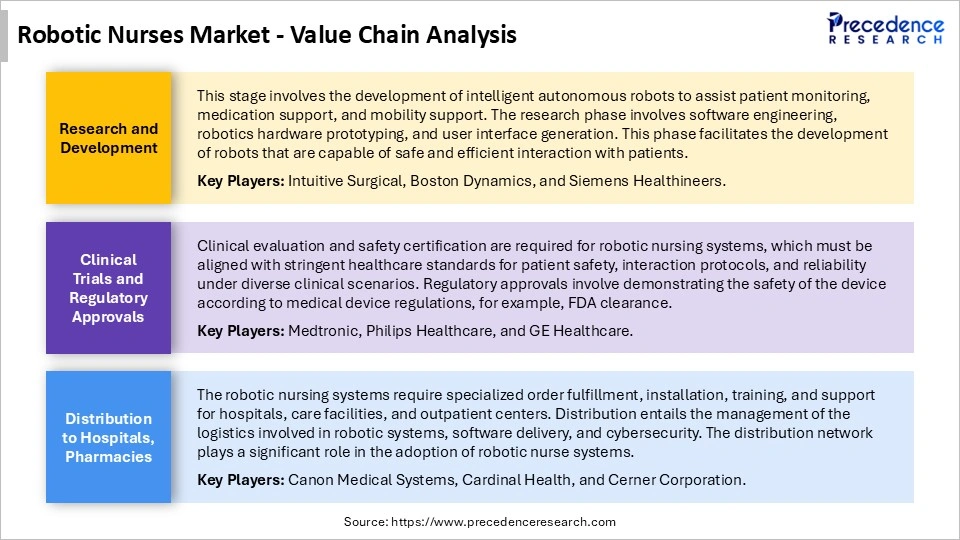

Robotic Nurses Market Value Chain Analysis

Robotic Nursing Market Market Companies

- Diligent Robotics

- SoftBank Robotics

- Toyota Motor Corporation

- Panasonic Corporation

- Aethon (ST Engineering Aethon)

- ABB Ltd.

- Intuitive Surgical, Inc.

- Cyberdyne Inc.

- Ekso Bionics

- ReWalk Robotics

- Hocoma AG

- Bionik Laboratories

- Savioke (Relay Robotics)

- Xenex Disinfection Services

- Blue Ocean Robotics

Recent Developments

- In April 2025, the National University Health System(NUHS) launched Missi Robot, a robotic nurse equipped with AI, which aims to monitor patients' vital organs. This robot also helps to dispense medication, guide patients, and support doctors during hospital rounds in its initial launch. (Source: https://www.straitstimes.com)

- In March 2025, Foxconn and Kawasaki Heavy Industries launched Nurabot, which is an AI-based robotic nursing assistant that aims to automate various medical tasks. This product automates the delivery of medication and the transportation of specimens. (Source: https://global.kawasaki.com)

Segments Covered in This Report

By System Type

- Autonomous Robotic Nurses

- Semi-Autonomous Robotic Nurses

- Mobile Assistive Robots

- Medication Dispensing Robots

By Application

- Patient Care

- Assistance for the Elderly

- Rehabilitation

- Hospital Logistics

- Surgical Assistance

By End User

- Hospitals

- Nursing Homes

- Home Care Services

- Healthcare Institutions

- Research & Educational Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting