What is the Sales Enablement Platform Market Size?

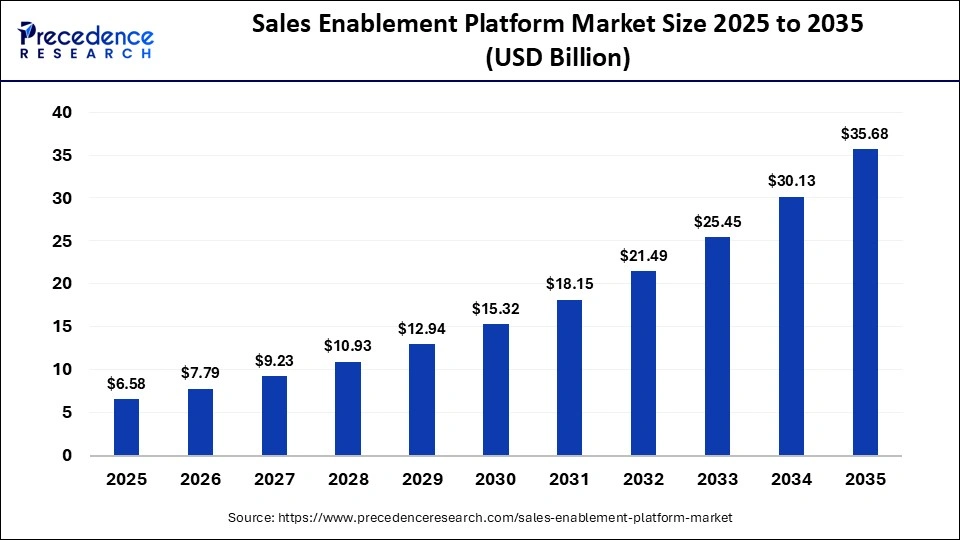

The global sales enablement platform market size was estimated at USD 6.58 billion in 2025 and is predicted to increase from USD 7.79 billion in 2026 to approximately USD 35.68 billion by 2035, expanding at a CAGR of 18.42% from 2026 to 2035. The sales enablement platform market is witnessing unprecedented growth, driven by the increasing integration of AI, analytics, and CRM systems.

Market Highlights

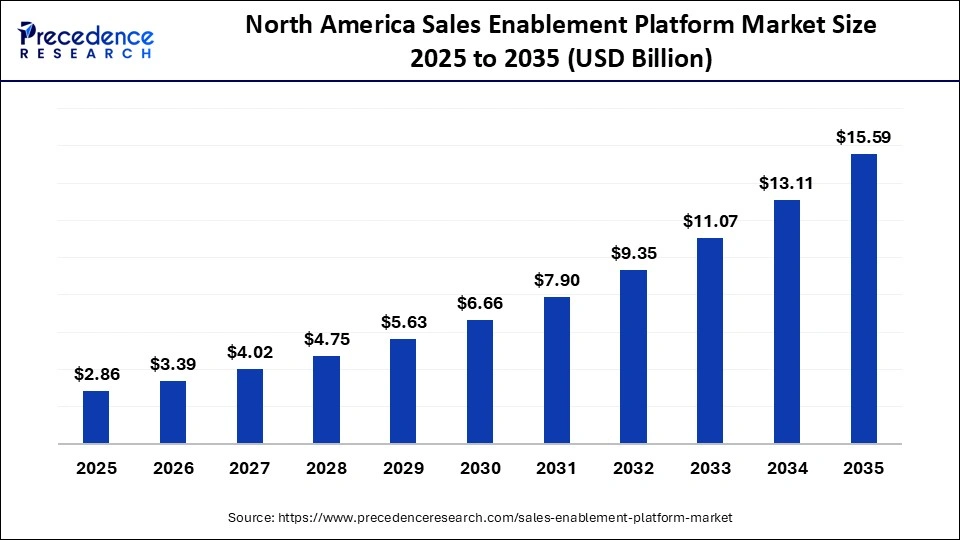

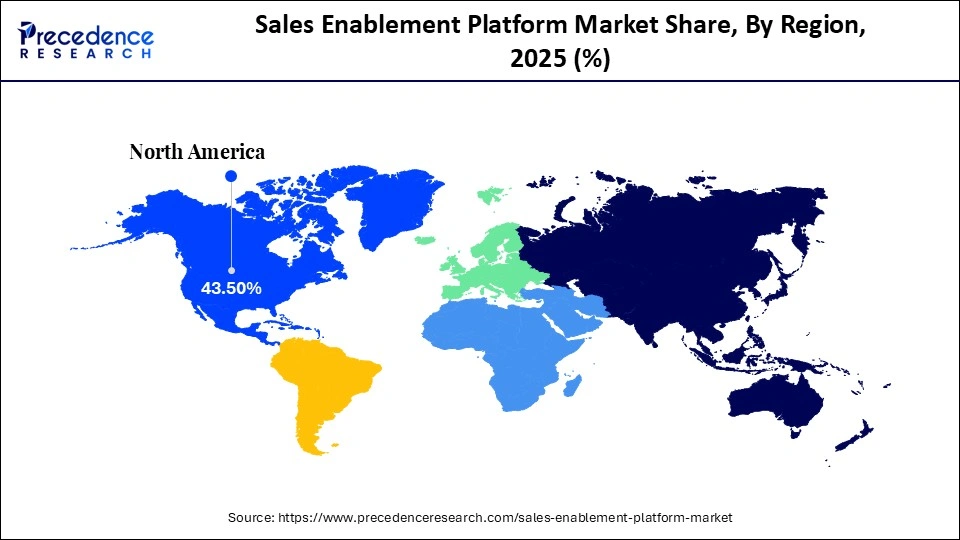

- North America dominated the market, holding the largest market share of 43.5% in 2025.

- The Asia-Pacific is expected to expand at the fastest CAGR of 15.5 between 2026 and 2035.

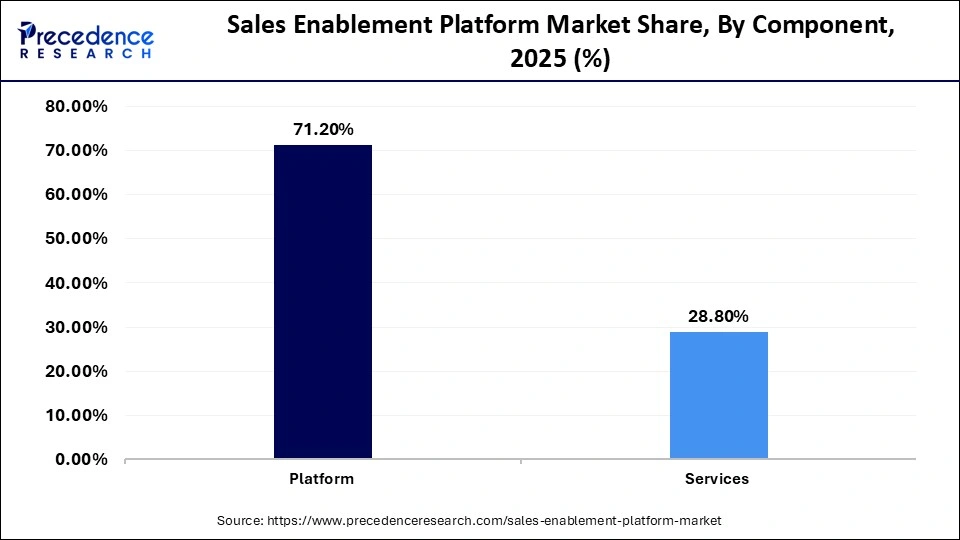

- By component, the platform segment accounted for the biggest market share of 71.2% in 2025.

- By component, the services segment is expected to grow at a remarkable CAGR of 14.7% between 2026 and 2035.

- By deployment mode, the cloud-based (SaaS) segment contributed the highest market share of 56.8% in 2025 and is growing at a healthy CAGR of 15.1% from 2026 to 2035.

- By end-user industry, the IT & telecom segment captured the largest market share of 44.5% in 2025.

- By end-user industry, the healthcare & life sciences segment is expanding at a remarkable CAGR of 4.3% between 2026 and 2035.

Sales Enablement Platform Market Overview

Sales enablement platforms equip sales teams with centralized access to content, training, coaching, and performance analytics that improve buyer engagement and support consistent revenue execution. These platforms act as a single system of record for marketing collateral, sales playbooks, product messaging, competitive intelligence, and learning modules, ensuring sellers receive the right guidance at each stage of the customer journey.

Integration with customer relationship management systems such as Salesforce and other enterprise sales tools allows organizations to align seller activity with pipeline data and buyer behavior. This integration enables granular measurement of how specific content assets, training interventions, and coaching actions influence deal progression, win rates, and sales cycle efficiency.

Most sales enablement solutions are deployed as cloud-based SaaS platforms, offering scalability, remote accessibility, and frequent feature updates. The market includes both core platform software and associated professional services such as implementation, content structuring, seller onboarding, and analytics configuration, which are particularly important for large and complex sales organizations.

How Are AI-Driven Innovations Reshaping the Sales Enablement Platform Market?

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is driving innovation and accelerating market growth in sales enablement platforms by enabling predictive analytics, enhancing automated workflows, and delivering personalized content recommendations. Leading enterprise sales organizations are increasingly adopting AI-driven workflows that automate content delivery, buyer engagement, and task management, allowing sales teams to operate with greater speed and precision. AI enables the creation of highly tailored buyer experiences by aligning messaging, timing, and content relevance with real-time buyer behavior.

The introduction of Natural Language Processing (NLP) and Machine Learning (ML) is personalizing seller training and supporting real-time content recommendations during customer interactions. Repetitive administrative tasks such as meeting summaries, data entry, CRM updates, and follow-up scheduling are being replaced by automation, allowing sellers to focus on higher-value, revenue-generating activities. Agentic AI supports autonomous execution, enabling systems to pursue defined objectives with minimal human intervention while maintaining alignment with sales strategy and governance controls.

According to Seismic's Generation Enablement Report, 92% of business leaders cite AI advancements as the primary driver behind increased investment in enablement technology. The ability to generate data-driven insights, automate repetitive tasks, and adapt in real time is strengthening sales productivity, enabling organizations to achieve more efficient revenue outcomes with leaner and more distributed sales teams.

Sales Enablement Platform Market Outlook

- Industry Growth Overview: Between 2025 and 2030, the industry is expected to experience accelerated growth. The growth of the market is driven by the growing demand for data-driven sales strategies, the rising shift towards remote and hybrid work models, increasing demand for personalized customer experiences, and the increasing need for automation in sales processes. Moreover, these platforms offer effective training, coaching, and onboarding tools for new and existing sales representatives to ensure teams are updated with the latest product information and modern sales techniques.

- Global Expansion: Several leading players in the sales enablement platform market are actively employing a wide variety of strategies to expand their global footprint, focusing on key high-growth regions. For instance, in July 2023, Highspot, the leading sales enablement platform that increases sales productivity, announced the launch of its India operations in Hyderabad. Highspot's expanded footprint enables the company to reinforce its commitment to innovation, agility, and helping customers worldwide drive predictable revenue growth.

- Major Investors: Several strategic investors and venture capital firms are actively engaged in the sales enablement platform market, including corporate venture arms and specialized VC firms. Major investors are increasingly focused on companies that integrate advanced analytics, AI, and CRM system capabilities to enhance sales performance and efficiency. Their investment accelerates market growth and drives innovation.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.58 Billion |

| Market Size in 2026 | USD 7.79 Billion |

| Market Size by 2035 | USD 35.68 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 18.42% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Deployment Mode, End-user Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Component Insights

What Causes the Platform Segment to Dominate the Sales Enablement Platform Market?

Platform: The segment accounted for the majority of the market share at 71.2% in 2025, as platforms offer unified and all-in-one functionality, enabling sales representatives to find the right resources and information without navigating multiple systems. These platforms also leverage AI and advanced analytics to provide valuable insights into sales performance, content management, and buyer behavior, which assist sales leaders in making informed and data-driven decisions to optimize sales processes. The use of platforms accelerates the onboarding of new sales representatives and facilitates continuous skill development through real-time feedback and performance tracking, thereby improving sales outcomes.

Services: This segment is expected to grow at a remarkable CAGR of 14.7% between 2026 and 2035, as services are increasingly deployed to address the rising complexity associated with generative AI adoption and more sophisticated sales models. As sales organizations integrate AI-driven content recommendations, predictive analytics, and automated coaching into their workflows, the need for specialized services to design, configure, and govern these systems continues to increase. Sales models are also shifting toward remote and hybrid operating structures, where distributed teams rely heavily on virtual engagement, digital content, and data-led decision-making. Professional services play a critical role in helping organizations adapt to these models by providing expertise in platform integration, data architecture, change management, and AI-enabled sales process redesign.

Deployment mode Insights

Which Segment Is Dominated by Deployment Mode in the Sales Enablement Platform Market?

Cloud-Based (SaaS): This segment is dominating the sales enablement platform market by holding a majority share of 56.8%, supported by its cost efficiency, scalability, and operational flexibility. SaaS-based solutions allow organizations to deploy and scale sales enablement capabilities rapidly without the infrastructure constraints associated with on-premise systems, making them well suited for dynamic and distributed sales environments.

Growth in this segment is expected to be the fastest during the upcoming forecast period, where the cloud-based (SaaS) applications are set to see a 15.1% CAGR, driven by seamless integration with customer relationship management systems such as Salesforce, enabling unified access to sales content, buyer insights, and performance analytics within existing sales workflows. The subscription-based, pay-as-you-go pricing model eliminates high upfront capital expenditure on hardware, installation, and ongoing maintenance, which significantly lowers the barrier to adoption for small and medium-sized enterprises.

End-user industry Insights

What Has Led the IT & Telecom Segment to Dominate the Sales Enablement Platform Market?

IT & Telecom: This segment is dominating the sales enablement platform market with a 44.5% share, owing to its commitment to leveraging these platforms to enhance the overall efficiency and productivity of the sales teams. As a technology-centric sector, IT & telecom companies are the earliest adopters of advanced analytics, data-driven strategies, and CRM integrations. Sales enablement platforms in this sector empower sales teams with analytics on content engagement and buyer behavior, allowing for a more targeted sales approach.

Healthcare & Life Sciences: On the other hand, the healthcare & life sciences segment is the fastest-growing in the sales enablement platform market with a 14.3% expected CAGR. The healthcare & life sciences industry is increasingly focusing on leveraging data analytics to measure sales performance and content effectiveness. Sales enablement platforms in the industry assist in tracking buyer engagement and empowering sales teams to make informed decisions and optimize their sales-driven strategies. Healthcare and life sciences products are often complex, which increases the need for highly specialized sales expertise to explain to highly informed customers like healthcare professionals.

Regional Insights

How Big is the North America Sales Enablement Platform Market Size?

The North America sales enablement platform market size is estimated at USD 2.86 billion in 2025 and is projected to reach approximately USD 15.59 billion by 2035, with a 18.48% CAGR from 2026 to 2035.

What Has Led the North America Region to Dominate the Sales Enablement Platform Market?

North America dominates the sales enablement platform market, holding a 43.5% market share in 2025, supported by a highly mature digital ecosystem and strong cloud adoption across enterprises of all sizes. High penetration of cloud infrastructure enables organizations to deploy advanced sales enablement tools at scale, supporting distributed sales teams and complex, multi-channel selling models.

The region is a clear leader in the early adoption of sophisticated technologies such as Artificial Intelligence (AI), Machine Learning (ML), and cloud computing for sales operations. Enterprises across the United States and Canada are actively integrating AI-driven analytics, content intelligence, and automated coaching into sales workflows to improve forecasting accuracy, buyer engagement, and seller productivity. Seamless integration with established CRM platforms such as Salesforce further strengthens adoption by embedding enablement directly into daily sales activities.

What is the Size of the U.S. Sales Enablement Platform Market?

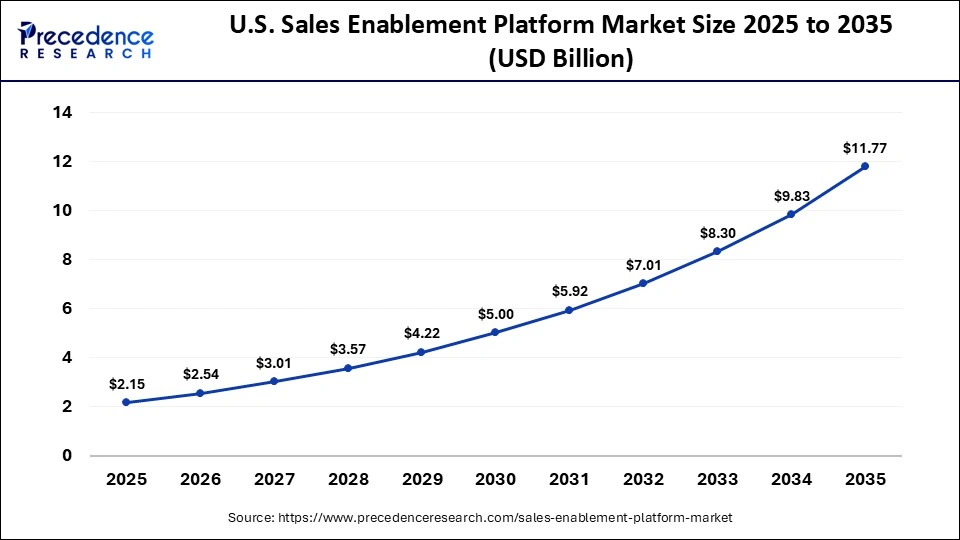

The U.S. sales enablement platform market size is calculated at USD 2.15 billion in 2025 and is expected to reach nearly USD 11.77 billion in 2035, accelerating at a strong CAGR of 18.53% between 2026 and 2035.

How Is the United States Transforming the Sales Enablement Platform Market?

The United States is transforming the sales enablement platform market, driven by the strong digital infrastructure, rise of remote and hybrid work models, early adoption of advanced technology like AI and cloud, and growing demand across various industries. The United States is a major contributor to the sales enablement platform market in the North American region. The country is home to leading vendors and the presence of a significant number of large enterprises that focus on digital transformation to enhance sales operations. Moreover, the rising use of data analytics to refine sales and boost marketing efforts is driving the market's growth during the forecast period.

How Is the Asia Pacific Region the Fastest-Growing in the Sales Enablement Platform Market?

Asia Pacific is the fastest-growing region in the sales enablement platform market, holding a 15.5% market share, driven by the expanding presence of global and regional platform providers and rising demand for AI-driven and cloud-based sales enablement solutions. Organizations across the region are increasingly prioritizing data analytics to support decision-making, sales forecasting, and performance measurement, which is accelerating adoption of integrated enablement platforms. Countries such as China, India, Japan, and South Korea are strongly focused on digital transformation across enterprise operations, including sales and customer engagement functions.

The rapid adoption of cloud infrastructure across Asia Pacific further supports market growth by enabling scalable deployment of sales enablement platforms across geographically distributed teams. Seamless integration with CRM systems and collaboration tools is becoming a key requirement as organizations seek unified visibility into customer interactions and sales performance. This shift is increasing demand for advanced tools that improve seller productivity, enable data-driven sales strategies, and support real-time content delivery aligned with buyer behavior.

China's Sales Enablement Platform Market Analysis

The country is experiencing significant growth. The country is rapidly undergoing a digital transformation, with favorable government initiatives and a vibrant tech ecosystem encouraging the adoption of AI-driven and cloud-based sales enablement solutions. The rapid industrialization, expanding e-commerce ecosystems, and increasing presence of SaaS startups and Small and Medium-sized Enterprises (SMEs) in the country are driving the market's growth during the forecast period.

Is the European Region Responsible for Growth in the Sales Enablement Platform Market?

The European region holds a substantial share in the sales enablement platform market, supported by steady adoption across both large enterprises and small and medium-sized businesses. Countries such as Germany, France, and the United Kingdom are leading adopters of cloud computing, Artificial Intelligence (AI), and Machine Learning (ML) within sales operations to automate routine tasks, enhance seller productivity, and optimize sales strategies for competitive differentiation.

Regional growth is underpinned by Europe's robust digital infrastructure and a supportive regulatory and policy environment that encourages secure cloud adoption and enterprise digital transformation. High standards for data protection and compliance are driving organizations to invest in enterprise-grade sales enablement platforms that offer controlled data access, analytics transparency, and secure CRM integration.

The increasing shift toward mobile-first sales tools, alongside the sustained rise of remote and hybrid work models, is further strengthening demand. Distributed sales teams across Europe require consistent access to content, training, and performance insights regardless of location.

Germany Sales Enablement Platform Market Analysis

The German sales enablement platform market is experiencing significant growth. Several businesses across the industry are increasingly focusing on leveraging sales tools to automate sales processes, improve sales representative performance, and boost customer engagement. The growth is largely driven by the rapid technological advancements, growing adoption of cloud-based solutions, increasing shift in remote and hybrid work models, increasing focus on customer experience management, and rising demand in various industries such as IT & Telecom, BFSI, healthcare & life sciences, retail & e-commerce, and manufacturing.

What Are the Significant Factors Driving the Growth of the Middle East & Africa Region in the Sales Enablement Platform Market?

The sales enablement platform market is expected to grow at a notable pace in the Middle East & Africa region, supported by accelerating digital transformation across sales and customer engagement functions. Organizations are increasingly adopting data analytics to inform decision-making, improve pipeline visibility, and optimize sales strategies, which is driving demand for integrated sales enablement solutions.

Rising emphasis on personalized buyer experiences is another key driver. Businesses across multiple industries are deploying sales enablement platforms to better understand customer behavior, tailor content and messaging, and improve engagement across increasingly digital sales journeys. Seamless integration with CRM systems is becoming a critical requirement, enabling unified tracking of customer interactions, sales activities, and performance metrics.

The South African Sales Enablement Platform Market Analysis

The country is experiencing remarkable growth. The country's growth is driven by significant investment in digital infrastructure, a surge in remote and hybrid work models, an increasing shift to marketing automation, an increasing shift in data analytics and performance insights, and the emergence of advanced technology, such as AI, ML, and cloud services. In addition, the country's growth is propelled by the growing adoption of cloud-based SaaS models among small and medium enterprises (SMEs), along with the supportive government policies & initiatives that are expected to drive the expansion of the sales enablement platform market in the coming years.

Key Players in the Sales Enablement Platform Market

- Seismic

- Highspot

- Showpad

- Outreach

- SalesLoft

- Mindtickle

- Allego

- Mediafly

- Salesforce

- HubSpot

- Groove

- Brainshark

- ClearSlide

- Showell

- SmartWinnr

Recent Developments

- In August 2025, InsureMO, the world's leading insurance middleware platform, and LifeCheq, South Africa's largest advisor enablement platform, announced a strategic partnership to transform insurance distribution across Asia and Africa. The collaboration seeks to build high-performing agency forces equipped with better products, new sales methods, and integrated platforms. By addressing challenges like poor lead quality, outdated systems, and heavy administrative workloads, the partnership promises a customer-focused and scalable model for insurance sales.(Source: https://fintech.global)

- In March 2025, Mindtickle, the leading AI-powered revenue enablement platform, announced new AI innovations designed to help sales teams sell smarter, coach more effectively, and drive measurable revenue impact. With AI capabilities designed for sellers, sales managers, and enablement teams, Mindtickle delivers real-time guidance, task automation, and deal-winning insights to power top-performing sales teams.(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Component

- Platform

- Services

By Deployment Mode

- Cloud-based (SaaS)

- On-premises

- Hybrid

By End-user Industry

- IT & Telecom

- BFSI

- Healthcare & Life Sciences

- Retail & E-commerce

- Manufacturing

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting