Transmission Sales Market Size and Forecast 2025 to 2034

The global transmission sales market size was estimated at USD 18.41 billion in 2024 and is predicted to increase from USD 19.44 billion in 2025 to approximately USD 31.66 billion by 2034, expanding at a CAGR of 5.57% from 2025 to 2034. The transmission sales market is driven by a growing need for commercial vehicles for automatic transmissions.

Transmission Sales Market Key Takeaways

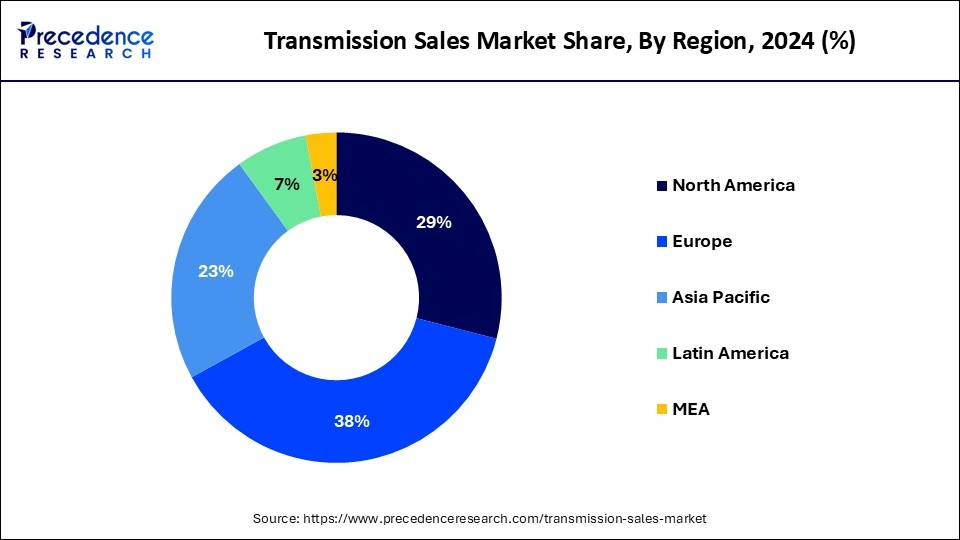

- Europe dominated the transmission sales market with largest revenue share of 38% in 2024.

- Asia- Pacific is the fastest growing market during the forecast period.

- By type, the reciprocating segment dominated the transmission sales market in 2024.

- By type, the rotatory segment is observed to be the fastest growing market during the forecast period.

- By application, the artificial lift segment dominated the transmission sales market in 2024.

- By end-user, the oil & gas segment dominated the transmission sales market.

- By end-user, the power generation segment is observed to be the fastest growing market during the forecast period.

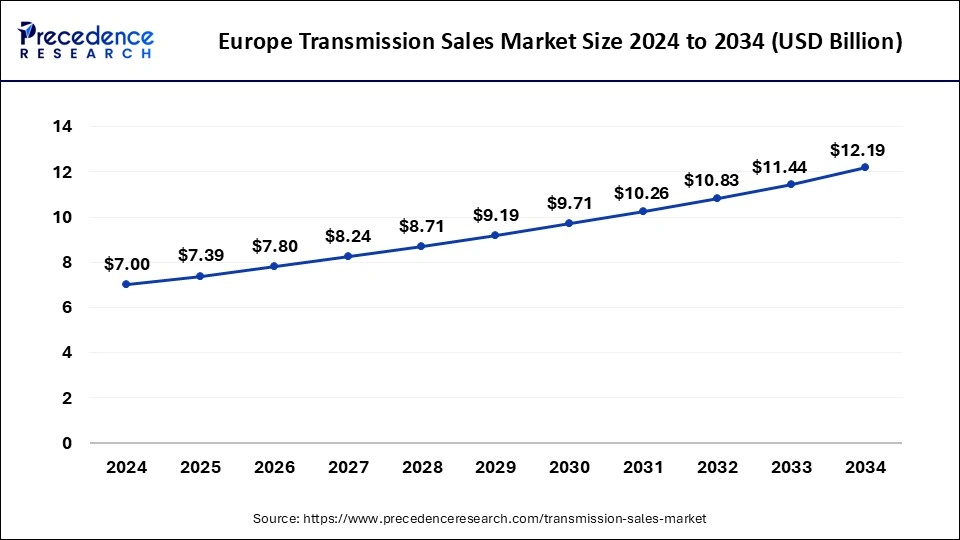

Europe Transmission Sales Market Size and Growth 2025 to 2034

The Europe transmission sales market size was estimated at USD 7.00 billion in 2024 and is predicted to be worth around USD 12.19 billion by 2034 with a CAGR of 5.70% from 2025 to 2034.

Europe had its largest market share in 2024 in the transmission sales market. Since the Industrial Revolution, Europe has had a long history of engineering and industry. Early adopters of mechanization, nations that includes Germany, France, and the United Kingdom established robust industrial bases that included the production of machinery and auto parts like transmissions. Its historical legacies made Europe's dominant position in the transmission sales industry possible. The range of solutions European transmission manufacturers offer is tailored to suit different vehicle segments and applications.

Whether for off-highway equipment, luxury cars, commercial trucks, or tiny cars, they have transmission systems designed to fit specific requirements. Their ability to appeal to a wide range of customers enables them to gain a greater market share.

Asia-Pacific is the fastest growing transmission sales market during the forecast period. Asia-Pacific's automotive industry is expanding at a rate never seen before, due to shifting consumer tastes, growing disposable incomes, and government programs that support renewable energy and electric cars (EVs). The need for conventional and electric transmissions is rising as automakers increase output to keep up with the demand. There is a significant need for heavy gear and equipment due to infrastructure initiatives, especially in developing nations such as India and Southeast Asia, which all depend on reliable transmission lines. The transmission sales market in the region receives substantial contributions from the mining, construction, and agricultural sectors.

Market Overview

The area of the economy that deals with the purchase and sale of transmission systems is known as the transmission sales market. Usually, these systems are associated with vehicles, machines, or other equipment that transfers power from an engine or motor to its wheels, gears, or other parts. A variety of parts, including gearboxes, axles, drive shafts, clutches, and differentials, are included in these systems.

Sales of transmissions make up a sizeable portion of the global market for automotive and industrial components. To meet the global need for transmissions, manufacturers and suppliers in this industry are essential. They make money by selling transmission systems and associated components. A vital part of many industrial machinery and equipment is transmission systems. These systems make transferring power and motion easier, allowing machinery to operate in production operations and building projects.

Transmission Sales Market Growth Factors

- Growing activity in the gas and oil industry, especially in shale gas production.

- Creation of novel, more effective transmission technologies, such as gears, chains, and belts.

- In the long term, the market for traditional transmission sales may face challenges from the increasing popularity of electric vehicles.

- Low operating costs connected to transmission networks.

- Expanding manufacturing operations that depend on adequate transmission infrastructure.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 19.44 Billion |

| Market Size by 2034 | USD 31.66 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.57% |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Innovations in transmission technology

Manufacturers increasingly use cutting-edge materials and creative design approaches for transmission components to create lighter, more compact cars. Lightweight materials like aluminum, magnesium, and sophisticated composites are used instead of typical steel parts to reduce weight and increase fuel economy. Furthermore, transmission systems may be integrated into small spaces thanks to modular architectures and compact designs, which makes it possible to construct cars that are more maneuverable and smaller without sacrificing functionality or performance.

Fluctuations in fuel prices influence consumer preferences

The global economic environment, which is impacted by supply and demand dynamics, geopolitical conflicts, and governmental policies, is intimately linked to fuel prices. As fuel prices rise, consumers seek more fuel-efficient solutions because they must pay more to operate their automobiles. In contrast, buyers may choose performance and larger automobiles over fuel efficiency with reduced fuel prices.

Restraint

Restrictions on the export of certain transmission technologies or products

Export controls may make it difficult for suppliers or producers of transmission technology to enter some overseas markets. This restriction on market reach may limit revenue opportunities by impeding the opportunity for sales growth and territory expansion. Geopolitical unrest or international economic conflicts can occasionally lead to export restrictions. Under such circumstances, sales of transmission technology might get mixed up in more general political disputes, which would raise market uncertainty and volatility. Companies could struggle to manage these intricacies and keep their sales channels steady. This restricts the growth of the transmission sales market.

Opportunities

Increasing adoption of renewable energy sources

It takes advanced transmission systems that can handle sporadic power generation and supply variations to integrate renewable energy into the grid. In contrast to conventional fossil fuel-based power plants, renewable energy sources are impacted by daylight changes and meteorological conditions. To preserve grid stability and balance supply and demand in real time, this unpredictability calls for sophisticated transmission technologies, such as smart grids, energy storage systems, and grid interconnections.

Favorable regulatory policies and government incentives

Renewable energy sources like solar and wind power are becoming increasingly important to many governments worldwide. To link these sources to the grid, though, they frequently need a sizable transmission infrastructure, mainly if they're situated in remote locations. Encouraging regulatory policies can expedite the permitting process for new transmission lines, thereby simplifying the grid connection process for renewable energy projects. The need for transmission services and equipment is therefore increased as a result. Governments prioritize energy efficiency measures to lower overall energy usage, in addition to attempts to boost the penetration of renewable energy.

A vital component of these efforts is upgrading the transmission infrastructure to reduce transmission losses and boost effectiveness. Policies that encourage the installation of energy-efficient transmission infrastructure, such as high-voltage transmission lines or sophisticated grid management systems, can influence demand within an industry. This opens the scope for the growth of the transmission sales market.

Type Insights

The reciprocating segment dominated the transmission sales market in 2024. Advances in design and engineering have significantly increased the efficiency and performance of reciprocating segments. Manufacturers have created cutting-edge technologies to improve these components' total efficiency and performance, including precise machining, optimum materials, and sophisticated lubrication systems. Reciprocal portions can transmit electricity at higher levels, reducing energy losses and wear and tear.

The rotatory segment is the fastest growing in the transmission sales market during the forecast period. Rotatory transmissions are incredibly flexible and can be used in various vehicles, such as off-road vehicles, commercial trucks, and passenger cars. Because of its adaptability, manufacturers can include rotary gearboxes in multiple cars, meeting the needs of different consumer demographics and market niches. Market trends show consumers are becoming more interested in cars with cutting-edge transmission systems that deliver better performance and fuel economy. The category's growth is driven by consumers' growing inclination towards vehicles with rotary gearboxes as they become more discriminating and ecologically sensitive.

Application Insights

The artificial lift segment dominated the transmission sales market in 2024. Manufacturers, suppliers, and service providers make up the strong service and support infrastructure that underpins the artificial lift market. By minimizing operational disruptions and optimizing uptime, this ecosystem makes sure that artificial lift systems are installed, maintained, and optimized on schedule. Artificial lift solutions' value proposition is further strengthened by the availability of extensive aftermarket services, which solidifies their leadership in the transmission sales market.

Artificial lift systems are more economically advantageous to implement than alternative techniques. Even while the initial outlay may be greater, the long-term financial advantages, such as higher production rates and longer lifespans, outweigh the outlay. Artificial lift systems are used by operators for performance optimization because of their large return on investment (ROI).

End-user Insights

The oil & gas segment dominated the transmission sales market in 2024. The materials carried out make oil and gas transmission systems frequently subject to criteria. They must endure corrosive environments, high pressure, harsh temperatures, and other difficult circumstances. Because of this, the sector is in great demand for specialized transmission equipment such as pipes, valves, pumps, and compressors that are made to meet these needs. Oil and gas operations now operate with more efficiency, safety, and dependability thanks to advancements in transmission technology.

Technological advances constantly improve the industry's transmission infrastructure, from cutting-edge monitoring and control systems to creative pipeline materials and construction methods. Consequently, to maintain their market supremacy, oil and gas corporations prioritize investments in state-of-the-art transmission solutions.

The power generation segment is the fastest growing in the transmission sales market during the forecast period. Globally, there is a growing demand for power as economies and populations expand. Modern technologies, industrialization, and urbanization are driving up demand for electricity in emerging economies. The electricity generation infrastructure needs to be updated and expanded to meet the increased demand. Many areas are updating and modernizing their aging electricity systems to increase resilience, efficiency, and dependability. Substations, new transmission lines, and other infrastructure installations fall under this category.

Higher capacity, renewable energy sources, and cutting-edge technologies like smart grids and digital monitoring systems are all built into modern grid architecture. As a result, new transmission equipment is needed to help with these modernization initiatives.

Transmission Sales Market Companies

- Caterpillar, Inc.

- GE

- Siemens

- Gazprom

- Cummins

- Atlas Copco

- HMS Group

- Mitsubishi Heavy Industries

- Toshiba

- Emerson

Recent Developments

- In January 2024, Kia India, a leading premium carmaker, embarked on five new Seltos 6-speed manual transmission variants in Tech line trims featuring diesel engine options. Starting at INR 11,99,900 (Ex-showroom) across India, Seltos now comes with 24 variants, offering its discerning customers the most extensive range of drive options.

Segments Covered in the Report

By Type

- Reciprocating

- Rotatory

- Centrifugal

- Axial Flow

By Application

- Artificial Lift

- Gas Processing Station

- LNG & FPS

- Storage & Facilities

- Others

By End-user

- Oil & Gas

- Power Generation

- Water and Wastewater Management

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting