What is the Sales Training Software Market Size?

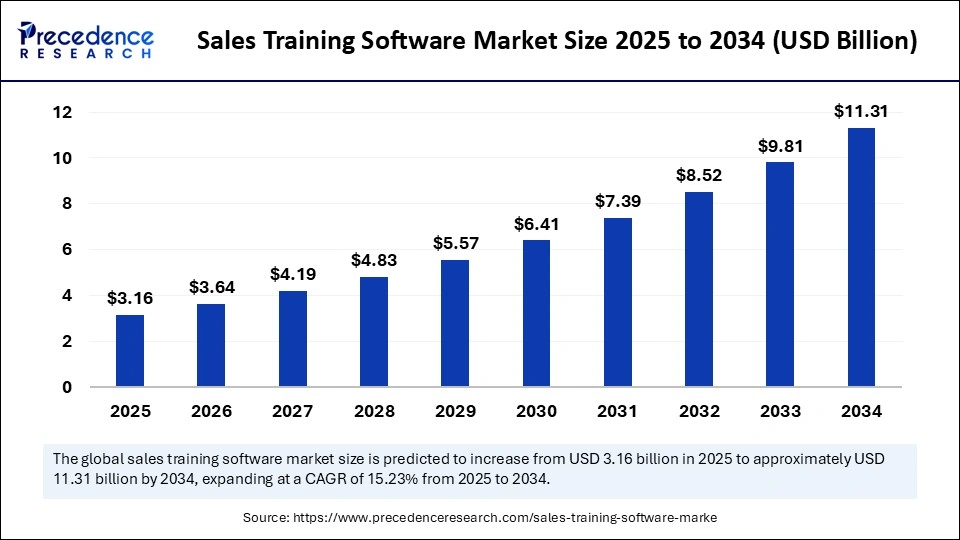

The global sales training software market size accounted for USD 3.16 billion in 2025 and is predicted to increase from USD 3.64 billion in 2026 to approximately USD 11.31 billion by 2034, expanding at a CAGR of 15.23% from 2025 to 2034. The market's growth is driven by the shift to remote and hybrid work models, the adoption of advanced AI solutions for sales teams, and the demand from emerging companies for comprehensive yet cost-effective training platforms.

Market Highlights

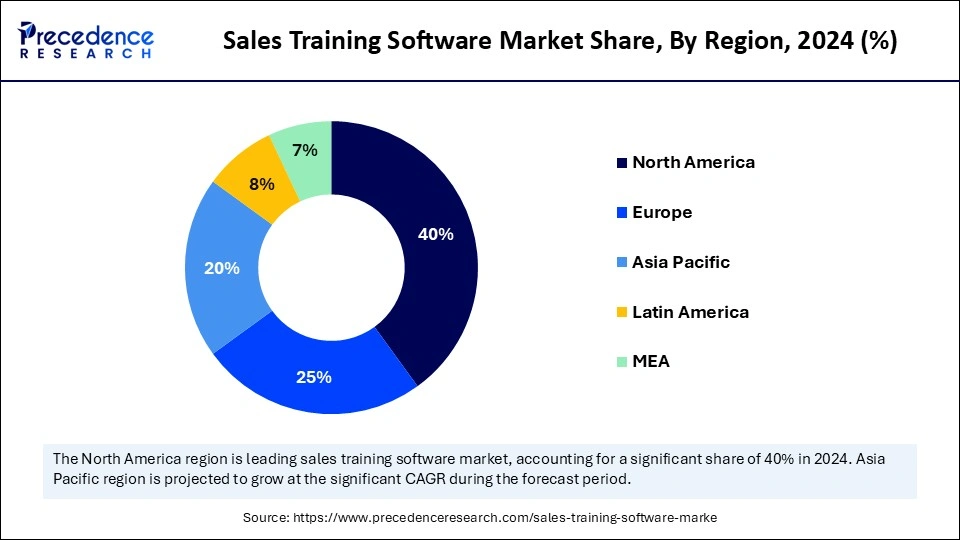

- North America accounted for the largest market share of 40% in 2024.

- The Asia Pacific is expected to grow the fastest CAGR from 2025 to 2034.

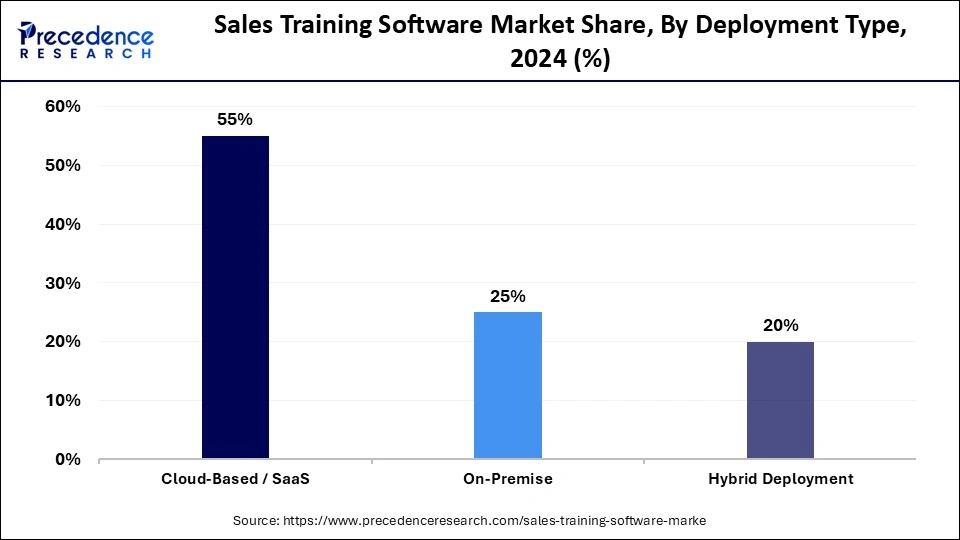

- By deployment type, the cloud-based / SaaS segment held the largest market share of 55% in 2024.

- By deployment type, the hybrid deployment segment is growing at the fastest CAGR between 2025 and 2034.

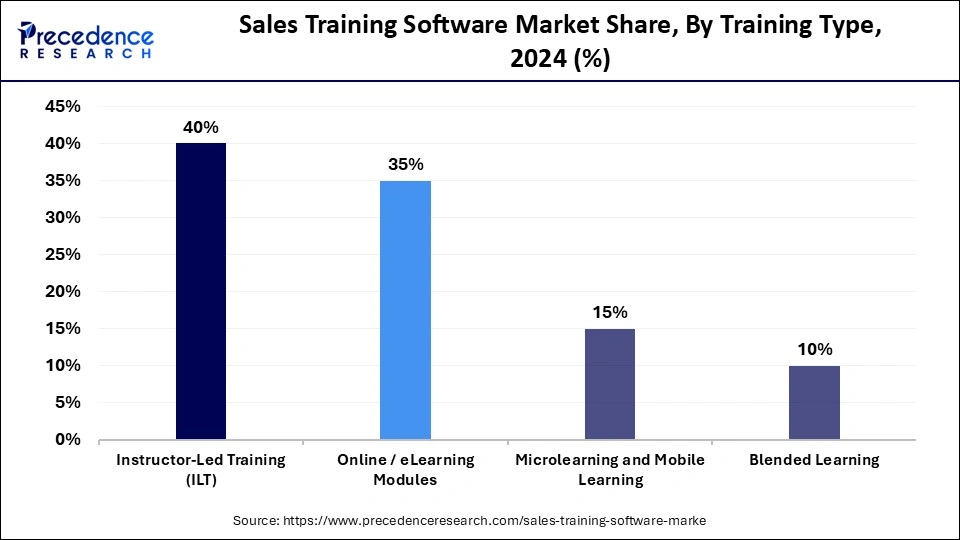

- By training type, the instructor-led training (ILT) segment contributed the highest market share of 40% in 2024.

- By training type, the microlearning & mobile learning segment is expanding at a significant CAGR from 2025 to 2034.

- By software type / functionality, the learning management system (LMS) integrated segment held the major market share of 45% in 2024.

- By software type, the sales enablement & performance tracking tools segment is expected to grow at a notable CAGR from 2025 to 2034.

- By end user, the large enterprises segment captured the biggest market share of 50% in 2024.

- By end user, the SMEs segment is expected to experience the fastest growth from 2025 to 2034

Defining Sales Training Software: Features, Use-Cases & Benefits

Sales training software refers to digital platforms and applications designed to enhance the skills, knowledge, and performance of sales teams within organizations. These solutions provide structured training programs, interactive modules, simulations, role-playing exercises, assessments, and analytics to improve sales effectiveness, onboarding efficiency, product knowledge, and customer engagement. The software is widely used across industries, including IT, retail, healthcare, financial services, and manufacturing, and supports both in-person and remote learning environments. Sales Training Software often integrates with Customer Relationship Management (CRM) systems and Learning Management Systems (LMS) to track progress, measure performance, and deliver personalized learning experiences.

From Static Modules to AI-Powered Coaching: The Evolution of Sales Training Software

The integration of artificial intelligence is profoundly transforming the sales training software market, shifting it from a fixed, one-size-fits-all model to a dynamic, data-driven, and personalized system. AI enables sales teams to train more efficiently by automating tasks, providing real-time feedback, and simulating real-world scenarios, ultimately shortening the sales cycle and boosting productivity. Unlike generic training models, AI can analyze the performance of individual salespeople and create customized learning paths. The software adjusts learning pace, content, and difficulty according to each person's abilities, from basic modules to complex negotiation skills. This level of customization allows organizations to upskill every team member effectively, ensuring higher-level competencies across the board.

Sales Training Software Market Outlook

The sales training software market is expanding due to the increasing shift toward remote and hybrid work models, which demand scalable, accessible, and cloud-based training solutions. The adoption of advanced technologies like AI and ML enables highly personalized learning experiences and data-driven insights. As a result, many organizations are investing in upskilling and reskilling their sales teams to stay aligned with evolving market needs.

Investments in sales training software come from venture capital, private equity, and corporate investors. Venture capital funding is particularly crucial for startups with innovative solutions, such as Mindtickle, which has secured significant funding. Large firms like Salesforce also engage in strategic collaborations and acquisitions of startups to expand their global reach.

The startup ecosystem in the market is vibrant and highly active, featuring specialized platforms and enablement tools. AI-driven platforms like Second Nature AI offer hyper-realistic training solutions, incorporating microlearning and gamification. The Asia Pacific region, particularly India, has emerged as a major growth hub, hosting startups such as Mindtickle, WorkRamp, Sales Impact Academy, and Second Nature AI.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.16 Billion |

| Market Size in 2026 | USD 3.64 Billion |

| Market Size by 2034 | USD 11.31 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.23% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Deployment Type, Training Type, Software Type / Functionality, End-User / Customer Segment, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Sales Training Software Market Segment Insights

Deployment Type Insights

The cloud-based segment dominated the market with the largest share of 55% in 2024. This dominance is attributed to its high flexibility, scalability, accessibility, and cost-effectiveness. The cloud-based software-as-a-service (SaaS) model aligns well with the growing need for continuous sales training. With sales teams often spread across multiple locations and working remotely, cloud-based software provides anytime, anywhere access, allowing professionals to complete small training modules without disrupting their schedules.

The hybrid deployment segment is expected to grow at the fastest CAGR over the forecast period. This is primarily due to its ability to combine the benefits of on-premises and cloud-based models, offering enhanced flexibility and cost efficiency. A hybrid approach enables a customizable learning environment tailored to different roles and individual learning preferences. Many enterprises favor this model as it allows them to use their own digital learning modules while keeping sensitive information on-site, thereby reducing the risk of data breaches.

Training Type Insights

The instructor-led training (ILT) segment led the market with the largest share of 40% in 2024. The segment's dominance is driven by the real-time, interactive learning experiences it offers, which are highly effective for skill development. Instructors can provide immediate feedback, foster discussions, and create an engaging learning environment, making it ideal for developing key sales competencies.

The microlearning & mobile learning segment is expected to expand at the fastest CAGR during the projection period. This growth is attributed to its ability to address modern sales challenges, including time constraints, knowledge retention, and just-in-time information delivery. Microlearning and mobile learning offer convenient, on-the-go training, meeting the evolving demands of today's workforce.

Software Type / Functionality Insights

The Learning management system (LMS) integrated segment dominated the market with a 45% share in 2024. The segment's dominance is driven by its scalable, cost-effective, and comprehensive solutions, which integrate features such as course management, analytics, and mobile compatibility. Other key growth drivers include the rising demand for e-learning, advancements in AI, and the need for flexible online learning platforms for working professionals. LMS solutions are particularly suited to modern work environments, including remote and hybrid models.

The sales enablement & performance tracking tools segment is expected to grow at the fastest CAGR during the foreseeable period because it directly connects training activities to measurable sales outcomes, allowing organizations to track productivity and ROI effectively. These tools leverage data-driven insights to optimize learning paths, improve skill application, and enhance overall sales performance. Additionally, their ability to provide real-time analytics and actionable feedback makes them indispensable for modern, performance-focused sales teams.

End User Insights

The large enterprises segment held the largest market share of 50% in 2024. This segment's dominance is driven by the need to manage extensive sales teams across multiple regions with scalable, consistent, and data-driven solutions. These organizations seek advanced platforms that ensure uniform training standards, track individual performance, and maximize return on investment.

The SMEs segment is expected to expand at the fastest CAGR during the foreseeable period. The segment's growth is fueled by the rapid expansion of sales teams within SMEs, which require cost-effective, flexible, and tailored training solutions. As a result, many emerging companies are adopting sales training software to meet these evolving needs.

Sales Training Software Market Region Insights

The North America sales training software market size is estimated at USD 1.10 billion in 2025 and is projected to reach approximately USD 4.52 billion by 2034, with a 15.18% CAGR from 2025 to 2034.

Why Did North America Lead the Sales Training Software Market?

North America led the market by holding the largest share of 40% in 2024. The region's dominance is attributed to its mature technological infrastructure, significant investment in employee development, and rapid adoption of AI-powered solutions. Additionally, high spending on corporate training programs, widespread implementation of hybrid and remote work models, ongoing digital transformation, and the strong presence of key industry players further reinforce North America's leadership in the market.

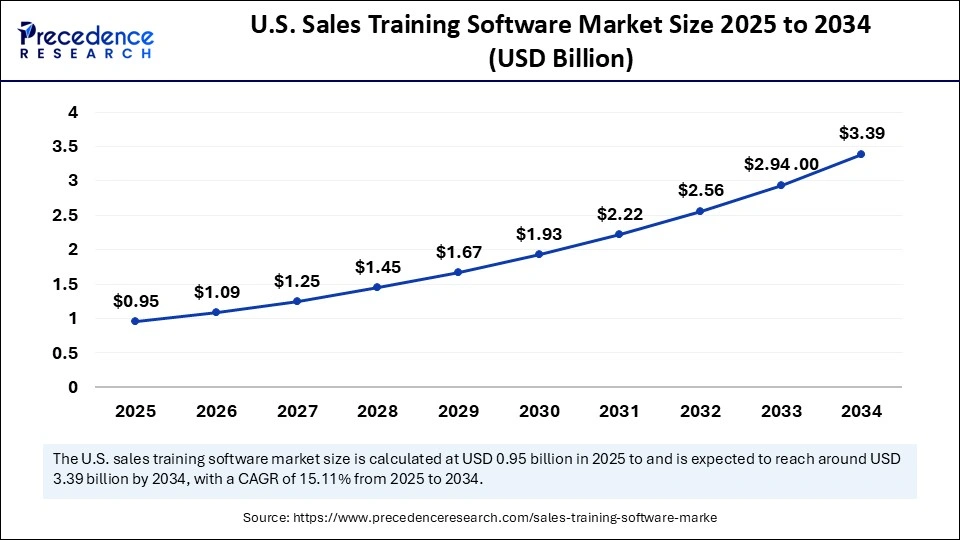

The U.S. sales training software market size is calculated at USD 950 million in 2025 and is expected to reach nearly USD 3.39 billion in 2034, accelerating at a strong CAGR of 15.11% between 2025 and 2034.

U.S. Sales Training Software Market Trends

The U.S. is a major contributor to the market. In the U.S., companies are focusing on developing software that delivers personalized, immersive, and AI-driven training experiences. Enterprises are increasingly integrating sales training tools with core sales technologies to streamline workflows and enhance overall efficiency.

The Asia Pacific sales training software market size is expected to be worth USD 639 million by 2034, increasing from USD 2,260 million by 2025, growing at a CAGR of 15.18% from 2025 to 2034.

What Makes Asia Pacific the Fastest-Growing Area in the Sales Training Software Market?

Asia Pacific is expected to experience the fastest growth during the forecast period of 2025-2034. The region's growth is driven by factors such as increasing digitalization across key sectors, the expansion of SMEs, a vibrant startup ecosystem, and government initiatives to upskill individuals. The growth is also boosted by the rise of e-commerce platforms, the demand for agile solutions, and the rapid adoption of AI and cloud-based platforms.

The booming IT sector and e-commerce in Asia Pacific are driving high demand for flexible sales training solutions. Along with shifts in consumer behavior and product innovation, many businesses are looking for strong upskilling platforms like sales training software to stay competitive globally.

China Sales Training Software Market Trends

China is rapidly adopting advanced technologies like AI and ML to automate training, provide real-time personalized coaching, and tailor learning paths to individual needs. The market is also shifting from traditional offline training to digital solutions, including online platforms and app-based learning.

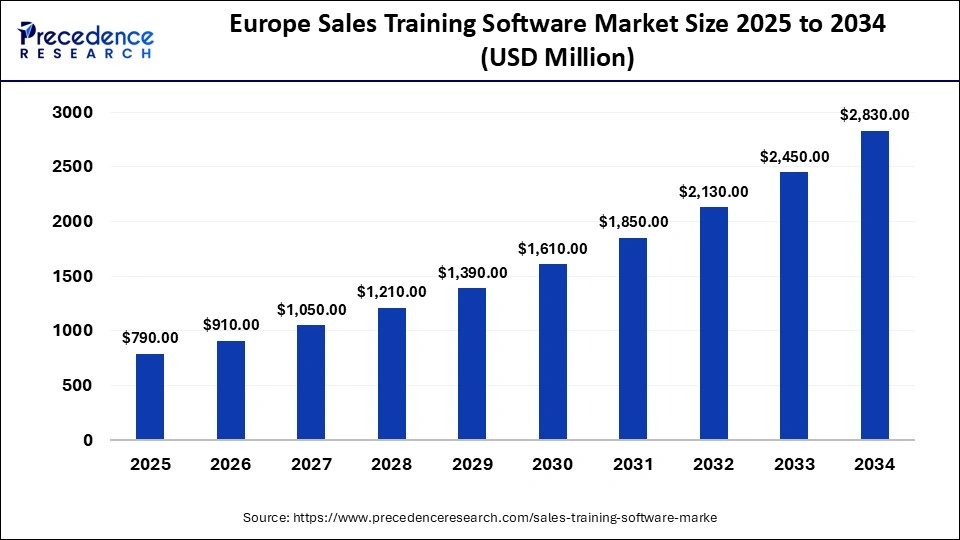

The Europe sales training software market size has grown strongly in recent years. It will grow from USD 790 million in 2025 to USD 2,830 billion in 2034, expanding at a compound annual growth rate (CAGR) of 15.16% between 2025 and 2034.

How is the Opportunistic Rise of Europe in the Sales Training Software Market?

Europe is expected to experience significant growth driven by digital transformation efforts, the expansion of e-learning solutions, and increasing demand for highly skilled professionals in the sales market. Regulatory compliances like GDPR require training to ensure data security and integrity as well. The rising shift toward remote work in Europe is another major factor fueling the market's growth.

Germany Sales Training Software Market Trends

Market trends in Germany are significantly influenced by increased digitalization and initiatives like “Industry 4.0,” which encourage businesses to adopt integrated software for advanced manufacturing. Additionally, the market is heavily impacted by high-quality training and security protocols such as GDPR, which further supports sector-specific training modules.

The Latin America sales training software market size is projected to grow from USD 250 million in 2025 to USD 900 million by 2034 at a CAGR of 13.67% from 2025 to 2034.

What Made Latin America a Notable Region of Growth in the Sales Training Software Market in 2024?

Latin America emerged as a significant growth region for the sales training software market in 2024, thanks to expanding digital transformation initiatives across commercial and sales organisations, growing penetration of cloud-based learning tools and greater investment in sales enablement and training solutions as companies strive to enhance sales productivity and deal-closure rates. Organisations in markets such as Brazil, Mexico and Colombia increasingly adopted SaaS training platforms to equip dispersed salesforces, improve onboarding of new sellers, and integrate training with CRM workflows.

The rising trend of remote/hybrid selling models, accelerated by pandemic-era shifts, amplified demand for scalable, interactive, mobile-friendly training solutions in the region. Cloud deployment became the dominant sub-segment in Latin America, reflecting the preference for flexible, on-demand software systems over legacy on-premise models. These factors combined positioned Latin America as one of the faster-growing regional markets for sales training software in 2024.

Brazil Market Analysis

In Brazil, the sales training software market in 2024 benefitted from a strong push by both large enterprises and SMEs to digitise their sales training and onboarding processes, recognizing that well-trained sales teams are critical amid increasingly competitive and digitalized markets. Brazilian companies are adopting cloud-based platforms that offer micro-learning, performance analytics, and integration with local CRMs and mobile tools, enabling sales teams across geographies and segments to stay up to date on product knowledge and selling skills.

Brazil's large and diverse sales workforce, spanning retail, telecom, financial services, and manufacturing sectors, is increasingly embracing interactive training solutions to shorten ramp-up times and improve retention of sales talent. The country's scale and enterprises' willingness to invest in sales enablement make Brazil a key national market in Latin America for sales training software providers seeking regional expansion.

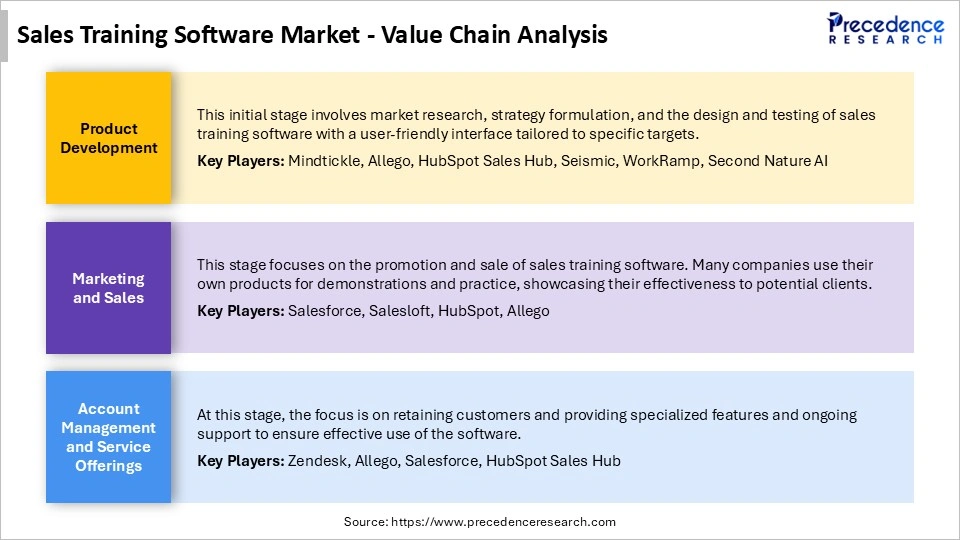

Sales Training Software MarketValue Chain

Sales Training Software Market Companies

- Headquarters: San Francisco, California, United States

- Year Founded: 1999

- Ownership Type: Publicly Traded (NYSE: CRM)

History and Background

Salesforce was founded in 1999 by Marc Benioff, Parker Harris, Dave Moellenhoff, and Frank Dominguez as one of the first companies to deliver business applications over the internet. Pioneering the concept of Software-as-a-Service (SaaS), Salesforce transformed customer relationship management (CRM) by replacing traditional on-premise systems with cloud-based software accessible from any device.

Over the years, Salesforce has expanded its offerings from core CRM to a comprehensive ecosystem of cloud platforms covering sales, service, marketing, analytics, and application development. Through major acquisitions such as MuleSoft, Tableau, and Slack, Salesforce has become one of the world’s leading enterprise software companies and a key enabler of digital transformation.

Key Milestones / Timeline

- 1999: Founded in San Francisco, California

- 2004: Initial public offering on the New York Stock Exchange (NYSE: CRM)

- 2018: Acquisition of MuleSoft, enhancing integration capabilities across enterprise systems

- 2019: Acquisition of Tableau Software, expanding analytics and visualization capabilities

- 2021: Acquisition of Slack Technologies, strengthening collaboration and workflow integration

- 2024: Launch of Einstein 1 Platform integrating AI, data, and CRM functions across all Salesforce Clouds

Business Overview

Salesforce operates as a global cloud-based software company providing solutions for sales automation, customer service, marketing, commerce, analytics, and application development. The company’s platform model enables businesses of all sizes to manage customer data, automate processes, and enhance customer engagement. Its AI and data-driven approach is central to the company’s ongoing innovation strategy.

Business Segments / Divisions

- Sales Cloud

- Service Cloud

- Marketing Cloud

- Commerce Cloud

- Data Cloud

- Tableau Analytics

- Slack Collaboration Platform

- MuleSoft Integration Platform

Geographic Presence

Salesforce operates in more than 100 countries with major offices and innovation centers in the United States, United Kingdom, France, Germany, Japan, India, and Australia.

Key Offerings

- Salesforce Customer 360 platform

- Einstein AI for predictive analytics and automation

- MuleSoft integration and API management

- Slack collaboration and workflow solutions

- Tableau data analytics and business intelligence

- Marketing and commerce automation tools

Financial Overview

Salesforce reports annual revenues exceeding $35 billion USD, maintaining strong double-digit growth across its cloud businesses. The company continues to lead the global CRM market with a share exceeding 20%, supported by recurring subscription revenues and expanding enterprise adoption of cloud-based solutions.

Key Developments and Strategic Initiatives

- March 2023: Introduced Einstein GPT, the world’s first generative AI for CRM applications

- July 2023: Announced Slack GPT integration for AI-driven productivity enhancements

- February 2024: Launched the Einstein 1 Platform unifying CRM, data, and AI capabilities

- September 2025: Expanded Data Cloud partnerships to integrate real-time analytics across customer workflows

Partnerships & Collaborations

- Strategic partnerships with Amazon Web Services, Google Cloud, and Microsoft Azure for infrastructure and AI integration

- Collaborations with global systems integrators including Accenture, Deloitte, and IBM for digital transformation projects

- Partnerships with leading universities and research institutions to advance ethical AI and data governance

Product Launches / Innovations

- Einstein GPT for CRM (2023)

- Slack Canvas for collaborative workflows (2023)

- Einstein 1 Platform for unified AI and data management (2024)

- Enhanced Marketing Cloud AI analytics and automation (2025)

Technological Capabilities / R&D Focus

- Core technologies: Cloud computing, AI and machine learning, data analytics, low-code application development, and enterprise integration

- Research Infrastructure: Global R&D and innovation hubs in the United States, India, and Europe

- Innovation focus: Generative AI for business automation, real-time customer insights, and unified data management

Competitive Positioning

- Strengths: Strong brand recognition, comprehensive CRM ecosystem, recurring subscription revenue model

- Differentiators: AI-driven CRM capabilities, integration of collaboration and analytics tools, cloud scalability

SWOT Analysis

- Strengths: Market leadership in CRM, strong partner ecosystem, continuous innovation

- Weaknesses: High dependence on enterprise subscription renewals

- Opportunities: Growth in generative AI, analytics, and vertical industry solutions

- Threats: Increasing competition from Microsoft, Oracle, and emerging SaaS platforms

Recent News and Updates

- June 2024: Salesforce announced expanded partnership with AWS to deliver AI-powered CRM solutions globally

- October 2024: Unveiled new Einstein Copilot features for automated customer interactions

- January 2025: Salesforce launched industry-specific Data Cloud modules for healthcare, finance, and retail sector.

Other Companies in the Market

- Microsoft: Microsoft's Dynamics 365 combines CRM and ERP capabilities, empowering businesses with unified data, AI insights, and seamless integration with Microsoft 365 and Azure. Its tools streamline sales, marketing, and customer service operations while leveraging generative AI and Copilot technologies for workflow efficiency.

- SAP: SAP offers SAP Customer Experience (CX) and SAP Sales Cloud, providing AI-enhanced CRM, marketing automation, and customer analytics. The platform integrates with SAP S/4HANA, enabling real-time data sharing across business functions for improved customer engagement and retention.

- Oracle: Oracle's CX Cloud Suite delivers a full suite of CRM, sales automation, and customer data management tools. Its Fusion Sales solution leverages AI and predictive analytics to guide sales teams through optimized pipelines. Oracle's cloud infrastructure ensures scalability for global enterprises.

- HubSpot: HubSpot provides an all-in-one inbound marketing, sales, and CRM platform tailored for SMBs and mid-sized businesses. Its easy-to-use interface integrates lead generation, marketing automation, and customer analytics. HubSpot's free CRM and modular hubs for sales, service, and marketing make it a top choice for growth-focused companies.

- Zoho: Zoho CRM offers a cost-effective and customizable CRM suite with AI-powered sales forecasting, automation, and multichannel communication. Its integration with the broader Zoho ecosystem enhances workflow efficiency for small and mid-sized enterprises.

- Adobe: Adobe's Experience Cloud integrates data-driven marketing and CRM functionalities powered by Adobe Experience Platform. It uses AI (Sensei) to deliver personalized, omnichannel customer journeys and real-time engagement analytics.

- Freshworks: Freshworks provides Freshsales, a CRM platform with AI-based deal insights, email automation, and lead scoring. It focuses on simplicity and affordability, making it ideal for SMBs aiming to scale efficiently.

- Pipedrive: Pipedrive offers a visual, sales-centric CRM designed to streamline deal tracking and pipeline management. Its automation and analytics tools help small businesses optimize conversions and sales forecasting.

- SugarCRM: SugarCRM delivers an AI-driven CRM suite that emphasizes automation, predictive insights, and customer retention. Its open architecture supports deep customization for enterprise clients in sales and marketing.

- Brainshark: Brainshark specializes in sales enablement and readiness solutions, providing tools for content creation, training, and performance analytics. Its platform enhances sales team productivity through AI-driven learning and onboarding capabilities.

- OpenSesame: OpenSesame offers a corporate learning platform that integrates with CRM and sales systems to enhance employee training and skill development. Its content marketplace helps organizations build effective sales enablement programs.

- Aurasell: Aurasell provides AI-powered sales engagement and automation tools that streamline prospecting, lead nurturing, and customer analytics. Its platform focuses on improving conversion rates through personalized communication and predictive insights.

Recent Developments

- In October 2025, Second Nature AI Inc., a startup focused on boosting sales team productivity, raised $22 million in a Series B round led by Sienna VC, bringing total funding to over $37 million. The company offers an AI-driven platform that simplifies onboarding by generating simulated sales conversations from natural language inputs, allowing managers to efficiently train and evaluate large teams.(Source: https://siliconangle.com)

- In April 2025, a leading firm, Microsoft, plans to collaborate with third-party companies that can handle more software sales to SMEs. Several in-house salespeople expect to offer various products and receive increased technical training aimed at providing AI-focused solutions.(Source: https://www.bloomberg.com)

Exclusive Analysis

The global sales training software market presents a compelling growth narrative driven by the confluence of digital transformation, AI adoption, and the strategic imperatives of modern enterprises to optimize sales performance. Escalating demand for cloud-based, scalable, and data-driven learning platforms underscores a paradigm shift from traditional instructor-led modules to hyper-personalized, AI-enabled microlearning and performance tracking solutions. Key growth vectors include the proliferation of hybrid and remote work environments, which necessitate decentralized, accessible training ecosystems, and the increasing strategic alignment of sales enablement tools with CRM and analytics platforms to directly influence revenue outcomes.

From an investment and innovation standpoint, opportunities abound in emerging markets such as Asia-Pacific, where nascent digital infrastructure and rapid enterprise adoption offer fertile ground for high-margin deployment. Furthermore, the integration of predictive analytics, AI-driven learning paths, and adaptive performance metrics presents significant upside potential for vendors capable of delivering measurable ROI, elevating training software from a cost-center function to a strategic lever for revenue acceleration and workforce optimization.

Sales Training Software MarketSegments Covered in the Report

By Deployment Type

- Cloud-Based / SaaS

- Multi-tenant SaaS platforms

- Single-tenant / private cloud solutions

- On-Premise

- Enterprise self-hosted software

- Custom internal deployment

- Hybrid Deployment

- Combination of cloud and on-premise

- Flexible enterprise adoption models

By Training Type

- Instructor-Led Training (ILT)

- Classroom-based programs

- Virtual instructor-led programs

- Online / eLearning Modules

- Video-based tutorials

- Interactive simulations

- Adaptive learning modules

- Microlearning & Mobile Learning

- Short-form learning bursts

- App-based mobile courses

- Blended Learning

- Mix of ILT and digital modules

By Software Type / Functionality

- Learning Management System (LMS) Integrated

- Tracking, reporting, and compliance

- Course catalog management

- Content Development & Authoring Tool

- Interactive content creation

- Simulations and gamified content

- Sales Enablement & Performance Tracking Tools

- Sales coaching & analytics

- Performance dashboards

- Collaboration & Communication Platforms

- Discussion forums

- Team-based learning

- Assessment & Certification Tools

- Quizzes, tests, and certifications

By End User / Customer Segment

- Large Enterprise

- Multi-national corporations

- Enterprise-level sales teams

- SMEs / Mid-Market Companies

- Emerging startups

- Regional mid-sized companies

- Educational / Training Institutes

- Professional development programs

- Sales certification institutes

- Independent Sales Professionals / Consultants

- Freelancers

- Independent coaching programs

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting