What is SGLT-2 Inhibitors Market Size?

The global SGLT-2 inhibitors market size is calculated at USD 18.18 billion in 2025 and is predicted to increase from USD 19.31 billion in 2026 to approximately USD 31.34 billion by 2034, expanding at a CAGR of 6.24% from 2025 to 2034. The SGLT-2 inhibitors market is driven by rising diabetes prevalence, expanding therapeutic applications, and increasing adoption of combination therapies globally.

Market Highlights

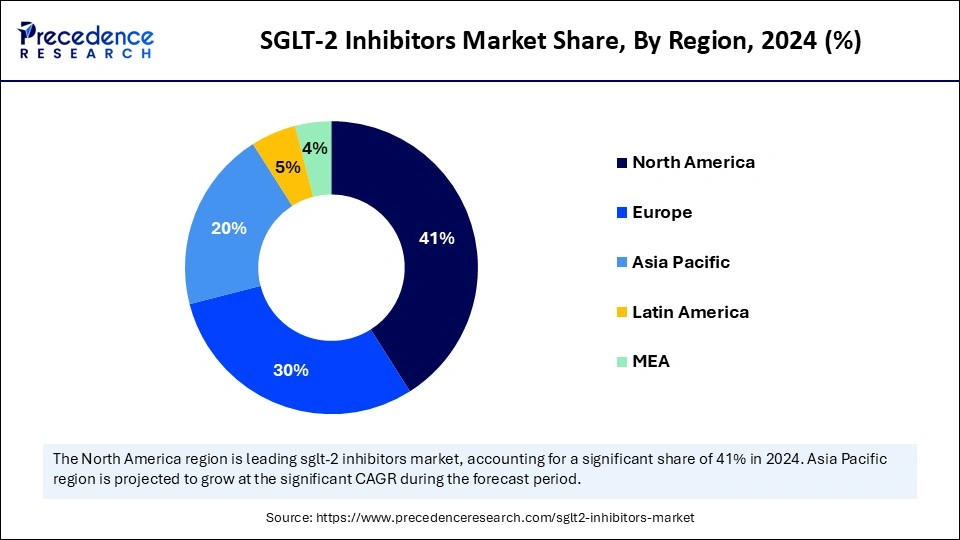

- North America dominated the SGLT-2 inhibitors market with around 41% share in 2024.

- Asia Pacific is expected to expand the fastest CAGR between 2025 and 2034.

- By drug, the Jardiance (empagliflozin) segment held the market share of 50% in 2024.

- By drug, the Farxiga (dapagliflozin) segment is expected to grow at the fastest CAGR between 2025 and 2034.

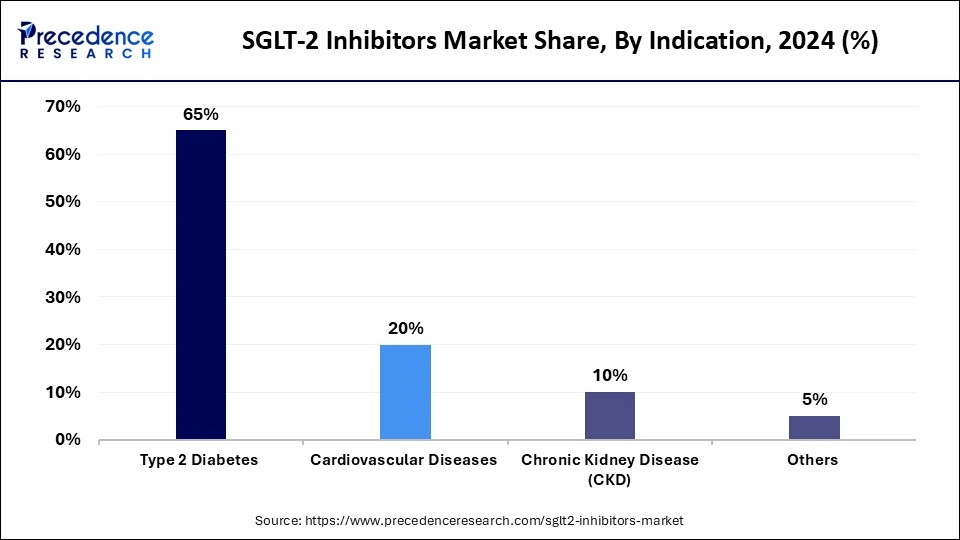

- By indication, the type 2 diabetes segment captured approximately 65% market share in 2024.

- By indication, the cardiovascular diseases segment is expected to expand at a notable CAGR over the projected period.

- By distribution channel, the hospital pharmacies segment contributed the highest market share of 60% in 2024.

- By distribution channel, the online pharmacies segment is expected to expand at the highest CAGR over the projected period.

Market Size and Forecast

- Market Size in 2025: USD 18.18 Billion

- Market Size in 2026: USD 19.31 Billion

- Forecasted Market Size by 2034: USD 31.34 Billion

- CAGR (2025-2034): 6.24%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What are SGLT-2 Inhibitors?

Sodium-glucose cotransporter-2 (SGLT-2) inhibitors are a class of oral antidiabetic drugs that reduce blood glucose by blocking reabsorption of glucose in the kidney. Beyond glycemic control in type 2 diabetes, they are increasingly used for cardiovascular diseases (heart failure), chronic kidney disease, obesity, and other metabolic risk conditions. The market covers branded and generic SGLT-2 inhibitor drugs, in all approved indications, across hospital & retail/ambulatory settings, including combination therapies

Major factors driving the growth of the SGLT-2 inhibitors market include the rising prevalence of type 2 diabetes worldwide and the increasing demand for combination therapy for glycaemic control. The growing body of clinical evidence in support of the reduced risk of heart failure and progression of chronic kidney disease has led to increased clinical utilization. In addition, ongoing innovation of drugs, increased patient awareness, and regulatory approvals continue to drive market growth in both developed and emerging healthcare systems.

How is AI Transforming the SGLT-2 Inhibitors Market?

Artificial intelligence (AI) is emerging as a disruptive force in the SGLT-2 inhibitors landscape, enhancing both precision treatment and drug development processes. A study published in August 2025 in the New England Journal of Medicine Catalyst reported that Twin Health's AI-driven precision care model enabled 71% of patients with type 2 diabetes to achieve healthy A1C levels below 6.5%. Remarkably, this approach also reduced the use of several costly medications, including SGLT-2 inhibitors, from 27% to just 1%. These findings suggest that AI-powered precision treatment can improve metabolic outcomes while minimizing reliance on unnecessary pharmacotherapy. (Source: https://usa.twinhealth.com)

Concurrently, AI and machine learning are revolutionizing the development of next-generation SGLT-2 inhibitors. Advanced algorithms are being employed to analyze molecular interactions, predict safety profiles, and identify novel inhibitor structures, thereby shortening development timelines and enhancing drug efficacy. Collectively, these advancements signify a paradigm shift toward data-driven diabetes management and more intelligent SGLT-2 drug design.

SGLT-2 Inhibitors Market Outlook

- Market Growth Overview: The SGLT-2 inhibitors market is experiencing rapid growth, driven by government-funded initiatives promoting integrated care models for diabetes, renal, and cardiovascular health. Broader clinical indications and accumulating real-world evidence supporting cardiovascular and renal outcomes are enhancing clinician adoption and improving long-term treatment adherence across both developed and emerging markets.

- Global Expansion: Pathways for global uptake have widened following FDA and EMA approvals for heart failure and chronic kidney disease indications. Coupled with evolving reimbursement frameworks, several developing markets are incorporating SGLT-2 inhibitors into national diabetes programs, creating new access points and accelerating uptake compared to established diabetes medications.

- Research and Development: R&D efforts continue to focus on developing dual SGLT1/2 inhibitors and combination therapies with superior glycemic and renal efficacy compared to current SGLT-2 inhibitors. Academic institutions increasingly complement pharmaceutical innovation, with clinical data demonstrating reductions in hospitalization and mortality, thereby expanding the cardiometabolic therapy pipeline.

- Major Inventors: Major pharmaceutical companies including AstraZeneca, Boehringer Ingelheim, and Eli Lilly are investing heavily in the development of SGLT-2 inhibitors alongside clinical studies. Public sector initiatives, such as India's Production Linked Incentive (PLI) scheme and numerous NIH-funded studies in the U.S., are fostering industry investment and emphasizing expanded outcome-driven cardio-metabolic portfolios.

- Driver: The rising prevalence of Type 2 diabetes and associated cardiovascular risk factors, as reported by WHO and IDF, with approximately 853 million individuals projected to live with diabetes (a 46% increase), over 90% of whom have Type 2 diabetes, is driving demand. This escalating disease burden necessitates oral therapies that not only provide glycemic control but also confer cardiovascular and renal protection.

- Constraint: Despite clear clinical benefits, high out-of-pocket costs remain a significant barrier to treatment access, particularly in low- and middle-income countries. U.S. insurance data indicate patients with higher copayments are less likely to initiate therapy, underscoring affordability as a critical challenge to widespread adoption.

Recruiting Clinical Trials For SGLT2 Inhibitors

| Study Table | Condition | Phases | Start Date | Completion Date |

| Phase III Trial of SGLT2 Inhibitor and Thiazolidinedione Fixed-Dose Combination vs. Monotherapy in Type 2 Diabetes Patients on Metformin | Type 2 Diabetes Mellitus (T2DM) | PHASE3 | 2026-09 | 2028-02 |

| Targeting the Pathophysiology of Sickle Cell-Related Kidney Disease Using the SGLT2 Inhibitors, Empagliflozin | Sickle Cell Anemia (HbSS, or HbSβ-thalassemia0)|Albuminuria | PHASE2 | 2025-12 | 2030-10 |

| SGLT2 Inhibitors in Geographic Atrophy | Retinal Degeneration|Retinal Diseases|Eye Diseases|Geographic Atrophy|Pathological Conditions, Anatomical | PHASE2 | 2025-10 | 2027-12 |

| SGLT-2 Inhibitors on Albuminuria in Chronic Kidney Disease Patients | Lupus Nephritis (LN)|ANCA Associated Vasculitis (AAV) | PHASE4 | 2025-09 | 2026-12 |

| Effect of Add-on SGLT2i, TZD, or Combination Therapy in Type 2 Diabetes Patients on DPP4 Inhibitors | Diabetes Mellitus, Type 2|Hyperglycemia|Insulin Resistance | PHASE4 | 2025-09 | 8/31/2030 |

| Cardiovascular Effects of SGLT2 Inhibitors in Hemodialysis Patients | Chronic Kidney Disease Requiring Hemodialysis | PHASE2 | 2025-05 | 2026-08 |

| Evaluation of Empagliflozin vs Standard Care in Veterans With Prediabetes | Prediabetes | PHASE1 | 2025-03 | 2026-06 |

| SGLT-2 Inhibitor and High-Dose Furosemide Plus Small-Volume Hypertonic Saline Solution in Acute HF | Heart Failure Acute|Diabetes Type 2|Heart Failure With Reduced Ejection Fraction|Heart Failure With Preserved Ejection Fraction | PHASE4 | 2024-06 | 3/30/2026 |

(Source:https://clinicaltrials.gov)

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 18.18 Billion |

| Market Size in 2026 | USD 19.31 Billion |

| Market Size by 2034 | USD 31.34 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.24% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug, Indication,Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Drug Insights

What Made Jardiance the Dominant Segment in the SGLT-2 Inhibitors Market?

The Jardiance (empagliflozin) segment dominated the market while holding approximately 50% share in 2024. This is mainly due to Jardiance's proven effectiveness in lowering blood glucose levels and lowering cardiovascular risk for diabetes patients. Multiple clinical trials and regulatory approval have positioned Jardiance as a well-known choice in the clinical arena. Currently used in over 90 countries, and supported by a strong global network of clinical partnerships, Jardiance continues to expand its footprint, particularly in the heart failure segment, aided by growing insurance coverage and guideline inclusion.

The Farxiga (dapagliflozin) segment is expected to grow at the fastest CAGR during the projection period. The segment's growth is driven by its expanding label across diabetes, cardiovascular disease, and chronic kidney disease (CKD) indications. AstraZeneca has strategically focused on generating real-world evidence and advancing clinical innovation, which has bolstered Farxiga's value proposition among healthcare providers and payers. Demonstrated renal- and cardio-protective benefits are positioning the drug for broader adoption. Furthermore, increasing awareness and inclusion in international treatment guidelines are expected to significantly influence uptake in both developed and emerging markets.

Indication Insights

Why Dis the Type 2 Diabetes Segment Lead the SGLT-2 Inhibitors Market?

The type 2 diabetes segment led the market by holding nearly 65% share in 2024. SGLT-2 inhibitors have achieved widespread adoption in managing Type 2 diabetes, owing to their dual benefits of blood glucose reduction and cardiovascular protection. Over the past two decades, the global prevalence of Type 2 diabetes has risen significantly, reinforcing the demand for effective oral therapies. The inclusion of SGLT-2 inhibitors in first-line treatment regimens, supported by robust long-term safety data and ongoing innovation, has strengthened physician confidence and contributed to their sustained clinical use.

The cardiovascular diseases segment is expected to expand at the fastest CAGR in the upcoming period. Clinical evidence continues to validate the efficacy of SGLT-2 inhibitors in reducing the risk of heart failure and major adverse cardiovascular events (MACE). Recent studies demonstrating mortality benefits have prompted cardiologists to adopt these therapies even for non-diabetic patient populations. Growing utilization in heart failure with preserved ejection fraction (HFpEF) and guideline updates recommending SGLT-2 inhibitors for broader cardiovascular indications have significantly accelerated growth. As a result, cardiovascular applications are emerging as a key driver of future market expansion.

Distribution Channel Insights

Which Distribution Channel Leads the SGLT-2 Inhibitors Market in 2024?

The hospital pharmacies dominate the market by holding about 60% share in 2024. These settings remain the primary dispensing channel for SGLT-2 inhibitors due to physician-led prescriptions and controlled patient monitoring. Hospitals offer structured support programs, including adherence education, safety protocols, and compliance monitoring, particularly in clinical study or specialist-led treatment environments. Advanced prescribing systems and specialist consultations further strengthen the role of hospital pharmacies as the leading distribution point for SGLT-2 therapies.

The online pharmacies segment is likely to grow at the fastest rate during the forecast period. This growth is fueled by the rise of digital health, telemedicine adoption, and increasing patient preference for convenience, competitive pricing, and home delivery. As awareness grows through both online and offline health channels, government-backed e-pharmacy regulations are improving accessibility and trust in digital medication platforms. Additionally, AI-powered tools, subscription refill programs, and virtual patient support services are enhancing medication adherence and counselling, positioning online pharmacies as a rapidly emerging distribution model for SGLT-2 inhibitors.

Regional Insights

U.S. SGLT-2 Inhibitors Market Size and Growth 2025 to 2034

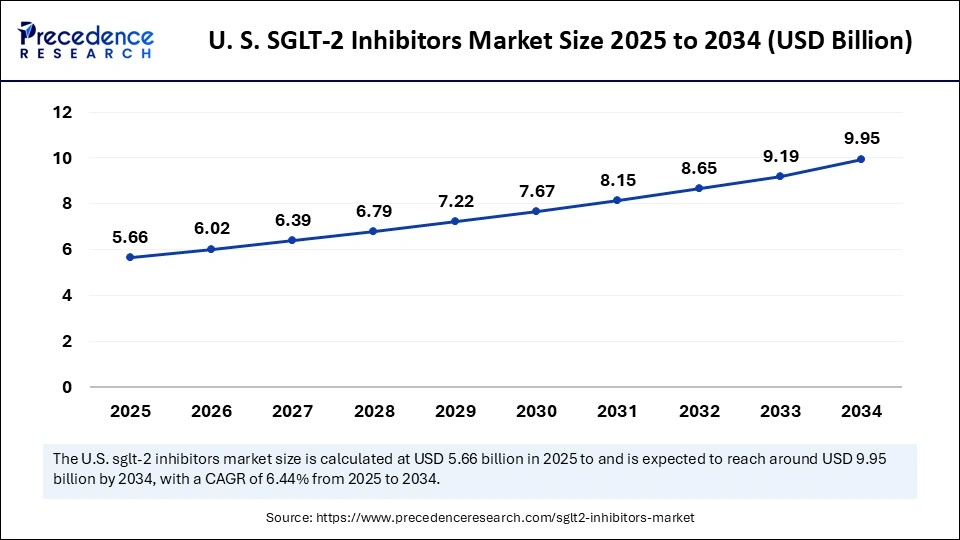

The U.S. SGLT-2 inhibitors market size is exhibited at USD 5.66 billion in 2025 and is projected to be worth around USD 9.95 billion by 2034, growing at a CAGR of 6.44% from 2025 to 2034.

What Made North America the Dominant Region in the SGLT-2 Inhibitors Market?

North America registered dominance in the SGLT-2 inhibitors market by capturing a 41% share in 2024. This leadership is primarily driven by the integration of SGLT-2 inhibitors into cardiometabolic care guidelines, broad private payer acceptance of cardiorenal benefits, and strong real-world clinical adoption across multidisciplinary care pathways in cardiology, nephrology, and diabetes management. Clinical guidelines from leading bodies such as the AHA/ACC/HFSA and American College of Cardiology list SGLT-2 inhibitors as foundational therapy for heart failure, as well as a first-line option for patients with type 2 diabetes and elevated cardiorenal risk. Clear regulatory endorsement by the FDA, including updated labeling for heart failure and cardiovascular risk reduction, has reinforced prescriber confidence and improved formulary access. Collectively, these clinical, regulatory, and system-level enablers have driven predictable demand and seamless integration into both inpatient and outpatient care models.

U.S. SGLT-2 Market Analysis

The U.S. continues to lead the North American SGLT-2 inhibitors market due to proactive regulatory approvals and guideline expansions that have moved SGLT-2 use beyond endocrinology and into cardiology and nephrology care pathways. This has led to increased multi-specialty prescribing, broader hospital procurement, and alignment with value-based care objectives. Moreover, the country benefits from a strong pipeline of real-world evidence (RWE) programs and payer engagement strategies, including the growing interest in value-based contracting. These dynamics favor manufacturers with a proven commitment to clinical outcomes and economic value generation, while creating market entry barriers for late-stage entrants.

- In April 2025, Novartis receives FDA accelerated approval for Vanrafia (atrasentan), the selective endothelin A receptor antagonist for proteinuria reduction in primary IgA nephropathy (IgAN).

What Makes Asia Pacific the Fastest-Growing Market for SGLT-2 Inhibitors?

Asia Pacific is expected to experience the fastest growth throughout the forecast period, rapid expansion in access, spurred by patent expiries that are enabling the launch of generic versions by both multinational and domestic pharmaceutical companies. The region is witnessing a rising burden of cardiometabolic diseases, prompting aggressive procurement strategies by both public health authorities and private payers to enhance drug affordability and availability. Governments and major insurers are increasingly recognizing the value of SGLT-2 inhibitors in cardiorenal care, particularly in light of health economic models that demonstrate reduced total costs through the prevention of hospitalizations and adverse events.

This shift in payer mindset, combined with the broad integration of international clinical guidelines into national formularies and treatment protocols across major APAC healthcare systems, is driving significant volume-based growth, even amidst ongoing price sensitivity and reimbursement constraints.

India SGLT-2 Market Trends

India is emerging as a major player in the market. This is mainly due to its large diabetes population, coupled with a cost-efficient generics supply chain and the increasing availability of affordable FDCs, which positions the country as a leader. This momentum is expected to accelerate further as clinical guideline adoption becomes more widespread and reimbursement frameworks evolve.

The patent expiry of empagliflozin in March 2025 triggered the immediate launch of numerous low-cost generics and fixed-dose combinations (FDCs) by domestic pharmaceutical players such as Glenmark, Alkem, and Mankind, significantly broadening access to SGLT-2 therapies for both primary care and secondary prevention.

In particular, Alkem Laboratories launched generic empagliflozin and its combinations at prices approximately 80% lower than those of the innovator products (Express Pharma, March 2025). These price reductions substantially reduce out-of-pocket costs for patients, enabling broader adoption of SGLT-2 inhibitors not only for glycaemic control, but also for cardiorenal protection, including heart failure and chronic kidney disease (CKD) management, aligning Indian clinical practice with global evidence-based guidelines.

Why is Europe Considered a Significant Growing Area?

Europe is expected to grow at a significant rate over the projection period, driven by progressive adoption of clinical guidelines supporting cardiorenal indications, the presence of well-established hospital cardiology networks, and a gradual expansion of national reimbursement pathways. These health systems are increasingly capable of operationalizing evidence-based SGLT-2 therapies across both diabetic and non-diabetic populations. However, Europe's payer fragmentation creates market heterogeneity, resulting in pockets of rapid uptake in certain countries and slower adoption in others.

UK SGLT-2 Market Analysis

The UK often acts as a bellwether for broader access across Europe, as NHS appraisal decisions set clinical and commissioning guidelines that cascade downstream into hospital practice. Recent draft guidelines and public debate around expanding SGLT-2 inhibitors as first-line therapies illustrate how a single-payer system can effectively leverage centralized decision-making to accelerate access. These dynamics provide a replicable framework for other European health systems navigating similar cost-effectiveness and clinical adoption challenges.

Value Chain Analysis of the SGLT-2 Inhibitors Market

- Research & Development (R&D):

This stage involves targeting the SGLT2 protein, developing selective inhibitors, and conducting preclinical and clinical trials. R&D efforts aim to establish therapeutic efficacy, demonstrate clinical potential in diabetes and cardiorenal diseases, and lay the foundation for regulatory approval and long-term market growth.

- Manufacturing & Supply Chain:

This stage encompasses the synthesis of active pharmaceutical ingredients (APIs), formulation of oral tablets, and global logistics management. It ensures consistent product quality, cost-efficient production, and the ability to meet growing international demand for SGLT-2 inhibitors through a robust and scalable supply chain.

- Marketing & Distribution:

Focused on driving market penetration, this phase includes engagement with healthcare professionals, pharmacy channel optimization, and payer negotiations. Effective marketing and access strategies influence prescription volume, patient uptake, and brand visibility, directly impacting commercial success across diverse healthcare markets.

- Post-Market Surveillance & Patient Care:

Post-commercialization efforts include pharmacovigilance, adverse event monitoring, patient education programs, and adherence to clinical guidelines. These activities reinforce the long-term safety profile, enhance treatment adherence, and solidify the drug's position as a standard of care in both diabetes and cardiorenal therapy pathways.

Major Players Operating in the SGLT-2 Inhibitors Market

Tier I – Major Players (~40–50% of Total Market Share)

These companies dominate the global SGLT-2 inhibitors market with blockbuster drugs, extensive clinical data, and global distribution networks. Together, they hold nearly half of the total market revenue.

- Boehringer Ingelheim: Co-marketer of Jardiance (empagliflozin), Boehringer Ingelheim drives significant revenue through its well-established presence in diabetes and cardiovascular care, supported by strong clinical data and global distribution networks.

- Eli Lilly and Company: Partnering with Boehringer Ingelheim for Jardiance, Eli Lilly leverages its extensive diabetes portfolio and strategic collaborations to expand the drug's adoption across cardiometabolic and renal indications worldwide.

- AstraZeneca: As the manufacturer of Farxiga (dapagliflozin), AstraZeneca leads innovation with expanding clinical indications in diabetes, heart failure, and chronic kidney disease, supported by real-world evidence and broad guideline inclusion.

- Johnson & Johnson: Through its subsidiary Janssen, Johnson & Johnson markets Invokana (canagliflozin) and focuses on cardiovascular and renal benefits, maintaining a strong position in key global markets with robust clinical support.

- Merck & Co.: Merck engages in the development of Steglatro (ertugliflozin) and combination therapies, investing in R&D and strategic partnerships to enhance efficacy and expand market penetration in diabetes and related cardiovascular diseases.

Tier II – Mid-Level Contributors (~30–35% of Market Share)

These companies hold a strong position in the market with innovative pipelines, specialty combination therapies, and growing geographic reach. Together, they contribute about one-third of the global revenue.

- Sanofi: Sanofi develops innovative combination therapies, such as Suliqua, that integrate SGLT-2 inhibitors with other antidiabetic agents, aiming to improve glycemic control and patient adherence.

- Lexicon Pharmaceuticals: Lexicon is a pioneer in dual SGLT1/2 inhibition with its drug sotagliflozin, offering broader therapeutic potential in diabetes management by targeting both glucose absorption and renal glucose reabsorption.

- TheracosBio: As an emerging player, TheracosBio focuses on next-generation SGLT-2 inhibitors and novel formulations, contributing to market growth through innovation and targeting unmet needs in cardiorenal and metabolic diseases.

Tier III – Niche and Regional Players (~15–20% of Market Share)

Smaller, regional, or generic manufacturers primarily targeting emerging markets. Individually, their shares are limited but collectively contribute significantly to expanding access and volume growth.

- Glenmark Pharmaceuticals

- Alkem Laboratories

- Mankind Pharma

- Other local generic manufacturers and emerging biotech companies

Recent Developments

- In March 2025, Glenmark Pharmaceuticals launched Empagliflozin and its fixed-dose combinations (Glempa, Glempa-L, Glempa-M) in India. These treatments target type 2 diabetes with cardiovascular risk, improving glycemic control while reducing cardiac and renal complications.

(Source: https://www.passionateinmarketing.com) - In May 2025, LG Chem unveiled Zemidapa, a fixed-dose combination therapy (gemigliptin + dapagliflozin), in Thailand as part of its global diabetes strategy. The company aims to expand exports into ASEAN and Latin American markets leveraging its existing distribution network.

(Source: https://www.indianpharmapost.com)

Exclusive Insights on the SGLT-2 Inhibitors Market

The global SGLT-2 inhibitors market is positioned at a pivotal inflection point characterized by robust expansion trajectories driven by multifactorial dynamics across therapeutic, regulatory, and technological domains. With entrenched clinical validation underscoring not only glycemic control but also cardiorenal risk mitigation, SGLT-2 inhibitors are transcending their original indication, catalyzing unprecedented uptake across multidisciplinary care pathways including endocrinology, cardiology, and nephrology.

Emerging reimbursement paradigms and accelerated guideline incorporations globally are facilitating deeper market penetration, particularly within high-burden geographies exhibiting escalating prevalence of type 2 diabetes and comorbid cardiovascular and renal diseases. Concurrently, patent expirations, most notably empagliflozin, herald a surge of generic entrants, especially in price-sensitive emerging markets, thereby unlocking volumetric growth potential and enabling broader patient access through cost-effective formulations.

Furthermore, R&D innovations encompassing dual SGLT1/2 inhibitors, fixed-dose combinations, and AI-driven drug discovery platforms are anticipated to recalibrate competitive dynamics, enhancing therapeutic efficacy and patient adherence. The integration of real-world evidence to substantiate health-economic outcomes is increasingly influencing payer negotiations, fostering value-based contracting models that could reshape market access and reimbursement frameworks.

Collectively, these factors delineate a landscape ripe with strategic growth opportunities for incumbents and newcomers alike, predicated on leveraging clinical differentiation, expanding indication portfolios, and optimizing market access to capture the expanding SGLT-2 inhibitors market.

Segments Covered in the Report

By Drug

- Jardiance (empagliflozin)

- Farxiga (dapagliflozin)

- Invokana (canagliflozin)

- Inpefa (sotagliflozin)

- Qtern (dapagliflozin/saxagliptin)

By Indication

- Type 2 Diabetes

- Cardiovascular Diseases

- Chronic Kidney Disease (CKD)

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content