What is Silicon Anode Battery Market Size?

The global silicon anode battery market size accounted for USD 536.53 million in 2025 and is predicted to increase from USD 536.53 million in 2026 to approximately USD 26,199.44 million by 2035, expanding at a CAGR of 47.53% from 2026 to 2035. The growth of the market is attributed to the increasing demand for high energy density batteries in electric vehicles (EVs), portable electronics, and grid storage applications.

Market Highlights

- Asia Pacific dominated the global market with the largest revenue share of 54% in 2025.

- North America is expected to expand at the fastest CAGR during the forecast period.

- By capacity, the <1,500 mAh capacity segment captured the biggest market share in 47% in 2025.

- By capacity, the 1,500 to 2,500 mAh segment is expected to grow at the fastest CAGR in the coming years.

- By application, the automotive segment contributed the largest revenue share of 38% in 2025.

- By application, the energy & power segment is expected to grow at a significant CAGR during the forecast period.

How does AI Enhance Silicon Anode Battery Production Efficiency?

By simplifying procedures, cutting down on material waste, and minimizing human error, artificial intelligence AI-driven solutions can greatly increase production efficiency in the silicon anodebattery market. AI systems can optimize anode fabrication parameters like temperature control, mixing ratios, and curing times through real-time monitoring and predictive analytics, leading to higher yields and consistent quality. Additionally, microscopic flaws in electrode coating or cell assembly can be found by machine learning algorithms, enabling early corrections that avoid expensive rework. This degree of accuracy promotes cost-effectiveness and scalability in the large-scale production of next-generation batteries while speeding up production.

Market Overview

The silicon anode battery market is witnessing significant growth due to the rising demand for high-energy-density batteries from the electronics and automotive industries. Compared to conventional graphite batteries, silicon anode batteries can store up to ten times as many lithium ions, which results in improved performance and longer battery life. Innovations like silicon-carbon composites and nanoengineering are addressing issues like silicon volumetric expansion during charging cycles and similar degradation. The market is expected to grow significantly in the coming years due to rising investments in battery research and an increased emphasis on environmentally friendly energy storage options.

What Makes Silicon Anode a Game-Changer in Next-Gen Battery Technology?

Silicon anode has the ability to store higher lithium than conventional graphite. This significantly enhances the performance and shelf life of batteries. Because of this, silicon anodes are perfect for portable electronics and electric cars. Silicon is positioned as a crucial material for energy storage thanks to advancements in silicon composites and nanostructuring. These advancements further address obstacles like cycle degradation. Moreover, silicon anodes have a higher theoretical specific capacity, which means they can store more energy. All these factors make them suitable for next-gen, long-lasting batteries.

Silicon Anode Battery MarketGrowth Factors

- The surge in EV Adoption: The global shift toward electric mobility is boosting the demand for high-capacity, fast-charging batteries.

- Technological Advancements: Innovations in binder chemistry, electrolyte additives, and nanostructuring address expansion issues and improve the performance of silicon anode batteries.

- Government Support: Rising government initiatives and subsidies for next-gen battery R&D accelerate innovation.

- Portable Electronics Boom: Increasing use of wearables and 5G-enabled devices require compact, high-energy batteries.

Market Schope

| Report Coverage | Details |

| Market Size in 2025 | USD 536.53 Million |

| Market Size in 2026 | USD 357.35 Million |

| Market Size by 2035 | USD 26,199.44 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 47.53% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Capacity, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for High Energy Density Batteries

Batteries with more energy storage capacity are becoming more and more necessary, particularly for portable electronics and electric vehicles (EVs). Compared to conventional graphite, silicon anodes can store more lithium ions, enhancing battery life and device performance. For wearable and mobile technologies, this higher energy density is important. The use of silicon anodes is growing as customers seek stronger, more durable products. Moreover, silicon anodes are more lightweight than conventional lithium-ion batteries, making them a promising option for applications where weight is a concern.

Growth of the Electric Vehicle Industry

The rapid expansion of the electric vehicle industry is driving the growth of the silicon anode battery market. Automakers are increasingly seeking batteries with greater driving range and faster charging times as a result of the global movement toward clean transportation. Silicon anodes solve EV performance issues by increasing energy storage capacity and charge rates. Stricter emission standards and government incentives for EV adoption are further supporting market growth. Silicon anode manufacturers are collaborating with top EV manufacturers to enhance their battery packs.

- On 10 April 2024, Panasonic launched a pilot production of silicon anode cells aimed at automotive clients, boosting EV battery capacity and reducing charge times.

Restraints

Volume Expansion and Mechanical Stability issues

Upon insertion of the lithium-ion, silicon expands by up to 300 percent, leading to significant structural deterioration and a loss of capacity over repeated cycles of charging. Loss of electrical contact, cracking, and particle pulverization within the anode is caused by this volume expansion. Stability can be enhanced by material engineering, but it is still challenging to completely address this problem on a commercial basis. The need for intricate composites and binders makes production even more difficult and shortens battery life.

Limited Cycle Life Compared to Graphite

Even with advancements, silicon anode batteries typically have a shorter cycle life than graphite anode technologies, restraining the growth of the silicon anode battery market. Reliability issues are raised by rapid capacity fading and decreased coulombic efficiency during repeated cycles of charging and discharging. This restriction has an impact on silicon anode batteries' long-term sustainability in demanding applications like electric cars.

Opportunity

Advances in Manufacturing Technologies

Technological advancements create immense opportunities in the silicon anode battery market. The production of silicon anodes is becoming more scalable and economical due to ongoing advancements in manufacturing techniques like nanostructuring and composite materials. These developments allow silicon-anode batteries to be produced in large quantities, enhancing accessibility. Businesses can take advantage of this chance to become industry leaders by investing in process automation and optimization technologies.

In January 2025, NEO Battery Materials Ltd., a low-cost silicon anode materials developer that enables longer-running, rapid-charging lithium-ion batteries, announced advancements in its commercialization efforts of Canada's first advanced silicon anode manufacturing facility.(Source: https://www.globenewswire.com)

Growing Demand for Consumer Electronics

The rising demand for consumer electronics opens new growth avenues. There is a high demand for batteries with higher energy density and faster charging capabilities for smartphones, laptops, and wearable devices. Silicon anode batteries are well-suited to meet these requirements, providing longer device usage times and enhanced performance. This trend opens new markets for silicon anode technology beyond automotive applications.

- In May 2025, TDK Corporation accelerated the launch of its next-generation silicon anode batteries, targeting the high-performance smartphone segment including upcoming flagship devices.

https://www.reuters.com/business/japans-tdk-accelerates-launch-next-generation-battery-2025-05-15/

Capacity Insights

Why Did the <1,500 mAh Segment Dominate the Silicon Anode Battery Market?

The <1,500 mAh segment dominated the market with the largest revenue share in 2025. This is mainly due to its extensive use in compact electronic devices like smartphones and wearables. These applications require moderate capacity dependable energy storage, and silicon anodes offer improved energy density and performance at an affordable prize. The affordability and established supply chains in this capacity bracket also facilitate quicker adoption by manufacturers. Silicon anode batteries with this capacity are lightweight, reducing the overall weight of the device. The rising production of smart electronics further supports segmental growth.

The 1,500 to 2,500 mAh segment is expected to grow at the fastest rate in the coming years due to the increasing adoption in mid-sized electronic devices, electric bikes, and portable power tools, which require higher energy storage without compromising on battery life or weight. The growth of the segment is also attributed to advancements in silicon anode technology that enable these batteries to maintain longer cycle life despite higher capacities. Additionally, the rising demand for lightweight and compact power sources in the personal mobility and industrial sectors is driving expansion. Manufacturers are investing in R&D to optimize silicon anodes for this capacity range, which is expected to unlock new market opportunities.

Application Insights

What Made Automotive the Dominant Segment in 2025?

The automotive segment dominated the market in 2025. This is mainly due to the increased preference for silicon anode batteries over conventional batteries to meet the need for high energy density. Quick charging and longer lifespan EVs require batteries with these qualities. The use of silicon anode batteries in this industry has been further accelerated by growing consumer demand for EVs and government regulations aimed at lowering carbon emissions. Furthermore, automakers are making significant investments to enhance battery performance and driving range, which will further solidify the dominance of automotive applications. To satisfy consumer demands and legal requirements silicon anode batteries must be able to decrease vehicle weight while increasing range. The automotive industry is the biggest user of silicon anode batteries because of their performance and compliance.

The energy & power segment is expected to grow at a significant CAGR during the forecast period. The growth of the segment is attributed to the growing use of grid-scale batteries and renewable energy storage systems, which take advantage of silicon anode materials' increased capacity and efficiency. The global movement toward sustainable energy solutions where long-lasting and effective batteries are essential for energy storage is driving this segment's growth. Due to their longer lifespans and promising benefits in terms of charge/discharge stability, silicon anode batteries are appropriate for varying power demands. This rapid growth trajectory is further supported by the growing number of microgrid installations and off-grid renewable energy projects.

Regional Insights

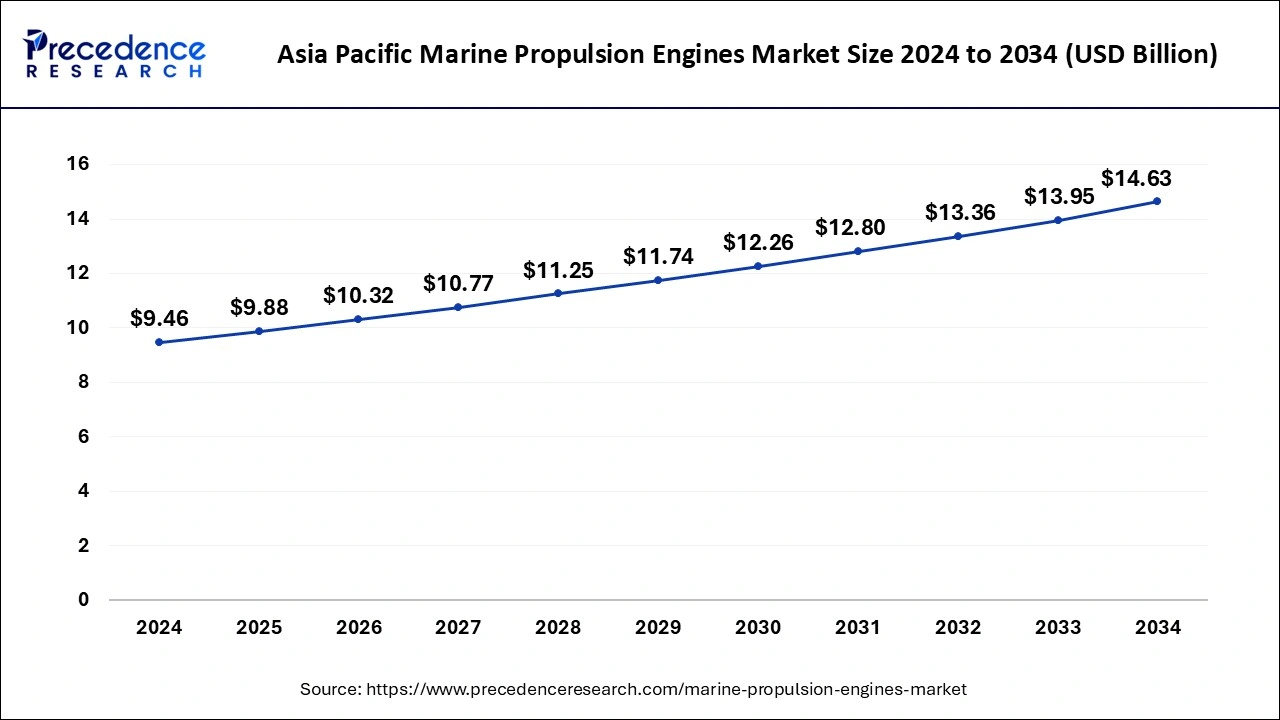

Asia Pacific Silicon Anode Battery Market Size and Growth 2026 to 2035

Asia Pacific silicon anode battery market size is exhibited at USD 289.73 million in 2025 and is projected to be worth around USD 14,286.37 million by 2035, growing at a CAGR of 47.67% from 2026 to 2035

What Factors Contributed to Asia Pacific's Dominate in the Silicon Anode Battery Market?

Asia Pacific dominated the market with the largest revenue share in 2025. This is mainly due to the presence of major battery manufacturers, raw material suppliers, and well-established electronics and automotive industries. Strong government backing, significant investments in battery R&D, and well-established supply chains all contribute to this region's favorable environment for the manufacturer and uptake of silicon anode batteries. Asia Pacific also keeps a competitive edge in the production of silicon-anode batteries due to its proximity to raw materials. Because of these factors, the region serves as a global center for silicon anode for battery production and consumption. With the rising production of electric vehicles and electronic devices, the demand for high energy density batteries is rising, bolstering the growth of the market.

India Market Analysis

India's silicon anode battery market is growing due to rising demand for electric vehicles and consumer electronics, coupled with government initiatives promoting clean energy and sustainable technology adoption. Investments in domestic battery manufacturing, supportive policies, and the development of supply chains for raw materials further boost market expansion, positioning India as a key emerging player in high-energy-density battery production.

What Makes North America the Fastest-Growing Region in the Silicon Anode Battery Market?

North America is expected to grow at the fastest rate in the upcoming period due to increasing investments in advancing battery manufacturing technologies, government incentives for clean energy technologies, and the expanding EV sector. The region is at the forefront of technological advancements, driving innovation in battery technology. Additionally, North America's increased emphasis on domestic supply chains for essential battery components lessens reliance on imports, fostering the development of silicon anode batteries. The rising adoption of smart electronics further creates the need for silicon anode batteries.

U.S. Market Analysis

The U.S. silicon anode battery market is expanding due to increasing investments in advanced battery technologies, government incentives for clean energy and electric vehicles, and the push for domestic production of critical battery components. Growing adoption of high-performance batteries in EVs, smart electronics, and energy storage systems further drives market growth and technological innovation in the region.

How is the Opportunistic Rise of Europe in the Silicon Anode Battery Market?

Europe is expected to grow at a considerable growth rate in the upcoming years, driven by stringent carbon emission regulations, rising EV adoption, and strong governmental funding toward sustainable technologies. The European Union's green deal and battery passport initiatives are prompting manufacturers to adopt high-performance battery chemistries like silicon anode. Furthermore, the region's focus on establishing a localized and ethical battery supply chain supports market growth. Major automakers and energy firms are also integrating silicon anode solutions to improve battery performance and meet decarbonization targets. Ongoing development of gigafactories and clean energy storage infrastructure solidifies Europe's role in this market.

UK Market Analysis

The UK silicon anode battery market is growing due to government support for low-carbon technologies, increasing adoption of electric vehicles, and investments in advanced energy storage solutions. Initiatives like localized supply chain development, funding for battery R&D, and the expansion of gigafactories boost production capacity. Rising demand for high-performance batteries in the automotive and renewable energy sectors further drives market growth.

Value Chain Analysis

- Raw Material Procurement

This stage involves the sourcing of quartz, biomass, and industrial byproducts using eco-friendly processes.

Key Players: Wacker Chemie AG, Elkem ASA, REC Silicon, Dow Inc, Hemlock Semiconductor - Doping and Layering Processes

Doping and layering improve silicon anode conductivity and reduce volume expansion, enhancing performance and cycle life in lithium-ion batteries.

Key Players: BASF, Nexeon Limited, Sila Nanotechnologies, Amprius Technologies, Enevate Corporation - Testing and Quality Control

Silicon anode batteries undergo material characterization, in-process monitoring, and performance testing to ensure safety and manage volume expansion.

Key Players: Tesla, Panasonic, LG Energy Solution, CATL, Samsung SDI

Top Companies in the Market & Their Offerings

- Huawei OneD Material, Inc.

Based in Palo Alto, California, this company develops SINANODE™ silicon nanowire on graphite technology to boost lithium-ion battery energy density and performance while remaining compatible with current manufacturing processes. - Nexeon Ltd.

Headquartered in Oxfordshire, UK, Nexeon produces advanced silicon-based anode materials that increase lithium-ion battery energy density, improve cycle life, and enhance performance for EVs and electronics. - California Lithium Battery

A U.S. focused battery materials company developing high-capacity silicon graphene composite anodes to extend battery life, improve charging speed, and support next-generation EV and portable device power solutions. - EoCell Inc.

Specializes in high-performance silicon anode battery technology, designing next-generation energy storage solutions optimized for electric vehicles and advanced portable power applications.

Latest Announcement By Industry Leader

- In May 2025, GDI announced the raising of an additional USD 11.5 million in Series A funding to scale up the production of its silicon anodes for electric vehicle batteries in the U.S. and Europe. The CEO of the company, Rob Anstey, stated that "the new funding will help expand production at the company's pilot facility in the Netherlands within 24 months."(Source: https://www.reuters.com)

Recent Developments

- In April 2025, NEO Battery Materials introduced its NBMSiDE P-300N silicon anode product. The P-300N is a mass-producible prototype that has NEO's highest capacity retention achieved to date and is optimized to enhance battery stability while maintaining low-cost production.(Source: https://chargedevs.com)

- In March 2024, Nexeon announced a major step forward with the groundbreaking of its first commercial production facility. This milestone positions Nexeon to deliver on its commitment to supply high-performance, cost-effective silicon anode material at commercial volumes starting in 2025. (Source: https://www.nexeonglobal.com)

Segments Covered in the Report

By Capacity

- <1,500 mAh

- 1,500 to 2,500 mAh

- >2,500 mAh

By Application

- Automotive

- Consumer Electronics

- Energy & Power

- Medical Devices

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content