What is the Smart Card in Government Market Size?

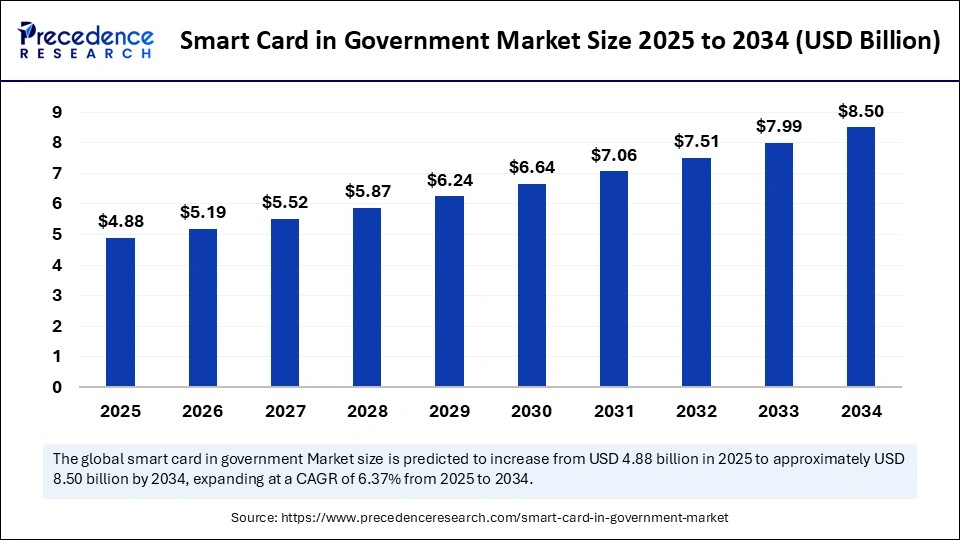

The global smart card in government market size was calculated at USD 4.59 billion in 2024 and is predicted to increase from USD 4.88 billion in 2025 to approximately USD 8.50 billion by 2034, expanding at a CAGR of 6.37% from 2025 to 2034. The global market is experiencing significant growth due to increased focus on secure identification and digital transformation across the government sector.

Smart Card in Government Market Key Takeaways

- In terms of revenue, the global smart card in government market was valued at USD 4.59 billion in 2024.

- It is projected to reach USD 8.50 billion by 2034.

- The market is expected to grow at a CAGR of 6.37% from 2025 to 2034.

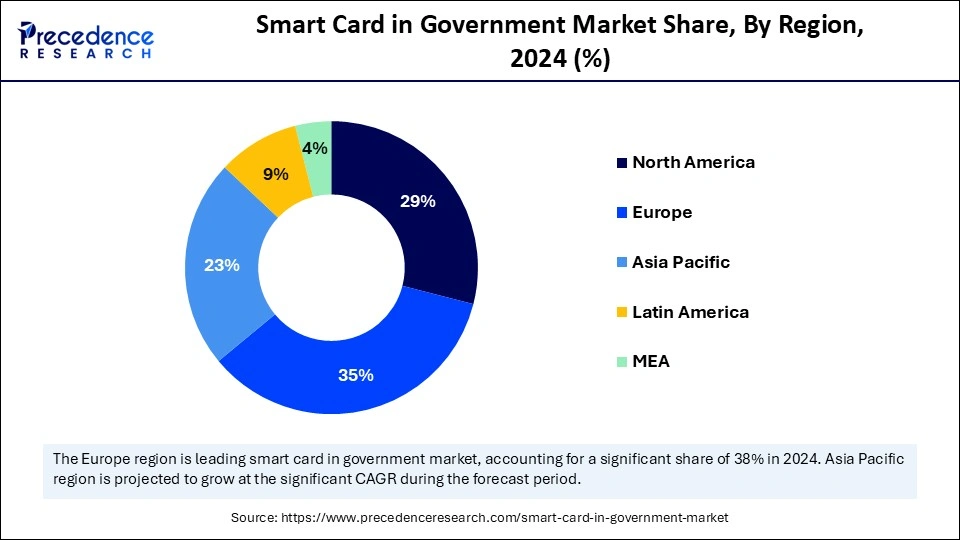

- Europe dominated the global smart card in government market with the largest share of 35% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

- By card type, the dual-interface smart cards segment contributed the biggest market share of 40% in 2024.

- By card type, the contactless smart cards segment is expected to grow at a notable CAGR between 2025 and 2034.

- By component, the hardware segment captured the highest market share of 55% in 2024.

- By component, the software and middleware segment will grow at a CAGR between 2025 and 2034.

- By application, the national ID cards segment held the maximum market share of 50% in 2024.

- By application, the healthcare and social security cards segment will grow at a CAGR between 2025 and 2034.

- By technology, the microprocessor smart cards segment generated the major market share of 60% in 2024.

- By technology, the biometric-enabled smart cards segment will grow at a CAGR between 2025 and 2034.

Market Overview and Major Quantitative Insights

The smart card in government market refers to the use of secure, tamper-resistant cards embedded with microprocessors or memory chips for authentication, identification, and secure data storage in public sector applications. These cards are widely adopted in e-passports, national ID cards, driver's licenses, healthcare cards, voter IDs, and social welfare programs, ensuring secure access, identity verification, and fraud prevention. Smart cards support both contact and contactless technologies and are increasingly integrated with biometric authentication, encryption, and blockchain solutions to enhance security. Market growth is driven by digital identity initiatives, rising cybersecurity threats, e-governance programs, demand for fraud-resistant solutions, and regulatory mandates worldwide.

The growing emphasis on the modern public sector for digital identity management, smart governance, and cybersecurity is driving the need for innovative approaches in smart card systems. Integration of smart card technology with existing government systems enables more efficient, accurate, fast, and affordable operations. For instance, with member states needing to provide one by 2026, the European government is leveraging its efforts toward the EUDI wallet initiatives.

AI Impact on Smart Cards in Government

Artificial intelligence is transforming the smart cards in the government sector by transforming the way these cards are used with more enhanced security, efficiency, and service delivery. AI is enabling enhanced security with smart cards in anomaly detection and biometric authentication. AI streamlines processes of automated identity verification and provides personalized services according to individual needs and requirements. AI integration with smart cars enables highly improved decision-making abilities through its real-time data analytics and predictive analytics. The government is focusing on leveraging AI with smart card services such as national ID cards and public services like healthcare, education, and social welfare for more efficiency and effectiveness.

What are the Key Trends of the Smart Card in Government Market?

- Digital Transformation: The rapid digitalization in the government sector, with the adoption of transformational initiatives and smart cards, is driving the global market.

- Secure Authentication: The increased risk of cyber threats has driven the need for a secure authentication process in government operations, driving demand for innovative and advanced feature-based smart cards.

- e-Governance Projects: The ongoing various e-governance projects, like electronic voting systems, e-passports, and national ID cards, are increasing the use of smart cards.

- Secure Data Storage Need: The rising need for secure storage of sensitive people data and encryption to protect sensitive information and prevent data breaches is fueling a shift toward the adoption of smart cards.

- Access Control: Smart cards play a crucial role in access control to government facilities, data, and systems for authorized individuals to access information, making them ideal in government applications.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 8.50 Billion |

| Market Size in 2025 | USD 4.88 Billion |

| Market Size in 2024 | USD 4.59 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.37% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Card Type, Component, Application, Technology, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased Demand for Secure Digital Identity

Governments worldwide are adopting smart cards for e-passports, health cards, voting, and state ID cards for enhancing security, streamlining citizen services, and preventing fraud. The largest innovations are ongoing in the development of technology in microprocessors, encryption capabilities, and integration with biometrics for secure digital authentication. The contactless technology enables convenient access to public services and shifts to digital transformation and cashless economies across the globe. The need for secure digital identity has increased in various sectors, particularly applications including healthcare, transportation, access control, and national identity and voting. Technological advancements such as near field communication (NFC), blockchain integration, and embedded microprocessors are fostering this growth.

Restraint

Lack of Standardization

The smart card technologies are facing challenges of a lack of standardization. The government experiences significant challenges in smart card adoption due to interoperability issues, integration, and high cost. The integration issues with security concerns, legacy systems, and the ability to gain seamless citizen services across various departments and regional areas are further creating standardization issues. These issues are adding to the high cost and complexity, driven by the large need for implementing and non-standardized systems for initial investments in hardware, software, and maintenance across various agencies, further hampering their acceptance in various government departments.

Opportunity

Emphasis on Implementation of Secure Payment System

The growing need for secure payment system implementation for government services is a significant opportunity for the emerging market. Public transportation, healthcare, and national ID programs are the major sectors driving the need for secure, contactless digital identity and transactions. Government initiatives for the adoption of smart cards to secure citizen data and reduce cyber threats and fraud are further fueling the shift to innovations in using these cards for payment solutions. The rising trend for contactless technology in payment transactions with secure and convenient digital options is transforming the market.

Card Type Insights

Which Card Type Leads the Smart Card in Government Market in 2024?

The dual-interface smart cards segment led the market in 2024, due to increased government adoptions of these cards for more versatility, security, and multi-application capabilities. The dual-interface smart cards combine traditional contact methods with modern functionality, helping to secure citizen identification, frictionless access control, and e-Governance services. The popularity of dual-interface smart cards has been driven by innovative security features, including EMV chip technology and biometric authentication. The adoption of national ID programs and public services has increased, increasing the traction of dual-interface smart cards with the ability to integrate physical and digital infrastructures.

The contactless smart cards segment is the second-largest segment, leading the market due to their ability to enhance citizen services and improve security measures. These smart cards enable faster, more secure, and convenient access to services for individuals. The adoption of national ID cards, e-passports, and public transport systems has increased for faster and more convenient services. Additionally, the government initiatives in promoting the use of cashless transactions and the use of NFC and RFID technologies are further aiding the segment's growth.

Component Insights

What Made the Hardware Components Dominate the Smart Card in Government Market?

The hardware segment dominated the market in 2024, due to growing innovations in hardware. The ongoing developments of NFC and RFID in hardware components enable faster and convenient transactions like contactless payments. Advanced chips and encryption help to enhance operational efficiencies through contactless technologies and reduce the risk of fraud with secure identity verification. The cutting-edge innovations like microchips, advanced encryption, and biometric integrations are driving growth in the adoption of hardware components like cards, chips, readers, and terminals.

The software and middleware segment is expected to grow fastest over the forecast period, driven by the growing trend for multi-application cards and miniature computing systems. The software and middleware components provide the required functionality, like operating systems, for on-card processing and advanced authentication tools. These components are essential in improving security and middleware that enables various applications and operating systems to interface with the cards. The growing demand for a single card with the ability to support multiple applications and facilitate seamless integration with existing government systems is contributing to this growth.

Application Insights

Which Application Dominates the Smart Card in Government Market?

In 2024, the national ID cards segment dominated the market due to the increased need for a central and secure digital identity for citizens. National ID cards enable enhanced security and reduce the risk of fraud. These smart cards provide a foundational platform for digital identity, enable multi-application services, and enhance citizen security. The rising advancements in biometric and contactless technologies with advanced features are fostering research and development to be more secure, scalable, and interoperable for smart cards.

The healthcare and social security cards segment is expected to grow fastest over the forecast period, driven by increased demand for enhanced security and data privacy measures in healthcare and social services. The smart cards enable versatile, secure, and interoperable services for managing patient data and social benefits. The ability of smart cards to enhance operational efficiency, data security, and fraud reduction makes them suitable for healthcare and social services. The demand for smart cards with features like contactless technology and multi-application capabilities has increased in this sector.

Technology Insights

What Made the Microprocessor Smart Cards Dominate the Smart Card in Government Market in 2024?

In 2024, the microprocessor smart cards segment dominated the market, due to their security, identity management, and multi-application functionality. The microprocessor smart cards are bringing essential benefits in enhancing security and preventing fraud. This technology improves security for digital identity, national ID programs, and e-passports via cutting-edge cryptographic capabilities. The microprocessor smart cards technology enables advanced and fast data processing, facilitates seamless service delivery, and enhances operational efficiency.The biometric-enabled smart cards segment is expected to lead the market over the forecast period, driven by its ability to improve security and user experiences.

The biometric-enabled smart cards provide convenience and operational efficiency via on-card biometric verifications. The government functions, such as identity verification and access control, are driving the necessity of biometric-enabled smart cards to reduce fraud. The growing trends for secure and contactless transactions for public services are driving the adoption of the biometric-enabled smart cards.

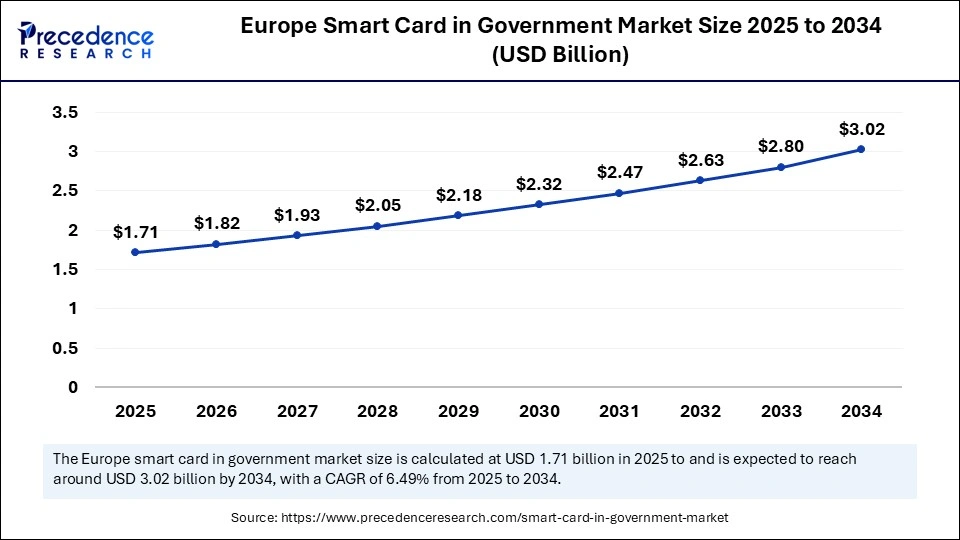

Europe Smart Card in Government Market Size and Growth 2025 to 2034

The Europe smart card in government market size is evaluated at USD 1.71 billion in 2025 and is projected to be worth around USD 3.02 billion by 2034, growing at a CAGR of 6.49% from 2025 to 2034.

Europe Smart Card in Government Market

Europe dominates the global smart card in government market, driven by the region's increased adoption of smart cards in public transport and healthcare. Governments of Europe are promoting the use of smart cards for more secure, faster, and accurate data transfer and transactions. The strong presence of key market players like Thales and Idemia, and their offering of sustainable cards and public transport ticketing solutions, is leveraging this growth. Additionally, regional organizations focus on integration of biometric authentication and multi-application capabilities to advance security and convenience through interoperability and data privacy, driving the need for significant innovations, leading to market growth.

European Countries Market Trends

Germany and the UK are the leading players in the regional market, contributing to growth due to digital strategies, government initiatives, and widespread adoption of smart ID cards for various applications like citizen services and secure transactions. The government supported eID programs, and the growing need for secure identity verifications is supporting this growth. Additionally, the rapid digital transformation across these countries is further contributing to the market expansion.

Asia Pacific Smart Card in Government Market

Asia Pacific is the fastest-growing region in the global smart card in government market, growth driven by the region's rapid digitalization initiatives, need for secure identification, and government initiatives. The Government of Asia is promoting national ID programs and e-services to boost digital transformation. The rapid urbanization and increased demand for cashless and contactless transactions are leveraging this growth. Countries like China, India, and Japan are leading the regional market with countries' strong focus toward secure data storage, integration of mobile services, and adoption of biometric and contactless card solutions.

China's Market Trends

China is a major player in the regional market, with growth driven by countries' well-established manufacturing capabilities. The large-scale production of novel technologies and government support for smart city infrastructure projects and digital accuracy initiatives are contributing to the growth. The advanced urban culture and need for contactless and cashless transactions are the major factors solidifying China's position in the market growth.

Government Initiatives to Boost Indian Digitalization

India is a significant player in the regional market, driven by a large population, rapid urbanization, and government initiatives. The Government of India has boosted the adoption of digital technologies, including smart cards, for various sectors. The Andhra Pradesh government has single-handedly launched the distribution of smart ration cards for 4.42 crore beneficiaries in the state. These smart cards allow beneficiaries to collect required commodities like palm oil, wheat, and dal from any of the 29,000 fair price shops across Andhra Pradesh. (Source: https://www.newindianexpress.com)

North America Smart Card in Government Market

North America is a notable player in the global smart card in government market, driven by government support and initiatives in digitalization, smart city projects, and increased demand for secure and advanced digital identity solutions. The increased need for improved security, operational efficiency, and secure user authentication across public services has boosted government adoption of smart cards in North America. Government initiatives like the First Responder Authentication Credential (FRAC) are fostering the use of smart card technology for secure identification and access across the region.

The U.S. Market Trends

The U.S. is a major player in the regional market, contributing to growth due to the country's rapid digitalization, strong presence of technology manufacturing giants, and government initiatives. The novel FIPS-compliant PIV cards for US federal agencies are showing the government's focus on the adoption of this technology. Additionally, the increasing emphasis on integration of biometric authentication and dual-interface cards further contributes to this growth.

Smart Card in Government Market Companies

- Thales Group (Gemalto NV)

- IDEMIA

- Giesecke+Devrient GmbH (G+D)

- Infineon Technologies AG

- NXP Semiconductors

- HID Global Corporation (Assa Abloy)

- CardLogix Corporation

- Watchdata Technologies

- CPI Card Group Inc.

- Valid S.A.

- Eastcompeace Technology Co., Ltd.

- Shanghai Huahong Integrated Circuit Co., Ltd.

- Athena Smartcard Solutions

- Bundesdruckerei GmbH

- SecuGen Corporation

- Identiv, Inc.

- NEC Corporation

- STMicroelectronics

- Samsung Electronics Co., Ltd.

- Atos SE

Latest Innovation in Government Smart Cards

- In April 2024, the Ministry of Finance initiated the national eIDAS for the government digital agency to implement the Finnish public sector wallet. The eIDAS 2.0 revision of eIDAS launched the European Digital Identity (EUDI) wallet, for users to store and manage personal identification information, including national IDs, driving licenses, and securely share it with public or private service providers across the EU. (Source: https://www.globalgovernmentforum.com)

- The Indian Ministry of Home Affairs (MHA) has mandated a biometric smart card for central government employees from July 2025. These smart cards can help employees access the new CCS-3 building, improving security by ordering ID card replacements and requiring a fresh registration process. The Ministry of Home Affairs (MHA) asks all central government employees who are shifted to the new CCS-3 building to get their biometric details for smart cards under the new security protocol for entering the government building. (Source: https://www.hindustantimes.com)

Recent Developments

- In April 2025, the Maharashtra state government plans to launch the ‘Mumbai One' smart card, which was announced by the Maharashtra Chief Minister Devendra Fadnavis. This announced the integration of smart cards to streamline public transportation in Mumbai city. (Source: https://www.indiatvnews.com)

- In February 2025, a ground-breaking initiative for modernization and improving the safety, security, and efficiency of the Indian civil aviation sector, the Electronic Personnel License (EPL) for pilots, was launched by Sh. Ram Mohan Naidu, the Union Minister for Civil Aviation. India has become a country globally for implementing the EPL cutting-edge system, after approval from the International Civil Aviation Organization (ICAO). (Source: https://www.pib.gov.in)

Segment Covered in the Report

By Card Type

- Contact-Based Smart Cards

- Contactless Smart Cards

- Dual-Interface Smart Cards

- Hybrid Smart Cards

By Component

- Hardware (Cards, Chips, Readers, Terminals)

- Software and Middleware (Operating Systems, Authentication Tools)

- Services (Consulting, Integration, Maintenance, Managed Services)

By Application

- National ID Cards

- E-Passports

- Driver's Licenses

- Voter ID Cards

- Healthcare and Social Security Cards

- Subsidy/Welfare Distribution Cards

- Border Control and Immigration

- Others (Defense, Law Enforcement)

By Technology

- Microprocessor Smart Cards

- Memory Smart Cards

- Biometric-Enabled Smart Cards

- Optical/Other Advanced Cards

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting