Smart Home Healthcare Market Size and Forecast 2025 to 2034

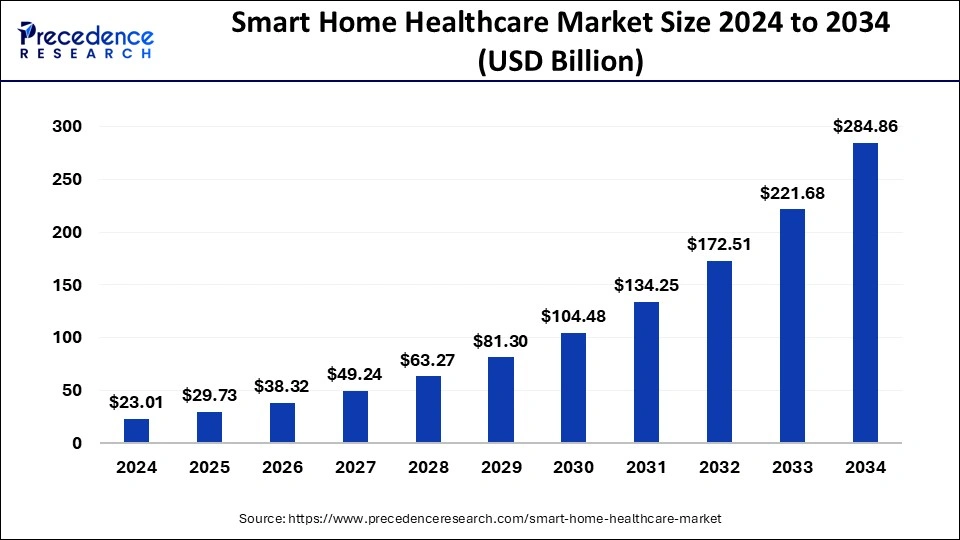

The global smart home healthcare market size accounted for USD 23.01 billion in 2024 and is predicted to increase from USD 29.73 billion in 2025 to approximately USD 284.86 billion by 2034, expanding at a CAGR of 28.50% from 2025 to 2034.

Smart Home Healthcare MarketKey Takeaways

- The global smart home healthcare market was valued at USD 23.01 billion in 2024.

- It is projected to reach USD 284.86 billion by 2034.

- The smart home healthcare market is expected to grow at a CAGR of 28.50% from 2025 to 2034.

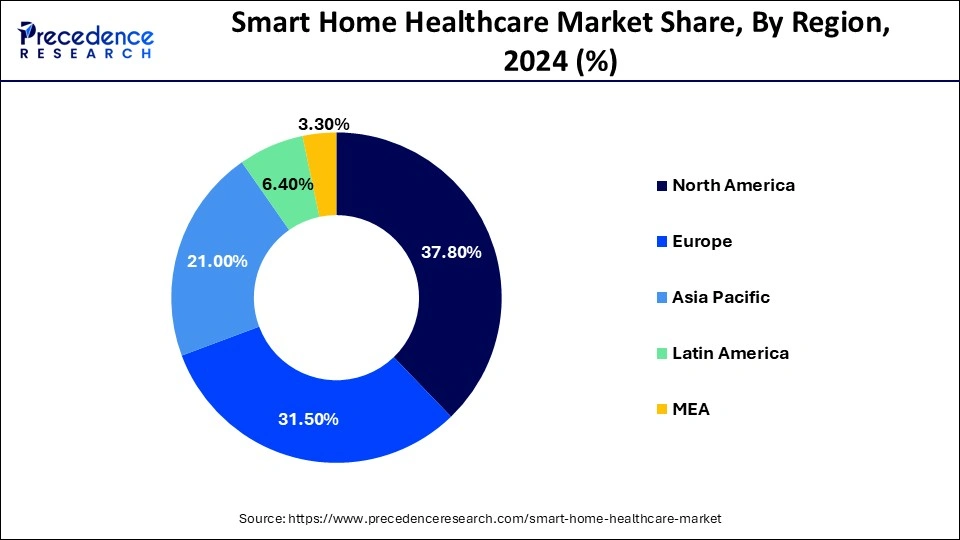

- North America dominated the market with the largest share in 2024.

- Asia Pacific is observed to grow at the fastest rate during the forecast period.

- By product, the smart glucose monitoring system segment held the dominating share of the market in 2024.

- By technology, the wireless segment is expected to grow at the fastest CAGR during the forecast period.

- By application, the health status monitoring segment dominated the market with the largest share in 2024.

U.S. Smart Home Healthcare Market Size and Growth 2025 to 2034

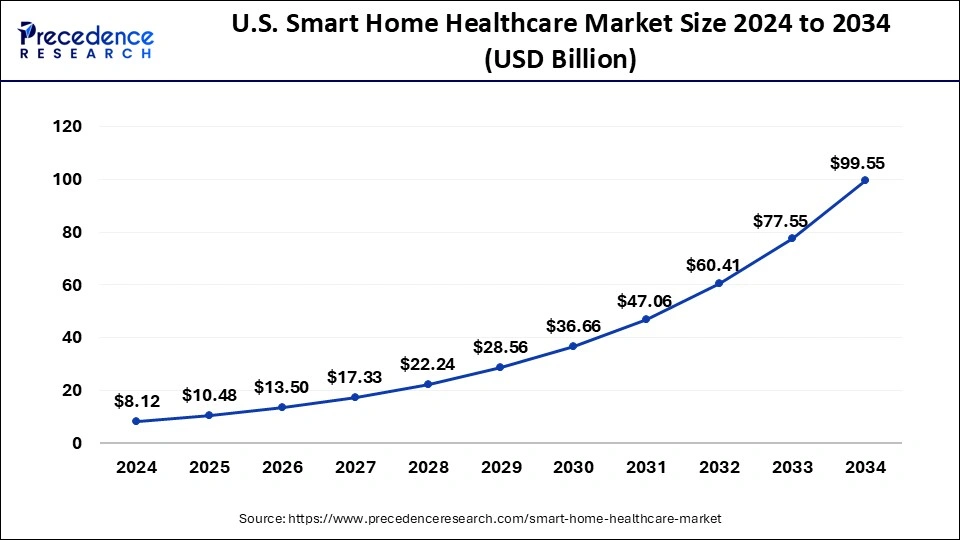

The U.S. smart home healthcare market size accounted for USD 10.48 billion in 2025 and is projected to be worth around USD 99.55 billion by 2034, growing at a CAGR of 28.50% from 2025 to 2034.

North America dominated the smart home healthcare market with the largest share in 2024 and is observed to sustain the dominance throughout the forecast period. North America has a rapidly ageing population, leading to an increased prevalence of chronic diseases and age-related conditions. Smart home healthcare solutions are vital in providing care and support for older adults to age in place independently. Moreover, the region's high healthcare spending and culture of innovation contribute to the development and adoption of advanced healthcare technologies. Investment in research and development supports the growth of the smart home healthcare market. Thus, driving the smart home healthcare market during the forecast period.

Asia Pacific is expected to grow at the highest CAGR during the forecast period. Modernizing healthcare delivery in the Asia Pacific region is the goal of the digital revolution and the proliferation of IoT devices. Furthermore, manufacturers all over the world have been offering economical and practical solutions, especially for Asian smart homes. Taiwan, South Korea, and Singapore are Asian nations that have high levels of data connection. The United Nations projects that by 2050, there will be 366 million older Chinese people, a number far more than the current total population of 331 million Americans. By then, the proportion of senior people in China will have risen from 12% to a projected 26%. The nation's aging population is probably going to be the main driver of the smart home healthcare market.

Market Overview

The smart home healthcare market offers ecosystem designed for in-home care of the elderly, outpatients, and people with disabilities. Smart home healthcare is comprised of sensors and gadgets placed in the house. Alert systems, smart watches, glucose monitors, oximeters, and fall prevention and detection systems are just a few examples of smart gadgets that measure numerous medical indicators to improve quality of life and deliver better healthcare services. To facilitate the remote monitoring and control of systems and appliances, including heating and lighting, smart homes are furnished with gadgets that are connected to the internet. Patients can wear smart gadgets or have them installed in their environment.

Smart Home Healthcare Market Growth Factors

- The global aging population is increasing, leading to a higher prevalence of chronic diseases and age-related health conditions. Smart home healthcare technologies offer solutions for remote monitoring, timely interventions, and improved management of chronic illnesses, which is particularly beneficial for the elderly population.

- There is a growing emphasis on preventive healthcare, and smart home healthcare technologies play a crucial role in early detection and prevention of health issues. Continuous monitoring and data analytics enable proactive interventions, reducing the risk of complications and hospitalizations.

- Smart home healthcare solutions have the potential to reduce healthcare costs by preventing hospital readmissions, enabling remote monitoring, and promoting outpatient care. This is particularly important in the context of efforts to optimize healthcare spending and make healthcare more efficient, promoting the smart home healthcare market's expansion.

- Ongoing advancements in technology, including the Internet of Things (IoT), artificial intelligence (AI), and wearable devices, contribute to the development of more sophisticated and interconnected Smart Home Healthcare solutions. These technologies enhance the capabilities of remote monitoring, data analysis, and personalized healthcare delivery.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 28.50% |

| Market Size in 2025 | USD 29.73 Billion |

| Market Size by 2034 | USD 284.66 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Technology, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising importance of health and wellness

Numerous governmental programs aimed at increasing lifespan contribute to the rapid increase in the world population. The majority of wealthy countries are witnessing an increase in the population that is becoming older. The World Health Organization projects that by 2030, one in six people will be over 60 globally. The number of people over 60 may rise from 1.0 billion in 2020 to 1.4 billion. The number of people over 60 in the globe might treble to 2.1 billion by 2050. Between 2020 and 2050, the number of people 80 years of age or older is predicted to treble globally, to 426 million. Thus, the growing older population along with increasing health and wellness trends drives the global smart home healthcare market during the forecast period.

Restraint

Privacy and interoperability issues

The collection and transmission of sensitive health data within smart home healthcare systems raise concerns about privacy and security. Individuals may be hesitant to adopt these technologies if they are not confident in the protection of their personal health information from unauthorized access or cyber threats. Additionally, the integration of various devices and platforms within smart home healthcare systems may face interoperability challenges. Different manufacturers may use different standards and protocols, leading to difficulties in seamless communication and data exchange between devices. This lack of interoperability can hinder the effectiveness of the overall healthcare system. Thereby, privacy and interoperability issues hamper the smart home healthcare market.

Opportunity

Increasing product launches

The increasing product launches are expected to offer a lucrative opportunity for the smart home healthcare market growth during the forecast period. For instance, in January 2023, the Intelligent Healthcare Platform is a new, all-inclusive digital health platform that HARMAN, a wholly-owned subsidiary of Samsung Electronics Co., Ltd., focused on connected technologies and solutions for automotive, consumer, and enterprise markets, unveiled.

The platform is intended to support healthcare and life sciences enterprises in their transition to individualized, customer-centric services. This week at CES, the HARMAN EXPLORE Showcase at the Virgin Hotel in Las Vegas will feature the newest innovation from HARMAN's Digital Transformation Solutions (DTS) business segment.

Product Insights

The smart glucose monitoring system segment held the dominating share of the smart home healthcare market in 2024. Smart glucose monitoring systems provide continuous and real-time monitoring of blood glucose levels. This continuous data collection allows for a more comprehensive understanding of glucose trends, helping individuals and healthcare providers make informed decisions.

Moreover, this system often has dedicated mobile applications that provide users with easy access to their glucose data. Cloud integration allows for secure storage of historical data and enables users to share their information with healthcare providers during telehealth consultations. Furthermore, the rising product launches are expected to propel the segment expansion.

- For instance, in November 2023, to facilitate further interaction with both new and current members, DarioHealth Corp., a pioneer in the worldwide digital health industry, announced the release of a new smart blood sugar meter for Apple iPhone 15 users. The USB-C charging connector included on the new iPhone 15 is a crucial component for Dario's smart blood glucose meter's real-time data collection. By providing members with a USB-C-compliant device, Dario's new smart blood sugar meter gives iPhone 15 users the same fast connectivity for real-time blood sugar readings as part of their tailored Dario health management experience.

The smart cardiac monitoring system segment is expected to grow at a rapid rate over the projected period. The segment expansion is attributed to the increasing prevalence of cardiovascular disease across the globe. Smart cardiac monitoring systems often feature user-friendly interfaces and intuitive mobile applications that make it easy for individuals to track and interpret their cardiac data. These interfaces may include visualizations of heart rhythms, trends over time, and personalized insights, empowering users to take an active role in managing their heart health.

Technology Insights

The wireless segment is expected to grow at the fastest CAGR in the smart home healthcare market during the forecast period. Wireless connectivity allows for remote monitoring of health parameters. Devices such as smart wearables, smart glucose monitors, blood pressure monitors, and other health sensors can transmit data wirelessly to centralized systems, providing real-time information to healthcare providers or family members.

Moreover, wireless connectivity supports telehealth services by enabling video consultations, remote monitoring, and virtual healthcare interactions. Patients can connect with healthcare providers from the comfort of their homes, reducing the need for in-person visits.

The wired segment is observed to hold a significant share of the smart home healthcare market. Wired connections are typically more stable and less susceptible to interference compared to wireless technologies. This can be crucial for ensuring the accuracy of medical measurements and data transmission. Thereby, driving the segment growth.

Global Smart Home Healthcare Market Revenue, By Technology, 2022-2024 (USD Million)

| Technology | 2022 | 2023 | 2024 |

| Wired | 5,544.7 | 7,320.3 | 9,508.9 |

| Wireless | 7,806.4 | 10,348.6 | 13,497.8 |

Application Insights

The health status monitoring segment held the dominating share of the smart home healthcare market in 2024. Numerous health factors may be continuously monitored due to smart home healthcare devices. Vital indicators including heart rate, blood pressure, temperature, oxygen saturation, and more are included in this. An individual's state of health may be fully viewed through continuous monitoring, which enables the early identification of any changes or anomalies. Moreover, they allow healthcare providers to monitor patients with chronic conditions from a distance, reducing the need for frequent in-person visits and improving overall patient outcomes.

Besides, the fall prevention & detection segment is expected to grow significantly over the forecast period in the smart home healthcare market. The integration of fall prevention and detection technologies into smart home healthcare reflects a commitment to enhancing safety and independence for individuals at risk of falls, promoting a higher quality of life and reducing the risk of injuries. As technology continues to advance, further innovations in this area are likely to contribute to improved fall prevention strategies and outcomes.

Smart Home Healthcare Market Companies

- Sunfox Technologies Pvt Ltd.

- Bayalarm

- Agatsa Software Pvt. Ltd.

- DexCom, Inc

- Qure4u

- Medical Guardian LLC

- Withings

- Tunstall Group

- Connect America

- Mytrex Inc.

Recent Developments

- In January 2022, the debut of Carrie was announced by Fresenius Medical Care, a prominent supplier of goods and services for people with renal disorders. The Asia-Pacific region's clinical teams and Fresenius Kidney Care nurses are connected, informed, and supported by this specially designed mobile application.

- In March 2022, the digital health company Quil, which was formed by Independence Health Group and Comcast, announced the limited commercial launch of Quil Assure, a new smart home platform that enables seniors to age in place and maintain support from friends and family acting as caregivers while granting them more freedom.

Segments Covered in the Report

By Product

- Smart Glucose Monitoring System

- Medical Device Alert Systems

- Smart Cardiac Monitoring System

- Others

By Technology

- Wired

- Wireless

By Application

- Health Status Monitoring

- Fall Prevention and Detection

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting