What is the Smart Pest Monitoring Management System Market Size?

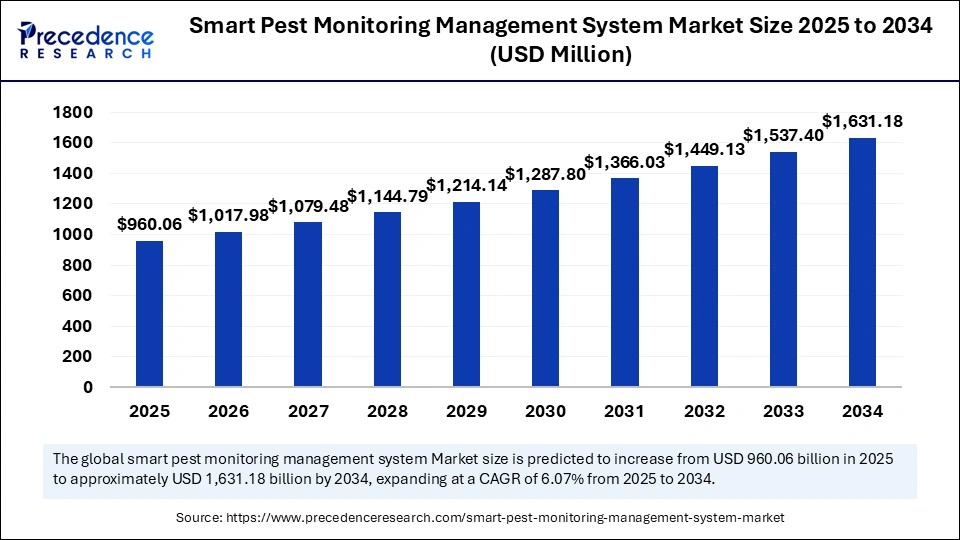

The global smart pest monitoring management system market size was calculated at USD 905.50 million in 2024 and is predicted to increase from USD 960.06 million in 2025 to approximately USD 1,631.18 million by 2034, expanding at a CAGR of 6.07% from 2025 to 2034. The market is experiencing significant growth due to the increasing adoption of IoT technologies and the demand for environmentally conscious solutions. This growth is further supported by rising concerns over food safety and public health, stricter government regulations promoting sustainable pest management. Additionally, the high cost-effectiveness of these systems in the long run further accelerates market expansion.

Smart Pest Monitoring Management System Market Key Takeaways

- In terms of revenue, the global smart pest monitoring management system market was valued at USD 905.50 million in 2024.

- It is projected to reach USD 1,631.18 million by 2034.

- The market is expected to grow at a CAGR of 6.07% from 2025 to 2034.

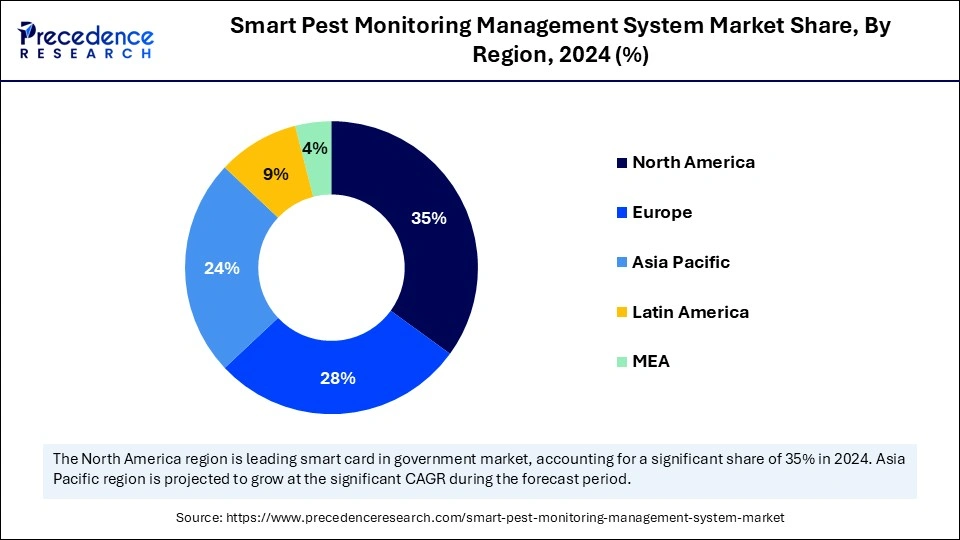

- North America dominated the global market the largest market share of 35% in 2024.

- Asia Pacific is expected to witness the fastest CAGR during the foreseeable period.

- By component, the hardware segment held the biggest market share of 45% in 2024.

- By component, the software segment is expected to witness the fastest CAGR during the foreseeable period.

- By pest type, the rodents segment captured the highest market share of 40% in 2024.

- By pest type, the insect segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By application, the food and beverage segment contributed the maximum market share of 35% in 2024.

- By application, the agriculture and healthcare segment will grow at a significant CAGR from 2025 to 2034.

- By technology, the IoT-based monitoring segment accounted for the significant market share of 50% in 2024.

- By technology, the AI and vision systems segment is projected to grow at a notable CAGR between 2025 and 2034.

- By deployment model, the cloud-based segment held the largest market share of around 55% in 2024.

- By deployment model, the on-premises segment is expected to witness the fastest CAGR during the foreseeable period.

- By end-user, the enterprises segment generated the major market share of 60% in 2024.

- By end-user, the government and municipal bodies segment is anticipated to grow at a significant CAGR from 2025 to 2034.

Market Overview

The smart pest monitoring management system market involves integrating IoT-enabled sensors, AI-powered analytics, automated traps, cameras, and cloud-based platforms to detect, monitor, and control pest activity in real-time. These systems support data-driven pest management, early detection of infestations, reduced pesticide use, and compliance with food safety and hygiene standards. Market growth is driven by increased demand for smart agriculture, stricter food safety regulations, urban pest challenges, cost savings from predictive pest control, and growing adoption of IoT and AI in facility management.

How Can AI Make an Impact in the Smart Pest Monitoring Management System Market?

Artificial intelligence is revolutionizing the smart pest monitoring and management market by providing precision, accuracy, and efficiency through machine learning and computer vision for early detection, accurate species identification, and predictive modeling. Systems use sensors, cameras, and drones to gather real-time data, which AI analyzes to recommend targeted pest control measures, reducing chemical use, environmental impact, and crop loss. By studying pest patterns and infestation hotspots, AI enables the development of precision pest management strategies, leading to targeted pesticide application.

What are the Key Trends in the Smart Pest Monitoring Management System Market?

- Urbanization and Changing Climates: The growth of urban populations and changes in weather patterns are leading to more frequent pest invasions. This situation increases the demand for reliable and intelligent detection systems in homes, businesses, and farms.

- Demand for Smart Homes and Proactive Solutions: Consumers are increasingly interested in personalized, efficient, and ethical options. This includes smart home integration and proactive measures to prevent pest-related health issues, such as allergies and vector-borne diseases.

- Growth in Residential and Commercial Construction: The rise in construction and renovation activities creates new opportunities to implement smart pest monitoring systems. These systems can effectively manage pest control in both new and existing properties.

- Data-Driven Decision Making: Smart pest monitoring systems provide actionable data, allowing pest control professionals and homeowners to make more informed and targeted decisions. This results in higher efficiency and lower costs.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,631.18 Million |

| Market Size in 2025 | USD 960.06 Million |

| Market Size in 2024 | USD 905.50 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.07% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Pest Type, Application, Technology, Deployment Model, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Global Demand for Sustainable and Eco-Friendly Pest Control Methods

The main driver for the smart pest monitoring management system market is the rising global demand for sustainable and eco-friendly pest control methods, fueled by regulations aimed at lowering pesticide usage and by a focus on food safety and public health. Growing organic farming practices and government initiatives promoting Integrated Pest Management (IPM) favor smart traps and sensors that enable precise pest control with minimal pesticide applications. The booming e-commerce sector and expanding warehouses create a significant need for continuous and remote pest monitoring.

Restraint

High Initial Investment and Ongoing Maintenance Costs

A key restraint for the smart pest monitoring management system market is the high initial investment and ongoing maintenance costs associated with the technology, along with a lack of widespread awareness and understanding of its benefits. High setup costs may deter potential users, especially in less affluent regions or smaller operations, while limited awareness about integrated pest management principles and the advantages of smart systems restricts broader adoption, posing challenges for some businesses and consumers.

Opportunity

Integration of New Technologies Such as Automated Response Systems

The most promising future opportunity in this market lies in integrating AI and IoT with automated response systems, which enables predictive, targeted, and sustainable pest management solutions. Cloud computing platforms facilitate processing and analyzing large datasets, leading to more accurate, timely, and data-driven pest control decisions across various sectors. This provides highly precise monitoring through real-time data from IoT sensors and drones, predictive analytics, and automated, non-toxic treatments.

Component Insights

What Made the Hardware Segment Dominate the Smart Pest Monitoring Management System Market in 2024?

The hardware segment led the market in 2024. This is mainly because it forms the foundation for data collection, including real-time pest detection through smart traps and sensors. Advanced hardware, like smart traps with built-in cameras and sensors, allows for automated, accurate data collection, essential for early pest detection and data-driven interventions. By enabling precise, localized actions, hardware-based systems help reduce pesticide use, benefiting the environment and lowering costs related to chemical treatments.

The software segment is expected to see the fastest growth. This is because it offers data-driven, actionable insights for improved precision, efficiency, and sustainability, overcoming the limitations of traditional pest control. AI allows for predictive pest identification, real-time monitoring, and optimized treatment timing by integrating data from sensors, weather reports, and satellites. The growth is driven by the convergence of AI with other technologies like IoT sensors and remote sensing, creating an integrated system for real-time monitoring and intervention.

Pest Type Insights

How Did the Rodents Segment Lead the Smart Pest Monitoring Management System Market in 2024?

The rodents segment held the largest market share in 2024, mainly due to rodents' highly destructive potential, health significance, and widespread presence in urban and agricultural areas, making them a primary target for cost-effective, automated control systems. Rodents inhabit diverse environments, from food processing plants and warehouses to city homes and farms, requiring constant vigilance. Traditional rodent control methods are labor-intensive and involve frequent manual inspections, which smart systems can significantly reduce.

The insect segment is expected to be the fastest-growing segment, mainly due to increased awareness of vector-borne diseases, high insect prevalence, especially mosquitoes and bedbugs, and technological advancements in IoT and AI that enable real-time, data-driven monitoring and targeted interventions. These technologies reduce costs by minimizing chemical use and allowing remote, automated control, resulting in more efficient, precise, and timely interventions.

Application Insights

How Did the Food and Beverage Segment Lead the Smart Pest Monitoring Management System Market in 2024?

The food and beverage segment maintained a dominant market position in 2024. This is primarily because of strict regulations, high risks of contamination and spoilage, and the need to protect product quality and brand reputation, all of which are directly addressed by integrated smart pest management systems. Pests pose a major threat to food safety by causing contamination and spoilage, leading to significant financial losses due to waste and potential product recalls. Advanced pest monitoring systems reduce reliance on traditional, labor-intensive methods.

The agriculture and healthcare segment is projected to experience the fastest growth in the coming years. This growth is driven by increased demand for sustainable pest control, leveraging AI-powered precision agriculture to optimize resource use and enhance yields, and addressing global food security challenges. Smart pest management systems integrated with IoT sensors, GPS, and data analytics provide real-time information on crop health and environmental conditions, helping to protect crops, improve productivity, and reduce losses from pests and diseases.

Technology Insights

Why Did the IoT-Based Monitoring Segment Dominate the Smart Pest Monitoring Management System Market in 2024?

The IoT-based monitoring segment led the market in 2024, mainly due to its ability to provide real-time data, automate responses, increase efficiency, and promote a more sustainable pest control approach. Data from connected devices is transmitted to a central platform, automating the monitoring process and reducing the need for manual inspections. This method allows for remote monitoring, precise treatment application, lower labor costs, and minimizes environmental impact by reducing unnecessary pesticide use, preventing small infestations from escalating problems.

The AI and vision systems segment is expected to grow the fastest. This is mainly because it provides real-time, accurate pest identification and data analysis that lead to precise, data-driven pest management strategies, reducing costs and pesticide use. This growth is further driven by advances in AI models for image recognition, such as Convolutional Neural Networks, which can identify pests and environmental factors from camera and sensor data more accurately and earlier than human inspection.

Deployment Model Insights

Why Did the Cloud-Based Segment Lead the Smart Pest Monitoring Management System Market in 2024?

The cloud-based segment led the market in 2024. This is mainly because of its scalability, cost-efficiency, real-time data analysis, and easy access via wireless platforms, enabling farmers to make timely and informed decisions. Cloud platforms serve as the backbone for AI and advanced data analytics, which can analyze large datasets to predict pest outbreaks, optimize resource use, and automate management processes. This approach offers a centralized hub for diverse sensor data, facilitating AI-driven pest detection and predictive analytics.

The on-premises segment is expected to be the fastest-growing segment. This is because it offers a balanced approach, combining on-premise control for critical data and sensitive operations with cloud flexibility and scalability for data analysis and advanced features. This setup addresses concerns about data security, compliance, and operational costs. It allows businesses to optimize resources, reduce large upfront infrastructure costs, and leverage remote monitoring and control capabilities to meet specific needs and regulatory standards.

End-User Insights

How Did the Enterprises Segment Lead the Smart Pest Monitoring Management System Market in 2024?

The enterprises segment dominated the market in 2024. This is mainly because they face significant economic and operational pressures to optimize costs, improve efficiency, and maintain product quality. Smart systems address these needs through real-time data, automation, and predictive analytics. These systems provide real-time data on pest populations and crop health, enabling businesses to make informed, timely decisions about targeted interventions. These benefits are especially vital for large and small-to-medium enterprises (SMEs) managing extensive operations or seeking growth, leading to higher adoption rates compared to residential sectors.

The government and municipal bodies segment is growing fastest in the smart pest monitoring market due to rising awareness of public health, food safety, environmental conservation, and the need for sustainable, data-driven pest management in urban and agricultural environments. Smart systems provide scalable, cost-effective solutions by delivering real-time data and enabling targeted, early interventions. Advances in IoT, AI, and cloud platforms support real-time monitoring and predictive analytics, facilitating proactive actions and reducing pesticide use.

U.S. Smart Pest Monitoring Management System Market Size and Growth 2025 to 2034

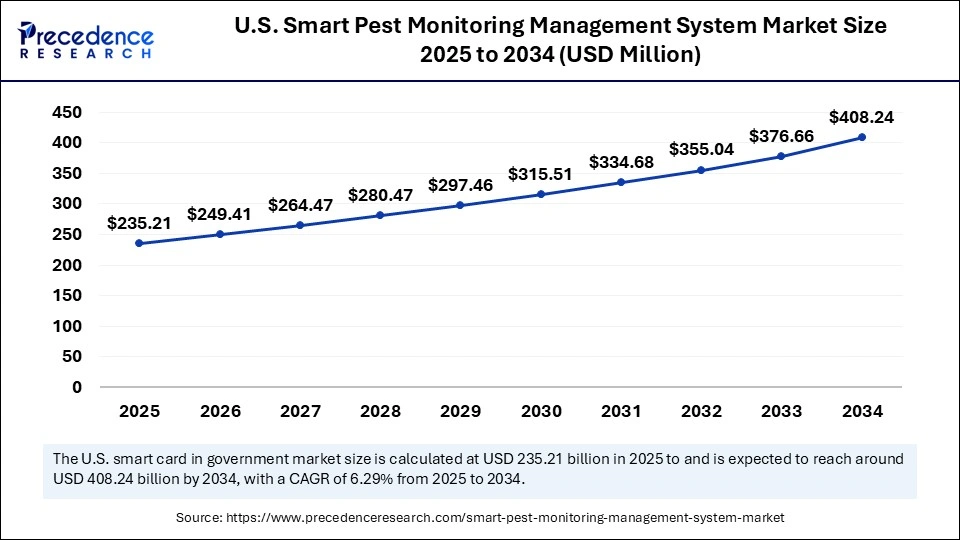

The U.S. smart pest monitoring management system market size was evaluated at USD 221.85 million in 2024 and is projected to be worth around USD 408.24 million by 2034, growing at a CAGR of 6.29% from 2025 to 2034.

How Did North America Lead the Smart Pest Monitoring Management System Market in 2024?

North America led the market in 2024. This is mainly due to its focus on sustainable agriculture, advanced technological infrastructure, a supportive regulatory environment for Integrated Pest Management (IPM), and substantial investment in research and development. This leadership is further reinforced by widespread adoption of IoT, AI, and automation in agriculture, alongside growing consumer and regulatory demand for eco-friendly, data-driven pest control. Major companies like Rentokil Initial, Anticimex, Bayer AG, and Ecolab invest heavily in research and development, fueling ongoing innovation in predictive and automated pest management strategies.

The U.S. Smart Pest Monitoring Management System Market Trends

The U.S. plays a key role in the global market because of its leadership in IoT, AI, and data analytics innovation. Strong demand across agriculture, urban areas, and food safety sectors, supported by government programs such as USDA-NIFA's Crop Protection and Pest Management, drives this growth.

Canada Smart Pest Monitoring Management System Market Trends

Canada also holds a notable position due to its focus on integrating advanced technologies like IoT sensors and AI-powered analytics to address pest control challenges in agriculture and urban settings. Its commitment to sustainable practices and precision farming also supports the adoption of smart pest management solutions, with both local and international firms contributing to market growth and innovation.

Why is Asia Pacific Considered the Fastest-Growing Region in the Smart Pest Monitoring Management System Market?

Asia-Pacific is the fastest-growing region for smart pest monitoring systems, driven by rapid urbanization, population growth, increased awareness of pest-borne diseases, and the modernization of agriculture through smart farming tools. These factors boost demand for automated, eco-friendly solutions that cut down pesticide use. Countries like China, India, and Japan are adopting smart farming techniques, which require advanced solutions for early detection and real-time monitoring of pests to reduce crop losses and strengthen food security.

Smart Pest Monitoring Management System Market Companies

- Rentokil Initial plc

- Ecolab Inc.

- Anticimex Group

- Bayer AG (Environmental Science Division)

- BASF SE (Pest Control Solutions)

- Corteva Agriscience

- Terminix Global Holdings, Inc.

- Orkin Pest Control (Rollins Inc.)

- PelGar International

- Bell Laboratories, Inc.

- Brandenburg (UK) Ltd.

- Pelsis Group

- Smart Pest Solutions

- SenesTech, Inc.

- IoTrap Technologies

- FytoBox Technologies

- Spotta Smart Pest Systems

- TrapView (EFOS d.o.o.)

- Farmers Edge Inc.

- Arrow Exterminators

Leaders Announcements

- In May 2025, Thompson Street Capital Partners announced the acquisition of Innovative Pest Control by PestCo Holdings. This move enables Innovative to continue delivering quality pest control services in East Texas and supports PestCo's growth plans. Jay Keating, CEO of PestCo, emphasized that providing a superior customer experience fosters loyalty and opens up more opportunities for PestCo team members.(Source: https://www.businesswire.com)

Recent Developments

- In August 2024, the National Pest Surveillance System (NPSS) was launched by the Union Minister of Agriculture and Farmers Welfare to strengthen pest and disease management nationwide. Using AI and ML, NPSS delivers real-time crop protection advice and features a mobile app for identifying pests affecting 61 crops, with specific guidance for 15 major crops like cotton, paddy, and wheat, enhancing agricultural practices.(Source: https://www.pib.gov.in)

- In July 2024, ioCrops introduced two new autonomous greenhouse robots: the HERMAI Spray Robot for automated pest control and the HERMAI Transport Robot for monitoring and transporting harvested crops. These robots help lower labor costs and improve efficiency in greenhouse operations.

(Source: https://www.hortidaily.com)

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Pest Type

- Rodents

- Insects

- Others

By Application

- Agriculture and Farming

- Food and Beverages Processing

- Warehouses and Cold Storage

- Residential

- Commercial Buildings

- Healthcare Facilities

- Others

By Technology

- IoT-based Monitoring

- AI and Machine Learning Analytics

- Camera-based Vision Systems

- Ultrasonic and Acoustic Detection

- Cloud-based and Mobile-enabled Platforms

By Deployment Model

- On-Premises

- Cloud-Based

By End-User

- Individual/Households

- Enterprises

- Government and Municipal Bodies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting