What is the Smart Thermostat Market Size?

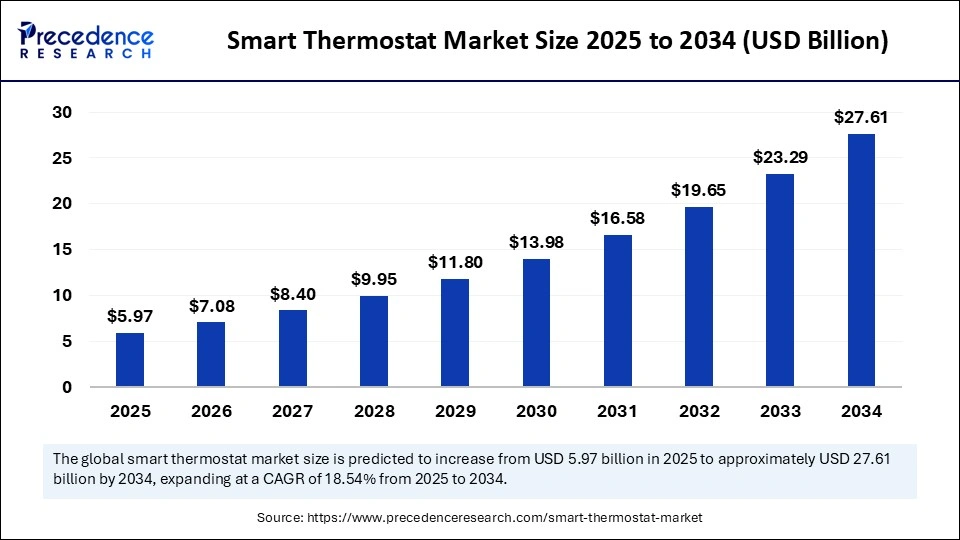

The global smart thermostat market size is calculated at USD 5.97 billion in 2025 and is predicted to increase from USD 7.08 billion in 2026 to approximately USD 27.61 billion by 2034, expanding at a CAGR of 18.54% from 2025 to 2034.The global market is experiencing significant growth, driven by the shift toward the adoption of smart homes, which is driving the adoption of smart thermostats. Technological advancements for cutting-edge features of smart thermostats are further contributing to this growth.

Market Highlights

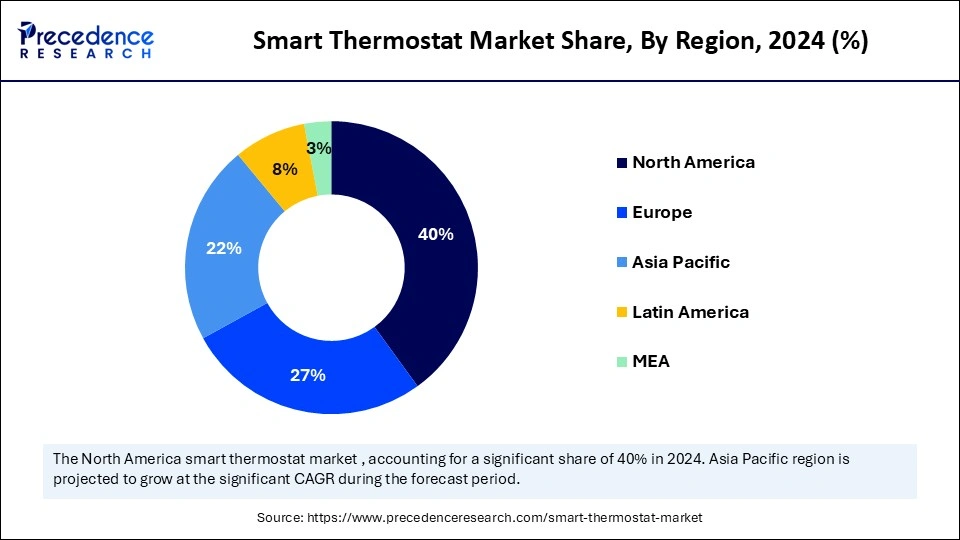

- North America dominated the global smart thermostat market with the largest share of 40% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 20245 to 2034.

- By component, the hardware segment contributed the biggest market share of 55% in 2024.

- By component, the software segment is expected to grow at a notable rate at a CAGR between 2025 and 2034.

- By technology, the learning/adaptive thermostats segment captured the highest market share of 45% in 2024.

- By technology, the connected/remote-controlled thermostats segment will grow notably between 2025 and 2034.

- By connectivity, the Wi-Fi segment held the maximum market share of 60% in 2024.

- By connectivity, the Zigbee segment will grow at a rapid CAGR between 2025 and 2034.

- By deployment mode, the residential segment accounted for the significant market share of 65% in 2024.

- By deployment mode, the commercial segment will grow rapidly between 2025 and 2034.

- By end-use application, the HVAC control and energy optimization segment generated the major market share of 50% in 2024.

- By end-use application, the smart grid and demand response integration segment will grow at a notable CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2024: USD 5.04 Billion

- Market Size in 2025: USD 5.97 Billion

- Forecasted Market Size by 2034: USD 27.61 Billion

- CAGR (2025-2034): 18.54%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is a Smart Thermostat?

The smart thermostat market refers to internet-connected, AI-enabled temperature control devices that allow users to monitor, manage, and optimize heating, ventilation, and air conditioning (HVAC) systems remotely. Smart thermostats use Wi-Fi, Bluetooth, Zigbee, or Z-Wave connectivity and often integrate with smart home ecosystems, voice assistants, IoT platforms, and mobile applications. They enable energy savings, predictive maintenance, demand response, and personalized comfort through data analytics, geofencing, and machine learning algorithms.

Market growth is fueled by rising adoption of smart homes, energy-efficiency regulations, increasing electricity costs, and integration with renewable energy and smart grids. The connected smart thermostats are gaining significant traction in the global smart thermostat market. Continuous innovations in wireless connectivity for installation, flexibility, and scalability in the smart home ecosystem are driving innovations and adoption of smart thermostats.

How is AI Impacting Smart Thermostat?

Artificial intelligence is playing a spectacular role in integration with smart thermostats for more convenience, remote control, and optimization of energy consumption for enhancing energy efficiency, enabling easy installation, and reducing cost. Machine learning algorithms analyze user behavior and adapt scheduling for occupancy patterns and environmental conditions to optimize temperature settings according to user needs and requirements. AI enables real-time data analysis from sensors and adjusts temperature settings to enhance comfort while reducing energy waste and achieving cost savings. Predictive analytics is making AI a more essential tool for smart thermostats to anticipate temperature and real-time occupancy patterns.

Smart Thermostat Market Outlook

- Industry Growth Overview: The market is poised for explosive growth between 2025 and 2034, driven by the increasing demand for energy efficiency, the proliferation of IoT and smart home technologies, and rising energy costs. The rising demand for connected/programmable and self-learning thermostats in both residential and commercial buildings also drives market growth.

- Integration of Smart & Connected Technologies:A major trend in the market is the rapid integration of smart and connected technologies. Manufacturers are investing in advanced sensors and cloud connectivity for remote monitoring, predictive maintenance, and integration with smart home and building management systems, improving operational efficiency through real-time analytics and proactive service models.

- Global Expansion:Market leaders are expanding geographically to address the global need for efficient climate control. While North America is the largest market due to high consumer awareness and robust R&D, the Asia-Pacific region is projected to be the fastest-growing market. Expansion is supported by government initiatives promoting energy efficiency and investments in smart city projects in countries like India and China.

- Major Investors: Established companies and venture capital firms are actively investing in the smart thermostat market, drawn by the alignment with digital health, sustainability, and smart home trends. Major players such as Google, Honeywell, Carrier, and Johnson Controls are leading innovation through R&D, partnerships, and acquisitions. Investment firms like the Amazon Alexa Fund and various VCs are backing startups to foster innovation in AI-driven features and RaaS models.

Startup Ecosystem: The startup ecosystem is thriving, with a focus on advanced connectivity protocols such as Thread/Matter, real-time data analytics, and predictive maintenance features. Emerging firms like tado° and Mysa are attracting significant funding by offering specialized solutions such as smart radiator controls and utility-scale virtual power plant integrations.

What are the Key Trends of the Smart Thermostat Market?

- Energy Efficiency and Sustainability Demands: The demand for sustainable and energy-efficient driving is shifting toward smart thermostats for energy consumption optimization and reducing waste.

- Smart Homes Adoption: The increasing adoption of smart homes and the shift toward IoT-enabled devices are rising the need for convenient, energy-efficient, and affordable devices like smart thermostats.

- Technological Advancements: The technological advancements, such as the integration of AI, voice assistants, and ML, enable highly functional and user-friendly smart thermostats.

- Focus on Personalization: Major brands are focusing on providing remote control and personalized temperature preferences for a smart thermostat.

Predictive Maintenance: The adoption of smart thermostats has increased to detect HVAC issues, reduce downtime, and repair costs, making smart thermostats more accessible and affordable.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.97 Billion |

| Market Size in 2026 | USD 7.08 Billion |

| Market Size by 2034 | USD 27.61 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 18.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Technology, Connectivity, Deployment Model, End-Use Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Government Initiatives for Energy Conservation

Governments worldwide are implementing stringent regulations for energy efficiency and conservation. The government is encouraging consumers and businesses to adopt sustainable and energy-efficient smart thermostats. Financial incentives for the installation of smart thermostats help consumers and businesses to reduce upfront costs and increase adoption rates. Regulatory mandates for energy efficiency standards and the offering of financial incentives like rebates and tax credits are fueling accessibility and affordability of smart thermostats to consumers and businesses.

Restraint

High Initial Investments

Smart thermostat required cutting-edge technology integration and specialized experts. The professional installation of a smart thermostat is quite expensive, which hampers its adoption in budget-conscious consumers or smart or medium-sized businesses. The complex installation of a smart thermostat requires ensuring integration with the existing HVAC system, leading to more investments. The high upfront investments required for smart thermostat installation hamper its accessibility to major market areas. Additionally, the technological complexity and compatibility issues further add to the cost.

Opportunity

Smart Home and Smart City Ecosystem

Rapidly growing adoption of smart home and smart city ecosystems is driving the need for cutting-edge technological integration, energy-efficient, and convenient climate control systems. The smart home and smart city ecosystem has increased the adoption of IoT technology. Government initiatives and incentives in promoting smart home and smart city projects are fueling this adoption.

The rising emphasis on sustainability and energy efficiency is fostering consumer shift toward a smart home and smart city environment, driving adoption of smart thermostats. Governments worldwide are implementing strict regulations and policies for promoting energy efficiency in urban areas, supporting smart cities trends, and increasing the adoption of smart buildings and thermostats for energy consumption management and comfort in densely populated environments.

Segments Insights

Component Insights

Which Component Segment Led the Smart Thermostat Market in 2024?

In 2024, the hardware segment led the market, due to its key role in enhancing energy efficiency and reducing costs. Hardware with a temperature sensor enables precise climate regulation. Display and controller hardware facilitate the integration of users and interaction with the smart home ecosystem. Hardware enables convenience and remote access through mobile phones and smartphones to smart devices. The ongoing innovations in hardware components for more accuracy, efficiency, and computability are increasing demand for smart thermostats for more comprehensive, cost-effective, and energy-saving home solutions.

The software segment is the second-largest segment, leading the market, due to increased consumer preference for personalized technology integration with the smart home ecosystem. AI/ML enables personalized optimization of energy use and thermostat settings, which leads to lower energy consumption and reduces the cost associated with utility. AI-integrated software needs intelligent and real-time controls of HVAC systems, reduces external factors such as utility prices, and facilitates device integration with numerous smart home systems.

Technology Insights

Which Technology Segment Dominates the Smart Thermostat Market?

The learning/adaptive thermostats segment dominated the market in 2024, due to its offering of improved energy efficiency and personalized comfort user experiences. AI-enabled learning/adaptive thermostats enable personalized heating and cooling schedules that can optimize energy use and lead to reduced costs and climate impacts. The consumer demand for seamless smart home integration and predictive maintenance capabilities for differentiating devices from basic models makes them more attractive. AI-enabled learning/adaptive smart thermostats can learn user behavior and adapt automatically for optimizing temperature and reducing energy waste, making them more convenient solutions and accelerating adoption in the smart home ecosystem.

The connected/remote-controlled thermostats segment is expected to grow fastest over the forecast period, driven by increased adoption of smart thermostats with connected and remote-control technology. These thermostats are more convenient to use, offer energy efficiency, and reduce costs. The smart thermostat with connected/remote-controlled technology is suitable for numerous smart homes and IoT ecosystems. The government initiatives for energy saving and technological advancements, like voice control integration in smart thermostats, are contributing to the segment's growth.

Connectivity Insights

What Made Wi-Fi Connectivity Dominate the Smart Thermostat Market in 2024?

The Wi-Fi segment dominated the smart thermostat market in 2024, due to more convenient remote controlling access and integration with the smart home ecosystem. The rising adoption of AI-enabled smart thermos for optimization is driving the need for Wi-Fi connectivity to monitor and reduce energy consumption. Wi-Fi connectivity enables easy installation without extensive wiring, driving the adoption of energy-efficient and convenient solutions in homes and businesses. The broader availability of Wi-Fi connections in homes and technological advancements in connectivity capabilities for more enhancements are contributing to the adoption of smart thermostats.

The Zigbee segment is the second-largest segment, leading the market, due to its affordability and energy efficiency. Zigbee connections offer low-power, high-reliability, and energy-efficiency of mesh networking, drive interoperability, and easy integration. Smart thermostats can easily integrate with a wide range of smart home devices through this connectivity. The growing consumer emphasis on home automation systems is driving the adoption of Zigbee connectivity, leading to sustainable segment growth.

Deployment Mode Insights

How the Residential Segment Dominated the Smart Thermostat Market in 2024?

In 2024, the residential segment dominated the market due to increased consumer demand for automated and connected home ecosystems. Consumers are seeking comfortable, energy-saving, and cost-saving devices. The rising smart home integration trends and growing availability of remote control and personalized scheduling features in technologies are solidifying the adoption of smart thermostats. Consumer awareness for energy conservation and government initiatives and incentives for energy-efficient and sustainable devices are contributing to the rapid adoption of smart thermostats in the smart home ecosystem.

The commercial segment is expected to grow fastest over the forecast period, due to increased adoption of energy-efficient and cost-reducing devices. Commercial consumers such as offices, retail, hospitality, and education buildings are rapidly adopting smart thermostats for energy efficiency and to optimize HVAC systems. The government incentives for sustainable and energy-efficient devices are contributing to this growth. The adoption of smart thermostats with cutting-edge features of centralized control, remote monitoring and control, and data analytics is high in the commercial sector.

End-Use Application Insights

Which End-use Application Dominates the Smart Thermostat Market?

In 2024, the HVAC control and energy optimization segment dominated the market, due to the ability of smart thermostats to reduce energy bills and environmental impacts. Smart thermostat improves user comfort with IoT integration for remote control and data analysis. This technology enables predictive maintenance, which helps to reduce costs and enhance equipment lifespan. The growing focus on AI algorithms integration and smart home ecosystems to improve energy use and automation, driving adoption in consumer and business sectors.

- In July 2025, the latest smart thermostat, the ADC-T25, was launched by Alarm.com, which is developed on the proven reliability of Alarm.com's suite of thermostats. This thermostat is the T25, compatible with most common HVAC systems, which provides the easiest installation, a streamlined design, and cutting-edge sensing capabilities. (Source: https://investors.alarm.com)

The smart grid and demand response integration segment is expected to grow fastest over the forecast period, driven by increased consumer demands for financial incentives and automated energy management. Smart thermostat integration enables communication with the grid and adjusts settings during peak hours. To enhance grid reliability, reduce peak loads, and promote energy efficiency and sustainability, contribute to this adoption. Smart grid and demand for response integration enabling high grid stability and peak load management via smart thermostats.

Regional Insights

U.S. Smart Thermostat Market Size and Growth 2025 to 2034

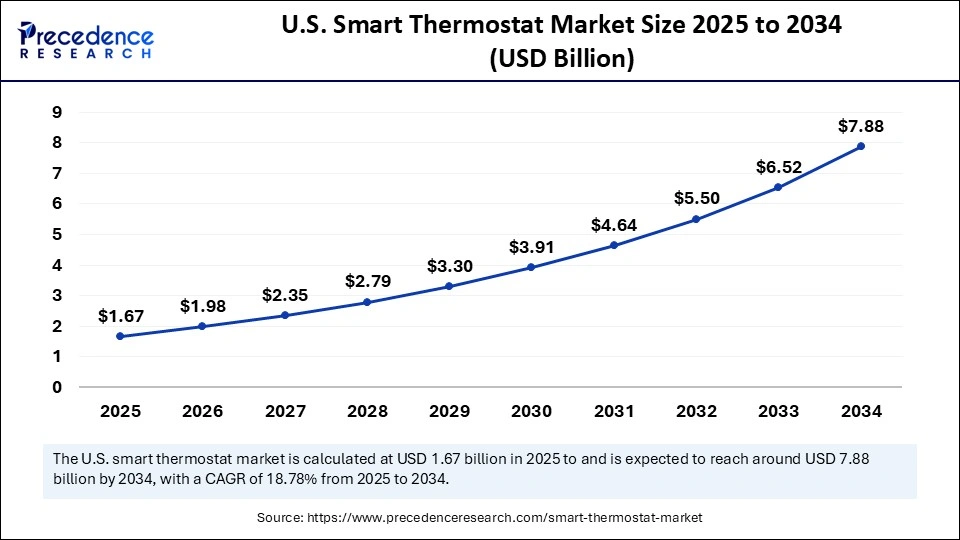

The U.S. smart thermostat market size was evaluated at USD 1.41 billion in 2024 and is projected to be worth around USD 7.88 billion by 2034, growing at a CAGR of 18.78% from 2025 to 2034.

North America Smart Thermostat Market

North America dominated the global smart thermostat market, holding the largest share of 40% in 2024, driven by the region's rapid adoption of smart home ecosystems and strict regulations for energy efficiency and sustainability. North America has experienced rapid growth in the adoption of smart home and smart cities environments, driven by a strong focus on cutting-edge technologies and government initiatives. The growing consumer awareness about tech-savvy value for cost saving and environmental advantages of smart thermostats is fueling this adoption range across the region.

The U.S. Market Trends

The U.S. is a major player in the regional market due to increased consumer demand for energy-efficient and comfortable devices. The strong presence of key market players like Ecobeee and Google Nest is launching new products with more cost-effectiveness and interoperable options for seamless connectivity within smart home ecosystems, which are driving this adoption. The strong emphasis on explaining Wi-Fi connectivity and the integrity of AI and machine learning with smart thermostats for more convenient experiences is contributing to the market growth.

Asia Pacific Smart Thermostat Market

Asia Pacific is the fastest-growing region in the global market, driven by rapid urbanization and a rising middle-class population. The rising disposable income in emerging countries like China and India is fueling the adoption of smart home and city projects ecosystem. Asian governments are promoting a smart project ecosystem, driving the need for smart thermostats for energy efficiency and sustainability. The rapid expansion of smart city infrastructure, advancements in technologies like AI and Wi-Fi connectivity, and the adoption of IoT devices are adding to this growth.

Government Initiatives: To Boost China's Market

China is a major player in the regional market, driven by rapid economic growth and consumer demands for cutting-edge and convenient devices. Chinese government initiatives for energy conservation and increased disposable income have shifted consumer preference for the adoption of smart thermostats for convenient experiences and sustainable practices. China has witnessed the spectacular growth of smart home ecosystems and IoT integration. The rising emphasis on AI integration for personalized automation and predictive analytics is driving demand for more energy-efficient and cost-saving devices, including smart thermostats.

Indian Market to Grow: With Increasing Consumer Awareness

India is the fastest-growing country in the regional market, contributing to growth due to increased consumer attraction toward energy-saving solutions and government initiatives. The rapidly growing urbanization, government support, and investments in smart city projects are reaping the benefits of this shift. Additionally, the rising disposable income and middle-class population are enabling consumer spending on advanced technologies and smart home integrations.

How Big is the Role of Europe in the Smart Thermostat Market?

Europe plays a notable role in the smart thermostat market, driven by stringent energy-efficiency regulations, high energy prices, and a strong push toward decarbonization. Government incentives and subsidies for installing energy-saving devices are key factors, especially in countries like Germany, the UK, and the Netherlands. The market features high penetration of smart heating systems (HVAC), with a focus on ensuring compatibility with existing building management systems and incorporating advanced features such as AI-powered optimization and geofencing to maximize energy savings.

Germany Smart Thermostat Market Trends

Germany is a leading market for smart thermostats in Europe, driven by strong environmental consciousness, a culture of engineering excellence, and a large installed base of traditional heating systems that are well-suited for upgrades. While the market is highly competitive, there is a strong emphasis on data privacy and products that deliver tangible energy savings. The market benefits from policies such as EnEV, which offer integrated solutions and incentives for consumers to adopt smarter energy management systems.

How is the Opportunistic Rise of Latin America in the Smart Thermostat Market?

Latin America is experiencing an opportunistic rise in the market, driven by rising energy costs and growing awareness of energy efficiency among consumers. Although initial adoption has been slower than in North America due to factors such as cost sensitivity and inconsistent internet infrastructure in some areas, key urban centers in countries such as Brazil, Mexico, and Chile are showing promising growth. The hospitality and commercial sectors are early adopters seeking to control operational costs, while the residential market is gradually expanding with internet penetration.

Brazil Smart Thermostat Market Trends

Brazil leads the smart thermostat market in Latin America, supported by a strong domestic electronics industry, a large urban population, and rising electricity prices. The market is seeing increased consumer demand for energy-efficient solutions and home automation. Both local and international companies are investing in partnerships with utility providers and property developers to deliver integrated smart home solutions along with major platforms like Amazon Alexa and Google Assistant.

What Factors are Driving the Growth of the Middle East and Africa Smart Thermostat Market?

The smart thermostat market in the Middle East and Africa is growing steadily, mainly driven by the Gulf Cooperation Council (GCC) countries. High energy uses due to extreme climate conditions and government initiatives aimed at sustainability and green building standards, such as in the UAE and Saudi Arabia, are key market drivers. The commercial and hospitality sectors, particularly luxury hotels and large office buildings, are major users of these technologies to optimize energy use and obtain green certifications. The residential market is expanding in affluent urban areas, supported by high disposable incomes and a desire for modern home automation features.

Saudi Arabia Smart Thermostat Market Trends

Saudi Arabia's smart thermostat market is on track for significant growth, driven by ambitious national initiatives that emphasize energy efficiency and smart city development, such as the NEOM project. The extreme temperatures make efficient cooling solutions crucial, making smart thermostats a smart investment for controlling high energy costs. The government actively promotes energy conservation, and with increasing awareness and the entrance of global tech companies into the market, rapid adoption is occurring across both residential and commercial sectors.

Value Chain Analysis

- Raw Material Procurement

The smart thermostat includes raw material procurement of numerous electronic components like microprocessors, temperature, memory chips, display, connectivity modules, and humidity sensors, which enable control of HVAC systems, remote access through mobiles and smartphones, and integration with the smart home ecosystem.

Key Players: Mouser Electronics, Texas Instruments (TI), Arrow Electronics, STMicroelectronics.

- Customer Support and Feedback Loop

The technical nature of smart thermostat devices requires their integration with complex smart home ecosystems, which requires consumer support and feedback loops to handle consumer compliance and recommendations to advance the personalization nature of the devices.

Key Players: Ecobee, Honeywell Home, Google Nest, and Emerson Sensi.

- End-of-Life Management

End-of-life agreement for smart thermostats includes the responsibility of handling devices when they are no longer functioning or any technological obsolescence occurs.

Key Players: ecobee, Resideo, Google Nest, and Emerson.

Top Companies in the Smart Thermostat Market and Their Offerings

- Alphabet Inc. (Google Nest): Nest Learning and standard Thermostats; self-learning algorithms, sleek design, Google Home integration.

- Honeywell International Inc.:T Series and Smart Color Thermostats; reliable with room sensors and broad smart home compatibility.

- Ecobee Inc.:Smart Thermostat Premium; includes room sensors, a built-in air quality monitor, and voice assistants (Alexa/Siri).

- Emerson Electric Co.: Sensi line of smart thermostats; easy to install, basic smart features, and multi-platform compatibility.

- Johnson Controls International plc: Lux Products thermostats and integrated building solutions for commercial and residential energy management.

Other Key Players

- Amazon.com, Inc. (ecobee, Honeywell partnerships)

- Schneider Electric SE

- Siemens AG

- Bosch Thermotechnology

- Lennox International Inc.

- Carrier Global Corporation

- tado° GmbH

- Netatmo (Legrand)

- LG Electronics Inc.

- Panasonic Corporation

- Trane Technologies plc

- Centrica Connected Home (Hive)

- Ingersoll Rand Inc.

- Leviton Manufacturing Co., Inc.

- Lutron Electronics Co., Inc.

Recent Developments

- In May 2025, ecobee by Generac Smart Thermostat with home energy management enhanced was launched by a global leader in energy solutions, Generac Holdings Inc. This is an all-new smart thermostat integrated with Generac PWRcell 2 solar battery storage solutions and Generac home standby generators for enhancing real-time system visibility.

(Source: https://investors.generac.com) - In January 2025, a leading global provider of solutions for home comfort, security, and safety, Resideo Technologies, launched a novel Honeywell Home X2S smart thermostat at CES 2025. This thermostat is available at home improvement retailers, the matter-enabled and ENERGY STAR-certified smart thermostat that provides unparalleled features at a cost-effective price. (Source: https://investor.resideo.com)

- In January 2025, ecobee launched its smart thermostat essential, a novel smart thermostat for providing significant value and maintaining the brand's signature comfort and convenience features at CES 2025. This thermostat has features of a full-color touchscreen at an affordable price, and is simple to install and delivers serious savings.

(Source: https://www.businesswire.com)

Segment Covered in the Report

By Component

- Hardware (Thermostats, Sensors, Displays, Controllers)

- Software (Energy Management, Analytics, AI/ML Algorithms)

- Services (Installation, Integration, Maintenance, Managed Services)

By Technology

- Programmable Thermostats

- Learning/Adaptive Thermostats (AI-enabled)

- Connected/Remote-Controlled Thermostats

By Connectivity

- Wi-Fi

- Zigbee

- Z-Wave

- Bluetooth

- Wired

By Deployment Model

- Residential

- Commercial (Offices, Retail, Hospitality, Education)

- Industrial (Manufacturing Facilities, Data Centers, Warehouses)

By End-Use Application

- HVAC Control and Energy Optimization

- Zonal/Room-Based Temperature Control

- Smart Grid and Demand Response Integration

- Indoor Air Quality and Comfort Monitoring

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting