Steam Turbine Aftermarket Size and Forecast 2025 to 2034

The global steam turbine aftermarket size accounted for USD 4.18 billion in 2024 and is predicted to increase from USD 4.36 billion in 2025 to approximately USD 6.61 billion by 2034, expanding at a CAGR of 4.69% from 2025 to 2034. The market growth is attributed to the increasing demand for energy-efficient solutions and the rising adoption of advanced steam turbine technologies across various industries.

Steam Turbine Aftermarket Key Takeaways

- In terms of revenue, the steam turbine aftermarket is valued at $4.36 billion in 2025.

- It is projected to reach $6.61 billion by 2034.

- The market is expected to grow at a CAGR of 4.69% from 2025 to 2034.

- Asia Pacific dominated the global market with the largest revenue share of 41.01% in 2024.

- North America is expected to grow at the fastest CAGR of 4.7% from 2025 to 2034.

- By type of services, the services segment held the biggest revenue share of 41.99% in 2024.

- By type of services, the repair segment is expected to grow at the fastest CAGR of 4.8% between 2025 and 2034.

- By technology, the fossil segment captured the heighted market share of 46.61% in 2024.

- By technology, the thermal renewable segment is projected to grow at the highest CAGR of 6.3% during the projection period.

- By capacity, the 100 MW to 300 MW segment contributed the major market share of 31.09% in 2024.

- By capacity, the less than 50 MW segment is projected to expand rapidly with a CAGR of 6% in the coming years.

- By service provider, the OEMs segment generated the largest market share of 73.55% in 2024.

- By service provider, the ISPs segment is projected to grow at the fastest CAGR of 5.1% in the future years.

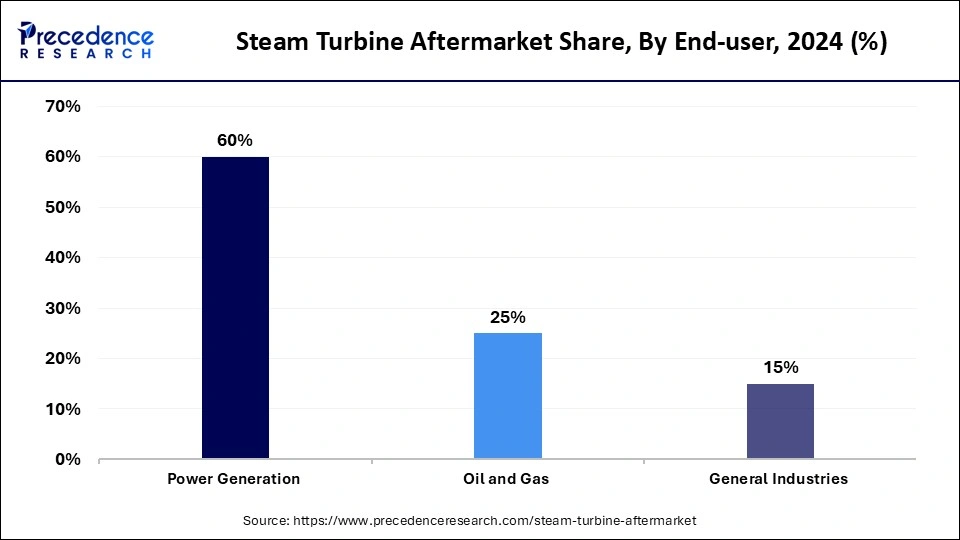

By end-user, the power generation segment captured the significant market share of 60.06% in 2024. - By end-user, the general industries segment is projected to witness the fastest CAGR of 6% during the forecast period.

Impact of Artificial Intelligence on the Steam Turbine Aftermarket

Artificial Intelligence (AI) is facilitating steam turbine aftermarket operations by creating advanced maintenance strategies for better service management. The deployment of AI-based predictive maintenance systems by companies allows them to track turbine performance while detecting initial wear indicators. Through AI technologies, service providers can execute customized maintenance plans, which maximize turbine component durability.

How Big is the Asia Pacific Steam Turbine Aftermarket?

According to Precedence Research, the Asia Pacific steam turbine aftermarket size was valued at USD 1.71 billion in 2024 and is expected to reacharound USD 2.76 billion by 2034, growing at a CAGR of 4.90% from 2025 to 2034.

Why Is the Steam Turbine Aftermarket Booming in Asia Pacific in 2024?

Asia Pacific led the steam turbine aftermarket by capturing the largest revenue share of 41.01% in 2024. The region's dominance is mainly attributed to the increased energy demand due to the rapid expansion of industries. There is a significant increase in the number of coal and natural gas-fired power plants. The majority of energy consumption occurs in the Asia Pacific, with two major economies, China and India, focusing on expanding their power infrastructure.

The region has numerous aging power facilities that need recurrent maintenance to maintain operational performance. The steam turbine aftermarket sector experienced sustained growth because of the increased need for power. Furthermore, the rapid transition toward thermal energy and combined power generation systems bolstered the growth of the market in the region.

Why Is the Steam Turbine Aftermarket Booming in North America?

North America is poised to grow at a CAGR of 4.7% in the market during the forecast period from 2025 to 2034. Power generation facilities are seeking comprehensive services to enhance energy efficiency alongside environmental regulation compliance. Governments of the U.S. and Canada are investing heavily to modernize their old power facilities to reduce emissions. The U.S. Energy Information Administration (EIA) reports that many North American power generation facilities soon need replacement, as their life span is ending. This boosts the need for turbine aftermarket services.

Market Overview

The steam turbine aftermarket is growing rapidly, as energy efficiency standards and cleaner energy transitions have become increasingly important. The worldwide increase in energy needs, particularly in developing economies, makes steam turbines indispensable for power production in both conventional fossil-based plants and nuclear power facilities. Steam turbines have long-lasting operational periods but need aftermarket services to maintain efficiency and adherence to modern emissions standards. The U.S. Energy Information Administration (EIA) demonstrated that 60% of the U.S. electricity generation capacity originates from fossil-fuel power plants. Furthermore, technological advancements and the rising adoption of hybrid thermal-renewable systems drive the market growth.

Steam Turbine Aftermarket Growth Factors

- High Demand for Power in Emerging Economies: The rapid industrialization in emerging economies is expected to drive the demand for reliable and efficient steam turbines, leading to growth in the aftermarket services sector.

- Increasing Renewable Energy Adoption: The global shift toward renewable energy sources, such as biomass and geothermal, is anticipated to drive the need for specialized steam turbine maintenance and upgrades.

- Aging Power Plant Infrastructure: The aging infrastructure of power plants globally is expected to create consistent demand for retrofit, repair, and spare parts services in the steam turbine aftermarket.

- Technological Advancements in Steam Turbines: The continuous innovation in turbine efficiency and performance is likely to result in increased demand for advanced aftermarket services, including optimization and upgrades.

- Government Emission Regulations: Stringent environmental regulations, particularly in Europe and North America, are projected to increase the need for emissions control solutions, boosting aftermarket service demand.

- Growing Industrial Cogeneration Systems: The rising adoption of combined heat and power (CHP) systems in industrial sectors is expected to drive the need for regular maintenance and upgrades of steam turbines.

- Integration of Smart Technologies: The integration of IoT and AI into turbine management systems is anticipated to create new aftermarket service opportunities for monitoring, diagnostics, and predictive maintenance.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 6.61 Billion |

| Market Size in 2025 | USD 4.36 Billion |

| Market Size in 2024 | USD 4.18 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.69% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type of Service, Technology, Capacity, Service Provider, End-user and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Demand for Energy Efficiency in Aging Power Plants

Increasing demand for energy efficiency in aging power plants is expected to drive the growth of the steam turbine aftermarket. Aging steam turbines in numerous thermal power plants across emerging economies continue to serve as the ideal technology, as they have not been replaced with newer technology. Turbine operators conduct maintenance tasks and implement performance upgrades to existing equipment in order to satisfy present standards. Thorough aftermarket services enable operations to reach their production goals and minimize operation expenses and environmental effects. The International Energy Agency (IEA) 2024 report reveals that more than 65% of worldwide coal-fired power facilities run with outdated technologies, which are older than 25 years. This indicates immediate requirements for efficiency modernization. Furthermore, the rising pressure for energy transition prompts operators to select aftermarket services, fuelling the growth of the market.

Restraint

Declining Focus on Coal-Based Power Generation

A declining focus on coal-based power generation is anticipated to hinder the growth of the steam turbine aftermarket. The implementation of renewable energy technologies, including solar power, wind power, and hydropower, has increased worldwide in the last few years, directly affecting the existence of coal-fired steam turbines. Furthermore, countries dedicated to decarbonization measures within their national energy plans restrict investments in traditional thermal power plant refurbishment, further reducing demand for aftermarket services.

Opportunity

Rising Investments in Industrial Cogeneration Projects

Rising investments in industrial cogeneration projects are likely to create immense opportunities for the players competing in the steam turbine aftermarket. Increased investments in industrial cogeneration projects generate freshly available aftermarket servicing possibilities. Steadily growing chemicals, oil refining, pulp & paper, and food processing industries use cogeneration technologies for efficient electricity generation. The critical operation of CHP systems depends on steam turbines. According to the United Nations Industrial Development Organization (UNIDO) 2024 report, manufacturing facilities that use cogeneration show a 25% increase in energy efficiency than traditional setups.

By Type of Service Analysis

Why Are Services Leading the Steam Turbine Aftermarket in 2024?

The services segment dominated the steam turbine aftermarket with the largest revenue share of 41.99% in 2024 due to the increased demand for improved operational efficiency and decreased downtime services. Operators of steam turbines actively look for overall service solutions that combine regular upkeep assistance with troubleshooting help. Furthermore, the improved energy efficiency measures and emission regulation bolstered the segmental growth.

On the other hand, the repair segment is expected to grow at the fastest CAGR of 4.8% in the upcoming period from 2025 to 2034. The growth of the segment is attributed to the rising demand for repair services to modernize aging equipment. Steam power plants depend on turbines requiring continuous maintenance to maintain operational performance. Plant operators heavily demand quick repairs and turnaround services, as they need to maintain turbine operational status and minimize costly downtime. Diagnostic tools with predictive maintenance technologies help identify problems earlier so organizations can conduct efficient and affordable repairs.

Global Steam Turbine Aftermarket Revenue (US$ Million), By Type of Service 2021 to 2024

| Type of Service | 2021 | 2022 | 2023 | 2024 |

| Spare Parts | 954.8 | 987.9 | 1,022.80 | 1,059.60 |

| Repair | 1,202.20 | 1,253.80 | 1,308.50 | 1,366.40 |

| Services | 1,534.50 | 1,604.10 | 1,677.70 | 1,755.80 |

By Technology Analysis

Why Is the Fossil Segment Driving Growth in the Steam Turbine Aftermarket in 2024?

The fossil segment held a major revenue share of 46.61% in 2024 due to the increased worldwide power generation dependence on coal and natural gas-fired power plants. Many areas, including emerging economies, depend on fossil fuel-based plants for their primary power source. Modernization and service solutions gain momentum because fossil fuel plants need to enhance their efficiency and reduce their environmental impact. Stringent emission regulations and rising operational requirements have elevated the demand for aftermarket services.

The thermal renewable segment is projected to grow at the highest CAGR of 6.3% during the projection period due to the growing reliance on renewable energy sources. Several countries that are focusing on enhancing power production while minimizing carbon emissions use renewable thermal power plants that incorporate geothermal systems. According to the International Renewable Energy Agency (IRENA), geothermal and biomass power facilities garnered a 16% share of worldwide renewable energy capacity in 2024 and are expected to increase in the future years. Moreover, as thermal power plants heavily rely on turbines, they require turbine maintenance and retrofitting services.

Global Steam Turbine Aftermarket Revenue (US$ Million), By Technology 2021 to 2024

| Technology | 2021 | 2022 | 2023 | 2024 |

| Combined Cycle | 873.7 | 920.2 | 969.80 | 1,022.70 |

| Fossil | 1,797.70 | 1,845.70 | 1,896.00 | 1,948.90 |

| Nuclear | 670.10 | 704.40 | 741.00 | 780.00 |

| Thermal Renewable | 349.90 | 375.50 | 402.20 | 430.20 |

By Capacity Analysis

Why Did the 100 MW to 300 MW Capacity Segment Dominate the Steam Turbine Aftermarket in 2024?

The 100 MW to 300 MW segment dominated the steam turbine aftermarket by holding more than 31.09% in 2024. This is mainly due to the widespread deployment of turbines of this capacity range in thermal and fossil fuel-based power plants across the world. The power generation industry incorporates these turbines due to their versatility, making them suitable for both industrial cogeneration systems and base-load electricity providers. Additionally, this capacity range experiences intense pressure for emission compliance, which drives manufacturers to seek aftermarket solutions that enhance operational efficiency.

The less than 50 MW segment is expected to expand at a CAGR of 6% in the coming years due to the rising demand for turbines of this capacity form small-scale distributed power generation plants. Small-scale chemicals, food processing, and agriculture companies adopt these compact turbines because they want operational independence and economic efficiency. The International Renewable Energy Agency (IRENA) documented an upward trend in small-scale cogeneration system installations. Less than 50 MW turbines are suitable for biomass and geothermal power plants.

Global Steam Turbine Aftermarket Revenue (US$ Million), By Capacity 2021 to 2024

| Capacity | 2021 | 2022 | 2023 | 2024 |

| Less than 50 MW | 738.70 | 778.9 | 821.70 | 867.40 |

| 50 MW to 100 MW | 917.40 | 959.60 | 1,004.30 | 1,051.70 |

| 100 MW to 300 MW | 1,169.20 | 1,210.50 | 1,254.10 | 1,300.00 |

| 300 MW to 600 MW | 531.80 | 548.3 | 565.6 | 583.9 |

| 600 MW and Above | 334.30 | 348.50 | 363.40 | 378.80 |

By Service Providers Analysis

Why Are OEMs Dominating the Steam Turbine Aftermarket in 2024?

The OEMs segment held the biggest revenue share of 73.55% in 2024 as they provide high-quality standardized replacement parts and custom steam turbine services. OEMs provide complete solutions for maintaining turbine performance and enhancing operational duration. Furthermore, the exclusive technical capabilities and proprietary turbine understanding of OEMs enable them to deliver comprehensive aftermarket services.

The ISPs segment is projected to grow at a notable CAGR of 5.1% in the future years, owing to the rising demand for cost-efficient and customizable aftermarket solutions. ISPs deliver comprehensive aftermarket solutions, consisting of turbine repair services and retrofitting. Moreover, the energy producers choose ISPs as their preferred solution because these entities deliver high efficiency with optimized operational costs.

Global Steam Turbine Aftermarket Revenue (US$ Million), By Type of Service Provider 2021 to 2024

| By Type of Service Provider | 2021 | 2022 | 2023 | 2024 |

| ISPs | 964.5 | 1,008.90 | 1,056.10 | 1,106.10 |

| OEMs | 2,727.00 | 2,836.90 | 2,953.00 | 3,075.70 |

By End-user Analysis

Why Is Power Generation Driving the Steam Turbine Aftermarket in 2024?

The power generation segment led the market with the major revenue share of 60.06% in 2024 due to the increased need for steam turbines from power generation plants. Turbines used within power generation facilities, specifically utilizing fossil fuel and nuclear technologies, represent opportunities for their widespread deployment because they supply electricity at large scales. Maintenance and replacement services are required in this sector for modernizing old operational facilities. Additionally, power generation facilities require aftermarket services to maintain equipment efficiency.

The general industries segment is projected to grow at a notable CAGR of 6% in the upcoming period. Several non-power generation industries are using steam turbines to generate power and process heat in various manufacturing facilities. Steam turbine-powered systems require regular maintenance for performance upgrades and component repairs. The rising need for decentralized and energy-efficient power generation systems that demand cost-effective aftermarket services further drives the segment growth.

Global Steam Turbine Aftermarket Revenue (US$ Million), By End-user Industry 2021 to 2024

| By End-user Industry | 2021 | 2022 | 2023 | 2024 |

| Power Generation | 2,236.50 | 2,323.30 | 2,414.90 | 2,511.70 |

| Oil & Gas | 931.4 | 969.8 | 1,010.40 | 1,053.30 |

| General Industries | 523.5 | 552.7 | 583.8 | 616.8 |

Steam Turbine Aftermarket Market Companies

- Ansaldo Energia

- Elliott Group IE

- General Electric Company

- HD Hyundai Heavy Industries Co. Ltd.

- Kessels

- Mitsubishi Power

- Shanghai Electric

- Siemens AG

- Stork

- Sulzer Ltd

Recent Developments

- In March 2025, GE Vernova Inc. announced that its industry-leading H-Class gas turbine technology has surpassed more than 3 million commercial operating hours across 116 units worldwide, equivalent to the capacity needed to power over 50 million U.S. homes. Along with enabling customers to deliver efficient, dispatchable baseload power and supporting the energy transition, the expanding fleet of operating HA gas turbines is expected to generate significant value for GE Vernova through long-term maintenance and service contracts.

- In December 2024, Toshiba Energy Systems & Solutions Corporation (Toshiba) announced that it has secured an order to supply a steam turbine and a generator from PT Inti Karya Persada Tehnik (IKPT), a subsidiary of Toyo Engineering Corporation and the EPC contractor for the Patuha Geothermal Power Plant Unit 2 in West Java, Indonesia, operated by PT. Geo Dipa Energi (Persero), an Indonesian state-owned enterprise. Unit 2 is scheduled to begin operations in 2027, offering a generating capacity of 60.3MW as a maximum continuous rating gross base. This marks Toshiba's second recent order for a geothermal power generation system in Indonesia, following the Wayang Windu Geothermal Power Plant Unit 3, announced in October 2024.

- In August 2024, Mitsubishi Power, a power solution brand of Mitsubishi Heavy Industries, Ltd. (MHI), announced that it has secured an order from Samsung C&T Corporation Saudi Arabia to deliver its M501JAC combined-cycle (CCGT) hydrogen-ready gas turbine for a new industrial steam and electricity cogeneration plant project in Saudi Arabia. The project is being developed by a consortium led by Abu Dhabi National Energy Company (TAQA), one of the largest listed integrated utility firms in Europe, the Middle East, and Africa, and JERA Co., Inc., Japan's largest power generation company. The plant will generate electricity and steam for a petrochemical complex located in Jubail, Eastern Province of the Kingdom of Saudi Arabia.

Segments Covered in the Report

By Type of Service

- Spare Parts

- Repair

- Services

By Technology

- Combined Cycle

- Fossil

- Nuclear

- Thermal Renewable

By Capacity

- Less than 50 MW

- 50 MW to 100 MW

- 100 MW to 300 MW

- 300 MW to 600 MW

- 600 MW and Above

By Service Provider

- ISPs

- OEMs

By End-user

- Power Generation

- Oil & Gas

- General Industries

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content