What is the Stem Cell Manufacturing Market Size?

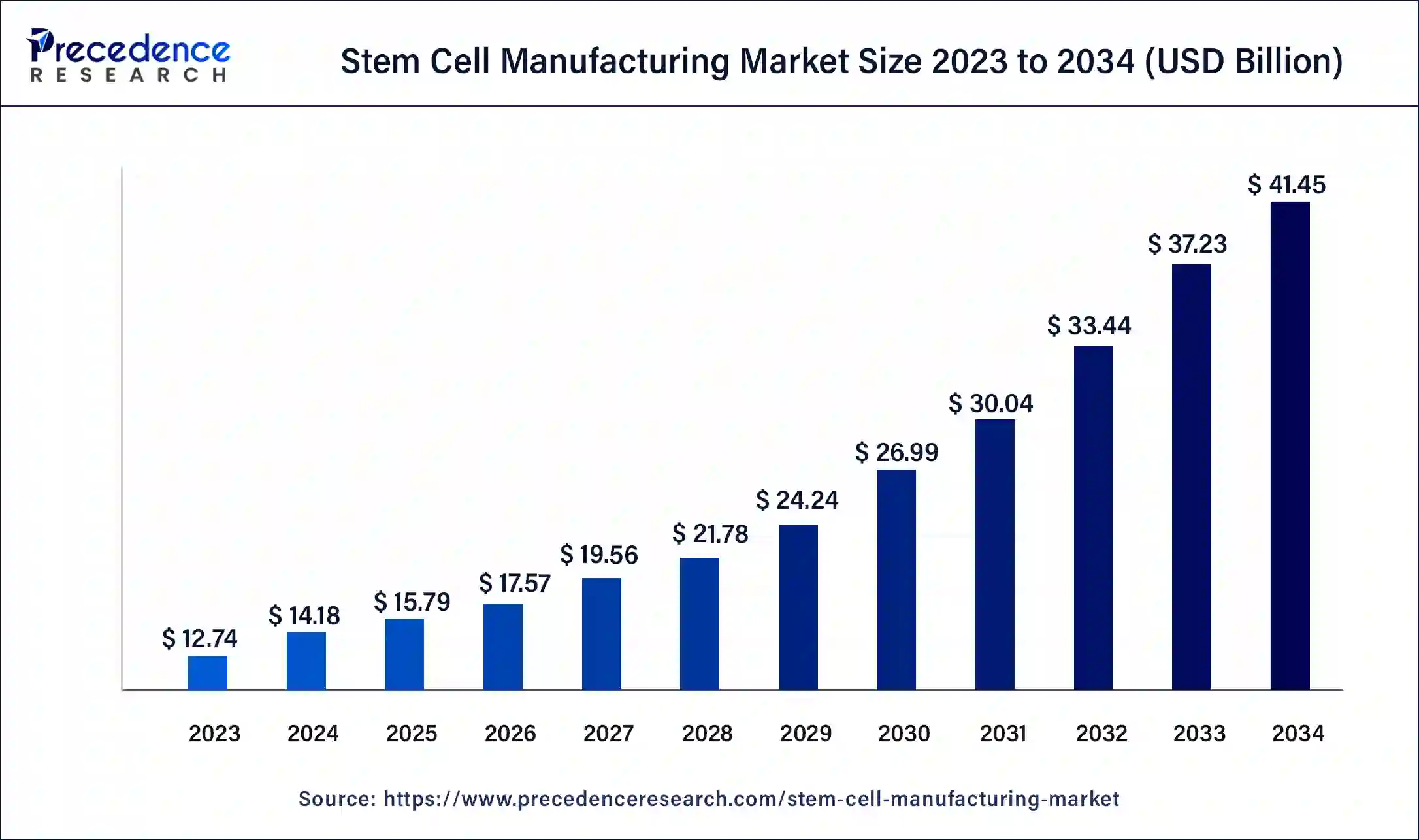

The global stem cell manufacturing market size is calculated at USD 15.79 billion in 2025 and is predicted to increase from USD 17.57 billion in 2026 to approximately USD 45.38 billion by 2035, expanding at a CAGR of 11.13% from 2026 to 2035.

Stem Cell Manufacturing Market Key Takeaways

- In terms of revenue, the global stem cell manufacturing market was valued at USD 15.79 billion in 2025.

- It is projected to reach USD 41.45 billion by 2034.

- The market is expected to grow at a CAGR of 11.13% from 2026 to 2035.

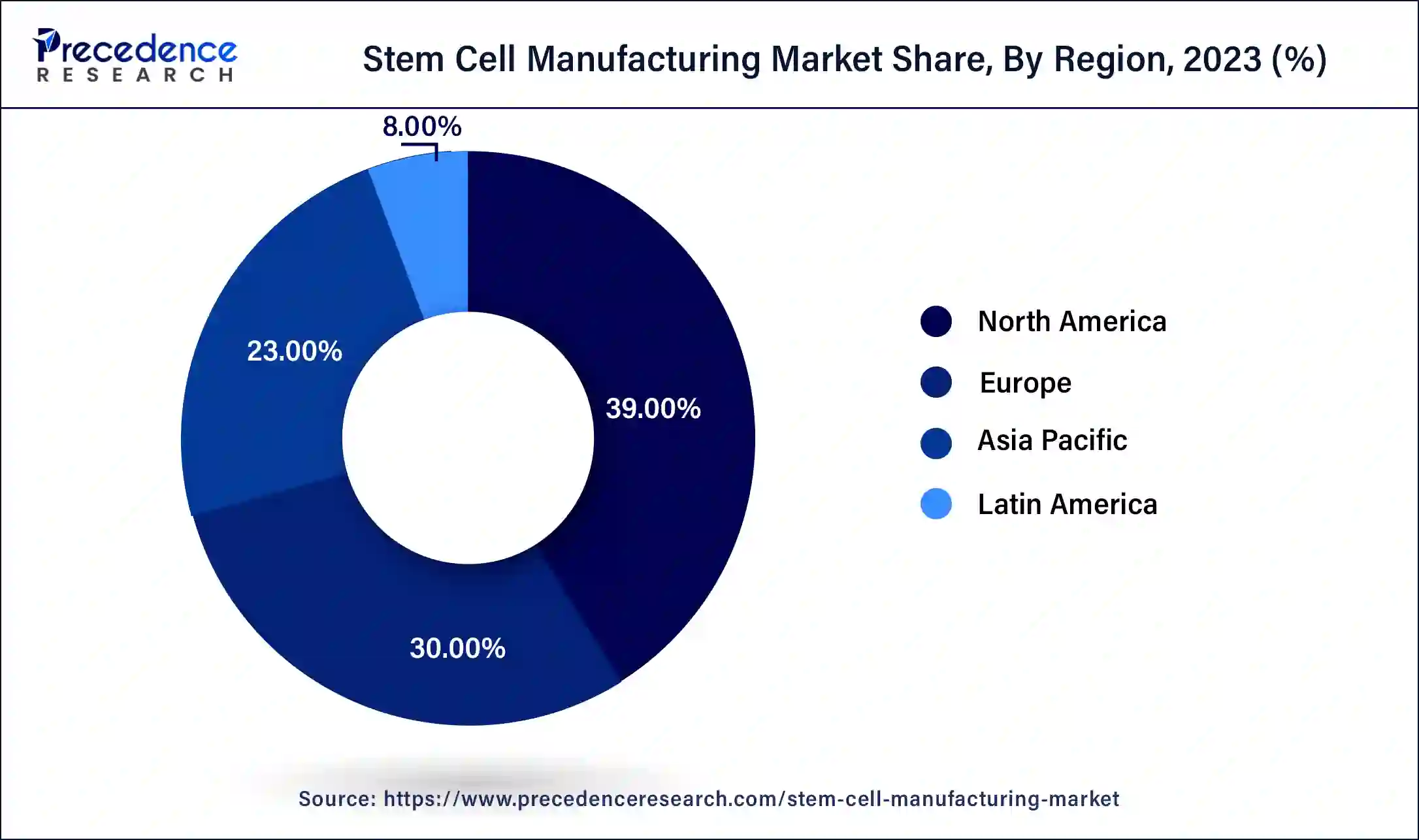

- North America dominated the stem cell manufacturing market with the largest market share of 39% in 2025.

- Asia- Pacific is observed to be the fastest growing in the stem cell manufacturing market during the forecast period.

- By product, the consumables segment dominated the stem cell manufacturing market in 2025.

- By product, the instruments segment is observed to be the fastest growing in the stem cell manufacturing market during the forecast period.

- By application, the clinical application segment dominated the stem cell manufacturing market in 2025.

- By end-user, the pharmaceutical & biotechnology companies segment dominated the stem cell manufacturing market in 2025.

Market Overview

The ability of stem cells to self-renew is fantastic. In the early stages of life and growth, they can differentiate into various cell types in the body. In regenerative medicine, stem cells are essential to replace or repair damaged tissues and organs. For this sector to advance, efficient stem cell manufacturing is necessary. The strict ethical and legal guidelines that control stem cell research and treatments also make the market noteworthy. The legitimacy and acceptance of stem cell-based therapies depend heavily on adherence to these norms.

- According to the American Cancer Society, in the United States, it is anticipated that there will be 609,820 cancer deaths and 1,958,310 new cancer cases in 2023.

- In October 2023, QHP Capital announced that it has acquired Applied StemCell, Inc., a top cell and gene therapy CRO/CDMO that helps the biotechnology industry and research community design and produce cell and gene products.

- QHP Capital added another firm to its list of contracted service providers when it acquired Applied StemCell, a gene and cell therapy leader, and announced plans to assist with its growth.

- In September 2023, Applied StemCell, Inc., a cell and gene therapy CRO/CDMO dedicated to assisting the biotechnology sector and research community in developing and producing cell and gene products, was purchased by QHP Capital. ASC provides comprehensive and personalized cell and gene CRO/CDMO solutions. Its TARGATT gene editing method, along with its platform of GMP-grade allogeneic induced pluripotent stem cells (iPSC), offers non-viral gene editing, genomic stability, safety, and faster production schedules.

How is AI is revolutionizing the cell manufacturing industry?

A recent work by a group of Northeastern University scientists shows how artificial intelligence may be used to produce pluripotent stem cells in large quantities. Numerous illnesses, including cancer, Parkinson's, Alzheimer's, spinal cord injuries, and age-related problems, can be cured by these cells. Researchers propose an AI framework for large-scale manufacturing of stem cells for regenerative medicine. Specific stem cells are born with the innate ability to divide into several cells and become unique, specialized cells like muscle, bone, or blood. These pluripotent stem cells, according to researchers, have great promise for developing cell treatments and regenerative medicine.

Stem Cell Manufacturing Market Growth Factors

- Age-related disorders are more common in older populations worldwide, which has led to a significant market for stem cell-based therapies.

- The market is expanding due to patients' and healthcare professionals' increasing awareness of and acceptance of regenerative medicine.

- The development and commercialization of stem cell products are accelerating due to government initiatives and financing for stem cell research. This drives the growth of the stem cell manufacturing market.

- Largely populated developing nations with expanding healthcare systems offer the stem cell manufacturing business tremendous growth potential.

- Technological advancements in cell culture, bioprocessing, and quality control can enhance the productivity and quality of stem cell manufacturing.

Key Market Trends

- Rapid Technological Advancements: Continuous innovations in stem cell isolation, culture, and differentiation techniques are enhancing therapeutic efficacy and expanding treatment applications.

- Increasing Adoption of Regenerative Therapies: There is a growing acceptance of adult stem cell therapies for treating various chronic conditions such as orthopedic injuries, cardiovascular diseases and neurological disorders.

- Expanding Research and Development Initiatives: Rising investments are underway in stem cell research by pharmaceutical companies, academic institutions, and government bodies.

- Emergence of Personalized Medicine: Customized stem cell therapies are gaining traction in the market as they are tailored to individual patient profiles, improving treatment efficacy and patient outcomes.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 45.38 Billion |

| Market Size in 2025 | USD 15.79 Billion |

| Market Size in 2026 | USD 17.57 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.13% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing stem cell banking industry

As our understanding of possible uses for stem cells grows, more people and families realize the advantages of stem cell banking. As a result, the need for services related to stem cell storage has increased. More and more people see stem cell banking to preserve vital biological material for use in the future, functioning as a preventive healthcare measure.

The therapeutic uses of stem cells in fields such as neurology, orthopedics, cardiology, and oncology are expanding the potential market for stem cell production. The need for stem cell banking is fueled by the emergence of customized medicine, which adjusts therapies based on each patient's unique genetic profile. This drives the growth of the stem cell manufacturing market.

Restraint

High cost associated with stem cell manufacturing

Stem cell manufacturing involves expanding and cultivating stem cells in a regulated setting. The process requires complex bioreactors, exact control of growing conditions, and frequent monitoring, which results in high operating costs. Strict testing and quality control procedures are also needed to guarantee the safety, efficacy, and purity of stem cells. Although these procedures are required to maintain patient safety and comply with regulatory standards, they come at a significant expense.

Manufacturing stem cells requires highly skilled workers, such as scientists, technicians, and quality control specialists. These employees' pay and experience levels increase the cost of production. This limits the growth of the stem cell manufacturing market.

Opportunity

Rise in the number of approvals partnerships relating to stem cell therapy

The market experiences a spike in demand for stem cell therapies as more are approved by regulatory agencies. Every approval frequently signals a novel therapeutic approach or progress in care, piquing the interest of patients and healthcare professionals. Improvements in manufacturing methods are typically required for the development of novel stem cell therapies. To create more reliable, scalable, and high-quality cells, businesses need to innovate. This is what propels the use of cutting-edge technology like automation, enhanced cell culture methods, and sophisticated bioprocessing.

Segment Insights

Product Insights

The consumables segment dominated the stem cell manufacturing market in 2025. Stem cell production, differentiation, and analysis require growth factors, reagents, andculture media. Every stage of stem cell research and production frequently uses these items, which creates a steady and strong demand. Large consumables are needed for the development of stem cell therapies, from research to clinical trials and commercialization. As a result of this shift, the market size and value of consumables rise as more stem cell-based products go into commercial manufacturing.

- Reputable consumables companies often form alliances with biotechnology companies and research organizations. Through these strategic collaborations, they can reach a wider audience and more successfully enter the market.

The instruments segment is observed to be the fastest growing in the stem cell manufacturing market during the forecast period. The governmental and corporate sectors have significantly increased their funding for stem cell research. As research advances, the requirement for sophisticated equipment to support increasingly complex and varied experiments increases. Modern instruments are in high demand because of funding for stem cell biology and regenerative medicine research and development projects. Strict legal regulations governing stem cells production need sophisticated tools to guarantee adherence to safety and quality requirements. There is a need for dependable, high-quality equipment since instruments must fulfill specific requirements for use in controlled conditions.

Application Insights

The clinical application segment dominated the stem cell manufacturing market in 2025. In regenerative medicine, stem cells play a crucial role by providing possible cures for various illnesses, such as spinal cord injuries, cardiovascular ailments, and neurodegenerative diseases. The significant money and effort put into creating stem cell-based treatments for these ailments boosts the clinical application market. Stem cell therapies have been applied in clinical settings to treat autoimmune disorders like multiple sclerosis andtype 1 diabetes.

Clinical trials and therapy alternatives are driven by the capacity to control immune responses and restore damaged tissues. Developing specialized stem cell labs and medical facilities improves the generation and use of stem cell treatments. These facilities supply the required research, manufacturing, and therapy infrastructure, hence supporting the clinical application sector.

- In December 2023, As the cell therapy expansion drives the contract development and manufacturing organization (CDMO) juggernaut, Fujifilm Corporation distributed wealth across two production units. The parent company is allocating $200 million to two subsidiaries: Fujifilm Diosynth Biotechnologies, the company's CDMO for biologics and cutting-edge therapies, and Fujifilm Cellular Dynamics, which focuses on the research, development, and production of human induced pluripotent stem cells (iPSCs).

End-user Insights

The pharmaceutical &biotechnology companies segment dominated the stem cell manufacturing market in 2025. Companies in the biotechnology and pharmaceutical industries are pioneers in research and development (R&D). They can perform state-of-the-art stem cell science research, including creating novel treatments and technologies, thanks to their strong R&D infrastructure.

Research like this frequently produces innovations and breakthroughs that propel the manufacture of stem cells forward. These businesses usually form strategic alliances with biotech companies, research organizations, and academic institutions. Such partnerships can facilitate the pooling of knowledge and resources and hasten the development of innovative stem cell technology. The commercialization of stem cell therapies and products is frequently the result of these collaborations.

Regional Insights

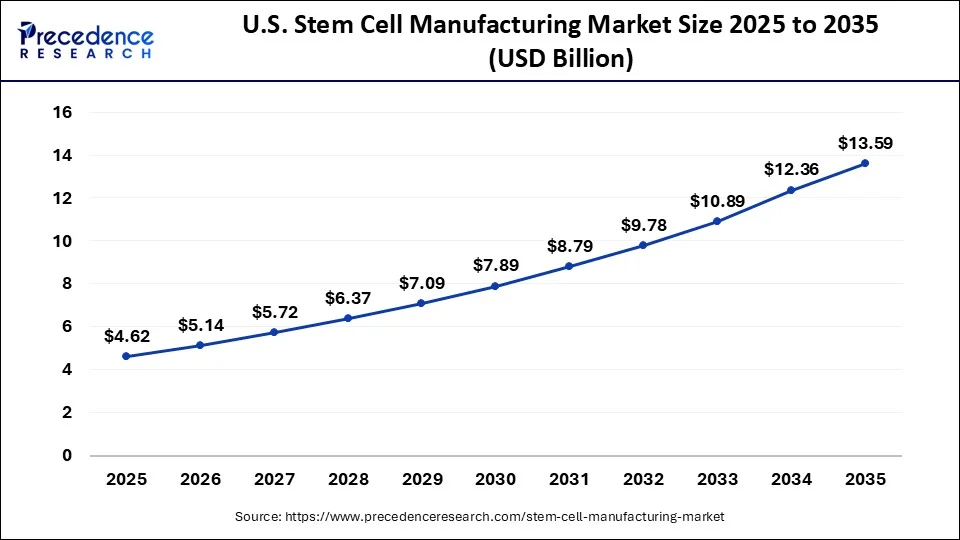

The U.S. stem cell manufacturing market size is exhibited at USD 4.62 billion in 2025 and is projected to be worth around USD 13.59 billion by 2035, poised to grow at a CAGR of 11.39% from 2026 to 2035.

North America accounted for the biggest market share of 39% in 2025. North American institutions, particularly those in the United States, have been at the vanguard of stem cell research. Innovations in adult and embryonic stem cells have paved the way for improvements in industrial processes. The Food and Drug Administration (FDA) of the United States plays a crucial role in establishing guidelines for stem cell therapy and production procedures. The FDA's regulatory structure is strict, yet it offers precise rules supporting efficacy and safety.

Europe is expected to witness a significant amount of growth in the market during the forecasted years. This growth is because this region maintains a top class healthcare system, with substantial government and private investment supporting stem cell research. The region is also home to leading academic institutions and biotech companies that helps to boost up innovation and clinical translation. The European Medicines Agency (EMA) has been seen developing more streamlined pathways for advanced therapy medicinal products, which is thus, encouraging pharmaceutical companies to expand their market reach.

Asia-Pacific is observed to be the fastest growing in the stem cell manufacturing market during the forecast period. Countries such as China, South Korea, Japan, and India have significant investments from both the public and private sectors in stem cell research and development. The general infrastructure for stem cell manufacturing, clinical applications, and scientific research are to be improved. Asia-Pacific's biopharmaceutical market is increasing, and many businesses are concentrating on biomanufacturing, including the generation of stem cells. Substantial biopharmaceutical industry expansion provides the infrastructure and know-how required for the stem cell manufacturing market to expand.

The Latin America stem cell manufacturing market is experiencing significant growth in the recent years. This growth is driven by the increasing prevalence of chronic and degenerative diseases in the region, rising government and private investments in research and development, and a growing focus on personalized medicine and regenerative treatments. Brazil and Mexico are the two countries which are leading the region, leading due to their well-established biopharmaceutical infrastructure and strong government support.

The Middle East and Africa stem cells market is picking up pace in the recent years. This growth and development is driven by advancements in regenerative medicine, increased funding for research purposes and the rising application of stem cells in therapeutic fields. High prevalence of diabetes, cardiovascular diseases, and genetic disorders all across Middle Eastern populations helps to propel the development for stem cell-based treatments. The region is expected to grow even more due to increasing public and private investments in stem cell research, grants, funding programs and public-private partnerships.

Value Chain Analysis

- Input and Raw Material

Stem cell manufacturing begins with defined cell substrates and high quality GMP based grade raw materials. This process must meet strict regulatory standards as well as fulfill all the necessary traceability and qualification requirements. This is because regulators and payers require clear chains of custody for biologics. The upcoming years will push growth in Xeno free media and certified single use systems, thus scaling up cell therapies.

Key Players: Lonza, Thermo Fisher, Cytiva - Manufacturing and Processing

This stage covers the manufacturing process as well as the production process of cell culture. Many developers all over the world prefer to outsource this process to CDMOs that are well equipped with specialized CGT suites. This ensures a robust and thorough process, closed automation and also decreases contamination risks.

Key Players: Charles River, Lonza, Catalent - Quality Checks and Compliance

In this market, quality control and checking is vital. Here in this stage, various tests are carried out and performed under validated methods prior to their release. Agencies such as the FDA and the EMA demand detailed data for any changes, errors, fluctuations etc. and also require extensive amounts of documentation. The market is set to witness more standardized, high throughput releases in the upcoming years, with a greater emphasis on data integrity and recording.

Key Players: Thermo Fisher, Lonza, Charles River

Stem Cell Manufacturing Markets Top 13 Companies

- Thermo Fisher Scientific, Inc.

- Lonza Group

- Eppendorf AG

- Miltenyi Biotec GmBH

- Anterogen Co. Ltd.

- American Cryostem Corporation

- Pluristem Therapeutics Inc.

- Daiichi Sankyo

- Sartorius AG

- Danaher Corporation

- CellGenix GmBH

- PromoCell

- Organogenesis Holdings Inc.

Recent Developments

- In December 2025, The U.S. Food and Drug Administration recently announced the approval of the first hematopoietic stem cell transplant therapy to treat patients with rare but severe aplastic anemia. This new therapy Omidubicel-onlv is allowed for patients 6 and older after reduced intensity conditioning, the FDA said in a news release.

(Source:www.msn.com) - In January 2024,the multinational pharmaceutical corporation Cipla announced a joint venture in the US with Manipal Education & Medical Group and Kemwell Biopharma. The joint venture endeavors to create and market innovative cell therapy solutions to address unmet medical needs in the US, Japan, and the EU. The UK-based subsidiary of Cipla, Cipla (EU), will acquire a 35.2% share in the recently established joint venture. The joint venture aims to accelerate cell therapies' research, production, and distribution by utilizing Cipla's experience in product development and commercialization, Kemwell's expertise in biologics, and Manipal's knowledge of healthcare delivery.

- In September 2023, The Novo Nordisk Foundation revealed plans to invest up to DKK 950 million in a new cell therapy manufacturing facility in Lyngby, Denmark. The Technical University of Denmark (DTU) campus will host the Cellerator, a facility used for the last stages of cell therapy development and upscaling for human testing.

Segments Covered in the Report

By Product

- Consumables

- Culture Media

- Other Consumables

- Instruments

- Bioreactors and Incubators

- Cell Sorters

- Other Instruments

- Stem Cell Lines

- Hematopoietic Stem Cells (HSC)

- Mesenchymal Stem Cells (MSC)

- Induced Pluripotent Stem Cells (iPSC)

- Embryonic Stem Cells (ESC)

- Neural Stem Cells (NSC)

- Multipotent Adult Progenitor Stem Cells

By Application

- Research Applications

- Life Science Research

- Drug Discovery And Development

- Clinical Application

- Allogenic Stem Cell Therapy

- Autologous Stem Cell Therapy

- Cell & Tissue Banking Applications

By End-user

- Pharmaceutical & Biotechnology Companies

- Academic Institutes, Research Laboratories & Contract Research Organizations

- Hospitals & Surgical Centers

- Cell & Tissue Banks

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting