What is the Synthetic Monitoring Market Size?

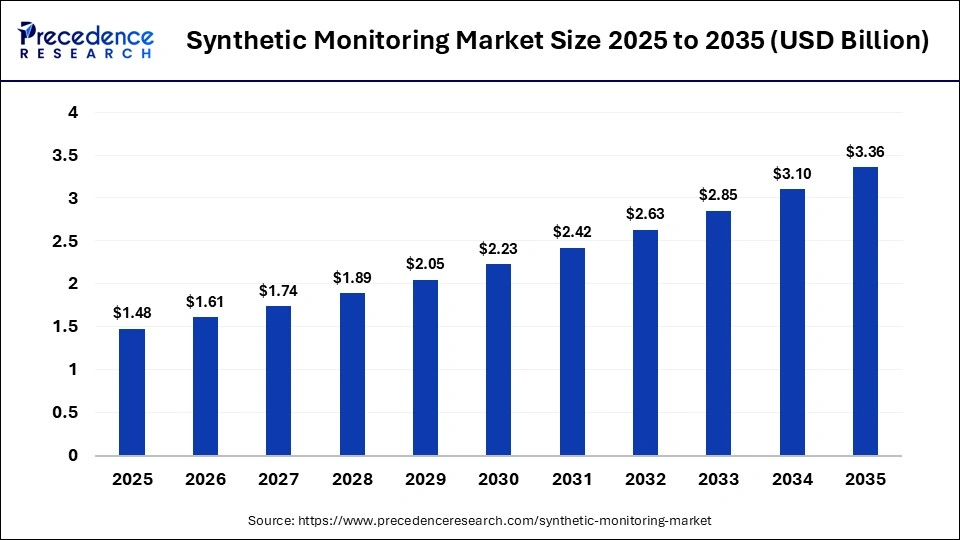

The global synthetic monitoring market size accounted for USD 1.48 billion in 2025 and is predicted to increase from USD 1.61 billion in 2026 to approximately USD 3.36 billion by 2035, expanding at a CAGR of 8.55% from 2026 to 2035. The global market is expanding steadily as organizations adopt proactive tools to simulate user interactions across websites, mobile apps, and APIs. Growth is driven by cloud adoption, microservices architectures, and digital-first business models that demand continuous performance assurance. Integration with DevOps, AI-driven analytics, and real-user monitoring is further strengthening enterprise observability strategies.

Market Highlights

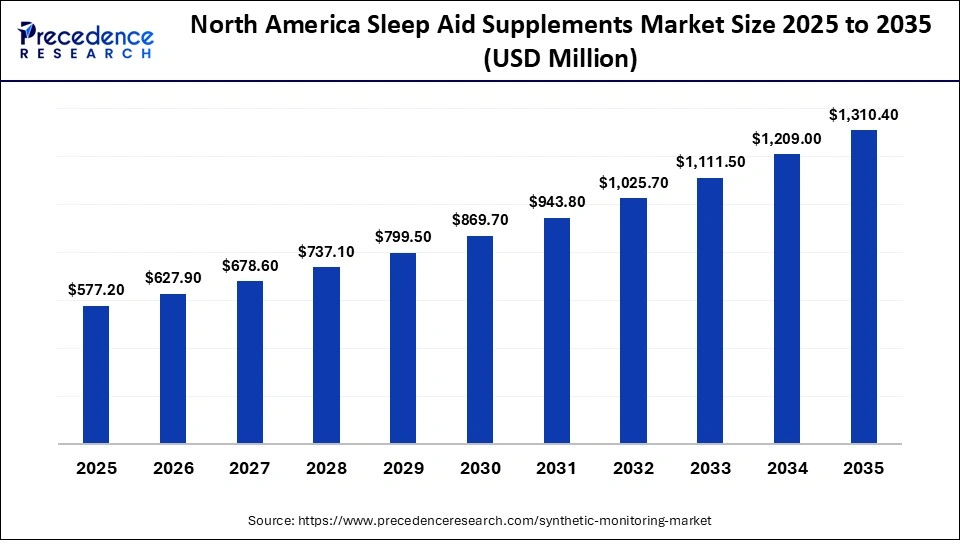

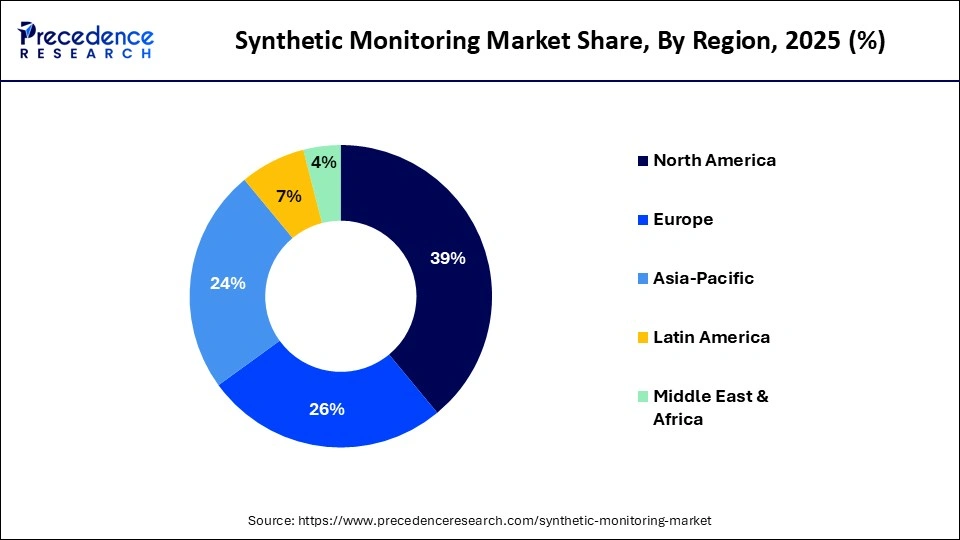

- North America led the synthetic monitoring market with a share of approximately 39% in 2025.

- Asia-Pacific is expected to expand at the highest CAGR of the market between 2026 and 2035.

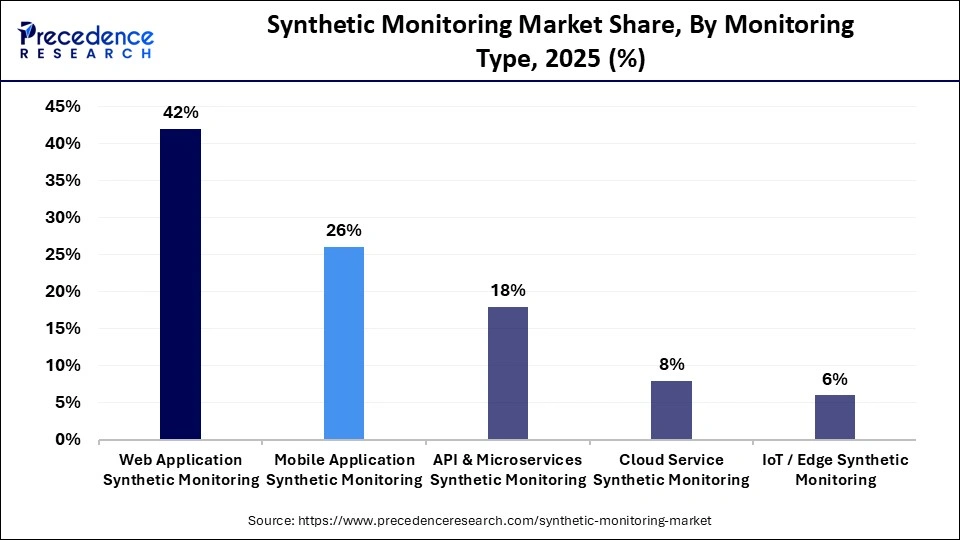

- By monitoring type, the web application synthetic monitoring segment held a dominant market share of approximately 42% in 2025.

- By monitoring type, the API & microservices synthetic monitoring segment is expected to grow with the highest CAGR between 2026 and 2035.

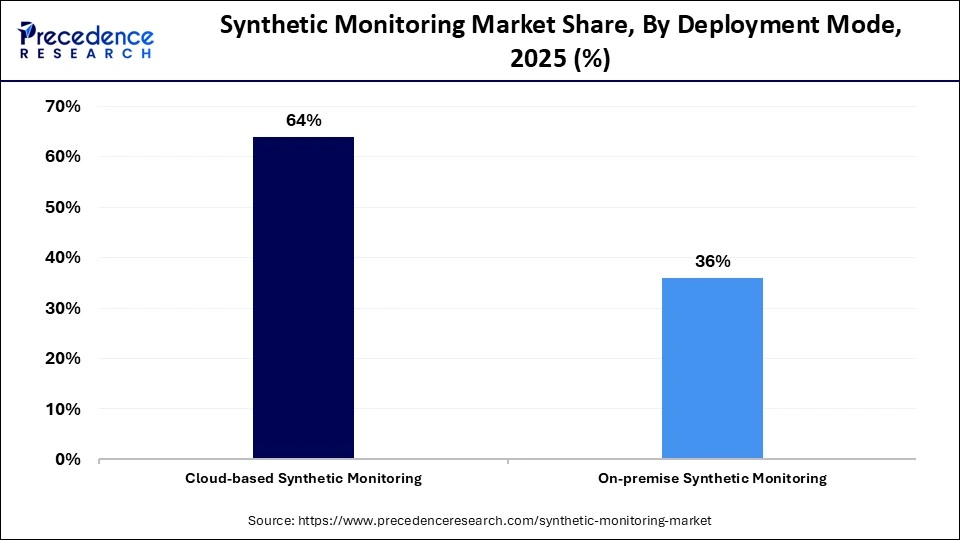

- By deployment mode, the cloud-based synthetic monitoring segment led the market with a share of approximately 64% in 2025.

- By deployment mode, the on-premise synthetic monitoring segment is expected to expand at the fastest CAGR from 2026 to 2035.

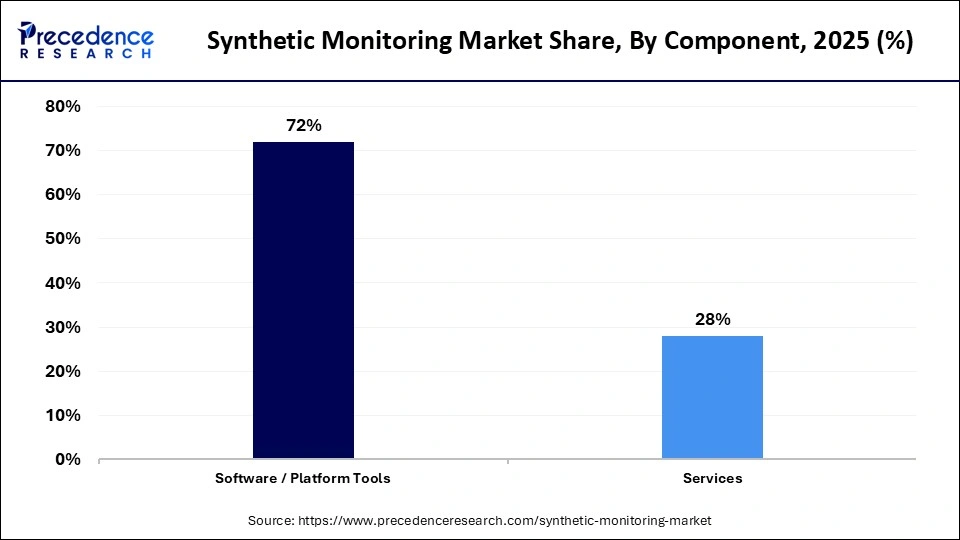

- By component, the software/platform tools segment held a dominant synthetic monitoring market share of approximately 72% in 2025.

- By component, the services segment is expected to grow at the highest CAGR between 2026 and 2035.

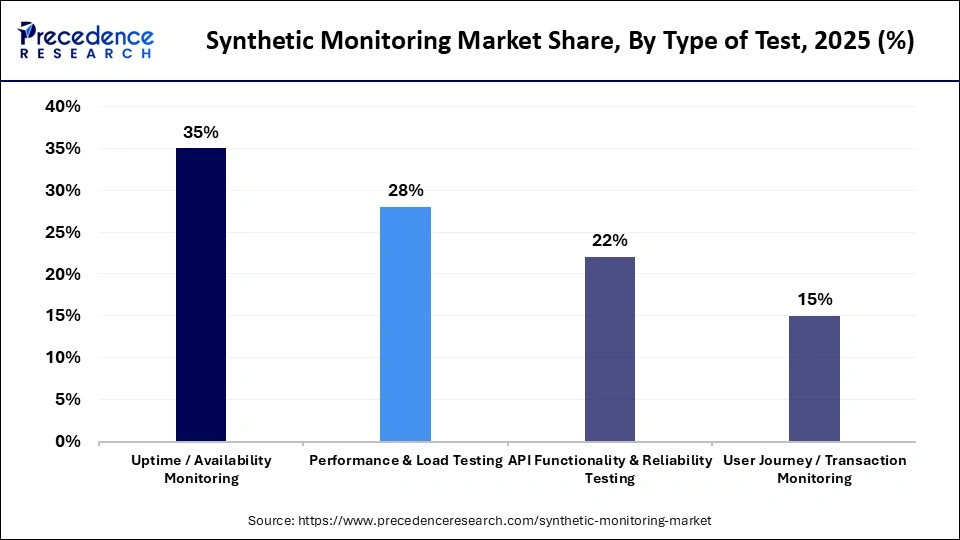

- By type of test, the uptime/availability monitoring segment held a dominant market share of approximately 35% in 2025.

- By type of test, the API functionality & reliability testing segment is expected to grow at the highest CAGR between 2026 and 2035.

- By end-user industry, the IT & telecom segment held a major revenue share of approximately 28% in 2025.

- By end-user industry, the healthcare & life sciences segment is expected to expand at the highest CAGR from 2026 to 2035.

Why is the Synthetic Monitoring Market Gaining Strategic Importance?

Synthetic monitoring is a proactive technique that uses scripted simulations of user journeys to test the availability, performance, and functionality of websites, applications, and APIs before real users are affected. The market is gaining strategic importance as enterprises shift to cloud-native, digital-first operations, where complex applications, microservices, and continuous DevOps cycles require constant performance validation to ensure uptime, customer experience, and business continuity.

How Is AI Reshaping the Synthetic Monitoring Industry?

Artificial intelligence is fundamentally reshaping the synthetic monitoring market by making monitoring systems more intelligent, automated, and predictive. AI algorithms can analyze large volumes of telemetry data to detect anomalies, forecast failures, and identify root causes faster than traditional rule-based tools. This enables proactive performance management rather than reactive troubleshooting. AI also automates synthetic test creation, interprets monitoring data using natural-language queries, and prioritizes alerts based on business impact. In advanced environments, agentic AI can even trigger self-healing actions, such as rerouting traffic or restarting services, improving uptime, efficiency, and overall digital experience.

Primary Trends Influencing the Global Synthetic Monitoring Market

- Growth of cloud-native and hybrid IT environments: Organizations are increasingly running applications across public clouds, private data centers, and hybrid infrastructures. This distributed architecture makes it difficult to maintain consistent performance without proactive testing. Synthetic monitoring helps simulate user interactions across multiple locations and cloud environments, enabling enterprises to identify performance issues early and maintain reliable digital services.

- Deeper alignment with DevOps and continuous delivery practices: Modern software teams are integrating synthetic monitoring into DevOps workflows and CI/CD pipelines. Automated performance checks are executed during development and before each deployment, allowing teams to detect issues earlier in the lifecycle. This approach reduces post-release incidents, shortens testing cycles, and supports faster, more reliable software updates.

- Increasing use of artificial intelligence and automation: AI and machine learning are being embedded into synthetic monitoring platforms to enhance accuracy and efficiency. These technologies help detect anomalies, predict potential outages, and automate root-cause analysis. As a result, organizations can move from reactive troubleshooting to proactive performance management, improving operational efficiency and system stability.

- Stronger focus on digital customer experience: Businesses involved in the synthetic monitoring market are prioritizing the quality of online interactions as customer expectations continue to rise. Synthetic monitoring allows companies to simulate real user journeys, such as account logins, purchases, or service requests, before customers encounter problems. This proactive testing helps maintain smooth digital experiences and protects brand reputation in competitive markets.

- Expansion of API-driven and microservices-based applications: Applications are increasingly built using microservices and interconnected APIs, creating complex service dependencies. Synthetic monitoring is evolving to continuously test API endpoints and service interactions, ensuring that each component functions correctly. This capability is critical for maintaining performance and reliability in highly distributed application architectures.

- Shift toward simplified and low-code monitoring solutions:Organizations are seeking tools that reduce the need for complex scripting and specialized technical skills. Low-code and automated test creation features allow teams to build and manage synthetic tests more easily. This trend is broadening adoption by enabling operations, QA, and business teams to participate in monitoring activities.

- Integration with broader observability and performance platforms: Synthetic monitoring is no longer a standalone tool; it is being combined with real-user monitoring, logging, and analytics solutions. This integration provides a more comprehensive view of application performance by correlating simulated tests with real-world usage data. As a result, organizations gain deeper insights into system behavior and can resolve issues more effectively.

- Greater attention to security, compliance, and risk prevention: Enterprises are increasingly using monitoring tools to support compliance and security objectives. Synthetic monitoring solutions are incorporating checks for system availability, transaction integrity, and regulatory requirements. This helps organizations detect vulnerabilities, maintain service reliability, and meet governance standards in regulated industries.

Marker Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.48 Billion |

| Market Size in 2026 | USD 1.61 Billion |

| Market Size by 2035 | USD 3.36 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.55% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Monitoring Type, Deployment Mode, Component, Type of Test, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Monitoring Type Insights

Which Monitoring Type Segment Dominated the Synthetic Monitoring Market?

The web application synthetic monitoring segment held a dominant position in the market with a share of approximately 42% in 2025 because websites serve as the primary interface for customer interactions, online transactions, and service access. Businesses prioritize consistent website performance to protect revenue and brand reputation. The rapid expansion of e-commerce, digital banking, and online services has increased the need for continuous, proactive monitoring of web-based user journeys.

The API & microservices synthetic monitoring segment is expected to grow at the fastest CAGR in the market between 2026 and 2035, as modern applications shift toward modular, service-based architectures. These environments rely on numerous interconnected APIs, increasing the risk of performance bottlenecks or failures. Organizations use synthetic monitoring to continuously test service interactions, ensure reliability, and maintain application performance across cloud-based, distributed, and frequently updated digital systems.

Deployment Mode Insights

How the Cloud-based Synthetic Monitoring Segment Dominated the Market?

The cloud-based synthetic monitoring segment accounted for a considerable revenue share of approximately 64% in the market in 2025 because organizations prefer scalable, flexible, and easily deployable monitoring solutions. Cloud platforms allow tests to run from multiple global locations without heavy infrastructure investment. They also support rapid integration with cloud-native applications, remote teams, and DevOps workflows, making them ideal for dynamic, distributed digital environments.

The on-premise synthetic monitoring segment is expected to grow with the highest CAGR in the market during the studied years as organizations in regulated industries prioritize data control, security, and compliance. Enterprises handling sensitive financial, healthcare, or government data prefer in-house monitoring environments to meet strict policies. On-premise deployments also offer greater customization, integration with legacy systems, and direct control over performance testing within internal networks.

Component Insights

Which Component Segment Led the Synthetic Monitoring Market?

The software/platform tools segment led the global market with a share of approximately 72% in 2025 as organizations prefer integrated solutions that provide automated testing, analytics, and alerting within a single platform. These tools offer scalability, ease of deployment, and compatibility with cloud, web, and mobile environments. Enterprises also favour platforms that support DevOps integration and centralized performance management across distributed applications.

The services segment is expected to expand rapidly in the market in the coming years, as many organizations lack the in-house expertise to design, deploy, and manage synthetic monitoring environments. Enterprises are increasingly relying on consulting, implementation, and managed services to optimize performance strategies. The rising complexity of cloud-native, multi-platform applications is also driving demand for specialized monitoring support and continuous performance management services.

Type of Test Insights

Why Did the Uptime/Availability Monitoring Segment Dominate the Market?

The uptime/availability monitoring segment held the largest revenue share of approximately 40% in the synthetic monitoring market in 2025. Because ensuring continuous service access is the most critical requirement for digital businesses, potentiating the demand for uptime/ availability monitoring. Organizations prioritize basic availability checks to confirm that websites, applications, and APIs remain accessible at all times. These tests are simple to deploy, cost-effective, and essential for preventing downtime, making them a foundational component of synthetic monitoring strategies.

The API functionality & reliability testing segment is expected to gain the highest market share between 2026 and 2035, as modern applications increasingly depend on interconnected APIs to deliver services. Any failure in an API can disrupt entire application workflows, making continuous testing essential. Organizations are adopting synthetic monitoring to validate API performance, detect errors early, and ensure seamless integration across cloud, mobile, and microservices-based environments.

End-User Industry Insights

Which End-User Industry Segment Dominated the Synthetic Monitoring Market?

The IT & telecom segment dominated the global market with a share of approximately 28% in 2025 because these organizations manage complex, high-traffic digital infrastructures that require constant performance validation. They rely heavily on cloud services, APIs, and real-time applications, where even minor disruptions can affect large user bases. Synthetic monitoring helps ensure network reliability, service availability, and a consistent user experience across distributed environments.

The healthcare & life sciences segment is expected to grow at the fastest CAGR in the market between 2026 and 2035 as digital health platforms, telemedicine, electronic records, and connected medical applications become more widespread. These systems require high availability, accuracy, and secure performance. Synthetic monitoring helps organizations test critical workflows, ensure system reliability, and maintain compliance, making it essential for delivering uninterrupted and safe digital healthcare services.

Regional Insights

How Big is the North America Synthetic Monitoring Market Size?

The North America synthetic monitoring market size is estimated at USD 577.20 million in 2025 and is projected to reach approximately USD 1,310.40 million by 2035, with a 8.54% CAGR from 2026 to 2035.

Why North America Dominated the Synthetic Monitoring Market?

North America dominated the market with a share of approximately 39% in 2025 due to its advanced digital infrastructure and early adoption of cloud, DevOps, and microservices technologies. The region hosts many leading technology providers and large enterprises that rely heavily on high-performance digital platforms. Strong investments in customer experience, cybersecurity, and application reliability also drive demand, as organizations prioritize proactive monitoring to maintain service quality across complex, distributed environments.

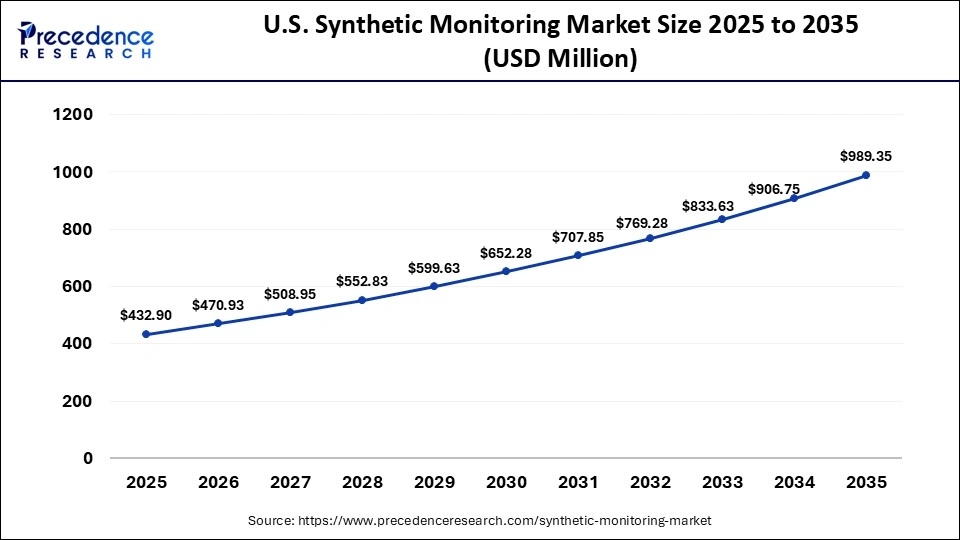

What is the Size of the U.S. Synthetic Monitoring Market?

The U.S. synthetic monitoring market size is calculated at USD 432.90 million in 2025 and is expected to reach nearly USD 989.35 million in 2035, accelerating at a strong CAGR of 8.62% between 2026 and 2035.

U.S. Market Trends

The U.S. dominates the North American market due to its mature digital economy, strong presence of leading technology companies, and widespread adoption of cloud, SaaS, and API-driven applications. Enterprises across sectors rely heavily on high-performance digital platforms, driving demand for proactive monitoring. Current trends include deeper integration with CI/CD pipelines, expansion of multi-cloud environments, and growing use of AI-enabled observability to improve uptime and user experience.

How is Asia-Pacific Growing in the Synthetic Monitoring Market?

Asia-Pacific is expected to be the fastest-growing region in the market due to rapid digital transformation, expanding e-commerce, and increasing cloud adoption across emerging economies. Businesses are launching more web and mobile services, creating demand for continuous performance testing. Growing investments in telecom infrastructure, fintech, and digital government services are further accelerating the need for proactive monitoring solutions.

China Market Trends

China leads the Asia-Pacific market due to its rapidly growing digital economy, extensive e-commerce activity, and widespread cloud adoption. Organizations are prioritizing continuous performance testing to ensure reliable user experiences, maintain security, and quickly resolve issues. Current trends include integrating synthetic monitoring with broader observability platforms, adopting AI-driven tools for predictive issue detection, and implementing proactive strategies to maintain application performance across complex, high-traffic digital systems.

Will Europe Grow in the Synthetic Monitoring Market?

Europe is expected to grow at a notable CAGR in the market during the forecast period as organizations increasingly adopt digital technologies, migrate to the cloud, and modernize IT systems. Strict regulations on data protection and service availability push enterprises to implement proactive performance monitoring. Rising demand for reliable digital services in industries like finance, healthcare, and government, along with the integration of synthetic monitoring into DevOps and observability platforms, is driving market expansion across the region.

Who are the Major Players in the Global Synthetic Monitoring Market?

The major players in the synthetic monitoring market include Dynatrace, New Relic, AppDynamics, Datadog, SolarWinds, Broadcom (CA Technologies), Micro Focus, LogicMonitor, Catchpoint, Uptrends, Site24x7 (Zoho Corporation), Pingdom (SolarWinds), Riverbed Technology, Splunk, ManageEngine, ThousandEyes (Cisco), Sematext, StackPath, ThousandEyes (Cisco), and CloudHarmony.

Recent Developments

- In February 2026, Athenatech.ai launched AxxonAI, Malaysia's first large language model-based synthetic data intelligence platform with agentic capabilities, in partnership with healthcare provider Sancy Berhad. The platform generates high-quality, privacy-compliant synthetic data to accelerate AI innovation while protecting sensitive information, supporting improved healthcare insights, operational efficiency, and secure data-driven decision-making.(Source: https://www.prnewswire.com)

- In February 2026, CoreWeave Inc. launched CoreWeave ARENA, a new testing environment designed to help organizations close the gap between AI testing and production. ARENA lets teams validate AI workloads on production-grade infrastructure that mirrors real-world conditions, enabling better performance, cost assessment, and deployment readiness before going live. (Source: https://www.forbes.com)

- In December 2025, Rocket Lab Corporation, a global leader in launch services and space systems, successfully launched its 21st Electron rocket of 2025 on December 21 from Launch Complex 1, New Zealand. The Wisdom God Guides mission deployed the QPS-SAR-15 satellite for Japan's iQPS, expanding its Earth-imaging radar constellation and reinforcing Rocket Lab's record annual launch cadence.(Source: https://rocketlabcorp.com)

Segments Covered in the Report

By Monitoring Type

- Web Application Synthetic Monitoring

- Mobile Application Synthetic Monitoring

- API & Microservices Synthetic Monitoring

- Cloud Service Synthetic Monitoring

- IoT/Edge Synthetic Monitoring

By Deployment Mode

- Cloud-based Synthetic Monitoring

- On-premise Synthetic Monitoring

By Component

- Software/Platform Tools

- Services

- Implementation & Integration

- Support & Maintenance

- Managed Monitoring

By Type of Test

- Uptime/Availability Monitoring

- Performance & Load Testing

- API Functionality & Reliability Testing

- User Journey/Transaction Monitoring

By End-User Industry

- IT & Telecom

- BFSI (Banking, Financial Services & Insurance)

- Retail & E-commerce

- Healthcare & Life Sciences

- Media & Entertainment

- Other Industries

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting