What is the Tantalum Carbide (TaC) Coated Graphite Substrate Market Size?

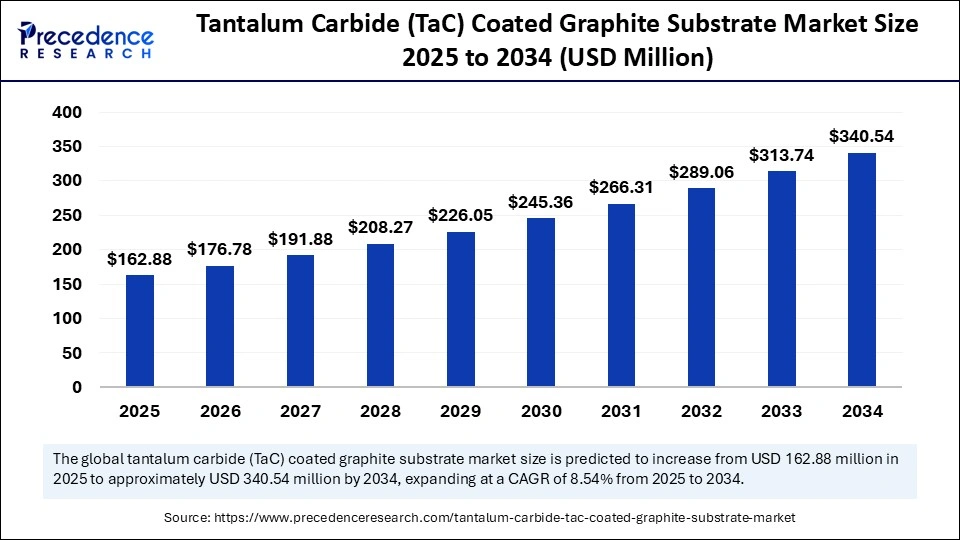

The global tantalum carbide (TaC) coated graphite substrate market size accounted for USD 150.06 million in 2024 and is predicted to increase from USD 162.88 million in 2025 to approximately USD 340.54 million by 2034, expanding at a CAGR of 8.54% from 2025 to 2034. The market is growing due to its super thermal stability, high hardness, and resistance to wear and corrosion, making it ideal for advanced aerospace, semiconductor, and high-temperature industrial applications.

Market Highlights

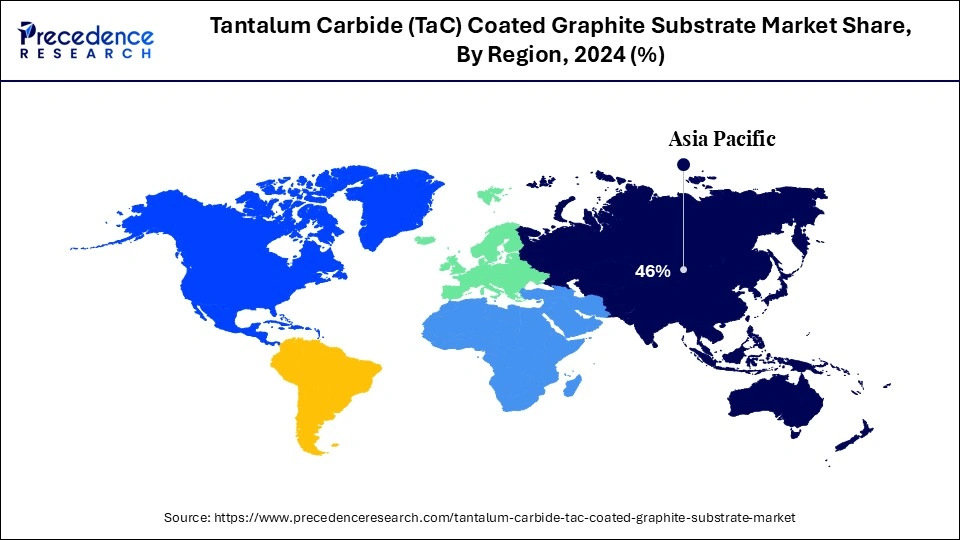

- Asia Pacific dominated the tantalum carbide (TaC) coated graphite substrate market with the largest market share of 46% in 2024.

- North America is expected to grow at a notable CAGR during the forecast period.

- By product form/shape, the susceptors segment held the biggest market share in 2024.

- By product form/shape, the precision-machined parts segment is expected to grow at the fastest CAGR during the forecast period.

- By coating deposition method, the chemical vapor deposition (CVD) TaC segment captured te highest market share in 2024.

- By coating deposition method, the hybrid/proprietary processes segment is expected to grow at the fastest CAGR during the forecast period.

- By application/end use, the semiconductor wafer processing segment led the maket in 2024.

- By application/end use, the advanced materials processing segment is expected to grow at the fastest CAGR during the forecast period.

- By performance/functional benefit, the chemical/etch resistance segment accounted for the significant market share in 2024.

- By performance/functional benefit, the thermal shock resistance segment is observed to grow at the fastest CAGR during the forecast period.

- By manufacturing/supply model, the integrated graphite+coating manufacturers segment held the largest share in 2024.

- By manufacturing/supply model, the contract coating and tolling segment is expected to grow at the fastest CAGR during the forecast period.

- By sales channel/customer type, the equipment manufacturers/OEMs segment generated the major market share in 2024.

- By sales channel/customer type, the aftermarket and refurbishment services segment is emerging as the fastest-growing from 2025 to 2034.

Market Size and Forecast

- Market Size in 2024: USD 150.06 Million

- Market Size in 2025: USD 162.88 Million

- Forecasted Market Size by 2034: USD 340.54 Million

- CAGR (2025-2034): 8.54%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Market Overview

What Is the Tantalum Carbide (TaC) Coated Graphite Substrate Market?

The market for tantalum carbide (TaC) coated graphite substrate is expanding steadily, driven by growing demand from sectors like high temperature manufacturing, semiconductors, and aerospace. These substrates are prized for their exceptional capacity to tolerate high temperatures, fend off chemical deterioration, and remain resilient in challenging circumstances. They have become more significant in next-generation applications due to the adoption of sophisticated coating techniques like Chemical Vapor Deposition, which has further improved their performance. Rapid industrial expansion in the Asia Pacific and continuous advancements in material engineering are also contributing to growth; however, issues with high production costs, complex coatings, and the need for constant quality control remain.

- In June 2024, SEMICOREX reported that tantalum carbide coatings on graphite offer superior chemical corrosion resistance compared to bare graphite or silicon carbide-coated graphite and that such coatings can be used reliably at high temperatures.(Source: https://www.semicorex.com)

What Is the Impact of AI and Machine Learning Technologies on the Tantalum Carbide (TaC) Coated Graphite Substrate Market?

Artificial intelligence and machine learning are significantly transforming the tantalum carbide (TaC) coated graphite substrate market by enhancing manufacturing precision, optimizing thermal management, and improving quality control. Real-time coating uniformity monitoring and defect detection are made possible by AI algorithms, which increase yield rates and decrease waste in semiconductor and LED manufacturing lines. Predictive maintenance and thermal modeling are made easier by ML models, which guarantee reliable operation even in the most adverse circumstances. Additionally, these technologies simplify inventory forecasting and supply chain management, allowing production schedules to be in line with changes in market demand and the availability of raw materials. The use of TaC-coated graphite substrates in cutting-edge applications is fueled by the increased productivity, cost savings, and product dependability that manufacturers can attain as a result.

- In August 2025, the Research Institute for Machine Learning Potential Development developed a machine learning potential based on the Moment Tensor Potential method for the TaN-Ce system, employed to investigate the interfacial structure and wetting behavior between liquid Ce and solid TaN, enhancing the understanding of material interactions at the atomic level.(Source: https://www.mdpi.com)

Tantalum Carbide (TaC) Coated Graphite Substrate Market Growth Factors

- Expansion of the Semiconductor Industry: TaC-coated graphite substrates are critical for high-temperature processes like CVD and epitaxial wafer growth, providing uniform heating and chemical resistance, driving demand.

- Adoption of Electric Vehicles (EVs) and GaN/SiC Devices: High-performance power devices require substrates that can withstand extreme thermal and chemical environments, increasing the market need for TaC-coated graphite.

- Investments in Aerospace and Advanced Materials Manufacturing: The durability and longevity of TaC-coated graphite make it suitable for aerospace and high-end industrial applications.

- Integration of AI and Machine Learning in Manufacturing: AI and ML improve production efficiency, monitor coating quality, reduce defects, and accelerate innovation in substrate design.

- Focus on Miniaturization and High Precision in Electronics: The push for smaller, high-performance electronic devices increases the demand for substrates with consistent thermal and chemical properties.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 150.06 Million |

| Market Size in 2025 | USD 162.88 Million |

| Market Size by 2034 | USD 340.54 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.54% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Form / Shape, Coating Deposition Method, Application / End-use, Performance / Functional Benefit, Manufacturing / Supply Model, Sales Channel / Customer Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand from Semiconductor Manufacturing

The surge in advanced power electronics, 5G networks, and electric vehicles is propelling the semiconductor industry's rapid expansion. Due to their ability to function in extremely hot and reactive environments, TaC-coated graphite substrates are becoming increasingly significant in wafer processing and compound semiconductor development. Demand in the market is being directly driven by this increasing reliance.

Stricter Quality and Reliability Requirements

There is growing pressure on industries today to increase yield, reduce contamination, and guarantee consistent performance. Manufacturers can better meet these demands by using graphite substrates coated with TaC, which provide increased reliability in challenging operating environments. In line with quality standards and operational efficiency, this promotes increased market penetration. In addition, customer expectations and regulatory standards require traceability, purity, and consistency over time, in addition to performance, which drives the development of better materials. Longer-lasting coatings are also becoming more appealing due to sustainability objectives and worries about waste and frequent replacement.

Restraints

High Upfront Cost of TaC Coated Components

Although TaC coatings greatly increase performance and durability, their initial cost is higher than that of uncoated graphite or less complex substitutes. Especially in industries where costs are a concern, this may discourage startups or smaller manufacturers from implementing them. Widespread adoption of high-quality coated components is hampered by the upfront capital investment needed, despite the potential reduction in lifecycle costs. Additionally, to preserve short-term profitability, businesses with limited resources might give priority to less expensive alternatives, which slow down market penetration overall. Longer ROI periods result from high upfront costs, which may deter investment in small-scale or experimental production lines.

Complexity and Cost of Coating Process

Advanced CVD or PVD techniques, as well as exact control over temperature, layer thickness, adhesion, and post-treatment, are necessary for the deposition of TaC on graphite. Due to their energy requirements and technical difficulties, these procedures may result in longer lead times and higher production costs. Additionally, inconsistent coating quality increases the risk for new adopters by increasing the likelihood of component failure. It is challenging to increase production without compromising uniformity, which restricts quick expansion. Additionally, smaller suppliers find it more difficult to access the process due to the requirement for highly qualified engineers and specialized equipment, which limits supply.

Opportunities

Expansion in Semiconductor and Advanced Electronics Manufacturing

There is a great need for high-performance TaC-coated graphite substrates due to the quick expansion of semiconductor fabrication, which includes the production of SiC and GaN devices for 5G, renewable energy, and electric vehicles. These substrates ensure process stability and higher yields by withstanding higher temperatures and corrosive environments. There is a greater need for robust coatings that can prolong component life as sophisticated nodes and intricate epitaxial layers become more prevalent. Moreover, coated graphite offers a strong solution for fabs looking to increase uptime and lower contamination, opening doors for suppliers to grow their business.

Advancements in Coating Technologies

Many consistent, adherent, and adaptable TaC coatings are now possible thanks to advancements in CVD and PVD deposition methods. Variable thickness regulated porosity, and the renovation of pre-existing components are examples of innovations that increase market potential. Now that coatings can be customized for particular industrial processes, their use is growing in a variety of applications. TaC-coated graphite is now more appealing to a wider spectrum of end users due to the gradual reduction in production costs made possible by these technological advancements.

Segmental Insights

Product Form/Shape Insights

Why Did the Susceptors Segment Dominate the Tantalum Carbide (TaC) Coated Graphite Substrate Market?

Susceptors dominated the tantalum carbide (TaC)- coated graphite substrate market in 2024 because they are essential for the epitaxial growth and CVD processes during semiconductor fabrication. They guarantee consistent wafer heating, maintain high thermal stability, and prevent chemical erosion, making them essential for yield and device quality. Furthermore, the significance of extremely dependable susceptor materials is increased by the expanding size of wafers and the growing complexity of semiconductor processes. Susceptors are the recommended option for advanced semiconductor fabrication because they also help to reduce the frequency of maintenance and the risk of contamination.

Precision-machined parts are the fastest-growing product segment because they are used in high-performance electronics and customized semiconductor tools, which demand precise tolerances and intricate geometries. Applications for R&D and advanced manufacturing are using these parts increasingly. More design flexibility and process customization are made possible by them, which is essential for next-generation semiconductor and power electronic devices. Miniaturization trends are another factor driving demand, necessitating extremely precise components with strong thermal and chemical resistance.

Coating Deposition Method Insights

Why Did the Chemical Vapor Deposition (CVD) TaC Segment Dominate the Market?

Chemical vapor deposition (CVD) TaC dominates the tantalum carbide (TaC) coated graphite substrate market since it produces coatings that are thick, consistent, and sticky. In semiconductor wafer processing and advanced material manufacturing, in particular, it is perfect for components subjected to high temperatures and corrosive gases. Additionally, CVD coatings provide exceptional control over surface characteristics and thickness, guaranteeing reliable performance in precision applications. Moreover, CVD-based TaC coatings improve process reliability, prolong service life, and lower component failure rates, all of which are crucial in high-value semiconductor and aerospace applications.

Hybrid/proprietary processes are growing rapidly in the market due to their ability to customize layer thickness, microstructure, and adhesion properties. These processes can be tailored to extreme application conditions that standard CVD may not fully address. They are increasingly adopted in aerospace, advanced semiconductor, and energy applications where highly specialized performance is required. The flexibility of hybrid processes also allows refurbishment of existing components, lowering overall lifecycle costs while maintaining high reliability.

Application/End Use Insights

Why Did the Semiconductor Wafer Processing Segment Dominate the Tantalum Carbide (TaC) Coated Graphite Substrate Market in 2024?

Semiconductor wafer processing is dominating the market because of the need for high-performance electronic devices and the growing complexity of chip manufacturing. TaC-coated graphite substrates are crucial for CVD and epitaxial growth procedures because they provide superior chemical resistance, thermal stability, and uniform heating, all of which enhance wafer yield and process efficiency. Dominance was further fueled by the quick growth of semiconductor factories, particularly in the Asia-Pacific region, and the rising demand for SiC and GaN wafers. Furthermore, as electronic devices continue to get smaller, superior long-lasting substrates are essential for the production of sophisticated semiconductors.

The advanced materials processing segment is growing the fastest in the tantalum carbide (TaC)- coated graphite substrate market because TaC-coated graphite substrates are being increasingly used in high-end energy, aerospace, and research applications. For procedures like thin-film deposition, 3D material fabrication, and advanced ceramics processing that call for high chemical and thermal stability, these substrates are perfect. They are becoming more and more well-liked in high-tech and R&D applications due to their resistance to harsh conditions and specialized shapes. The global expansion of pilot-scale manufacturing and experimental facilities also contributes to growth.

Performance/Functional Benefit Insights

Why Did the Chemical/Etch Resistance Segment Dominate the Tantalum Carbide (TaC) Coated Graphite Substrate Market in 2024?

The chemical etch resistance segment dominated the market due to the industry's growing need for substrates that can withstand extremely aggressive and corrosive chemicals during chemical and semiconductor processing. TaC-coated graphite reduces contamination risks and prolongs component life by offering superior protection against oxidation, chemical attack, and erosion. Because even small flaws can result in significant losses, these qualities are essential for high-value semiconductor fabrication.

Thermal shock resistance is the fastest-growing performance benefit as industries seek materials that can tolerate rapid temperature fluctuations without cracking or degrading. TaC-coated graphite substrates are increasingly used in aerospace, high-power electronics, and advanced manufacturing processes where thermal cycling is common. This property extends component life, reduces maintenance costs, and ensures operational reliability under extreme conditions.

Manufacturing/Supply Model Insights

Why Did the Integrated Graphite and Coating Manufacturers Segment Dominate the Market in 2024?

Integrated graphite + coating manufacturers dominated the tantalum carbide (TaC) coated graphite substrate market because combining graphite substrate production and TaC coating under one roof ensures better quality control, uniformity, and supply reliability. This model enables companies to tailor substrates for specific applications, allowing for tighter process control, which is crucial for the high-end semiconductor and aerospace industries. Integrated facilities also reduce dependency on third-party suppliers and minimize lead time, making them the preferred choice for large-scale industrial applications.

Contract coating and tolling are the fastest-growing models because they allow smaller manufacturers to access high-quality TaC coatings without investing in expensive coating infrastructure. This trend is particularly strong in emerging regions where local fabs or R&D centers rely on outsourced coating services for precision components. The flexibility and cost efficiency of contract coating accelerate the adoption of TaC-coated graphite in new industries and applications.

Sales Channel/Customer Type Insights

Why Did the Equipment Manufacturers/OEMs Segment Dominate the Market in 2024?

The equipment manufacturers/OEMs segment dominates the tantalum carbide (TaC)- coated graphite substrate market because they incorporate TaC-coated graphite components directly into expensive equipment, such as aerospace propulsion systems, wafer handling systems, and CVD reactors. Reliability, consistency, and the capacity to combine products with their equipment are advantages for OEMs that guarantee increased customer satisfaction and long-term service agreements.

Aftermarket and refurbishment services are the fastest-growing customer type, as industries increasingly prefer extending the lifecycle of existing TaC-coated graphite components to reduce capital expenditure. Refurbishment services also offer an eco-friendly and cost-effective solution, particularly for high-value semiconductor equipment and aerospace components, where replacement costs are substantial.

Regional Insights

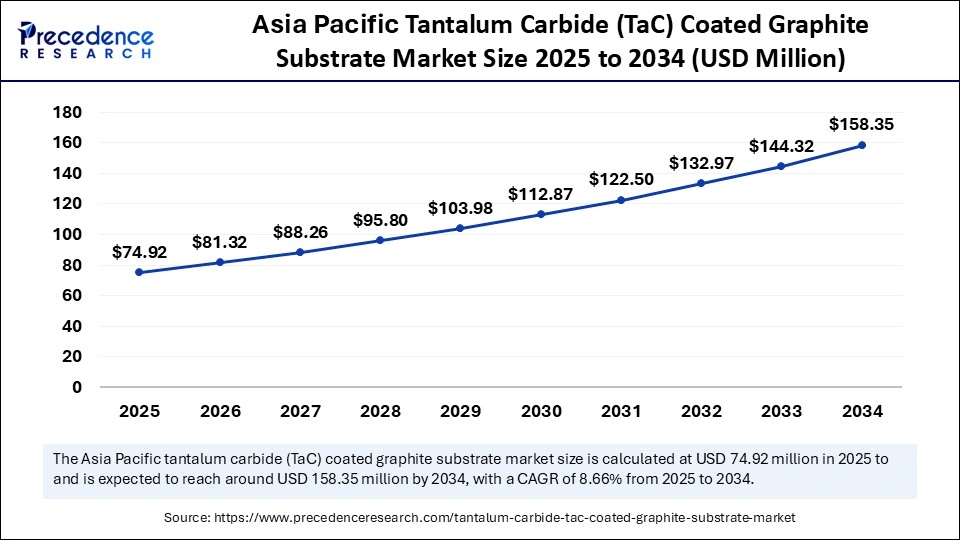

Asia Pacific Tantalum Carbide (TaC) Coated Graphite Substrate Market Size and Growth 2025 to 2034

The Asia Pacific tantalum carbide (TaC) coated graphite substrate market size was evaluated at USD 69.03 million in 2024 and is projected to be worth around USD 158.35 million by 2034, growing at a CAGR of 8.66% from 2025 to 2034.

Why Did Asia Pacific Dominate the Tantalum Carbide (TaC) Coated Graphite Substrate Market in 2024?

The Asia Pacific dominated the tantalum carbide (TaC) coated graphite substrate market and captured the largest market share of 46% in 2024,driven by rapid industrialization and strong investments in semiconductor fabrication, renewable energy, and the aerospace sector. The presence of key manufacturers and suppliers in the region further reinforces dominance, as local availability reduces lead time and cost for end users. Additionally, government incentives for high-tech manufacturing and R&D support have accelerated the adoption of high-performance materials, such as TaC-coated graphite. The region's established supply chains and skilled workforce enable faster deployment of advanced substrates across multiple industries.

North America is the fastest-growing region because advanced semiconductor devices, electric cars, and aerospace programs are becoming more and more popular. The market is expanding due to government incentives for clean energy and high-tech manufacturing, as well as growing demand from semiconductor fabs and research facilities. In addition, precision manufacturing in North America is expanding quickly, which is increasing demand for long-lasting, chemically resistant substrates. The region's emphasis on technological adoption and innovation facilitates the quicker integration of TaC-coated graphite components in novel industrial and R&D applications.

Tantalum Carbide (TaC) Coated Graphite Substrate Market Companies

- Toyo Tanso Co., Ltd.

- Tokai Carbon Co., Ltd.

- Mersen Group

- Momentive Technologies

- Bay Carbon, Inc.

- Ningbo HIPER Technologies

- VeTek Semiconductor

- Semicorex / Semicorex Group

- Semicera

- Stanford Advanced Materials

- Xinsheng Novel Materials Technology

- Liufang Technology

- NK-Carbon / NK Coatings

- ACME

- Specialized contract coaters / local CDMOs

Recent Developments

- In May 2024, Semicera announced a breakthrough in TaC coating technology, achieving high purity, temperature stability, and chemical tolerance. Their advanced coating process enhanced the quality of SiC/GaN crystals and EPI layers, extending the life of key reactor components.(Source: https://www.semicorex.com)

- In February 2025, CNVET Energy highlighted emerging trends in TaC-coated graphite susceptor technology, emphasizing advancements in CVD techniques and improved durability. These innovations are driving growth in semiconductor and aerospace applications, where high-performance materials are essential.(Source: https://www.cnvetenergy.com)

Segments Covered in the Report

By Product Form / Shape

- Susceptors (flat, disk, cup)

- Rings, boats & crucible liners

- Plates/tiles/wafers carriers

- Tubes, nozzles & pipes

- Precision-machined parts (custom geometries)

By Coating Deposition Method

- Chemical Vapor Deposition (CVD) TaC

- Pack/sol-gel / ceramic conversion TaC coatings

- Physical Vapor Deposition (PVD) / sputtered carbide films

- Hybrid / proprietary processes (surface impregnation + carbide conversion)

By Application / End-use (major industries)

- Semiconductor wafer processing (MOCVD, epitaxy, EPI) & SiC/GaN crystal growth (PVT)

- Advanced materials processing (SiC single crystal, sapphire growth)

- Aerospace & ultra-high-temperature components (thermal protection, nozzle parts)

- Metallurgy & refractory processing (crucibles, liners)

- Research & lab/specialty equipment

By Performance / Functional Benefit

- High-temperature stability/creep resistance

- Chemical / etch resistance (reduced contamination)

- Wear & erosion resistance (mechanical life extension)

- Dust suppression/impurity barrier (yield protection)

- Thermal shock resistance

By Manufacturing / Supply Model

- OEM direct (components supplied to equipment makers)

- Contract coating/tolling (third-party CVD/PVD coaters)

- Integrated graphite + coating manufacturers (vertical producers)

- Refurbishment & recoat service providers

By Sales Channel / Customer Type

- Equipment manufacturers / OEMs (bulk & qualified parts)

- Electronic materials & wafer fabs (end users purchasing qualified parts)

- Distributors/specialty materials suppliers

- Aftermarket/refurbishment services for installed base

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting