What is Thin-Film Photovoltaics Market Size?

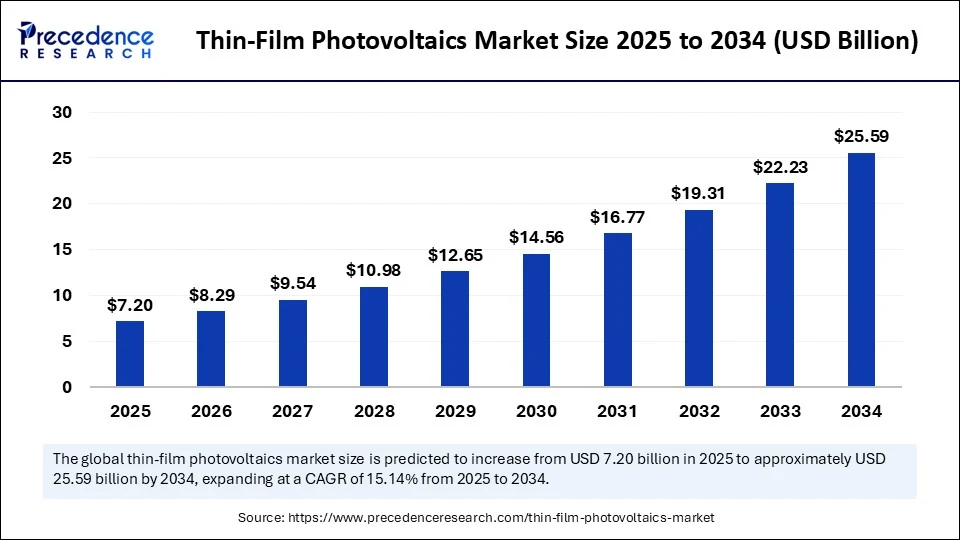

The global thin-film photovoltaics market size accounted for USD 7.20 billion in 2025 and is predicted to increase from USD 8.29 billion in 2026 to approximately USD 25.59 billion by 2034, expanding at a CAGR of 15.14% from 2025 to 2034. The market growth is attributed to rising global investments in renewable energy, accelerating demand for high-efficiency solar modules, and increasing adoption of thin-film technology in utility-scale and building-integrated applications.

Market Highlights

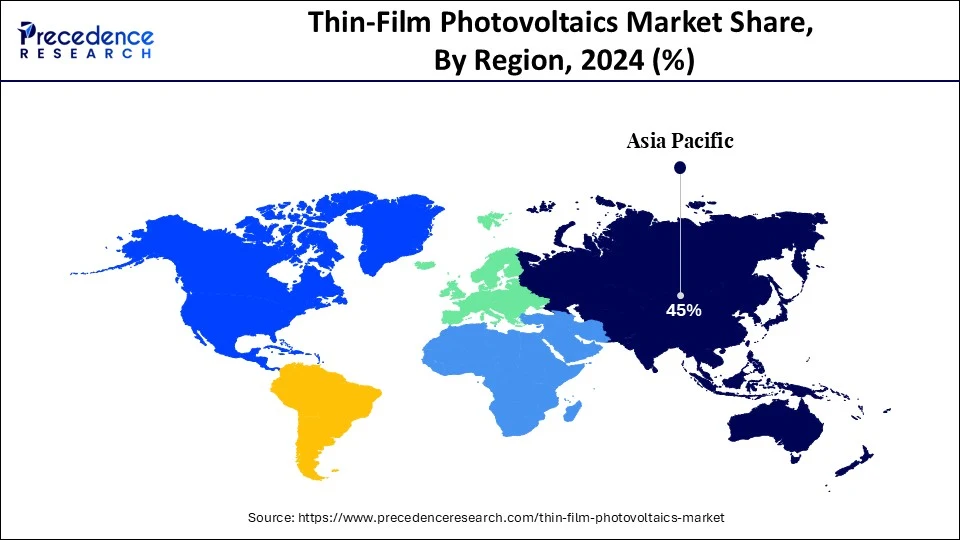

- Asia Pacific dominated the global thin-film photovoltaics market with the largest share of 45% in 2024.

- Europe is expected to grow at a notable CAGR from 2025 to 2034.

- By technology, the cadmium telluride (CdTe) segment held the major market share of 45% in 2024.

- By technology, the perovskite thin-film segment is projected to grow at a CAGR between 2025 and 2034.

- By module type, the rigid thin-film modules segment contributed the biggest market share of 60% in 2024.

- By module type, the flexible thin-film modules segment is expanding at a significant CAGR between 2025 and 2034.

- By application, the utility-scale power plants segment captured the highest market share of 50% in 2024.

- By application, the building-integrated photovoltaics (BIPV) segment is expected to grow at a significant CAGR over the projected period.

- By end-user industry, energy & power utilities segments generated the major market share of 55% in 2024.

- By end-user industry, the automotive & transportation segment is expected to grow at a notable CAGR from 2025 to 2034.

- By distribution channel, direct supply to project developers segments accounted for the significant market share of 58% in 2024.

- By distribution channel, online & emerging platforms projects are expected to grow at a notable CAGR from 2024 to 2034.

Impact of Artificial Intelligence on the Thin-Film Photovoltaics Market

Artificial intelligence (AI) is transforming the market of thin-film photovoltaics based on thin-films, as it will push the efficiency at all levels of the value chain. Process controllers use AI to refine deposition methods and track material consistency, and monitor defects at a micro-level. This allows manufacturers to minimize wastage and ensure that the modules perform consistently. Furthermore, with governments and investors driving towards fast decarbonization, AI integration into this market not only optimizes competitiveness but also increases the long-term sustainability of thin-film photovoltaics within the global energy mix.

Thin-Film Photovoltaics: Powering the Next Wave of Clean Energy

The growing focus on clean energy infrastructure being increased worldwide is expected to drive the thin-film photovoltaics market. Thin-film solar technology employs ultra-thin coats of cadmium telluride (CdTe), copper indium gallium selenide (CIGS), and amorphous silicon (a-Si) on a substrate, either glass, plastic, or metal. This turns the modules to be lightweight, bendable, and more adaptable building-integrated photovoltaics (BIPV), portable devices, and utility-scale projects in hot climates where crystalline silicon tends to perform poorly.

The International Energy Agency (IEA) forecasts that the investment in clean energy worldwide would go beyond USD 3 trillion in 2024, with solar energy registering the greatest%age of the new capacities. As noted by the IRENA 2024 report, solar PV had an installed capacity of 1,419 GW worldwide, and the thin-film was steadily making contributions to areas that are more land-conscious and lightweight. In the pursuit of its solar manufacturing revival plan, the European Commission Repower EU initiative still encourages the integration of thin-film into the roofs, facades, and transport. Such emerging economies, including India and China, with the help of the International Solar Alliance (ISA) and China Photovoltaic Industry Association (CPIA) policies, accelerate the diversification of PV technologies, such as thin-film, to enhance energy security.

Thin-Film Photovoltaics Market Growth Factors

- Driving Expansion of Lightweight Solar Solutions: Growing demand for portable and flexible energy systems is fuelling the adoption of thin-film modules in off-grid and mobile applications.

- Boosting Integration in Agriculture (Agri-PV): Rising focus on solar-powered farming infrastructure is propelling the deployment of thin-film panels on greenhouses and farmland.

- Fuelling Demand for Transparent Photovoltaics: Increasing R&D in semi-transparent thin-films is driving their use in windows, facades, and smart building designs.

- Rising Adoption in Electric Mobility: Growing EV charging infrastructure is boosting the integration of thin-film modules into charging stations and vehicle rooftops.

Market Outlook

- Industry Growth Offerings- The thin-film photovoltaics industry is growing due to rising demand for lightweight, flexible, and building-integrated solar solutions, increasing renewable energy investments, and technological advancements in CdTe, CIGS, and a-Si materials, driving global adoption across residential, commercial, and utility-scale projects.

- Global expansion- Global expansion of thin-film photovoltaics is driven by increasing adoption in emerging markets, supportive government policies, and large-scale investments in renewable energy. Growing demand for flexible, lightweight, and BIPV solutions further accelerates international market penetration.

- Startup ecosystem- The startup ecosystem for thin-film photovoltaics is expanding, focusing on innovative solutions such as flexible, semi-transparent modules, AI-driven efficiency optimization, and cost-effective manufacturing. Emerging companies aim to enhance adoption in BIPV, portable devices, and utility-scale solar projects globally.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.20 Billion |

| Market Size in 2026 | USD 8.29 Billion |

| Market Size by 2034 | USD 25.59 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.14% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Module Type, End-User Industry, Application, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Why Is the Rising Need for Flexible and Lightweight Modules Strengthening the Thin-Film Photovoltaics Market?

Increasing demand for lightweight and flexible solar modules is expected to accelerate the growth of the thin-film photovoltaics market. The demand for lightweight and flexible solar modules is increasing, and this is likely to propel the use of these modules in rooftop, portable, and off-grid usage. According to the International Energy Agency (IEA), the number of households adopting solar PV is projected to rise from around 25 million today to over 100 million by 2030 under the Net Zero Emissions by 2050 (NZE) Scenario. The cadmium telluride (CdTe), amorphous silicon (a-Si), and copper indium gallium selenide (CIGS) thin-film technologies offer better weight-to-power ratios than crystalline silicon. Their versatility on non-standard surfaces such as building facades, car roofs, and consumer electronics improves their marketability.

These modules are being favoured by industries that specialize in integrated solar solutions in the field of transportation and consumer goods because of their design flexibility. This is an advantage that makes the thin-film photovoltaics a viable option in regions where the installation of traditional rigid panels is restricted. In 2024, the US had manufactured 4.2 GW of PV modules, including a sizeable share of thin-film modules, as more manufacturers migrate towards the flexible and lightweight manufacturing.

International studies have put laboratory efficiencies of 23.6% for CIGS cells on glass and 22.2% for flexible CIGS substrates, which supports good performance in designs that are bendable. Furthermore, the growing emphasis on cost-effective solar energy solutions is anticipated to strengthen the competitiveness of thin-film technology in the coming years.

Restraint

Shorter Lifespan and Degradation Challenges Restricting the Thin-Film Photovoltaics Market

Shorter lifespan and degradation issues, likely to restrict adoption in conservative markets, further hindering the market growth. Crystalline silicon panels have a longer degradation curve than a thin-film module, which negatively affects long-term performance guarantees. This technical perception reduces the confidence of the utility investors, especially in markets where power purchase contracts need 25-30 years of life. Furthermore, the restrain growth due to high initial capital requirements for thin-film manufacturing facilities, anticipated to create entry barriers for new players.

Opportunity

Can Rising Global Investments in Renewable Infrastructure Accelerate the Expansion of the Thin-Film Photovoltaics Market?

Surging investments in renewable energy infrastructure are projected to create substantial opportunities for the thin-film installations market. International decarbonization and net-zero pledges compel states and businesses to hasten the scaling up of solar use. Thin-film modules are gaining momentum for their capacity to perform exceptionally well in hot-temperature zones and on cloudy days. The IRENA reports that the total investment in renewable power worldwide reached over USD 600 billion in 2024, and the biggest portion of investment went to solar power.

Utility-scale developers in Asia, the Middle East, and Latin America are progressively focusing on thin-film initiatives as a platform to support a predictable energy supply and diversify their renewable portfolios. The presence of public-private partnerships helps to scale up grid expansion actions, whereas programmes, such as the Repower EU plan (2024) by the European Union and the National Solar Mission plan (2024) by India, are active in providing funds to innovative PV technologies. Furthermore, the rising focus on building-integrated photovoltaics (BIPV) is expected to drive demand for thin-film technologies, further fuelling the market.

Segment Insights

Technology Insights

Why is Cadmium Telluride (CdTe) Technology Dominating the Thin-Film Photovoltaics Market?

Cadmium telluride (CdTe) segment dominated the thin-film photovoltaics market in 2024, accounting for an estimated 45% market share, due to its outstanding cost-to-performance ratio, energy payback time of less than a year, and ability to withstand high temperature and low light environments. Furthermore, the increases in recycling and recycling models such as closed-loop recycling facilities made by First Solar also contributed to the sustainability credentials, thus further boosting the segment in the coming years.

The perovskite thin-film segment is expected to grow at the fastest rate in the coming years, owing to its unrivaled efficiency enhancement rate and wide usage. In 2024, laboratory records at Oxford PV and NREL showed perovskite-silicon tandem cells with an efficiency outperforming most thin-film competitors. Additionally, the potential to grow perovskites onto flexible platforms, and with superior temperature capabilities than CdTe or silicon, is expected to reduce the cost of production, thus propelling their utilization.

Module Type Insights

How are Flexible thin-film Modules Emerging as the Leading Choice in the thin-film Photovoltaics Market?

Rigid thin-film modules segment held the largest revenue share in the thin-film photovoltaics market in 2024accounting for 60% of the market share. Due to their lifespan, established supply chain, and low cost performance in large-scale utility projects placed as the top type of module. Furthermore, the high utilization in grid-tied utility applications and bankability over the long, gave rigid thin-film modules their dominant role in the new market environment.

The flexible thin-film modules segment is expected to grow at the fastest CAGR in the coming years, owing to the flexibility, lightweight feature, and growing use in non-traditional energy markets. Their capability to be incorporated into building-integrated photovoltaics (BIPV), transportation, and portable power is expected to hasten implementation. Additionally, the alliances with large construction companies are expected to drive faster adoption in the BIPV markets, where aesthetic and functional flexibility are one of the primary distinguishing factors.

Application Insights

What Makes Utility-Scale Installations the Largest Application Segment in the Thin-Film Photovoltaics Market?

Utility-scale power plants segment dominated the thin-film photovoltaics market in 2024, due to their limited to utility-scale power plants, which comprised almost half of all worldwide installations. Large-scale use of cadmium telluride (CdTe) and amorphous silicon (a-Si) modules in solar farms, where efficiency, scalability, and cost-effectiveness are the determinants of project feasibility, has contributed to the growth of the segment.

The International Energy Agency (IEA, 2024) indicates that the size of utility-scale solar capacity worldwide exceeded 600 GW. In countries with high temperatures and diffuse light, where crystalline silicon panels were less efficient, a large share of capacity was made by thin-film technologies. In desert and semi-arid conditions, thin-film modules showed an improved energy output per installed kilowatt-hour and solidified their case in the value proposition of large-scale projects. Furthermore, the established long-term stability and minimization of the risks of investments for thin-film photovoltaics further fuel the market.

Building-integrated photovoltaics (BIPV) segment is expected to grow at the fastest CAGR in the coming years, owing to the increasing energy-positive buildings and sustainable urban infrastructure requirements. Thin-film technologies, especially perovskite and flexible CIGS modules, will hasten the movement into windows, facades, and rooftops due to their lightweight design, aesthetic flexibility, and high performance in low-light scenarios.

The European Commission of Renovation Wave Strategy (2024) exclaims that over 35 million buildings in the EU will have energy-efficient renovations before 2030, which is a big opportunity in terms of BIPV adoption. Additionally, the increasing corporate responsibilities to eco-friendly buildings also spur the need for transparent photovoltaic glass and integrated solar facades, which improve the business case of thin-film BIPV.

End-user Industry Insights

Why is the Energy & Power Sector the Key End-User Driving the thin-film Photovoltaics Market?

The energy & power utilities segment held the largest revenue share in the thin-film photovoltaics market in 2024, accounting for an estimated 55% market share, due to the massive implementation of CdTe and CIGS modules into grid-connected solar farms. The lower levelized cost of electricity (LCOE) and enhanced performance in extreme temperature environments rendered thin-films a powerful option.

Demand was also supported by government-supported clean energy requirements. The U.S. Department of Energy 2023 report emphasized that thin-film solar played an important role in the projects by the Solar Energy Technologies Office that aims to achieve 100% clean electricity by 2035. Furthermore, the policy support, technical appropriateness, and financial stability combination entrenched the energy and power utility segment dominance.

The automotive & transportation segment is expected to grow at the fastest rate in the coming years, owing to the escalating demand to incorporate built-in renewable energy in vehicles and transport systems. Flexible thin-film modules are expected to find favor in vehicle-integrated photovoltaics (VIPV), especially on electric vehicles (EVs), buses, and refrigerated trucks, in which on-board solar power generation minimizes grid reliance and extends range.

The International Energy Agency reported in its Global EV Outlook 2024 that there were more than 45 million units of EVs in the world and that this is a strong platform to integrate solar. Technologies such as perovskite and CIGS are thin-film technologies, which have lightweight and flexible characteristics, which are expected to be dominant in this application space. Moreover, the Japanese automakers have been testing thin-film PV on commercial vehicles and buses in Asia, and China is expected to drive VIPV demand with its EV push program.

Distribution Channel Insights

How is the Direct Sales Channel Strengthening its Hold on the thin-film Photovoltaics Market?

The direct-to-project developers segment dominated the thin-film photovoltaics market in 2024, accounting for 58% market share. Manufacturers reinforced this route by signing long-term contracts with utility-scale developers. This maximized logistics, minimized the cost, and enabled the customization of modules precisely when deployed in large volumes. Furthermore, the thin-film module integration in these big projects took advantage of volume purchasing and special logistics infrastructure, thus further boosting the market.

The online & emerging platforms segment is expected to grow at the fastest rate in the coming years, owing to the digital transformation and the development of decentralized solar procurement. These channels extended the market presence with the ease of access of scaled-down, flexible access to smaller and mid-sized customers, such as rooftop and building-integrated systems.

In 2024, under the PM Surya Ghar program in India, rooftop solar installations topped 1.1 GW in the first half of the year, facilitated by models of digital portal support and subsidy payment. Additionally, the new platforms integrated logistics performance, transparency of supply chain, and elastic financing to make thin-film solutions very accessible, particularly in urban and remote locations.

Regional Insights

Asia Pacific Thin-Film Photovoltaics Market Size and Growth 2025 to 2034

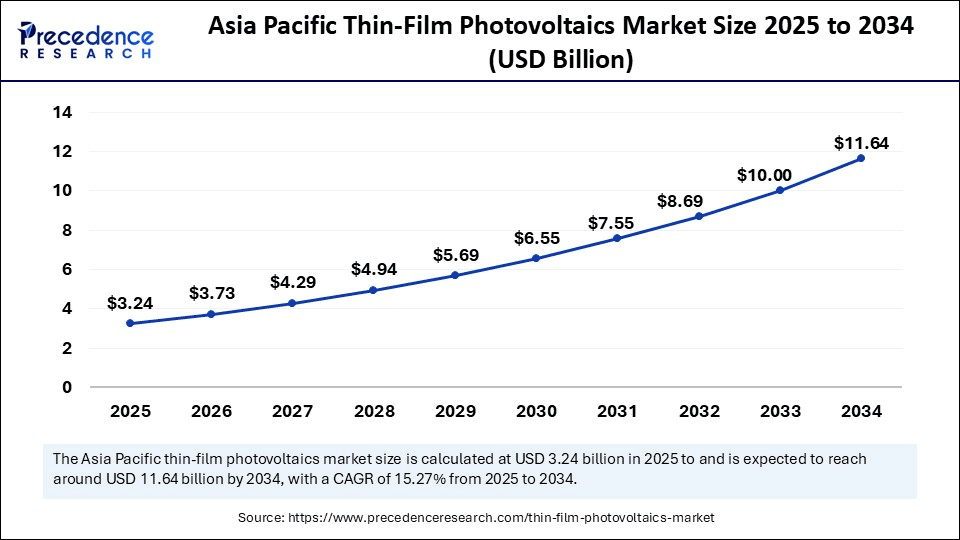

The Asia Pacific thin-film photovoltaics market size is exhibited at USD 3.24 billion in 2025 and is projected to be worth around USD 11.64 billion by 2034, growing at a CAGR of 15.27% from 2025 to 2034.

Why Does Asia–Pacific Continue to Lead Regional Growth in the thin-film Photovoltaics Market?

Asia Pacific led the thin-film photovoltaics market, capturing the largest revenue share in 2024, which held a market share of about 45%, due to spearheading utility-scale miniaturizations in China, India, and Southeast Asia. The region developers were drawn to high-irradiance solar parks, and thin-film modules were performing better than the crystalline in hot, diffuse-light conditions, reinforcing project LCOE.

IRENA affirmed that newer renewable capacity is adding more than 71% in Asia with over 413 GW of new generation, which will continue to drive high procurement through 2025-2026. In 2024, China alone accounted for a large portion of the world's PV installations, which formed the basis of platform-scale demand and supply synergies. Moreover, the Production-Linked Incentive (PLI) programme in India has been expanded in 2024, which focuses on lightweight and efficient solar technologies, further facilitating the market in this region.

- In March 2025, India-based Goldi Solar announced the commissioning of the nation's first AI-powered solar manufacturing line in Surat, Gujarat, with a planned 14 GW production capacity. The plant also employs AI-enabled Automated Optical Inspection (AOI) systems for real-time quality assurance, designed to detect and eliminate microscopic defects. The development is anticipated to strengthen India's position in the global photovoltaic manufacturing landscape.

Why is Europe Leading the Growth of Thin-Film Photovoltaics?

Europe is anticipated to grow at the fastest rate in the market during the forecast period, owing to the strict building energy standards. The updated EU Energy Performance of Buildings Directive 2024 requires all new constructions to be solar-ready and is likely to drive the adoption of flexible, semi-transparent thin-film modules.

Municipal net-zero retrofit and architectural integration initiatives are expected to redirect attention to the growth of BIPV. Local construction alliances and manufacturers who are aligned with local construction codes. This is likely to spur a surge in the integration of thin-film into facades and public buildings on a multi-year basis throughout the EU. Furthermore, the solar companies, such as Oxford PV, Hanergy, and CNBM, to commercializing semi-transparent modules, solidifying a transition in Europe between utility-scale focus and embedded solar in the built environment.

China's Thin-Film Solar Market: Leading the Global PV Revolution

China's market is expanding due to strong government support, favorable policies, and large-scale investments in renewable energy infrastructure. Growing emphasis on lightweight, flexible, and building-integrated PV solutions, combined with rising energy demand and climate goals, drives adoption. Initiatives by the China Photovoltaic Industry Association (CPIA) and international collaborations, such as with the International Solar Alliance (ISA), further accelerate the diversification of solar technologies, positioning China as a key player in the global thin-film PV market.

Why the UK is Embracing Flexible and Innovative Thin-Film PV

The UK market is expanding due to increasing government support for renewable energy, stringent carbon reduction targets, and growing demand for lightweight, flexible, and building-integrated solar solutions. Investments in clean energy infrastructure, coupled with technological advancements in thin-film materials, enable efficient performance in varied climates. Initiatives promoting sustainable construction and solar adoption across commercial and residential sectors further drive market growth, positioning the UK as a key adopter of innovative PV technologies.

North America Powers Ahead with Growing Thin-Film Photovoltaics Adoption

The North American market is growing due to rising investments in clean energy, supportive government policies, and increasing adoption of flexible, lightweight, and building-integrated solar solutions. Technological advancements in CdTe, CIGS, and a-Si materials enhance efficiency, especially in hot or low-light conditions. Expansion of utility-scale projects, growing demand for portable and rooftop solar installations, and strong focus on decarbonization and energy security are further accelerating the adoption of thin-film PV across the region.

The U.S. Solar Surges: Thin-Film Photovoltaics Take Center Stage

The U.S. market is increasing due to strong federal and state incentives promoting renewable energy adoption, including tax credits and clean energy targets. Rising demand for lightweight, flexible, and building-integrated PV solutions supports deployment in residential, commercial, and utility-scale projects. Technological improvements in CdTe, CIGS, and a-Si materials enhance efficiency and performance in diverse climates. Additionally, growing focus on energy security, decarbonization, and sustainable construction drives market expansion across the country.

Value Chain Analysis

- Resource Extraction

Involves sourcing raw materials for new thin-film solar cells and recycling components from decommissioned panels.

Recycling methods:

- Mechanical: crushing and sorting materials.

- Thermal: applying heat to separate compounds.

- Chemical: leaching to recover metals like CdTe and CIGS.

- Raw material deposition: vapor deposition for CIGS and CdTe, hydrocarbons for organic thin films.

Key players: First Solar, Hanergy, CNBM, Oxford PV, and Solar Frontier

- Power Generation :

- Converts sunlight into electricity using ultra-thin layers of semiconductor material on substrates like glass, plastic, or metal.

- Photons from sunlight excite electrons in the semiconductor, generating an electric current.

- Conductive contacts collect the current for external use.

Key players: First Solar, Hanergy, CNBM, Oxford PV

- Distribution Network Management

- Focuses on optimizing the supply chain from manufacturing to installation.

- Thin-film panels are lightweight, flexible, and delicate, necessitating specialized handling, packaging, and storage strategies.

- Efficient logistics ensure safe transport and timely deployment for residential, commercial, and utility-scale projects.

Key players: First Solar, Hanergy, CNBM, Oxford PV, and Solar Frontier

Key Players in Thin-film Photovoltaics Market and their Offerings

- EDC: Provides turnkey thin-film PV solutions and engineering services for utility-scale and BIPV projects.

- Siemens AG: Offers integrated solar energy systems, including thin-film PV components, monitoring, and smart grid solutions.

- Trina Solar: Manufactures flexible and semi-transparent thin-film modules for commercial, residential, and utility-scale applications.

- Solar Exhaust MD:Specializes in thin-film PV ventilation and energy-harvesting solutions for building integration.

- Jinko Solar:Produces high-efficiency thin-film PV panels and turnkey solar systems for diverse climates and applications.

Recent Development

- In June 2025, at the 18th International Solar Photovoltaic Exhibition (SNEC), LONGi officially introduced its newly developed Hybrid Interdigitated Back Contact (HIBC) technology and confirmed the commencement of mass production. This innovation marks a milestone for the solar industry, as the new modules deliver over 700 watts of power output on a standard-size format (2382mm × 1134mm).

- In March 2024, Australia's national science agency, CSIRO, in collaboration with an international research team, achieved a breakthrough by setting a new efficiency record for fully roll-to-roll printed solar cells. These ultra-lightweight and flexible cells are printed onto thin plastic films, enabling deployment in a wide range of environments beyond the reach of traditional silicon modules. (Source: https://solarquarter.com)

- In May 2025, Tokyo-based Komori Corporation (President and CEO: Satoshi Mochida) announced plans to accelerate development of thin-film coating technologies to support mass production of perovskite solar cells, recognized globally as a next-generation renewable energy solution. Perovskites are attracting attention for their high efficiency, lightweight structure, flexibility, and low production costs, yet challenges remain in achieving large-area, ultra-thin, and uniform film formation at high speed and precision.(Source: https://www.komori.com)

Segments Covered in the Report

By Technology

- Cadmium Telluride (CdTe)

- Copper Indium Gallium Selenide (CIGS)

- Amorphous Silicon (a-Si)

- Perovskite Thin-Film (emerging)

By Module Type

- Rigid Thin-Film Modules

- Flexible Thin-Film Modules

By Application

- Utility-Scale Power Plants

- Building-Integrated Photovoltaics (BIPV: facades, rooftops, windows)

- Consumer & Portable Electronics (chargers, wearables)

- Automotive & Transportation (EV roofs, integrated solar)

- Off-Grid & Remote Power (military, telecom towers, rural electrification)

By End-User Industry

- Energy & Power Utilities

- Construction & Real Estate (green buildings, smart cities)

- Consumer Electronics

- Automotive & Transportation

- Defense & Aerospace

- Industrial & Off-Grid Power Users

By Distribution Channel

- Direct Supply to Project Developers & EPCs

- Distributors & Installers

- Online & Emerging Energy Platforms

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East andAfrica

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting