What is Tocotrienol Market Size?

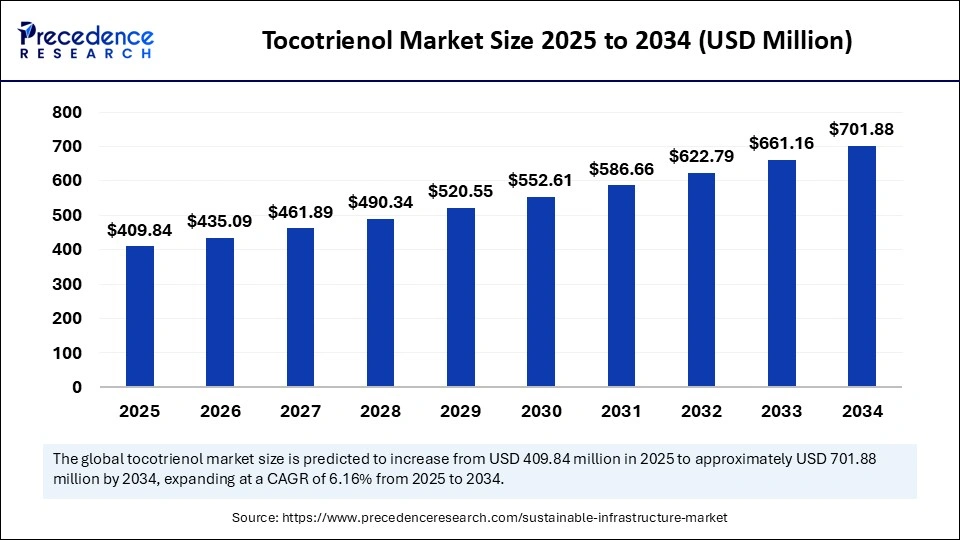

The global tocotrienol market size is calculated at USD 409.84 million in 2025 and is predicted to increase from USD 435.09 million in 2026 to approximately USD 701.88 million by 2034, expanding at a CAGR of 6.16% from 2025 to 2034. The market is experiencing steady growth, driven by rising health awareness, nutraceutical adoption, and expanding applications.

Market Highlights

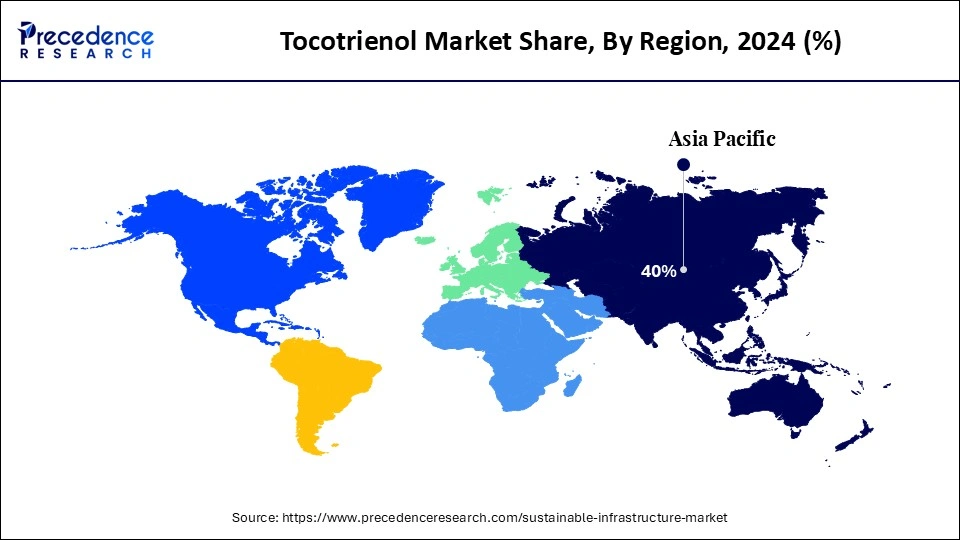

- Asia Pacific dominated the tocotrienol market with the largest market share of 40% in 2024.

- North America is estimated to expand the fastest CAGR between 2025 and 2034.

- By source, the palm oil segment held the biggest market share of 45% in 2024.

- By source, the annatto segment is expected to expand at a notable CAGR over the projected period.

- By product type, the gamma tocotrienol segment captured the highest market share of 35% in 2024.

- By product type, the delta tocotrienol segment is anticipated to have the fastest growth during the forecast period.

- By form, the capsules and softgels segment contributed the maximum market share of 40% in 2024.

- By form, the powder/granules segment is expected to expand at a notable CAGR over the projected period.

- By application, the dietary supplements segment held the considerable market share of 50% in 2024.

- By application, the cosmetics and personal care segment is expected to expand at a notable CAGR over the projected period.

- By distribution channel, the offline retail segment captured the largest market share of 55% in 2024.

- By distribution channel, the online retail segment is expected to grow at a notable CAGR over the projected period.

- By end-use industry, the healthcare and pharmaceuticals segment generated the major market share of 45% in 2024.

- By end-use industry, the food and beverage segment is expected to expand at a notable CAGR over the projected period.

Tocotrienol on the Rise: Fueling Growth in Health, Nutrition & Skincare

The global tocotrienol market refers to the production, distribution, and consumption of tocotrienols, a subgroup of Vitamin E compounds with strong antioxidant, anti-inflammatory, and neuroprotective properties. Tocotrienols are primarily derived from natural sources such as palm oil, rice bran oil, and annatto. They are widely used in dietary supplements, pharmaceuticals, functional foods and beverages, cosmetics, and animal nutrition. Market growth is driven by rising consumer awareness of preventive healthcare, increasing demand for natural antioxidants, clinical studies highlighting tocotrienols' role in cardiovascular health, cancer prevention, and cognitive function, as well as growing adoption in the nutraceutical and skincare industries.

Tocotrienol Market Growth Factors

- Increased demand for natural antioxidants: Consumer preferences are increasingly switching to natural antioxidants, such as tocotrienols, because they likely have a greater ability to scavenge free radicals. This shift is supporting demand across dietary supplements, functional foods, and nutraceuticals applications.

- Growing applications in chronic disease prevention: The body of evidence around tocotrienols has clearly established a benefit in the cardiovascular health space and as a neuroprotective and anti-inflammatory; this is leading to greater demand in preventive health products for chronic diseases like heart disease, diabetes, and neurodegenerative diseases.

- Growth in the nutraceutical and functional food industry: The nutraceuticals industry and functional food sector are booming; thus, there are tremendous opportunities because manufacturers are looking to include tocotrienols into their formulations to meet consumer demand for health-focused and premium nutrition products.

- Growing research and clinical evidence: Continued research and clinical studies of tocotrienols, particularly in cancer therapy, lipids, and cognitive health, are reinforcing scientific evidence, giving the consumer confidence, and are stimulating market growth and development around the world.

Market Outlook

- Industry Growth Offerings- The market is expanding with growing clinical evidence, rising demand for potent antioxidants, advanced lipid-based delivery systems, and increased adoption in nutraceuticals, functional foods, and cosmetics, supported by manufacturers investing in purity, bioavailability, and targeted health-positioned products.

- Global Expansion-The global market is widening as manufacturers enter new geographies, supported by rising preventive-health awareness, clean-label trends, expanding clinical research, and increasing adoption across North America, Europe, and Asia, with strong demand from nutraceutical, cosmetic, and functional food sectors.

- Startup ecosystem-The tocotrienol startup ecosystem is expanding through innovation-focused companies developing advanced delivery systems, sustainable palm-free sourcing, personalized nutrition products, and clinically supported formulations, supported by incubators, contract manufacturers, and rising investor interest in premium nutraceutical ingredients.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 409.84 Million |

| Market Size in 2026 | USD 435.09 Million |

| Market Size by 2034 | USD 701.88 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.16% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Product Type, Form, Application, Distribution Channel, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased Demand from the Growing Focus on Preventive Healthcare

Consumers are increasingly choosing antioxidants and plant-based products as they manage lifestyle diseases such as cardiovascular diseases, diabetes, and general skin aging. Tocotrienols, which provide strong anti-inflammatory properties and neuroprotective benefits, have continued momentum in new dietary supplements and functional foods. Recently published research in Frontiers in Nutrition (2024) demonstrated the ability of tocotrienols to reduce oxidative stress and improve lipid metabolism, further increasing the desirability of tocotrienols. Further growth is driven by rising demand in cosmeceuticals and nutricosmetics, because brands are activating tocotrienols for skin rejuvenation, skin anti-aging, etc., reflecting the global interest in holistic health, beauty, and wellness.

Restraint

Are High Production Costs Restricting the Tocotrienol Market?

A major constraint for the tocotrienol market is high production costs and raw material constraints. Tocotrienols are predominantly sourced from palm oil, rice bran, and annatto seeds, with processing requiring significant cost and complicated technology, far exceeding conventional tocopherols. Even though tocotrienols have many health benefits, such as antioxidant, anti-inflammatory, and heart health potential, these costs severely limit mainstream uptake, especially in dietary supplementation or functional food.

Additionally, the tocotrienol market is extremely vulnerable to agricultural disturbances. In 2023, part of Southeast Asia had inconsistent weather that diminished palm oil production by double digits, limiting supply. This type of price uncertainty and dependence on constraints in limited geographical areas keeps tocotrienols from being able to scale into mass market situations, keeping it in premium nutrition and niche healthcare.

Opportunity

Is Nutricosmetics the Disruptive Opportunity for Tocotrienols?

A widely shared opportunity for tocotrienols is increasing use in nutricosmetics, where nutrition and beauty are coming together. The antioxidant and anti-inflammatory properties of tocotrienols lend themselves nicely to being included in supplements that focus on supporting skin elasticity, hair strength, and anti-aging benefits. Recently, a couple of beauty and wellness brands noted the addition of tocotrienol-enriched capsules and functional beverages as part of their holistic skincare formulations, as well as including tocotrienols within their ranges of topical ointments and oils.

With consumers shifting toward natural substitutes, as choosers of consumption, being offered nutricosmetics derived from plants, such as tocotrienols from palm, rice, and annatto, is also gaining traction. This crossover into the beauty-from-within space is not only expanding application areas, but does presents a longer-lasting opportunity for tocotrienols to become an endemic resource for global wellness and household beauty-related solutions.

Segment Insights

Source Insight

Which Source Held the Largest Share of the Tocotrienol Market in 2024?

The palm oil segment is dominating the tocotrienol market, with Malaysia and Indonesia as the largest producers. Cost-effectiveness, abundance, and established extraction technologies have kept palm oil as the most utilized raw material. Palm oil maintains a reliable supply chain and has maximum largest-scale oil palm grown to produce tocotrienols, with palm oil remaining on top as the largest producer of tocotrienols globally.

On the other hand, the annatto segment is the fastest-growing source of tocotrienol because they are non-GMO, palm-free, and sustainably sourced. Consumers interested in cleaner, plant-based alternatives are driving demand for non-GMO alternatives. The rise in uptake across nutraceuticals and functional foods, and increasing demand in North America and Europe for non-palm-sourced tocotrienols, is driving the strong growth in this category.

Product Type Insights

Why does Gamma Tocotrienol Dominate the Tocotrienol Market?

The gamma tocotrienol segment dominated the tocotrienol market in 2024, due to its wide therapeutic applications. It is extensively researched for cardiovascular health, cholesterol management, and neuroprotective effects, positioning it as the preferred option in dietary supplements. The well-rounded antioxidant profile and efficacy in managing chronic diseases have maintained a strong demand for this product type from medical practitioners and nutraceutical companies.

The delta tocotrienol segment is the fastest-growing sub-segment amid increasing research of its anti-cancer, anti-inflammatory, and cholesterol-lowering properties. It is being introduced in more advanced nutraceuticals due to its higher potency compared with other isomers. A rise in clinical evidence and growing consumer interest in targeted, natural therapies will encourage more widespread adoption, especially within cancer and functional health dietary supplement products.

Form Insights

Why Capsules and Softgels Dominated the Tocotrienol Market in 2024?

The capsules and softgels segment is the dominant form in the tocotrienol market due to convenience, accuracy in dosage delivery, and consumer familiarity. Specifically, tocotrienols are available via retail pharmacy, health food stores, and clinical prescriptions. Encapsulated products continuously gain favor in the health and wellness industry because they are stable with a long shelf life and improved bioavailability. Encapsulated tocotrienols are the most trusted source in health supplements and health care.

The powder/granules segment is the fastest-growing source segment, particularly with its use in food and beverage fortifications due to its versatility. Powders provide an option to add tocotrienol into functional food forms, protein powders, and nutraceutical blends. As consumer preferences shift towards personalized lifestyle-focused nutrition, powdered tocotrienols increasingly offer manufacturers new opportunities to be included in smoothies, bars, and meal replacements, moving beyond classical supplement channels.

Application Insights

Which is the Most Dominant Application in the Tocotrienol Market?

The dietary supplements segment remained the dominant application in the tocotrienol market in 2024. Its importance comes from the need to keep stock levels right, reduce waste, and prevent supply shortages in hospitals and clinics. Good inventory systems help healthcare providers ensure that essential medical supplies and pharmaceuticals are available on time. This, in turn, improves patient care and operational efficiency.

The cosmetics and personal care segment is expected to grow the fastest during the forecast period. The rising complexities of healthcare regulations and increased focus on patient safety and supply authenticity have made compliance a key concern. Organizations are using better tools to handle regulatory paperwork, keep an eye on supplier risks, and ensure they meet changing national and international healthcare standards.

Distribution Channel Insights

Why Offline Retail Dominates the Tocotrienol Market?

The offline retail segment was the leading segment in the healthcare supply chain management market in 2024. Consumers have confidence in the in-person advice provided by pharmacists when it comes to supplements that are related to heart health and chronic medical concerns. Even as a channel that continues to grow rapidly, online retail is in a distant second place compared to offline sales.

The online retail segment is the fastest-growing channel for tocotrienol, where the uptake can be attributed to the growth of e-commerce retailers and targeted nutraceutical outlets. The transition into online purchases is buoyed by an increase in digital channel customer loyalty based on health and wellness conduct-based campaigns, marketing to promote and educate about the therapeutic benefits of tocotrienol, and subscription-based delivery. Increasingly, we see opportunities for consumers to further increase their product loyalty in direct-to-consumer channels where tocotrienol purchase decisions are being made.

End-Use Industry Insights

Healthcare and Pharmaceutical Industries Dominante

The healthcare and pharmaceuticals segment continues to be the primary end-use industry for tocotrienols, since it has significant applications in the areas of cardiovascular health, neuroprotection, and chronic disease. Tocotrienols are recognized by leading pharmaceutical companies as tocotrienols are incorporated in formulations that utilize their antioxidant and anti-inflammatory effects for use as both prevention and treatment.

The fastest-growing end-use segment is the food and beverage segment; tocotrienols are being utilized in fortified food and functional drinks, as tocotrienols are used in cereals, energy bars, milk alternatives, and nutritional drinks. This application supports consumer trends towards healthier, natural products, enhanced with tocotrienols; while at the same time, the trend toward preventive nutrition and lifestyle-focused diets is growing, allowing tocotrienols to find their place in mainstream food and wellness products.

Regional Insights

Asia Pacific Tocotrienol Market Size and Growth 2025 to 2034

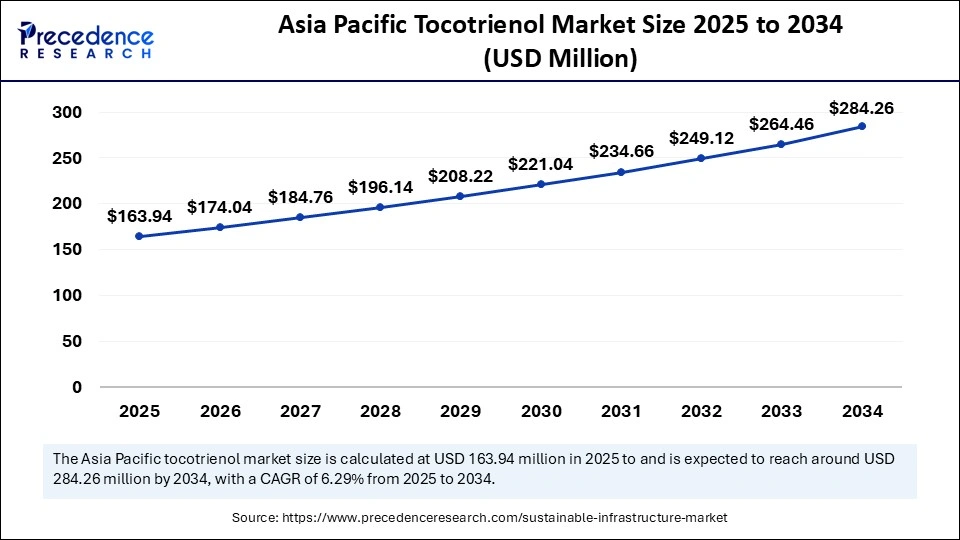

The Asia Pacific tocotrienol market size is exhibited at USD 163.94 million in 2025 and is projected to be worth around USD 284.26 million by 2034, growing at a CAGR of 6.29% from 2025 to 2034.

Asia Pacific: The Powerhouse of Tocotrienol Production and Demand

The dominance of the Asia Pacific region encompasses a critical supply side in upstream production and the largest demand side (consuming) markets, major production of palm oil, a maturing nutraceutical manufacturing base, and health awareness across large populations. Strategic advantages are the vertically integrated supply chains in Southeast Asia, ingredient processors already established, and R&D that is developing connections to tocotrienol efficacy regarding cardiovascular and metabolic health. Commercial avenues will be focused on ingredient-to-formulation collaborations, private-label supplements, and cosmetics active ingredients.

Why Does Malaysia Hold a Strategic Advantage in the Tocotrienol Market?

Malaysia would post significant advantages, having specialized extraction and concentration facilities, along with strong industry knowledge and experience with palm-derived tocotrienols, allowing for predictable supply and GMP-grade production for their global nutraceutical and cosmetic customers. Malaysia's institutions and proximity to palm raw materials provide particularly advantageous factors for reduced lead times and logistics costs. Also, scrutiny around sustainability and traceability (RSPO, buyer's request) continues to add pressure and demands capital for palm oil exporters (capex), though operational and compliance concerns, transparency, and reporting do have to be complied with.

How Regulatory Clarity and Premium Trends Are Boosting North America's Tocotrienol Market

North America demonstrates rapid demand growth as a result of aging demographics, high per-capita supplement consumption, and strong clinical interest in tocotrienol benefits. The market acceleration in North America is particularly true for formulators that integrate tocotrienol-rich fractions into heart health, cognitive support, and premium beauty-from-within SKUs. Growing regulatory clarity with dietary supplements regarding labeling requirements and health claims is lowering barriers to entry/substitution; however, third-party testing and clean label sourcing are becoming competitive differentiators.

How is Clinical Evidence Boosting Tocotrienol Acceptance in the U.S. Market

The breadth of clinical research activity in the U.S., high consumer awareness of evidence-backed nutraceuticals, and significant direct-to-consumer channels are amplifying the rate at which new ingredients are being adopted. Recent randomized trials and systematic reviews authored by U.S. and international groups are being used by marketers to support product claims, while there are contract manufacturers and ingredient distributors that can assemble supplies for national retail chains and online brands. Companies must build their business around solid quality documentation (COA, stability, safety), developing targeted clinician/influencer education, and informing payers/ insurance on the therapeutic adjacencies when targeting premium share.

Why is the Europe Tocotrienol Market Experiencing Strong Growth?

The Europe market is growing due to increasing consumer focus on natural, science-backed health ingredients and rising demand for antioxidant-rich supplements. Greater awareness of tocotrienols' benefits for cardiovascular health, skin repair, and cognitive support is boosting adoption. The region's strong nutraceutical, functional food, and cosmetic industries are integrating tocotrienols into premium formulations. Additionally, expanding research collaborations, clean-label trends, and higher spending on preventive healthcare are further accelerating market growth across Europe.

What factors Are Driving the Rapid Growth of the UK Tocotrienol Market?

The UK market is growing due to rising consumer interest in natural, plant-based antioxidants and increased adoption of premium dietary supplements. Growing awareness of tocotrienols' benefits for heart health, immune support, and skin rejuvenation is boosting demand. The UK's strong nutraceutical and functional food sectors are incorporating tocotrienols into advanced formulations. Additionally, expanding preventive healthcare trends, clean-label preferences, and increased R&D activity in vitamin E variants are further driving market expansion in the country.

Value Chain Analysis

- R&D

Research on tocotrienols is increasing as scientists explore their stronger health benefits compared to traditional alpha-tocopherol.

Although vitamin E was identified in the 1920s, tocotrienols have gained major research interest only in recent decades due to their potent antioxidant and therapeutic properties.

Current studies focus on cardiovascular protection, neurohealth, metabolic support, and anti-inflammatory effects.

Key players: American River Nutrition, Davos Life Science, ExcelVite, Carotech, and BASF. - Clinical Trials and Regulatory Approvals

Clinical studies completed so far show that tocotrienols are safe for use as dietary supplements, though they are not approved as pharmaceutical drugs for treating any specific illness.

Early research highlights potential benefits in cardiovascular support, cancer prevention, and brain health, but more extensive, long-duration clinical trials are needed to validate these effects.

Several tocotrienol ingredients have received FDA GRAS recognition, allowing their inclusion in foods, beverages, and supplements.

Key players: American River Nutrition, ExcelVite, Davos Life Science, Carotech, and BASF. - Formulation and Final Dosage Preparation

Tocotrienol formulations are developed to address challenges like low water solubility and limited oral absorption.

Advanced lipid-based delivery systems, including SEDDS and Nanostructured Lipid Carriers (NLCs), are widely used to enhance uptake in the body.

These delivery technologies are typically converted into softgel capsules or liquid oral formats for better stability and bioavailability.

Such systems help ensure improved therapeutic performance and consistent dosing.

Key players: American River Nutrition, ExcelVite, Davos Life Science

Key Players in Tocotrienol Market and their Offerings

- ExcelVite: Offers palm-based tocotrienols and tocopherols, including EVNol and EVNol SupraBio, providing high-bioavailability vitamin E solutions for nutraceutical, cosmetic, and functional food applications.

- Parchem: Parchem supplies specialty chemicals, vitamins, and nutraceutical ingredients like tocotrienols, offering global sourcing, distribution, and regulatory support for pharmaceutical, food, and nutrition manufacturers.

- Eisai Co. Ltd: It develops pharmaceutical-grade vitamin E derivatives and health supplements focused on neuroprotection, liver support, and cardiovascular wellness through research-driven, stable, and bioavailable formulations.

- SOP Nutraceuticals: Provides natural tocotrienol-rich extracts and functional supplements designed for antioxidant, anti-inflammatory, and cellular protection benefits across wellness, beauty, and sports nutrition markets.

- Davis Life Sciences: Davis Life Sciences delivers tocotrienol-based nutraceutical solutions, advanced lipid delivery systems, and antioxidant formulations aimed at cardiovascular health, metabolic support, and premium dietary supplement applications.

Recent Developments

- In July 2023, KLK OLEO, a leading organization in phytonutrients and oleo chemicals, launched a new line of sustainable products. Among them is the DavosLife E3 DVP 30-WD, a natural tocotrienol water dispersible powder. Made with tocotrienol, this product will be available in hard capsules, functional foods, and beverages, serving for anti-inflammation and autoxidation benefits.

Segments Covered in the Report

By Source

- Palm Oil

- Rice Bran Oil

- Annatto

- Others (cereal grains, barley, wheat germ)

By Product Type

- Alpha Tocotrienol

- Beta Tocotrienol

- Gamma Tocotrienol

- Delta Tocotrienol

By Form

- Oil/Extract

- Powder/Granules

- Capsules and Softgels

- Others

By Application

- Dietary Supplements

- Functional Foods and Beverages

- Pharmaceuticals

- Cosmetics and Personal Care

- Animal Nutrition

- Others

By Distribution Channel

- Online Retail (E-commerce, D2C)

- Offline Retail (Pharmacies, Health Stores, Supermarkets)

- Direct Sales (B2B, Institutional Supply)

By End-Use Industry

- Healthcare and Pharmaceuticals

- Food and Beverage

- Cosmetics and Personal Care

- Animal Feed

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting