What is the Universal Milling Machine Market Size?

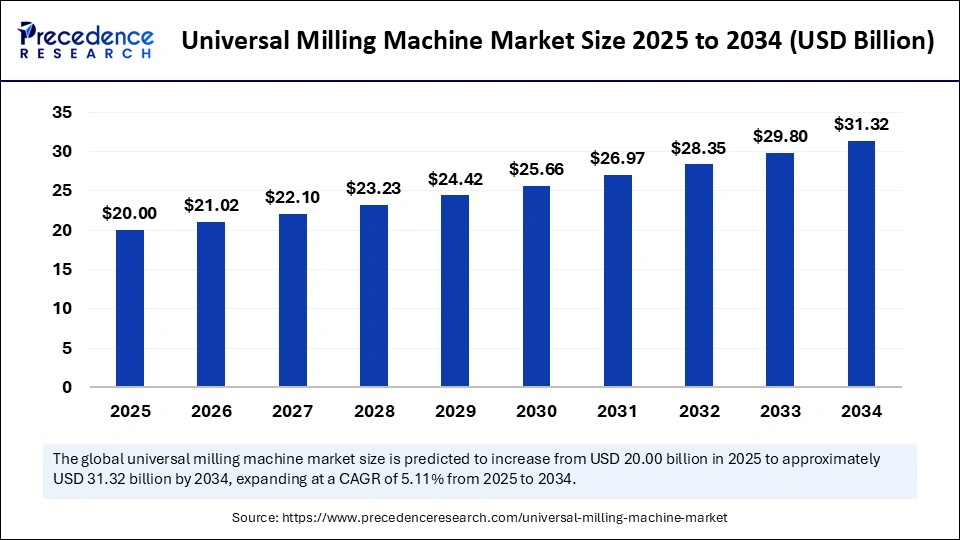

The global universal milling machine market size is calculated at USD 20.00 billion in 2025 and is predicted to increase from USD 21.02 billion in 2026 to approximately USD 31.32 billion by 2034, expanding at a CAGR of 5.11% from 2025 to 2034. The market is driven by the rising demand for precision machining, automation integration, and advanced manufacturing across automotive, aerospace, and industrial sectors.

Market Highlights

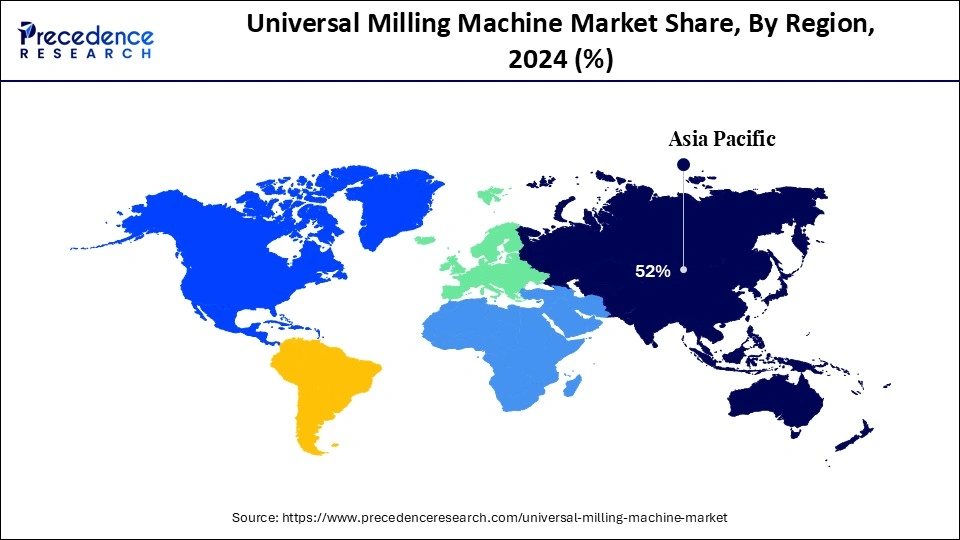

- By region, Asia Pacific dominated the universal milling machine market with the largest share of 52% in 2024.

- By region, North America is expected to witness the fastest growth during the forecasted years.

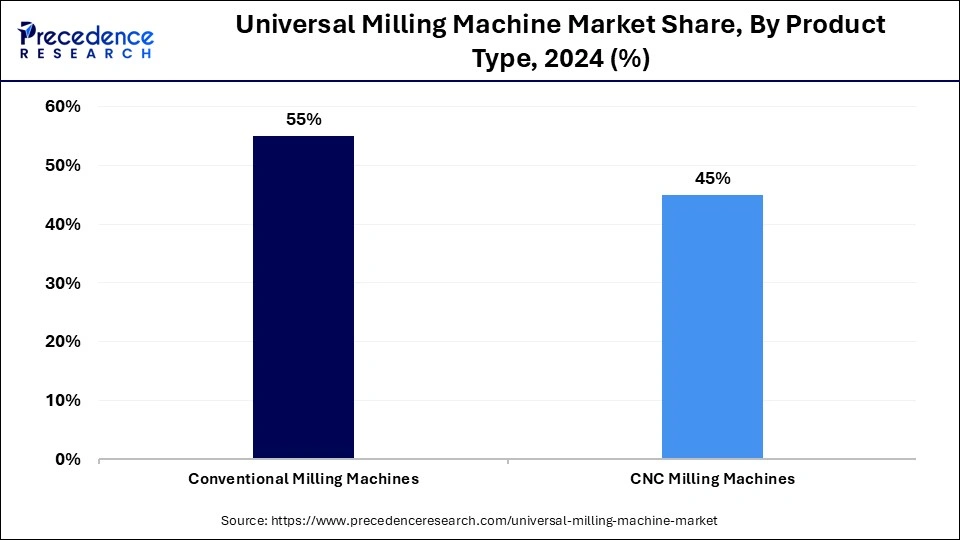

- By product type, the conventional milling machines segment captured a 55% revenue share in 2024.

- By product type, the CNC milling machines segment is expected to grow at the fastest CAGR over the forecast period.

- By coating/material type, the cast iron body segment led the market while holding a 50% share in 2024.

- By coating/material type, the steel body segment is expected to grow at a significant CAGR in the upcoming period.

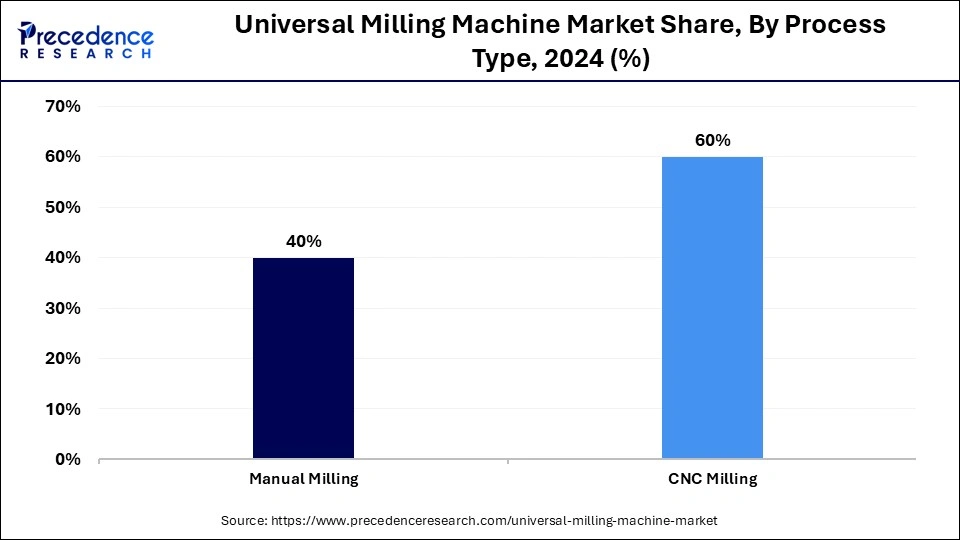

- By process type, the CNC milling segment held a 60% revenue share in 2024.

- By process type, the manual milling segment is expected to expand at the fastest rate over the forecast period.

- By application, the automotive components segment led the market while holding a 30% share in 2024.

- By application, the aerospace components segment is expected to show considerable growth in the market over the forecast period.

- By end-user industry, the automotive segment held a 32% share in the market in 2024.

- By end-user industry, the aerospace & defense segment is expected to grow at the highest CAGR over the forecast period.

What is a Universal Milling Machine?

The universal milling machine market comprises a broad range of precision machine tools used for both vertical and horizontal milling processes, making it highly applicable in diverse industrial activities. Universal milling machines have adjustable swivel tables, multiple axes, and replaceable options that perform complex machining operations (e.g., drilling, cutting, shaping, and slotting) on one machining system. These machines are used in industries such as aerospace, automotive, die and mold, energy, and environmental engineering, where flexibility and accuracy are major concerns.

The increasing demand for computerized and automated manufacturing processes has further increased the use of universal milling machines as essential equipment in both prototyping and high-volume production. The main factors influencing market growth are the increasing use of modern manufacturing technologies, such as CNC (Computer Numerical Control) systems, and the integration of Industry 4.0. Furthermore, the growth of the automotive and aerospace industries, along with the increasing popularity of energy-efficient production systems, drives the growth of the market.

Key Technological Shifts in the Universal Milling Machine Market Driven by AI

Artificial intelligence is revolutionizing the milling machine market by enhancing precision, efficiency, and operational predictability, making milling processes more universal and adaptable. AI-powered control systems optimize tool paths, reduce material waste, and maintain consistent machine quality through real-time data analysis. Predictive maintenance, enabled by AI, minimizes unplanned downtime and extends equipment lifespan by identifying potential malfunctions before failures occur. As part of the Industry 4.0 framework, AI also enables autonomous operations and smarter, interconnected remote sensors. With its growing adoption, AI is reshaping production strategies and setting new standards for productivity and flexibility in universal milling processes.

Universal Milling Machine Market Outlook

The universal milling machine market is experiencing steady growth, driven by automation, precision manufacturing, and the modernization of production workshops. The integration of CNC and digital technologies is enhancing productivity, efficiency, and flexibility across key industries such as aerospace, automotive, and general industrial manufacturing.

Industrialization in the Asia-Pacific region, along with increased manufacturing investments in Europe and North America, is fueling global market expansion. The globalization of production, rising export demand, and rapid technological advancements are accelerating growth in both developed and emerging economies.

Leading companies such as DMG Mori, Makino, Haas Automation, and Hurco are heavily investing in smart milling systems, automation integration, and sustainable manufacturing solutions. Additionally, government-backed high-tech manufacturing initiatives are encouraging venture capital and private equity investment in the sector.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 20.00 Billion |

| Market Size in 2026 | USD 21.02 Billion |

| Market Size by 2034 | USD 31.32 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.11% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Coating/Material Type, Process Type, Application, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Universal Milling Machine MarketSegment Insights

Product Type Insights

The conventional milling machines segment dominated the universal milling machine market with a 55% share in 2024. This is mainly due to their lower initial capital, mechanical simplicity, and ease of maintenance compared to CNC systems. Most operators in emerging economies tend to choose the traditional models of general-purpose machining, toolroom tasks, and low-volume production. Also, retrofitting conventional machines with solutions like digital readouts (DROs) improves the precision and functionality of these machines, thus contributing to their continued popularity. Conventional machines also require less technical training and offer lower operating costs, making them especially appealing in regions where automation adoption remains limited. As a result, traditional milling machines continue to hold a strong presence in conventional manufacturing environments and vocational education programs worldwide.

The CNC milling machines segment is expected to expand rapidly in the coming years, driven by increasing adoption of automation and high-precision manufacturing technologies. CNC machines, including 3-axis, 4-axis, and 5-axis systems, enable the machining of complex geometries with tight tolerances at high speeds. Industries such as aerospace, automotive, medical equipment, and energy rely heavily on CNC systems to ensure quality and repeatability in both prototyping and mass production. Furthermore, the integration of CAD/CAM software, IoT connectivity, and AI-powered predictive maintenance is significantly improving efficiency and productivity. As manufacturing shifts toward smart factories and digitalized processes, CNC milling machines are becoming essential for optimizing cycle times and minimizing human intervention in production workflows.

Coating/Material Type Insights

The cast iron body segment led the market while holding a 50% share in 2024, owing to its superior vibration-damping, rigidity, and thermal stability. Materials such as grey and ductile cast iron are commonly used in machine tool structures because they minimize chatter and enhance machining precision, even under high-speed or heavy-load conditions.

The inherent mass and damping characteristics of cast iron also reduce tool wear and improve surface finish, making it ideal for precision milling applications. Grey cast iron is known for being highly machinable, cost-effective, and offering good durability, while ductile iron provides greater tensile strength and toughness, further extending machine life. Additionally, cast iron offers an excellent cost-to-performance ratio, particularly for conventional and semi-automated milling machines used in small to mid-sized manufacturing operations. Manufacturers continue to prefer cast iron due to its reliability, ability to form complex geometries, and lower production cost compared to steel.

The steel body segment is expected to grow at a significant CAGR during the forecast period. This is mainly due to the increasing demand for strong yet lightweight materials with high elasticity and safety in modern machine design, driving the adoption of steel, particularly carbon and alloy steel. Steel machine frames offer superior load-bearing capacity, fatigue resistance, and structural stability, making them suitable for heavy-duty and high-precision CNC milling applications.

Alloy steels, in particular, provide enhanced hardness and wear resistance, which contributes to longer machine lifespan in demanding industrial environments. Moreover, ongoing R&D in heat treatment and material coatings is improving the dimensional stability and vibration resistance of steel components. As a result, steel-bodied universal milling machines are becoming an increasingly attractive option for high-performance, automated manufacturing settings.

Process Type Insights

The manual milling segment dominated the universal milling machine market, holding around 40% share in 2024. The manual milling machines, particularly knee-type and bed-type, are heavily used for their ease of operation, low initial expenditure, and ability to perform a variety of machining operations. They are ideal for short-run productions, prototypes, and repair work where the operator's skills and flexibility are very important.

Manual milling is still common in the emerging markets because of the large number of skilled machinists and the high cost of CNC automation. Moreover, industries working on custom fabrics and maintenance use manual construction to offer simplicity in control and rapid tool replacement. Manual milling machines still play a significant role in the current trend of automation because affordability, versatility, and mechanical control are more important than a digital process of precision.

The CNC milling segment is poised for the fastest growth in the market. The vertical and horizontal CNC milling machines are the most precise, swiftest, and repeatable machines to produce complex geometries of parts. They are computer-controlled to limit human error, improve productivity, and enable continuous, unmanned machining. CNC technology is becoming increasingly important in industries such as aerospace, automotive, and medical equipment, enabling them to meet high-quality and dimensional requirements. The design process is continuous from CAD to production, and IoT / AI-driven monitoring technology offers predictive maintenance and optimization. They require a greater upfront cost but offer efficient, scalable, long-term returns on investment and automation, which is why they are widely accepted.

Application Insights

The automotive components segment led the market with a 30% share in 2024, as milling machines are extensively used in producing automotive components for engine and transmission systems. Universal milling machines also play a vital role in manufacturing crucial automotive parts like the cylinder head, gear housing, crankcase, and drive shaft, where surface finish and dimensional accuracy are essential. Both CNC and manual universal milling machines have gained popularity with OEM and aftermarket production lines because they offer flexibility, repeatability, and the ability to address complex geometries. Also, the automation and digitalization of the automotive production process have initiated investments in CNC milling machines to facilitate efficiency, reduce cycle time, and increase production volumes.

The aerospace components segment is expected to grow at a significant CAGR over the forecast period. With the growing demands for sophistication and precision in structural components and aerospace parts, the use of advanced CNC universal milling machines has been encouraged. With these machines, it is possible to perform multi-axis machining on the complex geometry of turbine blades, airframe structures, and landing gear components. The high accuracy, repeatability, and adaptability of materials (particularly titanium, Inconel, and composite materials) are paramount to aerospace manufacturers. Therefore, universal milling machines have become essential in prototyping and production. Moreover, the increasing global demand for aircraft, driven by the growth of commercial aircraft and the modernization of defense forces, has led to increased investments in high-performance milling systems.

End Use Industry Insights

The automotive segment held a 32% share of the universal milling machine market in 2024, driven by the growing demand for highly engineered components in both original equipment manufacturing (OEM) and the aftermarket. Universal milling machines are essential for machining engine blocks, transmission systems, brake components, and chassis parts, as they require high dimensional accuracy and repeatability.

The industry's focus on improving performance, fuel efficiency, and lightweight design has further accelerated the adoption of advanced milling technologies, including multi-axis CNC machines. These technologies enable mass customization, rapid prototyping, and cost-effective production of complex components made from metals and composite materials. In addition to OEM applications, universal milling machines are widely used in the automotive aftermarket for repair, modification, and small-scale production, making them a critical asset across the entire automotive value chain.

The aerospace & defense segment is expected to grow at the fastest rate in the upcoming period due to increased investment in high-end manufacturing technologies. High-precision aircraft parts and defense parts (turbine housing, fuselage components, and weapon system components) are typically made in universal milling machines. The industry requires high-quality standards and high-performance materials like titanium, Inconel, and composites, which demand precision and surface integrity. These qualities can only be achieved through the application of multi-axis CNC milling systems. Continuous fleet modernization, defense modernization, as well as commercial aviation development are also stimulating the demand. Aerospace and defense manufacturing is changing its machining processes due to smart manufacturing technologies, including the deployment of AI-controlled systems, the use of digital twins, and automated tool calibration.

Universal Milling Machine Market Region Insights

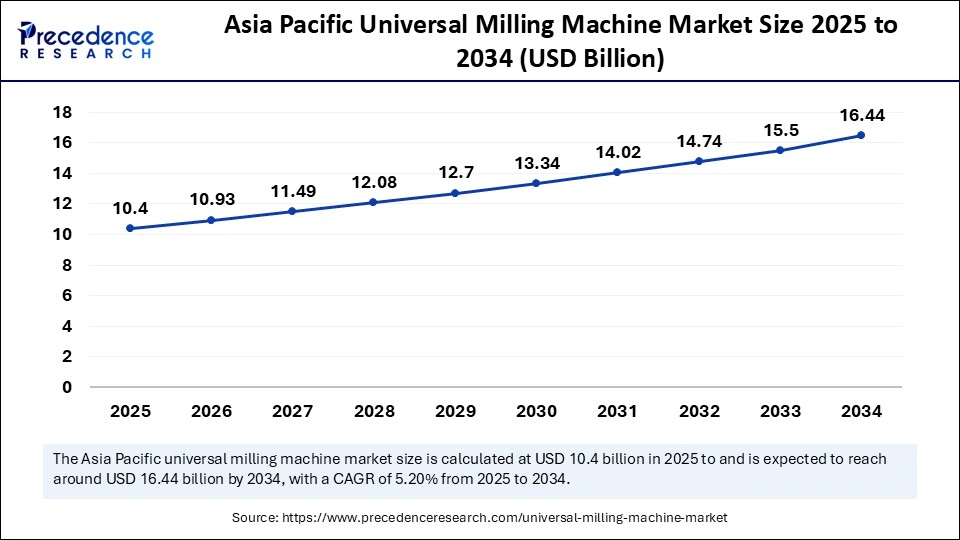

The Asia Pacific universal milling machine market size is evaluated at USD 10.40 billion in 2025 and is projected to be worth around USD 16.44 billion by 2034, growing at a CAGR of 5.20% from 2025 to 2034.

Why Did Asia Pacific Lead the Global Universal Milling Machine Market in 2024?

Asia Pacific led the global market with the highest market share of 52% in 2024, due to rapid industrialization, growth in manufacturing infrastructure, and government support for automation and precision engineering. Countries such as China, Japan, South Korea, and India are significant centers of automotive, aerospace, and general engineering, which continuously demand both conventional and CNC milling machines. The region's affordability as a place of production and the increased use of smart manufacturing technologies facilitated the modernization of machining facilities. Also, with major machine tool makers and growing foreign direct investments (FDI) in the industrial sectors, the region's growth is further reinforced. High equipment utilization is also due to the upsurge in the manufacturing of electric vehicles, infrastructure development, and the exporting of components.

China Universal Milling Machine Market Trends

China is a major contributor to the Asia Pacific universal milling machine market due to its huge manufacturing base and immense policy acceleration toward intelligent manufacturing as a part of the Made in China 2025 program. The machine tool industry in the country enjoys government incentives that favor automation, smart machining, and local innovation. The increased pace of the automotive, aerospace, and EV industries stimulates the constant need for multi-axis and hybrid milling machines. In addition, the Chinese workshops are being more productive with the introduction of AI, IoT, and predictive maintenance systems that cut down on downtime.

North America is expected to grow at the highest CAGR throughout the forecast period, due to increasing investments in high-technology manufacturing, automation, and improved precision engineering. The high-precision and multi-axis milling machines are in demand due to the region's robust aerospace, defense, automotive, and energy sectors. The innovation toward Industry 4.0 and smart factories has increased the use of CNC milling systems that incorporate the IoT, AI, and predictive maintenance functionality. Also, the modernization of equipment is being promoted by government incentives to encourage sophisticated manufacturing technologies and the restoration of manufacturing plants. The manufacturers of North America are starting to pay more attention to improving the productivity, quality, and efficiency of milling machines, resulting in massive increases in demand for these versatile, computer-enhanced machines.

U.S. Universal Milling Machine Market Trends

The U.S. is the largest exporter of the universal milling machine to the North American market. To meet the increasing demand for complex, high-precision parts and the need for strict regulation, producers are investing in upgrading their 3-axis to 5-axis CNC machines. The growing trend in additive manufacturing and hybrid machining operations complements traditional milling processes, making it easy to produce and fabricate prototypes quickly and at a low cost. The adoption of technology has also been enhanced by government initiatives that have resulted in advanced manufacturing, digital twin applications, and smart factory programs. The demand for high-performance AI-based milling systems arises from the need to focus on sustainability, energy-saving practices, and shorter cycle times.

The European universal milling machine market is witnessing sustainable growth, since the region is highly oriented toward developed manufacturing, precision engineering, and the adoption of Industry 4.0. As the major industrial centers, Germany, Italy, and France are stimulating the demand for high-precision CNC and multi-axis milling machines in the automotive, aerospace, energy, and general engineering industries. It is an advantage of the market that there are established machine tool manufacturers, a highly qualified labor force, and a well-designed infrastructure of R&D that facilitates the invention of new and efficient milling solutions. Also, government programs for sustainable and energy-efficient production processes stimulate the modernization of old equipment. Consequently, the European market is experiencing sustainable and smooth growth, countering both traditional and modern milling technologies.

UK Universal Milling Machine Market Trends

The market in the UK is growing due to the increasing use of CNC and multi-axis universal milling machines in the automotive, aerospace, and precision engineering industries. The concept of improving operational efficiency is growing in popularity among manufacturers through automation, digital controls, and AI-enhanced predictive maintenance. The modernization of milling equipment is gaining momentum due to the growth of high-value manufacturing industries and government support for smart factories and other innovation-focused projects. IoT and connected machine technologies are also incorporated in UK-based workshops to allow real-time monitoring, process optimization, and energy efficiency. The growing demand for prototyping, small-quantity productions, and highly specialized components also contributes to the increased use of flexible universal milling machines.

Universal Milling Machine Market Value Chain

This stage involves sourcing essential materials like cast iron, steel, aluminum alloys, and components such as motors, gears, spindles, and electronic parts. Reliable supply chains and high-quality raw materials are critical to ensure the durability, performance, and cost-efficiency of the final machine.

At this stage, individual parts such as machine frames, drive systems, tool holders, and electronic control units are fabricated. Precision engineering and high manufacturing standards are essential, as any deviation can directly impact the machine's accuracy and efficiency.

All components are brought together during the assembly phase, where mechanical systems are integrated with electrical and control systems. This stage also includes calibration, testing, and sometimes the addition of custom features like DROs (Digital Readouts) or CNC modules, depending on the machine type.

After quality approval, the machines are packaged and transported through distribution networks, either directly to end-users or through dealers and distributors. Efficient logistics, especially in exporting to international markets, plays a key role in maintaining delivery timelines and managing costs.

Once sold, machines are installed at the customer’s facility, followed by calibration and initial setup. This stage may also include operator training to ensure the end-users can use the machine efficiently and safely from day one.

Universal Milling Machine Market Companies

- DMG Mori Co., Ltd.:A global leader in precision machine tools, DMG Mori offers high-end universal milling machines with integrated CNC technologies, focusing on automation, IoT connectivity, and smart factory solutions.

- Yamazaki Mazak Corporation:Known for its advanced multi-tasking and 5-axis machines, Mazak produces versatile universal milling systems optimized for aerospace, automotive, and heavy industry applications.

- Haas Automation, Inc.:One of the largest U.S.-based machine tool builders, Haas delivers competitively priced, user-friendly universal CNC milling machines widely used in small to mid-sized workshops.

- Makino Milling Machine Co., Ltd.:Specializes in high-precision, high-speed milling solutions, Makino’s universal machines are widely used in die/mold, aerospace, and precision component industries.

- Okuma Corporation:A pioneer in intelligent CNC systems, Okuma integrates AI-based monitoring in its universal milling machines, offering enhanced stability and precision for complex machining.

- Hurco Companies, Inc.:Focuses on easy-to-use CNC controls and versatile machines suited for prototyping and low-volume production, catering to job shops and contract manufacturers.

- GF Machining Solutions:Provides advanced milling technologies with digital integration and automation capabilities, especially for high-end industrial and mold-making sectors.

- Hermle AG: German-based Hermle produces high-performance universal milling machines with a strong emphasis on accuracy, used in medical, aerospace, and tool-making sectors.

- Toshiba Machine Co., Ltd.: Offers robust and heavy-duty milling machines, including universal models for large-scale industrial and energy sector applications.

- Chiron Group SE: Specializes in high-speed, high-productivity milling centers suitable for universal machining tasks in automotive and precision manufacturing.

- Matsuura Machinery Corporation: Develops hybrid and multi-axis universal milling machines with automation, often used in high-precision and high-mix production environments.

- Doosan Machine Tools Co., Ltd.: Offers a wide range of universal and CNC milling machines, with a growing focus on smart manufacturing and heavy-duty industrial applications.

Recent Developments

- In December 2024, Nidec, the Japanese manufacturing giant, declared a 257 billion yen ($1.6 billion) unsolicited bid to purchase Makino Milling Machine, which is a market leader in selling universal milling machines. The bid was valued at 11,000 yen, representing a 42 percent premium over Makino's last price and indicating that Nidec was strategically positioning itself to strengthen its precision machining.(Source: https://www.reuters.com)

- In August 2023, CGTech launched VERICUT 9.4, the latest version of the CNC machine simulation software with new capabilities compared to the previous versions. The software is compatible with the aerospace, oil and gas, and medical technology sectors. The ToolsUnited interface provides access to 40 tool manufacturers and better tool data.(Source: https://www.aero-mag.com)

Exclusive Analysis on the Universal Milling Machine Market

The universal milling machine market is poised at a strategically advantageous inflection point, driven by the convergence of industrial automation, precision engineering, and the global reconfiguration of manufacturing supply chains. Amidst an ongoing digital transformation within legacy production frameworks, universal milling machines are re-emerging as critical assets, valued for their adaptability, configurability, and cost-to-performance optimization across both high-tech and traditional manufacturing verticals.

Elevated demand from aerospace, automotive, and medical device manufacturing continues to underpin the sector's structural resilience. However, the latent opportunity lies in the accelerated adoption of multi-axis CNC-integrated universal milling platforms within mid-tier enterprises in emerging economies. These systems offer a compelling alternative to capital-intensive machining centers, allowing for scaled precision manufacturing with lower operational complexity and footprint.

The market is also expected to benefit from the proliferation of Industry 4.0 frameworks, wherein universal milling machines serve as interoperable nodes within smart factory ecosystems, leveraging AI-driven predictive maintenance, real-time analytics, and seamless CAD/CAM integration. Furthermore, increased capex inflows into vocational training institutes and small-to-medium industrial clusters, particularly in Southeast Asia and Eastern Europe, signal sustained demand in conventional and hybrid machine categories.

Overall, the universal milling machine market exhibits a strong upside trajectory, underpinned by robust industrial demand, technological hybridization, and a gradual democratization of advanced machining capabilities across both developed and frontier markets.

Universal Milling Machine MarketSegments Covered in the Report

By Product Type

- Conventional Milling Machines

- Vertical Milling Machines

- Horizontal Milling Machines

- CNC Milling Machines

- 3-Axis CNC

- 4-Axis CNC

- 5-Axis CNC

By Coating/Material Type

- Cast Iron Body

- Grey Cast Iron

- Ductile Iron

- Steel Body

- Carbon Steel

- Alloy Steel

- Composite/Other Materials

- Polymer-Based

- Hybrid Materials

By Process Type

- Manual Milling

- Knee-Type

- Bed-Type

- CNC Milling

- Vertical CNC

- Horizontal CNC

By Application

- Automotive Components

- Engine Parts

- Transmission Components

- Aerospace Components

- Structural Components

- Precision Aerospace Parts

- Industrial Machinery

- Tooling Equipment

- Mechanical Assemblies

- Electronics & Precision Parts

- Circuit Boards

- Microcomponents

- Others

- Furniture Parts

- Custom Fabrication

By End Use Industry

- Automotive

- OEM Manufacturing

- Aftermarket Components

- Aerospace & Defense

- Aircraft Parts

- Defense Equipment

- Industrial Machinery

- Manufacturing Tools

- Heavy Machinery

- Electronics & Electrical

- Semiconductor Components

- Electrical Housings

- Others

- Furniture

- Custom Fabrication

By Region

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting