What is the Veterinary Antibiotics Market Size?

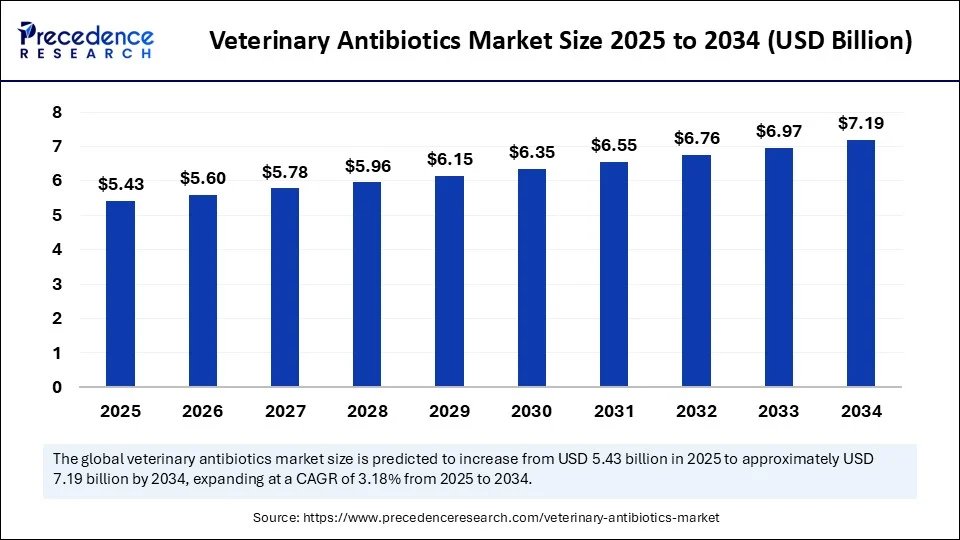

The global veterinary antibiotics market size is accounted at USD 5.43 billion in 2025 and is predicted to increase from USD 5.60 billion in 2026 to approximately USD 7.19 billion by 2034, expanding at a CAGR of 3.18% from 2025 to 2034. The increasing prevalence of livestock diseases and growing awareness of pet health and wellness are driving the growth of the veterinary antibiotics market. The rising demand for precision medicine further support market expansion.

Veterinary Antibiotics MarketKey Takeaways

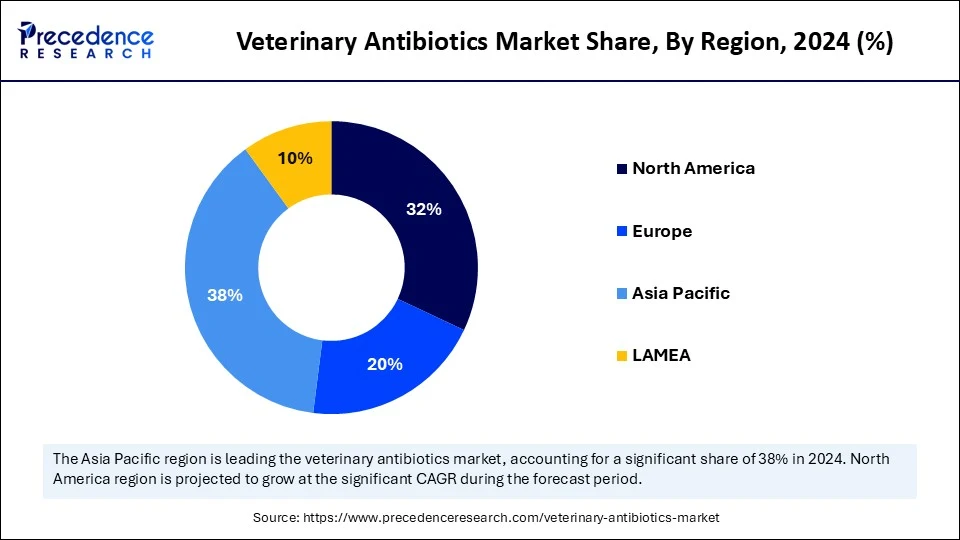

- Asia Pacific dominated the veterinary antibiotics market with the largest share of 38% in 2024.

- North America is expected to grow at the fastest CAGR from 2025 to 2034.

- By product type, the tetracyclines segment led the market while holding a 29% share in 2024.

- By product type, the fluoroquinolones segment will grow at a significant CAGR between 2025 and 2034.

- By route of administration, the oral segment dominated the market with a 45% share in 2024.

- By route of administration, the injectable segment will grow at the highest CAGR between 2025 and 2034.

- By animal type, the livestock segment contributed the largest market share of 36% in 2024.

- By animal type, the companion animals segment will expand at a significant CAGR between 2025 and 2034.

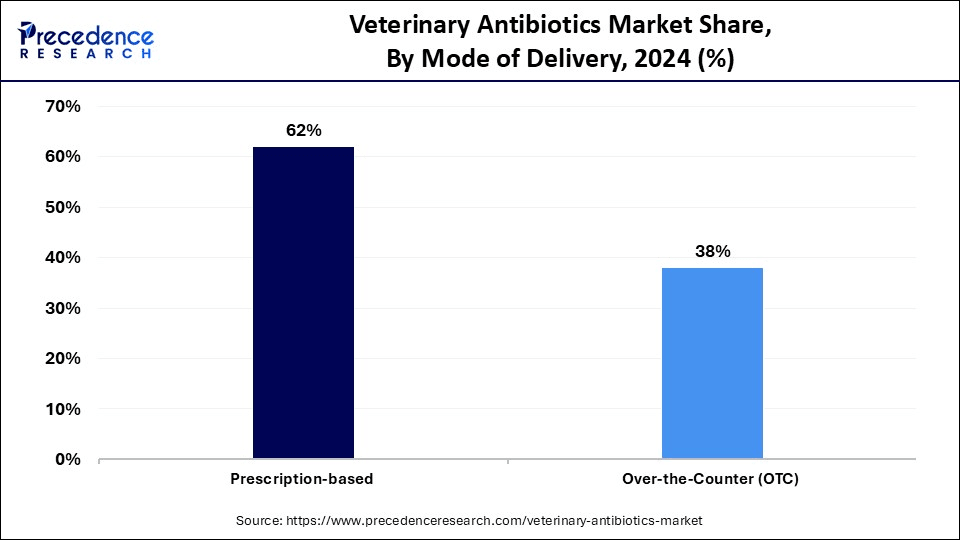

- By mode of delivery, the prescription-based segment led the market while holding a 62% share in 2024.

- By mode of delivery, the over-the-counter (OTC) segment will grow at the fastest CAGR between 2025 and 2034.

- By end-user, the animal farms segment held the major market share of 48% in 2024.

- By end-user, the online veterinary pharmacies segment is expected to grow at the fastest rate between 2025 and 2034.

- By distribution channel, the distributors/wholesalers segment dominated the market with a 52% share in 2024.

- By distribution channel, the online platforms segment will grow at a significant CAGR between 2025 and 2034.

Strategic Overview of the Global Veterinary Antibiotics Industry

The veterinary antibiotics market encompasses pharmaceutical products used to treat bacterial infections in animals, both companion animals (pets) and livestock (cattle, poultry, swine, etc.). These antibiotics are vital in preventing disease outbreaks, improving animal welfare, and ensuring food safety and productivity in the animal husbandry sector. The market is driven by growing demand for animal protein, rising pet ownership, and the emphasis on maintaining animal health amid increasing antimicrobial resistance (AMR) regulation.

The innovations of key companies in novel and innovative antibiotics, combined with the growing demand for animal healthcare products, contribute to market growth. Several companies are focusing on providing a range of antibiotic products with strict regulatory approvals, which is making a significant impact on market growth. The growing need to prevent the spread of infectious diseases in animals leads to significant innovations in the market.

Artificial Intelligence: The Next Growth Catalyst in Veterinary Antibiotics

Artificial Intelligencehas proven to be effective in the identification, formulation, and development of innovative medicines for animals. AI is playing a crucial role in providing faster and more precise disease detection. AI algorithms analyze a broad amount of data to provide personalized treatments subject to animals. AI has improved areas like diagnostic accuracy and streamlined decision-making abilities, making it easier the recommend personalized veterinary medicines and reducing the risk of antibiotic overuse. The ongoing use of AI in research & development is transforming data analysis and pattern identification for the discovery and development of novel and personalized treatments and therapies, including antibiotics.

Market Outlook

- Market Growth Overview: The Veterinary Antibiotics market is expected to grow significantly between 2025 and 2034, driven by rising demand for animal-derived food products, growing companion animal ownership, and increasing focus on alternative treatments.

- Sustainability Trends:Sustainability trends involve a shift to alternatives and preventative care, antibiotic stewardship and responsible use, and waste management and sustainable packaging.

- Major Investors: Major investors in the market include Zoetis Inc., Elanco Animal Health, Merck Animal Health, and Boehringer Ingelheim Vetmedica.

- Startup Economy:The startup economy is focused on innovation in alternatives to traditional antibiotics, developing advanced diagnostics, and creating digital solutions for antibiotic stewardship.

What are the Major Growth Factors of the Veterinary Antibiotics Market?

- Increased Livestock Disease Prevalence: The prevalence of diseases such as pneumonia and digestive infections has increased in livestock, driving demand for antibiotics.

- Animal Protein Demands: The increasing demand for animal proteins, driven by a growing awareness of nutritional needs in animals, is fueling livestock farming.

- Increased Pet Ownership: The global growth in pet ownership has driven demand for veterinary antibiotics to treat infections and diseases in animals, contributing to market growth.

- Government Initiatives: Government funding for animal healthcare and R&D investments for enhancing food security are emerging as significant market innovations.

- Novel Product Launching: The ongoing focus of key companies on launching novel and innovative products, with significant advancements in antibiotic formulations and delivery modes, is shaping market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 7.19 Billion |

| Market Size in 2026 | USD 5.60 Billion |

| Market Size in 2025 | USD 5.43 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.18% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Route of Administration, Animal Type, Mode of Delivery, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased Zoonotic Infections Prevalence

The increased prevalence of zoonotic infections is a major factor driving the growth of the veterinary antibiotics market. Zoonotic infections, such as rabies and blastomycosis, which can be transmitted from animals to humans, have shifted the focus of regulatory bodies and healthcare organizations to reduce the spread of these infections. This prompts the need for strict animal health monitoring and antibiotic administration. The increased prevalence of diseases in livestock and companion animals has led to a higher demand for effective antibiotics to prevent and control infections and their further spread. Several zoonotic infections can be transmitted through food, driving significant concerns for food safety and increasing the reliance of farmers and veterinarians on antibiotics to prevent and manage livestock infections.

Restraint

Stringent Regulations and Antibiotic Resistance

Veterinary antibiotics are highly regulated to ensure safety and effectiveness. Strict regulations, especially concerning antimicrobial resistance (AMR), are a significant restraint for the global veterinary antibiotics market. These regulations lead to increased production costs, hampering access to novel antibiotics. The concern over public health and food safety is encouraging such regulations, which can lead to the slow development of antibiotics. Moreover, the overuse of antibiotics can lead to the development of antibiotic-resistant bacteria, posing a threat to both animals and humans.

Several Regulations on the Use of Veterinary Antibiotics

- In May 2025, the Union Health Ministry of India issued a draft notification No. S. O. 2298 (E) dt 22-05-2025 for the prohibition of the import, manufacturing, and sales of 34 critical antimicrobials and formulations for veterinary use.

(Source: https://thehealthmaster.com)

- In April 2025, the Food Safety and Standards Authority of India (FSSAI) notified the Food Safety and Standards First Amendment Regulations, 2024, which came into effect to address crop contamination, the occurrence of toxic substances, and the use of antimicrobials and other drugs in veterinary practices.

(Source: https://www.downtoearth.org.in)

- A global veterinary medicines industry association, HealthforAnimals, has initiated the “Roadmap to Reducing the Need for Antibiotics,” launching a pledge to deliver 25 global actions by 2025 to reduce antibiotic use in animals. The initiative is supported by AnimalhealthEurope.

(Source: https://animalhealtheurope.eu)

Opportunity

Increasing Focus on Animal-Only Antibiotics

The increasing focus on animal-only antibiotics, including ionophores, driven by growing concerns about antimicrobial resistance and the need for more targeted and responsible antibiotics in animal health, presents significant opportunities for market growth. These antibiotics are gaining popularity for reducing the development of antimicrobial resistance in humans, through their restraint in human treatments. The animal-only antibiotics, including ionophore, offer effective and tailored treatments for addressing targeted diseases and conditions in the animals. The growing demand for targeted veterinary use to provide greater treatment results is contributing to a rising focus on animal-only antibiotics.

Segment Insight

Product Type Insights

Which Product Dominate the Veterinary Antibiotics Market in 2024?

The tetracyclines segment dominated the market while holding the largest market share of 29% in 2024. This is mainly due to its proven efficacy and low resistance profile. Tetracyclines are a class of antibiotics commonly used in veterinary medicine. The first-line use of tetracyclines in food-producing animals contributes to the segment growth, driven by large meat consumption and a growing focus on food safety concerns. This class is widely used in livestock and poultry.

The fluoroquinolones segment is expected to grow at the fastest rate over the forecast period, driven by increased antibiotic resistance and environmental concerns. The fluoroquinolones class offers good oral bioavailability, contributing to increased demand for convenient administration. The widespread use of fluoroquinolones in both human and animal medicines is fostering the segment growth.

Route of Administration Insights

What Made Oral the Dominant Segment in the Veterinary Antibiotics Market in 2024?

The oral segment dominated the market with the largest market share of 45% in 2024 due to its ease of administration, particularly in companion animals. The increased need for easy-to-use medicines in both livestock and companion animals drives the oral administration of antibiotics. Oral antibiotics are highly effective and convenient. Due to the increased healthcare costs, pet owners are seeking solutions that can be administered by themselves, boosting the demand for oral antibiotics. Ongoing advancements in formulations are enhancing the efficacy of oral antibiotics, supporting the long-term growth of the market.

The injectable segment is expected to grow a the fastest CAGR during the projection period, driven by the need for faster therapeutic results and long-acting antibiotics. The demand for injectable antibiotics is high in livestock populations to prevent and treat infectious diseases, impacting animal health and productivity. The ongoing innovations in drug delivery systems, like needle-free injectors and sustained-release formulations, are contributing to the segment's growth.

Animal Type Insights

How Does the Livestock Segment Dominate the Veterinary Antibiotics Market in 2024?

The livestock segment dominated the market, under which the cattle sub-segment held a maximum share of 36% in 2024. This is mainly due to the increased demand for disease treatments and prevention in food-producing animals. The increased prevalence of infectious diseases among livestock created the need for effective antibiotics. The expansion of animal farming, increased demand for meat and dairy products, and a growing focus on disease prevention are facilitating the long-term growth of the segment.

The companion animals segment is expected to expand at the highest CAGR in the market. The dogs sub-segment is leading the charge, as dogs are the most preferred companion animals. The increasing pet ownership and awareness of animal health and wellness support segmental growth. The spending on animal health and welfare has increased, driving demand for innovative and more effective treatment options for animal health. The rising pet ownership is contributing to the growth of animal antimicrobials and antibiotics use. The companion animals include dogs, cats, horses, and other animals. The dog sub-segment dominated the market due to the large ownership of dogs and the demand for effective treatments.

Mode of Delivery Insights

Why Did the Prescription-Based Segment Dominate the Veterinary Antibiotics Market?

The prescription-based segment dominated the market with the highest market share of 62% in 2024, driven by the increased demand for veterinary oversight to ensure accurate use of antibiotics and reduce resistance. The use of prescription-based antibiotics is high for severe or specific infections. Governments in many regions have implemented strict prescription-only regulations for the use of prescription-based antibiotics. The growing focus on the risk of antimicrobial resistance drives a preference for prescription-based antibiotic use.

The over-the-counter (OTC) segment is expected to grow at the fastest rate over the forecast period. This is mainly due to the increased purchases of over-the-counter antibiotics for minor ailments and preventive care. The need for convenient and cost-effective medications drives consumers toward over-the-counter delivery modes. The wide accessibility of medications to prevent minor health issues makes the over-the-counter segment most available for pet and livestock owners.

End-User Insights

What Made Animal Farms the Dominant Segment in the Market in 2024?

The animal farms segment dominated the veterinary antibiotics market by holding 48% of market share in 2024, as farmers increasingly focus on disease prevention and treatments, driven by increased demand for meat and dairy products. The use of antibiotics is rising for promoting growth and enhancing feed efficiency in animals, especially in the livestock population. The growing populations and demand for meat consumption for nutritional and animal protein are driving the use of antibiotics in livestock production. Moreover, the rising production of livestock animals ensures the long-term growth of the market.

The veterinary hospitals & clinics is the second-largest segment. Veterinary hospitals are focusing on patient-specific care, boosting the demand for antibiotics. With the rising pet humanization and pet healthcare spending, visits to veterinary hospitals are rising. Moreover, the increasing pet ownership and focus on animal health are likely to support segmental growth.

The online veterinary pharmacies segment is expected to grow at the fastest CAGR over the forecast period due to the increased consumer preference for convenience and a broad range of products. Online veterinary pharmacies offer convenient and flexible medication purchases to pet owners. The wide availability of veterinary medications makes online veterinary pharmacies popular among pet and livestock owners in remote areas. Additionally, the availability of antibiotics from multiple brands at competitive pricing encourages repeat purchases. These platforms also provide teleconsultation, which is beneficial for people in remote areas.

Distribution Channel Insights

Which Distribution Channel Holds the Largest Revenue Share of the Veterinary Antibiotics Market in 2024?

The distributors/wholesalers segment held the largest market share of 52% in 2024 due to their crucial role in facilitating the supply chain from manufacturers to end-users. The distributors/wholesalers ensure antibiotic access to veterinarians, farmers, and pet owners. The need for an efficient supply chain, wide reach, and easy product availability leads to the importance of distributors/wholesalers. Additionally, the key role of distributors/wholesalers in impacting the final product's reach and price drives the segment growth.

The online platforms segment is expected to expand rapidly in the market in the upcoming period, driven by the rise of e-commerce platforms and their role in providing convenience and accessibility to pet and livestock owners. Online platforms provide a wide range of antibiotic products, helping pet owners find their needed products. The expanding e-commerce and online pharmacies are contributing to the growth of the online distribution channel segment.

Regional Insights

Asia Pacific Veterinary Antibiotics Market Size and Growth 2025 to 2034

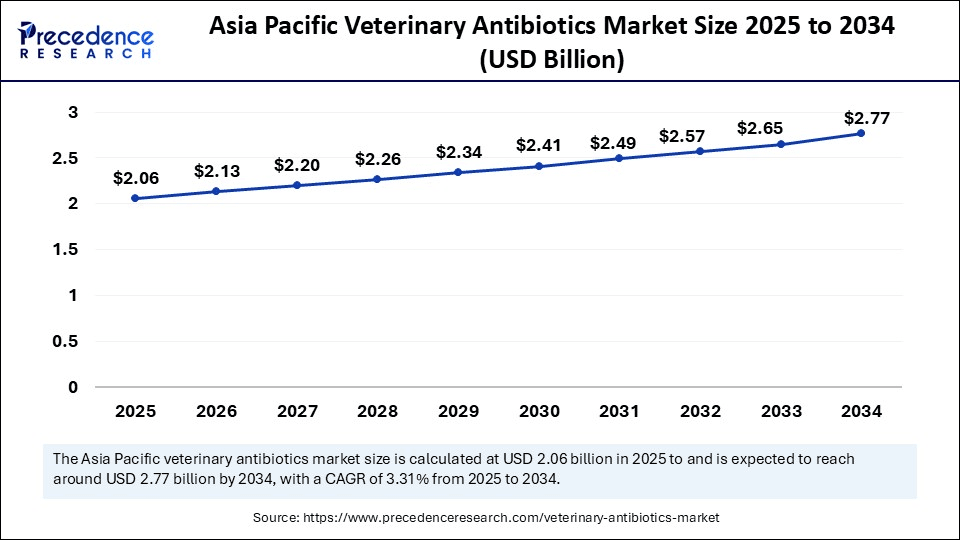

Asia Pacific veterinary antibiotics market size is exhibited at USD 2.06 billion in 2025 and is projected to be worth around USD 2.77 billion by 2034, growing at a CAGR of 3.31% from 2025 to 2034.

Why Did Asia Pacific Dominate the Veterinary Antibiotics Market in 2024?

Asia Pacific dominated the global veterinary antibiotics market in 2024, accounting for a significant market share of 38%, driven by increased meat consumption and government initiatives aimed at controlling the spread of infectious diseases in animals. The region is the hub for animal husbandry. The growing adoption of pets and expenditure on animal health are driving demand for innovative treatments in the region. Additionally, the government's initiatives to implement strict regulations and guidelines in veterinary services, which promote animal health, further contribute to market growth. Countries like China and India have placed a strong emphasis on quality standards and regulatory guidelines for food safety, which has contributed to market growth.

- In October 2024, the Union Ministry of Animal Husbandry published the new Standard Veterinary Treatment Guidelines (SVTG) to promote Ayurvedic treatments and regulate the use of antibiotics in veterinary care.

(Source: https://www.thehindu.com)

China Veterinary Antibiotics Market Trends

China is a leading player in the market. China has the largest livestock population, driving the demand for veterinary antibiotics. The growing infrastructure for animal healthcare and increasing pet ownership are contributing to a rise in demand for veterinary antibiotics. Additionally, government initiatives aimed at enhancing animal health and food safety are driving the development of novel antibiotics.

North America Veterinary Antibiotics Market Trends

North America is the fastest-growing region in the market. This is due to increased livestock and companion animal populations in the region. The growing pet ownership and rising awareness of pet health are fostering demand for effective treatments and therapies, including antibiotics. The robust veterinary healthcare system and stringent regulations, such as the FDA's oversight of antibiotic use in animals, are driving a focus on antibiotic administration and fueling demand. The robust R&D sector of North America and strong government investments in veterinary healthcare contribute to the region's market growth.

U.S. Veterinary Antibiotics Market Trends

The U.S. is a major player in the regional market due to its robust veterinary healthcare system. The pet ownership rates are high in the U.S. Additionally, advanced research and development in veterinary medicine, as well as key companies' collaboration and R&D investments, are bringing significant innovations to the emerging market. The strong presence of regulations, such as the FDA, and their approvals for novel antibiotics in veterinary medicine are driving the market.

FDA Approvals for Novel Veterinary Antibiotics

| Company | FDA Approval |

| Dechra |

In May 2025, the FDA approved Dechra's Otiserene for the treatment of external infections in dogs. The medicine is the first single-dose, long-acting otitis externa product to leverage the powerful antibiotics marbofloxacin. (Source: https://www.dechra-us.com) |

| Elanco Animal Health Incorporated |

In April 2024, Elanco Animal Health Incorporated announced FDA review completion for all major and minor technical sections for Credelio Quattro and the final 60-day administrative reviews. In January 2025, the company launched the Credelio QuattroTM, which is now available at CredelioQuattroVet.com for veterinarians' orders (Source: https://investor.elanco.com) |

Europe Veterinary Antibiotics Market Trends

Europe is expected to experience notable growth, driven by a rising livestock population, growing pet ownership rates, and awareness about animal health. Europe has a large livestock production industry, driving high demand for veterinary antibiotics. The stringent regulations on the use of antibiotics in animals contribute to the development of responsible antibiotic use. Additionally, the regulatory focus on large livestock management practices drives the need for novel and innovative antibiotics to promote animal health and productivity.

- In March 2025, the Federation of Veterinarians of Europe (FVF) welcomes the new and first European Sales and Use of Antimicrobials for Veterinary Medicine (ESUAvent) annual surveillance report published by the European Medicines Agency (EMA). According to the sales data, 98.4% of antimicrobials are sold for use in food-producing animals, with allocation to other animals, especially companion animals, being only 1.6%.

(Source: https://fve.org)

Germany Veterinary Antibiotics Market Trends

Germany's veterinary antibiotics market is shifting towards alternatives like vaccines and preventative hygiene measures, and a focus on animal-only antibiotics to comply with new EU regulations. This regulatory environment is simultaneously boosting demand for rapid diagnostics and antimicrobial susceptibility testing to enable judicious use.

Value Chain Analysis of the Veterinary Antibiotics Market

Research & Development (R&D) and Clinical Trials

This critical stage involves the discovery of new antimicrobial compounds, the development of novel delivery methods (e.g., oral, injectable), and rigorous testing through preclinical and clinical trials to ensure efficacy and safety.

- Key Players: Boehringer Ingelheim Pharma/GmbH, Bayer AG, Merck & Co. Inc., Elanco Animal Health Inc., Virbac SA, Ceva Santé Animale.

Manufacturing & Formulation

Raw active pharmaceutical ingredients (APIs) are manufactured, formulated into final dosage forms, and packaged for distribution.

- Key Players: Dechra Pharmaceuticals, Vetoquinol SA, and production facilities of major R&D firms like Boehringer Ingelheim.

Distribution & Sales

Finished products are distributed through a complex network including veterinary wholesalers, pharmacies, feed mills (for medicated feed), and direct sales to large farms and veterinary clinics.

- Key Players: Veterinary wholesalers (e.g., Covetrus), online veterinary pharmacies, and in-house distribution networks of manufacturers.

Veterinary Prescription & Diagnostics

Veterinarians diagnose animal health issues and prescribe appropriate antibiotics, guided by diagnostic results and antimicrobial susceptibility testing (AST).

- Key Players: Veterinarians and clinics, diagnostic companies like IDEXX Laboratories and Zoetis.

Operation, Service & Support

Post-sale activities include providing technical support, training for veterinarians and farmers on product administration, and managing pharmacovigilance (monitoring adverse effects).

- Key Players:Technical support teams of manufacturers, government regulatory agencies (German Federal Institute for Risk Assessment (BfR), European Medicines Agency), and farming associations.

Top Companies in the Veterinary Antibiotics Market & Their Offerings

- Zoetis Inc.: Zoetis develops, manufactures, and commercializes a comprehensive portfolio of animal health medicines, vaccines, and diagnostic products, including various antibiotics for livestock and companion animals.

- Elanco Animal Health: Elanco provides animal health products and services, with a strong focus on developing "animal-only" antibiotics to minimize the risk of antimicrobial resistance in humans. The company actively invests in R&D for novel solutions and has acquired Bayer Animal Health to broaden its product range.

- Merck Animal Health (known as MSD Animal Health outside the U.S. and Canada): This division of Merck is a global provider of veterinary pharmaceuticals, vaccines, and health management solutions, including a range of antibiotics for various species.

- Boehringer Ingelheim Vetmedica: As a major player in animal health, Boehringer Ingelheim provides a broad portfolio of products, including antibiotics for livestock and pets. It contributes through ongoing R&D of novel antimicrobials and solutions that support preventative animal healthcare.

- Ceva Santé Animale:Ceva specializes in animal health, focusing on the development and production of a range of veterinary antibiotics and vaccines for both production and companion animals. The company contributes to the market by addressing the health needs of animals while promoting responsible antibiotic use through preventative care.

- Virbac: Virbac is a global animal health company offering a comprehensive and practical range of products and services for the diagnosis, prevention, and treatment of animal diseases, including essential antibiotics. It focuses on delivering innovative solutions to veterinarians and farmers worldwide.

- Vetoquinol S.A.: Vetoquinol develops and distributes veterinary drugs and non-medicinal products, including numerous antimicrobial solutions, for livestock and pets. The company contributes to the market by providing innovative products that balance treatment efficacy with global efforts to reduce antibiotic resistance.

- Phibro Animal Health Corporation: Phibro develops, manufactures, and markets a broad range of animal health and mineral nutrition products, including antibiotics and feed additives for livestock. It focuses on helping producers maintain animal health and manage diseases effectively within regulatory guidelines.

- Bayer Animal Health (now part of Elanco): Before its acquisition by Elanco, Bayer Animal Health was a major provider of various animal health products, including antibiotics. Its contributions are now integrated into Elanco's portfolio, enhancing the combined entity's market presence and R&D capabilities.

- Norbrook Laboratories Ltd.:Norbrook is a leading global manufacturer of veterinary pharmaceuticals, including a wide range of injectable and oral antibiotics. It contributes to the market by providing high-quality, cost-effective generic products used in both livestock and companion animal medicine.

- Dechra Pharmaceuticals:Dechra specializes in the development and marketing of products for veterinarians worldwide, with a strong focus on endocrinology, dermatology, and antibacterials. .

- Neogen Corporation: Neogen develops and markets products dedicated to food and animal safety, including diagnostic test kits for antibiotic residues in food products. It contributes to market sustainability by ensuring food safety standards are met after antibiotic use in livestock.

- Zydus Animal Health (part of Zydus Lifesciences): This Indian company provides a range of animal healthcare products, including antibiotics, for the domestic and international markets.

- Huvepharma:Huvepharma is a fast-growing global pharmaceutical company providing products for animal health, including essential antibiotics and performance enhancers for livestock and poultry. It focuses on improving animal health and productivity through a broad and effective product portfolio.

- Kyoritsu Seiyaku Corporation: This Japanese company specializes in animal health products and veterinary services, offering antibiotics and other pharmaceuticals for companion animals and livestock in the Japanese market. It contributes to regional animal health and welfare through localized R&D and distribution.

- HIPRA S.A.:HIPRA is focused on prevention and diagnostics in animal health, primarily through vaccines, but also offers some related products and services within the market context.

- Ourofino Saúde Animal: A prominent Brazilian company in the animal health sector, offering a broad portfolio of products including various antibiotics for livestock and pets across Latin America.

- ECO Animal Health: ECO Animal Health is focused on the development and commercialization of animal health products, including a key antimicrobial product Aivlosin, for the poultry and swine markets. It contributes by providing targeted solutions for specific livestock diseases.

- ANI Pharmaceuticals (Animal Division): ANI focuses on generic pharmaceutical products for humans, but its animal health division provides some related products to the veterinary market. Its primary contribution is providing certain generic medications that may have veterinary applications.

- IDEXX Laboratories, Inc.: IDEXX is a leader in veterinary diagnostics, providing instruments, tests, and software that enable veterinarians to make informed decisions, including which antibiotics to use.

Recent Developments

- In May 2025, Merck Animal Health and the State of Kansas announced the expansion of their manufacturing and R&D facilities in De Soto with a $895 million investment in manufacturing and a $35 million investment in R&D laboratories, enhancing production capabilities of injectable antibiotics.

(Source: https://www.merck.com)

- In April 2025, Vetlen launched the new, smaller version of the 5mL pouch, an antibiotic delivery system developed for targeted antibiotic therapy in animals. This new version provides an alternative to the company's original 10mL version.

(Source:https://www.dvm360.com)

Segment Covered in the Report

By Product Type

- Tetracyclines

- Penicillins

- Sulfonamides

- Macrolides

- Cephalosporins

- Fluoroquinolones

- Aminoglycosides

- Others (e.g., Lincosamides, Carbapenems)

By Route of Administration

- Oral

- Injectable

- Topical

- Intramammary

- In-feed / In-water Medication

By Animal Type

- Livestock

- Cattle

- Poultry

- Swine

- Sheep & Goats

- Others

- Companion Animals

- Dogs

- Cats

- Horses

- Others (e.g., Rabbits, Exotic Animals)

By Mode of Delivery

- Prescription-based

- Over-the-Counter (OTC)

By End User

- Veterinary Hospitals & Clinics

- Animal Farms

- Retail Pharmacies & Drug Stores

- Online Veterinary Pharmacies

- Research Institutes & Academic Settings

By Distribution Channel

- Direct Sales (Veterinary Sales Representatives)

- Distributors / Wholesalers

- Online Platforms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting