Veterinary Biomarkers Market Size and Forecast 2025 to 2034

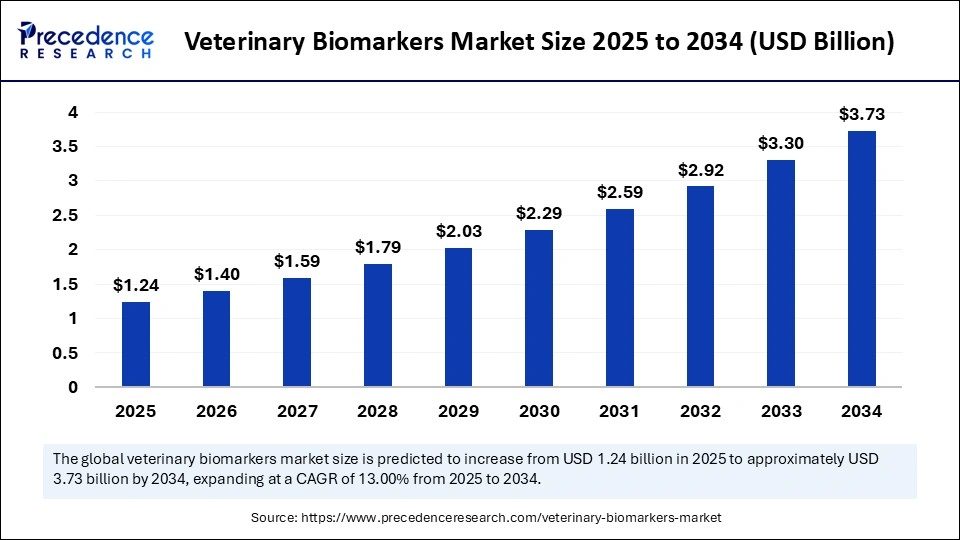

The global veterinary biomarkers market size was calculated at USD 1.10 billion in 2024 and is predicted to increase from USD 1.24 billion in 2025 to approximately USD 3.73 billion by 2034, expanding at a CAGR of 13.00% from 2025 to 2034. The market is growing at a rapid pace due to the increasing demand for rapid and accurate disease diagnosis in animals. Advancements in biotechnology and rising awareness of pet health and wellness further support market growth.

Veterinary Biomarkers Market Key Takeaways

- In terms of revenue, the veterinary biomarkers market is valued at $1.24 billion in 2025.

- It is projected to reach $3.73 billion by 2034.

- The market is expected to grow at a CAGR of 13.00% from 2025 to 2034.

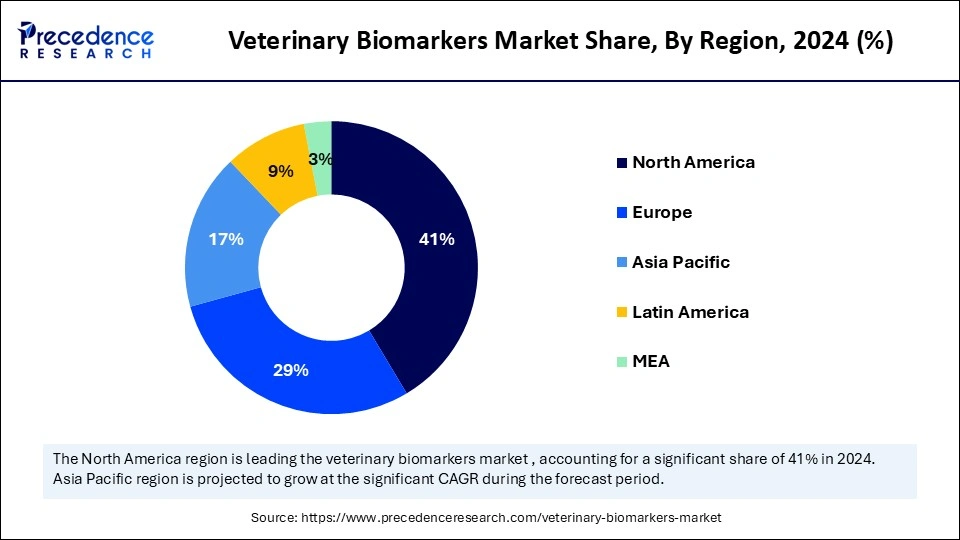

- North America dominated the global market with the largest share of 41% in 2024.

- Asia Pacific is expected to expand at a solid CAGR of 14.5% during the forecast period.

- By animal type, the companion animals segment led the market with the highest share in 2024.

- By animal type, the production animals segment is expected to witness significant growth during the predicted timeframe.

- By product, the biomarkers, kits & reagents segment held the largest share of the market in 2024.

- By product, the biomarker readers segment is expected to grow at the fastest rate in the coming years.

- By application, the disease diagnostics segment led the market in 2024.

- By application, the preclinical research segment is projected to grow at the fastest rate during the forecast period.

- By disease type, the inflammatory & infectious diseases segment held the biggest market share of 40% in 2024.

- By disease type, the cardiovascular diseases segment is expected to grow at a significant rate in the upcoming period.

Impact of AI on the Veterinary Biomarkers Market

AI is revolutionizing the veterinary biomarkers market by speeding up research, increasing diagnostic accuracy, and improving disease detection. Early disease detection through the analysis of biomarker data by machine learning algorithms results in quicker and more accurate diagnoses. Additionally, it supports individualized treatment regimens that maximize medication effectiveness while reducing side effects. Predictive models speed up the identification and validation of biomarkers in research and drug development, resulting in faster new treatments. Furthermore, real-time health monitoring is made possible by integrating artificial intelligence AI algorithms into wearable technology and smart sensors, which enable veterinarians to identify possible problems before symptoms manifest. Veterinary biomarker applications are being revolutionized by AI technology, which is increasing efficiency, decreasing costs, and expanding access to advanced diagnostics. Several companies are actively using AI to identify disease biomarkers. To improve disease detection in companion and livestock animals, Zoetis incorporates machine learning into diagnostics.

U.S. Veterinary Biomarkers Market Size and Growth 2025 to 2034

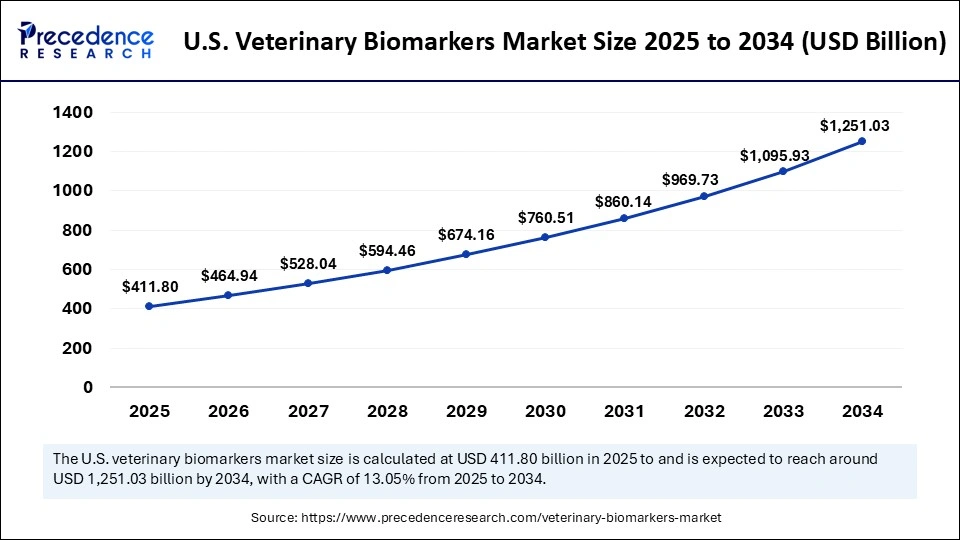

The U.S. veterinary biomarkers market size was exhibited at USD 365.31 million in 2024 and is projected to be worth around USD 1,251.03 million by 2034, growing at a CAGR of 13.05% from 2025 to 2034.

North America dominated the veterinary biomarkers market by holding the maximum share in 2024. This is mainly due to the increased pet ownership, especially in countries like the U.S. and Canada. As pet owners have become more aware of the health and wellness of pets, the spending on pet healthcare has increased. The increased research activities, higher diagnostic rates, and the presence of major market players further bolstered the growth of the market in the region. The region has a well-established veterinary healthcare infrastructure, with the widespread availability of biomarker-based diagnostic tools. Government programs that support the diagnosis of animal disease and the availability of pet insurance also contributed to the region's dominance.

Asia Pacific is expected to grow at the fastest rate in the veterinary biomarkers market during the forecast period, driven by growing awareness of the importance of biomarkers in veterinary practices and rising disposable incomes. The growing livestock population and the increasing prevalence of infectious diseases among animals are driving the growth of the market. The pet adoption rates are rising in countries like India and China, boosting the demand for cutting-edge veterinary diagnostic solutions. Additionally, the market is expanding faster due to government support for livestock health management.

Europe is considered to be a significantly growing area. The growth of the veterinary biomarkers market in Europe can be attributed to the rising pet ownership. The rising prevalence of animal diseases is boosting the need for advanced diagnostic solutions. The rising awareness among pet owners about early disease detection and prevention is further contributing to the growth of the market. In addition, the growing concerns about zoonotic diseases and the need for precision medicine in veterinary care support regional market expansion.

Market Overview

The veterinary biomarkers market is witnessing rapid growth, driven by growing pet ownership, increased awareness regarding animal health, and improvements in diagnostic technology. The increasing incidence of zoonotic diseases, the growing production of livestock, and the need for early disease detection are driving the growth of the market. There is a rising demand for rapid, precise, and portable diagnostic solutions. Faster and more accurate diagnoses are made possible by advancements in telemedicine, biosensors, and AI-driven diagnostics, which are revolutionizing veterinary healthcare. The market is anticipated to grow significantly over the next several years due to ongoing technological advancements and rising investments in animal healthcare.

Veterinary Biomarkers Market Growth Factors

- Technological Advancements: Innovations in biosensors, AI-driven diagnostics, PCR, and portable analyzers are enhancing diagnostic accuracy and speed.

- Growth in Livestock & Poultry Farming: Farmers are increasingly adopting PoC diagnostics for real-time disease monitoring, ensuring animal health and food safety.

- Rising Veterinary Healthcare Expenditure: Growing spending on veterinary care by pet owners and livestock farmers is boosting market growth.

- Shift Towards Telemedicine & Remote Diagnostics: The adoption of digital veterinary solutions and mobile diagnostic devices is improving accessibility and efficiency in animal healthcare.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.73 Billion |

| Market Size in 2025 | USD 1.24 Billion |

| Market Size in 2024 | USD 1.10 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.00% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Animal Type, Product Type, Application, Disease Type and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Prevalence of Zoonotic & Infectious Diseases

The rising prevalence of zoonotic and infectious diseases among animals is driving the growth of the veterinary biomarkers market. With the growing prevalence, the need for early detection of zoonotic and infectious diseases in pets and livestock to prevent outbreaks is rising. Real-time diagnostics are becoming more and more necessary due to the growing risk of these diseases that can infect humans as well. Brucellosis, influenza, and rabies outbreaks have brought attention to early detection. Rapid diagnostics are crucial because livestock farmers are under pressure to control diseases that can harm both consumers and animals. Additionally, the increased livestock population accelerated the spread of infections, which significantly propels the growth of the market. For veterinary healthcare providers, enhanced diagnostics and disease tracking are increasingly important, in which biomarkers are essential.

Expansion of Livestock & Poultry Farming

To guarantee food safety and stop outbreaks, on-site disease detection has become more important due to the growing demand for meat, dairy, and poultry products. Rapid testing kits are being used by farmers to keep an eye on animal health and boost output. Demand for biomarker-based testing is also rising, as governments and regulatory agencies have imposed stringent health monitoring standards for farm animals. Wearable sensors and automated diagnostic tools have enabled real-time livestock health monitoring.

Shift Toward Preventive Veterinary Care

The rapid shift toward preventative veterinary care approaches to prevent outbreaks drives the growth of the veterinary biomarkers market. Point-of-care diagnostic devices are becoming more popular as veterinary clinics and hospitals place a greater emphasis on early disease detection and prevention, in which biomarkers play a crucial role. Preventive care enhances animal health and lowers long-term medical expenses. Regular screenings with PoC diagnostics ensure prompt intervention by identifying diseases before they worsen. Clinics and hospitals are increasingly adopting biomarker-based diagnostic solutions to detect diseases in animals.

Restraints

High Costs and Risk of False Positives

Biomarker-based point-of-care (PoC) diagnostics provide rapid results in comparison to traditional diagnostic methods. However, the development cost of biomarker-based PoC diagnostic kits is substantial. Developing and validating new biomarkers requires substantial investments in research and clinical trials. Misdiagnosis due to false positives and negatives may result in needless treatment or postponed intervention. Environmental conditions, contamination, and inappropriate sample collection are some examples of factors that can affect test reliability. This issue is especially important in livestock farming since inaccurate results may cause disease outbreaks or needless culling. When deciding on a course of treatment, veterinarians frequently favor confirmatory laboratory testing rather than depending exclusively on point-of-care devices.

Storage & Shelf-Life Issues with Biomarkers

Some biomarkers exhibit excellent stability when stored at appropriate temperatures, while others may degrade rapidly. This short shelf-life factor may limit the adoption of biomarker-based diagnostic tests, thereby limiting the growth of the veterinary biomarkers market. Certain storage conditions are necessary for the continued effectiveness of many veterinary biomarker-based diagnostic kits, including rapid test strips and reagents. Test kits may deteriorate due to improper storage temperature and humidity exposure, producing unreliable results. This issue is prevalent in regions with harsh climates or insufficient storage infrastructure.

Opportunities

Rising Demand for Portable & Handheld Devices

The rising demand for portable diagnostic tools, particularly for field-visiting veterinarians, creates immense opportunities in the veterinary biomarkers market. Recently, IDEXX Laboratories has unveiled the VetScan VS2, a portable chemistry analyzer that allows for instant decision-making by providing real-time test results in a matter of minutes. Similarly, Heska Corporation provides veterinary clinics with point-of-care blood analyzers that yield results comparable to those of a laboratory. To diagnose and treat animals in remote areas without the use of lab facilities, there is an increasing need for portable, battery-powered diagnostic devices. Diagnostics are now more accessible, thanks to the growing popularity of portable imagining solutions like handheld ultrasound equipment.

Need for Livestock Health Monitoring

The rising need for livestock health monitoring solutions opens up new growth avenues for the veterinary biomarkers market. Businesses are investing in real-time monitoring solutions as concerns about livestock diseases grow. The SenseHub monitoring systems developed by Merck Animal Health help farmers identify early disease symptoms by tracking livestock health parameters like temperature and activity levels. Wearable sensors are being created to track vital signs continuously, which significantly lowers the risk of disease outbreaks. The need for real-time veterinary diagnostics is predicted to increase as smart farming solutions become more widely used.

Animal Type Insights

The companion animals segment dominated the veterinary biomarkers market with the largest share in 2024. This is mainly due to the increased pet humanization and pet ownership. Pet owners treat their pets like members of the family. The increased prevalence of infectious diseases among pets has raised concerns about their health and wellness among pet owners. This promoted the need for routine medical examinations and diagnostics. Pet-specific rapid point-of-care (PoC) diagnostic solutions covering infectious diseases, diabetes, and kidney disorders have been introduced by companies such as IDEXX Laboratories, Zoetis, and Antech Diagnostics. Additionally, the demand for routine diagnostic testing has increased due to increased awareness campaigns about preventive pet healthcare, further solidifying this segment's dominance. Pets are increasingly prone to chronic illnesses like cancer and arthritis, increasing the need for early detection.

The production animals segment is expected to witness significant growth during the predicted timeframe. The growth of the segment is attributed to the rising demand for meat, dairy, and poultry products. To keep an eye on animal health, stop disease outbreaks, and boost output, farmers are using PoC diagnostics more and more. The adoption of rapid diagnostics has been further accelerated by government initiatives aimed at controlling disease prevention in cattle.

PoC testing kits for the early detection of infections, metabolic diseases, and reproductive health problems in cattle, poultry, and pigs have been introduced by companies such as Merck Animal Health, Heska Corporation, and Boehringer Ingelheim. Technological developments in livestock monitoring tools, such as wearable health trackers and AI-driven disease detection, further support segmental growth. Additionally, the rising animal trade and the requirement for strict health monitoring to stop the spread of zoonotic diseases contribute to segmental growth.

Product Type Insights

The biomarkers, kits & reagents segment led the veterinary biomarkers market with the largest share in 2024. This is mainly due to their extensive application in regular veterinary diagnostics and disease surveillance. In animals, biomarkers are essential for identifying early indicators of infections, organ failure, and metabolic diseases. For the quick and precise diagnosis of diseases in companion and production animals, businesses such as Zoetis, IDEXX Laboratories, and Antech Diagnostics have created biomarker-based test kits. The increased use of biomarker-based tests for illnesses like kidney disease, heart problems, and inflammatory conditions further bolstered the segment. Biomarkers and reagents improve test accuracy. The widespread availability of readily usable consumables and reagents is likely to sustain the segment's long-term growth.

The biomarker readers segment is expected to grow at the fastest rate in the coming years, driven by the increasing need for biomarker-based portable and automated diagnostic tools. Biomarker readers lessen reliance on conventional laboratory setups by delivering fast and precise results, increasing the effectiveness of biomarker-based tests. Businesses like Heska Corporation, Randox Laboratories, and VMRD are investing in cutting-edge biomarker reader technologies. Point-of-care testing is now easier to access, thanks to the development of small portable biomarker readers, particularly in rural and isolated veterinary clinics. Additionally, the efficiency of record-keeping and diagnostic accuracy is being enhanced by the growing emphasis on integrating these readers with cloud-based data management systems. Veterinarians have placed higher priority on quicker and more accurate diagnostic tools, boosting the need for biomarker readers.

Application Insights

The disease diagnostics segment dominated the veterinary biomarkers market with the largest share in 2024. This is mainly due to the increased incidence of chronic and infectious diseases in both production and companion animals. The demand for rapid diagnostic solutions has increased due to the increased prevalence of Bovine parvovirus (BPV), leukemia, and Lyme disease. Companies such as IDEXX Laboratories, Zoetis, and Antech Diagnostics have developed numerous PoC diagnostic kits to identify parasitic, viral, and bacterial infections. The segment's dominance is being reinforced by the increased focus on routine screening and preventive healthcare. The need for in-clinic diagnostic solutions has increased as pet owners have become aware of early disease detection. Disease diagnostics are now more effective and accessible, thanks to technological developments like multiplex testing and portable analyzers.

The preclinical research segment is projected to grow at the fastest rate during the forecast period, driven by increasing funding for the development of veterinary medications and vaccines. PoC diagnostic tools are being used by research and academic institutions more frequently for animal disease modeling, biomarker discovery, and early-stage drug testing. To increase the effectiveness of preclinical trials, major companies like Elanco, Boehringer Ingelheim, and Merck Animal Health are investing in rapid diagnostic platforms. To further encourage the use of PoC diagnostics in research, regulatory bodies are highlighting the significance of animal health data in drug approval procedures. The rising veterinary research is likely to drive the growth of the segment.

Disease Type Insights

The inflammatory & infectious diseases segment dominated the veterinary biomarkers market in 2024. This is mainly due to the increased prevalence of parasitic bacterial and viral infections in companion and production animals. For diseases like influenza, bovine mastitis, canine parvovirus, and feline leukemia virus to be prevented and treated promptly, precise diagnosis is essential. Advanced PoC test kits have been developed by companies such as IDEXX Laboratories to identify the pathogens that cause these diseases.

The need for rapid and effective infectious disease diagnostics has also increased due to the growing emphasis on zoonotic disease prevention. PoC testing has become more popular because of expanding vaccination campaigns and disease surveillance programs, strengthening this segment's growth. The rising development of multiplex assays that can detect multiple infections at once further solidifies the segment's position in the market.

The cardiovascular diseases segment is expected to grow at a significant rate in the upcoming period, driven by the growing incidence of heart-related disorders in elderly pets. Rapid diagnostics solutions are needed because conditions like hypertension, valvular diseases, and congestive heart failure are becoming more prevalent in dogs and cats. Biomarker-based PoC tests help to detect cardiac troponins and natriuretic peptides, which are important markers of heart disease. The need for portable ECG monitors, blood pressure monitors, and biomarker readers is rising as pet owners have become more aware of early cardiac screening.

Veterinary Biomarkers Market Companies

- Zoetis

- Virbac

- Life Diagnostics

- ACUVET BIOTECH

- Merck & Co., Inc.

- IDEXX Laboratories, Inc.

- MI: RNA Diagnostics Ltd.

- Mercodia AB

- Antech Diagnostics, Inc.

- Avacta Animal Health Limited

Recent Developments

- In June 2024, VolitionRx introduced the Nu. Q Vet Cancer Test across multiple countries, leveraging AI to analyze blood biomarkers for early cancer detection, significantly improving survival rates through timely intervention.

- In January 2023, Susantha Gomis, professor and head of the Department of Veterinary Pathology in USask's Western College of Veterinary Medicine (WCVM), was awarded USD 170,000 to develop a biomarker-based fecal test for the early detection and control of diseases and performance improvement in commercial broiler chickens.

Segments Covered in the Report

By Animal Type

- Companion Animals

- Dogs

- Cats

- Others

- Production Animals

- Cows

- Pigs

- Others

By Product Type

- Biomarkers, Kits & Reagents

- Biomarker Readers

By Application

- Disease Diagnostics

- Preclinical Research

- Others

By Disease Type

- Inflammatory & Infectious Diseases

- Cardiovascular Diseases

- Skeletal Muscle Diseases

- Tumor

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting