What is Virtual Customer Premises Equipment Market Size?

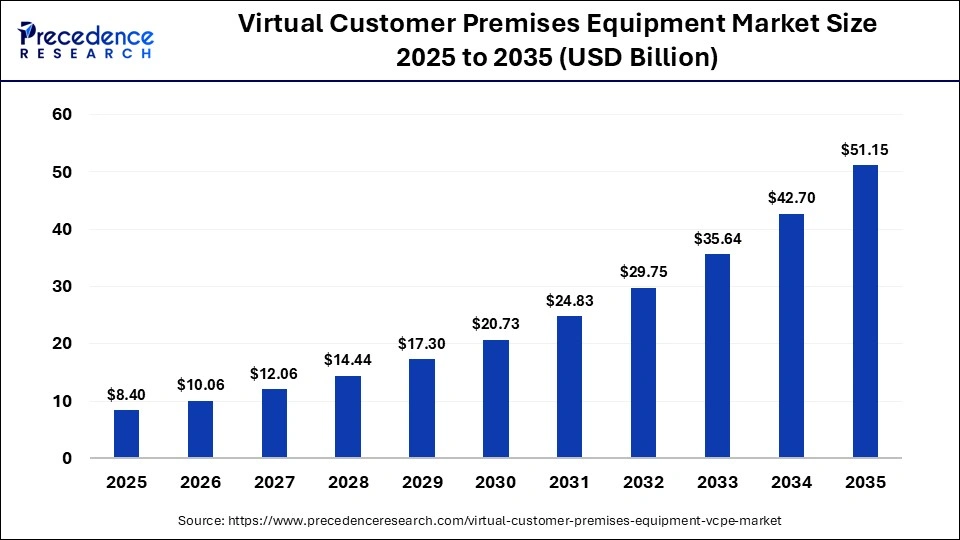

The global virtual customer premises equipment market size was calculated at USD 8.40 billion in 2025 and is predicted to increase from USD 10.06 billion in 2026 to approximately USD 51.15 billion by 2035, expanding at a CAGR of 19.80% from 2026 to 2035.The market is witnessing substantial growth due to the intense demand for network flexibility and cost-effective software-defined solutions, replacing traditional hardware with scalable, cloud-native virtualization.

Market Highlights

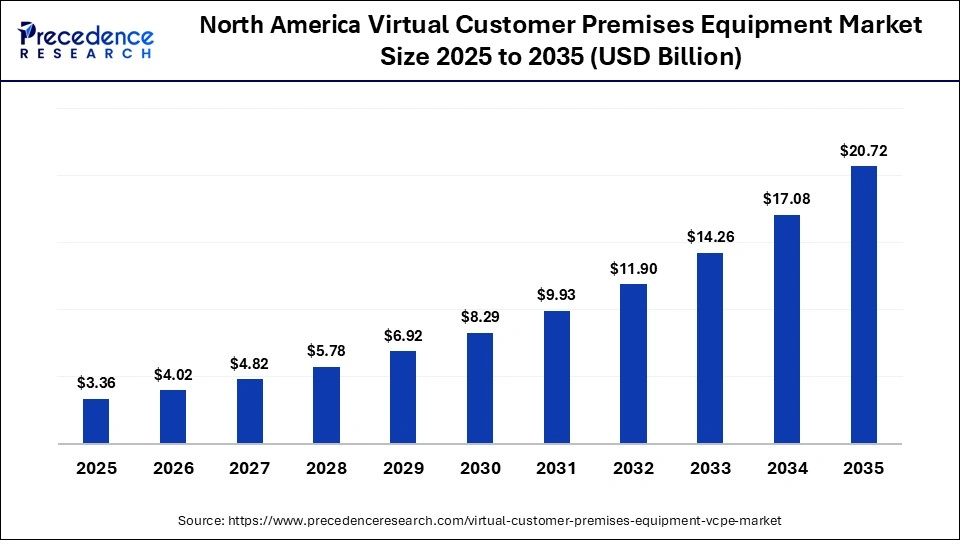

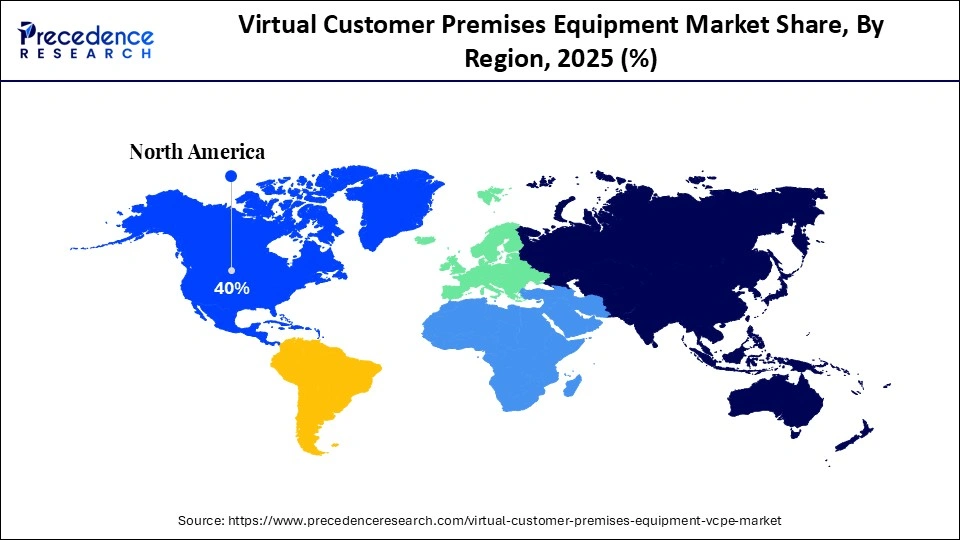

- North America dominated the market with a major share of around 40% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR of 20.4% between 2026 and 2035.

- By component, the solutions/tools segment held the biggest market share of around 60% in 2025.

- By component, the services segment is expected to expand at the fastest CAGR of 18.1% between 2026 and 2035.

- By deployment mode, the on-premises segment accounted for the largest market share of about 55% in 2025.

- By deployment mode, the cloud-based/hosted segment is expected to grow at the fastest CAGR of 18.3% between 2026 and 2035.

- By enterprise size, the large enterprises segment contributed the highest market share of 65% in 2025.

- By enterprise size, the small & medium enterprises (SMEs) segment is expected to grow at the highest CAGR of 18.8% between 2026 and 2035.

- By application / end user, the telecom & data centers segment held a major market share of around 40% in 2025.

- By application / end user, the enterprise segment is expected to expand at a strong CAGR of 18.6% from 2026 to 2035.

What is the Virtual Customer Premises Equipment Market?

The virtual customer premises equipment market comprises software-defined and virtualized network functions, including routers, switches, firewalls, and SD-WAN. Traditionally deployed on physical hardware at customer locations, vCPE enables centralized orchestration, reduced hardware dependency, improved network agility, remote management, and cost-efficient network services for enterprises and service providers. It leverages software-defined networking (SDN) and Network Functions Virtualization (NFV) technologies to virtualize network functions on standard servers, accelerating service deployment, scaling distributed networks, and supporting digital transformation across industries.

Major Trends in the Virtual Customer Premises Equipment Market

- Enhanced Integration of AI and Automation: The adoption of AI-driven network management, predictive maintenance, and advanced analytics is a major focus, enabling better security and reduced operational complexity.

- Rapid Expansion of 5G and IoT Ecosystems: vCPE is heavily utilized to support 5G-enabled services and massive IoT deployments, providing flexible and scalable network architecture for modern connectivity needs.

- Edge Computing Integration: There is a strong focus on deploying vCPE solutions that facilitate edge computing, which allows for localized data processing and significantly reduces latency for applications.

- Advanced Security and Compliance: As networks virtualize, embedding robust, built-in security features, rather than relying on or adding on separate, expensive hardware, is crucial for ensuring compliance and protection against threats.

How is AI Transforming the Virtual Customer Premises Equipment Market?

Artificial intelligence is transforming the global market. By leveraging ML, vCPE solutions now feature automated service provisioning, real-time troubleshooting, and AI-enablededge computing to manage data without requiring on-site interventions. AI enables automated provisioning, fault detection, and resource management, which streamlines network operations and improves efficiency. AI algorithms analyze data from vCPE to identify potential issues before they cause downtime, significantly enhancing system uptime and reliability, reducing operational costs, and improving user experiences.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8.40 Billion |

| Market Size in 2026 | USD 10.06 Billion |

| Market Size by 2035 | USD 51.15Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 19.80% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Component, Deployment Mode,Enterprise Size, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Outlook

Component Insights

What Made Solutions/Tools the Leading Segment in the Virtual Customer Premises Equipment Market?

The solutions/tools segment led the market with approximately 60% share in 2025. This dominance is primarily attributed to its ability to enable network operators to deploy, manage, and optimize virtualized network functions efficiently. This segment includes virtual routers, switches, compliance tools, and infrastructure management platforms. The growing popularity of cloud-based SD-WAN solutions and SDN is driving demand for centralized management and orchestration tools. These solutions facilitate faster service provisioning, improved security against threats, and optimized network performance.

The services segment is expected to grow at the fastest CAGR of 18.1% throughout the forecast period. This growth is driven by the increasing demand for managed services and professional support for complex network migrations, along with the shift toward subscription-based, agile network management. As businesses adopt vCPE, they are increasingly reliant on service providers to handle day-to-day operations, security, and performance optimization. The transition from physical to virtualized environments requires specialized skills, which is driving the need for professional services such as consulting and implementation.

Deployment Mode Insights

How Did the On-Premises Segment Dominate the Virtual Customer Premises Equipment Market?

The on-premises segment dominated the market with around 55% share in 2025. This is mainly due to the superior data security, regulatory compliance, and lower latency it offers for critical, data-intensive, and real-time applications. On-premises solutions are particularly suited for applications that require immediate, real-time responses, which is crucial in industries like manufacturing and telecommunications. Businesses with existing, complex infrastructures find it easier to deploy and manage on-premises vCPE, allowing them to keep sensitive data within their own data centers without immediately shifting to cloud-only models.

The cloud-based/hosted segment is expected to expand at the fastest CAGR of 18.3% in the upcoming period. This growth is primarily driven by its high scalability, flexibility, and cost-effectiveness compared to traditional hardware. The cloud model streamlines service deployment, offering centralized management and reduced operational complexity for both service providers and enterprises. The broader migration of data and services to cloud-native network functions, along with increasing demand for 5G, IoT solutions, and remote work infrastructure, is driving the need for cloud-first vCPE, enabling quicker service deployment and remote management.

Enterprise Size Insights

Why Did the Large Enterprises Segment Lead the Virtual Customer Premises Equipment Market?

The large enterprises segment led the market with around 65% market share in 2025. This is mainly due to these enterprises having stronger IT budgets to adopt centralized, software-driven network management, reducing their reliance on costly, fragmented traditional hardware. They utilize vCPE to lower operational expenses and improve network agility across numerous geographically dispersed locations. The demand for 5G, cloud services, and AI integration further drives large firms toward virtualized solutions for better network management.

The small and medium enterprises (SMEs) segment is expected to grow at the fastest CAGR of 18.8% in the upcoming period. The growth of this segment is driven by the high demand for cost-effective, scalable, and easy-to-manage network solutions. SMEs are quickly adopting vCPE to eliminate high upfront hardware costs, reduce complex maintenance, and enhance flexibility, benefiting from cloud-based, pay-as-you-go models. The increasing adoption of digital technologies and cloud services among smaller businesses is fueling the need for agile network infrastructure that can manage network functions effectively as they grow.

Application / End User Insights

What Made Telecom & Data Centers the Dominant Segment in the Virtual Customer Premises Equipment Market?

The telecom & data centers segment dominated the market with approximately 40% share in 2025. This is primarily due to the high demand for flexible, scalable, and cost-efficient network infrastructure in these sectors. Telecom operators and data center providers are increasingly adopting vCPE solutions to virtualize network functions, enabling faster service deployment, simplified management, and reduced operational costs.

The growing need for centralized control, automation, and orchestration to handle rising data traffic and support cloud-based services has further driven adoption. Additionally, the push for software-defined networking (SDN) and network function virtualization (NFV) in telecom and data centers has reinforced this segment's leadership, as vCPE allows for agile, programmable, and highly resilient network operations.

The enterprises segment is expected to grow at the fastest CAGR of 18.6% during the projection period. This growth is largely driven by the intense demand for improved branch connectivity, operational flexibility, and reduced hardware dependence for enhanced security and data compliance. The need to digitize and optimize branch operations through cloud-native solutions is also contributing to this growth. Enterprises in the healthcare industry are employing vCPE to support advanced HER systems, telemedicine initiatives, and improved data management, supporting segmental growth.

Regional Insights

How Big is the North America Virtual Customer Premises Equipment Market Size?

The North America virtual customer premises equipment market size is estimated at USD 3.36 billion in 2025 and is projected to reach approximately USD 20.72 billion by 2035, with a 19.95% CAGR from 2026 to 2035

What Made North America the Dominant Region in the Virtual Customer Premises Equipment Market?

North America dominated the global market by capturing around 40% share in 2025. This is mainly due to the early adoption of network virtualization, a mature, high-speed telecom infrastructure, and sustained demand for SDN and NFV. The U.S. and Canada are early adopters of NFV, SDN, and SD-WAN technologies, creating a robust, established ecosystem that provides a significant head start over other regions. The region is also home to numerous prominent vCPE vendors and technology leaders, including Cisco Systems, Juniper Networks, IBM, Dell Technologies, and Arista Networks.

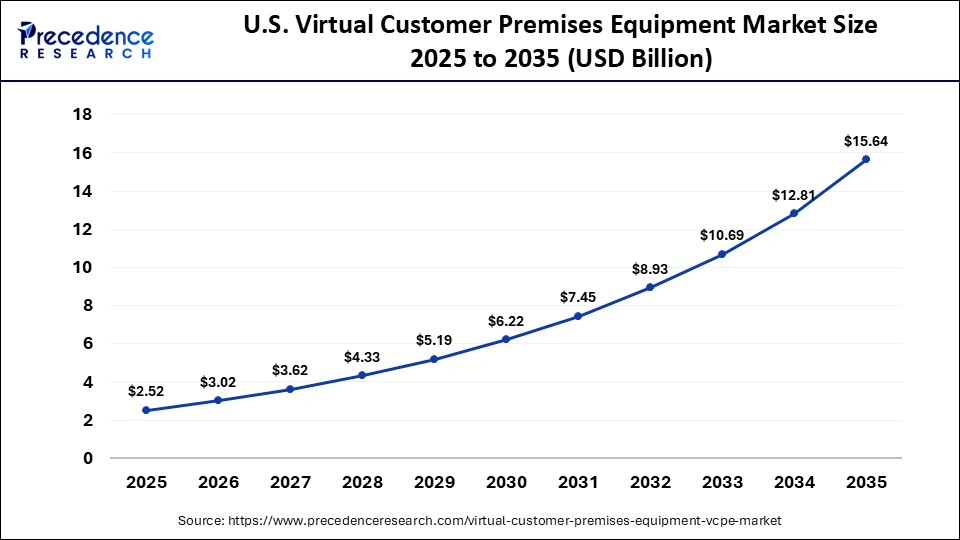

What is the Size of the U.S. Virtual Customer Premises Equipment Market?

The U.S. virtual customer premises equipment market size is exhibited at USD 2.52 billion in 2025 and is projected to be worth around USD 15.64 billion by 2035, growing at a CAGR of 20.03% from 2026 to 2035.

U.S. Virtual Customer Premises Equipment Market Trends

The U.S. is a major contributor to the North American market. The market in the U.S. is mainly driven by early adoption of Software-Defined Wide Area Network (SD-WAN) and Network Functions Virtualization (NFV) technologies. Additionally, it is home to major industry leaders such as Cisco, Hewlett Packard Enterprise, Juniper Networks, IBM, and Dell, driving innovation in network solutions. There is a rising adoption of specialized and secure networking solutions, contributing to the market.

Why is Asia Pacific Considered the Fastest-Growing Region in the Virtual Customer Premises Equipment Market?

Asia Pacific is expected to grow at the fastest CAGR of 20.4% in the upcoming period. This growth is mainly driven by massive investment in 5G infrastructure, rapid industrial digitalization, and urgent demand for cost-effective, agile network management. Countries in the region are heavily investing in 5G and edge infrastructure, which requires high-performance, low-latency networking that vCPE/uCPE solutions provide better. Rapid adoption of IoT devices in manufacturing, transportation, and utilities demands flexible, scalable network solutions to manage high data volume and diverse devices.

India Virtual Customer Premises Equipment Market Trends

India stands out as an emerging market within the region, driven by rapid digitization and expansion of network infrastructure. Significant investments in smart city initiatives and telecommunications networks are fueling demand for virtualized solutions. Additionally, growing awareness and adoption of cloud-based services and virtualized networking among businesses are enabling greater flexibility and cost efficiency. As a result, India is rapidly becoming a critical market for the adoption of scalable and next-generation networking technologies.

How is the Opportunistic Rise of Europe in the Virtual Customer Premises Equipment Market?

Europe is expected to grow at a significant rate in the market due to increasing investments in next-generation network infrastructure and the growing adoption of cloud-based and virtualized services. The region's focus on 5G rollout, network function virtualization (NFV), and software-defined networking (SDN) is driving demand for agile, scalable, and cost-efficient vCPE solutions. Additionally, stringent regulatory frameworks, growing digital transformation initiatives, and increasing enterprise reliance on flexible networking are creating favorable conditions for rapid market growth, positioning Europe as a key opportunity for vCPE providers.

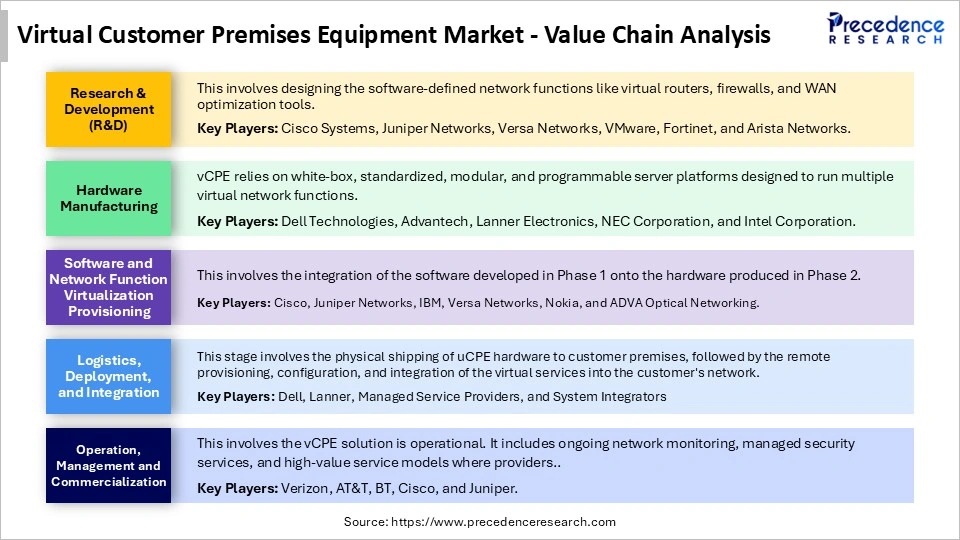

Value Chain Analysis

Who are the major players in the global virtual customer premises equipment market?

The major players in the virtual customer premises equipment market include Cisco Systems, Inc., Juniper Networks, Hewlett Packard Enterprise (HPE), VMware, Inc,. Ericsson, NEC Corporation, Versa Networks, Arista Networks, ADVA Optical Networking, Ciena Corporation, Nokia Solutions & Networks, Huawei Technologies, ZTE Corporation, Microsoft, and Amdocs

Recent Developments

- In May 2025, Reliance Jio began using its own network products to enhance 5G coverage, aiming for cost savings and reduced reliance on global vendors. The company is deploying locally made 5G small cell sites near Chennai through a joint venture with Sanmina Corp. to meet the rising demand from its 5G users. These small cells are part of Jio's broader 5G technology suite, improving mobile broadband in urban and indoor areas. (Source: https://www.telecomreviewasia.com)

- In December 2025, HCLTech announced it would acquire HPE's Telco Solutions business, bolstering its position in the telecom sector. This follows a previous transaction with HPE in 2024. The acquisition will enhance HCLTech's capabilities in intellectual property, engineering, and client relationships with leading Communication Service Providers. HPE's Telco Solutions, which supports over 1 billion devices globally, includes Operations Support Systems and advanced network automation, and has been successfully integrated into HCLTech's existing portfolio.(Source:https://www.prnewswire.com)

Segments Covered in the Report

By Component

- Solutions/Tools

- Services

By Deployment Mode

- On-Premises

- Cloud-Based/Hosted

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Application / End User

- Telecom & Data Centers / Service Providers

- Enterprises (BFSI, IT, Healthcare, Govt & Public, Others)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content