Wearable Sweat Sensors Market Size and Forecast 2025 to 2034

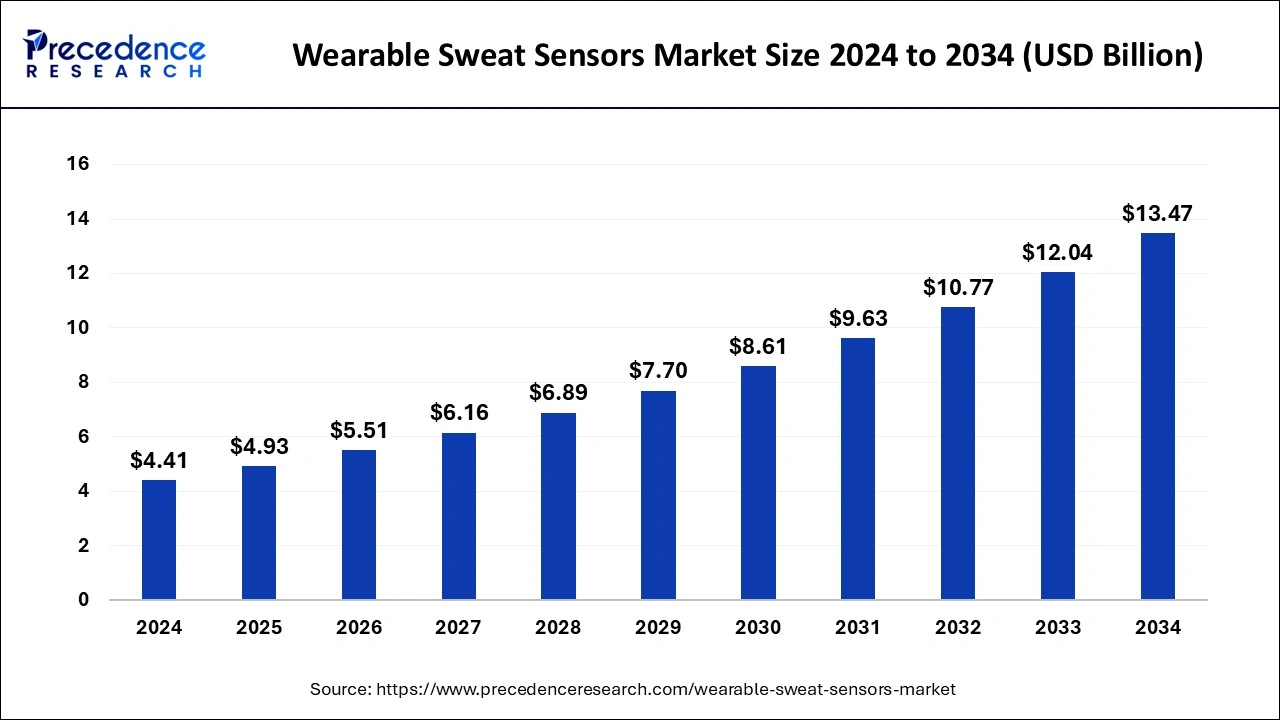

The global wearable sweat sensors market size was estimated at USD 4.41 billion in 2024 and is predicted to increase from USD 4.93 billion in 2025 to approximately USD 13.47 billion by 2034, expanding at a CAGR of 11.82% from 2025 to 2034.

Wearable Sweat Sensors Market Key Takeaways

- The global wearable sweat sensors market was valued at USD 4.41 billion in 2024.

- It is projected to reach USD 13.47 billion by 2034.

- The market is expected to grow at a CAGR of 11.82% from 2025 to 2034.

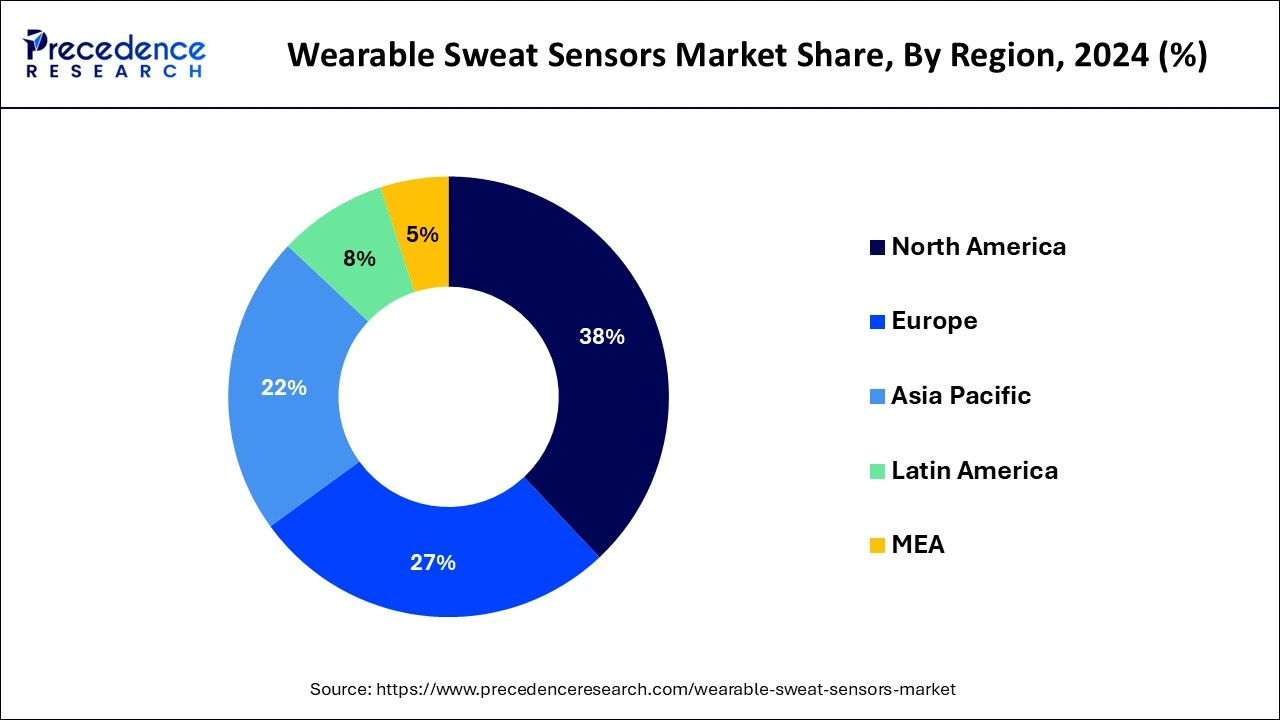

- North America dominated the wearable sweat sensors market in 2024 with revenue share of 38%.

- Asia-Pacific is expected to witness the fastest rate of growth in the wearable sweat sensors market during the forecast period.

- By mechanism, the biochemical segment held the largest segment of in 2024.

- By mechanism, the bioelectrical segment is expected to grow at a significant rate during the forecast period.

- By substance, the cortisol segment is expected to hold the dominating share of the market during the forecast period.

- By substance, the ethanol segment is expected to grow at a notable rate.

- By material, the soft polymers segment held the dominating share of the market in 2024.

- By material, the plastics segment is expected to grow at a notable rate.

U.S. Wearable Sweat Sensors Market Size and Growth 2025 to 2034

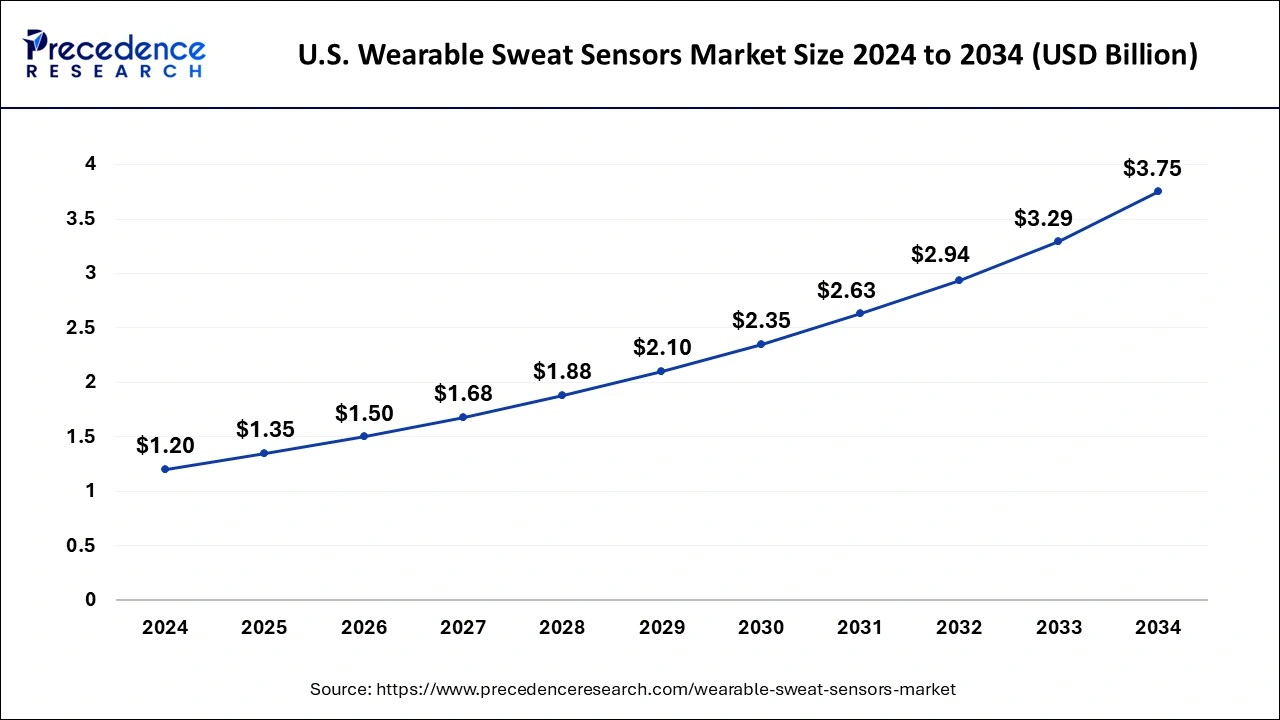

The U.S. wearable sweat sensors market size was estimated at USD 1.20 billion in 2024 and is anticipated to be surpass around USD 3.75 billion by 2034, rising at a CAGR of 12.07% from 2025 to 2034.

North America held the largest share of the market in 2024. due to its strong emphasis on health and fitness, and a well-established healthcare infrastructure. Wearable sweat sensors have gained significant attention in the region due to their applications in sports, fitness, healthcare, and research. Additionally, the region hosts numerous research institutions and companies actively engaged in R&D related to healthcare technologies. This fosters innovation in the development of wearable sweat sensors for medical applications.

Asia Pacific is poised for rapid growth in the wearable sweat sensors market due to various factors such as rapid technological advancements, increasing awareness of health and fitness, and a growing interest in wearable technologies. Countries like China, Japan, South Korea, and India are particularly active in this space. It is expected to witness significant growth as technology adoption increases, healthcare awareness rises, and the demand for fitness and health monitoring solutions continues to surge.

- In December 2023, Chinese Xi'an Jiaotong University researcher's team developed a device that provide a solution to various problem: A fiber-based, knittable, stretchable generator powered by human sweat.

Meanwhile, Europe is growing at a notable rate in the wearable sweat sensors market European countries are at the forefront of research and innovation in healthcare technologies. Ongoing efforts contribute to the development of advanced sensor technologies, including those for sweat analysis. The region boasts an advanced healthcare infrastructure, supporting the integration of wearable sweat sensors into medical practices and research institutions.

Market Overview

Wearable sweat sensors offer real-time monitoring of hydration levels, electrolyte balance, and other health indicators, making them valuable tools in optimizing athletic performance and managing certain medical conditions. However, challenges such as accuracy, comfort, and regulatory considerations persist. Technological trends include the integration of sweat-sensing capabilities into mainstream wearables like smartwatches, expanding the market's reach.

The wearable sweat sensors market's segmentation encompasses various sensor types, applications across sports, healthcare, and industrial sectors, and different end-user preferences. Regional variations in adoption highlight the dynamic nature of this market, with more developed regions often driving innovation and market growth. For the latest insights, it is advisable to refer to recent market reports and industry updates, as market trends in technology can evolve rapidly.

Wearable Sweat Sensors Market Data and Statistics

- In February 2023, California Institute of Technology's (Cal Tech) Gao lab scientists made a small, wearable device that analyzes sweat. It is developed to collect valuable chemical information from teeny bits of sweat. Gao Lab partnered with American Cancer Society (ACS) grant to study sweat sensors for people with certain types of leukemia. HIs lab's technological platform is a valuable tool to help realize a future where personalized and precision medicine is the standard of care.

- According to the Centers for Disease Control and Prevention (CDC) statistics, every year around 805,000 people in the U.S. have heart attacks. To Tackle these attacks the technology is advancing rapidly, and various smart wearable devices for cardiovascular care is increasing fast in the market. For instance, in 2022, Ohio State University Researchers developed a smart necklace biosensor that monitors physical health through a person's sweat.

Wearable Sweat Sensors MarketGrowth Factors

- Rising awareness about personal health and fitness has driven the demand for wearable devices, including sweat sensors, as people seek real-time insights into their physiological conditions during physical activities.

- The integration of sweat sensors in sports and fitness wearables has gained traction. Athletes and fitness enthusiasts use these devices to monitor hydration levels, electrolyte balance, and other vital metrics, enhancing their performance and training regimens.

- Wearable sweat sensors have found applications in healthcare, particularly in the continuous monitoring of certain medical conditions. For instance, they can assist in diabetes management by providing real-time glucose levels through sweat analysis.

- The trend of integrating sweat-sensing capabilities into existing wearables, such as smartwatches and fitness trackers, has broadened the market reach. This integration offers users a comprehensive health monitoring experience in a single device.

- Wearable sweat sensors that can monitor multiple parameters simultaneously, such as glucose, lactate, and electrolyte levels, are gaining popularity. This multi-functionality increases the utility of these devices for various applications.

- Increasing consumer interest in personalized health data and the quantified self-movement drive the demand for wearable sweat sensors. Users seek a deeper understanding of their body's responses to physical activity and environmental factors.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.93 Billion |

| Market Size by 2034 | USD 13.47 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 11.82% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Mechanism, By Substance, and By Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Sports and performance monitoring

The rising demand for sports and performance monitoring is a pivotal factor propelling the wearable sweat sensors market into prominence. Athletes and fitness enthusiasts alike recognize the significance of real-time physiological data, and sweat-sensing wearables offer a unique and holistic approach to performance optimization. The ability to tailor training regimens and hydration strategies based on individualized data sets is a game-changer for athletes aiming to push their limits while minimizing the risk of dehydration and fatigue.

Moreover, the integration of sweat-sensing wearables with other sports technologies, such as smart clothing and fitness-tracking apps, enhances the overall training experience. Athletes can receive immediate feedback on their physical condition, enabling them to make informed decisions about their performance, recovery, and injury prevention strategies. As the sports industry increasingly embraces data-driven approaches to training, the demand for wearable sweat sensors is anticipated to soar.

Restraint

High manufacturing and research cost

The demand for the wearable sweat sensors market may encounter a significant constraint due to the high research and manufacturing costs associated with the development and production of advanced devices. The intricate nature of designing and producing cutting-edge sensor technologies capable of accurately capturing and analyzing sweat biomarkers can necessitate substantial financial investments. Research endeavors to enhance sensor accuracy, reliability, and compatibility, coupled with the exploration of innovative materials and manufacturing processes, contribute to escalating research costs.

Moreover, companies in the wearable sweat sensors market may face challenges in achieving economies of scale initially, which can impact cost-effectiveness. As a result, the accessibility of these devices to a broader consumer base may be hindered, impeding market penetration.

Opportunity

Ongoing research and development efforts in the biomedical field

Researchers are delving into the vast potential of sweat as a non-invasive source of valuable health information, analyzing its composition to detect specific biomarkers associated with various health conditions.

- Penn State team of researchers developed a novel wearable made with a laser-modified graphene nanocomposite material that detects glucose levels in sweat for three weeks while simultaneously monitoring pH levels and body temperature.

The biomedical applications of wearable sweat sensors extend to disease detection, offering a revolutionary approach to early diagnosis and monitoring. These devices provide continuous, real-time data, allowing for the timely identification of biomarkers related to conditions such as diabetes, cystic fibrosis, and metabolic disorders. Furthermore, the integration of wearable sweat sensors into drug delivery systems is a promising avenue for advancing personalized medicine. These sensors can offer real-time feedback on the effectiveness of medications, facilitating precision in drug administration and improving therapeutic outcomes. Thus, ongoing research and development (R&D) initiatives in the biomedical field are presenting substantial opportunities for the wearable sweat sensors market.

Mechanism Insights

The biochemical segment dominated the wearable sweat sensors market in 2024; the segment is observed to continue the trend throughout the forecast period. Biochemical sweat sensors operate by analyzing the chemical composition of sweat. They detect and measure specific biomarkers, ions, or molecules present in sweat, providing information about an individual's health status. It is commonly used for monitoring various health parameters such as glucose levels, lactate, electrolytes, and other metabolites. They find applications in healthcare, sports science, and general wellness monitoring. It offers high specificity and sensitivity for targeted analyses. They are suitable for applications requiring precise measurement of specific chemical markers in sweat.

The bioelectrical segment is expected to grow at a significant rate throughout the forecast period. Bioelectrical sweat sensors measure electrical properties or signals associated with sweat. This can include parameters such as conductivity or impedance, providing insights into the overall electrical characteristics of sweat. It is often used to assess hydration levels and electrolyte balance. Changes in the electrical properties of sweat can indicate variations in the concentration of ions, offering valuable information for sports performance and health monitoring. it may provide real-time, continuous monitoring of sweat properties, offering insights into hydration status and electrolyte balance. They can be less invasive than biochemical sensors.

Substance Insights

The cortisol segment is observed to hold the dominating share of the wearable sweat sensors market during the forecast period. Cortisol is a steroid hormone associated with stress and plays a crucial role in various physiological processes, including metabolism and immune response. Cortisol monitoring through wearable sweat sensors can provide insights into an individual's stress levels. This has applications in stress management, mental health monitoring, and overall well-being assessment.

The ethanol wearable sweat sensors segment is expected to generate a notable share in the wearable sweat sensors market. Ethanol is the primary component of alcoholic beverages. Monitoring ethanol levels in sweat can be relevant for tracking alcohol consumption and its impact on the body. Ethanol sensors in wearables are valuable for applications such as alcohol monitoring, especially in scenarios where continuous, non-invasive tracking of alcohol levels is desired.

Material Insights

The soft polymer segment held the largest share of the wearable sweat sensors market in 2024. Soft polymers are flexible and elastic materials, often used to enhance the comfort and conformability of wearable devices. They allow the sensor to bend and stretch, making it suitable for applications where the device needs to adhere closely to the skin. Soft polymer-based sensors are commonly used in wearable devices that require a comfortable and skin-friendly interface. This is especially important for sensors designed for continuous and prolonged use.

The plastics segment is expected to generate a notable revenue share in the market. Plastics are versatile materials with a wide range of properties. Depending on the type of plastic used, it can provide flexibility, durability, and cost-effectiveness in the production of wearable sweat sensors. Plastics find applications in various components of wearable devices, including the sensor housing, substrate, or encapsulation. The choice of plastic can influence the mechanical properties and overall performance of the sensor.

Wearable Sweat Sensors Market Companies

- Technical Data Analysis, Inc.

- Xsensio

- Kenzen

- Gatorade

- GraphWear Technologies

- Balena

- Epicore Biosystems

- Gatorade

- Eccrine Systems

- Nix Hydration Biosensor

- Zansors

Recent Developments

- In February 2023, Epicore Biosystems announced that it is developing advanced sweat-sensing wearables that provide stress, personalized health insights for hydration, real-time, and wellness.

- In September 2022, Epicore Biosystems collaborated with 3M's and Innovize Inc. (Innovize) to further scale its portfolio of advanced wearable hydration solutions.

- In March 2021, Sports drink vendor Gatorade, a subsidiary of PepsiCo brand introduced a sweat-tracking wearable patch and fitness monitoring app platform aimed to provide athletes track their salt concentration, hydration, workouts, and other fitness-relevant metrics.

- In April 2019, Eccrine Systems, Inc. collaborated with Maxim Integrated Products, Inc. to integrate and develope analog signal processing technologies to drive Eccrine's sweat sensing platform.

Segments Covered in the Report

By Mechanism

- Biochemical

- Bioelectrical

By Substance

- Cortisol

- Ethanol

- Others

By Material

- Soft Polymer

- Plastics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting