What is the Wi-Fi Smart Thermostat Market Size?

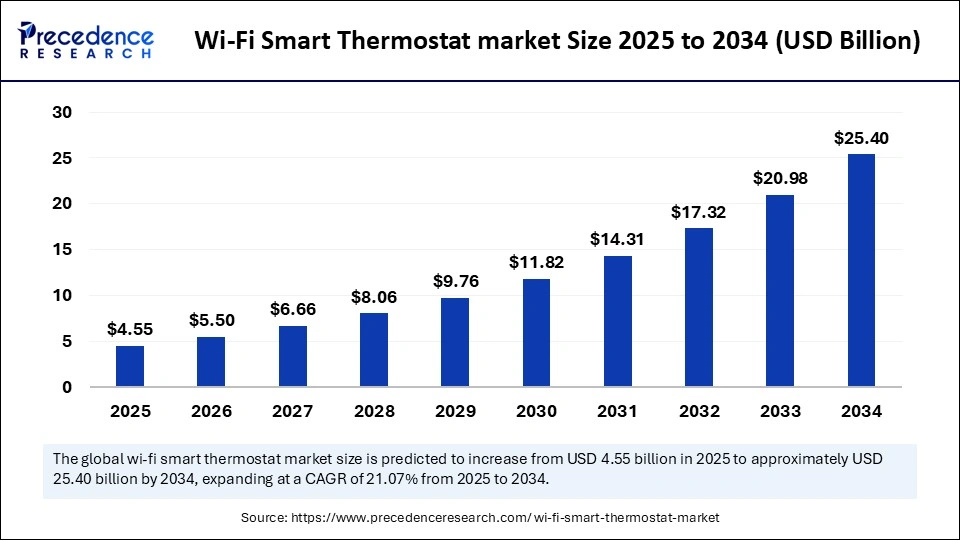

The global Wi-Fi smart thermostat market size accounted for USD 3.76 billion in 2024 and is predicted to increase from USD 4.55 billion in 2025 to approximately USD 25.40 billion by 2034, expanding at a CAGR of 21.07% from 2025 to 2034. The global market is witnessing growth driven by increased adoption of IoT and smart home technologies, driving demand for Wi-Fi-based smart thermostats.

Market Highlights

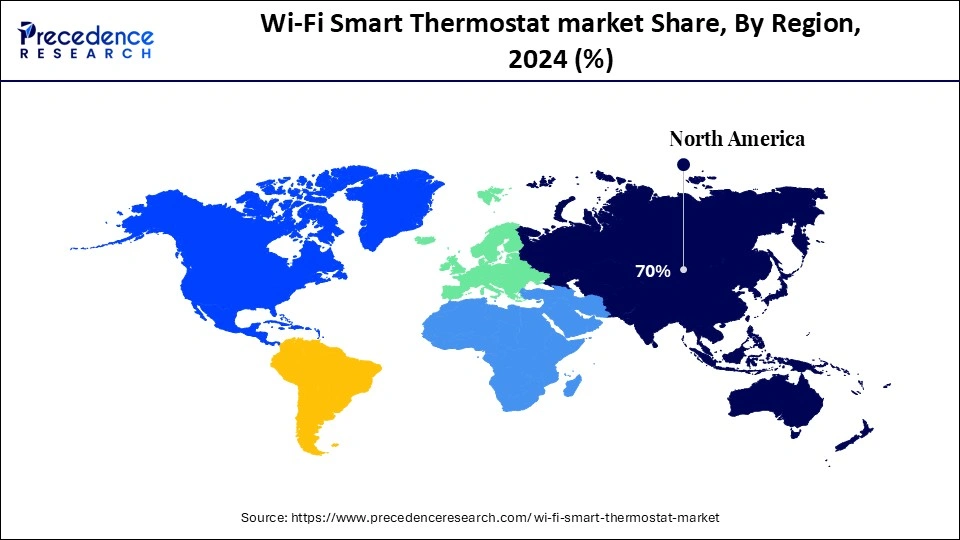

- North America dominated the global Wi-Fi smart thermostat market with the largest share of 70% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

- By product type, the learning thermostats segment captured the biggest market share of 45% in 2024.

- By product type, the zoned/multizone thermostats segment will grow at a significant CAGR between 2025 and 2034.

- By connectivity and integration, the Wi-Fi only segment contributed the highest market share of 50% in 2024.

- By connectivity and integration, the Wi-Fi + Zigbee/Z-Wave segment will grow notably between 2025 and 2034.

- By component, the hardware segment held the maximum market share of 60% in 2024.

- By component, the software segment is expected to grow at a notable rate at a CAGR between 2025 and 2034.

- By application, the residential segment accounted for the significant market share of 65% in 2024.

- By application, the commercial buildings segment will grow at a notable CAGR between 2025 and 2034.

- By distribution channel, the online retail segment generated the major market share of 55% in 2024.

- By distribution channel, the direct sales segment will grow rapidly between 2025 and 2034.

- By end-user preference, the DIY users segment led the market in 2024.

- By end-user preference, the professional installation customers segment will grow at a CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2024: USD 3.76 Billion

- Market Size in 2025: USD 4.55 Billion

- Forecasted Market Size by 2034: USD 225.40 Billion

- CAGR (2025-2034): 21.07%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is a Wi-Fi Smart Thermostat?

Wi-Fi smart thermostat refers to connected thermostat devices that allow users to remotely monitor, control, and optimize their home or commercial HVAC (heating, ventilation, and air conditioning) systems through internet-enabled platforms. These thermostats leverage Wi-Fi connectivity, sensors, AI-driven learning algorithms, and integration with smart home ecosystems (e.g., Alexa, Google Assistant, Apple HomeKit) to enhance energy efficiency, comfort, and cost savings. Growth is fueled by the rising adoption of smart homes, government initiatives for energy conservation, increasing electricity costs, and consumer demand for convenience and sustainability.

Governments worldwide are implementing favorable programs for energy conservation and sustainability. The awareness of environmental sustainability is increasing among consumers. End-users like residential and commercial sectors, such as buildings, retail spaces, and hospitality, are driving focus toward the adoption of sustainable and energy-efficient devices for large-scale energy consumption management and reducing overall cost, increasing demand for Wi-Fi smart thermostats.

AI Impacts on Wi-Fi Smart Thermostat

Artificial intelligence is significantly impacting Wi-Fi smart thermostats by learning user habits, adapting to changes, predictive climate control, increasing energy saving capabilities, system optimization adaptability, contextual awareness, and integration with seamless smart home systems. AI algorithms can learn users' preferences and habits, and help to create customized and personalized heating and cooling schedules. AI-enabled Wi-Fi smart thermostats can occupy sensors for adjusting temperatures as per optimal energy waste. AI-enabled geofencing technology makes thermostats sync with smartphones and other devices, enabling users to adjust temperature remotely and conveniently. AI enables higher energy efficiency, convenience, and insightful and analytical impacts on Wi-Fi smart thermostats.

What are the Key Trends of the Wi-Fi Smart Thermostat Market?

- Adoption of IoT and Smart Home Technologies: The adoption of state-of-the-art technologies like IoT devices and smart home devices has increased, driving the need for seamless connection for remote control, automation, and real-time monitoring.

- Energy Efficiency: The growing awareness about energy efficiency and government incentives on sustainable and energy-conservative technologies is fostering the adoption of Wi-Fi smart thermostats.

- Sustainability Focus: The government worldwide has implemented strict regulations for sustainability, reducing carbon emissions and environmental impact. The rising consumer awareness about sustainability is fueling the adoption of smart thermostats with Wi-Fi connectivity.

- Convenience and Comfort: The ability of Wi-Fi smart thermostats to offer convenient and comfortable facilities like remote access control and improved comfort within homes and buildings.

- Smart Home Ecosystem Integration: the Wi-Fi smart thermostat is a central component in a smart home ecosystem, enabling seamless integration and interoperability with advanced technologies, including cloud and IoT platforms.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 3.76 Billion |

| Market Size in 2025 | USD 4.55 Billion |

| Market Size by 2034 | USD 25.40 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 21.07% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Connectivity and Integration, Component, Application, Distribution Channel, End User Preference, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Technological Advancements and Connectivity

The increased adoption of advanced technologies like IoT, AI, ML, and other smart home technologies is driving the demand for Wi-Fi smart thermostats. These technologies are enabling remote control, predictive, and energy-saving capabilities while connecting through broadband Wi-Fi networks. Wi-Fi networks allow smart thermostats to seamlessly integrate with smart devices and voice assistants, to provide improved user experiences, great convenience, and personalized comfort. The connectivity technologies reflect near-universal router penetration and installation of workflows. The matter protocol standardization reduces friction in interoperability, enabling devices from various manufacturers and different brands to work together seamlessly.

Restraint

High Cost

The Wi-Fi smart thermostats need specialized installation and require professional expertise. The high initial investments for Wi-Fi-based smart thermostats and their installation hamper their adoption by budget-conscious consumers. Emerging economies are experiencing less adoption of these devices due to their high upfront investments. Additionally, the cost associated with complex components and integration with existing HVAC systems is further hindering the market. The manufacturing industry needs to reduce technological costs and enhance the installation process to increase market accessibility.

Opportunity

Government Initiatives for Energy Conservation

Governments worldwide are continuously implementing regulations and initiatives to promote energy-efficient application use, including smart thermostats. Several incentive programs of the government and regulatory measures for energy-conservative devices and sustainability are shifting consumer preference toward smart thermostats. This incentive encourages consumers or homeowners to increase their investments in smart thermostats for reducing energy consumption and increasing cost savings. Aligning the product with regulatory mandates and high consumer awareness to reduce cost via rebates and subsidies, driving consumers and commercial interest in Wi-Fi smart thermostats for more accessibility, reducing utility bills, and contributing to sustainability goals.

Segments Insights

Product Type Insights

What Made the Learning Thermostats Dominate the Wi-Fi Smart Thermostat Market?

The learning thermostat segment dominated the market in 2024, with approximately 45% of the market share, due to its high functionality and energy-efficient capabilities. The learning thermostats (AI-enabled adaptive control) help to improve functionality and user experiences by offering personalized climate management. This product can seamlessly integrate with other smart home devices and provides predictive maintenance. The increased consumer demands for automation and sustainability are driving the adoption of learning thermostats with AI-enabled adaptive control ability.

The zoned/multizone thermostats segment is expected to grow fastest over the forecast period, driven by its ability to enhance user experiences. The zoned/multizone thermostats offer high comfort, significant energy saving, and granular control in various areas in homes and buildings. The adoption of zoned/multizone thermostats is high in both residential and commercial spaces. The cost-effectiveness of zoned/multizone thermostats makes them highly regarded as a selling price-based product.

Connectivity and Integration Insights

What Made the Wi-Fi Only Connectivity Dominate the Wi-Fi Smart Thermostat Market in 2024?

In 2024, the Wi-Fi-only segment led the market, accounting for approximately 50% of the share, due to increased consumer preference for remote control through smartphones and other wearable devices. Wi-Fi connectivity enables energy-saving automation and ensures seamless integration with the smart home ecosystem. The need for a stable internet connection and secure network for smart home device functionality drives consumer preference for Wi-Fi-only connectivity. The advancements in Wi-Fi technology, like continuous function with its programmed schedule without internet connections, are contributing to this growth.

The Wi-Fi + Zigbee/Z-Wave segment is driven by a rapid shift toward hybrid smart thermostat systems. The Wi-Fi + Zigbee/Z-Wave enables highly flexible, power-efficient, and functional use of Wi-Fi for internet access and Zigbee/Z-wave for local access. The increased need for a strong, long-lasting, and scalable smart home ecosystem is driving the adoption of Wi-Fi + Zigbee/Z-Wave connectivity for Wi-Fi smart thermostats.

Component Insights

How Hardware Segment Leads the Wi-Fi Smart Thermostat Market in 2024?

In 2024, the hardware segment led the Wi-Fi smart thermostat market with a share of approximately 60%, due to its high functionality and performance. Wi-Fi models enable seamless connectivity and remote control via smartphone apps. Hardware components detect temperature, humidity, and occupancy, enabling precise and personalized temperature control. The growing consumer demands for improved comfort, convenience, and energy-efficient devices are contributing to the segment's growth.

The software segment is driven by its personalized settings and remote-control capabilities. Softwares like seamless applications and energy management platforms enables seamless automation integration of smart homes with other devices to reduce energy consumption and remote control. The growing consumer demands for sustainable, convenient, and connected services increase, fostering the adoption of software components.

Application Insights

What Made the Residential Segment Dominate the Wi-Fi Smart Thermostat Market in 2024?

The residential segment dominated the market, with a share of approximately 65% in 2024, due to increased consumer interest in smart home technology. The government incentives on smart home appliances for more sustainability and consumer awareness of energy efficiency, fostering the adoption of Wi-Fi smart thermostats for homes. The growing homeowners' shift toward energy-saving, convenient, and comfortable devices is fostering this growth. Additionally, technological advancements like remote access through mobiles and personalized learning features are driving the adoption of Ei-Fi smart thermostat for the residential sector.

The commercial buildings segment is expected to grow fastest over the forecast period, driven by the increased need for high-accuracy control over HVAC systems. The growing need for energy-efficient, cost-saving, and the trend of sustainability are encouraging the adoption of Wi-Fi smart thermostats in commercial buildings like offices and retail. The segment is further experiencing significant growth due to supportive government regulations and incentives for smart technologies.

Distribution Channel Insights

How Online Retail Segment Dominated the Wi-Fi Smart Thermostat Market in 2024?

The online retail segment dominated the Wi-Fi smart thermostat market with a share of approximately 55% in 2024, due to expanding e-commerce platforms and the use of online shopping sites. Online retail enables product selection, competitive pricing, and convenient home deliveries for consumers. Consumers can easily compare different devices and choose one of the best according to their needs and requirements. The growing reach of e-commerce in remote and rural areas is further adding to this growth.

The direct sales segment is the fastest-growing segment of the market, growth driven by the large contract base between builders and developers. The increasing use of Wi-Fi smart thermostats in new construction and enhancing property appeal drives their purchase directly from developers. The ability to B2B approach to standardize smart technology in the home. Leverage the value of connected features and energy efficiency promotions to make them highly preferred by the commercial sector.

End-User Preference Insights

Which End-User Preference Segment Dominates the Wi-Fi Smart Thermostat Market?

The DIY users segment dominated the market in 2024, due to increased accessibility of Wi-Fi smart thermostats and consumer preference for lower cost installation. The DIY users (self-installation) can lower the upfront cost and expand consumer access for a wider range of homeowners. The increased consumer demand for convenient, energy-saving, and integration with other smart home devices is driving DIY installation of smart thermostats. The growing homeowners' shift toward the adoption of Wi-Fi smart thermostats contributes to this growth.

The professional installation customers segment is the second-largest segment, leading the market, due to increased adoption of Wi-Fi smart thermostats in both residential and commercial sectors. Wi-Fi smart thermostats support new builds and retrofitting, and ensure optimal system performance. Professional expertise ensures efficiency in large-scale HVAC systems, contributes to cost reduction, and aligns with sustainability efforts. The Wi-Fi smart thermostat required specialized understanding for correct installation, which contributes to the segment's growth.

Regional Insights

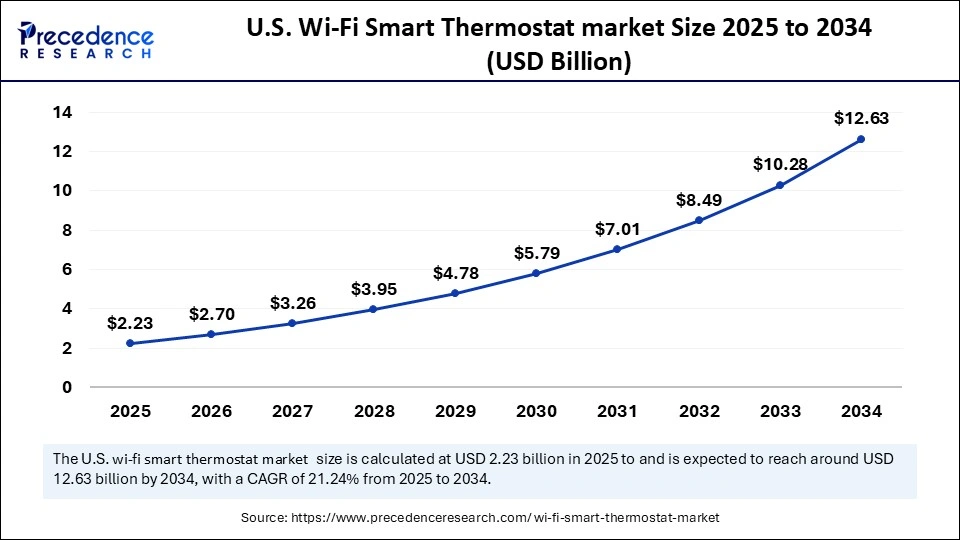

U.S. Wi-Fi Smart Thermostat Market Size and Growth 2025 to 2034

The U.S. Wi-Fi smart thermostat market size was evaluated at USD 1.84 billion in 2024 and is projected to be worth around USD 12.63 billion by 2034, growing at a CAGR of 21.24% from 2025 to 2034.

North America Wi-Fi Smart Thermostat Market

North America dominates the regional market, accounting for over 70% of the share, driven by increased demand for energy efficiency and cost savings across the region. North America is a hub for advanced technologies. The growing adoption of smart homes and government initiatives for smart cities has boosted the need for advanced devices like Wi-Fi smart thermostats. Regional key players are focusing on advancing technologies like AI, ML, and voice control for convenient and customized user experiences. The supportive government incentives, rapidly expanding smart city projects, and growing consumer preference for the convenience of remote control through mobile and other wearable devices are driving innovations and adoptions of Wi-Fi-based smart thermostats.

The U.S. Market Trends

The U.S. is a major player in the regional market, driven by countries' well-established smart cities, adoption of smart home ecosystems, and technological advancements. The U.S. has experienced high demand for reliable and user-friendly smart home solutions, enabling an accessible market for Wi-Fi smart thermostats. The government initiatives in promoting energy efficiency and demand for sustainable and energy-efficient solutions across both residential and commercial sectors are fueling this growth. The existence of key market players like Google Nest, Ecobee, Johnson Controls, and Honeywell Home is fostering significant advancements and innovations in Wi-Fi smart thermostats.

Asia Pacific Wi-Fi Smart Thermostat Market

Asia Pacific is the fastest-growing region in the global market, driven by increasing consumer demand for sustainable and energy-efficient devices. The Government of Asia has implemented several regulations and policies promoting smart cities and energy conservation programs. Ongoing trends like smart city integration, AI and personalization, and growing focus on product innovations are transforming this growth.

The emerging economies like China, Japan, India, and South Korea, and the increasing availability of disposable income, enable consumer spending on advanced devices and technologies, including Wi-Fi-based smart thermostats. The rising launch of feature-rich IoT-enabled thermostats by local manufacturers is bringing significant innovations and advancements in Wi-Fi smart thermostats.

China is a major player in the regional market, contributing to growth due to countries' expanding smart city projects and adoption of smart home ecosystems. The rising disposable income and middle-class population are driving the adoption of advanced technologies, including Wi-Fi smart thermostats. The Chinese government is actively promoting green technologies and energy-efficient solutions. China is leading smart home product production in the world. Government initiatives, access to advanced smart home devices, and cost-effectiveness contribute to increased adoption of Wi-Fi-based smart thermostats in China.

Value Chain Analysis

- Raw Material Sourcing (Metals, Electronics)

Wi-Fi smart thermostat needs high-quality electronic components, plastics, and metal. The raw materials range of electrical and housing materials mix standards.

Key Players: Texas Instruments, Renesas Electronics, Microchip Technology, Qualcomm.

- Component Fabrication and Machining

Wi-Fi smart thermostat arrays involve fabrications of injection molding, model design, and rapid prototyping, while requiring machining and specialized processes of terminal blocks, metal mounting brackets, and engraving.

Key Players: Alphabet (Google Nest). Emerson Electric Co., Johnson Controls, and Honeywell International.

- Installation and Commissioning

Installation of a Wi-Fi smart thermostat is complex, requires turning off HVAC power, laying wires, configuring the device through the app and Wi-Fi, and securing connection terminals. This is for secure precaution, verification of C-wire availability, photography of existing wiring, and the network-based commissioning.

Key Players: Daikin, Honeywell, Lennox, Google Nest, and ecobee.

Wi-Fi Smart Thermostat Market Companies

- Google Nest (Alphabet Inc.)

- Ecobee Inc.

- Honeywell International Inc.

- Emerson Electric Co. (Sensi)

- Johnson Controls International plc

- Schneider Electric SE

- Siemens AG

- Lennox International Inc.

- Carrier Corporation

- Resideo Technologies Inc.

- Tado GmbH

- Netatmo (Legrand)

- Bosch Thermotechnology

- Trane Technologies plc

- Hive Active Heating (Centrica)

- Danfoss A/S

- Control4 (Snap One Holdings)

- Lux Products Corporation

- Alarm.com

- Amazon (via Ring/Echo integration)

Recent Development

- In January 2025, Ecobee launched its smart thermostat essential at CES 2025. This is a novel smart thermostat that provides cutting-edge value and maintains the brand's signature comfort and convening features like a full color touchscreen at an affordable price. This thermostat is very simple in installation and use, and offers cost-effectiveness. (Source: https://www.businesswire.com)

- In August 2024, the fourth-generation Nest Learning Thermostat was launched by Google for a borderless design and the addition of temperature sensing with Matter support. Solid sensors have replaced conventional proximity and motion sensors with cutting-edge presence sensing. (Source: https://en.wikipedia.org)

Segment Covered in the Report

By Product Type

- Learning Thermostats (AI-enabled adaptive control)

- Programmable Thermostats

- Non-Programmable Wi-Fi Thermostats

- Zoned/Multizone Thermostats

By Connectivity and Integration

- Wi-Fi Only

- Wi-Fi + Bluetooth

- Wi-Fi + Zigbee/Z-Wave

- Integrated Smart Home Ecosystem (voice assistants, smart hubs)

By Component

- Hardware (sensors, display, control units)

- Software (apps, energy management platforms)

- Services (installation, maintenance, subscription-based monitoring)

By Application

- Residential

- Commercial Buildings (offices, retail)

- Industrial Facilities

- Hospitality (hotels, resorts)

By Distribution Channel

- Online Retail (e-commerce platforms, company websites)

- Offline Retail (electronics stores, HVAC distributors)

- Direct Sales (B2B, contracts with builders/developers)

By End User Preference

- DIY Users (self-installation)

- Professional Installation Customers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting