Wiring Devices Market Size and Forecast 2025 to 2034

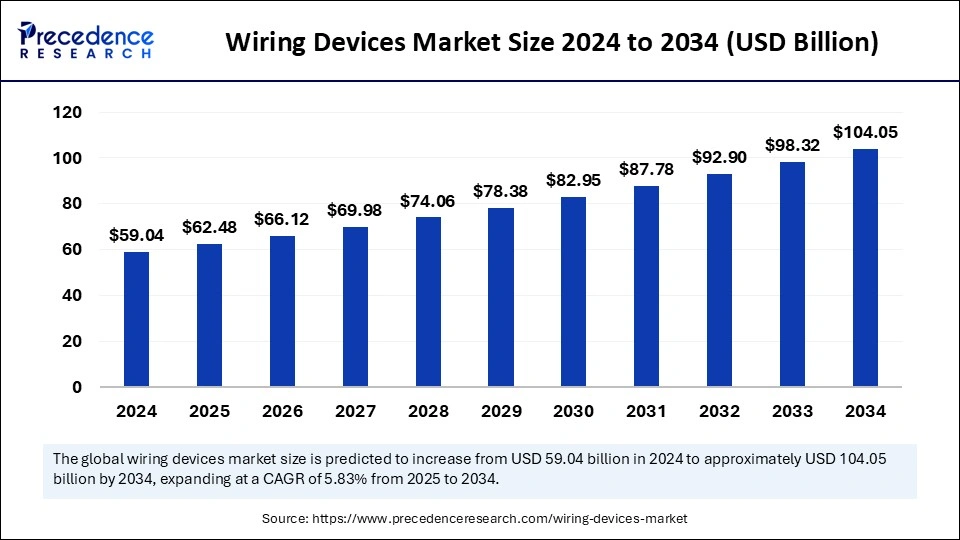

The global wiring devices market size was estimated at USD 59.04 billion in 2024 and is predicted to increase from USD 62.48 billion in 2025 to approximately USD 104.05 billion by 2034, expanding at a CAGR of 5.83% from 2025 to 2034.The market is growing due to urbanization, increasing energy efficiency demands, industrial expansion, stringent safety regulations, and rising smart home adoption, driving demand for advanced, connected, and efficient wiring solutions.

Wiring Devices Market Key Takeaways

- Asia Pacific led the global wiring devices market with the highest share in 2024.

- Europe is estimated to expand the fastest CAGR in the market between 2025 and 2034.

- The North American market has been expanding rapidly in recent years.

- By type, the current-carrying segment held the largest market share in 2024.

- By type, the non-current carrying segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By product, the switches segment captured the biggest market share in 2024.

- By product, the receptacles segment is expected to grow at a notable CAGR over the projected period.

- By end user, the residential segment captured the biggest market share in 2024.

- By end user, the commercial segment is expected to grow at a considerable rate during the projected period.

AI Powered Wiring Devices Transforming Smart, Safe, and Efficient Electrical Systems

Artificial intelligence (AI) is transforming the electrical industry by adding intelligence, automation, and connectivity to wiring devices. AI-based solutions improve operational performance and safety, such as smart switches designed to analyze energy consumption patterns and offer personalized insights or, too, automated wiring inspections that enhance safety standards and compliance. Furthermore, Edge AI allows for the processing of data to occur in real time within Internet of Things (IoT) devices. For instance, META-aivi Edge AI allows wiring to be inspected and for guidance to be offered to operators in real time, as well as can offer measures related to safety standards.

Smart switches are used increasingly in smart grid applications that allow for adjusting energy consumption based on factors like real-time pricing, grid conditions, and availability of renewable energy. In either case, incremental optimism and expediency are added by utilizing AI, resulting in reduced reliance on fossil fuels and enhanced sustainability attributes. The implications of AI will undoubtedly foster smarter, safer, and energy energy-efficient electrical systems, driving changes in consumer and industrial user applications.

Market Overview

The wiring devices market includes electrical systems that are used to control, distribute, and connect electricity to equipment, people, and devices across residential, commercial, and industrial applications. Wiring devices include switches, sockets, plugs, dimmers, and smart wiring solutions geared toward enabling energy efficiency and safety. The rapid advancements in automation across industrial and commercial spaces will only strengthen the growth of wiring devices, which is becoming increasingly attractive for investment.

The market will be driven by rapid urbanization, the adoption of smart homes, and growing demand for energy-efficient products. It is changing as the industry adapts to lightning-fast advancements in wireless control and IoT-enabled devices. In addition, the surge of construction and climbing safety regulation requirements are leading to more innovation of products in the market. Leading companies will continue to drive the market with smarter, modular, and more aesthetically pleasing designs to meet consumer preferences.

- In March 2025, AI advancements drove TS Conductor to invest USD 134 million in a new electric wire manufacturing plant near Savannah, Georgia.

Wiring Devices Market Growth Factors

- Rising demand for energy efficiency: With consumers becoming increasingly aware of energy management and as government regulations motivating energy-efficient wiring devices like smart switches, dimmers, and controlled solutions, this will support the rise of market growth.

- Expansion of industrial and manufacturing sectors: As industrial automation and growth in manufacturing continue, there is a demand for better wiring solutions for power distribution, control panels, and safety systems, which will increase the use of wiring devices that are more efficient.

- Stringent electrical safety regulations: Governments and regulatory bodies will enforce policies that will lead to a demand for quality wiring devices that can be tamper-proof and resist fire in residential, commercial, and industrial applications.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 104.05 Billion |

| Market Size in 2025 | USD 62.48 Billion |

| Market Size in 2024 | USD 59.04 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.83% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Product, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Global urbanization

Urbanization is increasing swiftly across the globe, with more than 4.4 billion people (more than half of the world's population) living in cities today. Specifically, nearly 7 in 10 people are expected to live in urban areas by 2050, with a significant increase in the need for residential and commercial infrastructure. This unprecedented urban expansion increases the need for reliable electrical installations, subsequently affecting the wiring devices market.

Governments across the world are also investing in smart cities and industrial corridors to accommodate urbanization growth. For example, India announced the Smart Cities Mission, which has funded 7,491 completed projects worth INR 1.5 lakh crore, with an additional 567 projects underway. As smart cities and modern buildings continue to evolve, there will be demand for switches, sockets, circuit breakers, and smart wiring devices as objectives, which will indicate the future growth of the wiring devices market overall.

Restraint

Soaring raw material costs

Commodity pricing in the wiring devices market is often influenced by sharp swings in the cost of raw materials, specifically, key components like copper, aluminum, and plastics. The long-term upward trend in copper prices is attributed to increased demand globally and speculation surrounding potential tariffs from the U.S. Some forecasts predict copper prices will reach or exceed USD 12,000 per tonne by 2025. Like copper, aluminum prices exhibit a high degree of variability due to supply chain issues and geopolitical uncertainty, although the World Bank anticipated moderate price increases of 2% in 2024 and an additional 4% in 2025.

These unpredictable pricing variances present significant problems for the profit margins of manufacturers, as well as the pricing strategy itself, which other research suggests is a restraint on the growth of the market. However, the effects of price changes don't stop there. Manufacturing companies are often forced to work through multiple uncertain cost estimates, which, in turn, complicate planned pricing schemes. The uncertainty can lead to reduced profitability for manufacturers and stalled innovation and expansion plans upon diverging capital dollars to immediate cost expenses. Even when manufacturers suggestion planned pricing, constantly adjusting prices can erode customer trust and competitiveness.

Opportunity

Growth in electric vehicle (EV) infrastructure

The global shift to electric vehicles is creating a significant opportunity for the wiring devices market, thanks in large part to the growing need for EV charging infrastructure. The number of public charging points is expected to increase more than four-fold by 2030 to over 15 million and nearly 25 million by 2035. With this acceleration comes the need for quality wiring devices, such as industrial-grade sockets, connectors, and circuit protection systems that help ensure safe and reliable power distribution. There will also be opportunities for the sale of integrated wiring solutions for residential, commercial, and public EV charging stations.

As public and private organizations invest heavily in EV infrastructure, this market will capitalize on manufacturers who provide durable, weather-resistant, and energy-efficient wiring solutions. Companies with custom solutions for smart connectivity, surge protection, and modularity will be at an advantage in this fast-paced market.

Type Insights

The current-carrying segment held the largest wiring devices market share in 2024, as they are the primary means of distribution of electrical energy. The continuing demand for electricity in residential, commercial, and industrial distribution and construction, as well as the continuing urbanization, support the market share of current-carrying wires. The introduction of higher technology receptacles with smart connectivity options further adds to the current-carrying factor.

The non-current carrying segment is anticipated to grow at a remarkable CAGR between 2025 and 2034 from increased emphasis on electrical safety and the resilience of the infrastructure. Due to heightened regulatory safety standards, the latest generation of electrical boxes and fittings are experiencing increased demand due to higher safety and regulatory compliance for commercial and industrial applications. The transition to smart buildings and more energy-efficient electrical systems is also fueling the growth of the non-current carrying devices.

Product Insights

The receptacles segment captured the biggest wiring devices market share in 2024 due to their necessity for all electrical systems. The electrification of residential and commercial buildings, combined with a growing consumer appetite for feature-rich receptacles (USB, surge protection, or tamper-resistant), continues to drive overall category growth. Increased emphasis on building codes requiring additional electrical safety features creates replacement demand for receptacles, further supporting the segment's dominance. Additionally, receptacles with smart plug configurations for the Internet of Things (IoT) add to the existing receptacle share where electrical system modernization is the highest priority in established markets.

The switches segment is expected to grow at a notable CAGR over the projected period, correlating to increased adoption of smart home technologies and energy-efficient lighting control schemes. Demand for touch-sensitive, voice, and wireless switches has led to accelerated growth in consumer demand for convenience, automation, and energy savings. Additionally, the developing landscape of connected devices in residential and commercial spaces has further added to the demand for advanced switch solutions. Finally, government initiatives in energy reduction, along with urban development initiatives under the Smart City framework, will lead to an increased demand for enhanced switching solutions as the fastest growing segment within the wiring devices market.

End User Insights

The residential segment captured the biggest wiring devices market share in 2024 due to accelerated urbanization, heightened electrification of homes, and growing consumer expenditures on home automation. The growth of both new housing unit construction and home renovations will support a large market for wiring devices. In addition, the rise of smart homes with IoT-enabled electrical systems is increasing the market for advanced wiring devices. The influence of government policies to support affordable housing and electrification projects in developing economies further reinforces the residential market's position.

The commercial segment is expected to grow at a considerable rate during the projected period due to the rapid expansion of office space, retail, hotel and lodging, and data centers. Increasing energy efficiency regulations and the adoption of smart electrical infrastructure in commercial buildings drive the demand for advanced wiring devices. The shift to a digital workplace environment, which is creating the need for more advanced power management systems, is contributing to the growth of the market. Along with the rising investment in commercial real estate and infrastructure development projects in developing economies, this all drives demand for advanced wiring devices, making the commercial market the fastest-growing segment of the total market.

Regional Insights

Asia Pacific: Dominance Fueled by Urbanization and Technological Advancements

Asia Pacific maintains its strength in the wiring devices market, largely driven by rapid urbanization and significant infrastructure development. In 2024, Vietnam saw record foreign direct investment (FDI), particularly in high-value sectors such as electronics and green technology. Increasing adoption of electric vehicles and smart technology will also contribute to growing demand across residential, commercial, and industrial markets.

- In November 2024, Shunsin Technology Co., a division of Foxconn, announced an USD 80 million investment in Bac Giang province for a planned plant that will produce approximately 4.5 million electronic components a year to be exported to the U.S., EU, and Japan.

Notably, China has seen increased sales in wiring devices due to government policies addressing energy efficiency and sustainable development. Smart city initiatives in China further drive the need for complex wiring devices. Additionally, the "China Plus 1" strategy, aimed at reducing dependence on Chinese manufacturing amid increased geopolitical tensions, is pushing companies to diversify their supply chains to emerging manufacturing hubs, such as Vietnam and Malaysia. The emergence of these manufacturing bases strengthens Asia Pacific's control of the market.

Europe's Market Expanding with Renewable Energy and Smart Tech

Europe is estimated to expand the fastest CAGR in the wiring devices market between 2025 and 2034 due to advances in technology and a focus on energy efficiency. The region's focus on sustainability has led to the adaptation of smart technologies throughout various infrastructure projects. For example, European cities are investing heavily in various smart city initiatives for improving the quality of urban life, which often include smart wiring systems to support improved connectivity and management of energy consumption. The use of renewable sources of energy, such as wind and solar, continues to drive growth in the market, as these applications require specific types of wiring solutions to support distributed energy generation.

Germany is a leader in the growth of the wiring devices market with renewable energies, supplying over 60% of public electricity generation for the first time in 2024. Moreover, Germany's growing automotive sector investment in electric vehicles (EVs) requires extensive charging infrastructures and smart wiring devices to accommodate expansion. As of July 2024, Germany had registered 142,793 public chargers; it now has 30,048 fast-charging public chargers available. Finally, the German government is supporting energy-efficient building codes, which promote the installation of smart devices in residential and commercial buildings.

North American Wiring Devices Surge with Manufacturing & Infrastructure Investment

The North American wiring devices market has been expanding rapidly in recent years due to a rebirth of manufacturing and significant upgrades in aging infrastructure. Advances in domestic manufacturing have created robust investment into new and improved factory upgrades, creating demand for more sophisticated wiring devices. For instance, the U.S. government has recently allocated USD 800 million towards infrastructure upgrades in national laboratories to enhance scientific and technological innovation. Moreover, efforts to upgrade aging power grids to accommodate renewable energy and improve resiliency of extreme weather events have also contributed to growth in demand for wiring devices.

In the United States, companies such as Schneider Electric are leveraging this growth by expanding their investment and workforces. In March 2025, Schneider Electric announced an emphasis on investing over USD 700 in U.S. operations through 2027. The investments will improve and enable energy infrastructure that is necessary for developments in artificial intelligence and drive greater capabilities for manufacturing goods in the U.S. The expansion will also create over 1,000 new jobs in multiple states, including Tennessee, Massachusetts, Texas, Missouri, Ohio, and the Carolinas. These also embody a larger trend of investments in domestic manufacturing and infrastructure, creating a pro-wiring device manufacturing environment and expanding the market.

Wiring Devices Market Companies

- ABB

- Furukawa Electric Co., Ltd.

- Hubbell

- KEI

- Legrand, LLC

- Leviton

- Marinco Power Products

- Molex

- Orel Corporation

- OSRAM GmbH

- Schneider Electric

- Simon Electric Pvt. Ltd.

- SMK Corporation

- TE Connectivity

- Vimal Switches

Recent Developments

- In March 2025, ELEGRP, a global leader in electrical supplies, unveiled its innovative TrapConnect™ technology at the 2025 International Builders' Show (IBS), transforming residential and commercial wiring with enhanced speed and efficiency.

- In August 2024, Schneider Electric, a leader in energy management and automation, announced the integration of Matter protocols into its X Series connected wiring devices, enhancing smart home connectivity and interoperability.

- In May 2024, ABB announced the acquisition of Siemens's wiring Accessories business in China, expanding its electrification portfolio and enhancing its smart building solutions for the regional market.

Segments Covered in the Report

By Type

- Current carrying

- Non-current carrying

By Product

- Receptacle

- Switches

- Others

By End User

- Residential

- Commercial

- Industrial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting