What is Zero Waste Packaging Market Size?

The global zero waste packaging market size was estimated for USD 316.89 billion in 2025 and is anticipated to reach around USD 784.14 billion by 2035, growing at a CAGR of 9.48% from 2026 to 2035.

Market Highlights

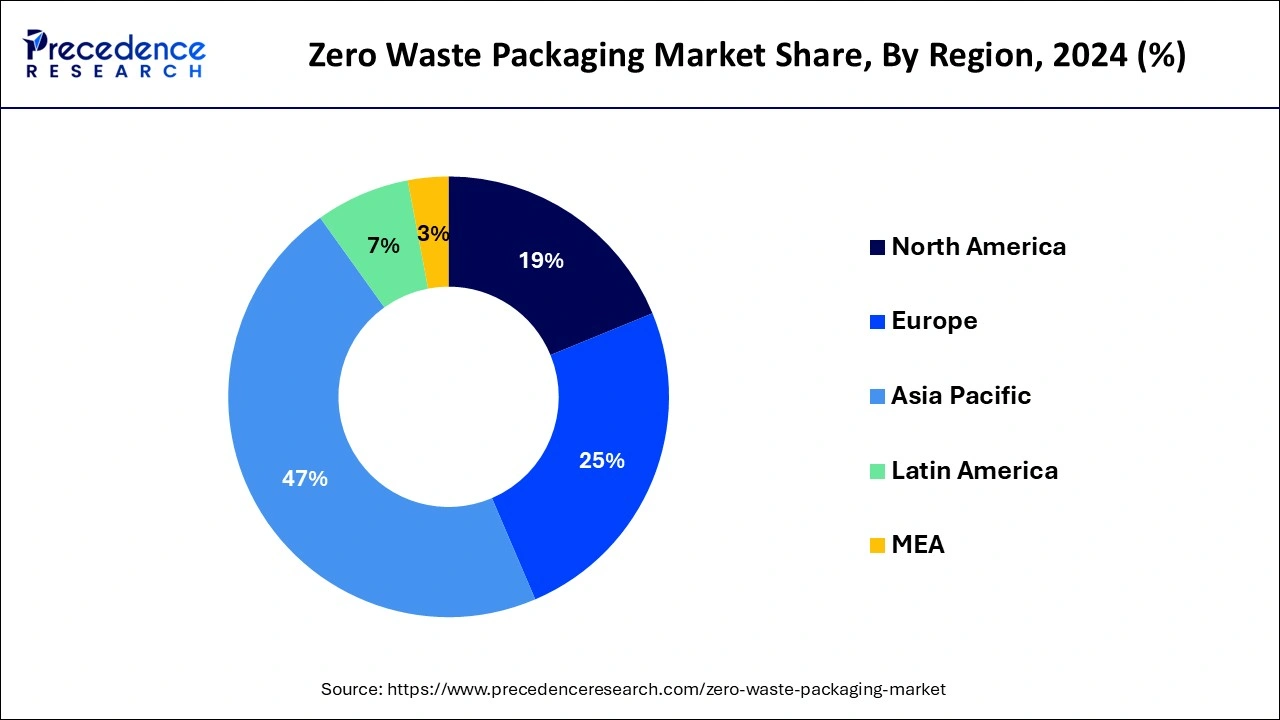

- Asia Pacific dominated the global zero waste packaging market with the largest market share of 47% in 2025.

- North America is growing at a CAGR of 9.65% during the forecast period.

- By material type, the compostable goods segment contributed the highest market share of 76% in 2025.

- By distribution channel, the offline segment held a significant market share in 2025.

- By distribution channel, the online segment is expected to grow at the fastest CAGR of 9.96% during the forecast period.

AI's Sustainable Role in the Zero Waste Packaging Sector

Artificial Intelligenceserves in a highly productive role that is essential zero waste packaging. AI-driven automated recycling systems can effectively identify and sort as well as process recyclable materials by directing them into separate bins while identifying contaminants. Intelligent packaging powered by sensors and RFID tags will become smart enough to record every step that a product undertakes from the point of production to consumption; thus, it will provide pertinent information for making informed decisions in the retail sector. This artificial intelligence is key to meeting sustainable goals anddeveloping sustainable packaging solutions, such as optimum material and design identification (the streamlining process) for waste reduction. AI-powered analytics can also improve supply chain efficiency while automating processes to deliver products on time and maintain quality. In a nutshell, it advocates that, with the help of AI, we can easily envision a different way of addressing the problems associated with packaging waste and having them safely adopted for sustainability and the greening of the industry.

Zero Waste Packaging Industry's In-Depth Overview

Zero waste packaging is hailed as a fresh industrial revolution. It guarantees that items will be packaged in a way that produces no waste. This is mostly accomplished through the use, recycling, and reuse of trash. Waste created by packing materials is an issue everywhere in the globe. As a result of being buried in landfills or thrown in the ocean, a sizable amount of the garbage also affects aquatic life and forms massive islands of rubbish. As a result, strict environmental rules have been developed. For instance, in 2020, the Singapore government launched a collaborative project called The Singapore Packaging Agreement (SPA). A joint initiative between the government of Singapore, NGOs and the packaging industry, to diminish packaging waste.

An agreement is optional in order to provide the sector freedom in implementing affordable waste reduction strategies. The requirement for zero waste retailers is being met by these growing concerns, which essentially encourage consumers to bring their own packing materials, including bags and containers, among others, to transport their purchases from the stores. Throughout the forecast period, these factors are projected to support the zero-waste packaging market's expansion.

The zero-waste packaging market is predicted to increase significantly as a result of the strict regulatory environment, the worldwide environmental crisis, and other factors. Over 200 million tonnes of plastic are being produced each year and landfilled. Furthermore, because it produces a significant amount of harmful gas waste during industrial burning, only a few number of recycling methods guarantee a totally clean-riddance. Furthermore, single-use plastics are prohibited in a large number of nations worldwide. The food and beverage businesses are quite concerned about this. Major businesses in the beverage industry claim that single-use plastic replacements are not currently practical or financially viable.

Players in the zero-waste packaging industry should expect to benefit from significant innovation possibilities as a consequence of the critical need and need to address an enduring issue. Fast moving consumer goods (FMCG) corporations have partnered with businesses like Dabur India Ltd., which uses zero-waste packaging techniques to deliver products to customers using minimum packaging and collect the residual waste for reuse and recycling. This procedure increases the profitability for zero-waste packaging producers while raising environmental issues with regard to trash management throughout the world.

The expensive cost of zero waste packaging materials, however, could serve as a market restraint. Though currently more expensive than plastic garbage, zero waste materials don't require extra costs like financing to clean the waste. For instance, according to estimates from the World Economic Forum, waste from plastic packaging causes an annual loss of $80 to $120 billion. Additionally, the quickly growing food and beverage sector and rising e-commerce sales are some of the reasons that are anticipated to create a number of potential opportunities for the market in the years to come.

Zero Waste Packaging Market Growth Factors

Waste created by packing materials is an issue everywhere in the globe. As a result of being buried in landfills or thrown in the ocean, a sizable amount of the garbage also affects aquatic life and forms massive islands of rubbish. As a result, strict environmental rules have been developed.

With the expansion of the consumer goods business, both marked and unmarked product consumption has multiplied, which in turn has raised the demand for sustainable packaging techniques. In an effort to use fewer raw materials, efforts include improving production methods, reducing the size and thickness of the actual packaging produced, eliminating unnecessary packaging, etc.

- Numerous uses for zero-waste packaging in the food, beverage, and other industries;

- Increasing demand for environmentally friendly packaging techniques.

Market Outlook

- Start-up Ecosystem: The start-up growth is at its peak due to the sustainable trends all over the region, considering the regulatory rules and initiatives. As observed, the start-ups are producing packaging from coconut fiber, mushroom mycelium, and several types of food waste, such as banana peels and coffee grounds. This fascinates many packaging giants, and thus, the start-ups are rewarded with the required growth to survive the vast packaging market.

- Industry Growth Overview:The industry growth is aligned with the rigorous regulatory pressure and materials innovation. Companies are largely accelerating the use of paper and cardboard and offer same to the clients, which leads to responsible industry growth throughout the packaging cycle and competition as well.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 316.89 Billion |

| Market Size in 2026 | USD 347.37 Billion |

| Market Size by 2035 | USD 784.14 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 9.48% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Material Type, Application, Distribution Channel and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Market Drivers

- Rising concern for environment- The biggest businesses in the world are rising to the challenge and implementing zero-waste packaging solutions as demand rises. Coca-Cola, for instance, recently revealed its World without Waste Initiative, with the goal of employing 50% recycled materials to attain 100% recyclable packaging. It also plans to collect and recycle one bottle or can for every item sold. Similar to this, Unilever announced a 50% decrease in its use of virgin plastics. It opened the door for brand-new techniques for handling and gathering plastic packaging.

- Adoption of Technologies- Over time, it is anticipated that the implementation of a number of cutting-edge technologies, including automation and 3D printing, will increase the production capacity of zero waste manufacturers, leading to lucrative market prospects. Additionally, increasing disposable income, the food and beverage industry's rapid expansion, and rising healthcare need are anticipated to increase demand for zero waste packaging and propel market growth.

Key Market Challenges

- Lack of Knowledge: Because they are unaware of how their current practices harm the ecosystem, many businesses today do not practice sustainability. The majority of them also need the expert advice required to evaluate their operations and comprehend how embracing sustainable practices will enhance earnings while also helping to save the environment.

- Special disposal technique: Zero-waste packaging materials can need special disposal techniques. Customers might not, however, be aware with the many types of packaging or how to properly dispose of them. These issues can hamper the zero waste packaging market growth over the forecast period.

Key Market Opportunities

- End-user packaging with zero waste - Adoption of zero-waste packaging promotes producers and customers to switch to sustainable lifestyles that involve reusing packaging so that ultimately no trash is produced. The use of FMCG items has significantly increased, especially as the consumer goods sector has expanded over the past several years. This has increased demand for environmentally friendly packaging techniques like zero waste packaging.

- Demand advanced, robust, and reliable packaging solutions- The zero waste packaging market is anticipated to grow considerably as the e-commerce and food and beverage sectors continue to look for innovative, robust, and trustworthy packaging solutions. E-commerce is dislodging conventional brick and mortar businesses in many regions of the world. It also serves as a driving force behind the growing global demand for food delivery. Major pharmacies like Walgreens have launched online ordering and delivery companies in reaction to Amazon. Electronics, apparel, and other new services will be in high demand as a result of the growth of this business. The market for zero waste packaging is anticipated to expand as a result of the rising need for innovative packaging as well as technological advancements like automation and 3D printing.

Segment Insights

Material Type Insights

The compostable goods segment contributed the highest market share of 76% in 2024. This is largely due to increased knowledge and worries about the importance of waste among the worldwide population that might have negative impacts on the environment.

As a result, consumers are increasingly looking for compostable goods as a reliable substitute for other disposable items when disposing of garbage. Since they are seen as a necessary alternative to other disposable items, compostable products have been more in demand for waste disposal. Additionally, the end-use industry's food and beverage sector is predicted to see the highest CAGR of 9.44% throughout the projection period.

Distribution Insights

Due to the rising demand for recycled and biodegradable packaging options, the offline sector dominated the worldwide zero waste packaging market. To reduce the usage of plastic, the retail firms are working with the suppliers of zero waste packaging solutions, which is anticipated to fuel the sector development over the forecast period. For instance, Virgin Megastore, a global network of entertainment retail stores, works with Avani Eco in November 2019. Virgin Megastore began utilizing customized Avani Bio's cassava bags in place of plastic bags at their UAE stores. The bags are entirely biodegradable since they are constructed of vegetable oil, organic polymers, and cassava starch. Another significant growth driver for the offline category in the next years will be the spike in consumer demand for eco-friendly packaging options.

Application Insights

The food and beverage sector held highest revenue share in 2024. The need for food and beverage packaging is mostly being driven by convenience foods because of its mobility, extended shelf lives, and simple manufacture. Convenience food is becoming in demand as a result of consumers' hectic lifestyles and the aging population. Innovative packaging and cutting-edge technologies have increased the range of easily available food alternatives, including packed, frozen, chilled, etc. Product safety and sustainability are the primary concerns of the majority of package manufacturers. Consumer goods corporations are increasingly packaging food, which has changed consumers' preferences for convenient foods. A lot of chemical suppliers are also shifting to more environmentally friendly solutions by using less plastic in packaging.

Geographically speaking, North America has accumulated the greatest market share due to the enormous volume of surgeries performed there on the region's vast population of elderly patients. The surgical sutures market has benefited greatly from the region's availability of cutting-edge medical facilities and equipment.

Regional Insights

Asia Pacific Zero Waste Packaging Market Size and Growth 2026 to 2035

The Asia Pacific zero waste packaging market size was estimated at USD 148.94 billion in 2025 and is anticipated to be surpass around USD 373.37 billion by 2035, rising at a CAGR of 9.63% from 2026 to 2035

Asia Pacific dominated the global zero waste packaging market with the largest market share of 47% in 2025. As countries in this region focus on reducing waste, enhancing recycling rates, and promoting environmental sustainability, the zero-waste packaging market is evolving rapidly. Governments across APAC are implementing bans and regulations on single-use plastics. For instance, countries like India, Thailand, and Indonesia have set stringent plastic waste management policies, which are encouraging businesses to explore alternatives such as paper, glass, metal, and biodegradable materials for packaging. As e-commerce businesses look for sustainable packaging options for shipping, there is an increasing trend toward zero-waste packaging, such as biodegradable, recyclable, or reusable materials.

Europe's Memorable Role in the Zero Waste Packaging Industry

Europe's endless support, investment, and initiatives to this industry include regional waste reduction goals, recycled content compulsion, and Packaging and Packaging Waste Regulation (PPWR) regulatory act. The single-use pack will soon be banned under strict regulatory control.

Alongside, the EU policies have precisely converted recycled content into a resourceful one that will leverage the recycling rate. The region is positioned for its top-notch recyclers. Moreover, the region intends to adopt the QR code system to serve the life cycle data of the material to further analyse the segregation and visibility.

How has Latin America contributed to the Zero Waste Packaging Sector?

Latin America's major contribution to this sector is its approach of ‘reuse-first', associating with the latest trends, and contributing to the environment as well. Simultaneously, tech recycling is a boon to the regional recyclers and converters. Around 90% material recovery rate in Brazil has achieved effective recyclability through waste collectors.

The company workers' efforts and a duty like responsibility towards reusable materials is a kindest efforts as a whole. Costa Rica made a move to ban polystyrene and will soon cut single-use plastics as well.

Value Chain Analysis of the Zero Waste Packaging Market

- Raw Material Sourcing: The raw material sourcing is the main root of the zero-waste packaging, a starting line for the circular economy. The recycled, biodegradable, or renewable resources are the centre point of the circular economy. It covers the journey from resources to materials that can be recycled, reused, or composted with the intention of reducing waste volume.

Key Players – Bambrew (India), WestRock/Smurfit Kappa, and Biome Bioplastics. - Material Processing and Conversion : The process to meet the professional regenerative system needs the apt selection of the reusable materials to meet the standards of the conversion and perform a hassle-free content processing. It includes allocating, structuring/differentiating, and assembling the sustainable materials.

Key Players – Amcor plc, Mondi Group, and Tetra Pak. - Recycling and Waste Management: This management is a crucial and effective component in measuring the success of the zero-waste packaging. It's like a final verdict and response to the choices and implementation of the packaging globally, focusing on environmental concerns.

Key Players – TIPA Corp, Loop (by TerraCycle), and DS Smith.

Zero Waste Packaging Market Companies

- Loop Industries Inc.

- PulpWorks, Inc.

- Lifepack

- Avani Eco.

- Loliware

- Aarohana Ecosocial Development

- Natural Vegan

- Agilyx

- Arekapak

- Bioplas

- Candy Cutlery

- Do Eat

- Evoware

- No Waste Technology

- Origin Materials

- Skipping Rocks Lab

- Sulapac

- TIPA

Recent Developments

- In April 2024, Walkers introduced paper outer bags for Snack A Jacks multipacks, aiming to reduce plastic use by 65 tonnes annually and cut GHG emissions by 52% per pack. These bags are designed for easy reuse and recycling through curbside collections. The company expects to cut down on greenhouse gas emissions per paper bag used by up to 52%. “Easily recycled with your usual household paper recycling, these new outer packs can be disposed of thoughtfully with little fuss,” said Snack A Jacks' marketing manager, Hannah Freeman.

- In January 2024, The European initiative called Elevating Reuse In Cities (ERIC) was launched to help European municipalities limit plastic waste generation through the training of local organizations in reuse systems and planning on effective prevention actions. Multiple municipalities across Europe, including in Cyprus, the Czech Republic, France, Italy, Slovenia, and Bulgaria, are participating in the initiative.

- In August 2023, Dow and Mengniu launched a recyclable all-PE yogurt pouch to facilitate a circular economy in China and include traditional hard-to-recycle packaging into closed-loop recycling streams.

Segments Covered in the Report

By Material Type

- Re-Usable Goods

- Compostable Goods

- Edible Goods

By Application

- Food and Beverage

- Healthcare

- Personal Care

- Industrial

- Others

By Distribution Channel

- Offline Retail

- Online Retail

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting