What is the Industrial Automation Market Size?

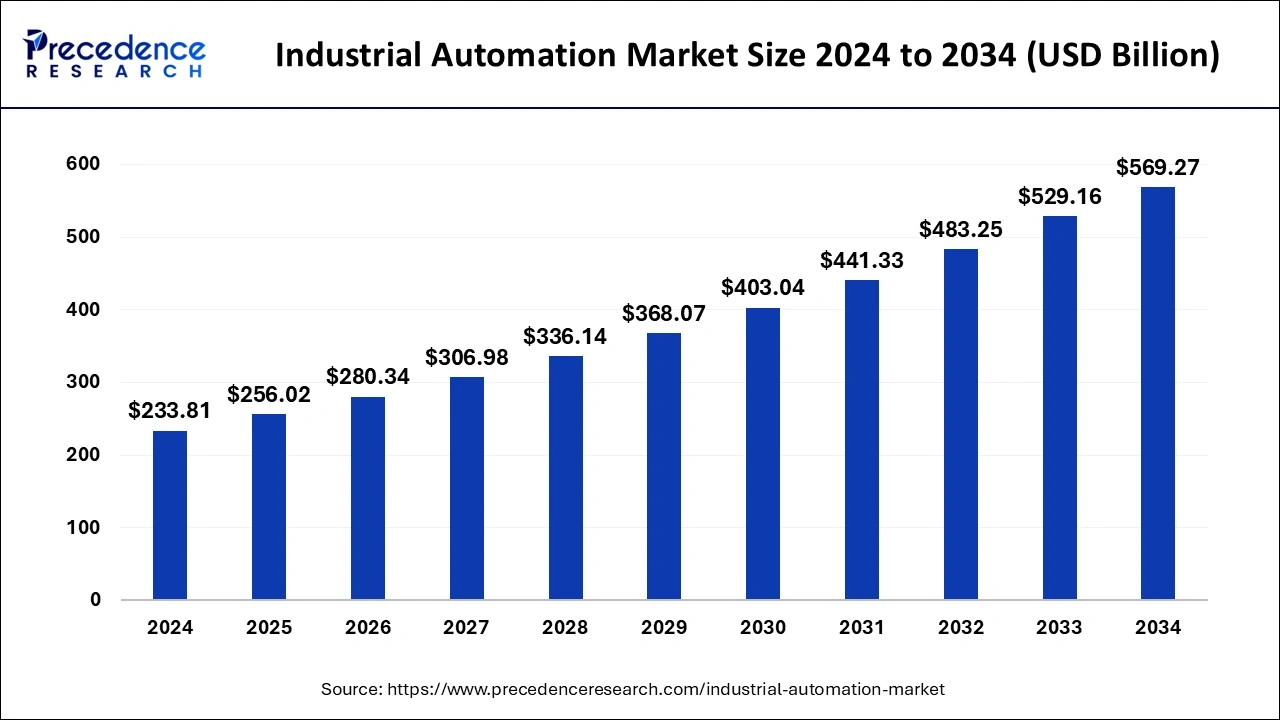

The global industrial automation market size is calculated at USD 256.02 billion in 2025 and is predicted to increase from USD 280.34 billion in 2026 to approximately USD 613.25 billion by 2035, expanding at a CAGR of 9.13% from 2026 to 2035.

Industrial Automation Market Key Takeaway

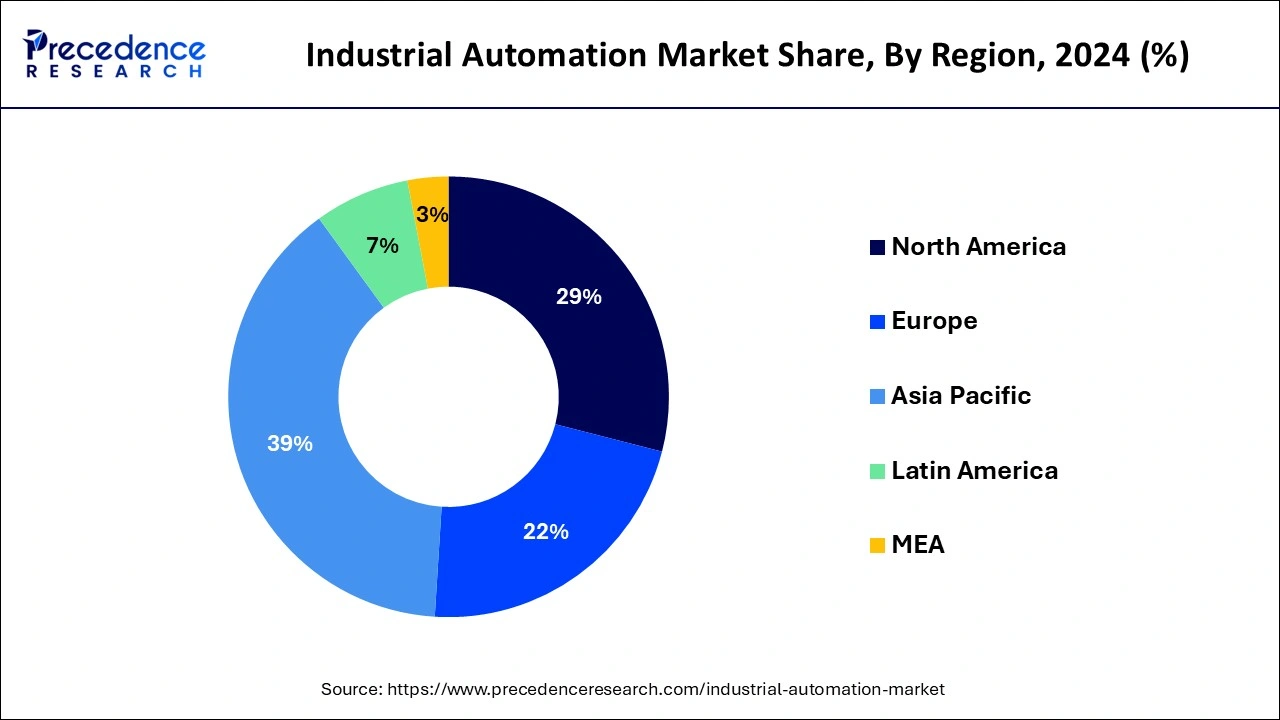

- Asia Pacific region has recorded a revenue share of over 39% in 2025.

- North America is expected to grow at a significant CAGR from 2026 to 2035.

- By component, the industrial robots segment is growing at a CAGR of 12% from 2026 to 2035.

- The sensors component type segment has held a revenue share of 23% in 2025.

- By control system, the distributed control systems (DCS) segment accounted revenue share of around 35% in 2025.

- The SCADA control system segment is growing at a CAGR of 10.2%.

- The manufacturing vertical segment has captured an 18% revenue share in 2025.

Market Overview

Real-time data analysis with increased demand and acceptance from the consumers with increased acquisition of the latest developed technologies in industrial automation with increased results and increased workflow, enhance proactive maintenance. This helps to get visibility during the manufacturing plant with increased efficiency. The increased flow of work with increased production and converting the raw material into the product. Automation involves reducing interference of the human with the manufacturing process. Less intervention of human while manufacturing the products which are in bulk. Improved number of types of equipment for processing the product with increased control over the machines. Machines such as boilers, steam jacketed vessel, heating oven (dryers) stabilizing ships, steering and others. Increased automation in households with wide applications controlling boiler.

Automation is also seen in banking section to reduce complications in algorithms by using simple developed technology of on and off. Increased performance by reducing the human intervention increased utilization of computer with software embedded system, robotics involved, improved control system with developed on and off technology. The outbreak of Covid-19 with the negative impact on the market with the imposed rules and regulations from the government led to lock down across various regions with wide spread of corona virus affected the market value of industrial automation market with reduced requirements from the market for the automated technology and decreased the market size of industrial automation during the forecast period.

Impact of post covid-19 situation largely developed the internet of things with increased requirements over the internet and easy work flow with high efficiency drives the market of industrial automation during the forecast period.

Impact of AI on the Industrial Automation Market

Integrating robotics and artificial intelligence (AI) technologies into automation processes revolutionizes the industry by enhancing operational capabilities and overall productivity. These cutting-edge technologies significantly improve quality assurance by reducing human error, which often leads to inconsistent product quality. Manufacturers are continually exploring innovative strategies to boost efficiency, lower production costs, and increase output levels. AI technologies enable manufacturing companies to optimize their workflows and streamline operations. For instance, AI-powered robotics can perform repetitive tasks with high precision and speed, allowing workers to focus on more complex activities. Moreover, AI algorithms can analyze vast amounts of data to predict machine failures, optimize supply chains, and improve decision-making processes. Together, these innovations not only enhance productivity but also contribute to the creation of safe working environments by mitigating risks associated with manual labor.

Industrial Automation Market Growth Factors

- The shortage of skilled workers and rising labor costs are major factors driving the growth of the market.

- The ongoing Fourth Industrial Revolution encourages industries to integrate smart and cutting-edge technologies into manufacturing and industrial processes, contributing to market expansion.

- Several industries are seeking solutions to reduce human interference and errors in manufacturing processes. Moreover, the increasing need to enhance production efficiency and workflows boosts the growth of the market.

- Increasing industrialization in emerging countries further fuels the market growth.

- Key market players are developing and launching innovative solutions according to the needs of various industries to facilitate workflow and reduce human errors, which significantly propels market growth.

Key Trends in 2025 for Industrial Automation and Control Systems

- Integration of AI and ML: The major trend that industrial automation and control systems are witnessing is the integration of AI and ML. These cutting-edge technologies are expected to hold their dominance in decision-making factors, predictive maintenance, and quality control. Predictive maintenance plays a key role in industrial automation by leveraging the capabilities of AI to analyze huge volumes of data in real-time, which can predict the potential of machine failure before it occurs. Such proactive approaches to predictions are critical in terms of costs and maintenance of equipment for longer periods.

- Application of 5G network: Another significant trend for the industrial automation and control system market is the application of 5G networks, which is transforming industrial automation by providing ultra-fast connectivity, minimizing latency, and ensuring high authenticity. Industries are seeking to deploy 5G to increase machine-to-machine communication, monitor remotely, and enhance automated processes. For instance, in automated warehouses, real-time inventory tracking is mandatory, which is achieved by 5G networks. Also, drones in industrial settings benefit from 5G speed and help improve logistics and transportation operations.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 256.02Billion |

| Market Size in 2026 | USD 280.34 Billion |

| Market Size by 2035 | USD 613.25 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 9.13% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Deployment Type, Component, and End-Use Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

- Enhance real time data analysis and predictive maintenance - Rapid advance developments in manufacturing and producing new technology in industries with increased competition of the available technologies. Increased manufacturing in oil and gas industries, food & beverages, automobile industry, aerospace defense industry with increased solution with real data analysis and increased management of the maintenance. Increased visibility, increased maintenance of the manufacturing equipments with high efficiency. Developed automation technologies for manufacturing for increasing the plant with high efficiency with real time analysis and involve multiple operations during manufacturing. Which supports to grow the market of industrial operational during the forecast period.

- Monitoring of the industrial automation technology such as temperature, current, voltage, speed, vibration and location. Increased maintenance of the equipment developed asset management software with newly developed solutions for the manufacturing which allows for higher efficiency with increased automation.

- Increased internet of things with developed software and technology and increased connectivity. Increased work flow management, easy transmission of work over the software. Increased consistency of the performance, Increased quality of the work without human intervention, higher predictability with improved maintenance, reduced labour work and cost, improved accuracy and precision.

Key Market Challenges

- Increased cost - Industrial automation with developed technologies with advance features developed. Increased installation of industrial automation with increased equipments led to increase cost of the automation technology may hamper the market growth of industrial automation during the forecast period.

- Lack of skill - Lack of skill regarding newly developed technologies in industrial automation. Improved technologies in machines and euipments and increased software system embedded requires thorough knowledge with completer information for performing the task. Lack of developed skill may alter the market growth of industrial automation

- Lack of standardised procedures- Lack of protocols for communicating with the devices and the technologies and system integrated in to the devices no protocols and management with increased complications and utilization of own method may hinder the market growth during the forecast period. Which results in lack of communication with other devices.

Key Market Opportunities

- Industrial automation involves numerous methods for the development of the technologies which may be hazardous to the humans during manufacturing of the products if any error take place. Increased safety management in automation technology to avoid such accidents, safety measures involved in industrial automation reduce the accidents.

- Early detection of the problems in machines during the process of manufacturing and increased solution on the malfunctions over the machine and system. Enhanced safety measures are imposed by the government for the machineries with international safety standards. Safety rules imposed by the International Electrotechnical Commission and International Standard Organization.

- Increased safety of the machineries and the humans with enhance quality of the product. Good output and increased performance in the industrial automation helps to boost the market growth during the forecast period.

Segment Insights

Deployment Type

On the basis of deployment type, industrial sensor with the largest market revenue share from the year 2026 to 2035. Sensor segment drives the market growth with increased utilization of sensor in newly developed automation technology and increased demands from the consumer for the industrial sensor with enhance developments. Rapid acceptance of the sensors used in manufacturing companies in machineries involved for processing with improved network connectivity which helps to enhance the wireless sensors involves in internet of things over the software. It involves saving the data with utilizing the sensors real time data analysis.

In maintenance sensors are the major components with improved solutions which helps to extend the market growth during the forecast period. Enhance options of sensors involved increased facilitating, improved communications. Which offers the lucrative growth of sensors in industrial automation.

Components Insight

The plant asset management a software with the highest growth with increased market value. Intelligence integrated in to the Plant Asset Management software with increased measurements and giving accurate data regarding assets that is software in to the manufacturing plant. Utilization of plant asset management is increasing with improvement for making the decisions, monitoring the conditions during manufacturing and early detection of the problem to avoid any mistakes in manufacturing. Which improves the quality of the technology and enahance data management. Which also helps to reduce waste material, with increased production with early detection of the problem with the system software with enhance connectivity.

Increased utilization of the plant asset management in other industries such as food and beverages, oil and gas industry, automobile industry with technological developments involved in industries with increased data collection for further access. Integration of the plant asset management with decreased rates of the software and increased operation involved. Which helps to boost the performance with increased market growth during the forecast period.

End-Use Industry

On the basis of end use industry, mining and metal industry to be the largest with increased market revenue share. It involves extraction of metals and minerals. Increased production with industrial automation, with high safety, reliability, decreased cost.

Regional Insights

What is the Asia Pacific Industrial Automation Market Size?

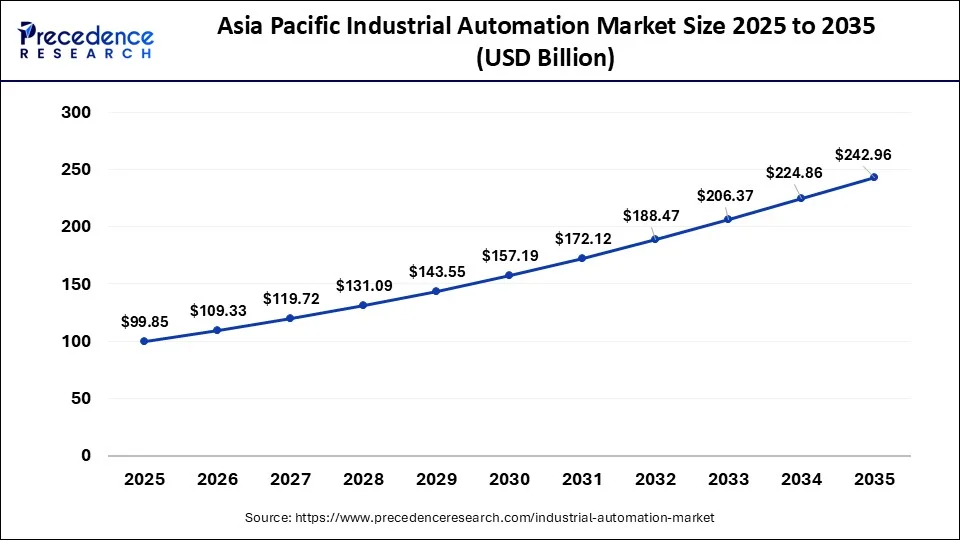

The Asia Pacific industrial automation market size was estimated at USD 99.85billion in 2025 and is predicted to be worth around USD 242.96 billion by 2035, at a CAGR of 9.30% from 2026 to 2035.

Why Does Asia-Pacific Hold the Largest Share of the Industrial Automation Market?

The Asia-Pacific region is leading the industrial automation market globally, and it is set to lead by sheer structure, technological benefits, and an active government framework. Increased demand for better productivity, ease of operation, and better management of quality has propelled firms within the region to fast adopt automation technologies. The region is experiencing an industrial revolution as advanced robotics, control systems, and smart manufacturing tools, as per Industry 4.0 principles, are being incorporated into industries in the region. Increasing foreign investments, particularly in electronics, automobiles, and heavy engineering industries, have also triggered the implementation of industrial automation solutions.

China Industrial Automation Market Analysis

China continues to be the centre piece of the Asia-Pacific industrial automation market. China, with one of the largest manufacturing bases in the world, is embarking on smart manufacturing that is tech-enabled, with the least dependence on labor. China also produces major parts for automatingsensors, batteries, and microchips. Also, the governments in the region are offering incentives and encouraging firms to modernize and go digital in their production systems, consolidating the reputation of Asia-Pacific as a manufacturing powerhouse in the world.

Why Is North America's Industrial Automation Market Growing?

The North American market is evolving to a considerable extent in terms of industrial automation systems, mainly due to the high focus on high-end manufacturing in the region. Major industries in automotive, aerospace, electronics, and healthcare sectors are gradually adopting automation to improve productivity, decrease operational costs, and adhere to high levels of safety and quality. This digital transformation is further supported in North America by the well-established infrastructure of the region and economic policies that were favorable towards it, thus providing industrial automation solutions with a sustainable environment to grow.

The governments have taken initiatives in financing next-generation technologies, which include tax incentives, grants, and regulatory frameworks. Moreover, the high level of safety and environmental standards in the area makes it necessary to include complex automation systems in the strategy to meet the standards and achieve good productivity.

U.S. Industrial Automation Market Trends

The technological integration, including private 5G networks, AI, ML, and collaborative robots, as well as significant investments in advanced manufacturing for EV batteries and electronics, drives growth in the U.S. market. Some of the top automation businesses in the U.S. are held by Rockwell Automation, Cognex, Applied Industrial Technologies, and Emerson Electric. They are leading in industrial automation and digital transformation solutions in the U.S.

Europe

Europe's Noticeable Growth in the Industrial Automation Market

Europe is expected to grow at a notable rate in the market, owing to the increased industrial focus on net-zero mandates, energy efficiency, automotive electrification, Industry 4.0, and digital transformation. The European Commission launched new AI strategies to boost the adoption of AI across the public sector, European industry, and scientific research. This initiative aims to strengthen global AI leadership and Europe's technological edge.

Latin America

Opportunities in the Industrial Automation Market in Latin America

Latin America is expected to grow at a significant rate in the market due to government-backed digital initiatives focusing on industrial robotics, AI, and IoT. Brazil is driving innovation and tech leadership as the largest economy in this region. Mexico and Brazil are key regional hubs, attracting foreign direct investment and automation suppliers while benefiting from strategic near shoring trends that encourage localized manufacturing.

MEA

Potential of the Industrial Automation Industry in the Middle East and Africa

The Middle East and Africa are expected to grow at a lucrative rate in the market, owing to the modernization of the oil and gas sectors, large-scale infrastructure projects, and the rapid expansion of e-commerce and logistics. The Middle East and North Africa region plays a vital role in the manufacturing sector. The regional industries are employing millions across industries such as chemicals, textiles, automotive, and food processing.

Industrial Automation Market-Value Chain Analysis

- Raw Material Procurement (Silicon Wafers, Gases): This stage includes strategic sourcing, supply chain integration, localized production, AI-enhanced supply chains, and joint ventures.

Key Players: Shin-Etsu Chemical, SUMCO Corporation, GlobalWafers, Siltronic AG, SK Siltron, Linde Plc, Air Liquide, Air Products and Chemicals, Taiyo Nippon Sanso, Merck. - Distribution to OEMs and Integrators: This stage focuses on data integration, digital B2B channels, modular and scalable solutions, localized supply chains, and service-based models.

Key Players: Siemens AG, ABB Ltd., Rockwell Automation, Schneider Electric, Arrow Electronics, Avnet, WPG Holdings, and RS Group. - Lifecycle Support and Recycling: This stage is expanding due to predictive maintenance, obsolescence management, service enhancements, regulatory frameworks, and circular economy practices.

Key Players: Schneider Electric, Siemens AG, ABB Ltd., Rockwell Automation.

Industrial Automation Market Companies

- ABB

- Emerson Electric Co.

- Fanuc

- General Electric

- Honeywell International

- Mitsubihi Electric

- Rockwell Automation

- Schneider Electric

- Siemens

- Yokogawa Electric

- Omron Corporation

Recent Updates on Industrial Automation- 2025

Prioritizing safety in collaborative robotics

- On 15 January 2025, a significant revision to ISO 10218, the fundamental international standard governing industrial robot safety, was published by the International Organization for Standardization (ISO). Cobots or collaborative robots are being used more and more in shared human environments. Specific safety metrics for power and force limitations, safety-rated monitored stops and speed, and separation monitoring are among the new additions. The update aims to ensure global alignment in robotic safety standards and reduce risks during human-robot integration.

Enhancing warehouse automation through tactile sensing - On 7 May 2025, Vulcan, a warehouse robot with sophisticated tactile sensing abilities, was made public by Amazon. To identify, sort, and handle objects with greater dexterity than conventional robots that rely on vision or suction, Vulcan uses its sense of touch. Currently, the robot can process almost 75% of the items in Amazon's logistics centers, improving speed and accuracy while lessening the physical strain on human employees. With this innovation, a new era of warehouse automation has begun in which robots function more like human hands.

Latest Announcement by Industry Leader

- In January 2025, Siemens unveiled breakthrough innovations in industrial AI at CES 2025. Industrial AI enables users to harness a plethora of data generated in industrial environments and turn it into insights that help in decision making. Peter Koerte, Member of the Managing Board, Chief Technology Officer, and Chief Strategy Officer at Siemens AG, stated that Industrial AI is a game-changer and will positively impact the real world across all industries.

Recent Development

- In April 2025, a global leader in digital transformation for energy management, Schneider Electric Company, introduced the open automation movement. The movement highlights its intent and includes liberalizing industrial automation to make it more accessible with the help of open and software-defined solutions. This initiative holds the vision of software-driven and vendor-agnostic automation solutions achieved by Schneider Electric.

- In March 2025, Oxa tapped NVIDIA to enhance industrial mobility automation. A self-driving vehicle software introduces, reinforcing its collaboration with the leader in the AI processor to expand its plans in the IMA sector. This can be attained with the support of physical AI, creating photoreal virtual real-world states to escalate its training tools.

- In January 2024, Ares Management Corporation announced the inauguration of Automated Industrial Robotics Inc. This newly formed industrial automation company focuses on fulfilling the global demand for manufacturing automation solutions.

- In May 2023, Renishaw, a global engineering technologies company, unveiled a newly developed product line specifically designed for the industrial automation market. The new RCS product line aims to transform the process of commissioning and servicing industrial automation technologies.

Segments Covered in the Report

By Deployment Type

- Industrial Robots

- Process Analyzer

- Machine Vision System

- Human Machine Interface

- Field Instruments

- Industrial Sensors

- Industrial 3D Printing

- Industrial PC

- Vibration Monitoring

By Component

- Plant asset management

- Manufacturing execution system

- Industrial safety

- Programmable logic controller

- Distributed control system

- Supervisory control and data acquisition

By End-Use Industry

- Automotive

- Metals & mining

- Water & Wastewater treatment

- Electronic & Semiconductors

- Energy & power

- Machine Manufacturing

- Food & beverages

- Pharmaceuticals & medical devices

- Chemicals

- Oil & gas

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting