What is Industrial Display Market Size?

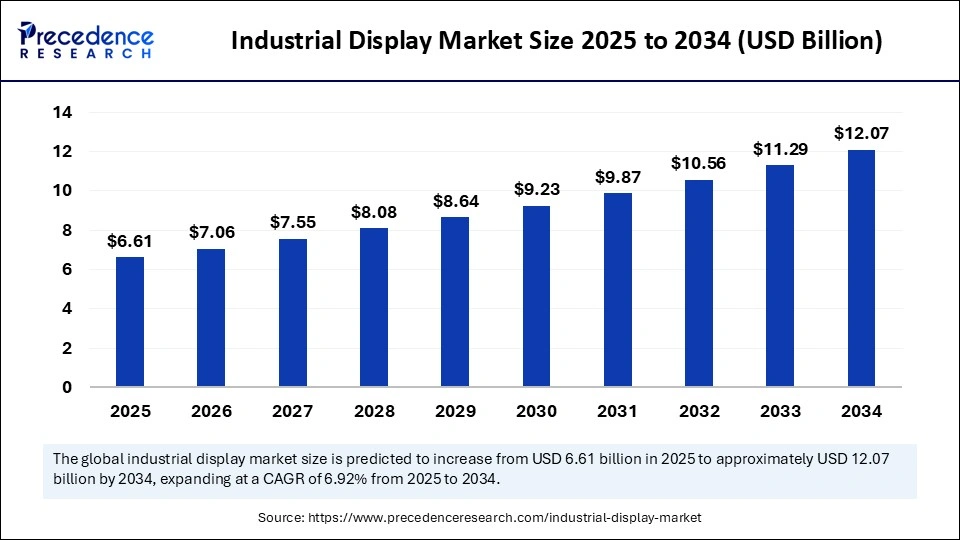

The global industrial display market size is calculated at USD 6.61 billion in 2025 and is predicted to increase from USD 7.06 billion in 2026 to approximately USD 12.07 billion by 2034, expanding at a CAGR of 6.92% from 2025 to 2034. In the ever-evolving landscape of urban innovation, the smart city ICT infrastructure market stands as the digital backbone of future cities, interweaving technology, governance, and citizen well-being into a unified ecosystem.

Market Highlights

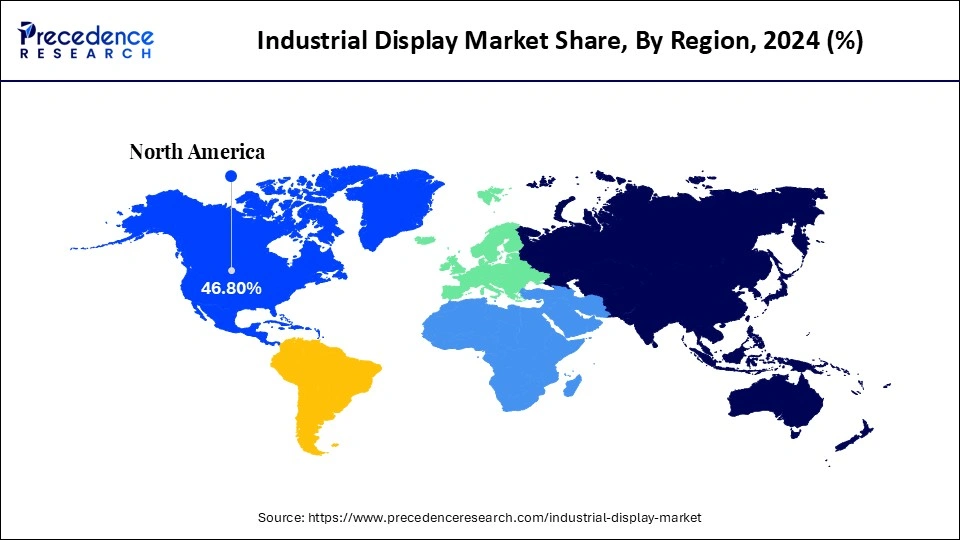

- By region, North America dominated the market, holding the largest market share of 46.8% in 2024.

- By region, Asia Pacific is expected to expand at the fastest CAGR of 7.8% between 2025 and 2034.

- By type, the rugged display segment held the largest market share of 50.4% in 2024.

- By type, transparent display is expected to grow at a remarkable CAGR of 7.6% between 2025 and 2034.

- By technology, the LCD segments contributed the highest market share of 40.4% in the industrial display market during 2024.

- By technology, the OLED segment is growing at a remarkable CAGR of 8.0% between 2025 and 2034.

- By panel size, the 14-21” segment captured the biggest market share of 43.4% in 2024.

- By panel size, the 14” segment is poised to grow at a strong CAGR of 7.6% between 2025 and 2034.

- By application, the human-machine interface segment held the major market share of 38.5% in 2024.

- By application, industrial automation is projected to grow at a remarkable CAGR of 7.4% between 2025 and 2034.

- By end-user, the automotive segment generated the biggest market share of 31.6% in 2024.

- By end-user, the manufacturing segments is expanding at a CAGR of 7.8% between 2025 and 2034.

Market Size and Forecast

- Market Size in 2025: USD 6.61 Billion

- Market Size in 2026: USD 7.06 Billion

- Forecasted Market Size by 2034: USD 12.07 Billion

- CAGR (2025-2034): 6.92%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is the Industrial Display Market?

The industrial display market comprises display systems designed for industrial environments, offering durability, high brightness, rugged enclosures, and advanced interfaces for human-machine interaction. These displays are integrated into control panels, automation systems, monitoring devices, and digital signage across industries such as manufacturing, energy, transportation, and healthcare. Industrial displays enhance productivity, visualization, and operational safety. Technologies include LCD, LED, OLED, and emerging display solutions, supporting touchscreen and embedded functionalities tailored to industrial-grade performance requirements.

Market growth has accelerated remarkably in recent years, fuelled by the surging adoption of IoT frameworks, 5G networks, and data-driven governance models. As cities embrace digital transformation, ICT infrastructure emerges not merely as a support system but as the very nervous system of urban intelligence. The growing population density and urban challenges have made connected infrastructure indispensable for sustainability, resilience, and economic competitiveness. Governments across continents are deploying integrated communication systems, edge computing, and AI to improve service delivery and civic engagement. The sector's rapid evolution symbolizes humanity's shift from reactive governance to proactive intelligence, ushering in an era where cities not only grow but also think.

Industrial Display Market Outlook

- Industry Growth Overview: The industry's expansion has been both exponential and inclusive, encompassing public utilities, transportation, healthcare, and security infrastructures. Digital integration within city operations has created new growth corridors stimulating employment, entrepreneurship, and smart investment. The rapid urbanization in developing economies has catalyzed the adoption of ICT-based management systems, promoting efficiency and transparency. Meanwhile, the private sector has become an indispensable partner, channeling resources into cloud platforms, cyber-secure frameworks, and real-time analytics. Furthermore, public-private partnerships are redefining how cities are funded and managed, blurring the lines between innovation and governance. The industry is, thus, not merely growing but also becoming more sophisticated, embodying the future of intelligent urban ecosystems.

- Sustainability Trends: Sustainability has emerged as the fulcrum of smart city infrastructure evolution. Modern ICT solutions are being designed to minimize environmental footprints while maximizing energy efficiency and circular resource usage. Renewable-powered data centers, sensor-driven waste management systems, and green cloud computing architectures are reshaping the sustainability narrative. Cities are leveraging predictive analytics to optimize energy grids and reduce carbon emissions, while digital twins simulate climate resilience. The emphasis on eco-conscious innovation reflects a collective global awakening, where smartness is defined not by speed but by stewardship. Sustainability, thus, has transitioned from a buzzword to a binding principle that undergirds every strand of ICT planning.

- Major Investors: Institutional investors, sovereign funds, and global venture capitalists have identified smart city infrastructure as a frontier of 21st-century growth. Giants from the telecom, semiconductor, and IT sectors are consolidating their presence through strategic mergers and cross-border partnerships. The steady influx of capital into ICT-enabled governance platforms highlights the confidence of investors in long-term digital urbanization. Additionally, sustainability-focused funds are directing resources toward green ICT startups, aligning profitability with planet-conscious innovation. As investors increasingly value social and environmental ROI alongside financial returns, the market's capital landscape reflects a paradigm shift from speculative funding to purposeful investing.

- Startup Economy: The startup ecosystem in smart city ICT is burgeoning with creativity and audacity. Agile tech ventures are pioneering breakthroughs in urban analytics, sensor networks, and AI-driven resource management. Unlike legacy corporations, these startups thrive on flexibility, offering bespoke, scalable solutions tailored to local governance needs. Government-backed innovation labs and accelerator programs have further catalyzed entrepreneurial momentum, bridging the gap between idea and implementation. The cross-pollination of academia, public policy, and tech innovation has created an incubation environment conducive to long-term success. Ultimately, the startup economy represents the pulse of the smart city revolution, a fusion of intellect, innovation, and intent.

Key Technological Shifts in the Industrial Display Market

The market is undergoing a tectonic transformation powered by converging technologies. The proliferation of 5G networks has unlocked ultra-low latency communication essential for smart grids, autonomous transport, and responsive city services. Cloud-native architectures and edge computing are decentralizing data management, enabling real-time analytics closer to the point of action. The integration of blockchain ensures data integrity and transparency across urban operations, reinforcing citizen trust. Meanwhile, AI and machine learning algorithms are evolving from predictive to prescriptive intelligence, allowing systems to self-optimize with minimal human intervention. The symbiosis of these technologies is sculpting the cities of tomorrow, self-aware, secure, and seamlessly interconnected.

Market Key Trends

- Digital inclusivity, cybersecurity, and ethical Artificial Intelligence governance dominate the prevailing trends in the smart city ICT market. Governments are investing in open-data ecosystems to democratize innovation and enhance civic participation.

- A noticeable trend is the rise of city-as-a-platform models, where APIs enable third-party developers to build applications atop municipal infrastructure. The fusion of spatial computing, IoT, and 6G visioning is also gaining traction, pushing urban intelligence toward greater autonomy.

- Another emerging trend is the prioritization of human-centric design, ensuring that smart cities serve citizens, not algorithms. Together, these shifts underscore an industry increasingly attuned to the delicate balance between efficiency and empathy.

Market Value Analysis

- Raw Material Sources: The backbone of ICT infrastructure rests on advanced semiconductor materials, fiber-optic components, and sustainable composites. Increasingly, manufacturers are pivoting toward eco-friendly materials, recycling rare earth metals, and minimizing electronic waste to ensure a greener production cycle.

- Technology Used:The technological foundation of smart city infrastructure is built on a triad of innovation: connectivity, cognition, and computation. IoT, AI, and 5G/6G networks form the bedrock, enabling instantaneous data transmission and machine-to-machine communication. Edge computing and blockchain ensure that this digital orchestra operates with precision, transparency, and trust.

- Investment by Investors: Global investors view the smart city ICT domain as the crucible of future civilization. Their investments are increasingly directed toward scalable, sustainable, and interoperable platforms capable of driving both profit and progress. Venture capitalists are now prioritizing projects that blend technology with social inclusivity, where returns are measured not merely in numbers but in impact.

- AI Advancements: Artificial intelligence stands at the very helm of this urban renaissance. From predictive traffic flow management to automated waste collection, AI is redefining the rhythm of city life. Machine learning algorithms are evolving from reactive tools to proactive architects shaping cities that pre-empt challenges before they manifest, ensuring not just efficiency but foresight.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.61 Billion |

| Market Size in 2026 | USD 7.06 Billion |

| Market Size by 2034 | USD 12.07 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.92% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Technology,Panel Size, Apllication,End-User Industry and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

Why Rugged Display is Dominating the Industrial Display Market?

The rugged display is dominating the industrial display market by holding a 50.4% share, driven by unmatched durability and reliability in harsh environments. These displays are engineered to withstand extreme temperature, dust, vibration, and moisture, making them indispensable in defense, aviation, and industrial sectors. The growing need for uninterrupted operations in critical applications such as field diagnostics and heavy machinery control further fuels their adoption. The integration of advanced touch technologies and anti-aging coatings has enhanced user experience even under challenging lighting conditions. Additionally, as industries move toward automation and outdoor digitalization, the demand for resilient visual systems continues to rise. Rugged displays thus remain the cornerstone of functional endurance in the modern industrial ecosystem.

The segment's dominance also stems from its ability to blend robustness with evolving design sophistication. Manufacturers are introducing sleeker, lightweight models without compromising on structural integrity. The convergence of ruggedization with smart interfaces has allowed these displays to enter new domains such as mining, maritime logistics, and public infrastructure. Their lifecycle cost advantage, achieved through reduced maintenance and downtime, strengthens their economic appeal. Furthermore, the emphasis on mission-critical reliability ensures that rugged displays remain integral to any digital infrastructure requiring absolute operational assurance.

The transparent display is the fastest-growing segment in the industrial display market, holding a share of 7.6%, due to its futuristic appeal, which offers both visibility and functionality, allowing real-time data overlay on physical objects. Industries such as retail, automotive, and architecture are increasingly leveraging these displays to enhance interactivity and engagement. As augmented reality interfaces and spatial computing gain traction, transparent displays are transitioning from novelty to necessity. Their adoption in smart signage and head-up displays reflects a growing appetite for immersive visual technologies.

Moreover, the transparent displays rapid progress symbolizing a paradigm shift toward experimental communication. These panels are now being integrated into next-generation workstations, collaborative control rooms, and showroom environments. Technological advances in transparent OELD and micro-LED materials are amplifying brightness, color fidelity, and energy efficiency. With businesses prioritizing customer experience and visual storytelling, transparent displays are poised to redefine how information and aesthetics converge in public and industrial spaces.

Technology Insights

Why LCD is Dominating the Industrial Display Market?

The LCD is dominating the industrial display market with a 40.4% share, supported by its cost efficiency, reliability, and scalability. The technology's maturity, coupled with continuous improvement in energy consumption and image clarity, keeps it relevant across multiple end-user sectors. LCDs remain the preferred choice for industrial control panels, rugged terminals, and transportation systems due to their longevity and adaptability. Manufacturers have optimized LCDs for high-brightness environments, extending their utility to outdoor applications and heavy-duty equipment. The ease of integration with capacitive touch systems also contributes to its sustained prevalence.

LCD technology continues to evolve in form and function, particularly through innovations in in-plane switching and backlight optimization. These enhancements have expanded color accuracy and viewing angles, meeting the demanding standards of professional visualization. The affordability of LCD panels ensures their accessibility even for small-scale enterprises seeking digital upgrades. Their recyclability and declining power footprint further reinforce their position in sustainability-driven procurement models. Ultimately, LCDs serve as the pragmatic foundation on which display technology ecosystems continue to flourish.

The OLED segment is the fastest-growing in the industrial display market by holding a share of 8.0%. Renowned for their self-emissive pixels and superior contrast ratios, OLEDs are revolutionizing the visual experience. Their ability to render deep blacks and flexible form factors makes them ideal for next-generation industrial dashboards and wearable control systems. As automation environments demand higher precision visualization, OLEDs offer responsiveness and clarity unmatched by traditional counterparts. Their use in energy-efficient smart panels also aligns with global sustainability goals.

The acceleration of OLED adoption reflects an industry-wide gravitation toward high-definition intelligence. Manufacturers are leveraging organic materials to create bendable, ultra-thin, and transparent formats suited for futuristic design aesthetics. The convergence of OLED with IoT interfaces allows for dynamic, context-sensitive displays adaptable to user inputs and environmental conditions. Although production costs remain relatively high, economies of scale and material innovation are steadily reducing barriers. OLEDs thus embody the market's evolution from utility-driven screens to emotionally resonant, adaptive visual systems.

Panel Size Insights

Why 14-21” is Leading the Industrial Display Market?

The 14-21” is dominating the industrial display market, holding a share of 43.3%, representing the optimal balance between functionality and spatial efficiency. This size category finds extensive use in control interfaces, diagnostic equipment, and automotive infotainment systems. Its versatility allows deployment across industries where visual clarity and ergonomic compactness are equally valued. The segment benefits from standardized manufacturing processes, making it cost-effective and widely accessible. As industrial digitization intensifies, these mid-range panels continue to serve as the workhorse of operational visualization.

The sustained preference for 14-21 panels also stems from their compatibility with both portable and fixed installations. They provide a comfortable visual footprint for multitasking operations without overwhelming workspace ergonomics. Enhanced resolution standards such as Full HD and 4K have further elevated the value proposition of this size range. With adaptive mounting solutions and weather-resistant variants, these solutions extend to outdoor kiosks and industrial vehicles. The 14-21 category, therefore, encapsulates a synthesis of practicality, adaptability, and performance continuity.

The below 14” is fastest growing the fastest-growing industrial display maket, by holding a share of 7.6%, driven by the proliferation of compact automation devices, handheld instruments, and smart wearables. The global shift toward mobile industrial solutions and IoT-enabled tools has created fertile ground for miniaturized displays. Their lightweight nature and reduced power requirements make them ideal for portable diagnostics and remote field operations. Furthermore, the convergence of mobility with data visualization ensures its strategic relevance in a digitally agile environment.

These small-format displays are redefining user interaction paradigms, blending portability with precision. Advances in micro-LED and high-resolution LCD/OLED technologies have enhanced visibility even on smaller surfaces. Industries like healthcare, logistics, and defense are rapidly integrating sub-14” panels into next-generation devices for real-time data interpretation. The trend signals a philosophical shift where efficiency no longer demands scale, but ingenuity in compactness. As human-machine interfaces become more decentralized, small displays will emerge as the silent yet vital nerve endings of industrial intelligence.

Application Insights

How Human-Machine Interface is Leading the Industrial Display Market?

The human-machine interface is dominating the industrial display industry, holding a share of 38.5%, while the industry increasingly prioritizes intuitive interaction between operators and automated systems. These displays serve as the visual and tactile bridge between human insight and machine precision. From production lines to aerospace control rooms, HMI panels facilitate operational efficiency and safety through real-time monitoring. Their flexibility across diverse sectors underscores their universality as the face of industrial digitalization. With the rise of Industry 4.0, HMIs have become indispensable for process transparency and decision-making agility.

The evolution of HMI displays is characterized by greater intelligence and personalization. Integration with AI-driven analytics enables predictive alerts and context-aware visualization. Multi-touch and gesture recognition interfaces are transforming operator engagement, reducing error rates and cognitive load. As the workplace becomes increasingly automated, HMIs preserve the essence of human oversight, ensuring technology remains an enabler rather than a replacement. This symbiosis defines the continuing dominance of HMI displays in the global ecosystem.

Industrial automation is the fastest-growing segment in the industrial display market, holding a share of 7.4% and reflecting the global surge in automated manufacturing, logistics, and process control. The need for real-time visualization of complex operations is pushing demand for high-performance displays tailored for rugged environments. Automation systems depend heavily on visual feedback to ensure synchronized workflows and predictive maintenance. The increasing integration of AI, robotics, and IoT is expanding the scope of display technologies in operational intelligence.

This acceleration is also symbolic of a deeper transformation where industries evolve from mechanical efficiency to cognitive automation. Displays are no longer static output screens but dynamic interfaces enabling adaptive communication between machines and systems. As factories adopt smart manufacturing principles, demand for high-fidelity visual feedback will intensify. Industrial automation displays, therefore, represent both the brain and the conscience of intelligent production.

End-User Industry Insights

How Automotive is Leading the Industrial Display Market?

The automotive industry is dominating the industrial display market, holding 31.6% and underscoring its centrality to the display technology market. Modern vehicles have metamorphosed into digital ecosystems, with displays serving as the primary interface for information, entertainment, and control. The surge in electric and autonomous vehicles has further accelerated demand for sophisticated, multifunctional panels. Automakers are adopting head-up displays, curved dashboards, and interactive control units to enhance driver experience and safety. The focus on ergonomic design and minimal distraction underpins this segment's dominance.

Automotive displays also exemplify the fusion of aesthetics and intelligence. The industry's push toward connected mobility ensures continuous innovation in touch sensitivity, visibility, and energy efficiency. As in-vehicle infotainment merges with telematics and ADAS systems, displays are becoming the nerve centers of vehicular communication. Moreover, with sustainability gaining traction, OEMs are investing in recyclable materials and low-power architectures. The automotive sector thus remains both the crucible and showcase of display evolution.

Manufacturing is the fastest-growing segment in the industrial display market, with an expected CAGR of 7.8%. This surge is driven by the digital transformation of factories through robotics, process visualization, and quality monitoring. Display technologies play a vital role in enabling intelligent supervision and seamless data interpretation. Manufacturers are deploying advanced interfaces in production cells, control centers, and inspection systems to ensure accuracy and efficiency.

This growth also highlights manufacturing's shift from manual supervision to automated cognition. Real-time dashboards powered by analytics enhance decision-making speed and reliability. The adoption of rugged and high-brightness panels ensures uninterrupted operation in high-temperature, high-vibration settings. As smart manufacturing becomes the new global paradigm, the role of visual intelligence within it grows indispensable. Displays are thus not mere tools of observation; they are the eyes through which the industry envisions its intelligent future.

Regional Insights

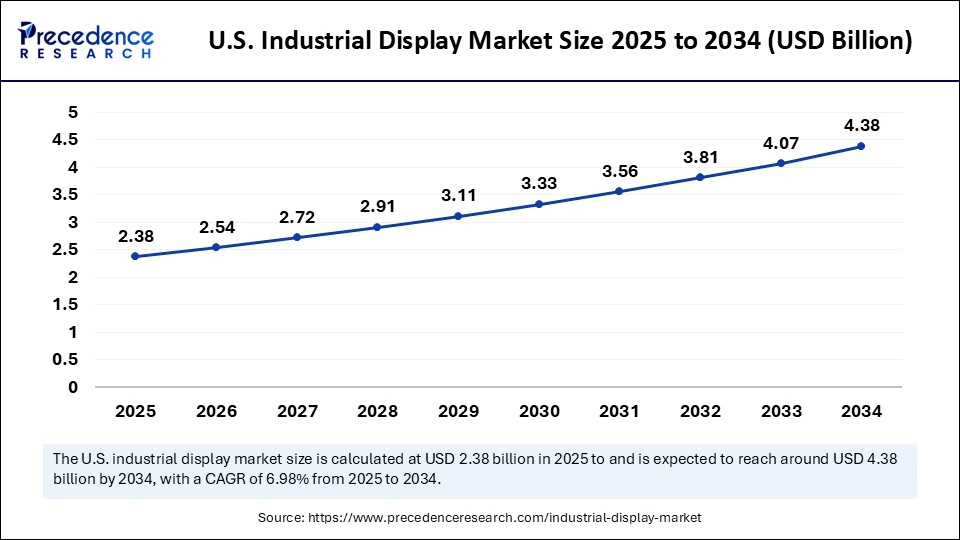

U.S. Industrial Display Market Size and Growth 2025 to 2034

The U.S. industrial display market size is exhibited at USD 2.38 billion in 2025 and is projected to be worth around USD 4.38 billion by 2034, growing at a CAGR of 6.98% from 2025 to 2034.

North America: Where Innovation Drives Industrial Display Advancement

North America continues to lead the global industrial display market, accounting for a significant 46.8% share, driven by early technological adoption and strong digital infrastructure. The region's industrial sectors, from manufacturing hubs in the U.S. to technology corridors in Canada, are integrating advanced display systems for automation, monitoring, and data visualization. The widespread implementation of IoT, 5G connectivity, and robust cybersecurity frameworks supports seamless communication across industrial environments. Collaboration between leading tech companies, government agencies, and research institutions further accelerates product innovation and application development. North America's strength lies in its ability to combine innovation with operational intelligence, ensuring productivity, safety, and sustainability in industrial operations.

How Is the U.S. Pioneering the Future of Industrial Display Technology?

The United States continues to lead the North American industrial display market, powered by its strong manufacturing base, advanced automation systems, and deep integration of cloud-driven analytics. Federal initiatives promoting digital transformation, along with private-sector innovation, have accelerated the adoption of intelligent display solutions across industries such as automotive, aerospace, healthcare, and energy. Companies are increasingly leveraging IoT-enabled and AI-powered displays to enhance real-time monitoring, safety, and process efficiency. While cybersecurity remains a key concern amid growing connectivity, the U.S. benefits from a vibrant ecosystem of startups, research institutions, and venture capital investment. This innovation-driven environment ensures the country remains at the forefront of industrial display advancements, setting global benchmarks for performance and reliability.

How Is Asia Pacific Emerging as the Ascending Arc of Industrial Transformation?

Asia Pacific has emerged as the fastest-growing region in the industrial display market, fueled by rapid industrialization, digital transformation, and supportive government policies. Expanding urban populations and rising middle-class aspirations are driving demand for smart infrastructure and intelligent display systems. Governments are implementing advanced monitoring, automation, and visualization technologies across sectors such as manufacturing, energy, and transportation to improve efficiency and sustainability. The private sector plays a crucial role through partnerships that foster innovation and hybrid funding models for industrial modernization. This transformation reflects a broader digital evolution—one that is reshaping Asia Pacific into a powerhouse of industrial intelligence and connected ecosystems.

How Is India Emerging as the Vanguard of Cost-Effective Industrial Display Innovation?

India is rapidly becoming a leading force in the industrial display market through its emphasis on affordable, scalable technology integration. Under national initiatives like the Smart Cities Mission and Digital India, numerous cities and industries are adopting digital control systems and smart displays to enhance governance, monitoring, and industrial productivity. Homegrown startups, supported by government programs, are developing cost-efficient IoT-based display solutions tailored for diverse industrial applications, from logistics to utilities. Despite infrastructural and policy challenges, India's innovation-driven approach combines inclusivity with technological advancement. The country's ability to merge tradition with digital progress is positioning it as a model for sustainable and accessible industrial display adoption in emerging markets.

How Is Europe Emerging as the Continent of Sustainable Industrial Intelligence?

Europe's growth in the industrial display market is anchored in its focus on sustainability, digital ethics, and human-centric innovation. The region's stringent regulatory frameworks promote responsible data usage, energy-efficient display technologies, and environmentally conscious manufacturing practices. European industries are integrating advanced display systems into renewable energy management, circular production models, and smart manufacturing processes. Governments and enterprises are investing in green digital infrastructure to balance technological advancement with social and environmental responsibility. Europe's approach demonstrates how technology can be refined to serve both progress and purpose, positioning the continent as a global benchmark for ethical and sustainable industrial innovation.

How Is Germany Engineering Precision in Industrial Display Excellence?

Germany, recognized as Europe's engineering powerhouse, is applying its hallmark precision and technological rigor to the industrial display sector. Its focus on interoperability, data sovereignty, and automation aligns with the principles of its Industrie 4.0 framework. German industries are leveraging smart display systems to enhance process control, real-time analytics, and intelligent manufacturing in cities like Hamburg and Munich. These systems support the development of smart factories, energy-efficient operations, and resilient industrial infrastructure. By emphasizing reliability, security, and long-term performance, Germany exemplifies how disciplined innovation and digital precision can redefine industrial efficiency and drive the global industrial display revolution.

Top Industrial Display Market Companies

- LG Display Co., Ltd.: LG Display is a global leader in advanced display technologies, specializing in OLED and industrial-grade LCD panels for automation, automotive, and medical sectors. Its ruggedized solutions deliver exceptional brightness, contrast, and durability for extreme environments. The company's innovations in transparent and flexible OLEDs position it at the forefront of next-generation industrial visualization solutions.

- Samsung Electronics Co., Ltd.: Samsung Electronics dominates the industrial display market with a wide portfolio of QLED, OLED, and high-resolution LCD technologies. Its industrial displays are renowned for superior color accuracy, energy efficiency, and longevity. By integrating AI-based image processing and smart factory solutions, Samsung enhances real-time monitoring and automation across industries.

- BOE Technology Group Co., Ltd.: BOE Technology Group is one of the world's largest display manufacturers, delivering TFT-LCD, OLED, and flexible panels for industrial, commercial, and healthcare applications. The company leverages IoT and AI technologies to produce intelligent, adaptive display solutions. With vast global production capacity and strong R&D investment, BOE is a cornerstone of the industrial display supply chain.

- AU Optronics Corp.: AU Optronics (AUO) is recognized for its durable, energy-efficient displays built for harsh industrial environments such as marine, transportation, and automation. Its focus on sustainability and green manufacturing underlines its role in the eco-friendly technology movement. Through innovations in mini-LED and LTPS panels, AUO continues to deliver performance-driven industrial visualization systems.

- Sharp Corporation: Sharp is a pioneering name in display technology, renowned for producing high-reliability industrial LCD modules with long lifespans and superior clarity. Its IGZO-based panels enable low power consumption and wide operational temperature ranges, ideal for automation and outdoor systems. Sharp's expertise ensures dependable visual solutions for demanding industrial applications worldwide.

Recent Developments

- In October 2024, industrial robots, particularly robotic arms, are now ubiquitous, quietly operating behind the scenes in factories worldwide. As these machines are routinely upgraded or decommissioned, they often end up being replaced or discarded, creating abundant opportunities to acquire once high-priced robots that are comparable in cost to luxury cars but at a fraction of their original value.

- In October 2025, Rabat Mohammed VI Polytechnic University (UM6P) embarked on an ambitious journey to advance Africa's industrial transformation with the establishment of the Smart Factory Academy, a permanent hub for training and technology demonstration designed to propel the continent into the era of Industry 4.0. The initiative was officially launched during the NextGen Manufacturing Summit Africa, held at UM6P's Benguerir campus. Mohamed Laklalech, Managing Director of UM6P's TECHNIX, told Morocco World News that the academy signifies a shift from a one-time summit model to a continuous, hands-on platform dedicated to driving industrial innovation and modernization.

Other Companies in the Industrial Display Market

- Panasonic Holdings Corporation: Panasonic manufactures rugged industrial displays with wide temperature tolerance, high brightness, and vibration resistance, suited for manufacturing and defense environments.

- Advantech Co., Ltd.: Advantech develops industrial touch displays and panel PCs for factory automation, healthcare, and logistics, focusing on reliability, connectivity, and Industry 4.0 integration.

- Siemens AG: Siemens offers industrial HMI and visualization systems optimized for continuous operation in process automation, integrating seamlessly with industrial control and monitoring systems.

- Mitsubishi Electric Corporation:Mitsubishi designs high-brightness, long-life industrial displays for control rooms, machine interfaces, and outdoor applications, known for exceptional reliability.

- Innolux Corporation:Innolux produces energy-efficient, high-resolution LCDs for automotive and medical use, with excellent durability and thermal stability in harsh environments.

- Kyocera Display Corporation: Kyocera delivers TFT-LCDs tailored for outdoor and automation use, featuring high brightness, low power consumption, and extended operational life.

- Winmate Inc.: Winmate specializes in rugged touchscreen displays and industrial panel PCs, widely deployed in marine, logistics, and defense applications for their toughness and connectivity.

- Rockwell Automation, Inc.: Rockwell develops industrial operator interfaces that integrate with its control systems, enhancing process visualization and factory automation efficiency.

- Planar Systems, Inc.: Planar designs high-performance visualization systems for control rooms and monitoring centers, recognized for precision image quality and long-term reliability.

- Pepperl+Fuchs SE: Pepperl+Fuchs produces explosion-proof industrial displays and HMIs built for hazardous and process-critical environments, offering superior robustness and safety compliance.

Segment Covered in the Report

By Type

- Rugged Displays

- Open Frame Monitors

- Panel-Mount Displays

- Marine Displays

- Video Walls

- Transparent Displays

By Technology

- LCD

- LED

- OLED

- E-Paper

- TFT

By Panel Size

- Below 14”

- 14–21”

- 21–40”

- Above 40”

By Application

- Human-Machine Interface (HMI)

- Industrial Automation

- Digital Signage & Advertising

- Remote Monitoring

- Interactive Display Systems

- Control Rooms

By End-User Industry

- Manufacturing

- Energy & Power

- Oil & Gas

- Automotive

- Healthcare

- Transportation

- Aerospace & Defense

By Region

- North America (US, Canada)

- Europe (EU, UK, Rest)

- Asia-Pacific (China, Japan, South Korea, Australia)

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting