What is the Active Implantable Medical Devices Market Size?

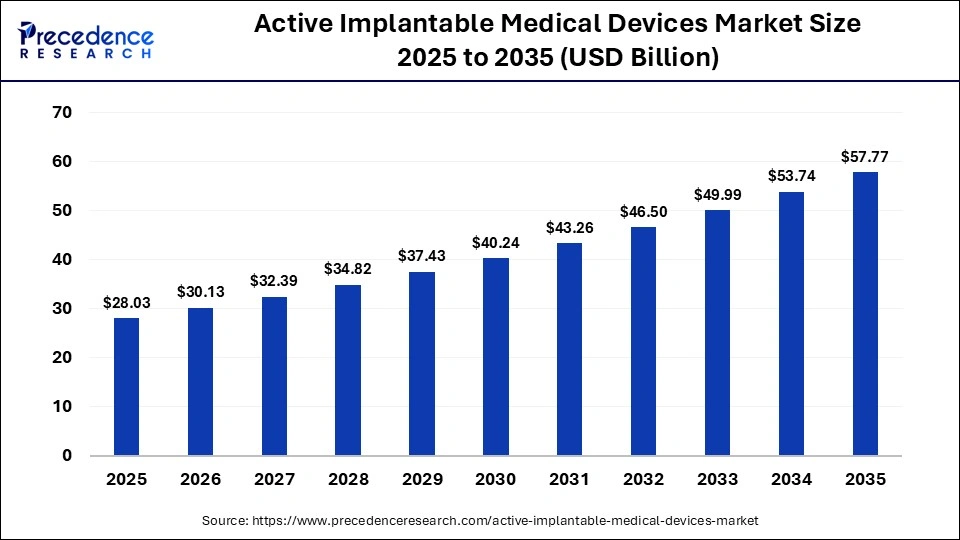

The global active implantable medical devices market size accounted for USD 28.03 billion in 2025 and is predicted to increase from USD 30.13 billion in 2026 to approximately USD 57.77 billion by 2035, expanding at a CAGR of 7.50% from 2026 to 2035. This market is growing due to the rising chronic disease burden, an aging population, rapid technological advancements, and increasing demand for personalized, long-term, and minimally invasive treatment solutions.

Market Highlights

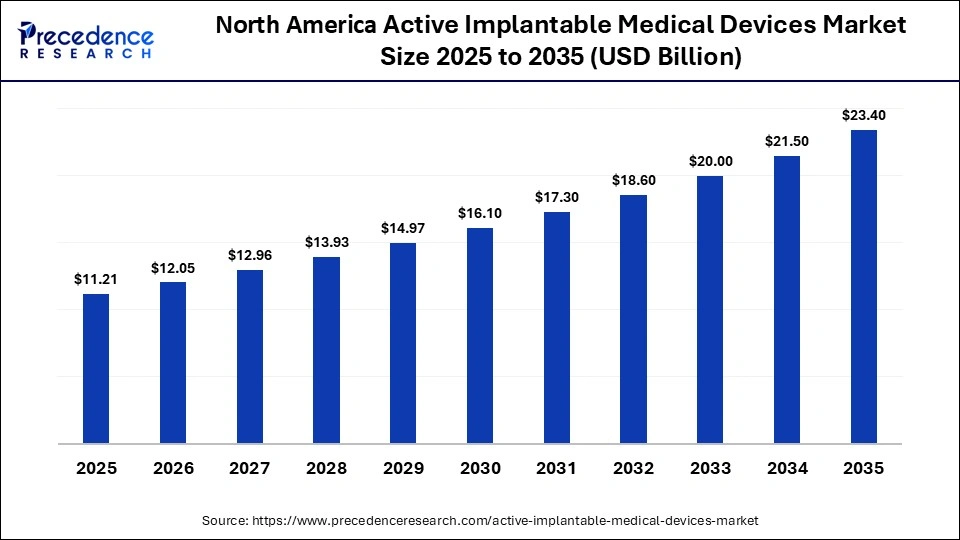

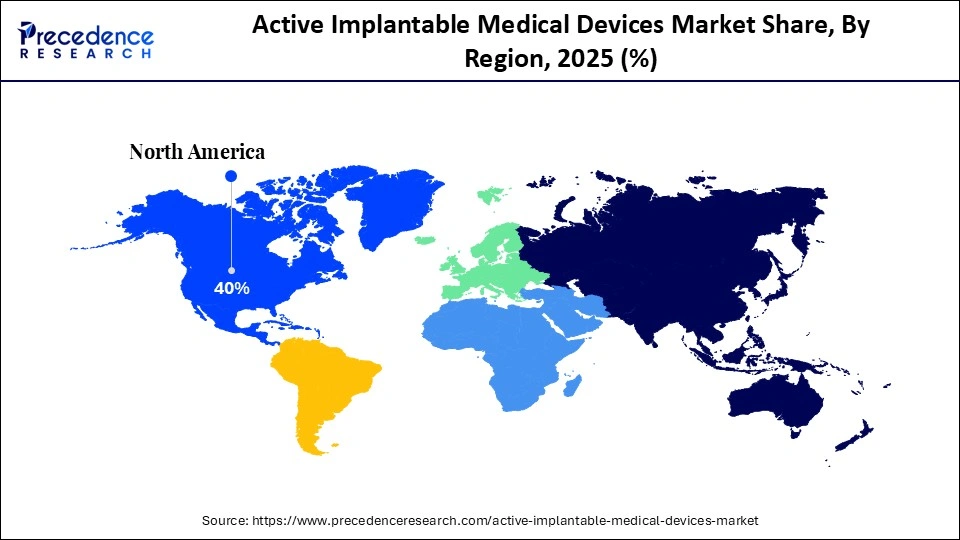

- North America dominated the active implantable medical device market with the largest market share of 40% in 2025.

- Asia-Pacific is expected to host the fastest-growing market in the coming years.

- By product, the implantable cardioverter defibrillators (ICDs) dominated the global market in 2025.

- By product, the implantable hearing devices segment is expected to be the fastest-growing in the active implantable medical devices market during the forecast period.

- By application, the hospitals segment dominated the market in 2025.

- By application, the specialty clinics segment is expected to witness the fastest growth in the market over the forecast period.

What are Active Implantable Medical Devices?

The active implantable medical devices market refers to the development and distribution of implantable medical devices for the management of a wide range of chronic disorders. An active implantable medical device is a medical device that is surgically placed inside the body and requires an energy source to perform its functions, such as regulating heart rhythm, delivering drugs, or supporting organ function. These devices play a critical role in managing chronic and life-threatening conditions, including cardiac disorders, neurological diseases, and severe hearing loss.

The market includes products such as pacemakers, implantable defibrillators, neurostimulators, cochlear implants, and drug infusion pumps, which are widely used to enhance patient survival and comfort. The market for active implantable medical devices is growing steadily because of the growing prevalence of chronic diseases, an aging population, and continuous advancements in medical technology.

How is AI Transforming the Active Implantable Medical Devices Market?

Artificial intelligence (AI) is rapidly transforming the market by making these technologies smarter, safer, and more responsive to individual patient needs. AI-powered technology enables real-time monitoring and continuous analysis of patient data, allowing devices such as pacemakers, neurostimulators, and insulin pumps to adjust therapy automatically for improved accuracy and outcomes. Predictive analytics helps detect early signs of complications, device malfunction, or disease progression, enabling timely medical hospital visits.

AI is also enhancing remote patient management platforms, improving treatment adherence and patient engagement while easing the burden on healthcare systems. In addition, machine learning models assist in optimizing device design, improving safety, and streamlining clinical workflows. AI is reshaping how implantable devices are developed, deployed, and managed. As healthcare systems increasingly prioritize precision medicine, AI-driven implantable technologies are expected to play a central role in delivering smarter, more effective, and patient-focused treatment solutions.

Active Implantable Medical Devices Market Trends

- The rising adoption of minimally invasive implant procedures is transforming patient care by reducing surgical risks, shortening hospital stays, and enabling faster recovery, making active implantable devices more appealing to both patients and healthcare providers.

- The growing prevalence of chronic diseases and an aging population are significantly increasing demand for long-term implantable solutions, particularly in cardiology and neurology, where consistent therapy delivery and monitoring are critical for survival and quality of life.

- The expansion of healthcare infrastructure and regulatory approvals in emerging economies is accelerating market growth by improving access to advanced implant technologies and encouraging wider adoption across developing regions.

- Technological advancements in battery life, wireless connectivity, and remote monitoring are improving device reliability and performance, allowing continuous patient tracking, early detection of complications, and more personalized treatment approaches.

- Strong investments in research, clinical trials, and product innovations are accelerating the development of next-generation implantable devices, enabling safer therapies, enhanced performance, and expanded treatment options for complex and previously untreatable medical conditions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 28.03 Billion |

| Market Size in 2026 | USD 30.13 Billion |

| Market Size by 2035 | USD 57.77 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.50% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Insights

Which Product Segment Dominated the Active Implantable Medical Devices Market?

By product, the implantable cardioverter defibrillators (ICDs) segment dominated the global market in 2025, due to their life-saving role in preventing sudden cardiac death caused by dangerous cardiac rhythm disorders. These devices continuously monitor heart activity and deliver corrective electrical shocks when abnormal rhythms are detected. The growing prevalence of cardiovascular diseases, increasing elderly population, and rising awareness of early cardiac intervention are driving strong demand.

Technological advancements such as wireless monitoring, smaller device size, and longer battery life have further improved patient acceptance. Hospitals increasingly prefer ICDs due to proven clinical outcomes, reduced emergency admissions, and improved survival rates. Strong reimbursement coverage and widespread clinical adoption continue to support market leadership.

By product, the implantable hearing devices segment is expected to be the fastest-growing in the market over the studied period, driven by the rising cases of hearing impairment, aging population, and the growing awareness of advanced hearing solutions. These devices offer improved sound clarity, speech recognition, and long-term comfort compared to traditional hearing aids. Technological advancements such as digital signal processing, wireless connectivity, and smaller implant sizes are making these devices more user-friendly and effective. Government support programs and insurance coverage in many countries are also improving the quality of life.

Application Insights

Why Did the Hospital Segment Dominate the Active Implantable Medical Devices Market?

By application, the hospitals segment held the largest revenue share of the market in 2025, due to advanced surgical facilities, skilled specialists, and the ability to manage complex implantation procedures. Most cardiac implants, neurostimulators, and hearing devices require specialized operating theaters, intensive care units, and continuous patient monitoring, which are primarily available in hospital settings. Patients also prefer hospitals due to the availability of favorable reimbursement policies. Moreover, hospitals invest heavily in adopting advanced medical devices for personalized care.

By application, the specialty clinics segment is expected to expand rapidly in the market in the coming years due to the increasing demand for outpatient procedures, faster treatment timelines, and lower procedural costs. Many follow-ups, diagnostics, device programming, and minimally invasive implant procedures are now shifting toward specialized cardiac, neurology, and ENT clinics. Improved clinical infrastructure, availability of trained specialists, and growing patient preference for convenient, same-day treatments are supporting rapid clinic adoption.

Regional Insights

How Big is the North America Active Implantable Medical Devices Market Size?

The North America active implantable medical devices market size is estimated at USD 11.21 billion in 2025 and is projected to reach approximately USD 23.40 billion by 2035, with a 7.64% CAGR from 2026 to 2035.

Which Factors Contribute to North America's Dominance in the Market?

North America held a major revenue share of the active implantable medical devices market in 2025, due to its advanced healthcare infrastructure, high healthcare expenditure, and strong adoption of innovative technologies. The region has a large patient population suffering from cardiac disorders, neurological diseases, and hearing loss, driving steady demand for implantable solutions. Strong regulatory standards, early access to innovative devices, and continuous product innovations also support market leadership.

For example, Medtronic's pacemakers and Abbott's implantable cardioverter defibrillators are widely used across hospitals in the U.S and Canada, supported by strong clinical evidence and physician trust.

In addition, high awareness, insurance coverage, and access to specialized surgical facilities allow faster adoption. Continuous investments in research, digital healthcare, and remote monitoring further strengthen the market.

What is the Size of the U.S. Active Implantable Medical Devices Market?

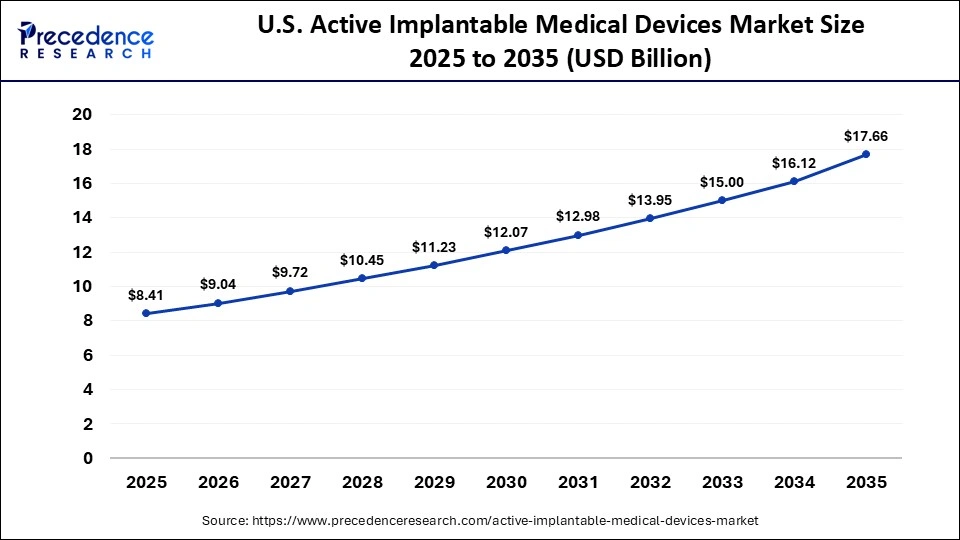

The U.S. active implantable medical devices market size is calculated at USD 8.41 billion in 2025 and is expected to reach nearly USD 17.66 billion in 2035, accelerating at a strong CAGR of 7.70% between 2026 and 2035.

U.S. Active Implantable Medical Devices Market Trends

The U.S market is witnessing strong growth driven by technological innovations, rising chronic disease burden, and increasing preference for minimally invasive treatments. Advanced products such as Medtronic's Micra leadless pacemaker and Boston Scientific's deep-brain stimulators are gaining popularity due to their improved safety and reliable performance. Growing awareness of early diagnosis and demand for personalized treatment also boost market expansion. Additionally, the aging population and rising lifestyle-related disorders are increasing the need for long-term implantable solutions, making the U.S. a key growth engine for this market.

How is Asia-Pacific Growing in the Market?

Asia-Pacific is expected to witness the fastest growth in the active implantable medical devices market during the predicted timeframe, due to the rising healthcare spending, advancing medical infrastructure, and growing awareness of advanced implantable therapies. Countries such as China, Japan, and South Korea are leading adoption, supported by strong manufacturing capabilities and government healthcare initiatives.

Products such as Medtronic pacemakers and Nurotron cochlear implants are gaining wide acceptance due to improved affordability and accessibility. The rising prevalence of heart diseases, diabetes-related complications, and hearing disorders is also accelerating market growth. Additionally, favorable government policies and increased focus on digital healthcare solutions are helping the region emerge as a high-potential market for active implantable medical devices.

India Active Implantable Medical Devices Market Trends

India's market is growing steadily due to rising healthcare awareness, expanding hospital infrastructure, and increasing access to advanced medical treatments. Growing cases of heart disease, hearing loss, and neurological disorders are driving demand for pacemakers, cochlear implants, and neurostimulators. Products such as Medtronic pacemakers and Cochlear India implants are widely used in leading hospitals. Increased health insurance coverage and public awareness campaigns are encouraging early diagnosis and timely treatment, positioning India as one of the most promising emerging markets in the implantable medical devices industry.

Why is Europe the Significantly Growing Region in the Market?

Europe is expected to grow at a considerable CAGR in the active implantable medical devices market in the upcoming period due to increasing healthcare investments, rising awareness of advanced treatment options, and strong regulatory support under the EU Medical Device Regulations. Countries such as Germany, France, and the UK are leading the adoption of active implantable devices due to well-developed hospital networks and access to advanced surgical care.

Public healthcare funding and favorable reimbursement policies improve patient access to these life-enhancing devices. In addition, Europe's aging population and growing burden of cardiovascular and neurological disease are driving long-term demand. Ongoing research collaboration, technology partnerships, and digital health integration are further strengthening Europe's position as a rapidly growing market.

Active Implantable Medical Devices MarketValue Chain Analysis

- R&D

Research and development in the market focuses on developing advanced material engineering, battery efficiency, and software integration to enhance device safety, performance, durability, and patient comfort, while supporting innovation in personalized and connected implantable medical technologies.

Key Players: Medtronic, Inc., Axonics, Inc., Biotronic, and Cochlear Ltd.

- Clinical Trials and Regulatory Approvals

Clinical trials evaluate safety, reliability, and therapeutic effectiveness in real-world settings, while regulatory approvals ensure compliance with strict medical standard, building trust among physicians, patients, and healthcare providers worldwide.

Key Players: Abbott Laboratories, Boston Scientific, and Stryker Corporation.

- Packaging and Sterilization

Packaging and sterilization of active implantable medical devices ensure contamination-free delivery, extended product shelf life, and compliance with medical safety protocols during transportation, storage, and hospital handling.

Key Players: Biotronik, LivaNova, Schott, and Cochlear Ltd.

- Distribution to Hospitals

Distribution to hospitals, specialty clinics, and surgical centers involves timely delivery, inventory management, proper storage, and careful handling of devices, ensuring easy availability.

Key Players: Intertek, BSI Group, Schott, and IMCD N.V.

- Patient Support and Services

Patient support and services focus on device training, remote monitoring, follow-up care, and technical assistance, helping patients adapt to implants, improve treatment adherence, and maintain long-term health outcomes.

Who are the Major Players in the Global Active Implantable Medical Devices Market?

The major players in the active implantable medical devices market include Medtronic, Abbott laboratories, Stryker, LivaNova plc, Boston Scientific Corporation, Cochlear Limited, Johnson and Johnson Services, Inc., Biotronik SE and Co. KG, NevroCorp, Smith & Nephew plc, St. Jude Medical, Integra LifeSciences, Elekta AB, Axonics, Inc., Aleva Neurotherapeutics, MicroTransporter Inc., NeuroPace, Inc., Berlin Heart, Blackrock Neurotech, and Bioventus Inc.

Recent Developments

- In January 2026, FineHeart announced that it raised €35 million in its Series C funding round. The funding was raised to accelerate the industrialization and clinical development of FlowMaker and establish itself as a future European AIMD leader.(Source: https://www.businesswire.com)

- In June 2025, CARMAT received CE marking for its Aeson system, a total artificial heart, as a Class III active implantable medical device. The device was designed for patients with advanced biventricular heart failure. This certification reinforces CARMAT's leadership in artificial heart innovation and expands access to advanced cardiac solutions across Europe.(Source: https://www.businesswire.com)

- In January 2025, Sequana Medical NV announced that it received the U.S. FDA approval of its alfa pump system, offering new hope to patients suffering from recurrent ascites due to liver cirrhosis. The device automatically removes excess abdominal fluid, reducing hospital visits and improving comfort. The approval shows an increase in the adoption of minimally invasive and patient-friendly technologies that enhance the quality of life.(Source: https://med-techinsights.com)

- In February 2024, the School of Biomedical Engineering & Imaging Sciences at King's College London opened a new facility for the manufacture of active implants and surgical instruments. The facility was opened with a grant of £5.2 million, focusing on delivering the benefits of healthcare innovations.(Source: https://www.kcl.ac.uk)

Segments Covered in the Report

By Product

- Implantable Cardioverter Defibrillators

- Transvenous Implantable Cardioverter Defibrillators

- Biventricular Implantable Cardioverter Defibrillators/Cardiac

- Resynchronization Therapy Defibrillators

- Dual-Chamber Implantable Cardioverter Defibrillators

- Single-Chamber Implantable Cardioverter Defibrillators

- Subcutaneous Implantable Cardioverter Defibrillators

- Implantable Cardiac Pacemakers

- Ventricular Assist Devices

- Implantable Heart Monitors/Insertable Loop Recorders

- Neurostimulators

- Spinal Cord Stimulators

- Deep Brain Stimulators

- Sacral Nerve Stimulators

- Vagus Nerve Stimulators

- Gastric Electrical Stimulators

- Implantable Hearing Devices

- Active Hearing Implants

- Non-active/Passive Hearing Implants

By Application

- Hospitals

- Specialty Clinics

- Ambulatory Surgery Center

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content