What is the Active Pharmaceutical Ingredients CDMO Market Size?

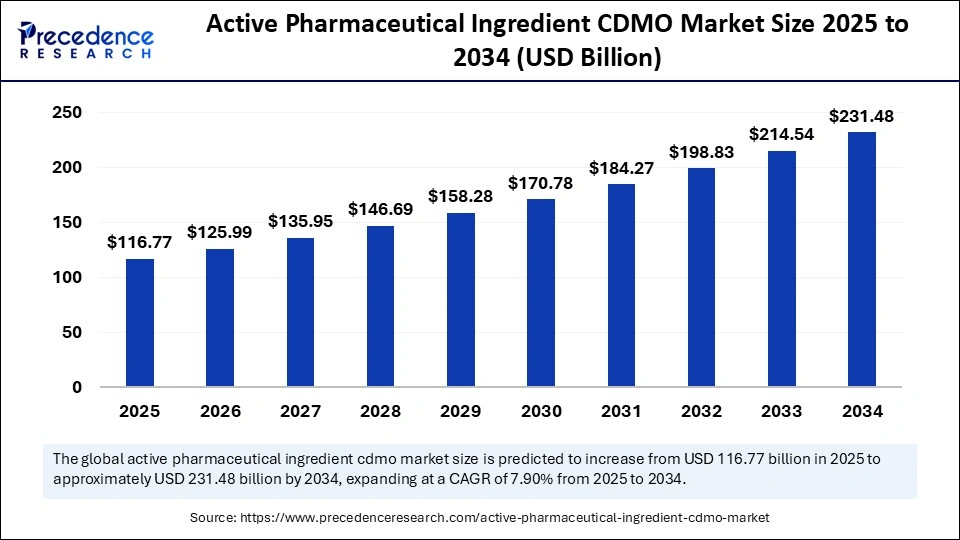

The global active pharmaceutical ingredients CDMO market size was calculated at USD 116.77 billion in 2025 and is predicted to increase from USD 125.99 billion in 2026 to approximately USD 231.48 billion by 2034, expanding at a CAGR of 7.90% from 2025 to 2034. The market is experiencing significant growth, as pharmaceutical companies are outsourcing API manufacturing to reduce costs and scale production. Additionally, rising demand for complex APIs, such as biologics and highly potent compounds, along with the need to diversify supply chains, mitigate risks, enhance operational efficiency, and accelerate time-to-market, are fueling further expansion.

Market Highlights

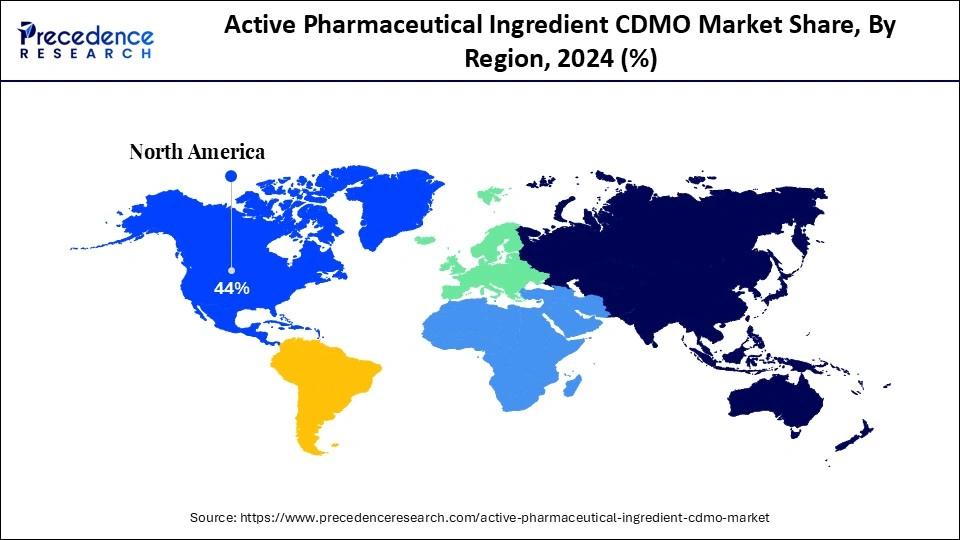

- North America held the largest market share of about 44% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of approximately 8.8% during the foreseeable period.

- By API type/molecule type, the small molecule APIs segment held the largest market share of around 38.5% in 2024.

- By API type/molecule type, the highly potent active pharmaceutical ingredients (HPAPIs) segment is expected to expand at around 8.6% CAGR from 2025 to 2034.

- By service/workflow stage, the clinical stage manufacturing segment dominated the market with around 34.5% share in 2024.

- By service/workflow stage, the commercial manufacturing segment is expected to grow at approximately 8.4% CAGR from 2025 to 2034.

- By therapeutic application/end use, the oncology segment led the market with about 42.5% share in 2024.

- By therapeutic application/end use, the cardiovascular diseases segment is expected to expand at around 8.1% CAGR from 2025 to 2034.

- By customer type, the generic drug manufacturers segment held about 40.5% market share in 2024.

- By customer type, the innovative / big pharma companies segment is expected to expand at the fastest CAGR of around 8.2% during the foreseeable period.

Market Size and Forecast

- Market Size in 2025: USD 116.77 Billion

- Market Size in 2026: USD 125.99 Billion

- Forecasted Market Size by 2034: USD 231.48 Billion

- CAGR (2025-2034): 7.90%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is an Active Pharmaceutical Ingredient CDMO?

An active pharmaceutical ingredient (API) CDMO is a Contract Development and Manufacturing Organization that specializes in the development and production of APIs, the biologically active components of pharmaceutical drugs. These services include process development, scale?up, synthesis, purification, formulation intermediates, and regulatory compliance for APIs, ranging from small molecules to biologics, highly potent APIs, and antibody-drug conjugate payloads. The market is driven by rising R&D outsourcing, drug pipeline complexity, regulatory demands, cost pressures, and demand for specialized capabilities. Through CDMOs, drug developers mitigate capital investment and focus on innovation, while leveraging external manufacturing expertise and capacity.

Key Technological Shifts in the Active Pharmaceutical Ingredients CDMO Market:

Artificial intelligence (AI) plays a transformative role in the active pharmaceutical ingredients CDMO market by optimizing drug development and manufacturing, speeding up route design, improving process control and quality assurance, predicting demand, managing supply chains, and supporting regulatory compliance. AI supports Industry 4.0 frameworks through smart monitoring, predictive maintenance, and trend analysis for continuous improvement. AI-powered tools help manufacturers analyze data to meet regulatory standards set by agencies like the FDA, creating a digitized and controlled ecosystem.

Active Pharmaceutical Ingredients CDMO Market Outlook

- Industry Growth Overview: The active pharmaceutical ingredients (API) CDMO industry is projected for robust growth between 2025 and 2034. This acceleration is fostered by the increased outsourcing of drug development and manufacturing, rising demand for complex and HP-APIs, and the need for specialized expertise for biologics and advanced therapies.

- Global Expansion: Leading CDMOs are expanding their global footprint to leverage manufacturing capacity and access key markets. While North America continues its dominance, driven by strong R&D, the Asia-Pacific region is the fastest-growing market, with countries like India and China capitalizing on cost advantages and increasing capacity.

- Major Investors: Significant investment is flowing into the API CDMO sector from venture capital, private equity, and strategic investors, driven by the strong margins, high technical barriers, and alignment with critical healthcare needs. Recent acquisition activity by major players like Cambrex, Lonza, and Thermo Fisher Scientific highlights investor confidence.

- Startup Ecosystem: The startup ecosystem is flourishing, particularly in specialized areas like high-potency and biologics manufacturing. Emerging firms are attracting funding by focusing on niche therapeutic areas, novel synthesis methods, and platform-based services, leveraging digital tools, and offering end-to-end integrated solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 116.77 Billion |

| Market Size in 2026 | USD 125.99 Billion |

| Market Size by 2034 | USD 231.48 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.90% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | API Type / Molecule Type, Service / Workflow Stage, Therapeutic Application / End Use, Customer Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Complexity of New Drug Molecules

The main driver in the active pharmaceutical ingredients CDMO market is the increasing complexity of new drug molecules, particularly HPAPIs, biologics, cell and gene therapies, and personalized medicine, which fuel demand for specialized manufacturing capabilities. CDMOs invest heavily in advanced technologies needed for these complex products, many of which drug developers lack in-house. This rising complexity creates strong demand for the technology and expertise that CDMOs provide, helping pharmaceutical and biotech companies outsource development and production more efficiently.

Restraint

Complex and Inconsistent Global Regulatory Environment

The main restraint in the active pharmaceutical ingredients CDMO market is the complex and inconsistent global regulatory environment, which causes supply chain vulnerabilities. While factors like cost reduction and rising demand for complex therapies drive the industry, CDMOs face significant hurdles navigating strict, diverse, and changing regulations across regions. Maintaining consistent quality control and oversight across a global network of suppliers with different manufacturing standards can be difficult, often leading to delays or product recalls.

Opportunity

Specialization in Complex and Emerging Therapeutic Modalities

A major future opportunity in the active pharmaceutical ingredients CDMO market lies in the specialization in complex and emerging therapeutic modalities. As the pipeline shifts toward HPAPIs and advanced biologics like oligonucleotides, CDMOs with specialized expertise, advanced technology, and high-containment facilities become essential partners for drug developers. These potent compounds require specialized, contained manufacturing facilities and highly skilled personnel to ensure safety, prevent cross-contamination, accelerate production, and increase efficiency.

Segment Insights

API Type/Molecule Type Insights

What Made Small Molecule APIs the Dominant Segment in the Market in 2024?

The small molecule APIs segment dominated the active pharmaceutical ingredients CDMO market by holding about 38.5% share in 2024, aided by a combination of market maturity, cost-efficiency, and therapeutic versatility. Small molecule drugs are well-established, cost-effective, and versatile, making them fundamental in treating widespread chronic conditions and a broad range of diseases, including infections, cardiovascular issues, diabetes, and neurological disorders. This allows drug developers to rely on specialized expertise, reduce capital investments, and accelerate time-to-market.

The highly potent active pharmaceutical ingredients (HPAPIs) segment is expected to grow at a CAGR of 8.6% throughout the forecast period. The growth of this segment is driven by the rising demand for targeted oncology therapies and the significant costs and complexity involved in manufacturing these compounds. HPAPIs are highly potent and toxic, requiring strict safety protocols to protect workers and prevent cross-contamination. Pharmaceutical companies increasingly outsource this specialized work to CDMOs with the necessary expertise.

Service/Workflow Stage Insights

How Does the Clinical Stage Manufacturing Segment Lead the Market in 2024?

The clinical stage manufacturing segment led the active pharmaceutical ingredients CDMO market with approximately 34.5% share in 2024, owing to the critical need for specialized expertise, cost-effective scalability, and faster drug development. During the clinical phase, pharmaceutical companies depend heavily on CDMOs to produce APIs for trials, a process that small and mid-sized firms often cannot handle internally. Partnering with a CDMO allows pharmaceutical companies to test new drugs without committing extensive resources, enabling them to focus on their core competencies.

The commercial manufacturing segment is expected to grow at a CAGR of 8.4% in the upcoming period. The growth of the segment is driven by the demand for large-scale production, the trend of outsourcing by pharmaceutical firms, and the increasing complexity of new therapies. The patent expiration of blockbuster drugs opens a significant market for generics and biosimilars APIs. Modern CDMOs offering end-to-end services, from development to large-scale manufacturing, provide a more efficient and streamlined route to market, ensuring a stable revenue stream.

Therapeutic Application/End Use Insights

Why Did the Oncology Segment Lead the Active Pharmaceutical Ingredients CDMO Market?

The oncology segment led the market with about 42.5% share in 2024, primarily due to the high demand for complex, innovative cancer treatments. These therapies, particularly targeted treatments and biologics, require specialized manufacturing capabilities and advanced technology, which are often more cost-effective for pharmaceutical companies to outsource. Advances in cancer treatments, including targeted therapies, immunotherapies, and biologics, involve complex molecules and intricate manufacturing processes that benefit from CDMO infrastructure and expertise.

The cardiovascular diseases segment is expected to grow rapidly at a CAGR of 8.1% during the projection period, driven by the increasing global prevalence of CVDs and rising demand for both generic and innovative heart-related meds. The aging population and widespread risk factors like obesity and sedentary lifestyles contribute to the steady demand for cardiovascular APIs. To reduce costs and focus on core activities like drug discovery and marketing, many pharmaceutical companies are increasingly outsourcing API manufacturing to CDMOs.

Customer Type Insights

Why Did Generic Drug Manufacturers Hold the Largest Market Share in 2024?

The generic drug manufacturers segment held around 40.5% share of the active pharmaceutical ingredients CDMO market in 2024 due to their high-volume outsourcing needs, cost-driven business models, and the global surge in generic drug consumption. The upcoming patent cliffs on many blockbuster drugs create a large need for CDMO partners capable of producing generics affordably and at scale. Since generic manufacturers operate on thin margins, reducing manufacturing costs is a key driver. Partnering with CDMOs helps mitigate various risks, including the substantial capital costs of building and maintaining their own facilities.

The innovative / big pharma companies segment is expected to expand at a CAGR of 8.2% in the coming years. This is mainly due to a strategic shift toward outsourcing complex and non-core manufacturing operations. This trend reflects their focus on optimizing R&D pipelines, reducing fixed infrastructure costs, and accelerating speed to market. Collaborating with experienced CDMOs that have proven infrastructure and regulatory knowledge can significantly shorten drug development timelines. Instead of investing huge capital into new facilities and tech, innovative pharmaceutical firms prefer partnering with CDMOs to access advanced expertise.

Regional Insights

U.S. Active Pharmaceutical Ingredients CDMO Market Size and Growth 2025 to 2034

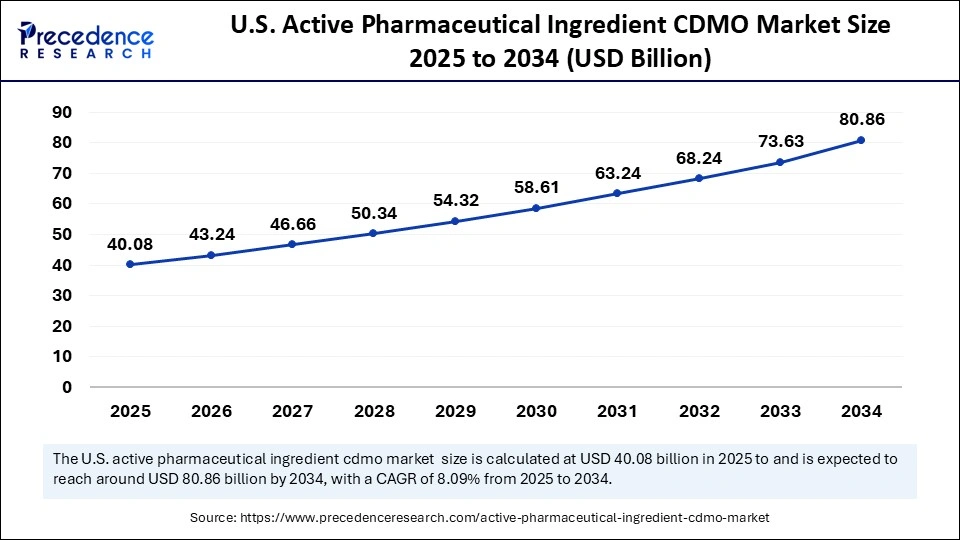

The U.S. active pharmaceutical ingredients CDMO market size is exhibited at USD 40.08 billion in 2025 and is projected to be worth around USD 80.86 billion by 2034, growing at a CAGR of 8.09% from 2025 to 2034.

What Made North America the Dominant Region in the Active Pharmaceutical Ingredients CDMO Market?

North America maintained a dominant position in the market by capturing about 44% share in 2024. This dominance is supported by a robust R&D ecosystem, advanced manufacturing capabilities, and a favorable regulatory environment. A mature and stable regulatory framework, primarily led by the U.S. FDA, emphasizes quality and safety. The region exhibits a high rate of adoption for advanced manufacturing technologies, including continuous manufacturing, advanced bioprocessing, and HPAPI production. This environment attracts global pharmaceutical companies to collaborate with regional CDMOs to ensure compliance with stringent standards and solidify the region's leading position.

- In January 2025, Agilent Technologies announced its agreement to acquire BIOVECTRA, a North American CDMO, in a deal valued at $925 million. This acquisition aims to expand Agilent's capabilities in producing biologics, APIs, and molecules for targeted therapies, thereby enhancing domestic manufacturing potential.(Source: https://www.investor.agilent.com)

U.S. Active Pharmaceutical Ingredients CDMO Market Trends

The U.S. is a major contributor to the global market due to the presence of robust pharmaceutical and biotech industries, significant R&D investments, and stringent FDA regulations. U.S. CDMOs are at the forefront of adopting advanced manufacturing technologies. Innovations such as continuous manufacturing, flow chemistry, automation, and AI-driven process optimization enhance quality, efficiency, and scalability. Government initiatives further strengthen the U.S. position in domestic manufacturing.

The Strategic Active Pharmaceutical Ingredients Reserve (SAPIR) was established to create a national stockpile of APIs for essential medicines, aiming to insulate the U.S. from foreign supply chain disruptions and reduce dependence on other countries for critical inputs.

Why is Asia Pacific Considered the Fastest-Growing Region in the Active Pharmaceutical Ingredients CDMO Market?

Asia Pacific is expected to experience the fastest growth with a CAGR of 8.8% during the forecast period, driven by cost advantages, strong government support, a skilled workforce, and increasing technological capabilities. Countries like India and China offer significantly lower manufacturing and labor costs, making them attractive outsourcing destinations for global pharmaceutical companies. This region is witnessing increased investments in pharmaceutical R&D, focusing on the development of complex APIs, biologics, and specialized therapies such as oncology drugs.

India Active Pharmaceutical Ingredients CDMO Market Trends

India plays a pivotal role in the market, leveraging its reputation as the Pharmacy of the World for generics. This is fueled by significant cost advantages, a vast pool of skilled scientific talent, and a robust, vertically integrated manufacturing infrastructure. The Indian government has also launched strategic initiatives, including Production-Linked Incentive (PLI) schemes and Bulk Drug Parks, to promote domestic API production and reduce its historical dependence on imports.

The PLI schemes were introduced to boost domestic manufacturing by offering financial incentives based on production performance. The PLI scheme for bulk drugs, with an outlay of ?6,940 crore, provides incentives for the production of 41 critical bulk drugs.

The Promotion of Bulk Drug Parks scheme, with a budget of ?3,000 crore, offers financial assistance to three states, Andhra Pradesh, Gujarat, and Himachal Pradesh, to establish mega bulk drug parks, which provide specialized zones with shared infrastructure.

Regulatory Landscape for the Active Pharmaceutical Ingredients CDMO Market

| Feature | U.S. | EU | India |

| Regulatory Body | Food and Drug Administration (FDA) | European Medicines Agency (EMA) + National Competent Authorities (NCAs) | Central Drugs Standard Control Organization (CDSCO) |

| Key Regulation | Current Good Manufacturing Practices (cGMP) | EudraLex & EU GMP | Drugs & Cosmetics Act, 1940 and Schedule M (GMP) |

| API Filing | Drug Master File (DMF) | Active Substance Master File (ASMF) | API Registration System |

| Inspections | Conducts domestic and foreign facility inspections for cGMP compliance. | NCAs inspect facilities; imports require Written Confirmation of GMP. | CDSCO inspects facilities; accepts GMP from select countries. |

| Global Alignment | Actively involved in the ICH to standardize practices. | Follows ICH guidelines for harmonization. | Working to align Schedule M with ICH/PIC/S. |

Active Pharmaceutical Ingredients CDMO Market Value Chain Analysis

- Raw Material Sourcing: This stage involves the procurement of chemical intermediates, solvents, reagents, and biological starting materials essential for API synthesis. CDMOs often maintain global supplier networks to ensure cost-effective and uninterrupted supply while complying with regulatory standards for quality and traceability, especially for controlled substances or high-potency ingredients.

- Process Development & Optimization: In this stage, CDMOs collaborate with pharmaceutical companies to develop and refine the synthesis pathway for APIs focusing on yield, scalability, purity, and cost-efficiency. Advanced technologies like flow chemistry, green chemistry, and continuous processing are increasingly adopted to enhance throughput and reduce environmental impact during API development.

- Analytical Development & Quality Control: CDMOs build robust analytical methods to validate and ensure the identity, potency, purity, and stability of APIs across all production stages. This includes method development, qualification, validation, and transfer as well as continuous monitoring via in-process controls (IPCs) and final product testing in compliance with ICH and pharmacopeial guidelines.

- Scale-Up & cGMP Manufacturing: Once processes are validated, CDMOs scale API production from lab to pilot and commercial-scale in current Good Manufacturing Practice (cGMP) facilities. This stage demands strict regulatory compliance, quality assurance, documentation, and containment infrastructure, especially for high-potency APIs (HPAPIs) and complex biologics.

- Regulatory Support & Documentation: CDMOs assist clients in generating comprehensive regulatory documentation such as Drug Master Files (DMFs), Chemistry Manufacturing and Controls (CMC) sections, and stability data needed for IND, NDA, ANDA, or EMA filings. This support is critical to ensuring regulatory approval in multiple geographies, streamlining the global commercialization pathway for pharmaceutical partners.

- Packaging & Logistics: The final step involves packaging APIs in compliance with Good Distribution Practices (GDP) and ensuring proper labeling, serialization, and tamper-evidence. CDMOs must coordinate temperature-controlled logistics, hazardous material handling, and customs compliance to deliver APIs securely and on time to formulation sites or end clients across international markets.

Top Companies Operating in the Active Pharmaceutical Ingredients CDMO Market

Tier I - Major Players

These CDMOs are global leaders with large scale operations, diverse capabilities (small molecules, HPAPIs, biologics), major facilities, and strong reputations. They likely hold much of the top revenue share in the market.

- Lonza - Known for its breadth (HPAPIs, biologics, ADC payloads, etc.) and global facility footprint.

- Thermo Fisher Scientific (including Patheon) - Significant presence in both early stage development and large scale commercial API manufacturing.

- Catalent, Inc. - Widely recognized for both API and drug product CDMO offerings, and advanced technological investments.

Tier II - Established / Mid Level Contributors

These companies have strong portfolios, often focused on specific geographies, molecules, or specialization (intermediates, generics, peptides). They contribute significantly but are less broad in capacity or regulatory reach than Tier I.

Piramal Pharma Solutions - Known for HPAPIs, custom synthesis, and intermediate scale chemical API work.

- WuXi AppTec - Strong in Asian manufacturing capacity, biologics, and expansion in biologically derived or complex APIs.

- Recipharm AB - Significant European/CDMO presence with API manufacturing and development capabilities.

Tier III - Emerging / Niche Players

These are smaller players, regionally strong, more specialized or more recent in expanding their API CDMO capabilities. They fill important niches and contribute to overall fragmentation of the market.

- Neuland Laboratories (India) - Known for peptide APIs, advanced intermediates, generic APIs.

- Laurus Labs (India) - Active in APIs, CDMO/speciality chemicals, with growing custom synthesis footprint.

- Apeloa Pharmaceutical (China) - Provides APIs, finished dosage forms, and CDMO-like services in various therapeutic areas.

Recent Developments

- In August 2025, Dutch API supplier Ofichem acquired the early phase drug substance site in Uppsala, Sweden from Meribel Pharma Solutions. The 20 employee facility, formerly Recipharm's OT Chemistry, specializes in non GMP small molecule and emerging modalities (antibody drug conjugates, oligonucleotides, PROTACs), augmenting Ofichem's early stage development capabilities.(Source: https://www.dcatvci.org)

- In April 2025, Lonza unveiled its new streamlined operating model, part of its One Lonza vision. This model, known as the Lonza Engine, focuses on five key components: high-performance teams, a robust scientific and technological ecosystem, strong customer partnerships, excellent execution, and flexible investment capabilities, improving customer experience and supporting future growth through three new CDMO business platforms.(Source: https://www.lonza.com)

- In February 2025, SK Pharmteco enhanced its capabilities by launching an advanced analytical testing laboratory in Rancho Cordova, California, dedicated to High Potency Active Pharmaceutical Ingredients (HPAPIs). The CGMP laboratory successfully released its first API, highlighting its commitment to safety and customer-centric service.

(Source: https://www.skpharmteco.com) - In October 2024, Thermo Fisher Scientific showcased its innovations during CPHI Milan 2024, highlighting its Accelerator™ Drug Development services. These solutions aim to support biotechnology and pharmaceutical companies in drug development and manufacturing, improving efficiency throughout the drug discovery process.

(Source: https://www.businesswire.com)

Exclusive Analysis on the Active Pharmaceutical Ingredients CDMO Market

The global active pharmaceutical ingredients CDMO market is poised at a pivotal inflection point, driven by the converging imperatives of cost containment, regulatory stringency, therapeutic innovation, and supply chain diversification. As innovator pipelines become increasingly weighted toward complex small molecules and emerging biologics, including HPAPIs, oligonucleotides, and antibody-drug conjugates, there is an accelerated outsourcing shift to CDMOs with advanced technical proficiencies and high-containment manufacturing infrastructure.

From a market analyst's vantage, the API CDMO space is not merely an adjunct to pharma manufacturing but is evolving into a critical enabler of speed-to-market and lifecycle optimization. The landscape is characterized by intensifying strategic partnerships, vertical integration by large CDMOs, and capacity expansions aimed at capturing demand from both emerging biotech and Big Pharma. The value proposition is further enhanced by the increasing emphasis on integrated development services, from route scouting to tech transfer, making full-service API CDMOs indispensable in a fragmented regulatory and geopolitical environment.

Opportunities abound particularly in specialized segments, such as oncology APIs, orphan drug manufacturing, and controlled substances, where regulatory complexity acts as a barrier to entry. Furthermore, reshoring trends and the reconfiguration of global supply chains post-COVID have realigned investment priorities toward dual-sourcing strategies, particularly benefiting well-capitalized CDMOs in North America and Western Europe.

In summary, the market represents a high-growth, opportunity-rich environment characterized by technical complexity, regulatory depth, and increasing reliance from both innovators and generics players. Firms with differentiated capabilities, scale, and end-to-end service offerings are positioned to capture outsized market share in the decade ahead.

Segments Covered in the Report

By API Type / Molecule Type

- Small Molecule APIs

- Biologic / Macromolecular APIs

- Highly Potent APIs (HPAPIs)

- Antibody-Drug Conjugate (ADC) Payloads

- Others (e.g., peptides, oligonucleotides)

By Service / Workflow Stage

- Process Development

- Clinical Stage Manufacturing

- Commercial Manufacturing

- Analytical & Regulatory Support

By Therapeutic Application / End Use

- Oncology

- Immunology & Autoimmune Diseases

- Cardiovascular Diseases

- Infectious Diseases

- Others (e.g. Neurology, Rare Diseases)

By Customer Type

- Innovative / Big Pharma Companies

- Biotechnology Firms

- Generic Drug Manufacturers

- Research Organizations / Academia

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting