What is Aesthetic Injectables Market Size?

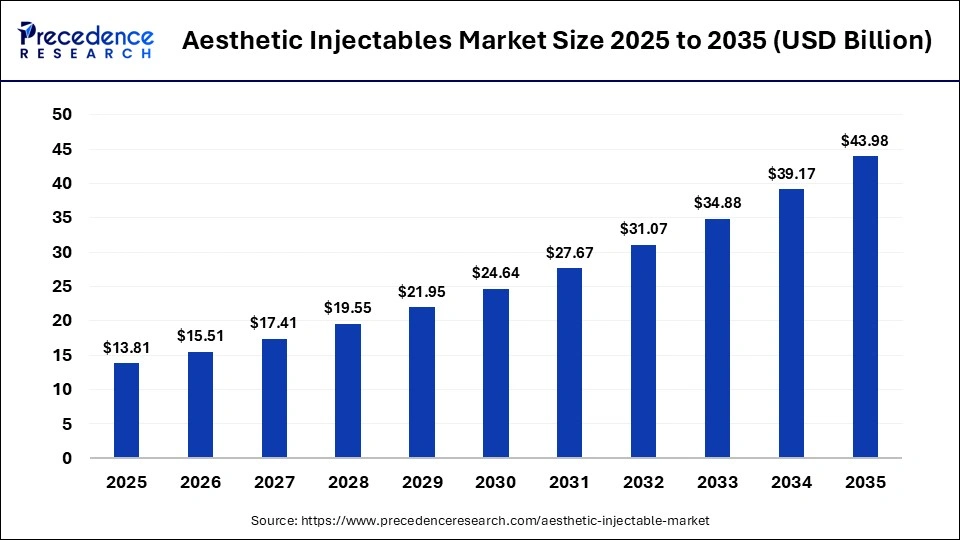

The global aesthetic injectables market size was calculated at USD 13.81 billion in 2025 and is predicted to increase from USD 15.51 billion in 2026 to approximately USD 43.98 billion by 2035, expanding at a CAGR of 12.28% from 2026 to 2035. The aesthetic industry has occupied a strong position due to the momentous growth of regenerative and biostimulatory injectables, long-term trust, AI-enhanced personalization, and predictive treatment planning.

Market Highlights

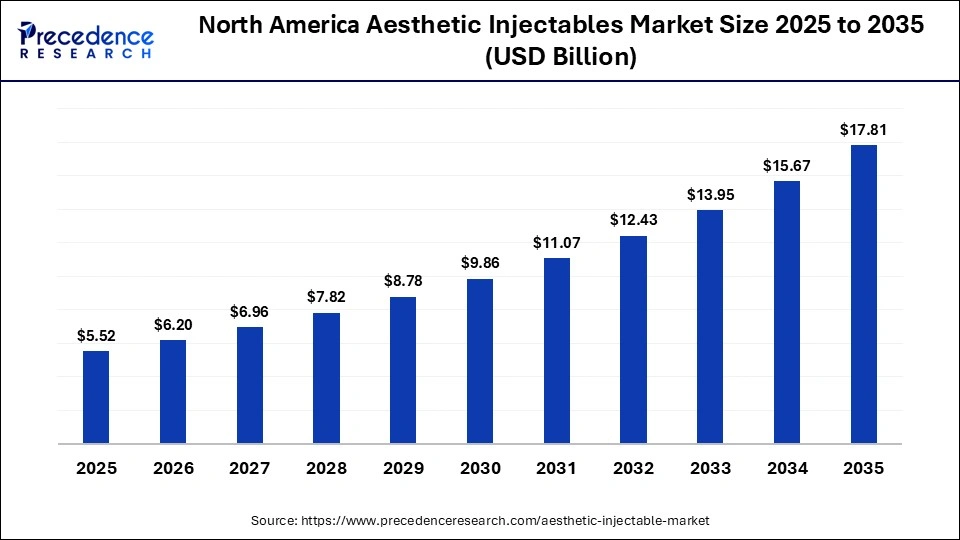

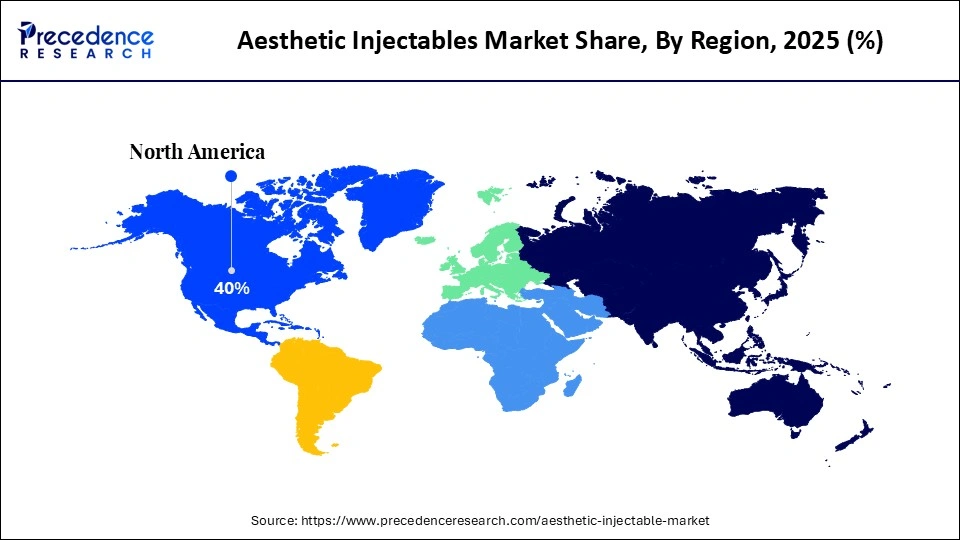

- North America dominated the aesthetic injectables market in 2025.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By product, the botulinum toxin segment dominated the market in 2025.

- By product, the hyaluronic acid segment in the market is expected to grow at the fastest CAGR in the market during the forecast period.

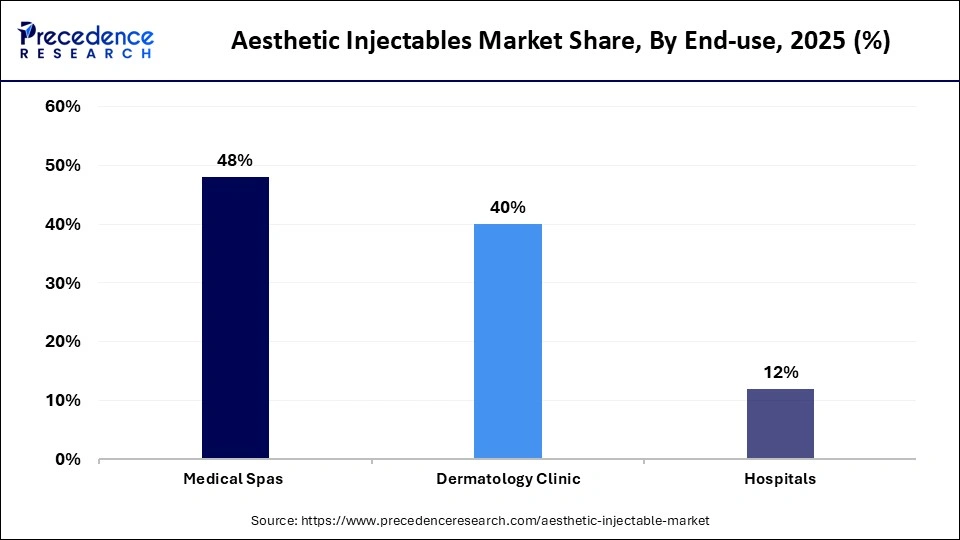

- By end-use, the medical spas segment dominated the market in 2025. The segment is expected to grow at the fastest rate in the market in 2025.

- By application, the facial line correction segment dominated the market in 2025. The segment is expected to grow at the fastest CAGR in the market during the forecast period.

Aesthetic Medicine Innovations: Driving the Future of Injectables

The aesthetic injectables market is transforming with the growing preferences of clients for subtle and regenerative results over treatments. The healthcare providers have hugely adopted new technologies, bio-stimulatory formulas, and data-driven precision to offer long-lasting and natural outcomes. Research focuses on growth-factor boosters and exosome-based injectables for skin repair and texture refinement. Moreover, the emerging advancements include micro-dosing neuromodulators, targeted filler techniques, correction, and refinement.

The leading players in the manufacturing sector, like Revance and Allergan Aesthetics, are rooted in transparency by expanding educational campaigns and maintaining safety in product science that builds long-term trust. Research suggests that the leading manufacturers are dedicated to developing regenerative and peptide-based injectables that stimulate collagen while improving elasticity and hydration. The injectables complement the surgical options, and their role is expected to expand for prevention, maintenance, and natural rejuvenation.

What are the benefits of AI in the Aesthetic Injectables Market?

Artifical Intelligence-assisted facial mapping and predictive treatment planning tools are revolutionizing the market by guiding injectors in assessing volume loss, symmetry, and optimal product placement. AI software helps in the analysis of 3D facial scans to model outcomes before treatments. Clinics are highly adopting AI in aesthetic medicine, which offers consistent and more personalized results while enhancing transparency in consultation services. Moreover, predictive analytics helps clinicians in the product selection by age, skin type, and lifestyle, and tailors dosing for patients.

Aesthetic Injectables Market Trends

- Prejuvenation and Combination Therapies: Patients in their 20s and 30s prefer this innovative approach to delay their visible aging and preserve their youthful skin. The combination therapies include a pairing of neuromodulators like Botox with laser treatments and preventative skincare to fight against early signs of aging.

- Mobile Aesthetic Clinics: These clinics are gaining traction in the market due to their great potential to offer luxury treatments to patients at their doorsteps. They are designed to maintain professionalism and cleanliness of conventional Med spas. Clinics that invest in blogs, educational marketing videos, and social content perform better than those that depend on promotion alone.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 13.81 Billion |

| Market Size in 2026 | USD 15.51 Billion |

| Market Size by 2035 | USD 43.98Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 12.28% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product Type, End Use, Application and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Insights

How does the Botulinum Toxin Segment Dominate the Aesthetic Injectables Market in 2025?

The botulinum toxin segment dominated the market in 2025, owing to its primary indications in aesthetic treatments like wrinkle reduction and medical therapies targeting neuromuscular conditions like muscle hypertrophy, dystonia, and spasticity associated with stroke or cerebral palsy. According to the National Institutes of Health (NIH), botulinum toxin has shown promising results in chronic migraine prophylaxis, leading to reduced migraine frequency and severity and fewer symptoms. Research suggests that botulinum toxin remains an effective approach across various neuromuscular and sensory conditions.

The hyaluronic acid segment is expected to grow at the fastest CAGR in the aesthetic injectables market during the forecast period, driven by the expanding applications of hyaluronic acid formulations in medical devices, cosmetics, and the pharmaceutical sector. Moreover, medical-grade applications of hyaluronic acid are expanding rapidly in wound healing and orthopedics. The hyaluronic acid ingredients offer superior performance, while related innovations focus on stability and bioavailability.

End-Use Insights

What made Medical Spas the Dominant Segment in the Aesthetic Injectables Market in 2025?

The medical spas segment dominated the market in 2025 and is estimated to grow at the fastest rate in the market during the predicted timeframe, owing to the leading trends like biostimulatory treatments, personalized skin treatments based on AI and skin scanning, and wellness-integrated aesthetics that are shaping the future of medical aesthetics. There is a growing demand for Men's aesthetic treatments like Brotox, laser treatments for hyperpigmentation or razor bumps, and more. Medical spas also provide popular services for skin barrier repair, which include LED therapy to reduce inflammation, skin cycling, gentle exfoliation, etc.

Application Insights

How did the Facial Line Correction Segment Dominate the Market in 2025?

The facial line correction segment dominated the market in 2025. The segment is anticipated to grow at the fastest rate in the aesthetic injectables market during the upcoming period due to the rise of facial injectable fillers as the most widely used cosmetic procedures, followed by the rising demand for facial rejuvenation and aesthetic enhancement. The industries are leading with their robust production of common materials like polycaprolactone, calcium hydroxylapatite, hyaluronic acid, and poly L-lactic acid that are widely used by clinicians. There is an increased focus on delivering promising services like soft tissue augmentation, facial rejuvenation, wrinkle removal, correction of volume loss, and treating facial disproportion caused by infection, trauma, or aging.

Regional Insights

How Big is the North America aesthetic injectables Market Size?

The North America Aesthetic Injectables market size is estimated at USD 5.52 billion in 2025 and is projected to reach approximately USD 17.81 billion by 2035, with a 12.43% CAGR from 2026 to 2035

How does North America dominate the Aesthetic Injectables Market in 2025?

North America dominated the market in 2025, owing to the U.S. FDA approvals for next-generation products, high adoption of prejuvenation treatments among younger people, and a notable surge in the male patient base. In July 2025, Boulevard raised US$80 million with the reshaping of demand for beauty technologies by Med spa. The major initiatives by North American governments in the aesthetic injectables market focus on product transparency and consumer safety.

- In January 2025, Allergan Aesthetics launched a new AA signature program to redefine patient-centric and multimodal treatment plans. It aims to combine high-quality products to help patients achieve signature looks.

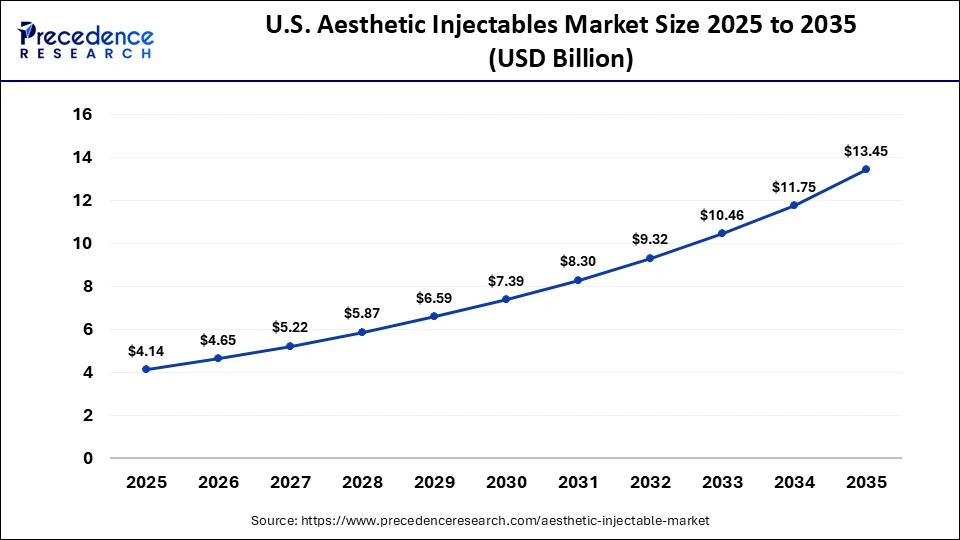

What is the Size of the U.S. Aesthetic InjectablesMarket?

The U.S. aesthetic injectables market size is calculated at USD 4.14 billion in 2025 and is expected to reach nearly USD 13.45 billion in 2035, accelerating at a strong CAGR of 12.51% between 2026 and 2035.

U.S. Aesthetic Injectables Market Analysis

The U.S. aesthetic industry experiences a massive growth due to product innovations and FDA approvals for long-acting neurotoxins, specialised fillers, and regenerative aesthetics. The U.S. FDA introduced regulatory changes in the cosmetics industry in 2025, which include the Modernisation of Cosmetics Regulation Act (MoCRA), OTC sunscreen reform, toxic-free cosmetics laws beyond PFAS, and more.

- In February 2025, Allergan Aesthetics planned to launch three new state-of-the-art training centers in the U.S., aiming to expand access to high-quality aesthetics training. These services are intended to support loyal patient relationships and deliver outcomes with excellence.

What is the Potential of the Aesthetic Injectables Market in the Asia Pacific?

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to the massive demand for anti-aging treatments, more accessible aesthetic treatments, and the emerging trends in facial enhancement that drive the aesthetic injectables market. In December 2025, Bliss Aesthetics raised $17.5 million to launch an AI-powered cosmetic surgery platform that will use AI to connect patients with board-certified plastic surgeons. South Korea is shaping the future of aesthetic medicine, where the government raised a K-beauty public-private venture fund of $27 million in the year 2024 for beauty-tech startups.

India Aesthetic Injectables Market Trends

The Indian market and the aesthetic medicine industry are rapidly expanding due to technological advancements that are centralising aesthetic and cosmetic procedures. Research suggests that over 500,000 international patients for aesthetic services are welcomed yearly by medical tourism in India.

How is the Noticeable Progress of Europe in the Aesthetic Injectables Market?

Europe is expected to grow at a notable rate in the market, owing to the expanding service access through the rapidly growing Med spa chains and clinics, more affordable treatments, social media influence, and improved safety profiles. In December 2025, Innerskin secured €12.8 million for the expansion of its network of medical aesthetics centres and integrated skin-health services across Europe and France. The UK government announced the UK national licensing scheme to regulate non-surgical aesthetic procedures like fillers and Botox.

Germany Aesthetic Injectables Industry Analysis

The German aesthetic injectables market advances with a rapid shift towards non-invasive treatments, robust consumer awareness, and a well-established aesthetic infrastructure. In March 2024, Germany launched a major subsidy scheme for promoting greener industry, which has invited glass, steel, and paper-making industries to submit proposals to conduct green technology projects.

What Factors Drive a Pivotal Reach of the Aesthetic Injectables Market in Latin America?

Latin America is expected to grow at a significant rate in the market due to medical tourism hub, high social acceptance for aesthetic treatments, and flexible financing options in healthcare. This region is leading in beauty innovation and supporting the market, followed by regulatory alignment, networking, business development, knowledge exchange opportunities, and regional expertise. In September 2025, Hugel, Inc. strengthened its presence in Brazil with the launch of a toxin product named Letybo and a new partner, Derma creme.

Brazil Aesthetic Injectables Market Trends

Brazilian industry for aesthetic medicine offers innovative financing, introduces new product launches, and supports technological developments. In July 2025, GEKA, a leading company in beauty application solutions, expanded its global footprint with major investments across its Brazil site, which aims to bring innovative technologies, streamline processes, and enhance production capacity in the beauty industry.

- In October 2025, Brazil's health regulatory agency, named Anvisa, launched a public consultation on regulation for handmade cosmetics, perfumes, and personal care products that was accessible until November 2025.

What Opportunities Exist in the Aesthetic Injectables Market in the Middle East and Africa?

The Middle East and Africa are expected to grow at a lucrative rate in the market, owing to a notable cultural shift towards self-care and wellness, increased preference for preventative anti-aging treatments, and investments in high-end aesthetic services. The major government initiatives towards the aesthetic injectables market include the Saudi Food and Drug Authority (SFDA) digital transformation, Vision 2030 healthcare projects, and restricted substance regulation. In late 2025, L'Oréal launched its first standalone travel retail beauty boutique in Africa, which marks a notable shift towards aesthetic retail in the Nigerian market.

Saudi Arabia Aesthetic Injectables Industry Analysis

Saudi Arabia expanded with regulatory support, streamlined imports, rigorous safety standards, and consumer confidence in the quality of injectable products. The country introduced cosmetic regulations that also streamline exports to Saudi Arabia through proactive compliance, enhanced market access, and trusted certification.

Value Chain Analysis: Aesthetic Injectables Market

- R&D:This stage includes formulation development, biocompatibility integration, clinical trials, regulatory pathways, regenerative medicine integration, and digital and AI innovation.

Key Players: Allergan Aesthetics, Revance Therapeutics, Galderma, Merz Aesthetics, Ipsen Pharma, Evolus. - Distribution to Hospitals, Pharmacies: This stage is expanding through direct-to-provider models, specialised logistics, centralised procurement, hospital pharmacy storage, and e-pharmacy integration.

Key Players: AbbVie, Galderma, Merz Pharma, Revance Therapeutics, Hugel, Inc., Sinclair, Imeik Technology, Ipsen Pharma. - Patient Support & Services : This stage is gaining traction due to virtual consultations, pain management, remote monitoring, wellness integration, and patient safety protocols.

Key Players: AbbVie, Galderma, Merz Pharma, Revance Therapeutics, Hugel, Inc., Sinclair, Imeik Technology, Ipsen Pharma.

Who are the Major Players in the Global Aesthetic Injectables Market?

The major players in the aesthetic injectables market include Allergan Aesthetics (AbbVie), Galderma, Merz Aesthetics, Revance Therapeutics, Ipsen Aesthetic, Evolus, Sinclair Pharma, Hugel Inc., Medytox, and Bloomage Biotech

Recent Developments in the Aesthetic Injectables Market

- In October 2025, Galderma reported its record of net sales of 3.737 billion USD in the first nine months of the year 2025, and net sales growth of 15.0% at constant currency. This success is followed by a robust product portfolio, including injectable aesthetics, dermatological skincare, neuromodulators, and therapeutic dermatology.

(Source: https://www.galderma.com) - In February 2025, Evolus announced the U.S. FDA approval of Evolysse smooth injectable hyaluronic acid gels and Evolysse form. This new launch has established Evolus as a multi-product performance beauty company and expanded the market by 78%. (Source: https://finance.yahoo.com)

Segments Covered in the Report

By Product

- Hyaluronic Acid (HA)

- Botulinum Toxin (Botox)

- Aquatic Light Injections

- Others

By End-use

- Medical Spas

- Dermatology Clinics

- Hospitals

By Application

- Facial Line Correction

- Lip Augmentation

- Face Lift

- Acne Scar Treatment

- Lipoatrophy Treatment

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content