What is AI in Energy Management Systems Market Size?

The global AI in energy management systems market drives innovation in predictive analytics, load balancing, and decentralized energy control to support sustainable operations. The market growth is being driven by the global push toward clean energy generation and decarbonization, the rising energy demand across industrial and commercial sectors, and the rapid evolution of AI technologies that can be seamlessly integrated into existing energy management systems.

Market Highlights

- North America held the largest market share of nearly 45% in 2024.

- Asia Pacific is expected to witness the fastest growth during the foreseeable period of 2025-2034.

- By application, the energy consumption optimization segment held the largest market share of nearly 35% in 2024.

- By application, the predictive maintenance segment is expected to grow at the fastest CAGR during the foreseeable period.

- By end user, the utilities segment held the largest market share of nearly 40% in 2024.

- By end user, the residential segment is expected to expand at the fastest CAGR during the foreseeable period.

- By deployment mode, the cloud-based solutions segment held the largest market share of nearly 50% in 2024.

- By deployment mode, the hybrid solutions segment is expected to expand at the fastest CAGR during the foreseeable period.

- By component, the software segment held the largest market share of nearly 60% in 2024.

- By component, the services segment is expected to grow at the fastest CAGR during the foreseeable period of 2025-2034.

What is AI in Energy Management Systems Market?

The AI in energy management systems market involves the integration of artificial intelligence technologies into energy management frameworks to optimize energy consumption, enhance grid reliability, and support sustainable energy practices. AI-driven EMS solutions leverage machine learning, predictive analytics, and real-time data processing to improve energy efficiency across various sectors, including utilities, industrial facilities, commercial buildings, and residential areas. The market is poised for robust growth, driven by the convergence of decarbonization mandates and intelligent grid optimization. Rapid advancements in AI enable real-time energy forecasting, load balancing, and operational efficiency across industrial and utility sectors.

- In September 2025, new research from KPMG unveils that integrating AI models with energy management systems can significantly reduce energy consumption in commercial buildings and surpass conventional retrofits. (Source: https://aimagazine.com)

Energy Management Systems Market Outlook

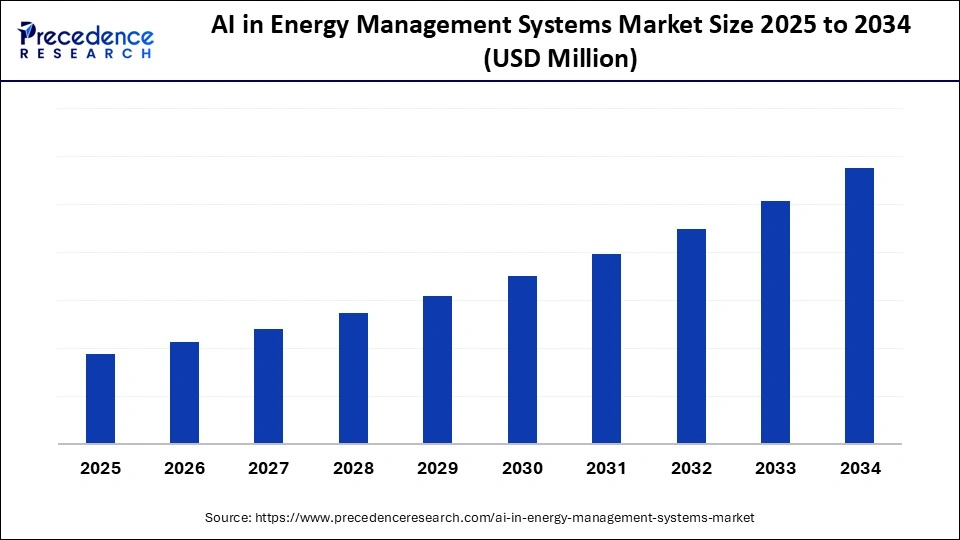

- Market Growth Overview: The AI in energy management systems market is poised for significant growth between 2025 and 2034, driven by the global push for energy efficiency, carbon footprint reduction, and the integration of smart grid technologies. Further expansion is supported by the rising demand for energy-efficient solutions and the growing need to manage renewable energy sources effectively during periods of energy intermittency.

- Sustainability Trends: Global shift toward net-zero emissions and adoption of renewable energy are driving demand for intelligent systems that can optimize energy use and reduce carbon footprints. AI-powered energy management solutions support these goals by enabling real-time analytics, predictive maintenance, and smarter integration of clean energy sources into existing infrastructures.

- Rise of EaaS Model: Energy-as-a-Service (EaaS) model, which facilitates improved integration of renewable energy while optimizing charging cycles to enhance energy storage. Commercial buildings with AI-integrated energy management systems can achieve energy savings of up to 37%, underscoring the efficiency and growing adoption of AI-driven Building Energy Management Systems (BEMS).

- Major Investors: Leading firms such as BlackRock are aggressively investing in the intersection of AI and energy infrastructure. In partnership with GIP, Microsoft, and the investment vehicle MGX, BlackRock is working to raise $30 billion, aimed at scaling AI functionalities and their integration into energy supply systems. Additionally, numerous established firms are backing AI-energy startups to gain early-mover advantages in this fast-evolving sector.

Key Technological Shifts in the AI in Energy Management Systems Market

The AI in energy management systems market is witnessing increased integration of emerging technologies such as Edge AI, blockchain, and IoT. Deploying AI models on edge devices significantly reduces latency and enhances scalability in distributed energy systems, enabling faster response times and real-time control without sole reliance on centralized data centers. Moreover, AI can work in synergy with digital twin technology to create accurate virtual models of energy systems, enabling precise performance predictions and operational optimization. AI is also being paired with blockchain to ensure secure data transmission, while IoT devices provide real-time data to AI-powered systems, enabling responsive and adaptive energy management.

Restraint

Black Box Nature of AI Algorithms

Despite its benefits, the market faces key challenges such as the black box nature of certain AI algorithms, which obscures the decision-making logic behind energy optimization models. This lack of transparency raises concerns in critical areas such as grid architecture and operational safety.

Additionally, the high implementation costs associated with integrating AI into legacy energy infrastructures pose a significant barrier, particularly for established energy providers with rigid systems and limited digital transformation capacity.

Opportunity

Focus on Energy Optimization

One of the most compelling opportunities in this market is the potential for enhanced energy efficiency coupled with lower operational costs. AI reduces reliance on fossil fuel-based systems, which are environmentally harmful, while optimizing energy usage in a cost-effective manner. This leads to reduced energy leakage, better budget control, and improved sustainability metrics.

Furthermore, AI can predict energy disruptions by detecting anomalies and managing real-time load balancing, thereby increasing grid reliability and enabling seamless integration of renewable energy sources across various sectors, including commercial, industrial, and residential.

Segment Insights

ApplicationInsights

How Does the Energy Consumption Optimization Segment Lead the Market?

The energy consumption optimization segment led the AI in energy management systems market, accounting for the largest share of approximately 35% in 2024. This dominance is attributed to its tangible benefits, including significant cost reductions, improved operational efficiency, and compliance with environmental regulations, all of which reinforce its reliability and widespread adoption. As energy systems become increasingly complex, the need for precise AI models to manage and optimize smart grids continues to grow.

Meanwhile, the predictive maintenance segment is expected to expand at the fastest CAGR during the forecast period. This growth is driven by its ability to minimize operational costs and prevent unplanned downtime. By analyzing real-time data from various sensors, AI-powered predictive maintenance systems can identify potential equipment failures before they occur, enabling a proactive maintenance approach that extends asset life and ensures operational continuity.

End-User Industry Insights

Why Did the Utilities Segment Dominate the AI in Energy Management Systems Market?

The utilities segment dominated the market with around 40% in 2024. This segment's dominance is driven by the rising demand for real-time grid management, accurate demand forecasting, and proactive fault detection, all essential for handling complex energy flows and the variability inherent in renewable energy sources such as wind, solar, and tidal power. AI enables a more resilient and adaptive energy infrastructure for utility providers, further propelling the segment's growth.

The residential segment is expected to register the fastest CAGR during the forecast period. The growth of this segment is fueled by rising energy costs, the increasing adoption of smart home technologies that require uninterrupted power supply, and a growing shift toward sustainable energy solutions. AI plays a crucial role in managing home energy consumption, improving efficiency, and facilitating the integration of renewable sources at the household level.

Deployment Mode Insights

What Made Cloud-Based Solutions the Dominant Segment in the AI in Energy Management Systems Market?

The cloud-based solutions segment dominated the market with the largest share of nearly 50% in 2024. This dominance is attributed to its superior data management capabilities, high scalability, and flexibility, allowing organizations to adjust computing power and storage dynamically based on fluctuating energy demand. Cloud-based systems are easily adaptable to the varying energy requirements of businesses across sectors, making them a preferred deployment model.

The hybrid solutions segment is expected to expand at the fastest CAGR during the foreseeable period. The growth of the segment is driven by the ability of hybrid systems to integrate multiple energy sources, resulting in highly reliable and resilient energy generation infrastructures. AI plays a crucial role in designing and managing these complex, multi-source renewable energy systems, enhancing performance and operational efficiency.

Component Insights

Why Did the Software Segment Lead the AI in Energy Management Systems Market?

The software segment led the market with about 60% share in 2024. This leadership is primarily driven by offerings such as real-time monitoring, predictive analytics, and automated control systems, all critical components for energy optimization and cost reduction. Additionally, software solutions provide comprehensive dashboards and analytics capable of processing large volumes of energy data, enabling enterprises to accurately monitor and manage their consumption patterns.

The services segment is expected to grow at the fastest CAGR during the foreseeable period of 2025-2034. The rapid growth of this segment is attributed to the complexity of implementing AI-based energy management platforms, which require continuous monitoring and specialized expertise. Many organizations still operate on legacy systems, making the integration of advanced AI technologies challenging and increasing the demand for expert services to facilitate successful deployment and maintenance.

Regional Insights

What Made North America the Dominant Force in the AI in Energy Management Systems Market?

North America registered dominance in the market by capturing approximately 45% share in 2024. The region's dominance stems from several factors, including strong government support for technological transition, rising demand for smart energy solutions, and significant private sector investments in AI. Policies such as tax credits and subsidies encourage investments in the renewable energy sector, which is increasingly supported by AI technologies in the region.

Substantial government funding directed toward grid maintenance and the modernization of aging energy infrastructure further fuels market growth in North America. Additionally, the presence of tech giants like IBM, Microsoft, and Honeywell, who are heavily investing in developing and commercializing AI-powered energy solutions, strengthens the region's leadership.

How are Canada and the U.S. Contributing to the North American AI in Energy Management Systems Market?

Canada is advancing its AI in energy management systems market through government-backed initiatives, a vibrant startup ecosystem, and growing emphasis on industrial and private sector applications. A notable strategic investment is the “Canadian Sovereign AI Compute Strategy,” which allocates $2 billion to foster AI development nationally.

In the U.S., the Department of Energy (DOE) is making significant investments to integrate AI within the national energy conservation framework, promoting research and development focused on AI applications for decarbonization and energy security. Initiatives like Artificial Intelligence for Interconnection (AI4X) aim to accelerate the integration of new energy sources, including renewables and grid connections, using AI. Furthermore, many leading U.S. companies are heavily investing in AI adoption to enhance energy management systems.

Why is Asia Pacific Considered the Fastest-Growing Area for AI in Energy Management Systems?

Asia Pacific is expected to experience the fastest growth during the forecast period of 2025-2034. The regional market growth is driven by several key factors, including surging energy demand, ambitious clean energy targets, and government-backed strategies focused on decarbonization and energy efficiency through AI adoption. The region is also experiencing widespread integration of smart grids and digital infrastructure, laying the groundwork for scalable AI applications. Additionally, the rapid deployment of smart meters and digital technologies across utilities is generating massive volumes of data, critical inputs for training and refining AI models to optimize energy use and predict demand patterns.

How Is the Indian Government Emphasizing AI Adoption in Energy Management?

India aims to generate 500 GW of renewable energy by 2030 and achieve net-zero emissions by 2070, setting a strong foundation for AI-driven energy transformation. The government has launched the National Smart Grid Mission (NSGM) to modernize and digitize the power grid infrastructure.

The National AI Strategy, developed by NITI Aayog, explicitly promotes the application of AI for sustainable energy solutions and efficiency gains.

Leading Indian energy firms, such as Tata Power, ReNew Power, and Power Grid Corporation of India, are actively integrating AI technologies for real-time load forecasting, predictive analytics, and optimization of renewable energy operations.

Value Chain Analysis of the AI in Energy Management Systems Market

Data Acquisition and Processing

This is the initial stage where vast amounts of energy-related data are collected from various sources and fed into the AI system. The unprocessed data is then transformed into a structured format suitable for training AI/ML models, ensuring accuracy and usability.

Key Players: AI Superior, DeepBrainz AI, Siemens, ABB, GridPoint, Webdyn India

Modeling and Analytics

In this stage, machine learning models are developed by data scientists and AI engineers to derive actionable insights. These models are used for predictive maintenance, grid optimization, energy demand forecasting, and other critical energy management functions.

Key Players: Enverus, C3.ai, Prescinto, Grid4C

Deployment and Integration

This crucial phase involves deploying AI models into existing energy infrastructure and integrating them with business operations. The focus is on ensuring that AI-powered solutions can function effectively in real-world energy management scenarios, delivering measurable value.

Key Players: IBM, ABB, Schneider Electric, Honeywell

Top Companies in the AI in Energy Management Systems Market & their Offerings

Tier I – Major Players (~40–50% of Total Market Share)

These are the dominant companies in the AI in energy management systems market. Each holds a significant individual share and together account for approximately 40–50% of the total market revenue. These players have a global footprint, robust R&D capabilities, and mature AI-powered EMS platforms.

Schneider Electric SE

Schneider Electric is a global leader in energy management and automation, offering AI-powered platforms such as EcoStruxure™ that enable real-time energy monitoring, predictive analytics, and smart grid optimization across industrial, commercial, and residential sectors. The company invests heavily in AI integration to support sustainable energy use, operational efficiency, and decarbonization initiatives globally.

Siemens AG

Siemens leverages its MindSphere and Grid Software Suite to deploy AI for grid automation, demand forecasting, and infrastructure resilience, helping utilities and cities manage distributed energy systems more intelligently. With deep expertise in industrial digitalization, Siemens plays a pivotal role in advancing smart grid and building energy management systems through AI and IoT convergence.

Honeywell International Inc.

Honeywell delivers AI-integrated energy management solutions through platforms like Honeywell Forge, focusing on building automation, energy optimization, and predictive maintenance across critical infrastructure. Its AI tools enhance energy visibility and reduce consumption, particularly in large commercial and industrial environments.

General Electric (GE Digital)

GE Digital contributes through its Predix platform and AI-driven energy analytics, which support grid modernization, real-time load balancing, and outage prediction for utilities. The company combines AI with digital twins and IoT to optimize renewable energy integration and improve the reliability of energy delivery systems.

Tier II – Mid-Level Contributors (~30–35% of Market Share)

These companies have a strong presence in the energy and automation space, with growing AI-based offerings. While not as dominant as Tier I firms, they contribute significantly to the market, accounting for 30–35% of the total share collectively.

- ABB Ltd.

- IBM Corporation

- Johnson Controls International

- Eaton Corporation

- Mitsubishi Electric Corporation

Tier III – Niche and Emerging Players (~15–20% of Market Share)

These companies are either regionally focused, emerging startups, or niche solution providers. While individually their market shares are modest, together they represent approximately 15–20% of the global market. They often specialize in advanced analytics, forecasting, and edge-AI applications.

- C3.ai

- Grid4C

- AutoGrid Systems, Inc.

- Prescinto Technologies

- Verdigris Technologies

- Other local and startup firms

Recent Developments

- In September 2025, Microsoft has signed a $6 billion deal with Nscale and Aker to build a large-scale, renewable-powered AI infrastructure in Northern Norway. The 5-year project aims to provide sustainable AI compute capacity across Europe to meet surging demand.(Source: https://www.esgtoday.com)

- In March 2025, Carrier Global Corporation and Google Cloud entered into a partnership to enhance grid flexibility and smarter energy management. The collaboration integrates Carrier's battery-enabled HVAC and HEMS solutions with Google Cloud's AI-powered analytics and WeatherNext models from DeepMind, aiming to deliver intelligent, connected energy solutions for residential HVAC customers.(Source: https://www.prnewswire.com)

Expert Analysis

The AI in energy management systems market is poised for robust expansion over the next decade, driven by the convergence of intelligent automation, decarbonization imperatives, and next-gen grid modernization strategies. As global energy infrastructures evolve from centralized legacy systems to distributed, data-centric ecosystems, AI is emerging as the foundational enabler of real-time optimization, adaptive forecasting, and autonomous decision-making across both demand and supply paradigms.

The escalating volatility in energy supply chains, amplified by the integration of intermittent renewables, has catalyzed demand for AI-powered platforms capable of executing predictive analytics, dynamic load balancing, and fault detection with minimal human intervention. Moreover, the transition from static consumption models to prosumer-driven energy networks is accelerating the deployment of edge-AI and federated learning frameworks, particularly within residential and commercial microgrids.

Strategic opportunities lie in the layering of AI with digital twin ecosystems, advanced metering infrastructure, and blockchain-enabled transaction frameworks, offering new value pools across predictive maintenance, decentralized storage orchestration, and carbon footprint minimization. As regulatory frameworks tighten around energy efficiency and climate disclosure, AI-infused EMS solutions are not merely operational tools but strategic levers for sustainability-driven capital allocation.

Segments Covered in the Report

By Application

- Energy Consumption Optimization

- Smart Building Energy Management

- Industrial Energy Efficiency

- Commercial Facility Optimization

- Grid Management

- Smart Grid Operations

- Demand Response Management

- Voltage and Frequency Control

- Predictive Maintenance

- Equipment Health Monitoring

- Failure Prediction Algorithms

- Maintenance Scheduling Optimization

- Energy Storage Optimization

- Battery Management Systems

- Energy Storage Scheduling

- Peak Shaving Strategies

- Renewable Energy Integration

- Solar and Wind Energy Forecasting

- Hybrid Energy System Management

- Grid Stability Enhancement

By End-User Industry

- Utilities

- Electric Grid Operators

- Renewable Energy Providers

- Transmission and Distribution Companies

- Manufacturing

- Heavy Industries

- Process Manufacturing

- Automotive and Electronics

- Commercial

- Office Buildings

- Retail Chains

- Hospitality Sector

- Residential

- Smart Homes

- Multi-family Units

- Urban Housing Complexes

- Transportation

- Electric Vehicle Charging Stations

- Fleet Management

- Public Transport Systems

By Deployment Mode

- Cloud-Based Solutions

- SaaS Platforms

- Cloud Storage and Computing

- Remote Monitoring and Control

- On-Premises Solutions

- Localized Data Processing

- Customized Hardware Integration

- Enhanced Security Features

- Hybrid Solutions

- Combination of Cloud and On-Premises

- Edge Computing Integration

- Flexible Deployment Options

By Component

- Software

- AI Algorithms and Models

- Data Analytics Tools

- User Interface Applications

- Hardware

- Sensors and IoT Devices

- Smart Meters

- Communication Infrastructure

- Services

- Consulting and Integration

- Maintenance and Support

- Training and Education

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting