Alzheimers Drug Market Size and Forecast 2025 to 2034

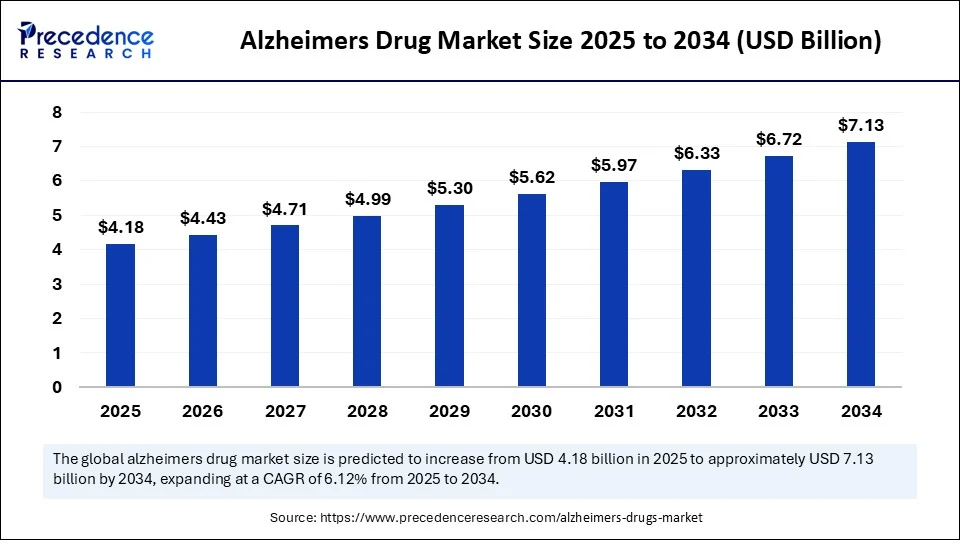

The global alzheimers drug market size accounted for USD 3.94 billion in 2024 and is predicted to increase from USD 4.18 billion in 2025 to approximately USD 7.13 billion by 2034, expanding at a CAGR of 6.12% from 2025 to 2034. With the global aging population, the prevalence of neurodegenerative disorders is on the rise, boosting the growth of the market. The rising discovery and development of novel, effective Alzheimer's treatment support market growth.

Alzheimer's Drug Market Key Takeaways

- In terms of revenue, the global alzheimers drug market was valued at USD 3.94 billion in 2024.

- It is projected to reach USD 7.13 billion by 2034.

- The market is expected to grow at a CAGR of 6.12% from 2025 to 2034.

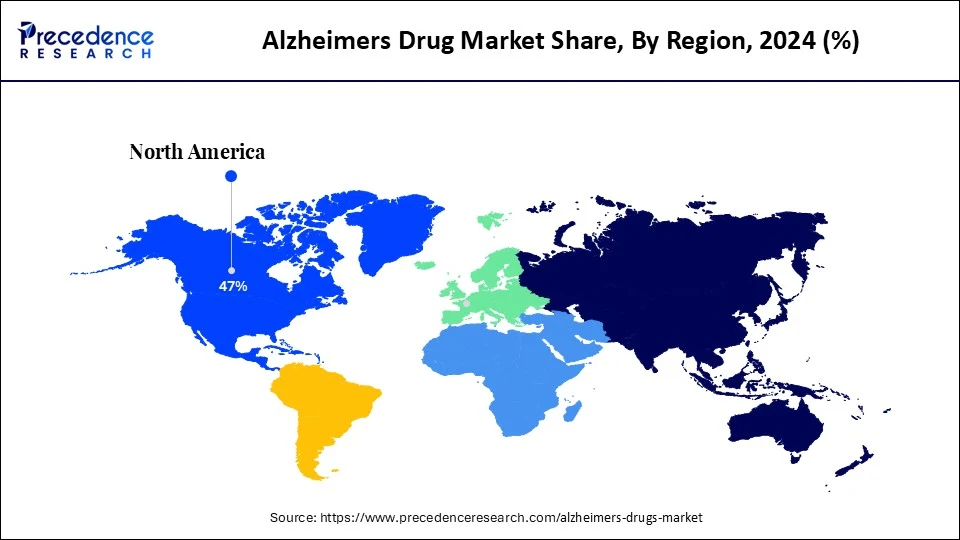

- North America dominated the Alzheimer's drug market by holding a 47% share in 2024.

- Asia-Pacific is expected to expand at the fastest CAGR in the market between 2025 and 2034.

- By drug class, the anti-amyloid monoclonal antibodies segment held the largest market share of 44% in 2024.

- By drug class, the tau aggregation inhibitors segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By disease stage, the severe Alzheimer's segment held a 48% market share in 2024.

- By disease stage, the early stage / mild Alzheimer's segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By mechanism of action, the amyloid beta inhibitors segment held the largest market share of 46% in 2024.

- By mechanism of action, the tau protein modulators segment is expected to grow at a remarkable CAGR between 2025 and 2034.

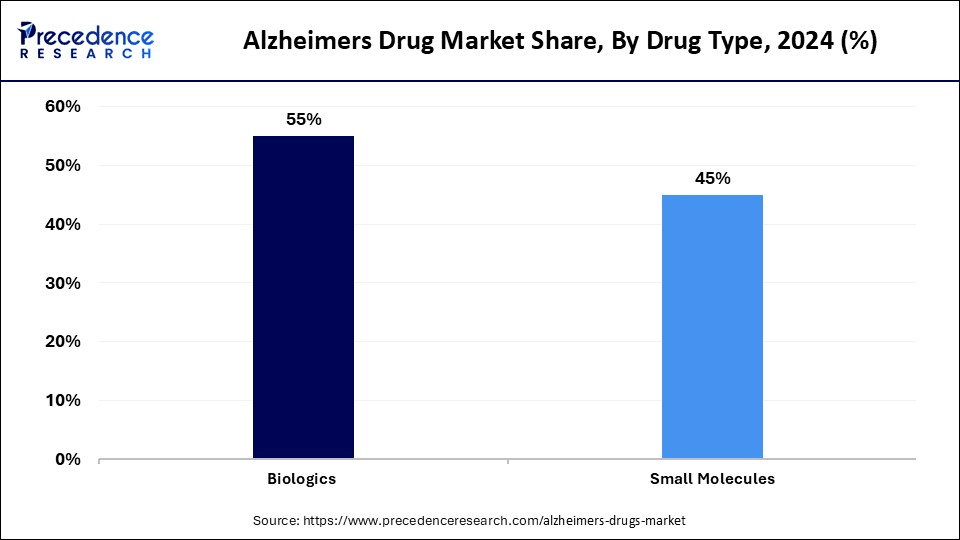

- By drug type, the biologics segment held the largest market share of 55% in 2024.

- By drug type, the small molecules segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By distribution channel, the hospital pharmacies segment held a 42% share in 2024.

- By distribution channel, the online pharmacies segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By end user, the specialty clinics & neurology centers segment held a 39% share in 2024.

- By end user, the homecare settings segment is expected to grow at a remarkable CAGR between 2025 and 2034.

How is AI Revolutionizing the Alzheimer's Drug Market?

Artificial intelligence is becoming a silent yet powerful ally in the fight against Alzheimer's disease. Its integration into the pharmaceutical pipeline, from early diagnostics to late-stage drug discovery, is significantly reshaping the trajectory of this traditionally challenging therapeutic space. AI-powered tools are revolutionizing early detection by analyzing subtle patterns in MRI scans, PET imaging, and even voice patterns. By identifying biomarkers like beta-amyloid plaques or tau proteins at a preclinical stage, AI enables pharmaceutical companies to initiate treatments before cognitive decline sets in, dramatically improving efficiency rates.

By using machine learning algorithms, researchers can now analyze vast datasets to identify new drug targets and mechanisms of action more efficiently. AI reduces the traditional trial-and-error process in drug discovery, thus cutting costs and accelerating time to market, which is crucial in a market often hindered by lengthy clinical trials. AI helps optimize clinical trial design by segmenting patient populations based on genetic profiles, risk factors, and disease progression. This stratified approach leads to more precise and effective trials, reducing dropout rates and increasing success probabilities —a major win for Alzheimer's R&D.

U.S. Alzheimers Drug Market Size and Growth 2025 to 2034

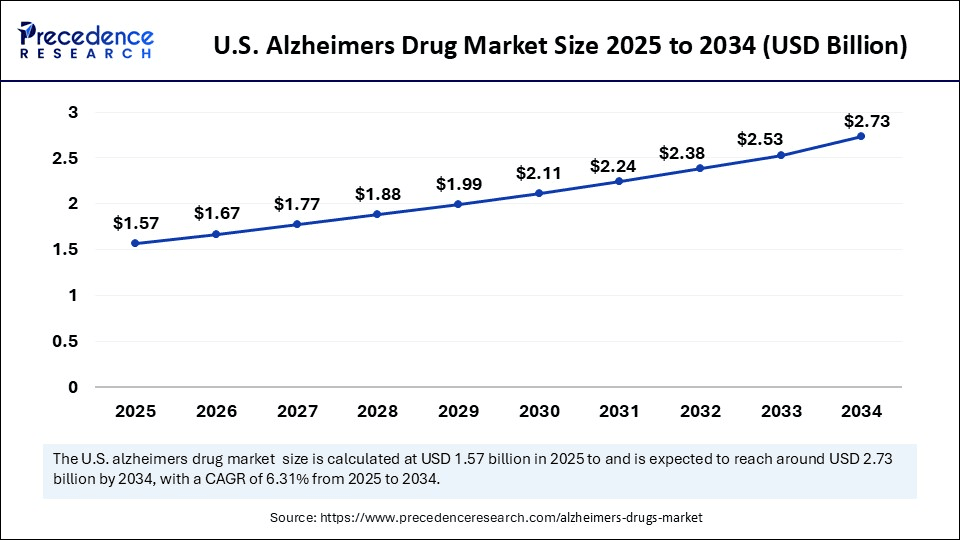

The U.S. alzheimers drug market size was exhibited at USD 1.48 billion in 2024 and is projected to be worth around USD 2.73 billion by 2034, growing at a CAGR of 6.31% from 2025 to 2034.

Why Did North America Dominate the Alzheimer's Drug Market in 2024?

North America dominated the market by capturing a 47% share in 2024. The region's dominance is mainly attributed to the high prevalence of Alzheimer's disease, along with an aging population. There is a strong focus on research and development (R&D) in the field of neurology, leading to rapid innovation and approval of groundbreaking therapies such as Leqembi and Aduhelm. These drugs represent significant advancements in Alzheimer's treatment, offering hope for patients and their families through improved efficacy and targeted mechanisms of action.

Additionally, the demographic dynamics of North America play a crucial role in the market's expansion. The aging population is particularly susceptible to Alzheimer's disease, resulting in a higher prevalence of the condition. As the number of older adults continues to rise, so does the urgency for effective screening and intervention strategies. The growing emphasis on early diagnosis is crucial, as it allows for timely treatment, potentially modifying the disease's course and improving the quality of life for patients. Recent neurological surveys in the U.S. indicate a rising number of diagnosed cases of Alzheimer's, boosting the need for novel drugs. Increased awareness and improved diagnostic tools facilitate earlier and more accurate identification of the disease, supporting market growth.

Why is Asia-Pacific Considered the Fastest-Growing Market?

Asia-Pacific is expected to experience the fastest growth, driven by several key factors. One of the most significant factors is the aging population in countries such as China, Japan, and India, where increasing life expectancy correlates with a rise in the incidence of Alzheimer's disease and other forms of dementia. This demographic shift leads to a higher demand for effective treatments and support systems. Additionally, there has been a growing awareness of Alzheimer's disease across the region, resulting in earlier diagnosis and a greater willingness among patients and families to seek treatment. Enhanced healthcare infrastructure in these countries also plays a pivotal role, as investments in medical facilities and education surrounding dementia facilitate access to innovative therapies.

In China, the government is investing heavily in healthcare improvements, recognizing the urgency posed by the rising number of Alzheimer's cases. This commitment positions China as the largest market for Alzheimer's drugs in the region. Japan, home to one of the oldest populations globally, benefits from a robust healthcare system that emphasizes elderly care and chronic disease management, thus facilitating access to new treatments and driving research advancements. Meanwhile, in India, although healthcare infrastructure is still developing, there is a growing awareness and willingness to confront mental health issues, especially in urban areas where access to healthcare is improving. Healthcare providers and institutions are becoming more proactive in screening for Alzheimer's, recognizing its complex nature and the need for comprehensive care.

Market Overview

The Alzheimer's drug Market comprises pharmaceutical and biologic therapies aimed at preventing, delaying progression, or treating symptoms of Alzheimer's Disease (AD), a chronic neurodegenerative disorder characterized by memory loss, cognitive decline, and behavioral issues. The market includes both symptomatic treatments and disease-modifying therapies (DMTs). Recent breakthroughs in anti-amyloid monoclonal antibodies, combined with a growing aging population, have significantly reshaped the treatment landscape, leading to increased investment and innovation in this space.

The market is undergoing a transformative era marked by scientific breakthroughs, regulatory shifts, and intensifying investment. With only a few approved therapies and millions of patients globally, the unmet medical need continues to drive innovation and opportunity. This expansion is fueled by rising incidence rates, increasing awareness, and advancements in both symptomatic and disease-modifying therapies. The market is witnessing a notable shift from traditional acetylcholinesterase inhibitors to more advanced biologics and monoclonal antibodies like Lecanora and Aducanumab. Disease-modifying drugs (DMTs) are especially gaining traction, targeting amyloid and tau pathways to alter disease progression rather than merely managing symptoms. Regulatory bodies like the FDA and EMA are approving novel Alzheimer's drugs, recognizing the urgent need for treatments.

Key Market Trends

- Increased Research Investment: Significant funding is being directed towards Alzheimer's research, with pharmaceutical companies and governments prioritizing the development of novel therapeutics aimed at treating or slowing the progression of the disease.

- Emergence of Disease-Modifying Treatments: There is a growing emphasis on creating drugs that target the underlying pathology of Alzheimer's, such as amyloid plaques and tau tangles, rather than just alleviating symptoms. Several candidates are currently in late-stage clinical trials.

- Regulatory Changes and Accelerated Approvals: Regulatory agencies are considering faster approval pathways for drugs targeting Alzheimer's, reflecting the urgent need for effective treatments and a growing willingness to adopt innovative clinical trial designs.

- Focus on Combination Therapies: Researchers increasingly recognize that a multifaceted approach may be necessary to effectively combat Alzheimer's disease. Combination therapies that incorporate different mechanisms of action are gaining traction in clinical research.

- Rise of Biomarkers in Drug Development: The use of biomarkers for early diagnosis and patient stratification is becoming critical in Alzheimer's drug development. These biomarkers help identify individuals most likely to benefit from specific treatments.

- Growing Importance of Patient-Centric Trials: There is a shift towards designing clinical trials that prioritize patient engagement and input, focusing on real-world outcomes and quality of life in addition to traditional efficacy measures.

- Expansion of Focus Beyond Traditional Pharma: Biotech startups are increasingly entering the Alzheimer's space, bringing innovative approaches such as gene therapy, immunotherapy, and digital health solutions aimed at improving cognitive outcomes.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 7.13 Billion |

| Market Size in 2025 | USD 4.18 Billion |

| Market Size in 2024 | USD 3.94 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.12% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Class, Disease Stage, Mechanism of Action, Drug Type, Distribution Channel,End User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

An Aging Population

One of the major factors driving the growth of the Alzheimer's drug market is the growing aging population worldwide. As people live longer due to improvements in healthcare and life expectancy, the proportion of elderly individuals, particularly those over 65 years, is rising dramatically across regions. Aging is the strongest risk factor for Alzheimer's disease, and this demographic shift is creating an escalating need for preventive and curative neurological care. According to medical insights, after the age of 65, the risk of developing Alzheimer's doubles approximately every five years. This surge in patient population is placing immense pressure on healthcare systems, caregivers, and insurance providers. As a result, governments and health organizations are ramping up funding and research efforts, creating a fertile environment for pharmaceutical companies.

Restraint

High Failure Rate in Clinical Trials

The development of Alzheimer's drugs involves significant financial investments and time commitment, with many candidates failing in clinical trials, creating a barrier for some companies. The regulatory approval process for new treatments is often lengthy and rigorous, leading to delays in market entry for new therapies. Many drugs in development have shown limited efficacy in clinical trials, which may lead to skepticism from healthcare providers and patients regarding new treatments. Competition with Established Therapies. The presence of existing therapies, even if they are not highly effective, can make it challenging for new entrants to capture market share. The high cost of Alzheimer's treatments can limit accessibility for patients, potentially restricting market growth and leading to challenges in reimbursement policies.

Opportunity

Rising Research & Development Activities

The increasing number of research and development activities to identify underlying mechanisms of Alzheimer's disease presents a significant opportunity in the Alzheimer's drug market. These R&D efforts lead to the discovery of potential drug targets and novel treatment options. Breakthroughs in molecular biology and genetics are opening new avenues for effective drug development. Increased funding from governmental organizations and non-profit groups focused on Alzheimer's research can enhance R&D efforts, leading to innovative therapies entering the market. There is an increasing emphasis on integrated care models for managing Alzheimer's, which can lead to higher adoption rates of new therapies, especially those that address comorbid conditions.

Drug Class Insights

Why Did the Anti-Amyloid Monoclonal Antibodies Segment Dominate the Market in 2024?

The anti-amyloid monoclonal antibodies segment dominated the Alzheimer's drug market with the largest revenue share of 44% in 2024. This is primarily due to their targeted approach in treating Alzheimer's disease. These therapies focus on reducing amyloid-beta plaques, which are believed to play a crucial role in the disease's progression. The increasing understanding of the amyloid hypothesis and the clinical successes of drugs like aducanumab have significantly bolstered investor interest and market confidence in this category. Additionally, the high prevalence of Alzheimer's and the urgent need for effective treatments have amplified the demand for these therapies.

On the other hand, the tau aggregation inhibitors segment is expected to grow at the fastest rate in the upcoming period due to their promising potential in addressing neurodegenerative processes that are not directly related to amyloid plaques. As research advances, there is a growing focus on tau pathology, which is linked to neuronal loss and cognitive decline. This emergent interest in tau-targeted therapies is being driven by the need for comprehensive treatment options that can tackle multiple aspects of Alzheimer's disease and other tauopathies. As clinical trials progress and show favorable results, the market for tau aggregation inhibitors is expected to expand rapidly, complementing the existing anti-amyloid treatments.

Disease StageInsights

How Does the Severe Alzheimer's Segment Dominate the Alzheimer's Drug Market in 2024?

The severe Alzheimer's segment dominated the market with a major revenue share of 48% in 2024. This is mainly due to the increased prevalence of Alzheimer's, especially among the aging population, which has resulted in a rising demand for effective diagnostic tools and treatment options. As life expectancy continues to grow, more individuals are diagnosed with this condition, contributing to the market's expansion. Moreover, the severe stage of Alzheimer's is particularly impactful because it often requires extensive care and resources. Patients in this stage not only need medical treatment but also 24/7 caregiving support, which drives up the demand for healthcare services, pharmaceuticals, and assistive technologies specifically designed for advanced dementia.

On the other hand, the early stage/mild Alzheimer's segment is expected to grow at the fastest rate during the forecast period. The growth of the segment can be attributed to an increasing awareness of early disease detection and the potential for intervention before symptoms progress to more severe stages. There is a growing focus on cognitive screenings and preventative care, leading to earlier diagnoses of mild Alzheimer's. Additionally, the development of new therapies aimed at halting or slowing the progression of the disease in its early stages is generating interest and investment in this segment. As more individuals are identified with mild cognitive impairment, there is high demand for innovative solutions.

Mechanism of ActionInsights

What Made Amyloid Beta Inhibitors the Dominant Segment in the Alzheimer's Drug Market?

Amyloid beta inhibitors are leading the Alzheimer's drug market with the largest revenue share of 46% in 2024 due to their pivotal role in addressing the underlying pathophysiology of Alzheimer's disease. These inhibitors target beta-amyloid plaques, which are hallmark features of the disease, and have garnered significant attention following recent breakthroughs in their development and approval. Their ability to potentially modify disease progression rather than just alleviate symptoms positions them as a frontrunner in the therapeutic landscape. The strong clinical data supporting the efficacy of compounds like Aducanumab has bolstered confidence among healthcare providers and investors alike, fostering widespread adoption and usage. Additionally, with heightening awareness of the importance of early intervention in Alzheimer's treatment, these drugs are becoming increasingly crucial in managing the disease at its roots.

On the other hand, Tau protein modulators are identified as the fastest-growing segment in the market. This growth of the segment can be attributed to the rising awareness of tau pathology in Alzheimer's, as tau tangles are equally critical in the progression of the disease. Recent research has underscored the importance of targeting tau alongside amyloid beta, highlighting the need for innovative therapies that can simultaneously address multiple aspects of the disease.

The promising pipeline of tau-targeting therapies and growing clinical trials focused on their efficacy are contributing to an optimistic outlook in this area. As more data emerges supporting the benefits of these modulators, their market presence is expected to accelerate, reflecting a shift towards comprehensive treatment strategies that aim to modify disease progression effectively. The combination of ongoing research, favorable regulatory pathways, and the urgent need for effective treatment options is driving the rapid growth of this segment in the Alzheimer's drug market.

Drug Type Insights

Why Did the Biologics Segment Dominate the Market?

The biologics segment dominated the Alzheimer's drug market, capturing the largest revenue share of 55% in 2024. Unlike traditional drugs that manage symptoms, biologics are designed to target the disease at a molecular level, often focusing on amyloid beta or tau proteins responsible for neurodegeneration. Their specificity and potential for disease modification are what set them apart in this complex therapeutic space. The segment's growth is also reinforced by increased approval and acceptance of monoclonal antibodies, such as Aducanumab and Lecanemab, which have paved the way for next-generation treatments.

Biologics offer a targeted mechanism that slows disease progression, an approach that has brought renewed hope to patients and caregivers alike. Regulatory authorities, including the FDA, have shown supportive stances toward biologics, granting accelerated approvals and breakthrough designations to promising candidates. These favorable policies not only fast-track market entry but also boost investor confidence, fueling further research in biologics as the preferred treatment model.

Meanwhile, the small-molecule drugs segment is expected to grow at the fastest rate in the coming years. These compounds, often administered orally, offer immense potential due to their ease of delivery, cost-effectiveness, and scalable manufacturing, making them attractive for both patients and healthcare systems. Small molecules are increasingly being developed to modulate enzymes, receptors, and neurotransmitters involved in Alzheimer's pathology. Unlike biologics, which often require injections or infusion, small molecules offer more accessible treatment options that can be easily administered in outpatient or home settings, broadening their appeal, especially in low- and middle-income regions. Pharmaceutical innovators are now focusing on multi-targeted small molecules that not only address beta-amyloid or tau pathways but also provide neuroprotective and anti-inflammatory benefits.

Distribution Channel Insights

Why Did the Hospital Pharmacies Segment Dominate the Market in 2024?

Hospital pharmacies dominated the Alzheimer's drug market in 2024 by holding more than 42% of revenue share in 2024 primarily due to their immediate access to medications following diagnosis and treatment. They play a crucial role in patient care by offering a wide range of complex medications that may not be readily available elsewhere and by collaborating closely with healthcare providers to ensure tailored treatment plans. Additionally, hospital pharmacists provide valuable patient education on medication use and safety, enhancing overall treatment efficacy. Conversely

On the other hand, the online pharmacies segment is expected to grow at a rapid pace thanks to their convenience and accessibility, allowing customers to order medications from home at any time, often at lower prices. The ability to receive home delivery of prescriptions, along with the integration of telehealth services, makes online pharmacies particularly appealing for patients seeking quick and efficient service. While hospital pharmacies excel in providing immediate care within the healthcare system, online pharmacies cater to increasing consumer demand for convenience and cost-effectiveness.

End User Insights

How Does the Specialty Clinics & Neurology Center Segment Dominate the Alzheimer's Drug Market?

The specialty clinics & neurology center segment dominated the market by holding the largest share of 39% in 2024 due to several key factors. Firstly, the increased prevalence of neurological disorders, including Alzheimer's disease, leading to a heightened demand for specialized care. Patients are seeking tailored treatment plans that address their specific conditions, prompting clinics to offer advanced diagnostic tools and specialized therapies. Additionally, the rise in aging populations globally continues to fuel growth in this field, as older adults are more susceptible to neurological issues.

Meanwhile, the homecare settings segment is expected to grow at the fastest CAGR during the projection period. The preference for receiving care in the comfort of one's home is rising, particularly among elderly patients and those with chronic conditions. Homecare allows for personalized attention, which can lead to better health outcomes and patient satisfaction. Advances in technology have also made it easier to provide effective care at home, such as telehealth services and remote monitoring tools. Moreover, the cost-effectiveness of home care compared to traditional hospital settings plays a significant role, as it often reduces the financial burden on patients and healthcare systems alike.

Alzheimer's Drug Market Companies

- Eisai Co., Ltd.

- Biogen Inc.

- Eli Lilly and Company

- Roche Holding AG (Genentech)

- Acumen Pharmaceuticals

- Cassava Sciences

- Vaxxinity Inc.

- Anavex Life Sciences

- Alzamend Neuro

- Oryzon Genomics

Recent Developments

- In May 2025, Vesper Bio ApS, a biotech company in the clinical stage working on an oral treatment for frontotemporal dementia, announced that it has achieved a significant milestone in patient enrollment for the Ib/IIa phase of its ongoing SORT-IN-2 study involving its primary candidate. This Phase Ib/IIa trial focuses on asymptomatic carriers of a mutation in the progranulin (GRN) gene, which is a leading cause of genetically inherited frontotemporal dementia (FTD), known as FTD-GRN. Six asymptomatic volunteers with the GRN mutation have been enrolled so far, with participants located at sites in the Netherlands and the UK. Despite reaching this enrollment milestone, the trial continues to accept new participants.

(source:https://www.passagebio.com)

- In April 2025, Eisai Co., Ltd. announced that the European Commission (EC) has granted the amyloid-beta (Aβ) monoclonal antibody Leqembi (lecanemab) Marketing Authorization (MA) in the European Union (EU). This makes the medicine the first therapy that targets an underlying cause of Alzheimer's disease (AD).

(Source:https://www.eisai.com)

Segments Covered in the Report

By Drug Class

- Cholinesterase Inhibitors

- Donepezil

- Rivastigmine

- Galantamine

- NMDA Receptor Antagonists

- Memantine

- Combination Drugs

- Donepezil + Memantine

- Anti-Amyloid Monoclonal Antibodies

- Lecanemab (Leqembi)

- Aducanumab (Aduhelm)

- Donanemab (under review)

- Tau Aggregation Inhibitors

- Others

- Anti-inflammatory drugs

- Insulin resistance modulators

- Neuroprotective agents

By Disease Stage

- Early Stage / Mild Alzheimer's

- Moderate Alzheimer's

- Severe Alzheimer's

- Prodromal / Mild Cognitive Impairment (MCI)

By Mechanism of Action

- Amyloid Beta Inhibitors

- Tau Protein Modulators

- Neurotransmitter Modifiers

- Anti-inflammatory Agents

- Others

- Mitochondrial stabilizers

- Synaptic function enhancers

By Drug Type

- Biologics

- Small Molecules

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By End User

- Hospitals

- Specialty Clinics & Neurology Centers

- Homecare Settings

- Academic & Research Institutions

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting