What is the Artificial Intelligence (AI) Infrastructure Market Size?

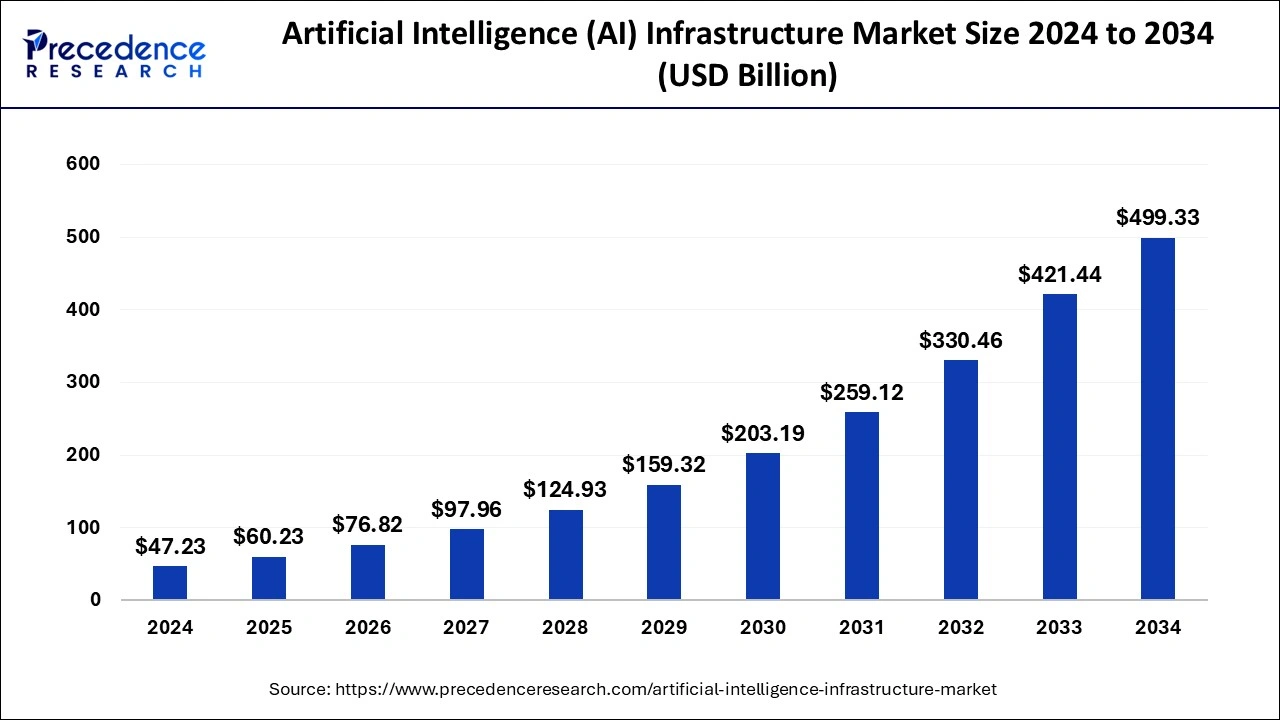

The global artificial intelligence (AI) infrastructure market size accounted for USD 72.02 billion in 2025 and is predicted to increase from USD 91.21 billion in 2026 to approximately USD 465.86 billion by 2034, expanding at a CAGR of 23.05% from 2025 to 2034. An increasing amount of strong artificial intelligence (AI) infrastructure is needed to serve these applications as companies in a variety of industries realize how AI can boost productivity, creativity, and competitive advantage.

Artificial Intelligence (AI) Infrastructure Key Takeaways

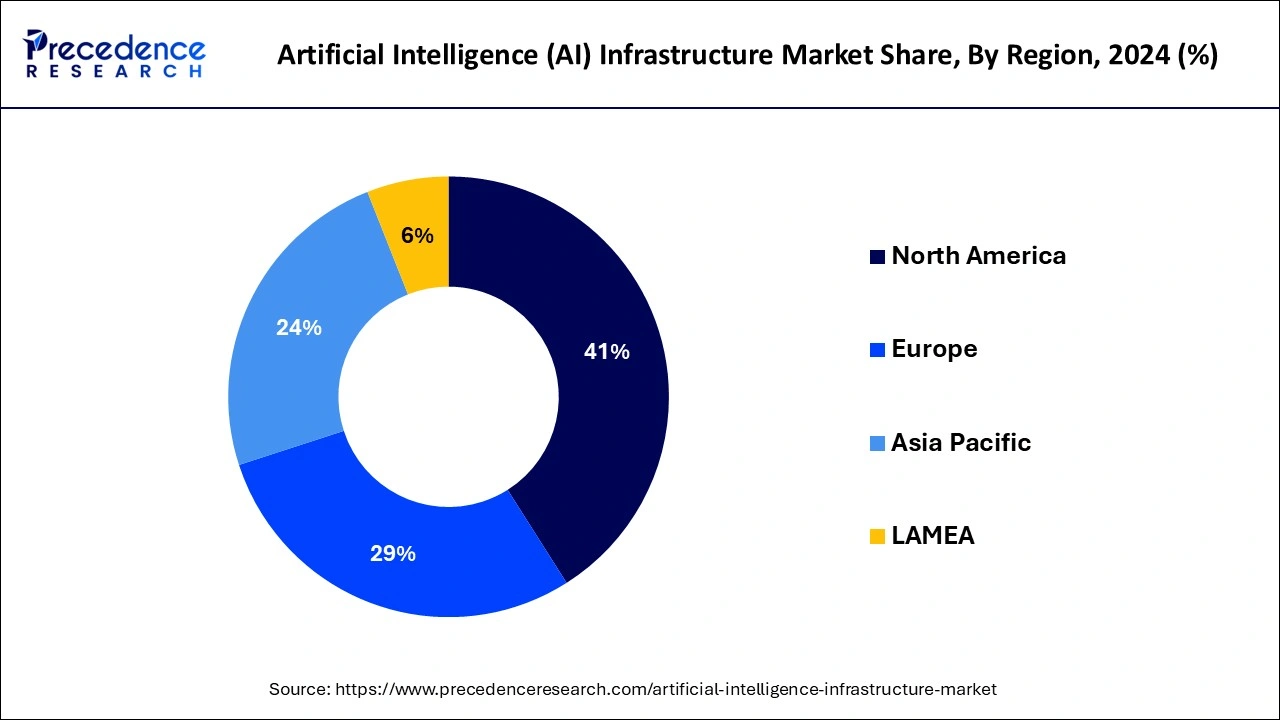

- North America held the largest share of 41% the global Artificial Intelligence (AI) infrastructure market.

- Asia Pacific is expected to witness the fastest growth during the forecast period.

- By technology, the machine learning segment held the largest share of the market.

- By technology, the deep learning segment is expected to obtain a notable market share during the forecast period.

- By end use, the enterprises segment held a significant share of the market in 2025 and is expected to grow rapidly during the forecast period.

- By end use, the government organizations segment is expected to gain a substantial share of the market during the forecast period.

- By offering, the hardware segment dominates the global.

- By offering, the software segment is projected to expand substantially during the forecast period.

- By deployment, the on-premises segment held a significant share of the market in 2025.

- By deployment, the cloud segment is expected to grow rapidly during the forecast period.

Market Overview

The artificial intelligence (AI) infrastructure market has been expanding steadily due to the rising need for AI-driven solutions in industries including healthcare, banking, retail, manufacturing, and automotive. Because of their capacity for parallel computing, graphics processing units (GPUs) are frequently employed to accelerate artificial intelligence workloads.

There has been an increase in the creation of specific AI processors (like Google's TPUs and Intel's FPGAs) intended to maximize AI processing. TensorFlow, PyTorch, and MXNet are a few examples of software frameworks that give developers the necessary tools and libraries to effectively create and train AI models. These frameworks are always changing, with new versions emphasizing scalability, usability, and performance optimization.

Cloud service providers such as Microsoft Azure, Google Cloud Platform (GCP), Amazon Web Services (AWS), and Google Cloud Platform (GCP) provide Artificial intelligence (AI) infrastructure and services to enterprises that want to use AI without having to make significant upfront investments in hardware and software. These cloud-based solutions offer scaling, adaptability, and simplicity of deployment for AI applications.

The demand for real-time AI inference and the growth of IoT devices have led to an increasing focus on edge computing solutions. By allowing AI inference to be done locally on devices, edge AI solutions improve privacy and security while lowering latency and bandwidth needs. The artificial intelligence (AI) infrastructure market is expanding quickly, but it still faces several obstacles, such as interoperability problems, ethical dilemmas, skill shortages, and privacy difficulties with data. Resolving these issues will be essential to maintaining the market's long-term growth.

Artificial Intelligence (AI) Infrastructure Market Growth Factors

- The need for artificial intelligence (AI) infrastructure is growing as companies in a variety of sectors incorporate AI into their operations to obtain insights, automate procedures, and improve decision-making. This covers both software frameworks and tools for AI development and deployment, as well as hardware like GPUs, TPUs, and specialist AI chips.

- The increasing ubiquity of cloud computing offers resources that are both affordable and scalable for the implementation of artificial intelligence (AI) infrastructure. By providing AI-specific services and solutions, cloud service providers allow businesses to access strong computing resources without having to make a sizable upfront hardware investment.

- The artificial intelligence (AI) infrastructure market is growing as a result of the advent of AI companies and a thriving ecosystem of developers, academics, and businesses. These organizations stimulate market expansion by fostering innovation in AI services, software, and hardware.

- AI is being used for specialized use cases in a number of industries, including manufacturing, finance, healthcare, automotive, retail, and demand forecasting. Some of these use cases include personalized medicine, fraud detection, autonomous vehicles, and predictive maintenance. The need for specific Artificial intelligence (AI) infrastructure that meets their needs is driven by these industries' embrace of AI.

- The ethical, security, and data privacy regulatory frameworks have an impact on how AI technology is deployed. Regulations frequently call for particular features and functionalities in Artificial intelligence (AI) infrastructure solutions, which propels the expansion of the artificial intelligence (AI) infrastructure market as businesses work to comply with legal standards.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 23.05% |

| Market Size in 2025 | USD 72.02 Billion |

| Market Size in 2026 | USD 91.21 Billion |

| Market Size by 2034 | USD 465.86 Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offering, Deployment, Technology, End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Cloud-based AI services

Scalability is a feature of cloud-based AI services that lets companies easily scale their artificial intelligence (AI) infrastructure up or down in response to changing demands. This flexibility is especially useful for managing changing demands and workloads. Cloud-based AI services facilitate remote collaboration and provide easy access to AI tools and resources from any location with an internet connection. This drives the growth of the artificial intelligence (AI) infrastructure market.

Thanks to this accessibility, teams working on AI initiatives are encouraged to innovate and collaborate. Businesses can more easily embrace AI technologies without having to make changes to their current operations thanks to cloud-based AI services, which are made to interface smoothly with existing IT infrastructure and applications. Numerous cloud service providers provide managed AI services, in which they take care of an organization's infrastructure and application setup, upkeep, and optimization.

Restraint

Data privacy and security

Providers of artificial intelligence (AI) infrastructure must make sure that their products comply with these laws, which frequently include specifications for data encryption, user permission, and the right of deletion. Robust access control systems guarantee that sensitive data and AI models are only accessible by authorized individuals. This covers frequent audits of user permissions, multi-factor authentication (MFA), and role-based access control (RBAC). Techniques like anonymization and pseudonymization should be supported by artificial intelligence (AI) infrastructure in order to reduce the possibility of people being re-identified in massive datasets. artificial intelligence (AI) infrastructure providers should make their privacy rules obvious to clients and be open about how they manage user data.

Opportunity

AI chip design services

AI chip design services are essential to the artificial intelligence (AI) infrastructure market because they offer customized solutions to satisfy application requirements. These services cover a wide range of chip design tasks, including testing, co-designing hardware and software, architecture design, and algorithm optimization. AI chip designers maximize efficiency for AI applications like training and inference through the use of specific architectures and algorithms. Scalability becomes crucial as AI workloads continue to increase in complexity and scale. Whether in data centers or edge devices, chip design services create scalable architectures that can manage growing computational needs. By striking a balance between performance, power, and area limitations, AI chip design services seek to provide affordable solutions.

Segment Insights

Technology Insights

The machine learning segment held the largest share of the artificial intelligence (AI) infrastructure market. The increased usage of AI technologies across many industries has led to notable growth in the machine learning segment of the market. The goal of machine learning, a branch of artificial intelligence, is to create models and algorithms that let computers learn from data and make judgments or predictions without needing to be explicitly programmed.

It is now simpler for enterprises to implement machine learning models and algorithms at scale without having to make investments in on-premises infrastructure, thanks to the availability of scalable cloud computing resources. Machine learning solutions are being adopted for data privacy, security, and compliance reasons due to compliance standards like GDPR (General Data Protection Regulation) and HIPAA (Health Insurance Portability and Accountability Act).

The deep learning segment is expected to obtain a significant market share during the forecast period. Because more and more industries are using deep learning technologies, the deep learning section of the artificial intelligence (AI) infrastructure market has been growing significantly. Neural networks with numerous layers are used in deep learning, a subset of machine learning, to process large and complicated data sets. In applications like voice recognition, image recognition, and natural language processing, among others, this technology has demonstrated amazing capabilities. In order to evaluate and extract insights from this enormous volume of data, deep learning, and other advanced AI technologies are in high demand due to the exponential development in data generation from numerous sources, including social media, IoT devices, and sensors.

End-use Insights

The enterprises segment held a significant share of the Artificial intelligence (AI) infrastructure market in 2025 and is expected to grow rapidly during the forecast period. NVIDIA, well known for its GPUs (Graphics Processing Units), has grown into a significant force in the artificial intelligence (AI) infrastructure space as a result of the widespread use of its GPUs for deep learning training and inference workloads.

A variety of Intel devices, such as CPUs (Central Processing Units), FPGAs (Field-Programmable Gate Arrays), and other specialized circuits, are suited for AI tasks. Additionally, they offer libraries and software tools for AI development. Dell offers servers, storage systems, and networking solutions designed specifically for machine learning and deep learning applications, as well as infrastructure solutions optimized for AI workloads. Cisco provides networking infrastructure solutions, including hardware tailored for high-performance computing and data-intensive applications, that enable AI workloads.

The government organizations segment is expected to gain a substantial share of the Artificial intelligence (AI) infrastructure market during the forecast period. The NSF provides funding for a broad range of artificial intelligence (AI) infrastructure research projects, including the creation of software tools, hardware, and algorithms. In order to prepare the upcoming generation of AI specialists, it actively supports educational projects. DARPA makes investments in cutting-edge artificial intelligence (AI) infrastructure for defense uses, such as enhanced computing, cybersecurity, and autonomous systems.

The European Commission actively participates in the development of AI rules and policies inside the EU. It establishes standards for the creation and application of moral AI and provides funding for research initiatives through initiatives like Horizon Europe. Projects involving artificial intelligence (AI) infrastructure that enhance Canada's competitiveness and economic growth are supported financially by the SIF. It focuses on topics including digital technologies, clean energy, and innovative manufacturing.

Offering Insights

The hardware segment dominated the global Artificial intelligence (AI) infrastructure market in 2025. 4GPUs are essential to artificial intelligence (AI) infrastructure because of their parallel processing power, which makes operations like AI model inference and training faster. This market is dominated by top GPU manufacturers like NVIDIA, whose Tesla and Quadro series are made especially for AI workloads. FPGAs provide flexible and performant programmable hardware that can be tailored for certain AI workloads. Prominent participants in this space include Intel (with its Intel Arria and Stratix series) and Xilinx. CPUs are still necessary for general-purpose computing and are frequently used in artificial intelligence (AI) infrastructure, especially for preprocessing and post-processing operations, even if they are not as specialized for AI tasks as GPUs or TPUs are.

The AI software segment is projected to expand substantially during the forecast period. A cloud-based platform called NVIDIA's NGC offers GPU-optimized software containers for high-performance computing, machine learning, and deep learning. It consists of pre-trained models, optimized libraries, and frameworks such as TensorFlow, PyTorch, and MXNet. Workflows for data science, data engineering, and machine learning are made possible by Databricks' Unified Data Analytics Platform, which is based on Apache Spark. Integrations with well-known AI frameworks are provided, and MLflow is included to handle the entire machine learning lifecycle. Scalable and distributed machine learning is the focus of H2O.ai's open-source H2O.ai machine learning platform. It has autonomous AI for automated feature engineering and model creation, as well as AutoML features for automating model selection and hyperparameter tuning.

Deployment Insights

The on-premises segment held a significant share of the Artificial intelligence (AI) infrastructure market in 2025. In contrast to being hosted on cloud-based platforms, hardware and software solutions that are implemented and run within a company's own physical premises are referred to as part of the on-premises artificial intelligence (AI) infrastructure industry. For businesses with steady or predictable workloads, this paradigm may result in cheaper long-term expenses as well as more control over data security and regulatory compliance. Specialized hardware accelerators, such as GPUs (Graphics Processing Units) or TPUs (Tensor Processing Units), along with software frameworks and tools for developing and implementing machine learning models, are commonly found in on-premises infrastructure. Workloads relevant to artificial intelligence, including data processing, model training, and inference, are handled by these infrastructures.

The cloud segment is expected to grow rapidly during the forecast period. Because cloud platforms offer scalable resources, businesses may easily scale up or down in response to changes in their AI processing requirements. Deep learning models and other AI applications that demand a lot of processing power will especially benefit from this. Numerous AI services and tools, such as machine learning frameworks, pre-trained models, and data processing capabilities, are available on cloud platforms. As a result, businesses may select the tools that best suit their requirements without having to create and maintain them from the ground up. Remote teams may collaborate on AI projects more easily with cloud-based artificial intelligence (AI) infrastructure since it is accessible from any location with an internet connection.

Regional Insights

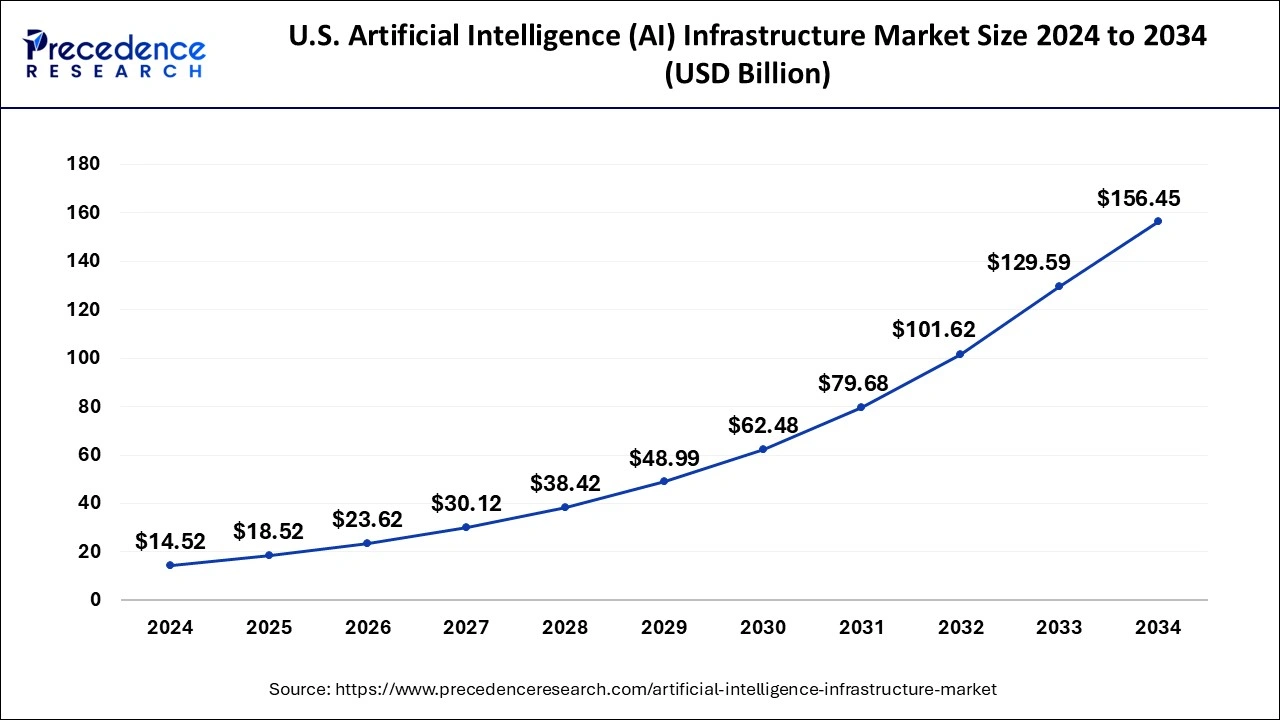

U.S.Artificial Intelligence (AI) Infrastructure Market Size and Growth 2025 to 2034

The U.S. artificial intelligence (AI) infrastructure market size was valued at USD 26.29 billion in 2025 and is expected to be worth around USD 166.19 billion by 2034, growing at a CAGR of 22.74% from 2025 to 2034.

North America held the largest share of the global Artificial intelligence (AI) infrastructure market. There was fierce rivalry in the North American industry, and businesses were often coming up with new ideas to enhance the effectiveness, scalability, and performance of their Artificial intelligence (AI) infrastructure products. In the market, corporations frequently undertake mergers and acquisitions in an effort to bolster their artificial intelligence capabilities and increase their market share. The necessity for high-performance computing power to train and implement AI models, along with improvements in AI algorithms and applications, was driving demand for Artificial intelligence (AI) infrastructure. Furthermore, the need for edge Artificial intelligence (AI) infrastructure was being driven by the rise of edge computing and the Internet of Things (IoT).

U.S.

The large-scale investment in AI-ready cloud platforms, hyperscale data centers and custom AI chips in the United States has made it the largest contributor to AI in the U.S. The continuing rapid growth in demand for scalable, energy efficient AI Infrastructure has been driven by a rapidly growing number of federal AI initiatives, the growth of enterprise AI adoption and the rapid growth of new startups.

Asia Pacific is expected to witness the fastest growth during the forecast period. The region is witnessing a swift adoption of AI technology by numerous industries, including banking, healthcare, manufacturing, and retail, with the aim of augmenting operational efficiency, improving customer experience, and gaining a competitive edge. Governments in Asia-Pacific are actively encouraging the advancement and use of AI technology by means of a range of financing schemes, policy frameworks, and initiatives.

To meet the rising demand for the Artificial intelligence (AI) infrastructure market, there is a rise in investments being made in Artificial intelligence (AI) infrastructure projects by the public and commercial sectors. These projects include data centers, cloud computing services, and high-performance computing (HPC) facilities. Many AI firms are springing up in Asia Pacific with the goal of creating cutting-edge AI platforms and solutions. For instance, National AI policies have been introduced by nations including South Korea, Japan, and China in an effort to promote economic growth and innovation.

China

China has the largest number of AI data centers, large-scale deployment of industrial automation and public services, through the extensive deployment of AI in these areas. The sustained growth of China's economy is driven by government-funded Digital Programs, and the resulting high volume of data has supported continuous growth of AI Data centers in China

How Europe Making Progress in Building AI Infrastructure?

AI infrastructure development in Europe is increasing at a rapid pace as many organizations are trying to build secure, ethical & energy efficient AI systems, to support the rapidly growing adoption of AI technology in the areas of automotive, industrial automation, healthcare & financial services; thus creating a growing demand for HCI and commercial cloud infrastructure to support them. The focus on protecting personal data, creating green data centers, and establishing collaboration between countries to digitize data within the EU are relationships that are helping Europe build balanced and sustainable AI infrastructure.

Germany

Germany is the country leading the development of AI infrastructure in Europe; Germany has a very strong AI infrastructure in the manufacturing, automotive engineering and industry 4.0 landscape; investments in industrial data platforms, edge AI systems & secure cloud environments are helping to strengthen Germany's AI infrastructure capabilities.

Is Latin America poised to become a new frontier for AI growth?

Latin America is developing Artificial Intelligence (AI) infrastructure market. This development is occurring as Cloud technologies become more widely used by organizations to facilitate Digital Transformation activities. As companies move into the AI space for customer analytics, financial technology (FinTech) services, and logistics optimization, the availability of data centers across the region is helping to aid this movement toward AI using data from cloud service providers. The level of infrastructure maturity varies across Latin America, but both private and public investments into Artificial Intelligence suggest a long-term growth opportunity for companies in Latin America.

Brazil

Brazil is leading Latin America in terms of cloud adoption and data center growth due to the increased adoption of cloud computing services. The growth of cloud services has also contributed to the growth of artificial intelligence (AI) in the banking, retail, and agricultural industries in Brazil, and supportive digital policies combined with a large talent pool of technology specialists continue to enhance the AI ecosystem in Brazil.

Is The Middle East & Africa Making Progress In Developing Their Artificial Intelligence (AI) Infrastructure Market?

There is ongoing development in the development of new and improved AI infrastructure in the Middle East & Africa Region through digital strategies at the national level, through the strategic development of smart cities. Major investments are being made in cloud computing, high processing capacity data network centers and AI based public service initiatives. While penetration varied across countries, increasing interest and demand for automation, cybersecurity, digital governance is promoting the development of AI's infrastructure during economic diversification, and tech centric markets.

- In November 2025: Brookfield Asset Management launched a US$100 billion global AI infrastructure program with NVIDIA and Kuwait Investment Authority to invest across the AI value chain, anchored by a new dedicated fund. (Source:economictimes.indiatimes.com)

UAE

The UAE has been a driving force in the development of AI infrastructure within the region through its governmental investments in building the required data center platforms for AI, through their governmentally supported AI program initiatives and smart cities initiative. Their current interest in fostering digital governance, innovation hubs and cloud partnerships, are continuing to build momentum for growth Of AI infrastructure.

Artificial Intelligence (AI) Infrastructure Market Companies

- Advanced Micro Devices, Inc

- Amazon Web Service

- Cadence Design Systems

- Cisco

- Dell

- Graphcore

- Gyrfalcon Technology

- Hewlett Packard Enterprise Development LP

- IBM

- Imagination Technologies

- INTEL

- Micron Technology

- Microsoft

Recent Developments

- In December 2025, Evermind AI unveiled EverMemOS, an open-source foundational memory infrastructure for AI that helps developers integrate long-term memory capabilities into applications via flexible deployment options. (Source: heraldmailmedia.com)

- In December 2025, NIST announced two new AI centers for U.S. manufacturing productivity and critical infrastructure cybersecurity, backed by a $20 million investment to accelerate AI adoption and strengthen national competitiveness. (Source: nist.gov)

- In November 2025, AWS and OpenAI agreed on a multi-year strategic partnership giving OpenAI access to AWS's cloud infrastructure to run and scale its advanced AI workloads globally. (Source: aboutamazon.com)

- In March 2024, a? 10,371.92 crore corpus was authorized by the Union cabinet on Thursday to finance AI start-ups and computing infrastructure in India. This fund would be utilized to cover the viability gap in projects that would have higher setup expenses for data centers and other facilities of similar kinds in India.

- In February 2024, to enable the tremendous processing power that businesses require to thrive in the AI era, Cisco and NVIDIA today announced plans to develop simple-to-deploy and operate Artificial intelligence (AI) infrastructure solutions for the data center to enable the tremendous processing power that businesses require to thrive in the AI era, Cisco and NVIDIA today announced plans to develop simple-to-deploy and operate Artificial intelligence (AI) infrastructure solutions for the data center. According to Chuck Robbins, Chair and CEO of Cisco, "AI is fundamentally changing how we work and live, and history has shown that a shift of this magnitude is going to require enterprises to rethink and re-architect their infrastructures."

Segments Covered in the Report

By Offering

- Hardware

- Software

By Deployment

- On-premises

- Cloud

- Hybrid

By Technology

- Machine Learning

- Deep Learning

By End-use

- Enterprises

- Government Organization

- Cloud Services Provider

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting