Artificial Organs and Bionic Implants Market Size and Forecast 2025 to 2034

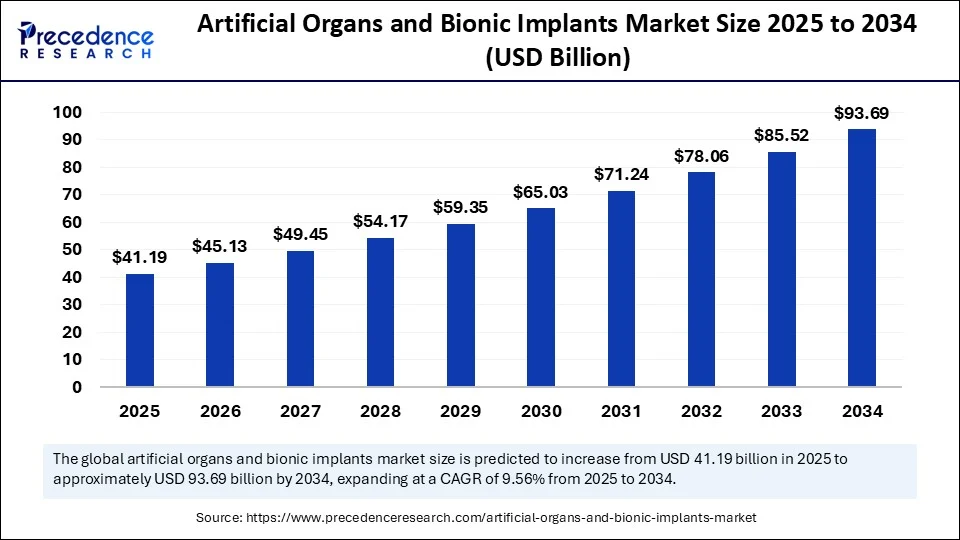

The global artificial organs and bionic implants market size was estimated at USD 37.60 billion in 2024 and is predicted to increase from USD 41.19 billion in 2025 to approximately USD 93.69 billion by 2034, expanding at a CAGR of 9.56% from 2025 to 2034. The growth of the market is attributed to the rise in chronic diseases, an aging population, shortages of organs, and increasing rates of accidental injuries. Ongoing technological advancements, including 3D bioprinting, neural bionics, biohybrid organs, AI integration, and miniaturized, self-powered implants, are supporting market growth.

Artificial Organs and Bionic Implants Market Key Takeaways

- In terms of revenue, the global artificial organs and bionic implants market was valued at USD 37.60 billion in 2024.

- It is projected to reach USD 93.69 billion by 2034.

- The market is expected to grow at a CAGR of 9.56% from 2025 to 2034.

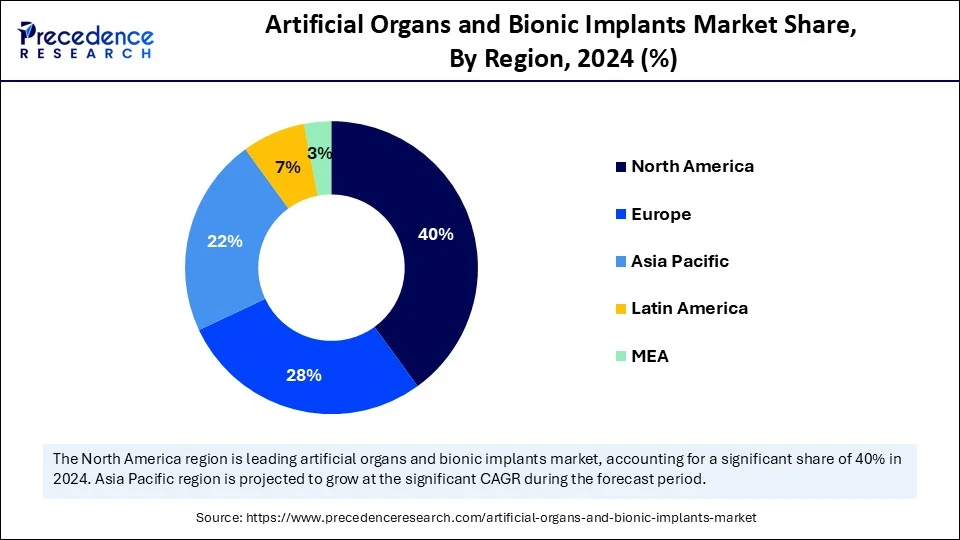

- North America dominated the global artificial organs and bionic implants market with the largest market share of 40% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR in the market between 2025 and 2034.

- By product type, the artificial organs segment led the market in 2024.

- By product type, the bionic implants segment is anticipated to grow at the highest CAGR between 2025 and 2034.

- By technology, the electronic bionics segment captured the biggest market share of 55% in 2024.

- By technology, the biohybrid bionics segment is expected to expand at a notable CAGR over the projected period.

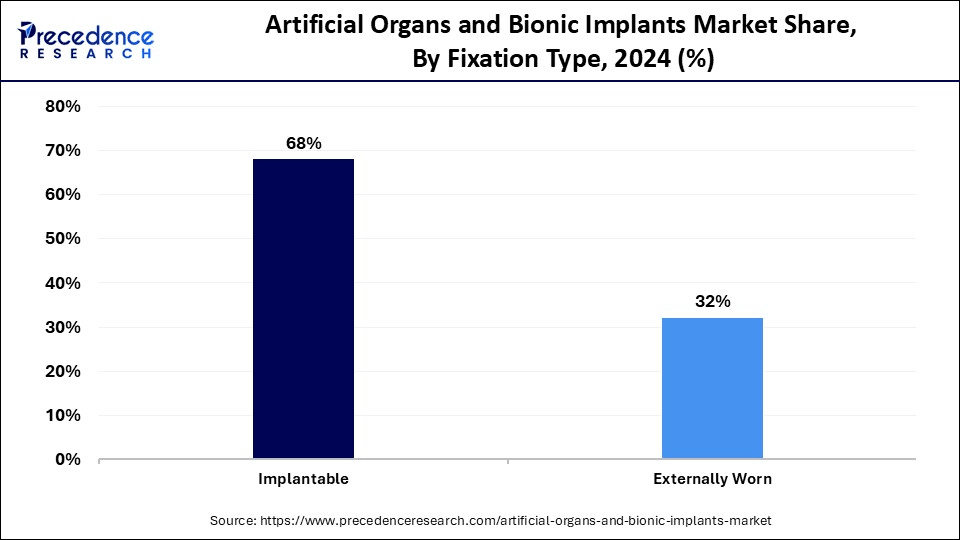

- By fixation type, the implantable segment contributed the highest market share of 68% in 2024.

- By fixation type, the externally worn segment is expected to expand at a notable CAGR over the projected period.

- By end user, the hospitals segment held the major market share of 45% in 2024.

- By end user, the home care settings segment is expected to expand at a notable CAGR over the projected period.

- By age group, the adults segment generated the largest market share of 62% in 2024.

- By age group, the geriatrics segment is expected to expand at a notable CAGR over the projected period.

Impact of AI on the Artificial Organs and Bionic Implants Market

Artificial intelligence is quickly changing the market for artificial organs and bionic implants by improving how humans and machines interact and work together. Researchers have recently created next-generation cloud-connected bionic limbs, using 5G and edge/cloud computing. This technology helps with heavy processing and provides quick control for more natural prosthetic movements. A bionic knee that connects directly to bone and implanted neural electrodes allowed amputees to climb stairs and navigate obstacles with greater precision and a stronger feeling of limb ownership.

This marks a significant step toward full physiological integration. In March 2025, at UC San Francisco, a brain-computer interface enabled a paralyzed person to control a robotic arm using only their thoughts. The AI adapts to changes in neural signals over months without needing retraining, providing reliable functionality in home settings. These advancements highlight AI's crucial role in transforming implants from simple assistive tools to smoothly integrated parts of the body, improving mobility, sensory feedback, and independence.(Source: https://scitechdaily.com)

U.S. Artificial Organs and Bionic Implants Market Size and Growth 2025 to 2034

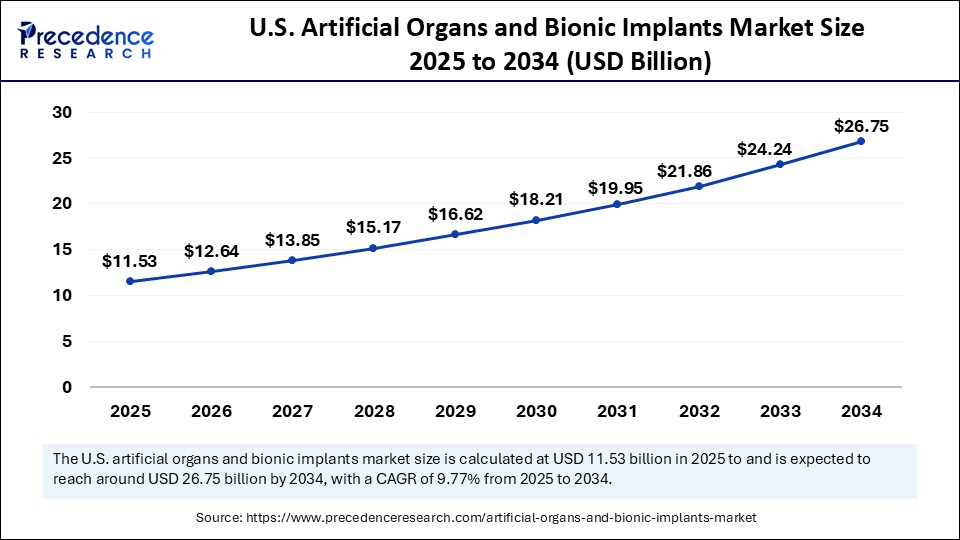

The U.S. artificial organs and bionic implants market size was evaluated at USD 10.53 billion in 2024 and is projected to be worth around USD 26.75 billion by 2034, growing at a CAGR of 9.77% from 2025 to 2034.

What made North America the dominant region in the artificial organs and bionic implants market?

North America dominated the market by capturing the largest share in 2024. This is mainly due to its well-developed healthcare system, high prevalence of chronic illnesses, and increasing use of advanced medical technologies. There is strong governmental support for organ transplantation plans. Several biotech firms in the region have dedicated their resources to trials and the promotion of bionic prosthetics and artificial organ creation. Additionally, the upward trends in the elderly population and high prevalence of ailments directly related to lifestyle will only maintain the need for medical implants that provide life support and improve mobility.

The U.S. is a major contributor to North America's leadership, as it has many leading companies and research institutes focusing on bioengineering. The Food and Drug Administration (FDA) permits quicker methods of getting next-generation implants and devices approved and permitted, while also promoting speed to market. Specifically, the country has achieved advances in the development of 3D bioprinting of organ tissues, tissue engineering, and neural-controlled prosthetics. There is also an ever-increasing number of patients awaiting organ transplants, further foreshadowed by the inclusion of artificial intelligence within the medical device industry; both of these issues demonstrate that the U.S. market anticipates outstanding future breakthroughs in artificial organs and the adoption of bionics.

Why Is Asia Pacific Emerging as the Fastest-Growing Market for Artificial Organs and Bionic Implants?

Asia Pacific is experiencing the fastest growth in the artificial organs and bionic implants market. This growth is due to better healthcare access, rising investments in biotechnology, and increased awareness of modern medical treatments. Rapid urbanization and a growing aging population are driving demand for organ support and prosthetic solutions in the region. Additionally, public-private partnerships and the creation of local production facilities are lowering costs, making these treatments more available to larger populations in urban and semi-urban areas.

Japan is a major player in the Asia Pacific artificial organs and bionic implants market, leading in medical robotics and regenerative medicine. The country has been a pioneer in developing bionic limbs with advanced neuro-integration and creating artificial organs using stem cell technology. With strong government support for innovation and a high proportion of elderly citizens, Japan's medical sector focuses on developing bioengineered organs and smart prosthetics. Furthermore, Japanese companies are forming more partnerships with global firms to speed up product development, clinical trials, and exports. This solidifies Japan's role as an important center for innovation in this growing market.

Market Overview

The artificial organs and bionic implants market refers to the industry focused on the development, manufacturing, and commercialization of mechanical or electronic substitutes that replace or augment the function of damaged or failing human organs and body parts. Artificial organs aim to sustain life and improve the quality of living by mimicking natural functions (e.g., artificial hearts or kidneys), while bionic implants are typically electronically integrated devices that restore sensory or motor functions (e.g., bionic limbs or cochlear implants).

Artificial Organs and Bionic Implants Market Growth Factors

- Global Aging Population: Growing numbers of older adults with organ failure and mobility impairments are greatly increasing demand for artificial organs and bionic implants that can help restore function and quality of life.

- High Prevalence of Chronic Disease: Higher incidence of heart disease, diabetes, vision/hearing impairments, etc. is requires clinical interventions via devices, such as pacemakers, retinal implants, and insulin-delivery devices.

- Demand from Trauma & Accidents: Increased frequency of vehicle accidents and injuries leading to amputations and damaged organs has contributed to the desire for prosthetics, limb implants, and replacement organs.

- Surge in Technological Innovation: The rise of AI, robotics, biomaterials, 3D-printing, and biohybrid interfaces has enabled the creation of smarter, more differentiable, and functional implants and organs that are more likely to be adopted and have clinical outcomes.

- Government-Private Funding for R&D: Government funding and support, research collaborations between academia and industry, high rates of reimbursement, and new favorable government reimbursement have all increased the rate of development of these emergent medical solutions.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 93.69 Billion |

| Market Size in 2025 | USD 41.19 Billion |

| Market Size in 2024 | USD 37.60 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.56% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Technology, Fixation Type, End User, Age Group, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Chronic Disease Prevalence and Shortage of Organs

The combination of increasing chronic diseases, the existing organ shortage crisis, and the growing divide between organ supply and demand is prompting a tremendous uptick in both bioengineered artificial organs and bionic implants market products. With the CDC reporting that 37 million Americans suffer from chronic kidney disease and over 6 million adults are currently suffering from heart failure, chronic diseases will dramatically expand the existing organ need/demand gap. With over 103,223 current organ transplant waiting lists in the U.S., and approximately 13 people dying each day because of the lack of organ availability, there is high demand for biobased engineered organ replacement technologies to provide additional medical solutions to alleviate long-term damage.

(Source: https://www.organdonor.gov)

While the organ shortage crisis is expanding, there is ongoing medical innovation toward the creation of bioengineered artificial organs and bionic implants, such as artificial kidneys, hearts, limbs, and retinal implants. These technologies are viable life-saving alternatives that can replace vital organ functions, reduce a patient's reliance on donor organs, and ultimately, can increase long-term survival. When confronted with the life-threatening demand/supply gap in healthcare systems, artificial organ solutions will quickly become the solution with the most traction in research and practical scenarios.

Restraint

High Cost and Limited Accessibility of Implants Hinder Market Expansion

One major factor holding back the artificial organs and bionic implants market is the high cost and limited access to these technologies, especially for low- and middle-income populations. Devices like bionic limbs, artificial hearts, and implantable vision systems often require specialized materials, custom engineering, and complex surgical procedures.

This makes them unaffordable for many patients. For example, a single bionic limb can cost an average selling price of $250.00, depending on its complexity and features. This would indicate a total volume of $7,750,000 per year. Insurance coverage for these technologies varies widely among providers and regions. Access to these devices is mostly limited to urban hospitals. This financial barrier restricts widespread use, even though the clinical need is growing.

(Source: http://www.oandplibrary.org)

Opportunity

Could Breakthrough Mechanical Hearts and Biohybrid Implants Redefine Possibilities in Organ Replacement?

An exciting opportunity exists in the artificial organs and bionic implants market lies in technological advancements in fully implantable mechanical devices and biohybrid systems. For instance, in May 2025, Australia saw its first successful implantation of the BiVACOR total artificial heart, a titanium, magnetically levitated device. The patient survived 105 days with the implant and was released before eventual transplantation. This was a groundbreaking achievement supported by the Australian government's Artificial Health Frontiers Program.

At the same time, researchers at the University of Chicago have developed bionic hands that provide realistic touch sensations through brain-computer interfaces. This marks significant progress in neuroprosthetics. These advancements, along with new biohybrid implants that mix living tissue with electronic interfaces, are broadening treatment options for heart failure, paralysis, and sensory loss. As clinical evidence builds and regulatory pathways become available, these innovations hold the potential to change the landscape for providers, clinicians, and patients, marking the start of a new era in regenerative and assistive medicine.

Product Type Insights

Why did the artificial organs segment dominate the market in 2024?

Artificial Organs

The artificial organs segment dominated the artificial organs and bionic implants market with the largest share in 2024, as they play a crucial role in replacing failed body functions. This is particularly important for patients with chronic illnesses, such as kidney failure and diabetes. Artificial kidneys, particularly dialyzers, lead the artificial organs segment. They are essential for treating end-stage renal disease. Their extensive use in dialysis centers and hospitals, along with the rising number of kidney-related disorders and increased awareness of renal health, is maintaining their strong position in the market across both developed and developing countries.

The artificial pancreas sub-segment is growing at a rapid pace because this pancreas automates insulin regulation. This reduces the need for manual glucose monitoring. The increasing global prevalence of diabetes, along with the greater use of closed-loop insulin delivery technologies, is driving demand. Ongoing research and positive regulatory approvals are also aiding this segment's growth.

Bionic Implants

The bionic implants segment is expected to expand at the highest CAGR in the upcoming period due to technological advancements and the increasing need for better mobility and sensory restoration in people with physical impairments. Cochlear implants lead the bionic implant segment, as they significantly restore hearing for people with severe hearing loss. Greater awareness, more pediatric cases of hearing disorders, and better minimally invasive surgical techniques have increased their adoption. Government programs that support access to hearing aids also help this segment grow.

Bionic limbs, especially bionic hands, are seeing rapid growth due to advancements in prosthetic functionality and control systems. More traumatic injuries, military amputees, and the demand for intuitive, lifelike prosthetics have fueled innovation. Partnerships between tech companies and medical device manufacturers are speeding up growth in this area.

Technology Insights

How does the electronic bionics segment dominate the market in 2024?

The electronic bionics segment dominated the artificial organs and bionic implants market in 2024, mainly due to its widespread use in cochlear implants, cardiac devices, and bionic limbs. Electronic bionics systems use electronic circuits and sensors to mimic or support biological functions. They provide reliable and proven solutions for patients. The maturity of this technology and ongoing improvements have helped maintain its dominance across various therapeutic applications.

The biohybrid bionics segment is expected to grow at the fastest rate during the projection period. It combines synthetic frameworks with biological tissues to allow more natural interactions with the human body. This innovation drives advancements in prosthetics and organ replacements, particularly for applications needing complex feedback mechanisms, adaptability, and seamless integration with living tissues for improved performance.

Fixation Type Insights

What made implantable the dominant segment in the artificial organs and bionic implants market?

The implantable segment led the fixation type segment in 2024 because implantable devices are widely used in long-term treatments like artificial kidneys, cardiac devices, and cochlear implants. These devices are placed inside the body, providing better functionality, less maintenance, and improved patient outcomes. The need for ongoing support for chronic conditions fuels the growth of this segment in the market.

The externally worn segment is likely to grow at the highest CAGR over the forecast period. This is mainly due to the non-invasive design of externally worn devices. Improvements in lightweight materials and sensor technology are enhancing functionalities of these devices, boosting mobility and rehabilitation. Increased use in elderly care, physical therapy, and military settings helps drive this segment's rapid growth and continuous technological innovation.

End User Insights

Why did the hospitals segment lead the market in 2024?

The hospitals segment dominated the artificial organs and bionic implants market with the largest share in 2024. Hospitals are considered the largest end-users because they perform many complex surgical procedures. These facilities have the necessary infrastructure and skilled professionals to implant artificial organs and bionic devices. The rising rates of chronic diseases and higher healthcare spending further boost the demand for these technologies in hospitals.

The home care settings segment is expected to expand at the fastest CAGR in the coming years due to the increasing preference for patient-focused care and post-operative recovery at home. New advancements in portable and easy-to-use bionic devices support this shift. Moreover, aging populations and cost-effective healthcare delivery models drive the rapid growth of this segment.

Age Group Insights

How does the adults segment dominate the artificial organs and bionic implants market?

The adults segment dominated the market while holding the largest share in 2024, as this age group often experiences lifestyle-related illnesses such as kidney failure, diabetes, and hearing loss. Adults are generally the population group that requires artificial kidneys, cochlear implants, or prosthetics, which leads to higher adoption rates. The increasing awareness and access to advanced treatments are also accelerating consumer adoption in this segment.

The geriatrics segment is expected to grow at the fastest rate in the upcoming period because of the growing population of elderly people and aging-related organ deterioration. This demographic often requires artificial organs, assistive bionic devices in order to help them with their mobility and quality of life. The innovation of biocompatible materials and minimally invasive procedures means these solutions are safer and much more acceptable to geriatrics.

Artificial Organs and Bionic Implants Market Companies

- Medtronic plc

- Cochlear Limited

- Abbott Laboratories

- Boston Scientific Corporation

- Zimmer Biomet Holdings, Inc.

- Edwards Lifesciences Corporation

- Berlin Heart GmbH

- SynCardia Systems LLC

- Össur hf

- Ekso Bionics Holdings Inc.

- BiVACOR Inc.

- Cyberdyne Inc.

- ReWalk Robotics Ltd

- BioVentrix Inc.

- LivaNova PLC

- Nurotron Biotechnology Co. Ltd.

- Pixium Vision

- Touch Bionics (a part of Össur)

- Retina Implant AG

- Nano Retina Inc.

Recent Developments

- In September 2024, Axiles Bionics unveiled its Lunaris product line, which includes AI-integrated bionic ankle-foot prosthetics. The device is designed for personalized gait adaptation and uses sensors along with real-time machine learning to mimic natural movement and improve mobility for lower-limb amputees.(Source: https://www.axilesbionics.com)

- In January 2024, Carmat introduced a major software upgrade for its Aeson artificial heart. This upgrade enhances AI-driven monitoring and responsiveness. It allows for real-time adjustments to physiological conditions, improving patient outcomes and strengthening the heart's ability to adapt in changing clinical situations.(Source: https://www.medicaldevice-network.com)

- In May 2023, Swiss firm Novostia announced the beginning of first-in-human trials for its next-generation artificial heart valve. Built with AI-assisted precision, the valve aims to provide a long-lasting, anticoagulant-free solution for patients with aortic or mitral valve disorders.(Source: https://ggba.swiss)

Segments Covered in the Report

By Product Type

- Artificial Organs

- Artificial Heart

- Artificial Kidney (Dialyzers)

- Artificial Pancreas

- Artificial Lungs

- Liver Support Devices (Bioartificial Liver)

- Others (Bladders, Trachea, etc.)

- Bionic Implants

- Bionic Limbs

- Bionic Arms

- Bionic Legs

- Bionic Hands & Fingers

- Vision Bionics

- Retinal Implants

- Bionic Eyes

- Hearing Bionics

- Cochlear Implants

- Auditory Brainstem Implants

- Neural Bionics

- Deep Brain Stimulators

- Spinal Cord Stimulators

- Vagus Nerve Stimulators

- Others (Bionic Skin, Exoskeletons)

- Bionic Limbs

By Technology

- Mechanical Bionics

- Electronic Bionics

- Biohybrid (Biological + Artificial Interface)

By Fixation Type

- Implantable

- Externally Worn

By End User

- Hospitals

- Specialty Clinics

- Home Care Settings

- Rehabilitation Centers

- Others (Military Facilities, Research Institutes)

By Age Group

- Adults

- Pediatric

- Geriatric

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting