Automotive Elastomers Market Size and Forecast 2025 to 2034

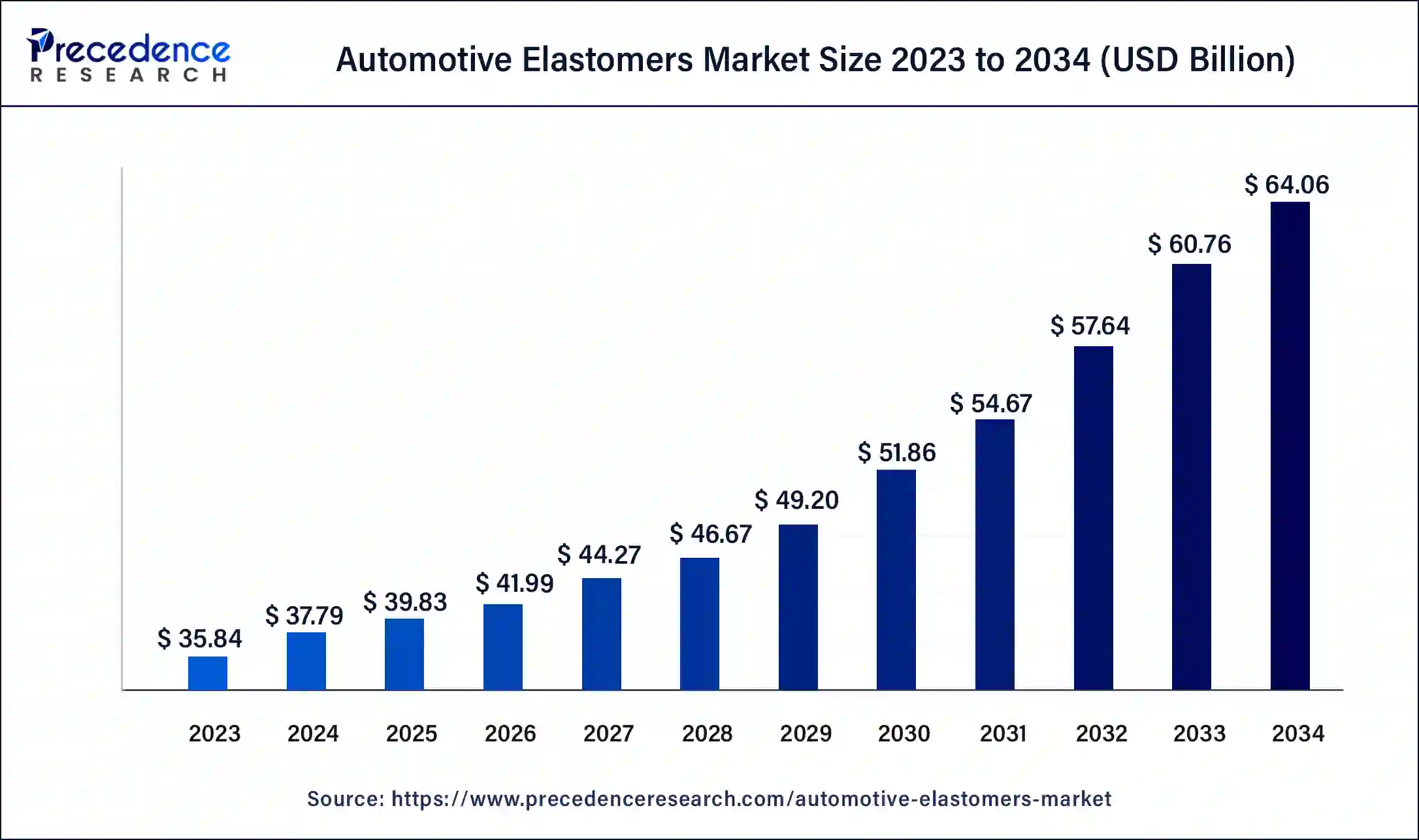

The global automotive elastomers market size was valued at USD 37.79 billion in 2024, and is projected to hit around USD 39.83 billion by 2025, and is anticipated to reach around USD 64.06 billion by 2034, growing at a CAGR of 5.42% over the forecast period 2025 to 2034. The automotive elastomers market is driven by the increasing demand for automobiles that are lightweight and fuel-efficient.

Automotive Elastomers Market Key Takeaways

- In terms of revenue, the automotive elastomers market is valued at $39.83 billion in 2025.

- It is projected to reach $64.06 billion by 2034.

- The automotive elastomers market is expected to grow at a CAGR of 5.42% from 2025 to 2034.

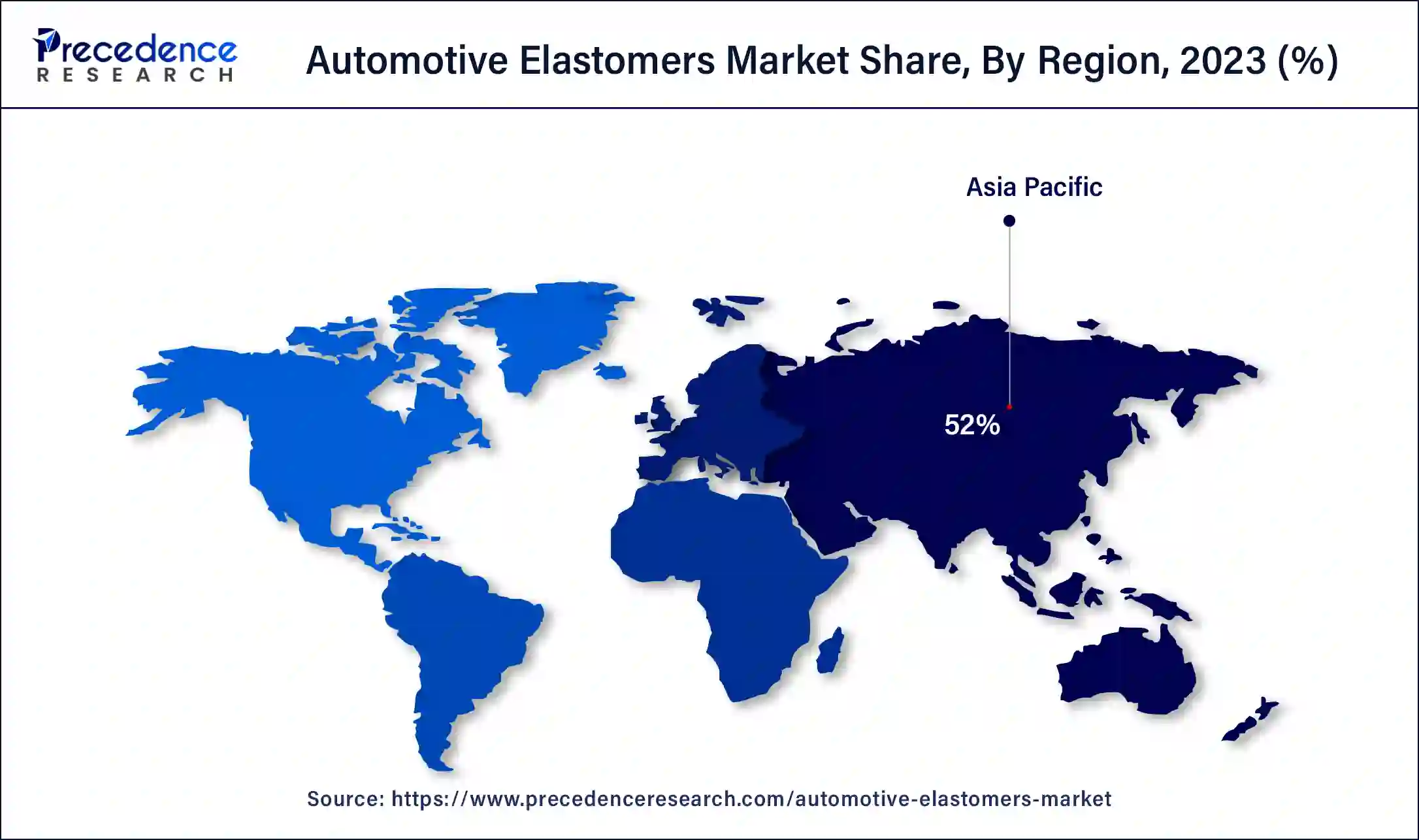

- Asia Pacific dominated in the automotive elastomers market with the largest market share of 52% in 2024.

- North America is expected to expand at a solid CAGR of 4.16% during the forecast period.

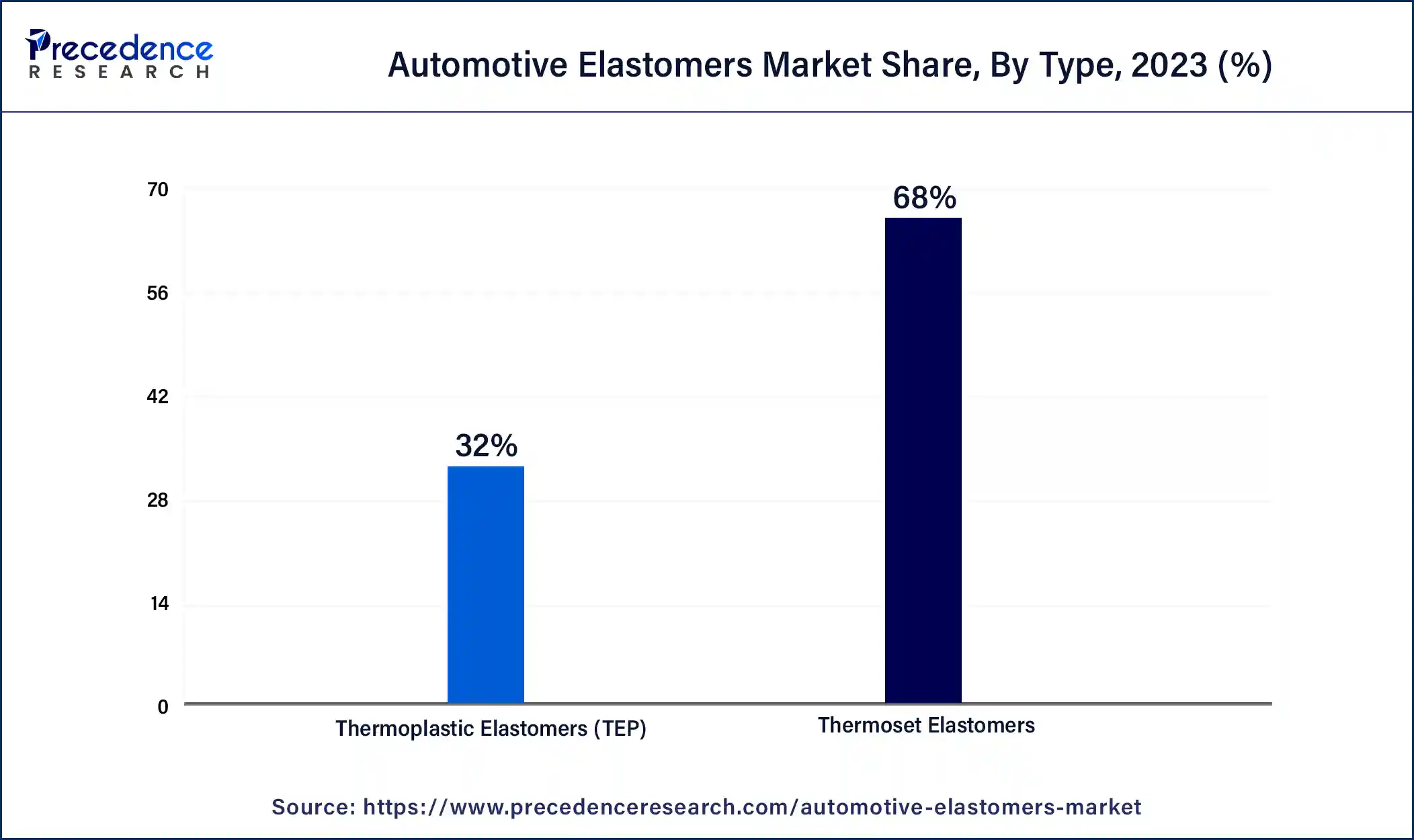

- By type, the thermoset elastomers segment has contributed more than 68% of market share in 2024.

- By type, the thermoplastic elastomers (TEP) segment is predicted to grow at a CAGR of 5.72% during the forecast period.

- By vehicle type, the passenger cars segment has recorded the biggest market share of 57% in 2024.

- By vehicle type, the light commercial vehicles segment is poised to grow at a notable CAGR of 5.07% during the forecast period.

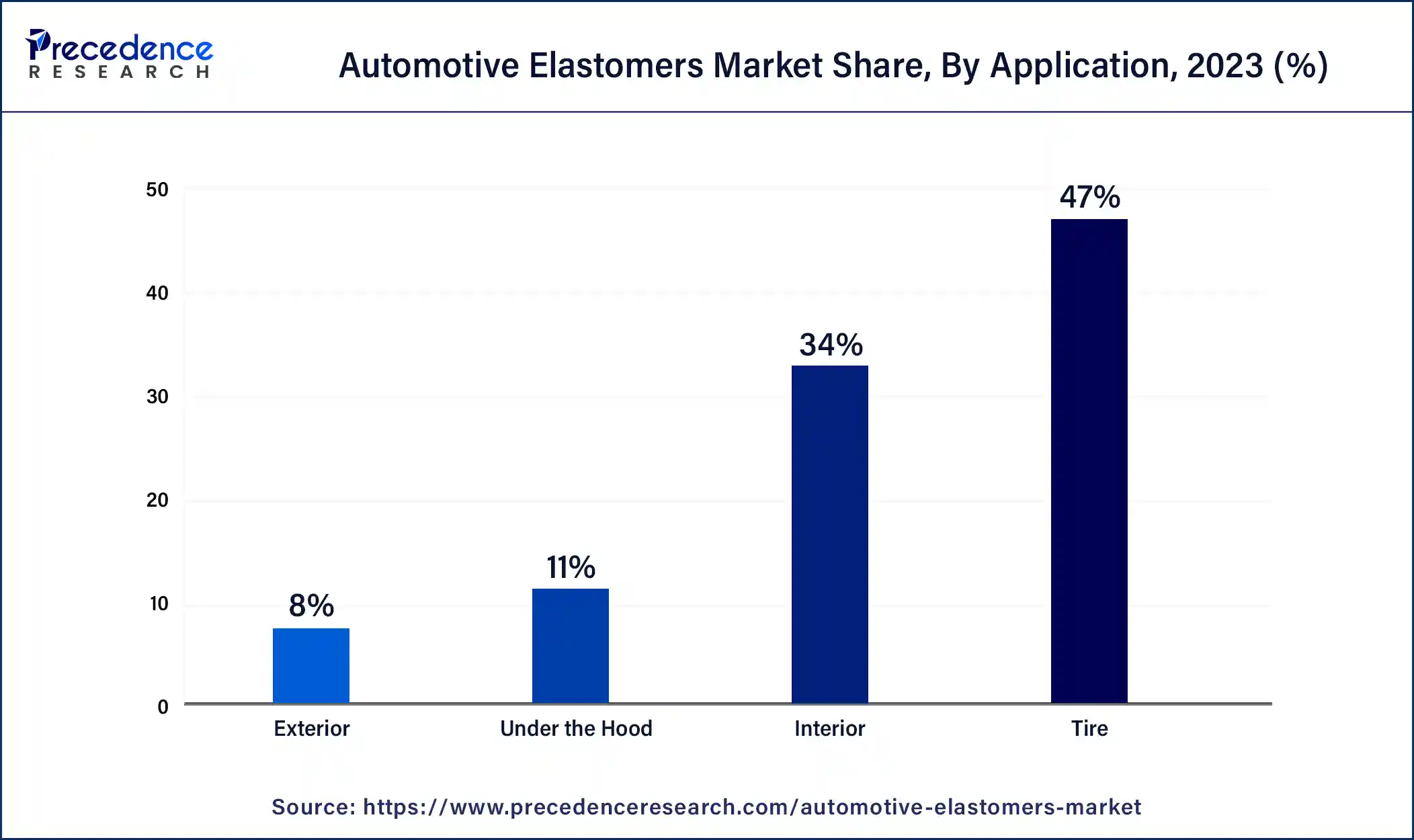

- By application, the tire segment accounted for the highest market share of 47% in 2024.

- By application, the interior segment is registering a remarkable CAGR of 5.83% during the forecast period.

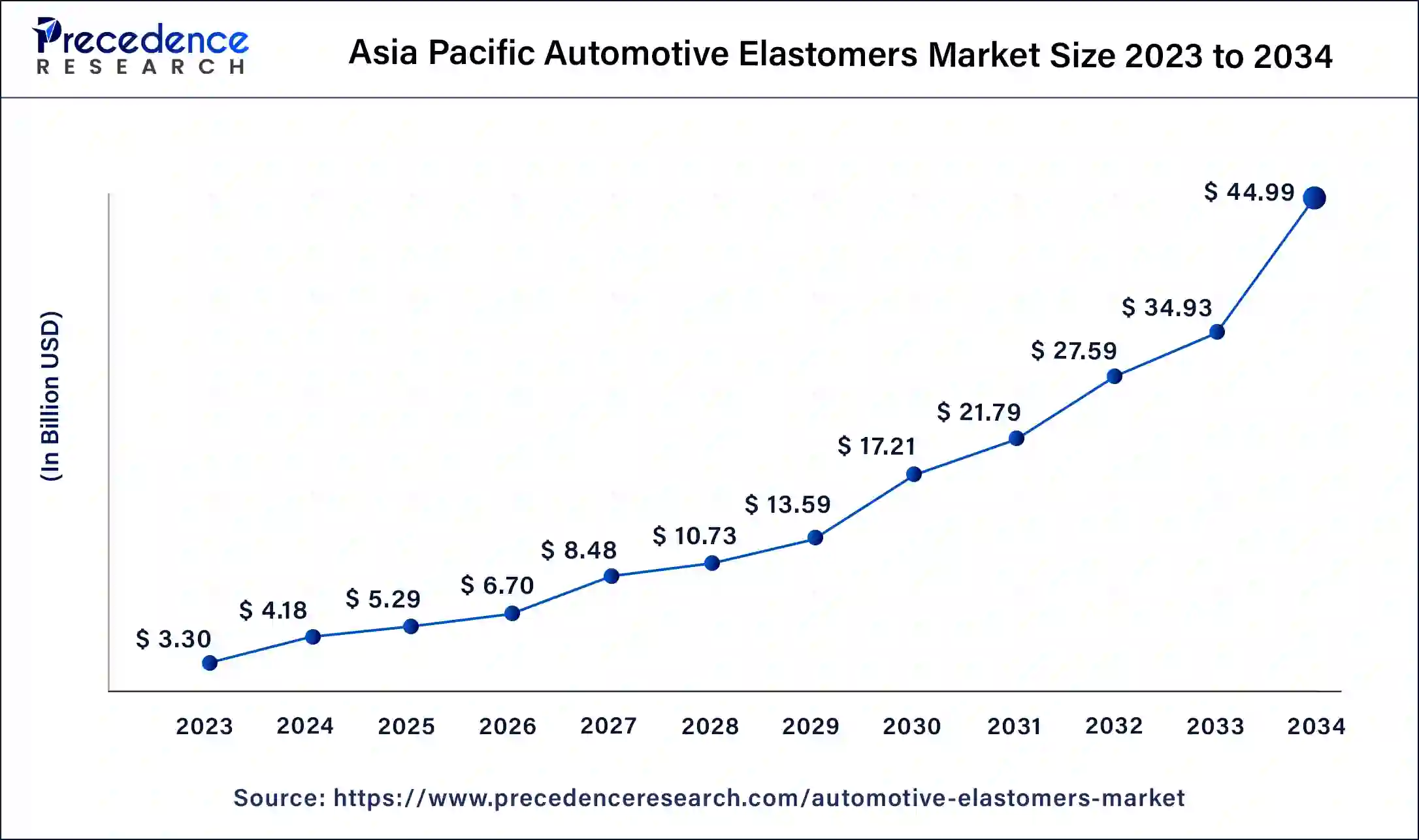

Asia Pacific Automotive Elastomers Market Size and Growth 2025 to 2034

The Asia Pacific automotive elastomers market size is exhibited at USD 39.83 billion in 2025 and is projected to be worth around USD 33.63 billion by 2034, poised to grow at a CAGR of 26.82% from 2025 to 2034.

Asia-Pacific dominated in the automotive elastomers market in 2024. China is the world's largest automobile market, and as such, the demand for automotive elastomers is greatly impacted by its enormous production and sales volumes. The nation serves as a global manufacturing center for foreign and domestic automakers. Governments in the Asia-Pacific area frequently offer tax breaks and financing for research and development of innovative materials and other incentives and subsidies to encourage the automobile sector. Demand for automotive components, such as elastomers, has increased due to rising middle-class populations and the desire of people in nations like China and India to own a car.

The United States is leading the automotive elastomer market because of its sophisticated automotive manufacturing environment and need for lightweight and durable components. In 2025, significant winter weather resulted in some short-term supply interruptions, but overall, domestic production helped stabilize the sector. Continued innovation in electric and hybrid-powered vehicles continues to spur the use of performance elastomers for both internal and external components.

China is a leader in the Asia Pacific automotive elastomers market, largely due to the explosive growth of electric vehicle uptake and the production of vehicles at scale. The output of electric vehicles in China reached an all-time high in 2024, which created greater demand for PEM in seals, hoses, and other under-the-hood applications. China is also incentivizing greener mobility and encouraging material innovations that lead suppliers to work harder to develop elastomers that can fit into changing performance and safety regulations.

North America shows a significant growth in the automotive elastomers market during the forecast period. Vehicle production has steadily risen in North America due to rising customer demand and technological developments in the car industry. The need for automotive elastomers, which are necessary for various vehicle components like tires, hoses, gaskets, and seals, is naturally increased by this increase in manufacturing. Innovation in automotive elastomers is being fostered by large research and development expenditures made by major industry participants and academic institutions in North America. This invention is essential for creating more resilient, efficient, and affordable elastomers while promoting market expansion.

Market Overview

The automotive elastomer market is the part of the automotive industry that produces, distributes, and uses elastomeric materials made especially for automotive purposes. Since they can regain their original shape after deformation, elastomers, polymers with elastic properties, are perfect for a variety of automobile components that are subjected to mechanical stress, vibration, and temperature changes.

To ensure dependable performance over extended periods, vehicles need elastomers that can survive various climatic conditions, such as heat, cold, and exposure to chemicals. Growing environmental restrictions encourage elastomer innovation toward environmentally benign materials that improve recyclability and lower emissions, affecting market dynamics. Elastomers are utilized in various automobile parts, including vibration dampers, tires, hoses, gaskets, suspension systems, and seals. These properties allow them to be flexible, strong, and resistant to abrasion.

- In March 2023, Petra Automotive items have launched Several maintenance items intended to safeguard the requirements of modern passenger automobiles and trucks. Manufacturers, service departments, and independent shops can offer premium fluids and engine products with these improved items, which will lead to happier customers and better-running automobiles.

Automotive Elastomers Market Trends

- In August 2023, Trelleborg Sealing Solutions revealed its exclusive ability to use finite element analysis (FEA) to simulate the compression set of elastomers and forecast seal lifetime for its semiconductor clients. Using this method instead of the industry-standard simulation compression set testing allows engineers to obtain precise seal compression set data, which is a major improvement.

- In February 2023, A novel thermoplastic elastomer (TPE) known as a "eco-conscious thermoplastic elastomer" was created by Teknor Apex. Its 35% sustainable component comprises UBQ, a biobased, recyclable substance derived from organic and non-recyclable waste, and post-consumer recycled material.

Automotive Elastomers Market Growth Factors

- Rising worldwide auto sales and disposable income in developing nations are driving the demand for additional automotive elastomers.

- Due to the growth of the automotive industry, especially with electric vehicles, there is a growing need for novel elastomers with certain features. This drives the growth of the automotive elastomers market.

- Elastomers are being used more often in automobile parts due to pollution, fuel economy, and passenger safety regulations.

- The need for replacement parts made of elastomers will rise as the world's car fleet ages.

- The demand for lighter auto parts to increase fuel efficiency benefits the elastomer market, particularly the thermoplastic elastomer (TPE) sector.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 64.06 Billion |

| Market Size in 2025 | USD 39.83 Billion |

| Market Size in 2024 | USD 37.79 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.42% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Vehicle Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rapidly growing and expanding automobile industry

As the automotive industry expands, there is a growing need for different elastomer-based vehicle components. These include gaskets, hoses, belts, interior and external parts, and seals. Naturally, higher car production rates translate into higher elastomer usage. Elastomers offer excellent performance and durability in various settings, such as high temperatures and mechanical stress. Their demand rises due to their suitability for crucial automotive applications where durable components are essential. This drives the growth of the automotive elastomers market.

Increasing manufacturers of automotive elastomers

Increased manufacturing capacity from more producers guarantees a consistent supply of elastomers to meet rising demand. This aids in keeping pricing steady and cutting lead times. Manufacturing competition encourages innovation. Businesses spend money on R&D to produce elastomers with greater qualities, like increased toughness, enhanced thermal resistance, and enhanced performance under pressure. This cycle of constant innovation advances the market by providing better goods.

The emergence of new manufacturers in various places often extends the geographic scope of elastomer production. This lessens reliance on imports, cuts down on lead times and transportation costs, and effectively serves local markets.

Restraint

Fluctuating price of raw material for thermoplastic elastomers

Changes in crude oil prices, disruptions in the supply chain, geopolitical instability, and fluctuations in demand can all lead to regular swings in the prices of raw materials used in thermoplastic polymers (TPEs), such as polypropylene, polystyrene, and different rubbers. Production costs are unknown due to this fluctuation. Supply chain problems frequently accompany price volatility. For instance, abrupt increases in raw material prices might be brought about by shortages or issues with transportation resulting from geopolitical tensions or natural disasters. This discrepancy may cause production schedules to slip and make it more challenging to satisfy client requests. This limits the growth of the automotive elastomers market.

Opportunity

Rising preferences of light weight vehicles

Better handling and performance are two important selling factors for buyers of lighter cars. Elastomers, which offer components that are more durable, flexible, and lightweight, make this possible. Crucial safety devices, including vibration-damping systems, seat belts, and airbags, require elastomers. Their capacity to cushion and absorb impact improves the overall safety of lightweight vehicles.

By customizing elastomers to fulfill specific performance requirements, manufacturers can create components that precisely match the specifications of lightweight automobiles. Because of their adaptability, elastomers are recommended for a range of automotive applications. This opens an opportunity for the growth of the automotive elastomers market.

Type Insights

The thermoset elastomers segment dominated the automotive elastomers market in 2024. Thermoset elastomers exhibit Excellent thermal resilience, which is crucial in automotive applications where components are frequently subjected to high temperatures. These elastomers offer lifespan and dependability by preventing deterioration from vehicle fluids like fuels, oils, and coolants. They are appropriate for heavy-duty applications because of their exceptional mechanical qualities, which include tensile strength, tear resistance, and impact resistance.

The thermoplastic elastomers (TEP) segment shows a significant growth in the automotive elastomers market during the forecast period. One of the most adaptable polymers today is thermoplastic elastomers or TPE. TPE comprises two distinct phases: the easy-to-process soft phase, which represents the rubber segment and offers elastic qualities, and the difficult phase, which represents the thermoplastic segment and offers full recyclability. Traditional processing techniques can be used to model thermoplastic elastomers into desired shapes.

Vehicle Type Insights

The passenger cars segment dominated the automotive elastomers market in 2024. Car ownership has increased due to rising disposable income and the growing middle class in emerging economies. Rising urbanization trends drive car sales since more people live in cities and depend on their cars for transit. To stop leaks and lessen noise, elastomers are widely used in car sealing and insulation applications, including window seals, door seals, and under-the-hood parts. Elastomers improve passenger car comfort and driving experience by effectively damping vibrations and lowering noise. They also provide better resistance to heat, chemicals, and wear, resulting in parts that last longer and require less maintenance.

The light commercial vehicles segment shows a significant growth in the automotive elastomers market during the forecast period. The demand for effective last-mile delivery solutions has increased due to the growth of e-commerce. Light commercial vehicles are indispensable to move items from warehouses to their final locations. The requirement for strong, flexible materials like elastomers directly correlates with this demand increase. Another key factor is the ongoing innovation in vehicle design and materials. Vehicle performance, safety, and comfort are improved by using elastomers in various components, including hoses, suspension systems, gaskets, and seals. Modern LCVs require elastomers because of their ability to adapt to various design requirements.

- In May 2024, Bridgestone EMEA unveiled the Duravis Van Winter ENLITEN, a new premium winter tire for light commercial vehicles. This tire will lower the overall cost of ownership while assisting van owners and fleets in navigating the winter season's daily operating conditions.

Application Insights

The tire segment dominated in the automotive elastomers market in 2024. Tire performance, safety, and longevity have all increased due to developments in tire technology, including better tread designs, higher-quality materials, and more advanced production techniques. Because of these upgrades, more people are buying newer, more energy-efficient tires to replace outdated ones. The industry has grown, and diversified consumer needs are being met by developing specialty tires for various vehicle types and situations (e.g., off-road, winter, and performance tires).

Elastomers balance manufacturing costs and performance, providing tire producers an affordable option. This economic efficiency supports the tire segment's dominance in the automotive elastomers market.

The interior segment is observed to be the fastest growing in the automotive elastomers market during the forecast period. Modern consumers are increasingly demanding higher standards of comfort, style, and elegance from car interiors. Elastomers are perfect for improving the comfort and aesthetics of car interiors because of their superior flexibility, cushioning capabilities, and aesthetic diversity. The desire for individualized and adaptable car interiors drives up elastomer demand. Elastomers' versatility allows automakers to offer a wider range of interior material, texture, and color options.

Requirements and growing environmental concerns are driving the use of recyclable and sustainable materials. The increased demand for elastomers in the automobile interior industry can be attributed to their numerous eco-friendly design options.

Automotive Elastomers Market Companies

- Dow

- LANXESS

- DuPont

- ExxonMobil Corporation

- Mitsui Chemicals, Inc.

- BASF SE

- SABIC

- Huntsman International LLC

- Continental AG

- INEOS

Recent Developments

- In February 2025, tire recycler Prism Worldwide partnered to introduce Prism's sustainable thermoplastic elastomers (TPEs) into extruded TPE sheets. Prism notes that extruded TPE rubber sheets are widely used across multiple industries, including automotive, where they serve as materials for bin mats, mud flaps, and wheel well protectors.

- In April 2025, Tenneco's Clevite Elastomers business, a premier global partner to vehicle manufacturers in providing smoother, quieter, safer, and more sustainable ride experiences, showcased its extensive portfolio of leading-edge NVH and thermal isolation solutions for EVs and other automotive applications.

- In February 2024, LANXESS India completed the expansion of its Rhenodiv production plant in Jhagadia, marking a significant milestone for the company's Rhein Chemie business unit. This milestone demonstrates LANXESS's dedication to innovation, sustainability, process safety, and environmental responsibility in tyre and elastomer manufacture.

- In May 2024, New EPDM adhesion compounds from KRAIBURG TPE are being introduced for the exterior and automobile sealing markets. With an emphasis on the markets in Europe, North America, South America, and Central America, these compounds cater to demands and requirements on a global scale. These compounds provide the adhesion, durability, and processability necessary for demanding applications, exemplifying a tremendous material technology advance.

- In March 2024, Dow introduced artificial leather based on polyolefin elastomer (POE), a first for the worldwide vehicle seating industry. This innovative leather substitute, created in partnership with HIUV Materials Technology, satisfies demanding automotive standards with its soft texture, improved color stability, and higher resistance to aging and low temperatures.

Segments Covered in the Report

By Type

- Thermoset Elastomers

- Natural Rubber (NR)

- Synthetic Rubber (SR)

- Styrene-Butadiene Rubber (SBR)

- Butyl Rubber (IIR)

- Poly Butadiene Rubber (BR)

- Neoprene Rubber / Polychloroprene Rubber (CR)

- Nitrile Butadiene Rubber (NBR)

- Acrylic Rubber (ACM)

- Ethylene Propylene Diene Monomer (EPDM)

- Polyisoprene Rubber (IR)

- Silicone (Q) Elastomers

- Fluoroelastomers

- Thermoplastic Elastomers (TEP)

- Styrene Block Copolymer (SBC)

- Thermoplastic Polyurethane (TPU)

- Thermoplastic Polyolefins (TPO)

- Thermoplastic Vulcanizates (TPV)

- Thermoplastic Polyester Elastomers (TPC)

- Polyether Block Amide (PEBA)

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Medium and Heavy Commercial Vehicles

By Application

- Tire

- Interior

- Hoses And Seals

- Door Panels

- Airbags

- Conveyors and Transmission belts

- Dash Boards

- Seating

- Instrument & Soft Touch Panels

- Window and Door Trim

- Anti-Slip Mats

- Exterior

- Front End Body Panel

- Breaks & Suspensions

- Bumper Fascia

- Rocker Panel

- Roof Molds & Window Shields

- Under the Hood

- Battery Casing

- Hoses and nozzles

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting