What is the Automotive Extended Reality (XR) Market Size?

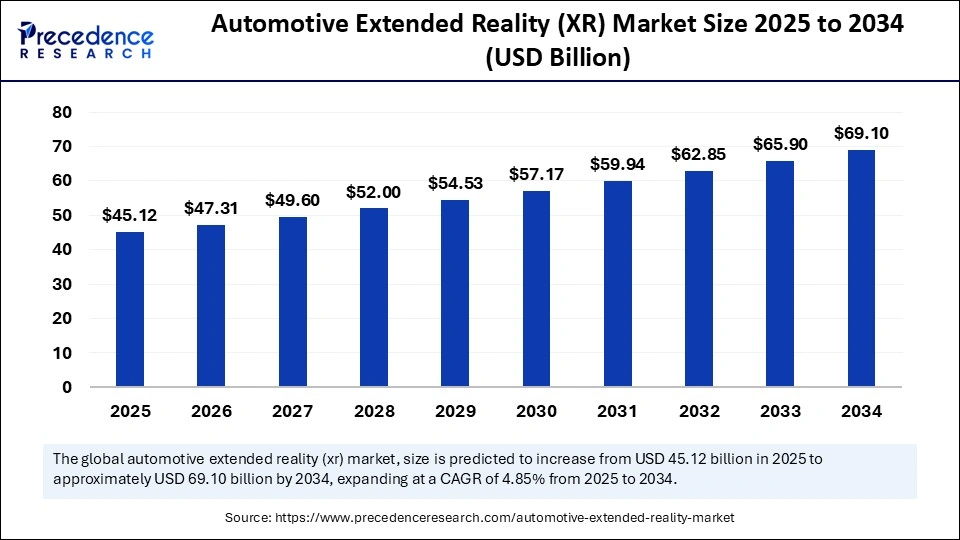

The global automotive extended reality (XR) market size was calculated at USD 43.03 billion in 2024 and is predicted to increase from USD45.12 billion in 2025 to approximately USD69.10 billion by 2034, expanding at a CAGR of 4.85% from 2025 to 2034. The automotive extended reality market stands at the confluence of digital imagination and engineering pragmatism, weaving together augmented, virtual, and mixed realities into the very fabric of mobility the automotive extended reality (XR) market continues to evolve rapidly.

Market Highlights

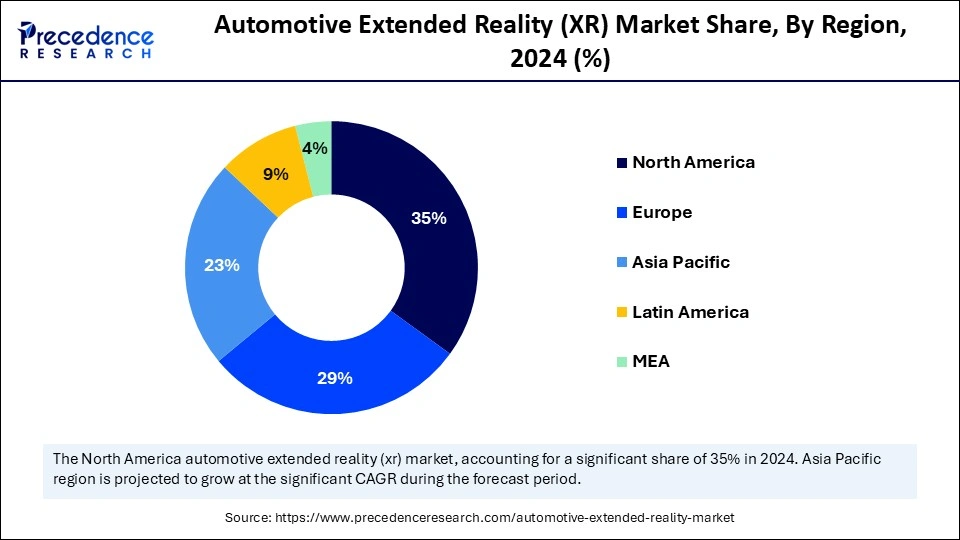

- North America dominated the automotive extended reality (XR) market with the largest market share of 35% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By technology type, the augmented reality segment held the biggest market share of 45% in 2024,

- By technology industry type, mixed reality (MR) is expected to grow at a remarkable CAGR between 2025 and 2034,

- By application type, the design and prototyping segments captured the highest market share of 30% in 2024.

- By application type, in-vehicle applications is expected to grow at a remarkable share CAGR between 2025 and 2034,

- By component type, the hardware segment contributed the maximum market share of 50% in 2024.

- By component type, software to grow at a remarkable CAGR between 2025 and 2034,

- By end-user type, the Automotive OEMs segment generated the major market share of 40% in 2024.

- By end-user type, dealerships & retailers to grow at a remarkable CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2024: USD 43.03 Billion

- Market Size in 2025: USD 45.12 Billion

- Forecasted Market Size by 2034: USD 69.10 Billion

- CAGR (2025-2034): 4.85%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What Is the Automotive Extended Reality (XR) Market?

The inevitability of market growth is due to the industry's insatiable appetite for immersive technology that enhances efficiency, safety, and consumer delight. The demand for XR in the automotive domain is driven by its ability to reduce prototyping cycles, enable experiential showrooms without physical presence, and create driver-assist systems that extend perception beyond the naked eye. Such innovations have ushered in an epoch where automotive ecosystems transcend the mechanical and embrace the experiential.

Augmented reality (AR),virtual reality (VR), and mixed reality (MR) technologies into automotive design, manufacturing, training, and in-vehicle experiences. XR is increasingly being used by automakers and suppliers for immersive prototyping, digital twin simulations, assembly line optimization, and advanced driver-assistance training. In vehicles, XR enhances infotainment, head-up displays, and driver awareness systems. Automotive dealerships are also leveraging XR for interactive showrooms and customer engagement. With advances in hardware, AI-powered visualization, and 5G connectivity, XR is transforming vehicle R&D, driver safety, and customer experience. While North America and Europe lead adoption in design and training, Asia Pacific is emerging fastest due to large-scale automotive manufacturing and consumer technology integration.

Key Technological Shift in the Automotive Extended Reality (XR) Market

The most striking technological metamorphosis in this market lies in the fusion of XR with artificial intelligence, 5G-enabled latency minimization, and advanced haptics. Virtual prototyping has attained uncanny realism, with tactile feedback enabling designers to “feel” surfaces that exist only digitally. AI algorithms now tailor virtual environments to specific user behavior, personalizing automotive XR experiences in real time. Moreover, cloud-powered XR ecosystems allow teams scattered across continents to collaborate as if co-located. This is not technology in service of spectacle, but in service of precision, collaboration, and profound efficiency.

Automotive Extended Reality (XR) Market Outlook

- Industry Growth Overview: The industry has witnessed exponential proliferation, with design validation costs reduced, virtual training ecosystems mushrooming, and dealerships morphing into digital galleries. XR's ability to democratise innovation has enabled both industry titans and fledgling start-ups to participate in this unfolding revolution.

- Sustainability Trends: Sustainability is not merely a rhetorical garnish but a functional reality in XR's automotive application. By replacing physical prototypes with digital twins, manufacturers curtail material wastage and carbon footprints. Virtual showrooms reduce the need for sprawling physical infrastructure, conserving energy and land resources. In training modules, mechanics can rehearse infinite iterations without consuming tangible components. XR, in this sense, emerges as an eco-conscious catalyst cloaked in technological marvel.

- Major Investors: Global technology behemoths, venture capital titans, and forward-looking automakers have poured substantial resources into XR initiatives. From Silicon Valley accelerators to sovereign wealth funds in the Middle East, investors are recognising XR not as a gamble but as an inevitability. Their capital fuels R&D, nurtures startups, and accelerates adoption across the automotive continuum.

- Startup Economy: The startup ecosystem around automotive XR is nothing short of effervescent. Agile innovators are crafting specialized solutions from hyper-realistic AR dashboards to AI-driven VR training suites that traditional players were too sluggish to conceive. These nimble enterprises bring imagination, investors bring scale, and automakers bring validation, together forging a triumvirate of progress.

Market Key Trends

- Immersive design validation accelerating product launches

- Digital showrooms replacing physical dealerships

- AI-personalised driver-assist XR solutions

- Haptic and sensory augmentation becoming mainstream

- XR integration into after-sales maintenance and training

- Cross-industry convergence enriching automotive XR applications

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 43.03 Billion |

| Market Size in 2025 | USD 45.12 Billion |

| Market Size by 2034 | USD 69.10 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.85% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Application, Component, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Immersion as the New Imperative

The foremost driver of XR adoption in the automotive sector is its transformative power to create immersive, life-like experiences that enrich every phase of the value chain. Design engineers wield XR to experiment with prototypes without incurring prohibitive costs. Dealerships leverage VR to allow prospective buyers to test drive without leaving the showroom. Training programs harness AR to elevate skills acquisition. Consumers, meanwhile, crave multisensory engagement that transcends conventional driving. This collective yearning for immersion ensures XR is not ornamental but indispensable.

Restraint

The Latency of Adoption

Yet, the march of progress is not without impediments. XR adoption in the automotive landscape is throttled by the high capital intensity of infrastructure, the paucity of universally accepted standards, and lingering ergonomic challenges of XR hardware. Network latency and motion-sickness issues continue to dampen user enthusiasm in certain applications. Moreover, resistance to change among entrenched stakeholders tempers the pace of integration. This inertia constitutes the gravitational pull against XR's meteoric ascent.

Opportunity

The Dawn of Cognitive Mobility

The opportunities that glisten on the horizon are manifold. XR's symbiosis with AI heralds a new era of cognitive mobility, where vehicles anticipate driver intent and augment human capability. Virtual showrooms present untapped retail landscapes in emerging economies. The democratisation of design tools empowers smaller automakers to compete with giants. Even post-sale, XR-driven diagnostics and remote maintenance offer vast revenue streams. The automotive XR market is not merely evolving it is metamorphosing into a fountainhead of opportunity.

Segment Insights

Technology Insights

Why is Augmented Reality Dominating the Automotive Extended Reality (XR) Market?

Augmented reality (AR) has assumed the mantle of dominance in the automotive extended reality (XR) market with a share of 45%. From heads-up displays that project navigational cues directly onto the windscreen to AR-enhanced repair guides for mechanics, its utility is both practical and profound. Automakers deploy AR to showcase vehicles virtually, permitting customers to explore features with remarkable fidelity. In the design arena, AR expedites collaboration between dispersed teams, collapsing the tyranny of distance into a shared immersive space. Its accessibility via smartphones and tablets has broadened adoption, requiring no extravagant hardware. AR thus reigns supreme as the technology of choice for everyday automotive applications.

What strengthens AR's dominance further is its ability to blend invisibly into the user's existing routines. Unlike VR, which demands full immersion, AR requires only subtle accretions of information, making it intuitively adoptable. Drivers and passengers experience enhanced safety with overlays that reveal blind spots or anticipate hazards. Engineers wield AR during assembly to minimise error margins and streamline operations. The technology's incremental, almost surreptitious, integration into vehicles assures its sustainability. Thus, AR is not a disruptive intruder but a loyal augment or, entrenching its supremacy within the automotive XR market.

Mixed reality (MR) is rapidly ascending as the fastest-growing technology in the automotive extended reality (XR) market, combining the immersion of VR with the contextual awareness of AR. In automotive prototyping, MR enables engineers to interact with life-sized digital car models in physical space, simultaneously seeing and touching the future. It allows designers to step inside vehicles yet to be manufactured, walking around interiors and evaluating ergonomics in a manner traditional CAD cannot rival. Such experiential power accelerates innovation while reducing material wastage. Furthermore, its adoption is fuelled by the quest for increasingly immersive training environments. MR is thus carving a trajectory of meteoric growth.

The acceleration of MR adoption is also attributable to advancing hardware, lighter headsets, more responsive sensors, and improved field-of-view optics. The synergy of MR with 5G ensures interactions occur with negligible latency, vital in collaborative automotive design and testing. Startups are particularly active in MR, fashioning new tools that reimagine everything from driver simulation to dealership experiences. Automakers, once hesitant, now embrace MR for its capacity to wow consumers and streamline operations. As cost barriers diminish, MR will leap from niche to mainstream. This is no mere trend; it is the vanguard of automotive XR's next epoch.

Application Insights

Why is Augmented Reality Dominating the Automotive Extended Reality (XR) Market?

Design and prototyping dominate the automotive extended reality (XR) market, holding the share of 30%. XR platforms enable engineers to test multiple iterations of a component without chiseling a single physical prototype. This slashes development timelines and liberates designers from the tyranny of tooling constraints. Virtual mock-ups allow instant adjustments, permitting faster decision-making and fewer budget overruns. Collaboration is enriched as globally dispersed teams convene in shared digital spaces. Consequently, design and prototyping constitute XR's most indispensable application in the automotive ecosystem.

This dominance also stems from OEMs' inherent need to stay ahead in an intensely competitive industry. XR empowers them to differentiate not merely on horsepower or torque but on experience. The ability to unveil virtual models before production grants OEMs the agility in responding to market feedback. In training, XR minimizes human error, bolstering quality assurance. Their scale, resources, and strategic urgency ensure that OEMs remain XR's prime adopters. In effect, they are both patrons and beneficiaries of the XR renaissance.

In-vehicle applications are the fastest-growing segment of the automotive extended reality (XR) market, driven by consumer hunger for safety, entertainment, and personalised experiences. Augmented dashboards project real-time hazard alerts, speed limits, and navigation guidance directly onto the windscreen, making driving safer and less stressful. Passengers enjoy immersive infotainment experiences through AR overlays and VR headsets, transforming commutes into cinematic journeys. Voice-assisted XR interfaces deepen human-machine symbiosis, reducing cognitive overload. Increasingly, in-vehicle XR is becoming not a luxury but a competitive differentiator. This explains its rapid acceleration across global markets.

The growth trajectory of in-vehicle applications is supercharged by connectivity advances such as 5G and edge computing. Automakers integrate XR to distinguish their vehicles in fiercely contested markets, appealing especially to tech-savvy millennials and Gen Z. Electric vehicle manufacturers leverage XR to educate drivers about battery performance and eco-friendly driving techniques in real time. Additionally, XR aids advanced driver assistance systems, effectively extending human perception. The fusion of safety, delight, and intelligence makes in-vehicle XR the industry's most dynamic growth frontier. Its adoption curve is not rising, it is soaring.

Component Insights

Why is Hardware Leading the Automotive Extended Reality (XR) Market?

Hardware dominates the automotive extended reality (XR) market, holding the share of 50%, driven by physical enablers headsets, sensors, haptic gloves, and displays. The immersive promise remains a mirage. Automakers rely on sophisticated head-mounted displays for engineers and technicians, while dealerships use high-resolution VR sets to simulate test drives. Optical sensors, motion trackers, and haptic devices form the backbone of XR integration into manufacturing and training workflows. Hardware represents the tangible infrastructure upon which all XR experiences rest. Its indispensability cements its dominance.

Moreover, continual hardware innovation reinforces this dominance. Miniaturisation reduces ergonomic burdens, making devices lighter and more user-friendly. Advances in optics yield lifelike visuals, while haptic actuators simulate touch with uncanny precision. Manufacturing ecosystems around semiconductors, optics, and polymers feed into an ever-expanding hardware market. Even as software grows more sophisticated, it is hardware that must carry its executional weight. Hence, the dominance of hardware is not fleeting, it is foundational and enduring.

Software emerges as the fastest-growing in the automotive extended reality (XR) market, followed by the boundless possibilities of algorithmic creativity. It is software that animates hardware, rendering immersive environments and orchestrating user experiences. Automakers employ software platforms for prototyping, consumer engagement, and remote maintenance. AI-powered engines dynamically personalise XR environments, tailoring every interaction to the user's preferences. The agility of software allows rapid updates, upgrades, and innovations, making it the most vibrant frontier.

This meteoric growth is fuelled by the proliferation of cloud-based XR ecosystems, enabling collaboration without geographical boundaries. Open-source communities and startup ventures continually enrich the software landscape with fresh solutions. Automakers seek software-driven differentiation, where immersive showrooms or predictive maintenance XR tools become brand hallmarks. Furthermore, software's scalability ensures adoption across both premium and mass-market vehicles. As XR pivots towards intelligence rather than spectacle, software takes centre stage. Its ascendancy, though recent, is undeniably irresistible.

End-User Insights

Why are Automotive OEMs Leading the Automotive Extended Reality (XR) Market?

Original equipment manufacturers (OEMs) dominate the automotive extended reality (XR) market, holding the share of 40%, because they are the principal custodians of vehicle design, development, and production. For them, XR is not decorative but existential, slashing costs, improving quality, and accelerating innovation. OEMs use XR to validate prototypes, train workers, and engage customers long before a car touches the road. Their large-scale investments in XR infrastructure cement their commanding role. Furthermore, OEMs' global reach magnifies XR's transformative influence across the value chain.

This dominance also stems from OEMs' inherent need to stay ahead in an intensely competitive industry. XR empowers them to differentiate not merely on horsepower or torque but on experience. The ability to unveil virtual models before production grants OEMs the agility in responding to market feedback. In training, XR minimises human error, bolstering quality assurance. Their scale, resources, and strategic urgency ensure that OEMs remain XR's prime adopters. In effect, they are both patrons and beneficiaries of the XR renaissance.

Dealerships and retailers constitute the fastest-growing in the automotive extended reality (XR) market, , as XR redefines consumer engagement at the point of sale. Virtual showrooms allow prospective buyers to explore car models without geographical constraints. Customers can customize interiors, experiment with color palettes, and even simulate driving experiences through immersive setups. Such personalized, interactive engagement fosters deeper emotional resonance with brands. In a world of digital-first consumers, XR has become a retailer's golden wand.

Regional Insights

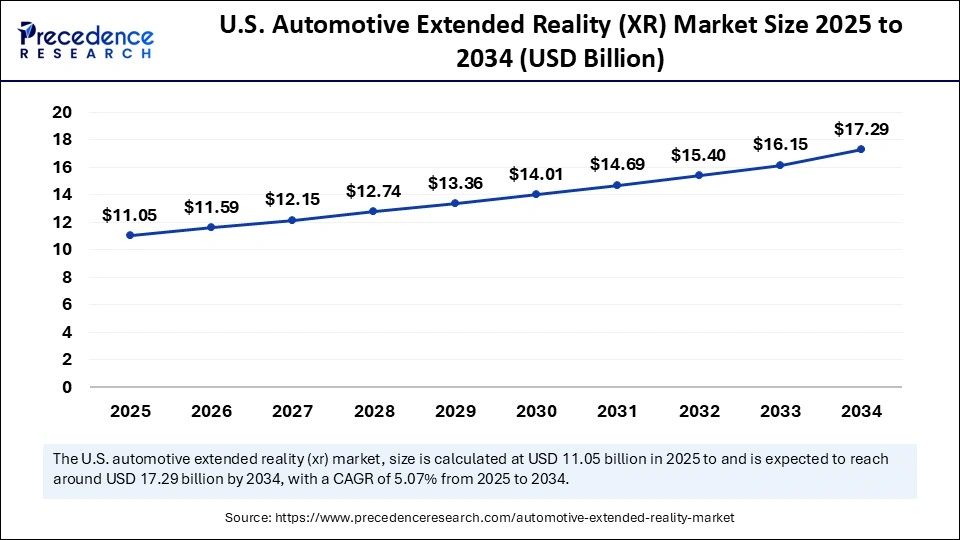

U.S. Automotive Extended Reality (XR) Market Size and Growth 2025 to 2034

The U.S. automotive extended reality (XR) market size was exhibited at USD 10.54 billion in 2024 and is projected to be worth around USD 17.29 billion by 2034, growing at a CAGR of 5.07% from 2025 to 2034.

Why Does North America Reign Supreme in the Automotive Extended Reality (XR) Market?

North America is dominating the automotive extended reality (XR) market, driven by mature automotive infrastructure and an insatiable consumer appetite for innovation. Automakers in the United States and Canada have aggressively embraced XR to truncate design cycles, reduce dealership footprints, and improve customer engagement. The region's leadership in AI and cloud infrastructure has further turbocharged XR integration, ensuring seamless adoption across design, retail, and maintenance.

Moreover, a supportive policy environment, coupled with the presence of Silicon Valley's innovation juggernauts, has catalysed growth. Startups flourish under the patronage of venture capital, while legacy automakers collaborate with tech titans to accelerate deployment. North America thus enjoys the rare duality of being both the crucible of invention and the theatre of adoption.

Why is Asia Pacific the Fastest Growing Market?

Asia-Pacific emerges as the most scintillating theatre of growth, fuelled by rising automotive demand, burgeoning middle classes, and digital-native populations. Countries such as China, Japan, South Korea, and India are leveraging XR to redefine the consumer journey from virtual showrooms to hyper-localised in-car AR experiences. The rapid roll-out of 5G infrastructure provides fertile ground for XR ecosystems to flourish with minimal latency.

Equally important is the entrepreneurial vigour of Asia-Pacific's startup economy, which is unearthing ingenious XR applications tailored to local sensibilities. Governments, too, are investing heavily in digital infrastructure, further greasing the wheels of adoption. The region is not merely following global trends; it is reinterpreting XR through its own cultural and economic prism, ensuring that its growth outpaces all others.

Automotive Extended Reality (XR) Market Value Chain Analysis

- Raw Material Sourcing: The XR automotive value chain weaves together raw material providers for optical and display technologies, hardware manufacturers crafting headsets and sensors, software firms designing immersive applications, and integrators embedding XR into automotive lifecycles. Automakers, dealerships, and end consumers constitute the downstream beneficiaries, forming a symbiotic chain of innovation and consumption.

- Technology Used: Augmented reality HUDs, VR-based prototyping tools, AI-driven XR content personalization, 5G-enabled low-latency XR experiences, and Cloud XR collaboration platforms are emerging technologies transforming the landscape of immersive experiences.

- Investment by Investors:Funding has cascaded into hardware innovation, AI-algorithm development, XR software ecosystems, and retail XR platforms, with venture capital and corporate venture arms forming the primary conduits.

- AI Advancements: Artificial intelligence refines XR by personalizing content, predicting user needs, enabling natural language interaction, and generating real-time environmental reconstructions. It is the invisible orchestrator behind the XR spectacle.

Automotive Extended Reality (XR) Market Companies

- Qualcomm Technologies Inc: Provides XR chipsets and platforms enabling immersive automotive AR/VR experiences, in-car infotainment, and driver-assist systems.

- Accenture PLC: Offers consulting and integration services for XR in automotive design, training, and customer engagement solutions.

- SoftServe Inc: Specializes in software development for AR/VR applications, including automotive simulation and virtual prototyping.

- SphereGen Technologies LLC – U.S.-based technology solutions provider specializing in custom software, augmented & virtual reality, and digital transformation services.

- Northern Digital Inc. (NDI) – Canadian company recognized as a global leader in optical and electromagnetic 3D measurement and tracking technologies for healthcare and research.

Recent Developments

- In September 2025, On Tuesday, the state cabinet gave its nod to the Animation, Visual Effects, Gaming, and Comics (AVGC) policy, aimed at boosting growth and investment in this emerging sector. The initiative is expected to create new opportunities for talent development, attract industry players, and position the state as a hub for creative digital industries. (Source: https://timesofindia.indiatimes.com)

- In September 2025, LH Evaporator announced a two-stage MVR evaporation system deployed for treating saline industrial wastewater, achieving a salt recovery rate of 100%, organic compound recovery of 98%, and water reuse of 95%. (Source: https://www.lhevaporator.com)

Segments Covered in The Report

By Technology

- Augmented Reality (AR)

- Virtual Reality (VR)

- Mixed Reality (MR)

By Application

- Design & Prototyping

- Vehicle Design Simulation

- Digital Twin Modeling

- Manufacturing & Production

- Assembly Line Optimization

- Maintenance & Repair Simulation

- Training & Education

- Workforce Training

- Safety Protocols

- Sales & Marketing

- Virtual Showrooms

- Customer Experience Engagement

- In-Vehicle Applications

- Head-Up Displays (HUDs)

- Immersive Infotainment

- Driver Awareness & Assistance

By Component

- Hardware (Headsets, Sensors, Displays)

- Software (XR Platforms, CAD/Simulation Tools)

- Services (Integration, Support, Consulting)

By End User

- Automotive OEMs

- Automotive Suppliers

- Dealerships & Retailers

- Training Institutes

- Fleet Operators

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting