What is the Biomanufacturing Specialty Chemicals Market Size?

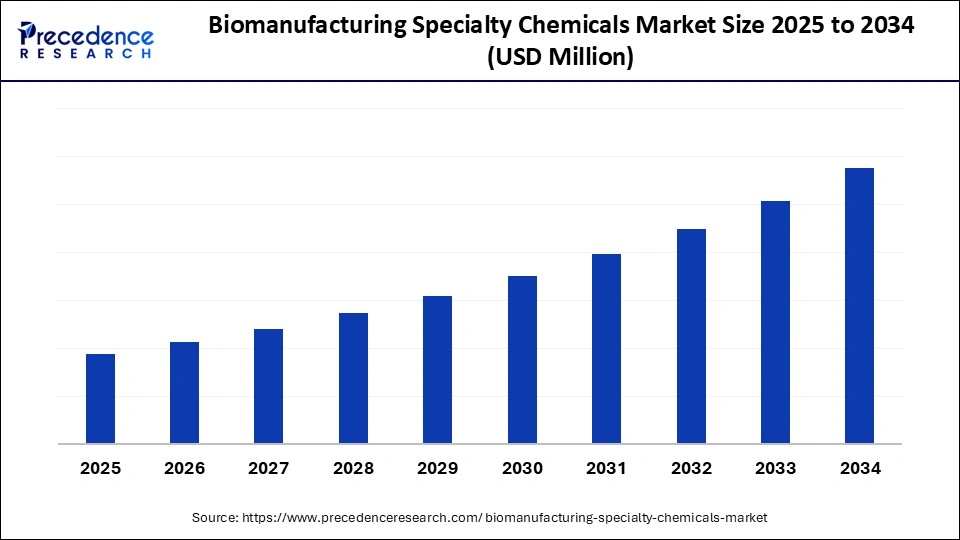

The global biomanufacturing specialty chemicals market size is estimated at USD 12.39 billion in 2025. It is projected to increase from USD 13.51 billion in 2026 to approximately USD 26.99 billion by 2034, growing at a CAGR of 9.04% from 2025 to 2034.

The global biomanufacturing specialty chemicals market is witnessing strong growth as pharmaceutical and biotech companies rely on specialized chemicals to support biologics and cell therapy production.This market is growing due to increasing demand across multiple end-use industries, rapid industrialization in emerging economies, and a global shift toward sustainable and bio-based products.

Biomanufacturing Specialty Chemicals Market Key Takeaways

- Europe dominated the market, holding the largest market share of 55% in 2024.

- Asia Pacific is expected to grow at a notable rate in market share.

- By product type, the industrial enzymes segment held the largest share of the market at 32% in 2024.

- By product type, the specialty enzymes segment is expected to grow at the fastest rate during the forecast period.

- By feedstock, the sugar & starch segment held the largest market share of 40% in 2024.

- By feedstock, the lignocellulosic biomass segment is expected to grow at the fastest rate during the forecast period.

- By application, the pharmaceuticals segment held the largest share at 35% in 2024.

- By application, the personal care & cosmetics segment is expected to grow at the fastest rate during the forecast period

- By scale of production, the commercial scale segment is expected to grow at the fastest rate of 60% in the biomanufacturing specialty chemicals market.

- By scale of production, the pilot scale segment held the largest share in the market in 2024.

- By end user, the specialty chemicals manufacturers segment held the largest share at 48% in 2024.

- By end user, the startups & SMEs segment is expected to grow at the fastest rate during the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 12.39Billion

- Market Size in 2026: USD 13.51 Billion

- Forecasted Market Size by 2034: USD 26.99 Billion

- CAGR (2025-2034): 9.04%

- Largest Market in 2024: Europe

- Fastest Growing Market: Asia Pacific

Market Overview

The biomanufacturing specialty chemicals market is witnessing steady growth as sectors move toward bio-based and environmentally friendly production techniques. Technological innovation in bioprocessing is being propelled by the growing demand in personal care, agriculture, and pharmaceuticals. An increasing number of businesses are spending money on R&D to improve the yield, effectiveness, and affordability of bio-based chemicals. Biomanufacturing is positioned as a major force behind the chemicals industry of the future, and this trend is in line with global sustainability goals.

- In April 2025, IFF and Kemira announced the launch of AlphaBio, a joint venture for the commercial-scale production of renewable bio-based specialty materials. (Source: https://greenchemicalsblog.com)

Market Outlook

- Industry Growth Overview: The market is steadily growing because of the growing need for bio-based sustainable chemicals in industrial, personal care, pharmaceutical, and agricultural applications. Enhancing efficiency and yield are developments in enzymatic processes, fermentation, and synthetic biology.

- Sustainability Trends: To lessen their impact on the environment and satisfy consumer and regulatory demands, businesses are concentrating on waste valorization, green production technologies, and renewable feedstocks.

- Global Expansion: Emerging markets in Asia-Pacific, North America, and the Middle East are driving growth, with governments supporting biotech infrastructure and increased adoption across industries.

- Major Investors: Private equity, venture capital, and multinational chemical firms are investing in scalable bioprocessing, enzyme optimization, and pilot-to-commercial facilities to stay competitive.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 12.39 Billion |

| Market Size in 2026 | USD 13.51 Billion |

| Market Size by 2034 | USD 26.99 Billion |

| CAGR from 2025 to 2034 | 9.04% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Feedstock, Application, Scale of Production, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Opportunity

Sustainable Alternatives to Petrochemicals

Specialty chemicals derived from petroleum have a significant chance to be replaced by bio-based substitutes in industries like packaging, food additives, and cosmetics due to tighter environmental regulations and growing consumer demand for eco-friendly products. This change also helps businesses reach carbon-neutral goals and win over eco-aware customers.

Market Challenge

High Production Costs

Bio-based specialty chemicals are frequently still more costly than their petroleum-based counterparts, even with technological advancements. One of the biggest challenges facing manufacturers is increasing production while keeping costs competitive. Cost reduction requires ongoing investment in advanced biotechnologies and process optimization.

Regional Insights

Country-Level Investments & Funding Trends for Biomanufacturing Specialty Chemicals Market

| Country | Investment Focus | Funding Objective |

| India | Strategic initiatives to strengthen the chemical industry through government policies & attract the chemical sector. | Expand biomanufacturing & specialty chemicals while strengthening manufacturing competitiveness. |

| Canada | Government-backed programs for next-gen biomanufacturing include the strategic innovation fund for expanding the country's biomanufacturing. | Build capacity for advanced medicines and develop talent infrastructure in the life sciences sector. |

| United States | DoD-supported biomanufacturing projects are for the Department of Defense for national security and military applications. Ions. | Develop pilot & commercial-scale facilities to create resilient domestic production and strengthen the bioeconomy. |

| UAE | Industrial development initiatives such as “Operation 300bn,” which is a broad strategy to boost the country's overall manufacturing sector. | Support chemical manufacturing & industrial growth by diversifying the economy and attracting investment in advanced manufacturing. |

Segmental Insights

Product Type Insights

Why did the industrial enzymes segment dominate the market in 2024?

Industrial enzymes segment is dominating the biomanufacturing specialty chemicals market due to their extensive applications across food & beverages, detergents, textiles, and pulp and paperindustries. Theor robust demand is driven by established industrial processes, cost efficiency, and proven effectiveness, making them the backbone of enzyme utilization in large-scale manufacturing.

Specialty enzymes are the fastest-growing segment in high-value industries like fine chemicals, biopharmaceuticals, and diagnostics. Higher specificity, stability, and efficacy are provided by these enzymes, which are designed for particular reactions nd support the expansion of specialized applications where accuracy is essential.

Feedstock Insights

Why did the sugars & starch segment dominate the biomanufacturing specialty chemicals market in 2024?

Sugars & starch remain the primary feedstock for specialty enzymes because they are readily available, cost-effective, and widely used in fermentation, biofuel, and food processing industries. Their predictable yield and established supply chains make them a staple in industrial enzyme production.

Lignocellulosic biomass is growing rapidly in the market, driven by the desire for second-generation biofuels and sustainability trends. Technological developments in pre-treatment and enzymes are opening their potential for large-scale production of specialty enzymes, and they provide a plentiful and renewable source.

Application Insights

What made the pharmaceuticals segment dominate the market in 2024?

Pharmaceutical applications currently dominate specialty enzyme usage, due to stringent regulatory standards and consistent demand for enzyme-assisted drug manufacturing, diagnostics, and vaccine production. Enzymes provide high specificity and efficiency, crucial for maintaining quality in pharmaceuticals.

Personal care & cosmetics are growing fastest in the market as skincare, haircare, and cosmetic formulas increasingly include enzymes, increasing consumer awareness and preference for sustainable, plant-based ingredients is propelling the industry's adoption of enzymes, and the ability to tailor enzyme performance provides precise, targeted, and gentle solutions.

Scale of Production Insights

What made commercial scale dominate the market in 2024?

Commercial-scale production dominates the specialty enzyme market, supported by established infrastructure, large-scale bioreactors, and optimized downstream processing, and is increasingly leveraging genetic engineering to create custom enzymes with superior functionality and higher yields. This ensures consistent quality, high yield, and cost efficiency for mass production.

Pilot scale segment is growing rapidly in the market as small batch manufacturing and innovative enzymes are tested by startups and research-driven businesses, who test innovative enzymes through small-batch manufacturing, while pilot plants enable quick iterations, creativity, and flexibility before scaling up.

End User Insights

Why did specialty chemicals manufacturers segment dominate the market in 2024?

Specialty chemicals manufacturers segment is dominating the biomanufacturing specialty chemicals market as they are the largest consumers of enzymes for chemical synthesis, biotransformation, and industrial processes. Their established demand and integration into production chains solidify their leading position.

Startups & SMEs are growing rapidly by utilizing enzymes for cutting-edge uses in biopharmaceuticals, green chemistry, and functional foods. Smaller players can quickly adopt specialized enzymes thanks to agility and niche targeting, enabling the quick and precise development of specialized enzymatic solutions.

Regional Insights

Europe Biomanufacturing Specialty Chemicals Market Size and Growth 2025 to 2034

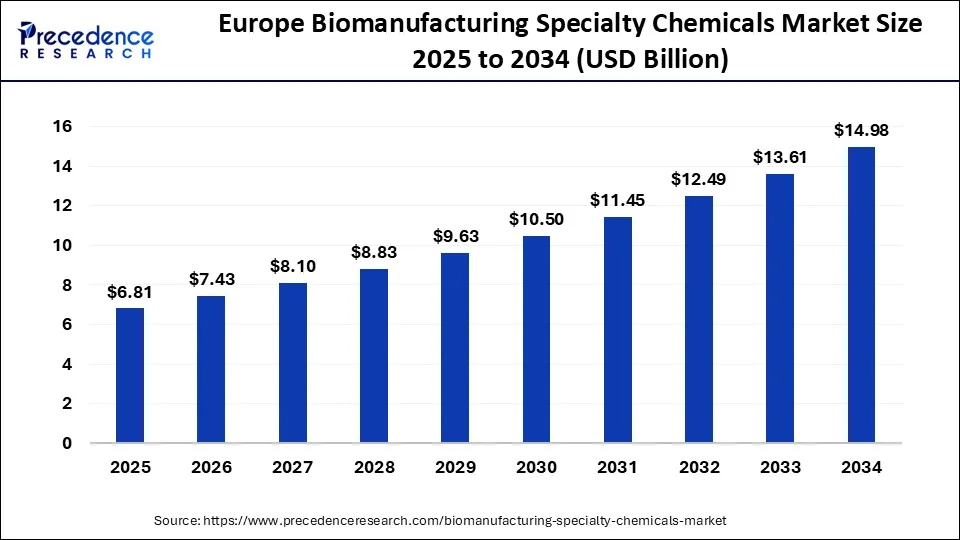

The Europe biomanufacturing specialty chemicals market size is evaluated at USD 6.81 billion in 2025 and is projected to rise from USD 7.43 billion in 2026 to approximately USD 14.98 billion by 2034, growing at a CAGR of 9.13% from 2025 to 2034.

What made Europe dominate the market in 2024?

Europe dominates the specialty enzymes market due to advanced biotechnology infrastructure, stringent regulations promoting quality and sustainability, and the presence of major enzyme manufacturers. The region also has strong adoption across pharmaceuticals, food, and industrial sectors.

Asia Pacific is the fastest-growing market, fueled by increasing industrialization, rising demand for bio-based products, and government support for biotechnology initiatives. Growing pharmaceutical, food, and personal care industries are accelerating enzyme adoption due to the expansion of pharmaceutical, food, and personal care industries, coupled with a focus on sustainable manufacturing processes.

Biomanufacturing Specialty Chemicals Market Companies

- BASF SE: A global leader in chemicals with a significant bio-based division.

- Corbion: A Dutch company focused on bio-based ingredients, known for its expertise in fermentation.

- DuPont: A major player in bio-based chemicals and industrial enzymes.

- Evonik Industries AG: A German specialty chemicals company that leverages biotechnology for sustainable products.

- International Flavors & Fragrances (IFF): A prominent producer of bio-based flavors and fragrances.

- Novonesis: The company formed from the merger of Novozymes and Chr. Hansen specializes in enzymes and microbial solutions.

Recent Developments

- In September 2025, FUJIFILM Biotechnologies celebrated the grand opening of its commercial-scale cell culture manufacturing site in Holly Springs, North Carolina, marking one of the largest biomanufacturing facilities in North America. (Source:https://www.fujifilm.com)

- In April 2025, BioMADE announced the launch of a demonstration-scale biomanufacturing facility in Maple Grove, Minnesota, backed by a $132 million investment, to support scale-up of bio-industrial processes.(Source: https://www.biomade.org)

Segments Covered in the Report

By Product Type

- Enzymes

- Industrial Enzymes (detergents, textiles, pulp & paper)

- Food Enzymes (bakery, dairy, brewing)

- Pharmaceutical Enzymes (therapeutic, diagnostic)

- Specialty Enzymes (research, niche industrial use)

- Amino Acids

- Essential Amino Acids (lysine, methionine, threonine, tryptophan)

- Non-Essential Amino Acids (glutamine, glycine, alanine)

- Specialty Amino Acids (D-amino acids, cysteine derivatives)

- Organic Acids

- Citric Acid

- Lactic Acid

- Succinic Acid

- Itaconic Acid

- Other Niche Acids (gluconic, fumaric, malic)

- Biopolymers

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Starch-Based Polymers

- Other Specialty Biopolymers (chitosan, alginate derivatives)

- Biosurfactants

- Rhamnolipids

- Sophorolipids

- Mannosylerythritol Lipids (MELs)

- Other Emerging Biosurfactants

- Bio-Solvents

- Ethanol

- Butanol

- Acetone

- Glycerol Derivatives

- Others

By Feedstock

- Sugars & Starch

- Lignocellulosic Biomass

- Algae

- Glycerol

- Waste Streams

By Application

- Pharmaceuticals

- Food & Beverages

- Agriculture

- Personal Care & Cosmetics

- Industrial Chemicals

- Textiles

- Environmental Applications

By Scale of Production

- Laboratory Scale

- Pilot Scale

- Commercial Scale

By End User

- Specialty Chemical Manufacturers

Contract Manufacturing Organizations (CMOs) - Research Institutes

- Startups & SMEs

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting