Automotive Speaker Market Size and Forecast 2025 to 2034

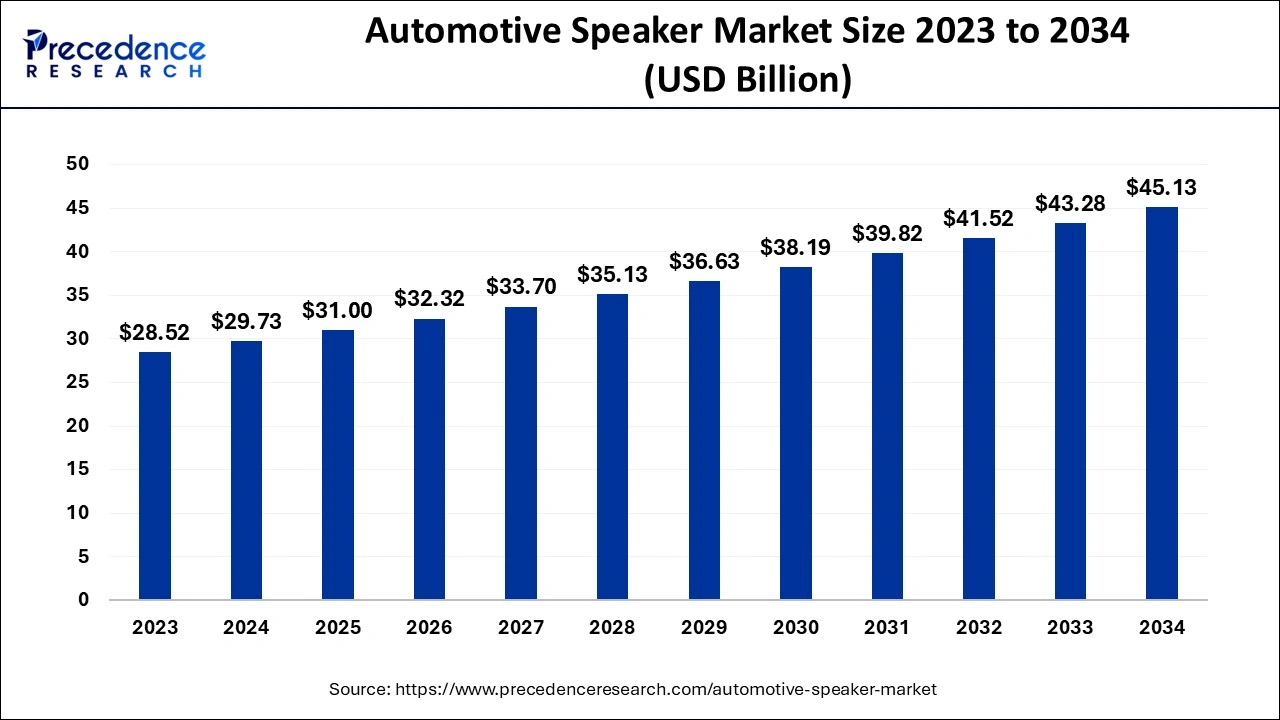

The global automotive speaker market size was valued USD 29.73 billion in 2024 and is projected to surpass around USD 45.13 billion by 2034, growing at a CAGR of 4.26% from 2025 to 2034. The automotive speaker market is gaining traction due to the rising demand of consumers to have a vehicle that offers an immersive and enjoyable audio experience.

Automotive Speaker Market Key Takeaways

- In terms of revenue, the market is valued at $31 billion in 2025.

- It is projected to reach $45.13 billion by 2034.

- The market is expected to grow at a CAGR of 4.26% from 2025 to 2034.

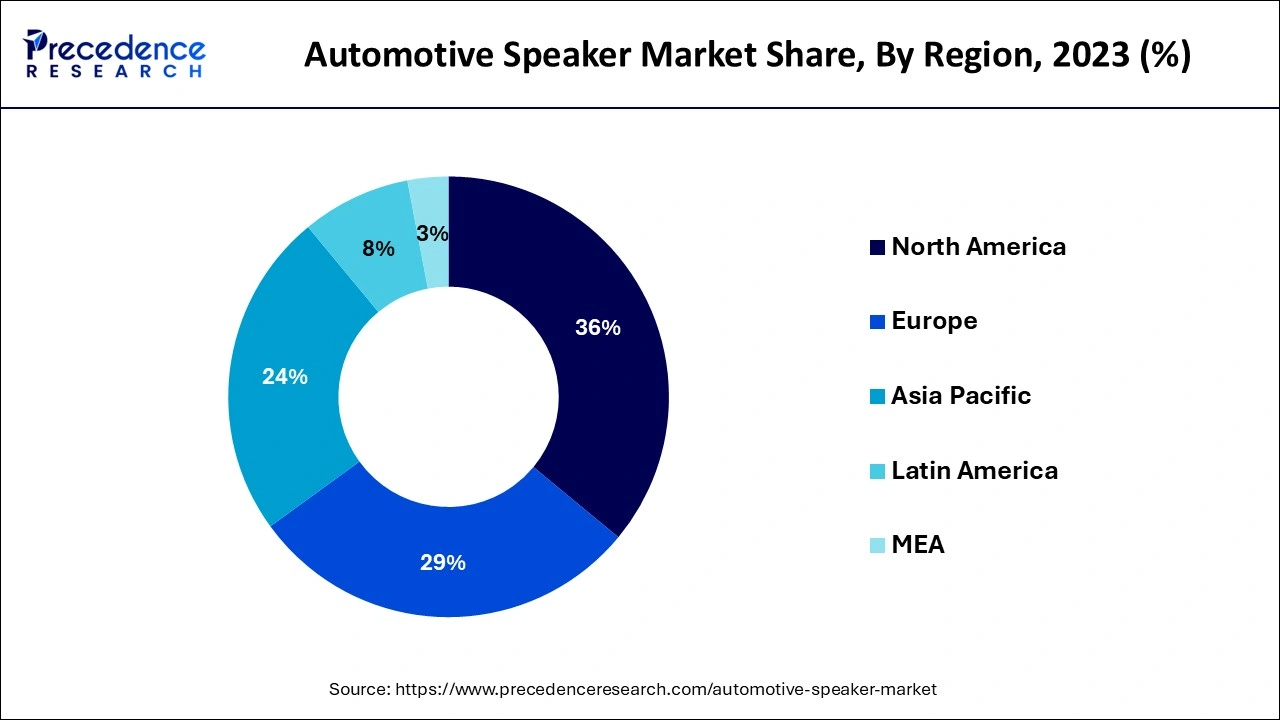

- North America dominated the global market with the largest market share of 36% in 2024.

- Europe is expected to show the fastest growth during the forecast period.

- By speaker type, the coaxial segment contributed the highest share in 2024.

- By speaker type, the component segment is projected to grow at a significant CAGR during the forecast period.

- By power handling, the 40-100 watts segment captured the biggest share in 2024.

- By power handling, the 100-200 watts segment is expected to grow at the fastest CAGR during the projected period.

- By frequency response, the 20-20,000 Hz segment generated the major market share in 2024.

- By frequency response, the 20-30,000 Hz segment is projected to grow at a significant CAGR during the forecast period.

- By mounting location, the door segment dominated the market in 2024.

- By mounting location, the dashboard segment is anticipated to grow at a significant CAGR during the forecast period.

- By application, the passenger car segment contributed the largest share in 2023.

- By application, the commercial vehicle segment is projected to grow at a notable CAGR during the forecast period.

How is Artificial Intelligence Changing the Automotive Speaker Market?

Artificial intelligence algorithms have the capability to transform the driving experience in the automotive speaker market. The AI algorithms are designed and continuously improved through over-the-air updates to enhance the driving experience. AI integration allowed for a flexible and efficient user interface, a new way of approaching audio experience design. The innovations in the automotive industry, such as systems-focused development platforms, artificial intelligence, and stronger processors, are providing drivers and passengers with advanced adaptive, real-time responsiveness.

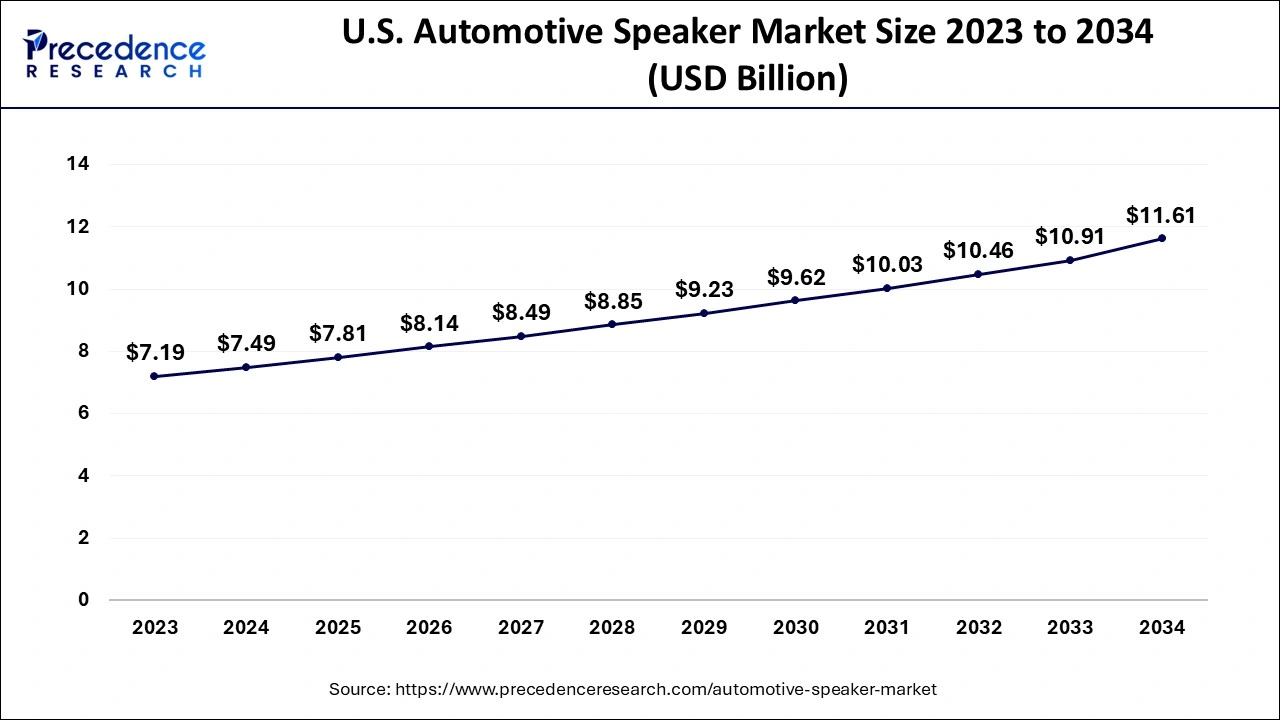

U.S. Automotive Speaker Market Size and Growth 2025 to 2034

The U.S. automotive speaker market size was evaluated at USD 7.49 billion in 2024 and is projected to be worth around USD 11.61 billion by 2034, growing at a CAGR of 4.45% from 2025 to 2034.

North America dominated the global automotive speaker market in 2024. The growth in the region is especially noticed in the United States and Canada. The significant dominance is due to the high consumer demand for advanced audio technology. Additionally, the market is expanding in the region due to the increasing hours spent in cars while in traffic congestion. Traffic in America costs both time and money. On average, Americans spend 51 hours stuck in traffic. Adding to the statement, the constant stop-and-go traffic causes a waste of gas. People seek a high-quality audio system for entertainment, music, and traffic-free navigation purposes to pass their time in traffic.

Europe is expected to host the fastest-growing automotive speaker market during the forecast period. The expansion of this is due to the presence of key players in Germany, France, the U.K., and Italy. The market in the region is driven by innovation and urbanization. European Union employment in manufacturing is about 2.6 million people working in direct manufacturing of motor vehicles. The widely known car manufacturers in Europe are Volkswagen AG, Stellantis NV, Mercedes-Benz Group Ag, Bayerische Motoren Werke AG, and Renault SA.

- In 2023, Germany was the largest automobile manufacturing country in Europe, with about 4.1 million vehicles produced. Spain was the second largest, with 2.5 million vehicles manufactured.

Market Overview

Automakers have changed the dynamics of automotive with original equipment manufacturer (IEM) systems. Every car audio system consists of three main components. The first is the radio or head unit that controls the entire system and generates the audio signal. The second is the amplification, which optimizes the strength of the audio signal so that it can successfully drive the third component, the speaker that reproduces the sound. Most of the basic automotive speakers are designed to be ‘full range' and cover the entire frequency range. It is essential to choose the right speaker that can elevate the driving experience, turning everyday commute into an immersive audio journey.

Automotive Speaker Market Growth Factors

- Enhance sound quality: A high-quality car audio system significantly improves sound quality. Investing in a better speaker, amplifiers, and subwoofers provides an enjoyable and better experience.

- Advanced connectivity options: Any modern audio system is in-build with advanced connectivity options that enhance convenience and functionality. Advanced systems offer features such as Apple CarPlay and Android Auto, which help provide easy access to navigation, messaging, and entertainment apps directly from the dashboard.

- User-friendly features: New audio systems are designed to have a user-friendly interface that offers intuitive controls and easier media access. The touchscreen display, similar to smartphones and tablets, seamlessly transitions into vehicles, providing convenience and safety.

- Increases vehicle value: An upgraded audio system increases the car value in the automotive speaker market. The buyer seeking a high-quality sound system finds this attractive in the resale market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 45.13 Billion |

| Market Size in 2025 | USD 31.00 Billion |

| Market Size in 2024 | USD 29.73 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.26% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Speaker Type, Power Handling, Frequency Response, Mounting Location, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Market Dynamics

Drivers

Advancing music in the automotive industry

In recent years, many automotive companies have partnered with premium audio system brands to enhance the vehicle experience. The combination of audio systems and vehicles enables a new category of in-car capabilities that completely transform the automotive speaker market. The motive to have a high-quality sound system is to eliminate the noise from the road, the engine, and the wind. The sound engineers have dedicated themselves to ensuring a rich, deep, and authentic sound.

Restraint

High cost

Despite its enjoyable benefits, there is a challenge in the high cost of purchasing and installing premium audio systems. There is always a drawback of cost and compatibility. However, the automotive speaker market leaders have overcome this problem by investing in R&D for cost-effective solutions, collaborating with tech firms for seamless integrations, and emphasizing user-friendly designs, which have grown customer satisfaction.

- In January 2024, Tesla downgraded the sound system in the base version of Model Y RWD to one amp and seven speakers. The approach of cutting down the prices comes with one less feature.

Opportunity

Emerging smart technologies

The automotive speaker market is expected to witness rapid growth in the future due to the integration of advanced audio technology and smart technologies in vehicles. Innovation in the sound system is increasing the demand for connected vehicles and electric vehicles (EVs). As consumer demand for premium in-car audio systems is rising, companies are under pressure to fulfill the demands of high-end sound solutions. Leading audio system brands such as Bose, Harman, Bang & Olufsen, and Bowers & Wilkins are innovating advanced technologies such as active noise cancellation, 3D surround sound, and immersive audio experience. Additionally, the integration of smart technology in vehicles, such as virtual assistance from well-known brands such as Amazon Alexa, Google Assistance, and Apple Siri, is transforming the automotive industry by enhancing user interaction, using voice commands, and adjusting audio settings.

- In June 2024, Geely and Meizu, the Chinese companies have partnered together to leverage their connection to revolutionize the in-car audio experience. Geely-controlled Meizu officially released the ‘Galaxy Flyme Auto intelligent cockpit system and the ‘Flyme Sound Limitless Voice' AI-powered sound system, aiming to redefine the standards of in-car entertainment.

Speaker Type Insights

The coaxial segment contributed the highest share of the automotive speaker market in 2024. The dominance of this segment is noted owing to its less complicated installation and full-range speaker. These speakers are combined with all the elements, including the woofer and tweeter, into a single unit. Additionally, it offers versatile sound quality and is available in various sizes and print points, making it easily accessible for any budget.

The component segment is projected to grow at a significant CAGR in the automotive speaker market during the forecast period. The growth of this segment is observed due to its top-tier sound quality. The speaker component is designed with separate drivers such as woofers, tweeters, and external crossovers that each handle certain sound frequencies. The greatest advantage of the component speaker is its installation flexibility.

Power Handling Insights

The 40-100 watts segment captured the biggest share of the automotive speaker market in 2024. The dominance of these segments is observed due to their affordability and extensive usage in entry-level and mid-range vehicles. If the vehicle owner is using just an aftermarket stereo for power, the ideal speaker with power handling is no higher than 75 watts RMS.

The 100-200 watts segment is expected to grow at the fastest CAGR in the automotive speaker market during the projected period. The growth of this segment is experienced due to the sizeable premium audio system, demanded by luxury vehicles.

Frequency Response Insights

The 20-20,000 Hz segment contributed the highest share of the automotive speaker market in 2024. The dominance of this segment can be attributed to the ideal speaker frequency response that covers the full range spectrum of human hearing, which is 20-20,000Hz. However, it depends on individual preferences and environmental factors.

The 20-30,000 Hz segment is projected to grow at a significant CAGR in the automotive speaker market during the forecast period. The growth of this segment is observed due to the increasing demand for high-quality audio systems in luxury vehicles.

Mounting Location Insights

The door segment dominated the global automotive speaker market in 2024. Two speakers are in the front of the vehicle, one on each door. Some have four speakers in front, two per side. They use a full- range. Door speakers are generally woofers on the door and tweeter either higher up in the door, in the corner pillar, or at the dash. The rear door speaker offers sound to the backseat passenger. However, they do not have a significant contribution to the sound experience in the front seat.

The dashboard segment is anticipated to grow at a significant CAGR in the automotive speaker market during the forecast period. Many vehicles have center dash speakers, which are typically responsible for vehicle essentialities such as door chime and navigation prompts, along with playing music.

Application Insights

The passenger car segment contributed the largest share of the automotive speaker market in 2024. The dominance of this segment is highly observed as passenger car systems provide music, and navigation prompts, promoting safety, enjoyment, and hand-free calls. The segment is driven by the consumer's demand for high-quality sound with advanced features systems such as smartphone connectivity and voice recognition.

The commercial vehicle segment is projected to grow at a notable CAGR in the automotive speaker market during the forecast period. The expansion of this segment is noted as the audio system in commercial vehicles is integrated with GPS and telematics which helps the drivers in navigation and logistics management.

Automotive Speaker Market Companies

- Rainbow

- Kicker

- Bose Corporation

- Focal

- Hertz

- Alpine Electronics

- Audison

- Sony Corporation

- Morel

- DLS

- Harman International

- Panasonic Corporation

- JL Audio

- Ground Zero

- Pioneer Corporation

Recent updates on automotive speaker

Premium Sound Systems Gain Popularity with Rise in Connected Vehicles

- On 21 March 2025, the market for car speakers grew rapidly due to rising demand for connectivity and entertainment within cars. With the increasing popularity of luxury cars and electric vehicles (EVs), consumers are looking for immersive audio experiences. To improve the experience of drivers and passengers, automakers are collaborating with luxury audio companies to incorporate multi-channel surround sound and noise cancellation capabilities into next-generation infotainment systems.

Lightweight and Energy-Efficient Speakers Support EV Design Trends

- In April 2025, the market for car speakers grew rapidly due to rising demand for connectivity and entertainment within cars. With the increasing popularity of luxury cars and electric vehicles (EVs), consumers are looking for immersive audio experiences. To improve the experience of drivers and passengers, automakers are collaborating with luxury audio companies to incorporate multi-channel surround sound and noise cancellation capabilities into next-generation infotainment systems.

Latest Announcements by Industry Leaders

- In January 2024, Jeffery Fay, SVP of Global Product Development Consumer at HARMAN, said, “We have consistently pushed barriers to provide premium sound experiences in the automotive industry, especially with our groundbreaking Infinity Reference line of speakers.” He further adds, “With this new line, we're excited to upgrade the line with a variety of options providing affordable sound upgrade solutions to a wider market.”

Recent Developments

- On 20 February 2025, Harman International unveiled its latest audio platform, Infinity Quantum Sound, targeted at electric and autonomous vehicles. The platform offers AI-driven adaptive sound zones and customizable audio profiles, enabling personalized in-car audio experiences.

- In March 2025, Bose Corporation introduced a new generation of Ultra Nearfield headrest speakers, which deliver spatial sound for individual passengers in multi-seat entertainment setups. This innovation is particularly designed for ridesharing and luxury vehicles with advanced infotainment systems.

- Also in March 2025, Panasonic Automotive Systems launched an eco-friendly speaker line made from recycled resins and bio-based materials. The company aims to support automakers' sustainability goals while maintaining premium sound quality in compact speaker designs.

- In March 2025, Sony Corporation announced a partnership with a major EV manufacturer to co-develop vehicle-integrated 360 Reality Audio systems. These systems use cabin shape modeling and dynamic driver positioning for real-time acoustic optimization during driving.

- In May 2024, Sony India launched 2 new car speakers with coaxial and component speakers, beginning from INR 12,990. The XS-162GS AND XS-160GS car speakers are aimed to enhance the in-car auditory experience.

- In January 2024, HARMAN Internation Industries launched the newest generation of the Infinity Reference full-range speakers. The series consists of a total of 13 models designed to deliver Infinity's signature sound in more vehicles.

Segments Covered in the Report

By Speaker Type

- Coaxial

- Component

- Subwoofer

By Power Handling

- 40-100 Watts

- 100-200 Watts

- 200-500 Watts

- Over 500 Watts

By Frequency Response

- 20-20,000 Hz

- 20-30,000 Hz

- 20-40,000 Hz

- 20-50,000 Hz

By Mounting Location

- Dashboard

- Door

- Rear Deck

- Truck

By Application

- Passenger Cars

- Commercial Vehicles

- Aftermarket

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting