What is the Bauxite Mining Market Size?

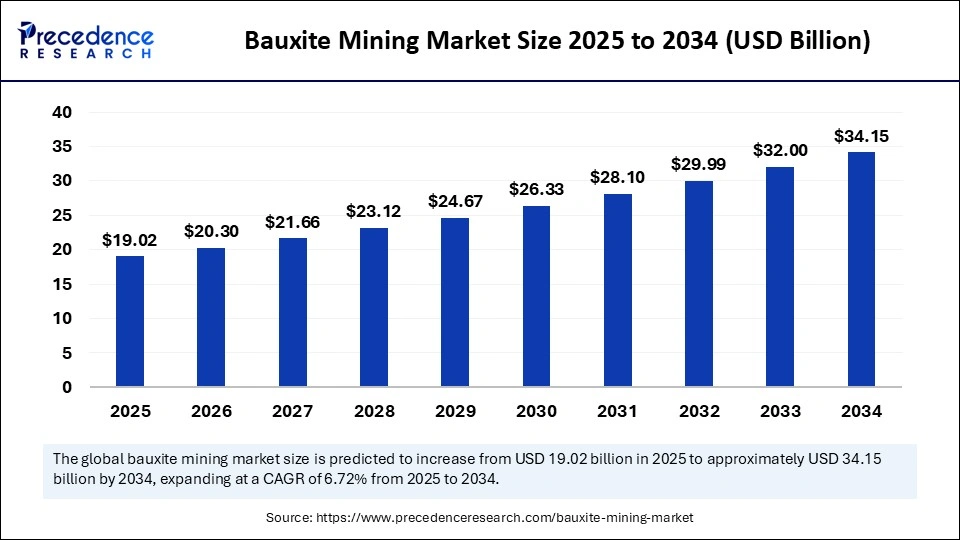

The global bauxite mining market size was calculated at USD 17.82 billion in 2024 and is predicted to increase from USD 19.02 billion in 2025 to approximately USD 34.15 billion by 2034, expanding at a CAGR of 6.72% from 2025 to 2034. The bauxite mining market is a significant sector within the mineral extraction industry, reflecting its increasing global importance and economic impact.

Market Highlights

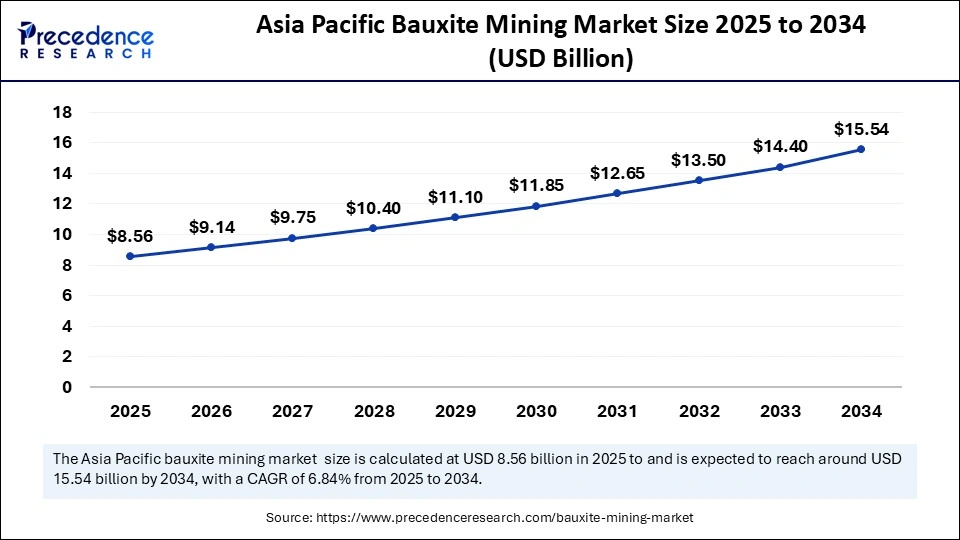

- Asia Pacific dominated the market, holding largest market share of 45% in the year 2024 and is expected to expand at the fastest CAGR in the market between 2025 and 2034.

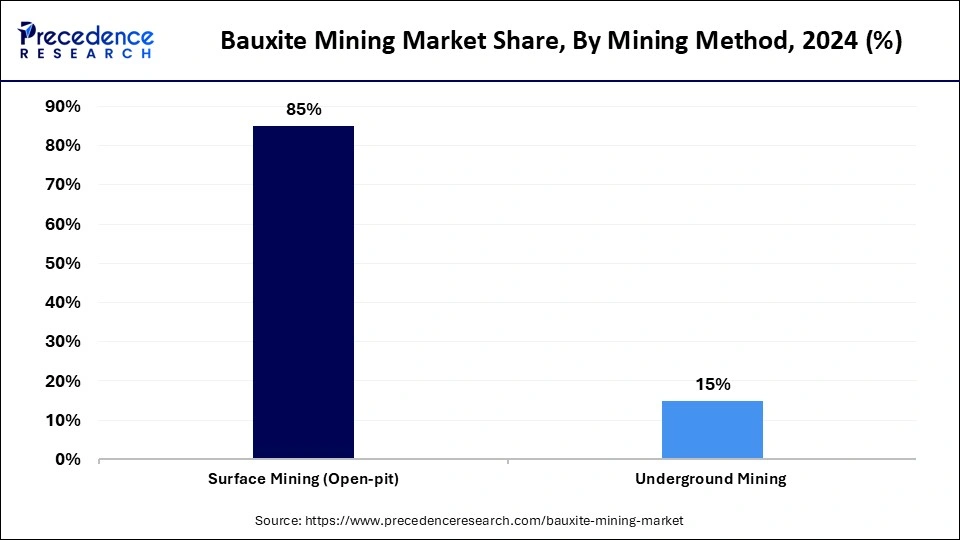

- By mining method, the surface mining segment held the largest share of 85% in 2024 and is expected to grow at a remarkable CAGR between 2025 and 2034.

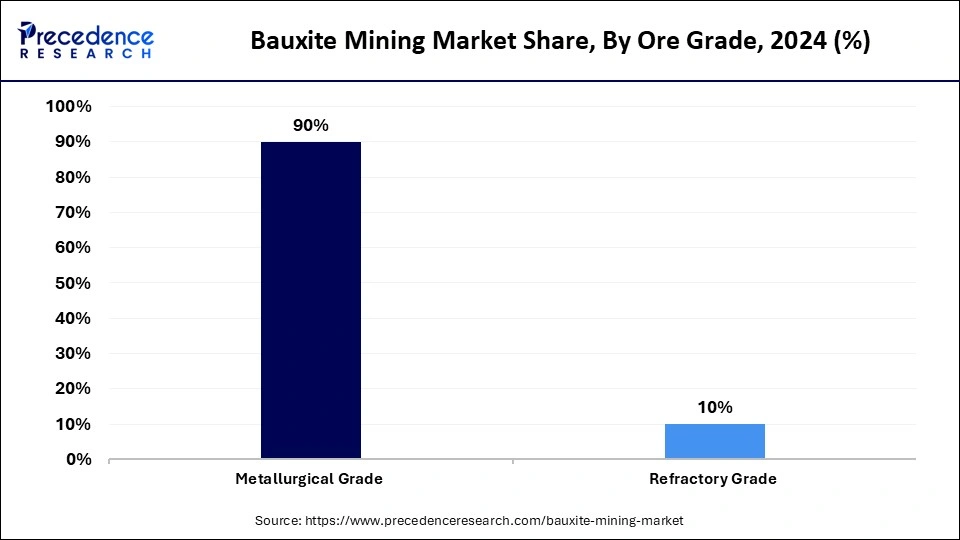

- By ore grade, the metallurgical grade segment held the largest market share of 90% in 2024 and is expected to grow at the highest CAGR during the forecasted period.

- By end-user industry, the alumina production segment held the largest share, accounting for 70% of the bauxite mining market in 2024.

- By end-user industry, chemicals & others is expected to grow at a remarkable CAGR between 2025 and 2034.

- By product type, the lump bauxite segment held the largest share, accounting for 50% of the bauxite mining market during 2024.

- By product type, software & analytics platforms are expected to grow at a remarkable CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2024: USD 17.82 Billion

- Market Size in 2025: USD 19.02 Billion

- Forecasted Market Size by 2034: USD 34.15 Billion

- CAGR (2025-2034): 6.72%

- Largest Market in 2024: Asia Pacific

What Is Encompassed in the Bauxite Mining Market?

Speciality bauxite mining tools are specially designed equipment adapted to handle the abrasive and variable nature of bauxite ore. These include surface miners and bucket-wheel excavators for direct extraction, rotary drills and blasting tools for hard deposits, and wear-resistant crushers, loaders, and haul trucks for ore handling. Additional tools such as dust suppression systems, scrubbers, and protective linings ensure safe, efficient, and low-contamination mining operations.

The bauxite mining market is witnessing steady growth, driven by the rising demand for aluminum across multiple industries. Increasing urbanization, infrastructure development, and the expanding use of lightweight materials in automotive and aerospace sectors are fueling the need for bauxite as the primary source of alumina. The market also benefits from the growing shift toward renewable energy, where aluminum plays a vital role in solar panels, wind turbines, and power transmission. Investments in mining projects and technological advancements in extraction and processing are enhancing production efficiency and cost-effectiveness. However, environmental concerns and regulatory challenges remain significant factors that shape the market landscape. Overall, the market for bauxite mining is positioned as a critical enabler of industrial growth, sustainability, and global economic development.

Key Technological Shifts in the Bauxite Mining Market

Some key technological shifts in the bauxite mining market include the inexorable move towards automation and digitization, transforming what was once a purely labor-intensive endeavor into a precision-driven enterprise. The integration of advanced geological mapping tools, coupled with artificial intelligence, has imbued the industry with unprecedented accuracy in resource estimation and extraction planning. Sophisticated sensor-based ore sorting technologies now enable miners to distinguish between high- and low-grade material with remarkable efficiency, thereby reducing waste and maximizing yield. Simultaneously, the deployment of autonomous haulage systems and remote-operated equipment has not only elevated productivity but also significantly curtailed human exposure to hazardous environments. Moreover, innovations in refining processes are increasingly focused on reducing the energy intensity and carbon footprint traditionally associated with alumina production.

Bauxite Mining Market Outlook

- Industry Growth Overview: The bauxite mining industry is poised for consistent growth, underpinned by rising global aluminum consumption in transportation, construction, energy, and consumer goods. Rapid industrialization in emerging economies and sustained demand from mature markets continue to anchor expansion. Investments in refining and smelting infrastructure are amplifying the growth trajectory, ensuring a steady linkage between mining and downstream industries.

- Sustainability Trends: Sustainability has become an imperative, with companies embracing eco-conscious mining practices such as progressive land rehabilitation, water recycling, and reduction of greenhouse gas emissions during alumina refining. A growing emphasis on circular economy models, including aluminum recycling, is reshaping the market's ecological footprint. Additionally, advancements in energy-efficient technologies are fostering greener production methods while aligning with global carbon neutrality goals.

- Major Investors: The bauxite mining sector attracts substantial capital from multinational mining conglomerates and sovereign wealth funds seeking long-term returns on strategic mineral assets. Large-scale investors are channelling resources into expanding bauxite reserves, developing refining capacities, and establishing integrated aluminum supply chains. Public-private partnerships and state-backed initiatives also play a vital role in financing new projects in resource-abundant regions.

- Startup Economy: Alongside established giants, an emergent cohort of startups is carving a niche in the bauxite value chain, particularly in technology-driven sustainability solutions. Startups are pioneering innovations in ore sorting, remote monitoring, and waste-to-value processes, often supported by venture capital and green funds. Their agile, technology-first approach is helping the industry address environmental challenges while enhancing operational efficiency.

Market Key Trends

- Sustainable Mining Practices: Companies are increasingly adopting eco-conscious extraction and rehabilitation methods, emphasizing reduced environmental impact and responsible resource management.

- Technological Integration: Automation, remote monitoring, AI-driven geological surveys, and advanced ore-sorting technologies are revolutionizing productivity and operational efficiency.

- Rising Aluminum Demand: The surge in demand for lightweight, durable materials in automotive, aerospace, and packaging sectors continues to drive bauxite consumption globally.

- Diversification of End-Use: Beyond aluminum, bauxite is gaining prominence in chemicals, refractories, cement, and abrasives, expanding its industrial applications.

- Emergence of New Production Hubs: Resource-rich emerging economies, particularly in Africa and the Asia-Pacific, are attracting investment, reshaping global supply chains.

- Circular Economy & Recycling: There is a growing focus on aluminum recycling, which indirectly stimulates the bauxite mining market while supporting sustainability objectives.

- Regulatory and Environmental Oversight: Stringent environmental policies and mining regulations are shaping operational practices and encouraging the adoption of greener technologies.

- Strategic Partnerships and Investments: Joint ventures, public-private partnerships, and foreign direct investments are increasing to secure reserves and optimize production capacities.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 17.82 Billion |

| Market Size in 2025 | USD 19.02 Billion |

| Market Size by 2034 | USD 34.15 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.72% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Mining Method, Ore Grade, End-Use Industry, Product Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The Aluminum Appetite Ascendancy

The inexorable expansion of global industries, from automotive to aerospace, has precipitated an insatiable appetite for aluminum, thereby catalyzing the demand in the bauxite mining market. Lightweight yet durable, aluminum has become the metal of choice in an era increasingly defined by efficiency and sustainability. This structural preference ensures a steady upward trajectory for bauxite consumption, entwining its destiny with the march of industrial progress. Emerging economies, particularly those undergoing rapid urbanization, are amplifying this surge with mammoth infrastructure undertakings. Concurrently, the proliferation of renewable energy technologies has only deepened the indispensability of aluminum, thereby reinforcing bauxite's preeminence. In essence, the market is propelled by a powerful confluence of industrial necessity and ecological prudence.

Restraint

The Ecological Conundrum

Despite its strategic indispensability, the bauxite mining industry finds itself ensnared in an environmental quagmire. The extraction process, often disruptive to ecosystems, has elicited stringent regulatory scrutiny and mounting societal opposition. Land degradation, water contamination, and carbon-intensive refining practices exacerbate the sector's reputational and operational challenges. As governments impose increasingly rigorous sustainability benchmarks, compliance costs spiral, eroding profitability margins. Moreover, logistical bottlenecks and geopolitical frictions frequently accentuate the fragility of global supply chains. Thus, what might otherwise be a seamless growth story is tempered by the immutable imperative of environmental stewardship.

Opportunity

The Green Metallurgical Renaissance

Amidst the challenges, the industry stands at the cusp of an extraordinary metamorphosis, one shaped by sustainability and technological ingenuity. The burgeoning demand for recycled aluminum is unlocking fresh avenues for bauxite miners to reposition themselves as stewards of a circular economy. Breakthroughs in low-carbon refining technologies promise not only to curtail emissions but also to recalibrate the economics of aluminum production. Simultaneously, untapped reserves in emerging regions offer fertile ground for expansion, supported by infrastructure investments and trade liberalization. The fusion of digitalization, automation, and green innovation heralds a new era of mining efficiency. Consequently, the bauxite sector is poised to transmute adversity into opportunity, heralding what may aptly be termed a green metallurgical renaissance.

Segment Insights

Mining Method Insights

Why Is Surface Mining Dominating and the Fastest Growing Segment in the Bauxite Mining Market?

The surface mining segment has emerged as both the dominant and fastest-growing in the bauxite mining sector, accounting for an 85% share due to its operational efficiency and lower extraction costs. By enabling the removal of vast quantities of ore with minimal underground hazards, it ensures both scale and safety in operations. The method is particularly well-suited to tropical and subtropical terrains where bauxite deposits lie near the surface, reducing logistical complexities. Advancements in mechanization and earth-moving technologies have further enhanced productivity, allowing operators to meet burgeoning industrial demand. Environmental management practices, such as progressive land rehabilitation, have been increasingly integrated into surface mining operations. Consequently, surface mining continues to anchor the industry's growth, balancing efficiency with ecological responsibility.

The expansion of surface mining is also driven by global aluminum consumption trends, as producers seek high-volume, cost-effective methods to feed downstream refineries. Governments and private enterprises alike have invested heavily in surface mining infrastructure, ensuring operational continuity and scaling capacity. The integration of digital monitoring and automation tools has allowed for real-time optimization of extraction processes. Moreover, surface mining facilitates the co-location of processing facilities near mines, reducing transportation bottlenecks.

Ore Grade Insights

Why Is Metallurgical Grade Leading and Expected to Be the Fastest Growing in the Bauxite Mining Market?

The metallurgical grade segment is leading the bauxite mining industry, representing both the dominant and fastest-growing segment with a share of 90% due to its superior alumina content. Its exceptional quality renders it indispensable for aluminium production, where purity and efficiency are paramount. The high alumina-to-silica ratio ensures optimal energy consumption during refining, further elevating its industrial desirability. Mining operations increasingly prioritize metallurgical-grade deposits, leveraging geological surveys and ore-sorting technologies to maximize yield.

Market demand for lightweight, durable aluminium in automotive, aerospace, and packaging sectors continues to propel this grade's prominence. Consequently, metallurgical-grade bauxite remains a critical driver of both market volume and profitability. The growth trajectory of metallurgical-grade bauxite is reinforced by technological advancements in refining, allowing producers to optimize alumina extraction with minimal waste. International trade dynamics further accentuate its strategic importance, with import-dependent nations actively seeking high-quality ore. Environmental and energy efficiency standards incentivize the selection of metallurgical-grade deposits to reduce carbon footprints. Government policies and incentives in key producing regions also favor high-quality bauxite extraction.

End-Use Industry Insights

How Did Alumina Production Come to Lead the Bauxite Mining Market?

The alumina production segment remains the predominant segment, making up 70% in the bauxite mining market consumption because of its pivotal role as the precursor to aluminum, a metal integral to construction, transportation, and packaging, which ensures sustained demand. Refining processes convert raw bauxite into alumina with remarkable efficiency, reinforcing its centrality in industrial supply chains. Investments in alumina smelters and associated infrastructure continue to expand production capacities across key regions. The segment also benefits from technological enhancements in energy efficiency, which reduces costs and environmental impact. In sum, alumina production forms the backbone of bauxite utilization, linking raw ore to global industrial consumption.

The dominance of alumina production is further solidified by global trends favoring lightweight and durable materials. High-volume demand from emerging economies accelerates capacity expansion, particularly in the Asia Pacific. Integration of sustainable refining practices enhances both environmental compliance and operational efficiency. Strategic partnerships between mining companies and downstream smelters optimize supply chain coordination. Additionally, the segment attracts significant investor interest due to stable returns and long-term growth potential. Collectively, these dynamics ensure alumina production remains the quintessential driver of the bauxite market.

The chemicals and other industrial applications segment is experiencing the fastest growth in the bauxite mining market, driven by bauxite's versatility beyond aluminum production. Its utility in refractories, abrasives, cement, and chemical manufacturing has created diversified demand streams. Technological innovations are enabling bauxite-derived materials to enhance industrial performance while reducing energy consumption. Growing industrialization in emerging economies is further amplifying demand for non-alumina applications. Sustainability imperatives have also encouraged the adoption of bauxite in eco-friendly chemical processes. Consequently, the chemicals and other applications segment are rapidly gaining strategic significance in the broader market landscape.

This growth is accentuated by increased exploration of high-purity bauxite for specialized applications, allowing industries to optimize material performance. Research and development efforts are fostering new uses, including advanced composites and specialty chemicals. The segment also benefits from a global shift towards environmentally sustainable industrial practices. Trade liberalization and improved logistics facilitate the international movement of bauxite for chemical applications. Regulatory support in key regions promotes safe handling and utilization in industrial processes. Together, these factors underscore the segment's dynamic growth and expanding influence.

Product Type Insights

Why is Lump Bauxite Dominating the Bauxite Mining Market?

The lump bauxite segment remains dominant in the sector for bauxite mining, driving the lion's share of 50% because it is prized for its direct suitability for alumina extraction. Its relatively coarse size simplifies handling and processing, allowing smelters to maintain consistent operational efficiency. Mining operations often prioritize lump bauxite due to its higher yield potential and lower processing requirements. The segment's market strength is reinforced by long-standing industrial familiarity and established supply chains. Moreover, it supports high-volume consumption patterns, particularly in large-scale smelters and refineries. Consequently, lump bauxite continues to anchor the product portfolio, balancing industrial demand with operational practicality.

The sustained dominance of lump bauxite is bolstered by advancements in extraction and transportation efficiency. Robust infrastructure ensures seamless movement from mines to processing facilities, maintaining product quality. Its compatibility with automated handling systems further enhances its industrial appeal. Governments and industry bodies continue to recognize lump bauxite as a strategic resource, ensuring regulatory alignment. Investment in mining technologies prioritizes the extraction of lump deposits to maximize output. Collectively, these factors consolidate its position as the cornerstone of the bauxite market.

Calcined bauxite is quickly emerging as the fastest-growing segment in the bauxite mining market, primarily due to its application in high-performance refractories and abrasives. The heat-treated transformation enhances its alumina content and structural integrity, making it indispensable for industries demanding thermal and mechanical resilience. Rapid industrialization and technological advancements in steel, cement, and refractory sectors are propelling its demand. Producers are increasingly investing in calcination facilities to cater to specialized industrial requirements. Sustainability trends are also driving interest, as calcined bauxite enables efficient energy use in high-temperature applications. Consequently, this segment represents a vibrant growth frontier within the broader bauxite product spectrum.

The ascent of calcined bauxite is further facilitated by global infrastructure development, which stimulates demand for durable industrial materials. Innovations in calcination technology have improved energy efficiency and product quality, reinforcing its industrial relevance. Export opportunities are expanding as emerging economies seek high-grade refractory materials. Industrial collaborations and research initiatives are enhancing its performance characteristics, opening new markets. Regulatory alignment ensures safe production and handling, fostering market confidence.

Regional Insights

Asia Pacific Bauxite Mining Market Size and Growth 2025 to 2034

The Asia Pacific bauxite mining market size was evaluated at USD 8.02 billion in 2024 and is projected to be worth around USD 15.54 billion by 2034, growing at a CAGR of 6.84% from 2025 to 2034.

Why Does Asia Pacific Reign Supreme in the Bauxite Mining Industry?

Asia Pacific has emerged as both the dominant and the fastest-growing player in the global bauxite mining market, underpinned by its abundant natural reserves and robust industrial ecosystem. Nations such as China and Australia serve as pivotal hubs, fuelling the aluminium supply chain that stretches across construction, automotive, and packaging industries. Rapid urbanization, coupled with burgeoning infrastructure projects, has intensified the demand for aluminium, thereby anchoring the region's pre-eminence in bauxite production. Technological adoption in mining operations, ranging from automation to advanced refining techniques, has further augmented efficiency and output. Additionally, strong regional government initiatives and strategic investments in mineral exploration have reinforced the region's competitive advantage. Collectively, these factors render Asia Pacific an unrivalled fulcrum in the bauxite market, harmonizing supply with the crescendo of regional demand.

The region's growth trajectory is also catalyzed by its integration into global trade networks, enabling seamless export of bauxite and alumina to import-dependent economies. The presence of established ports, logistics infrastructure, and specialized refineries ensures that production meets both domestic and international demand with agility. Moreover, the rising emphasis on renewable energy and lightweight industrial materials has only deepened the strategic importance of the Asia Pacific's bauxite reserves. Environmental stewardship and sustainable mining practices are increasingly being incorporated, reflecting a balance between economic growth and ecological responsibility.

Bauxite Mining Market: Value Chain Analysis

- Raw Material Sources: Bauxite is predominantly extracted from tropical and subtropical regions through extensive mining operations, with key producers being Australia, Guinea, Brazil, and China. Once mined, the bauxite undergoes processing to obtain alumina, which is then smelted to produce aluminum.

- Storage and Cold Chain Logistics: Bauxite, being a stable mineral, does not necessitate cold chain logistics and instead depends on conventional supply chain methods. Its transportation from mines to processing facilities typically involves a combination of inland transport, port handling, and maritime shipping.

- Processing and Packaging: In bauxite mining, the ore is first extracted and then subjected to crushing and grinding before being combined with a caustic soda solution. This mixture undergoes the Bayer process, resulting in the formation of a sodium aluminate solution.

Country-Level Analysis for the Bauxite Mining Market

| Country/ Region | Regulatory Body | Key Regulators | Focus Areas | Notable Notes |

| Australia | Department of Agriculture, Water and the Environment | Environmental protection and Biodiversity conservation act |

Environmental impact assessment, minesafety, and rehabilitation.

|

Strong emphasis on sustainable mining practices and land restoration. |

| Guinea | Ministry of Mines and Geology | Mining Code of Guinea | Resource management, social responsibility, and environmental protection | Encourage foreign investment while maintaining strict local compliance |

| Brazil | National Mining Agency | Mining Code | Safety Standards | Regulatory framework aligns mining operations with national development goals |

Top Companies in the Bauxite Mining Market

- Alcoa Corporation (USA): A leading integrated producer of bauxite, alumina, and aluminum, supplying high-purity bauxite for smelting and industrial uses. The company emphasizes sustainable mining, land rehabilitation, and innovation across operations in Australia, Brazil, and Guinea.

- Rio Tinto (UK/Australia): Operates large-scale bauxite mining and alumina refining facilities, primarily in Australia's Weipa and Gove regions. Focuses on sustainable extraction, renewable energy integration, and a vertically integrated supply chain from mine to metal.

- Norsk Hydro ASA (Norway): Sources bauxite primarily from Brazil for its global aluminum operations, emphasizing low-carbon, energy-efficient production. Hydro positions itself as one of the most sustainable aluminum producers, advancing circular economy and recycling initiatives.

- South32 Limited (Australia): Engages in bauxite mining and alumina refining through operations like the Worsley Alumina project. With a diversified mining portfolio, South32 maintains downstream integration and a strong focus on operational efficiency and sustainability.

- Aluminum Corporation of China Limited (CHALCO) (China): China's largest aluminum producer, active in domestic and international bauxite mining, alumina refining, and smelting. Expanding globally into Guinea and Indonesia, CHALCO emphasizes self-sufficiency, innovation, and technological advancement.

Bauxite Mining Market Companies

- United Company RUSAL

- Emirates Global Aluminium PJSC

- Hindalco Industries Limited

- Vedanta Resources Limited

- China Hongqiao Group Limited

- Jiangxi Gangfeng Mining Co., Ltd.

- Guinea Alumina Corporation S.A.

- Compagnie des Bauxites de Guinée (CBG)

- Eurasian Resources Group

- Anglo-Australian Bauxite Limited

- Alufer Mining Limited

- Gulkula Mining

- Shaanxi Coal and Chemical Industry Co., Ltd.

- National Aluminium Company Limited (NALCO)

- Alcoa World Alumina and Chemicals (AWAC)

Recent Developments

- In September 2025, Villagers from Narla in Kalahandi organized street plays in Ullisirka, Narla, and Samarkata to advocate for local bauxite mining and to highlight the burden of expensive imports. Despite India sitting on reserves exceeding 5 billion tonnes of bauxite, the country imports 4.5 million tonnes annually, at a cost of ?4,000–5,000 crore, while Kalahandi continues to grapple with underdevelopment.(Source: https://pragativadi.com)

- In August 2025, Saudi Arabia's Ma'aden Bauxite & Alumina Company (MBAC) signed a 30-year Power Purchase Agreement (PPA) with Emerge (a joint venture between Masdar and EDF) to supply renewable energy to its Al Baitha bauxite mine through an 8 MWp solar plant plus a 30 MWh battery storage system, aiming to reduce ~13,800 t CO? emissions annually.(Source: https://masdar.ae)

Segments Covered in Report

By Mining Method

- Surface Mining (Open-pit)

- Underground Mining

By Ore Grade

- Metallurgical Grade

- Refractory Grade

By End-Use Industry

- Alumina Production

- Abrasives

- Refractory Materials

- Cement

- Chemicals & Others

By Product Type

- Lump Bauxite

- Calcined Bauxite

- Granulated Bauxite

- Other Forms

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting