What is the Bio-Based Polycarbonate Market Size?

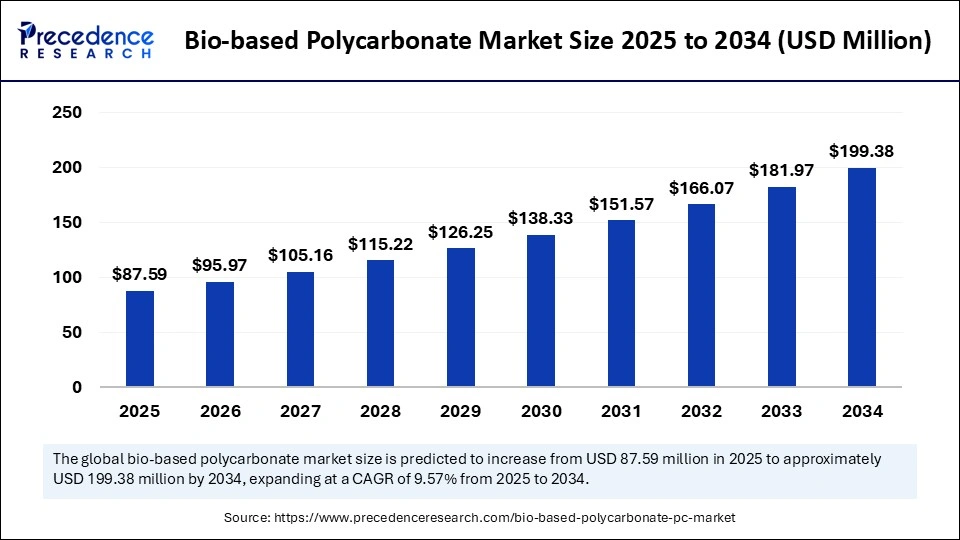

The global bio-based polycarbonate market size accounted for USD 79.94 million in 2024 and is predicted to increase from USD 87.59 million in 2025 to approximately USD 199.38 million by 2034, expanding at a CAGR of 9.57% from 2025 to 2034. The market growth is driven by increasing demand for sustainable, non-petroleum-based polymers across automotive, electronics, and consumer goods sectors.

Market Highlights

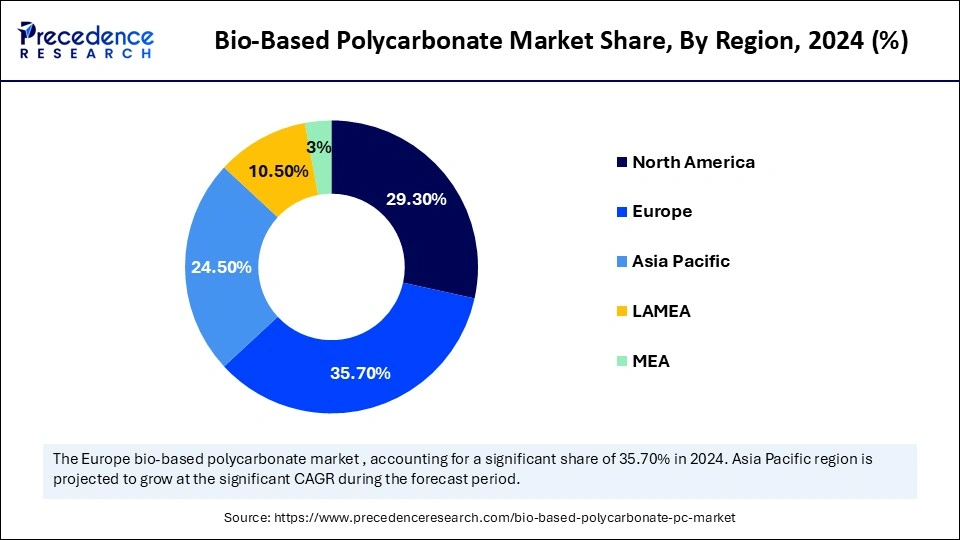

- By region, Europe held a 35.70% share of the bio-based polycarbonate market in 2024.

- The Asia Pacific is expected to grow at the fastest CAGR of 10.40% from 2025 to 2034.

- By grade, the engineering grade segment dominated the market with a 32.40% share in 2024.

- By grade, the medical grade segment is expected to expand to the fastest CAGR of 9.70% from 2025 to 2034.

- By application / end-use industry, the automotive & transportation segment dominated the market with a 27.60% share in 2024.

- By application / end-use industry, the electrical & electronics segment is likely to grow at the fastest CAGR of 10.10% in the coming years.

- By processing technology, the injection molding segment led the market with a 41.80% share in 2024.

- By processing technology, the 3D printing segment is expected to expand at the fastest CAGR of11.20% from 2025 to 2034.

- By form factor, the pellets segment held the largest market share of 44.50% in 2024.

- By form factor, the films segment is expanding at a notable CAGR of 9.90% from 2025 to 2034.

- By bio-content, the 30-50% bio-based segment led the market while holding a 36.20% share in 2024.

- By bio-content, the 100% bio-based segment is expected to grow at a notable CAGR of 12.40% from 2025 to 2034.

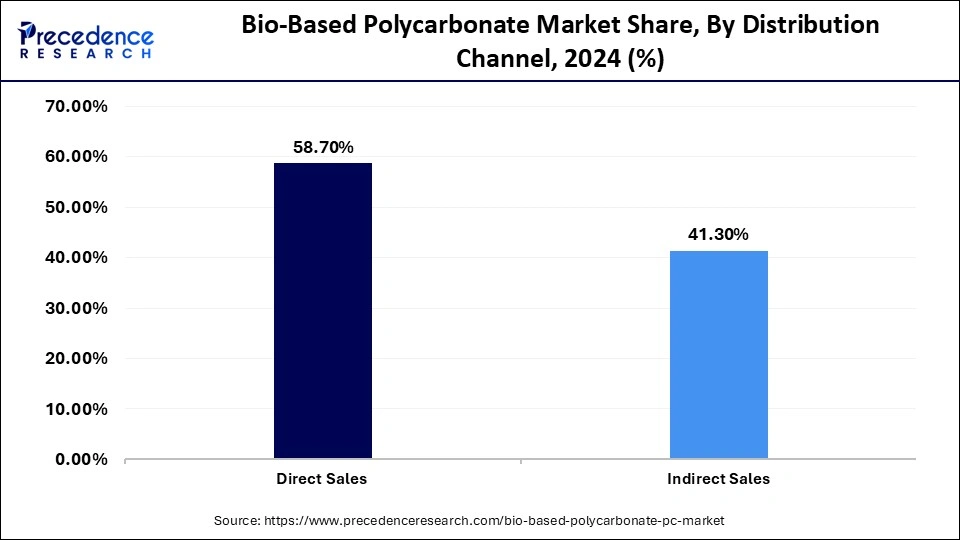

- By distribution channel, the direct sales segment dominated the market with a 58.70% share in 2024.

- By distribution channel, the indirect sales segment is growing at a solid CAGR of 8.50% from 2025 to 2034.

Market Size and Forecast

- Market Size in 2024: USD 79.94 Million

- Market Size in 2025: USD 87.59 Million

- Forecasted Market Size by 2034: USD 199.38 Million

- CAGR (2025-2034): 9.57%

- Largest Market in 2024: Europe

- Fastest Growing Market: Asia Pacific

What is Bio-Based Polycarbonate?

Bio-based polycarbonate is an eco-friendly alternative to traditional petroleum-based polycarbonate. It has similar characteristics as the petroleum-based product and decreases dependence on non-renewable resources by lowering its overall carbon footprint. Bio-based polycarbonates are made from sources such as agricultural waste, sugars and other biomass, which makes them a popular option in today's day and age, where sustainability is a priority.

The market is witnessing rapid growth, as industries are moving toward sustainable alternatives to fossil-based plastics. Bio-based polycarbonate is preferred for its reduced environmental impact. As consumer awareness and demand for eco-friendly products rises, bio-based polycarbonate is gaining recognition particularly in sectors such as automotive, electronics, healthcare, and packaging.

Impact of AI on the Bio-Based Polycarbonate Market

Artificial Intelligence is significantly reshaping the bio-based polycarbonate market by enhancing both product design and manufacturing efficiency. AI-driven generative design algorithms enable the creation of complex, lightweight structures that optimize material usage, crucial for sectors like aerospace and medical devices. In manufacturing, machine learning models continuously adjust process parameters such as temperature and material flow, ensuring consistent quality and minimizing defects. Real-time monitoring through AI-integrated sensors allows for proactive detection and correction of production anomalies, reducing downtime and material waste. Overall, AI is accelerating innovation, sustainability, and scalability within the bio-based polycarbonate value chain.

What are the Key Trends in the Bio-Based Polycarbonate Market?

- Rising Demand from the Building & Construction Industry: The building and construction industry is increasingly adopting bio-based polycarbonate due to its cost-efficiency, faster installation, and design flexibility. Architects favor it over traditional materials for enabling innovative structures. Growing urbanization, rising investments, and demand for modern housing are further driving its widespread use in construction.

- Focus on Sustainability: The medical device sector's shift toward sustainability, driven by consumer demand and regulatory pressures, is creating strong growth opportunities for the bio-based polycarbonate market. Key players are actively replacing petroleum-based materials, accelerating market expansion.

- Demand for Temperature Resistance Material: Rising demand for spike temperature resistance is boosting the use of polycarbonate, which can endure heat up to 1166°F for hours without distortion, unlike traditional glass. This makes it ideal for high-heat applications in construction and housewares.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 79.94 Million |

| Market Size in 2025 | USD 87.59 Million |

| Market Size by 2034 | USD 199.38 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.57% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Grade, Application / End-Use Industry, Processing Technology, Form Factor, Bio-content (%), Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

What are the Major Factors Driving the Bio-Based Polycarbonate Market?

The market is growing rapidly, driven by rising environmental concerns like climate change and resource depletion. Industries and consumers are increasingly opting for renewable alternatives over petroleum-based options. Supportive government policies, incentives, and regulations are further accelerating adoption, while technological advancements have improved production efficiency and lowered costs, broadening market reach.

Rising consumer demand for natural, eco-friendly products is pushing companies to adopt bio-based materials to meet market expectations. Additionally, corporate sustainability goals and increased R&D investment are key factors driving the growth of the market.

Restraint

Volatility in Raw Materials Prices

The bio-based polycarbonate market is facing several restraints that could hinder its growth. A major challenge lies in the volatility of raw material prices. Fluctuations driven by supply chain disruptions, global demand shifts, and geopolitical tensions directly impact production costs and manufacturer profit margins. Additionally, the extraction and refinement of bio-based raw materials remain complex and costly, with limited production infrastructure further elevating expenses. This poses a significant barrier for small and mid-sized companies attempting to compete in the market. Although demand for bio-based polycarbonate is rising, the lack of economies of scale continues to limit broader adoption and delay market expansion.

Opportunity

Rising Demand for Sustainable Materials

The bio-based polycarbonate market presents several promising opportunities for growth, fueled by the rising demand for sustainable materials. One of the most significant prospects lies in the automotive sector, where the shift toward lightweight and fuel-efficient vehicles is accelerating the use of bio-based alternatives. Automakers are increasingly incorporating bio-based polycarbonate to reduce vehicle weight, enhance fuel economy, and comply with stringent global environmental regulations. Additionally, the growing adoption of electric vehicles is expected to further boost demand, as these vehicles require components that are both lightweight and highly durable.

Another key opportunity for the market lies in the electronics industry, where the rising demand for sustainable electronic products is encouraging the shift toward eco-friendly materials. Consumers are increasingly favoring green electronics, prompting manufacturers to integrate bio-based polycarbonate films into their designs. The growing popularity of flexible electronics and wearable devices is also driving demand, as bio-based polycarbonates provide superior flexibility, durability, and optical clarity. Ongoing technological advancements in bio-based material production are further improving performance and broadening their application across the electronics sector.

Segments Insights

Grade Insights

Which grade segment dominate the bio-based polycarbonate market in 2024?

The engineering grade segment dominated the market with the largest share in 2024. The dominance of this segment is driven by its versatility and widespread use across various industries, including automotive, electronics, and consumer goods. Engineering-grade bio-based polycarbonate retains the same durability, heat resistance, and optical clarity as its petroleum-based counterparts, making it a popular choice for various applications. Their advantage lies in their sheer size of their industries and their push for sustainable options.

The medical grade segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment is attributed to the healthcare industry's increasing demand for safer, BPA-free materials for medical devices, diagnostic equipment, and drug delivery systems. Regulatory agencies and hospital networks are advocating for greener options to minimize patient exposure to harmful chemicals, aligning with global ecological goals.

Application / End-Use Industry Insights

Why did the automotive & transportation segment hold the largest market share in 2024?

The automotive & transportation segment held the largest share of the bio-based polycarbonate market in 2024. This is mainly due to the industry's shift toward sustainable, lightweight materials that enhance fuel efficiency and reduce emissions. Bio-based polycarbonate provides a robust yet lightweight alternative to metal and traditional petrochemical plastics, making it particularly advantageous for automotive components such as dashboards, headlamp lenses, and interior panels. As regulatory pressures for reduced vehicle emissions intensify, particularly in North America and Europe, automakers are increasingly incorporating materials that support their sustainability goals.

The electrical & electronics segment is expected to grow at the fastest rate in the upcoming period. The growth of this segment is attributed to the push for environmentally friendly, high-performance materials. Bio-based polycarbonate's excellent insulation properties, combined with its durability and resistance to high temperatures, make it well-suited for electronic housings, circuit boards, and components. As consumers increasingly prioritize eco-friendly electronics, manufacturers are under pressure to reduce their carbon footprint across all stages of production, from materials sourcing to manufacturing processes.

Processing Technology Insights

How does the injection molding segment lead the market in 2024?

The injection molding segment led the bio-based polycarbonate market with a major share in 2024. This is due to its long-established role in high-volume manufacturing for industries such as automotive, electronics, consumer goods, and packaging. Bio-based polycarbonate can be easily adapted to injection molding, offering the same processing efficiency, dimensional stability, and strength as its petroleum-based counterpart. This makes it a good substitute for companies transitioning to sustainable materials.

The 3D printing segment is likely to expand at the fastest CAGR over the forecast period. Bio-based polycarbonates are being increasingly tested for 3D printing because they offer high mechanical strength while having a lower environmental impact. Its ability to produce complex, lightweight, and customized components with minimal material waste makes it suitable for various industrial applications. The durability, thermal stability, and eco-friendly properties of bio-based polycarbonate make it well-suited for additive manufacturing applications across various industries, including aerospace, medical, and consumer electronics.

Form Factor Insights

What made pellets the dominant segment in the bio-based polycarbonate market?

The pellets segment dominated the market in 2024. This is because they are compatible with large-scale industrial processing methods such as injection molding, extrusion, and blow molding. Pellets are typically the preferred choice for the automotive, electronic, and consumer goods industries, as they offer better uniformity, stability, and ease of handling during large-volume production runs. They integrate smoothly into supply chains, making them hassle-free. They also meet global sustainability standards without compromising on speed, quality, or cost, making them the ideal choice.

The films segment is expected to grow at the fastest rate in the coming years. Bio-based polycarbonate films are being increasingly adopted in various applications, including packaging, optical lenses, and medical devices. They offer excellent optical clarity, impact resistance, and lightweight properties, thus making them attractive for sustainable solutions. Sectors such as solar panels and flexible displays have also begun experimenting with these films, as they are durable in nature.

Bio-Content Insights

Which bio-content segment led the bio-based polycarbonate market in 2024?

The 30-50% bio-based segment led the market while holding the largest share in 2024. This is due to its optimal balance between performance, cost-effectiveness, and sustainability. Partially bio-based materials are easier to commercialize on a scale, balancing sustainability with cost-effectiveness and technical performance. Most industrial users, particularly in the automotive and electronics domains, prefer this range as it allows them to market greener products while still relying on proven petrochemical feedstocks. Partial substitution provides a realistic middle ground for companies transitioning towards environmentally safer alternatives.

The 100% bio-based segment is expected to grow at the fastest rate throughout the forecast period, as it represents the highest level of sustainability, aligning closely with global decarbonization goals and stringent environmental regulations. With increasing pressure on industries to eliminate fossil-based materials, demand has surged for fully renewable alternatives that offer a complete shift toward circular and low-impact manufacturing. Advances in green chemistry, such as utilizing isosorbide derived from plant starch and CO2-based feedstocks, are opening up new opportunities and enabling the deployment of fully renewable polycarbonate alternatives.

Distribution Channel Insights

Why did the direct sales segment dominate the market in 2024?

The direct sales segment dominated the bio-based polycarbonate market in 2024. This is due to its ability to offer customized solutions, better pricing control, and stronger client relationships. Manufacturers prefer direct engagement with end-users, particularly in industries such as automotive, electronics, and construction, where technical specifications and material performance are crucial. This channel enables seamless communication, faster feedback loops, and tailored support, which are essential when dealing with specialized, sustainable materials. Additionally, direct sales enable companies to build long-term partnerships and enhance brand positioning in a market that is increasingly driven by sustainability and innovation.

The indirect sales segment is expected to grow at the fastest CAGR in the upcoming period, driven by its broad market reach, efficient distribution networks, and ability to serve diverse end-use industries across multiple geographies. Distributors and third-party vendors enable manufacturers to tap into new markets without the need for direct infrastructure, reducing overhead costs and accelerating product availability. This channel is especially effective in targeting small to mid-sized customers who may not have direct access to large suppliers.

Regional Insights

Europe Bio-Based Polycarbonate Market Size and Growth 2025 to 2034

The Europe bio-based polycarbonate market size was evaluated at USD 28.54 million in 2024 and is projected to be worth around USD 71.28 million by 2034, growing at a CAGR of 10.37% from 2025 to 2034.

Why did Europe dominate the bio-based polycarbonate market in 2024?

Europe dominated the bio-based polycarbonate market by capturing the largest share in 2024. This dominance is driven by stringent environmental regulations and a strong emphasis on sustainability. The European Union's Green Deal, along with various other national policies, focuses on circular economy principles that promote market growth. Countries such as Germany, France, and the UK are leading the way in adopting sustainable materials, driven by government initiatives and a rising consumer demand for eco-friendly products. Europe's well-established industrial infrastructure and government-backed incentives further reinforced its leadership in advancing bio-based polycarbonate production and adoption.

Germany is a significant contributor to the European bio-based polycarbonate market, primarily due to its robust chemical manufacturing base and ambitious sustainability goals outlined in the European Green Deal. A combination of industrial capacity, regulatory pressure, and strong downstream demand further drives its leading position. The country benefits from key players such as Covestro, BASF, and Evonik, who have been investing heavily in bio-based polycarbonates and experimenting with advanced technologies to optimize efficiency and production.

Why is Asia Pacific considered the fastest-growing region?

Asia Pacific is expected to experience the fastest rate throughout the forecast period, driven by expanding industrialization, rising environmental awareness, and increasing demand for sustainable materials across emerging economies. Countries like China, Japan, and South Korea are heavily investing in green technologies and eco-friendly manufacturing practices, aligning with global sustainability goals. The region's booming automotive, electronics, and construction sectors are creating strong demand for lightweight and durable bio-based alternatives. Additionally, supportive government policies, cost-effective production capabilities, and growing R&D activities are accelerating market expansion across Asia Pacific.

Value Chain Analysis

- Raw Material Sourcing and Bio-based Feedstock Production: This initial stage involves sourcing renewable raw materials such as bio-based phenols, derived from biomass like plant oils or sugars. Sustainable feedstock production is crucial for ensuring the bio-based nature of polycarbonate and reducing reliance on fossil fuels. Key players in this stage include Cargill, Novozymes, and DuPont, who specialize in bio-based chemical intermediates and enzymatic processes for biomass conversion.

- Monomer and Polymer Manufacturing: At this stage, bio-based monomers such as bio-based bisphenol-A (BPA) are synthesized and polymerized into bio-based polycarbonate resin. This process demands advanced chemical engineering to maintain material performance comparable to petroleum-based counterparts. Companies like BASF, Covestro, and Mitsubishi Chemical are leading innovators, developing scalable, sustainable production technologies for bio-based polycarbonate.

- Material Processing and Compounding: Bio-based polycarbonate resins are processed into pellets or compounded with additives to enhance properties like durability, flame resistance, and UV stability. This stage prepares the material for end-use manufacturing while ensuring consistency and quality. SABIC, Trinseo, and Mitsui Chemicals play pivotal roles here, offering customized formulations tailored to specific industry requirements.

- End-Product Manufacturing and Fabrication: In this phase, bio-based polycarbonate materials are fabricated into finished products such as automotive components, electronic housings, and construction materials. Advanced processing techniques like injection molding and 3D printing are employed to meet precise specifications. Major players in this stage include Bayer MaterialScience, GE Plastics, and various automotive and electronics manufacturers adopting bio-based polycarbonate for sustainability.

- Distribution and Sales: The distribution stage ensures bio-based polycarbonate reaches manufacturers and end-users via direct sales or through distributors and agents. Efficient logistics and supply chain management are critical for timely delivery and market penetration. Companies such as Brenntag, IMCD Group, and Univar Solutions facilitate global distribution networks, supporting market growth through wide product availability.

- End-Use Industries and Consumers: The final stage encompasses industries like automotive, electronics, construction, and medical devices that incorporate bio-based polycarbonate into their products, driven by demand for sustainable materials. Consumer awareness and regulatory pressures are pushing adoption further, reinforcing the entire value chain's growth. Prominent end-users include automotive OEMs like Toyota and BMW, electronics giants such as Samsung, and construction firms embracing green building materials.

Bio-Based Polycarbonate Market Companies

- Covestro AG

- Teijin Limited

- Mitsubishi Chemical Group

- SABIC

- Chimei Corporation

- NatureWorks LLC

- Samyang Corporation

- RTP Company

- Evonik Industries AG

- Asahi Kasei Corporation

- BASF SE

- LG Chem Ltd.

Recent Developments

- In August 2024, Covestro introduced a range of polycarbonates based on chemically recycled attributed material from post-consumer waste via mass balance: Makrolon RP. The aim is to manufacture high-quality and durable products with chemically recycled attributed feedstocks. At the end of a long usage phase, the plastics can still achieve a "third product life" through mechanical recycling and the further development of chemical recycling technologies.

(Source: https://www.gizbot.com) - In May 2025, Primex introduced Prime Sulapac sheets, made from bio-based Sulapac material, which offer a safe, sustainable, and high-performance alternative to traditional plastics. Sulapac has been developed by Helsinki-based Sulapac Ltd, an award-winning material innovation company trusted by global luxury brands. By combining the exceptional biomaterial and sustainability expertise, extrusion excellence, and industry experience of the two companies, this partnership has immense potential to accelerate the green transition of the packaging industry at scale.(Source: https://www.sulapac.com)

Segments Covered in the Report

By Grade (US$ Billion & Tons)

- Engineering Grade

- Optical Grade

- Medical Grade

- Food Contact Grade

- Flame Retardant Grade

- UV-Stabilized Grade

- Reinforced Grade

- General-Purpose Grade

By Application / End-Use Industry

- Automotive & Transportation

- Interior Trim Panels

- Exterior Components

- Lighting Systems

- Battery Enclosures

- Electrical & Electronics

- Device Casings

- Light Diffusers

- Connectors & Switches

- Optical Storage Media

- Construction & Building

- Transparent Sheets

- Wall Panels

- Noise Barriers

- Medical & Healthcare

- Drug Delivery Devices

- Diagnostic Equipment

- Surgical Tools

- Consumer Products

- Reusable Bottles

- Kitchenware

- Toys

- Eyewear

- Packaging

- Food Containers

- Bottles

- Blister Packs

- Textiles & Fibers

- Technical Fiber

- Blended Fabrics

- Agriculture

- Greenhouse Films

- Drip Irrigation Components

- Others (Sports Goods, etc.)

By Processing Technology

- Injection Molding

- Extrusion

- Blow Molding

- Thermoforming

- 3D Printing

- Compression Molding

By Form Factor

- Pellets

- Powders

- Sheets

- Films

- Preforms

- Filaments

By Bio-content (%)

- <30% Bio-Based

- 30–50% Bio-Based

- 51–85% Bio-Based

- 100% Bio-Based

By Distribution Channel

- Direct Sales

- Indirect Sales

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting