What is the Biocatalysis Market Size?

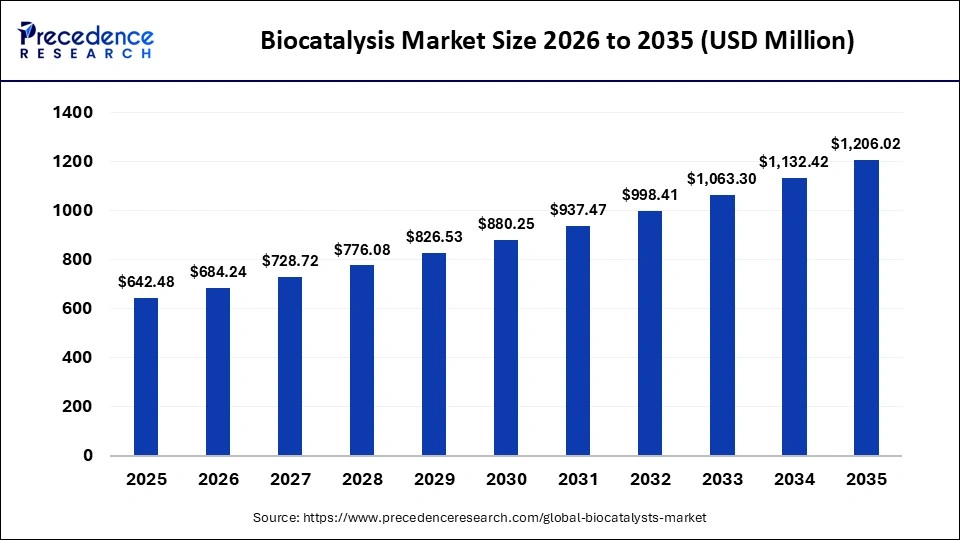

The global biocatalysis market size accounted for USD 642.48 million in 2025 and is predicted to increase from USD 684.24 million in 2026 to approximately USD 1,206.02 million by 2035, expanding at a CAGR of 6.50% from 2026 to 2035. The market is growing due to rising demand for sustainable and eco-friendly processes, expanding industrial applications, and increased customer preference for natural and clean-label products.

Market Highlights

- North America dominated the market, holding the largest share in 2025.

- The Asia Pacific is expected to grow at the fastest rate from 2026 to 2035.

- By technology, the enzyme-based biocatalysis segment held the biggest market share in 2025.

- By technology, the whole-cell biocatalysis segment is growing at the fastest CAGR from 2026 to 2035.

- By product type, the enzymes segment contributed the highest market share in 2025.

- By product type, the whole-cell catalysts segment is expected to expand at a noteworthy CAGR from 2026 to 2035.

- By application, the pharmaceutical & drug manufacturing segment captured the major market share of the market in 2025.

- By application, the biofuels & renewable energy segment growing at a strong CAGR between 2026 and 2035.

- By end-user, the pharmaceutical & biotech companies segment held the largest share of the market in 2025.

- By formulation, the liquid enzyme preparation segment dominated the market in 2025.

What is the Biocatalysis Market?

The market for biocatalysis is expanding due to rising demand for eco-friendly processes, process intensification, and tailored enzyme solutions. The biocatalysis market involves using enzymes and whole-cell biocatalysts to catalyze chemical reactions in a selective, efficient, and sustainable way for industrial, pharmaceutical, and biotechnological applications. Biocatalysis promotes green chemistry, reduces energy use, and increases product yields while minimizing environmental impact. It is applied in pharmaceuticals, fine chemicals, biofuels, food processing, agriculture, and environmental sectors.

How Is Artificial Intelligence Impacting the Biocatalysis Market?

Artificial intelligence is transforming the biocatalysis market by enabling faster discovery. AI is transforming protein engineering from depending solely on natural enzymes to designing new, custom biocatalysts with improved features. It accelerates the development and commercialization of enzyme-based solutions. Projections suggest a substantial growth in market size over the next decade. AI-driven biotech attracts significant funding for startups and research efforts focused on creating innovative enzymes.

- According to the National Institute of Health (NIH), using machine learning to accelerate biocatalyst distribution represents a paradigm shift in enzyme engineering, discovery, and design.

Biocatalysis Market Outlook

The biocatalysis market is growing due to increasing demand for sustainable and eco-friendly industrial processes, along with rapid technological advancements that have improved the performance and cost-effectiveness of biocatalysts. This growth is further fueled by the expanding use of biocatalysts across key industries such as pharmaceuticals, food and beverages, and biofuels, where their efficiency and specificity offer distinct advantages over traditional chemical methods.

The sustainability trend is reshaping the market by driving a shift toward enzyme-based processes that reduce energy use, minimize chemical waste, and lower the environmental footprint compared to traditional chemical synthesis. As industries pursue greener manufacturing, demand for biocatalysts is rising across pharmaceuticals, food processing, and biofuel production, creating new opportunities for eco-efficient, scalable solutions.

The market is expanding worldwide as industries increasingly adopt enzyme-based processes to improve efficiency, reduce costs, and meet growing sustainability and regulatory demands. Emerging regions offer strong opportunities due to expanding pharmaceutical manufacturing, rising investment in green chemistry, and the growing adoption of bio-based industrial processes in Asia-Pacific, Latin America, and the Middle East.

Major investors in the biocatalysis market include pharmaceutical companies, biotechnology firms, industrial chemical manufacturers, and venture capital groups focused on sustainable technologies. They contribute by funding enzyme engineering innovations, scaling bioprocessing facilities, and accelerating the commercialization of eco-friendly catalytic solutions across multiple industries.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 642.48 Million |

| Market Size in 2026 | USD 684.24 Million |

| Market Size by 2035 | USD 1,206.02 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.50% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology/Approach, Product Type, Application, End-User, Formulation/Product Offering, Revenue Model, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand for Sustainable and Eco-Friendly Processes

The Biocatalysis market is significantly influenced by the rising demand for sustainable and environmentally friendly manufacturing methods. Biocatalysts, which are natural substances like enzymes and microorganisms, facilitate cleaner and more efficient chemical production compared to traditional, often harsh, chemical processes. This transition supports the 12 Principles of Green Chemistry, a guiding framework for creating chemical products and processes that reduce or eliminate hazardous substances.

- In September 2025, Cascade Bio secured $6 million to advance its biocatalytic technologies. Such investments fuel innovation and accelerate market entry for new solutions.

Increasing Demand From the Pharmaceutical Sector

The high selectivity of biocatalysts is a major advantage in pharmaceutical manufacturing. Enzymes distinguish between different parts of a molecule, including mirror-image isomers, or enantiomers. This reduces byproducts, eliminates protective steps, and enhances sustainability and cost-effectiveness, all under milder conditions, leading to waste reduction and the use of renewable resources. Speed and efficiency in drug development also drive market growth.

Restraints

High Cost and Technical Challenges

Biocatalysts, especially highly specialized enzymes, demand significant financial investment for large-scale production. The costs of fermentation, recombinant DNA technology, and extensive purification can make them too costly for price-sensitive industries. Poor stability and reusability, challenges in scale-up, and the fact that many biocatalysts are highly specific to certain substrates limit their range of applications.

Regulatory Barriers

Regulatory uncertainty in emerging economies and unclear, inconsistent regulations create barriers to overall expansion. The biocatalysis market competes with long-established and often cheaper chemical catalysis methods. The high initial investment required to transition to new biocatalytic technology can deter industries that are resistant to change.

Opportunities

Industrial Expansion

The increasing adoption across many industries is leading to the replacement of traditional chemical processes with greener and more efficient alternatives. The biopharmaceutical sector uses biocatalysts to synthesize complex molecules, such as active pharmaceutical ingredients and drug intermediates, with high selectivity and fewer byproducts. The food industry employs biocatalysts for processing, flavor enhancement, and extending product shelf life. The markets for cleaning agents, agriculture, and feed industries are also driven by this growth.

Technological Innovation

The enzyme engineering, evolution, and genetic engineering techniques allow scientists to develop novel biocatalysts with enhanced stability, activity, and broader substrate specificity, enabling their use in more demanding industrial environments. High-throughput screening, machine learning, and computational modeling help accelerate the design-test cycle for new enzymes, reducing the time needed to bring a new biocatalytic process to market. Integrating biocatalysts with continuous flow reactors provides better temperature control, increased enzyme stability, and easier incorporation of multiple reaction steps.

Biocatalysis Market Segment Insights

Technology Insights

The enzyme-based biocatalysis segment dominated the biocatalysis market in 2025 due to its high selectivity, specificity, and efficiency under mild conditions, providing significant advantages over traditional chemical catalysts. Technological advancements such as directed evolution, immobilization, and machine learning have improved enzyme performance and stability. The segments market dominance is further strengthened by its alignment with the increasing demand for sustainable manufacturing, especially in key sectors like pharmaceuticals and food. This combination of performance, cost-effectiveness, and environmental benefits makes enzyme biocatalysis the preferred choice for industrial applications.

The whole-cell biocatalysis segment is expected to grow at the fastest rate in the coming years due to the elimination of expensive cofactor requirements, reduced production and processing costs, and the facilitation of multi-step reactions. The rapid development of molecular biology tools, including synthetic biology and metabolic engineering, has enabled the rational design and optimization of whole-cell catalysts. Introduce genes for novel or optimized enzymes into host organisms to expand their catalytic range.

Product Type Insights

The enzymes segment dominated the market in 2025, driven by their high specificity, efficiency, and key role in sustainable manufacturing. Widespread adoption across pharmaceuticals, food and beverages, and biofuels further drives their demand. Continuous innovation in enzyme engineering enhances performance and reusability, solidifying its market leadership over other biocatalysts. Consequently, enzymes are positioned as a mature and economically viable alternative to traditional chemical processes.

The whole-cell catalysts segment is growing rapidly due to significant cost and efficiency benefits compared to purified enzymes. By eliminating the need for enzyme purification and incorporating costly cofactors, they significantly reduced manufacturing costs. The cells also act as tiny bioreactors, performing multi-step reactions with enhanced enzyme stability in a single vessel. Additionally, recent progress in genetic and metabolic engineering enables the rational design of whole-cell catalysts, broadening their application for producing complex, high-value chemicals.

Application Insights

The pharmaceuticals & drug manufacturing segment dominated the biocatalysis market in 2025, as biocatalysis offers superior selectivity and purity, enhances manufacturing efficiency, reduces production steps, and increases yields. Significant advancements in enzyme engineering, continuous breakthroughs in genetic engineering, the increasing prevalence of chronic diseases, and the push toward more personalized, biologics-based medicine are driving the need for complex active pharmaceutical ingredients (APIs) and chiral building blocks, thereby supporting segmental growth.

The biofuels & renewable energy segment is expected to grow at the fastest rate in the market due to strict government regulations aimed at reducing carbon emissions. This trend was sped up by rapid technological advances, such as improved enzyme engineering, which made biofuel production more efficient and affordable. The global move toward a greener, bio-based economy and increasing demand for sustainable energy options also drove this quick growth.

- In June 2024, the Indian Institute of Science (IISc) announced a breakthrough biocatalyst capable of converting fatty acids into pure biofuels with up to 95% efficiency.

End-User Insights

The pharmaceutical & biotech companies segment dominated the market in 2025 because they rely heavily on biocatalysis for producing complex, high-purity chiral Active Pharmaceutical Ingredients (APIs). These companies leverage biocatalysis for its superior selectivity, eco-friendly manufacturing, and cost-effectiveness compared to traditional chemical synthesis. Advancements in enzyme engineering further fueled this dominance by accelerating drug development and expanding biocatalytic applications. This makes biocatalysis central to modern, sustainable drug production, driving significant market growth.

In March 2024, Cambrex, a small-molecule API manufacturer, announced it was nearing the end of a five-year expansion project. This infrastructure development added advanced capabilities for biocatalytic routes, including a new lab for high-potency APIs (HPAPI) and a continuous flow chemistry lab designed to integrate biocatalytic cascade reactions.

The industrial & chemical manufacturing segment is expected to grow at the fastest rate in the upcoming period due to increasing demand for eco-friendly processes. Advancements in enzyme engineering have made biocatalysis a cost-effective and environmentally friendly alternative. Its high selectivity enables the precise synthesis of high-value compounds, including pharmaceuticals and fine chemicals, boosting its widespread industrial adoption.

Formulation Insights

The liquid enzyme preparations segment dominated the market in 2025 due to superior solubility, enabling rapid, seamless integration into automated industrial processes. Key applications in the food and beverage, pharmaceutical, and cleaning agent sectors were driven by enhanced performance and stability. This segments growth is supported by a growing focus on green chemistry and technological advances, such as improved enzyme stabilization. The liquid forms ease of use and high reactivity cemented its market leadership over powdered or immobilized alternatives.

In March 2025, IFF and Kemira established a joint venture called Alpha Bio to expand the production of sustainable, bio-based materials using enzymatic technology. This project aimed to use liquid enzymes to create biopolymers, boosting industrial applications and market potential for this sector.

The customized enzyme solutions segment is expected to grow at the fastest rate during the forecast period, driven by advancements in technology, particularly in protein engineering and AI. Demand from the expanding biopharmaceutical industry and a push for sustainable manufacturing are fueling this segments growth. The rising development of highly specific and efficient biocatalysts for niche applications also contributes to segmental growth. Overall, custom enzymes provide a more precise, cost-effective, and environmentally friendly alternative to traditional methods across various industries.

In September 2024, the US Food and Drug Administration (FDA) approved biologics, further emphasizing the industrys robustness and reliance on tailored enzymes for precision manufacturing.

Biocatalysis Market Regional Insights

North America dominated the biocatalysis market with the largest share in 2025. This is due to its robust biopharmaceutical industry, which drives significant demand for drug synthesis. A strong emphasis on sustainable processes and supportive regulations, like those from the EPA, further incentivized biocatalyst adoption across industries. The region also benefited from advanced R&D and tech innovation, including enzyme engineering and AI, which increased efficiency and productivity. Strategic investments and collaborations solidified its market-leading position.

Asia Pacific is the fastest-growing region, driven by the rising demand for pharmaceuticals, food, and beverages. Strong government support and investments in biotechnology further propelled this growth. Additionally, the region benefited from significant advancements in enzyme engineering and process optimization. This combination of factors established APAC as a key hub for sustainable industrial manufacturing.

Europe is a notably growing area in the biocatalysis market due to its strong regulatory push for sustainable manufacturing and reduced chemical waste, which encourages industries to adopt enzyme-based processes. The regions robust pharmaceutical, food, and chemical sectors, combined with significant R&D funding and collaborations between academia and industry, further accelerate innovation and market expansion.

The biocatalysis market in Latin America is steadily growing as bioethanol production is growing, an increase in outsourcing of pharmaceuticals, and the creation of governmental programs promoting the development of green chemistry. The agricultural feedstock supply in Latin America is strong, and therefore, there is also a growing investment in developing the infrastructure for industrial biotechnology in the region.

Brazil Biocatalysis Market Trends

Biocatalysis in Brazil has been rapidly adopted into the production of both biofuels and fine chemicals. This is due to Brazil's established ethanol market and its focus on producing lower-carbon industrial products.

The MEA Biocatalysis industry is in its early stages; however, there is increasing interest in transitioning from petroleum-chemical production to sustainable manufacturing processes. There is a growing investment in pharmaceutical production, food processing, and specialty chemicals in many of the regions of the MEA, where there is diversification away from a petroleum-based economy.

Saudi Arabia Biocatalysis Market Trends

Saudi Arabia has the potential to be a leader in biomanufacturing due to its Vision 2030 initiatives, which are designed to facilitate the growth of the biotechnology industry and sustainable chemical manufacturing through strategic investments in industry.

Value Chain Analysis of the Biocatalysis Market

- Discovering Enzymes and Engineering Strains: The focus of upstream activities is via microbe screening, genetically modifying microbes, and creating proteins, which produce biocatalysts that are highly selective and stable. Having extensive intellectual property and research and development (R&D) capabilities creates a significant competitive advantage at this stage.

Key Players: Novozymes, Codexis, BASF - Producing and Formulating Biocatalysts: This portion of the value chain encompasses all aspects of the fermentation, downstreaming processes, the immobilization of enzymes, as well as the formulation of enzymes to be usable by customers in various industrial environments.

Key Players: DSM-Firmenich, Amano Enzyme, DuPont - Integrating End-Users and Optimizing Manufacturing Processes: End-users are looking for all-in-one solutions, including technical support, help with compliance to regulatory requirements, and the selection of default solutions to improve production efficiency while reducing waste and energy costs.

Key Players: Evonik Industries, AB Enzymes, Chr. Hansen

Biocatalysis Market Companies

A Danish biotechnology company that was a global leader in producing industrial enzymes and microorganisms.

A global leader that creates and manufactures ingredients and solutions for food, beverage, health, and biosciences.

A protein engineering company that designs and develops high-performance enzymes using its proprietary CodeEvolver technology.

The largest chemical producer in the world, headquartered in Germany, and is known for creating and selling a broad portfolio of products, including chemicals, plastics, performance and agricultural products, for a wide variety of industries.

A Swiss-Dutch company, formed in 2023 from the merger of Royal DSM and Firmenich, that is a leading innovation partner in nutrition, health, and beauty.

A German-headquartered biotech company specializing in developing, manufacturing, and supplying enzyme solutions for industrial applications worldwide.

A Japanese company founded in 1899, is a global leader in the production and sale of specialty enzymes for a wide range of industries, including food, healthcare, and green chemistry.

A Danish bioscience company that developed and produced natural ingredients like microbial cultures, enzymes, and probiotics for the food, pharmaceutical, and agricultural industries.

A global company that provides analytical instruments, equipment, software, reagents, and services to accelerate scientific research and support diagnostics.

A U.S.-based company with significant R&D and manufacturing operations in China, providing enzymes, co-factors, and contract manufacturing services for the food, pharmaceutical, and fine chemical industries.

A UK-based biotechnology company specializing in the development and large-scale manufacturing of specialty enzymes for the food, beverage, and life science industries.

A U.S.-based company that provides a wide range of enzyme products and related services for life science research and industrial applications. Leveraging its manufacturing expertise, the company serves diverse sectors such as pharmaceuticals, food and beverage, and diagnostics.

Recent Developments

- In July 2025, the CATCO2NVERS project, presented at Biotrans, involves a collaboration with Wageningen University to use engineered enzymes to convert carbon dioxide into high-value chiral molecules, such as D-lactic acid.(Source: https://catco2nvers.eu)

- In March 2024, Kerry launched Biobake Fibre in Europe, an enzyme solution for bakery products. While primarily a European launch, such innovations often signal future rollouts or increased availability in the highly connected APAC markets. (Source: https://fooddrinkinnovations.com)

Biocatalysis Market Segments Covered in the Report

By Technology/Approach

- Enzyme-based Biocatalysis

- Whole-cell Biocatalysis

- Immobilized Enzymes & Biocatalyst Systems

- Engineered/Recombinant Enzymes

By Product Type

- Enzymes

- Whole-cell Catalysts

- Co-factors & Co-enzymes

By Application

- Pharmaceuticals & Drug Manufacturing

- Biofuels & Renewable Energy

- Food & Beverage Processing

- Agriculture & Feed Additives

- Environmental Applications

- Other Applications

By End-User

- Pharmaceutical & Biotech Companies

- Industrial/Chemical Manufacturers

- Academic & Research Institutes

- Other End-Users

By Formulation/Product Offering

- Liquid Enzyme Preparations

- Powder/Solid Enzyme Preparations

- Immobilized Enzyme Systems

- Customized Enzyme Solutions/Services

By Revenue Model

- Product Sales

- Licensing & IP-based Revenue

- Services

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting