What is the Bulk Aseptic Packaging Market Size?

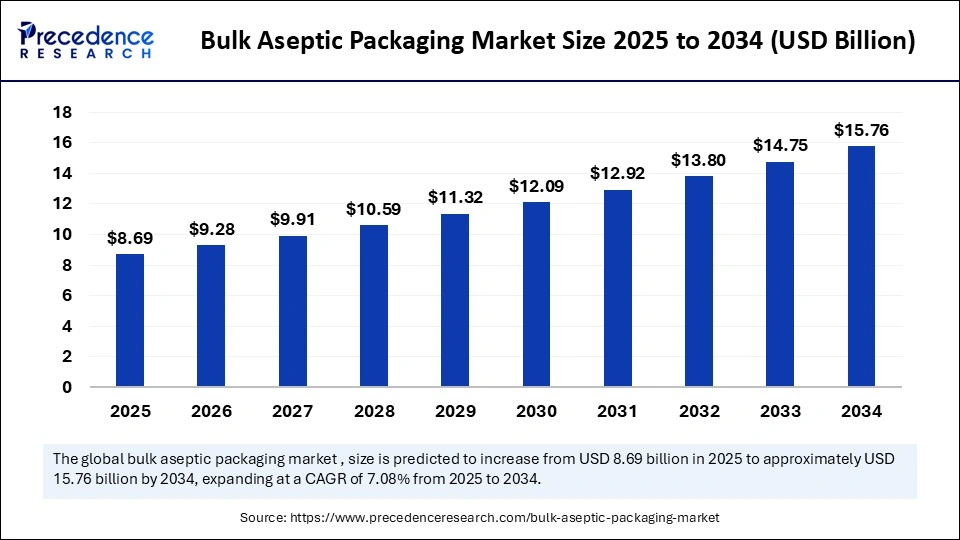

The global bulk aseptic packaging market size was calculated at USD 8.13 billion in 2024 and is predicted to increase from USD 8.69 billion in 2025 to approximately USD 15.76 billion by 2034, expanding at a CAGR of 6.84% from 2025 to 2034. The bulk aseptic packaging market is witnessing significant growth, driven by rising demand for safe, sustainable, and durable packaging solutions across the food & beverages, pharmaceutical, and consumer goods industries.

Market Highlights

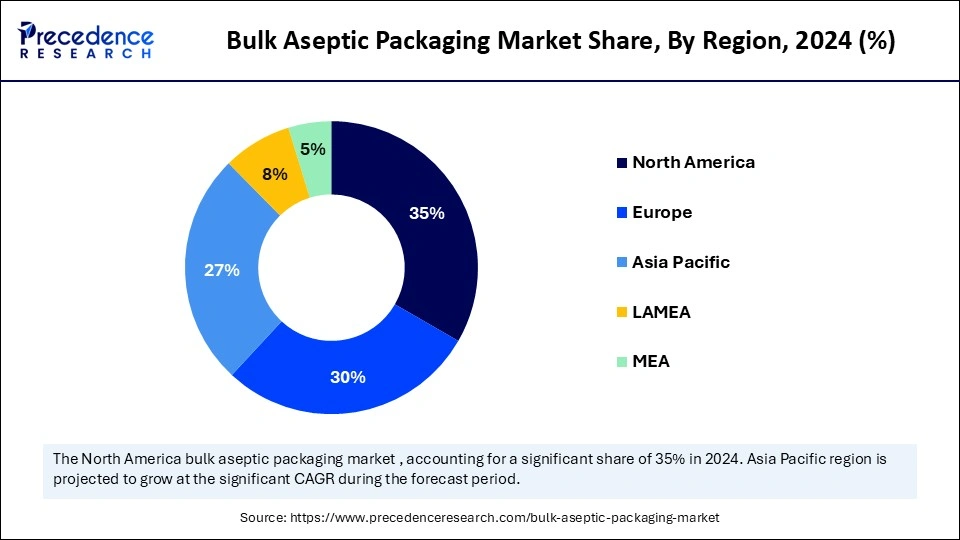

- North America led the bulk aseptic packaging market with around 35% share in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By product type, the aseptic cartons segment held approximately 50% share of the market in 2024.

- By product type, the aseptic pouches segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By application, the food & beverage segment captured approximately 60% market share in 2024.

- By application, the pharmaceuticals segment is expected to expand at a notable CAGR over the projected period.

- By material type, the paperboard segment captured approximately 45% market share in 2024.

- By material type, the plastic segment is expected to expand at a notable CAGR over the projected period.

- By end-user industry, the food processing segment held approximately 55% market share in 2024.

- By end-user industry, the beverage manufacturing segment is expected to expand at a notable CAGR over the forecast period.

Market Size and Forecast

- Market Size in 2024: USD 8.13 Billion

- Market Size in 2025: USD 8.69 Billion

- Forecasted Market Size by 2034: USD 15.76 Billion

- CAGR (2025-2034): 6.84%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

How is the Bulk Aseptic Packaging Market Booming?

The bulk aseptic packaging market is experiencing significant growth, driven by rising demand for safe and extended-shelf-life food and beverages. Aseptic packaging is a specialized process in which a sterile product, usually liquid or perishable food, is packaged in a sterile container under sterile conditions to prevent contamination by bacteria, viruses, or other microorganisms. It is commonly used in the dairy, beverage, and pharmaceutical industries to enable long-term storage and is distributed globally.

The market encompasses the global industry involved in producing packaging solutions that preserve the sterility of perishable products without requiring refrigeration. This includes materials and technologies used to package liquids, such as dairy products, juices, sauces, and pharmaceuticals, in a sterile environment. The market is driven by the increasing demand for shelf-stable products, advancements in packaging technologies, and the need for sustainable packaging solutions. The increasing demand for ready-to-drink beverages is likely to drive demand for aseptic packaging.

AI Innovation: The New Paradigm of Aseptic Packaging

Artificial intelligence is accelerating the production process of bulk aseptic packaging through automation, including vision-based inspections, predictive maintenance, and digital twin simulations, thereby eliminating the risk of contamination and downtime. Organizations are now installing robots with AI capabilities and vision-based cobots to facilitate SKU complexity and eliminate human contact at fill-finish lines.

- In February 2025, Ranpak's AI-enabled computer vision packing systems and Rabot, a developer of a Vision AI platform, collaborated to enhance its AI-driven packaging ecosystem. This exclusive multi-year agreement enables Ranpak to offer advanced warehouse insights that optimize packing operations, reduce waste, and boost productivity, beginning with a North American rollout. Regulators and manufacturers are trialing workflows to create 'alternative' auditing from audit trails and utilize AI techniques to reduce traditional plastic use, such as blister packaging.(Source: https://ir.ranpak.com)

Bulk Aseptic PackagingMarket Outlook

- Market Growth Summary: The bulk aseptic packaging market is poised for rapid expansion between 2025 and 2034, driven by the increasing use of aseptic packaging to extend the shelf life of perishable goods without the need for refrigeration. Stringent regulations regarding the safety of food and pharmaceutical products further enhance the need for fully validated sterile filling lines, including step-wise process controls of sterilization. Regulatory guidance (e.g., FDA, Codex) creates technical barriers but also standardizes market entry.

- Sustainability Trends: The movement toward regulations for recyclability and restrictions on substances deemed hazardous to human health (EU Packaging & Packaging Waste Regulation, food-contact regulations) forces suppliers of aseptic-pack to redesign multilayer laminates and coatings, fueling the research and design of recyclable laminates and barrier biopolymers that meet the recyclability designation and PFAS restrictions.

- Regulatory Landscape: Policies promoting low-waste, shelf-stable forms have given rise to recyclable aseptic cartons and mono-material pouches. Manufacturers and suppliers whose packaging demonstrates food safety and circularity can secure contracts, resulting in increased production and supply of aseptic packaging.

- Challenge: Technical complexities (validated aseptic sterilization and container integrity) are compounded by chemical and recyclability regulations, which narrow the scope of compliance costs and increase the complexity of meeting these requirements. Smaller converters will incur additional capital and testing costs to meet FDA/Codex regulations and EU regulations, creating supply chains that do not accommodate smaller manufacturers as the dynamic food packaging market grows.

- Global Expansion: Global trade with aseptically packaged products expands as Codex and individual national sanitary standards create harmonized safety and handling requirements, promoting longer export supply chains for juices, dairy, and soups. Providing export readiness support and technical grant programs helps reduce the friction of adoption in key producing regions.

- Major Investing Organizations: Public research and development grants (e.g., Horizon Europe calls, USDA Sustainable Packaging programs) and large food and beverage manufactures strategic capex are primary sources of capital raised, or pilot projects, and scaling recyclable barriers, aseptic line upgrade, or new processes, rather than boutique private equity with initial prototypes of limited runs.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 8.13 Billion |

| Market Size in 2025 | USD 8.69 Billion |

| Market Size by 2034 | USD 15.76 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.84% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, Material Type, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Preservative-Free and Minimally Processed Beverages

One of the major driving factors of the bulk aseptic packaging market is rising consumer demand for preservative-free and minimally processed beverages, as this packaging method allows products to remain shelf-stable without the need for chemical preservatives. Aseptic packaging enables products, such as dairy, plant-based beverages, and fruit juices, to remain fresh for extended periods without the need for refrigeration or chemical preservatives. This packaging preserves flavor, nutrition, and quality while ensuring safety, making it ideal for a range of beverages.

Also, there is a dramatic increase in global consumption of dairy alternatives in 2024. Consumers in the U.S. are increasingly opting for plant-based milk alternative beverages over conventional milk, reflecting recent shifts in dietary preferences among various demographics. Coca-Cola and PepsiCo have attempted to meet the rising demand for healthy beverage options by expanding their aseptic filling lines in Asia and Europe. This shift to clean-label, nutrient-dense beverages is subsequently accelerating the movement toward bulk aseptic packaging solutions.

Restraint

High Costs

High capital expenditure for aseptic systems is a significant barrier; sterile filling rooms, clean rooms, specialized sterilization chambers, and barrier films all require substantial capital investment before production can commence. A manufacturer recently spent $100 million to add additional sterile fill lines. Even with the help of automation and new sterilization technologies that shorten timelines, end-user systems continually extend project schedules due to delayed deliveries by suppliers and component shortages. As a result, several smaller companies are hesitant to engage in the risk of such large capital expenditures without anticipated demand.(Source: https://www.fiercepharma.com)

Opportunity

Demand for Sustainable Packaging

One key opportunity in the bulk aseptic packaging market lies in the rising consumer and regulatory expectations for sustainable materials and designs. An example is SIG's new aseptic folding carton factory in Ahmedabad, which opened in 2025 and has the capacity to produce 4 billion packs each year, while improving its environmental profile.

Additionally, in May 2025, SIG's recent product developments in aseptic cartons have eliminated the use of aluminum, resulting in a 61% reduction in carbon footprint for this product compared to traditional aseptic solutions. As brands adopt aspirational sustainable goals, the demand for bulk aseptic packaging made from renewable or recyclable materials is expected to rise.(Source: https://www.sig.biz)

Segment Insights

Product Type Insights

Why Did the Aseptic Cartons Segment Lead the Bulk Aseptic Packaging Market?

The aseptic cartons segment led the market, accounting for approximately 50% of the market share in 2024. This is mainly due to their widespread application in packaging dairy products, fruit juices, and liquid foods. They are lightweight, easily recyclable, and possess strong barrier characteristics to ensure a longer shelf life without refrigeration. An increasing focus on sustainability and a desire for reduced packaging costs are solidifying aseptic cartons as the dominant sub-segment.

The aseptic pouches segment is expected to grow at the fastest rate in the upcoming period due to their convenience, flexibility, and portability. Aseptic pouches occupy less shelf space, can reduce logistics costs, and are widely used for ready-to-drink beverages, soups, or medical liquids. In addition to their lightweight or recycled nature, aseptic pouches are meeting the needs of health-conscious, on-the-go consumers, providing an environmentally friendly option that contributes to the rapidly growing demand for aseptic pouches.

Application Insights

What Made Food & Beverage the Dominant Segment in the Market in 2024?

The food & beverage segment dominated the bulk aseptic packaging market while holding a 60% share in 2024. This is primarily due to stringent regulations regarding food safety, a focus on enhancing food shelf life, and high demand for convenient packaging solutions. Dairy products, fruit juices, sauces, and liquid food products all require aseptic solutions to maintain freshness and quality. As the consumption of packaged and ready-to-consume food products continues to rise, the demand for aseptic packaging is likely to increase in this segment.

The pharmaceuticals segment is expected to expand at the fastest CAGR over the forecast period. This is primarily due to the need for sterility, safety, and prolonged shelf stability for injectable drugs, vaccines, and biologics. There is a high demand for biologics, which require sterile packaging to maintain their effectiveness. Stringent regulations regarding the safety and efficacy of pharmaceuticals further contribute to segmental growth.

Material Type Insights

Why Did the Paperboard Segment Dominate the Market in 2024?

The paperboard segment dominated the bulk aseptic packaging market while capturing a 45% share in 2024. This is because of its lightweight nature, recyclability,and cost-effectiveness, making it ideal for aseptic cartons. Consumers have become increasingly aware of environmental sustainability, driving up demand for paper-based packaging. Advances in barrier coatings have also improved the durability and protection of paperboard packaging, supporting segmental growth.

The plastic segment is expected to grow at the highest CAGR, with the metallized PET sub-segment likely to lead the charge in the coming years. This is because it has the ability to provide enhanced protection against oxygen, moisture, and light, which are essential in maintaining product quality. Metallized PET is being widely utilized in the packaging of beverages, dairy products, and pharmaceuticals. Its lightweight structure, enhanced functionality, and durability are major factors driving its adoption.

End-User Industry Insights

How Does the Food Processing Segment Contribute the Largest Market Share in 2024?

The food processing segment held approximately a 55% share of the bulk aseptic packaging market in 2024, as aseptic packaging provides food safety, freshness, and extended shelf life for dairy products, sauces, soups, and processed meals. Because food processors want to prevent food waste, they favor this packaging, which relies less on refrigeration and helps maintain flavors. The growing demand for packaged and ready-to-eat food products also contributes to segmental dominance.

The beverage manufacturing segment is expected to grow at the fastest CAGR during the projection period, driven by an increase in juice, energy drinks, and dairy alternative consumption. Aseptic packaging offers stability for extended shelf life without the need for preservatives, aligning with health-conscious and grab-and-go consumption lifestyles. Additionally, rapid urbanization and continued innovation of premium beverage categories contribute to growth in this segment.

Regional Insights

U.S. Bulk Aseptic Packaging Market Size and Growth 2025 to 2034

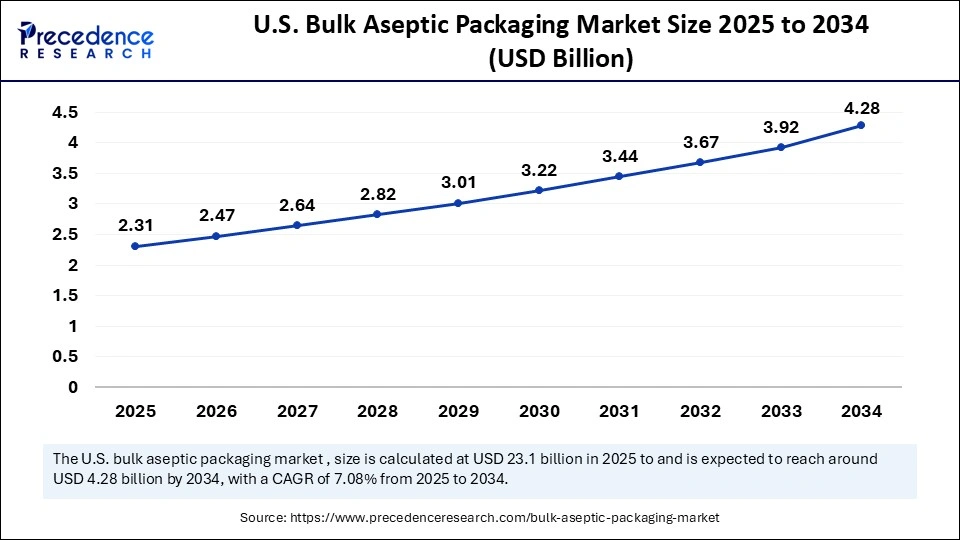

The U.S. bulk aseptic packaging market size was evaluated at USD 2.16 billion in 2024 and is projected to be worth around USD 4.28 billion by 2034, growing at a CAGR of 7.08% from 2025 to 2034.

What Nade North America the Dominant Region in the Market?

North America dominated the bulk aseptic packaging market by capturing a 35% share in 2024. The region's dominance is attributed to several factors, including mature supply chains for food & beverages, developed aseptic-filling infrastructure, and stringent regulatory standards that reward sterile and shelf-stable formats. Large-scale producers of dairy, juice, and ready-to-drink products are investing to automate existing lines and modernize single-use aseptic technology to reduce contamination risk and shorten cold-chain costs. Regulatory guidelines and regular audits trigger capital expenditure for compliant aseptic lines and emphasize investing with fewer suppliers to develop predictable industrial demand.

The U.S. is a major contributor to the market within North America, driven by high consumption of processed beverages and a growing volume of dairy product exports. Dairy processors in the U.S. are acquiring new production lines to increase shelf life, rather than relying on preservatives. The USDA data illustrate that production growth and favorable export statistics encourage processors to enhance aseptic bulk filling of dairy products, including both liquid and powdered streams. Companies are balancing a strategic focus on developing scalable aseptic capacity to meet domestic retail as well as growing international opportunities.

What Makes Asia Pacific the Fastest-Growing Market for Bulk Aseptic Packaging?

Asia Pacific is expected to experience rapid growth in the market, driven by rapid urbanization, rising disposable incomes, and increasing demand for convenient, shelf-stable beverages and food products. The growing popularity of clean-label and preservative-free products in countries like China, India, and Southeast Asian nations further fuels this demand. Additionally, expansion in the food and beverage processing sector, along with investment in cold-chain alternatives, is boosting adoption. Government initiatives supporting sustainable packaging and technological advancements also contribute to the region's rapid growth.

India is emerging as a key player in the Asia Pacific bulk aseptic packaging market, driven by growing disposable incomes, a more urban lifestyle, and increasing production of dairy and juice products. Both domestic brands and multinationals are investing in aseptic carton plants to develop local supply and reduce dependence on imports. Due to rising consumer demand for sustainable packaging in the dairy sector, SIG plans to create full barrier aseptic cartons with 85% paper-based materials by 2025 and 90% paper-based materials by 2030. This investment will support new product launches, distribution at scale, and relative efficiencies, making India a central hub for aseptic packaging growth at a regional level.(Source: https://www.sig.biz)

Value Chain Analysis of the Bulk Aseptic Packaging Market

- Raw Material Sourcing: The materials used, including paperboard, polymers, aluminum foil, and glass, all provide barrier protection and structural integrity. Raw material prices can fluctuate, which in turn affects production costs. This makes sourcing efficiently and developing good supplier relationships critical in maintaining profitability.

- Manufacturing: Raw materials are processed into cartons, pouches and bottles. These processes are done in a highly controlled and precise way. While improved manufacturing efficiency increases durability and product safety, it requires significant capital investment and stringent quality control systems for regulatory compliance.

- Technology & Machinery: Rapid, sterile filling and sealing machines enable automation and scalability. Although an important part of efficient and sterile manufacturing, these machines can be costly on the front end, complicated in maintenance, and require a higher operational expense for manufacturers.

- Product Manufacturing: Food and beverage manufacturing companies, as well as pharmaceutical companies, would utilize aseptic packaging on their production lines. Aseptic packaging helps extend shelf life of products without adding preservatives, however, the use of aseptic packaging for regulated products is also an increase in costs due to stricter compliance measures to regulations.

- Distribution: After production is complete, aseptically packaged items are transported to retailers and consumers without the need for refrigeration of food items. The use of aseptic packaging reduces costs in logistics, however, in emerging markets, underdeveloped infrastructure and inconsistent regulations can complicate distribution of goods.

- End-of-Life: After food use, consumer disposal focuses on recycling and recovering materials to mitigate environmental waste. There is difficulty in recycling often due to more complex multi-layer packaging structures that are challenging to separate. As a result, a larger approach to recycling will be needed to capture regulated materials and the system that replaces them or mitigates waste globally.

Top Key Players in the Bulk Aseptic Packaging Market and Their Offering

- Tetra Pak International S.A.: Multinational food packaging and processing company that pioneered aseptic carton packaging. Tetra Brik Aseptic is its world's best-selling carton package range for long-life liquid foods.

- SIG Combibloc Group Ltd.: A global leader in aseptic packaging systems and solutions for liquid food and beverages. Its aseptic packaging enables the highest food safety and quality, with a shelf life of up to 12 months, without the need for refrigeration or storage.

- Elopak AS: Global supplier of fiber-based packaging solutions, with a strong focus on aseptic carton packaging for ambient (long-life) liquid products.

- Greatview Aseptic Packaging Co., Ltd.: Multinational provider of aseptic carton packaging and filling machinery for the liquid food industry.

- UFlex Ltd.: First aseptic packaging materials manufacturer with an advanced facility in India, located in the industrial hub of Sanand in Gujarat, and emerged as a leading aseptic liquid packaging company in a short span of time with innovative liquid packaging solutions.

- Scholle IPN: A global leader in flexible aseptic packaging, specializing in bag-in-box and spouted pouch solutions.

- Sidel Group: A global leader in aseptic PET packaging solutions, offering integrated systems for sensitive beverages like juices, teas, and dairy products.

- Mondi Group: Mondi provides its customers with aseptic cartons that are cost-effective and safe and they emphasize both protective qualities and environmental benefits.

- Amcor Limited.: Amcor is a major provider of aseptic packaging solutions for food, beverages, and medical products.

Recent Developments

- In February 2025, SIG, headquartered in Neuhausen, Switzerland, and a global leader in aseptic packaging and filling solutions, opened its first aseptic carton plant in India with production capacity of up to 4 billion aseptic carton packs.(Source: https://www.sig.biz)

- In November 2024, MilkyMist, in collaboration with SIG and AnaBio Technologies, launched the world's first long-life probiotic buttermilk in aseptic carton packs, allowing probiotics to be incorporated into shelf-stable drinks in aseptic cartons for the first time.(Source: https://www.foodanddrinktechnology.com)

Segments Covered in the Report

By Product Type

- Aseptic Cartons

- Aseptic Pouches

- Aseptic Bags

- Aseptic Bottles

- Others (e.g., Prefilled Syringes)

By Application

- Food & Beverage

- Pharmaceuticals

- Cosmetics & Personal Care

- Industrial & Chemicals

- Others

By Material Type

- Paperboard

- Plastic (Polyethylene, Metallized PET, Nylon)

- Aluminum Foil

- Others

By End-User Industry

- Food Processing

- Beverage Manufacturing

- Pharmaceutical Production

- Cosmetic Manufacturing

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting