What is the C Resin Market Size?

The global C resin market size was calculated at USD 3.32 billion in 2024 and is predicted to increase from USD 3.52 billion in 2025 to approximately USD 6.04 billion by 2034, expanding at a CAGR of 6.16% from 2025 to 2034. The market is experiencing significant growth due to the increasing demand for adhesive coatings and printing inks. This growth is further supported by the excellent solubility, gloss, and compatibility of C resins with other resins. Additionally, the expanding applications in the packaging, automotive, and construction industries are expected to fuel market expansion.

C Resin Market Key Takeaways

- In terms of revenue, the global C resin market was valued at USD 3.32 billion in 2024.

- It is projected to reach USD 6.04 billion by 2034.

- The market is expected to grow at a CAGR of 6.16% from 2025 to 2034.

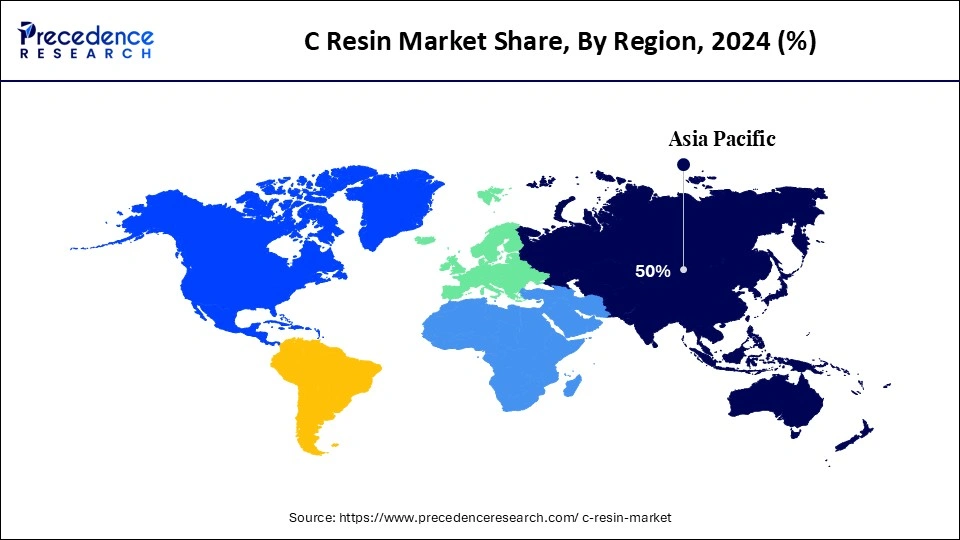

- Asia Pacific dominated C resin market with the largest market share of 50% in 2024 and is expected to sustain growth during the forecast period.

- By type, the pure indene-coumarone resin segment held the biggest market share of 55% in 2024.

- By type, the hydrogenated indene-coumarone resin segment is expected to witness the fastest CAGR during the foreseeable period.

- By application, the adhesives and sealants segment captured the highest market share of 35% in 2024.

- By application, the rubber compounding segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By end-use industry, the construction and infrastructure segment contributed the maximum market share of 40% in 2024.

- By end-use industry, the automotive and transportation segment is expanding at a significant CAGR from 2025 to 2034.

- By function, the tackifier segment led the market in 2024.

Market Overview

The C resin market encompasses the specialty thermoplastic resins primarily derived from coal tar distillation by-products such as indene, coumarone, and methyl indene. C resins (coumarone-indene resins) are used as tackifiers, modifiers, and binders in adhesives, coatings, rubber compounding, paints, and printing inks. These resins enhance adhesion, hardness, gloss, and chemical resistance in end-use products. Market growth is driven by the expansion of the construction, automotive, and packaging industries, increasing demand for cost-effective tackifiers, and their compatibility with both natural and synthetic rubbers. However, environmental concerns and the availability of alternatives, such as hydrocarbon and terpene resins, also influence market dynamics.

How Can AI Impact the C Resin Market?

Artificial intelligence (AI) is transforming the C resin market by optimizing production through real-time monitoring and predictive modeling, enhancing material consistency, and enabling faster, more efficient research and development cycles for new formulas. AI speeds up the development of new resin formulations through predictive modeling, reducing time-to-market. By minimizing waste, automating complex tasks, and optimizing resource use, AI leads to significant improvements in operational efficiency and sustainability. AI also provides deep insights from production data, helping manufacturers make better decisions for process improvements and quality control.

What Are the Key Trends in the C Resin Market?

- Industrialization and Urbanization: The rapid growth of industries and expanding construction activities is fueling the demand for advanced resins in building materials, automotive parts, and electronics, especially for high-temperature resins.

- Technological Advancements: Ongoing research and development are leading to enhanced resin properties, including improved thermal stability, chemical resistance, and mechanical strength. These advancements are expanding application areas in high-performance sectors such as aerospace, electronics, and medical devices.

- E-commerce and Packaging: The increase in e-commerce and growing consumer demand for packaged goods are driving the growth of the packaging industry, making it a significant market for resins like polyethylene and polypropylene.

- Demand for High-Performance Materials: Resins with properties such as lightweight, high flexural strength, chemical resistance, and thermal stability are increasingly being used in demanding applications, promoting a shift away from traditional petrochemical-based products.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 6.04 Billion |

| Market Size in 2025 | USD 3.52 Billion |

| Market Size in 2024 | USD 3.32 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.16% |

| Dominating Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End-Use Industry, Function, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Demand from the Construction, Automotive, and Electronics Industries

The primary driver of the C resin market is the increasing demand from the construction, automotive, and electronics industries, fueled by rapid industrialization and infrastructure expansion. Lightweight, chemically resistant, and cost-effective polypropylene, a type of C resin, is increasingly used in auto parts. Demand for resins in building materials like adhesives, coatings, and roofing solutions is rising due to new infrastructure projects and urbanization. The electronics sector relies on high-performance resins for various components and devices, further boosting demand. Strict environmental policies are encouraging the development of eco-friendly resins.

Restraint

Volatility of Raw Material Prices

The main restraint in the C resin market is the volatility of raw material prices, tied to fluctuations in crude oil, which makes production costs unpredictable and hampers market growth. C Resins are derived from C5 and C9 petroleum fractions, making their cost directly dependent on crude oil prices. Fluctuating oil prices create uncertainty in feedstock costs, which can raise the overall production expenses of C Resins, leading to higher prices for consumers. The high costs associated with C Resins, both in materials and manufacturing, limit their adoption by consumers.

Opportunity

Development and Adoption of Sustainable and Eco-Friendly Resins

The key future opportunity in the C resin market is the development and adoption of sustainable and eco-friendly resins, driven by growing consumer demand and stricter environmental regulations. The most promising opportunity lies in creating and using sustainable resins, such as bio-based, biodegradable, and recyclable options. Manufacturers are focusing on bio-based and recyclable resins to lessen environmental impact. This trend is driven by changing consumer preferences for eco-conscious products, government regulations, and a commitment to reducing volatile organic compound (VOC) emissions.

Type Insights

What Made the Pure Indene-Coumarone Resin Segment Lead the C Resin Market in 2024?

The pure indene-coumarone resin segment led the market in 2024. This is mainly due to its superior properties like improved tensile strength, abrasion resistance, and mold flow, along with its versatility in applications such as high-performance coatings, rubber products, and sealants. The resin significantly enhances the properties of various materials. In rubber, it increases tensile and tear strength, improves abrasion resistance, and boosts molding flow for faster extrusion. Continuous innovation in resin formulation and manufacturing processes drives market growth, focusing on efficiency and environmental sustainability.

The hydrogenated indene-coumarone resin segment is the fastest-growing in the market. This is due to its ability to provide better stability, durability, and compatibility with other resins, especially in high-performance applications like automotive coatings, adhesives, and packaging. Hydrogenated resins show excellent compatibility with a broader range of resins and polymers, allowing for more versatile formulations in adhesives, coatings, and sealants. Advances in hydrogenating these resins, which offer improved properties like heat resistance and flexibility, meet the rising demand from these industries and support sustainability trends.

Application Insights

How did the Adhesives and Sealants Segment Dominate the C Resin Market in 2024?

The adhesives and sealants segment led the market in 2024. This is because of its wide application across growing sectors such as construction, automotive, and packaging, driven by the need for lightweight materials, better fuel efficiency, and strong, weather-resistant bonds. The growth of the packaging sector also adds to demand, especially for water-based adhesives used in paper bags, labels, and wood assembly. This trend increases the need for advanced bonding solutions. Acrylic and silicone resins are particularly popular due to their excellent bonding, high chemical and moisture resistance, and versatility across different temperature ranges.

The rubber compounding segment is expected to grow fastest. This growth is mainly driven by rising demand from the automotive industry, especially for electric vehicles, which require innovative, high-performance tires. C-resins are used to improve properties such as abrasion resistance and temperature stability in tires and other auto parts, fueling growth in the tire market. The overall expansion of the automotive industry, including vehicle production and replacement parts, directly increases rubber compound consumption.

End-Use Industry Insights

How did the Construction and Infrastructure Segment Lead the C Resin Market in 2024?

The construction and infrastructure segment held the dominant position in 2024. This is mainly due to the increasing global demand for advanced building materials, which are critical for structural reinforcement, anchoring, and protective coatings in infrastructure projects like highways, bridges, and tunnels. Since resins are widely used to make paints, coatings, and adhesives for protecting structures from corrosion and wear, and for bonding different construction materials, they offer desirable properties such as lightweight, chemical resistance, and high flexural strength, making them ideal for these uses.

The automotive and transportation segment is expected to see the fastest growth during the forecast period. This is mainly because of the rising demand for lightweight, fuel-efficient vehicles, which increases the use of high-performance resins for components like body panels and interiors. Advances in vehicle technology, including electrification and autonomous driving, further drive the need for advanced composite materials and resins to ensure safety and structural integrity. Additionally, growing attention to sustainable manufacturing is leading to the development and increased use of resins from renewable sources.

Function Insights

Why Did the Tackifier Segment Lead the C Resin Market in 2024?

The tackifier segment dominated the market in 2024. This is mainly due to its essential role in improving adhesive properties, which boosts demand across key sectors like construction, packaging, and automotive. As tackifiers enhance crucial adhesive qualities such as instant grip, long-term stability, cohesion, and surface adhesion, they are vital in modern manufacturing. The segment is further propelled by a rising demand for high-performance, sustainable solutions, leading to innovations in bio-based and eco-friendly products that expand their applications and improve their performance in current formulations.

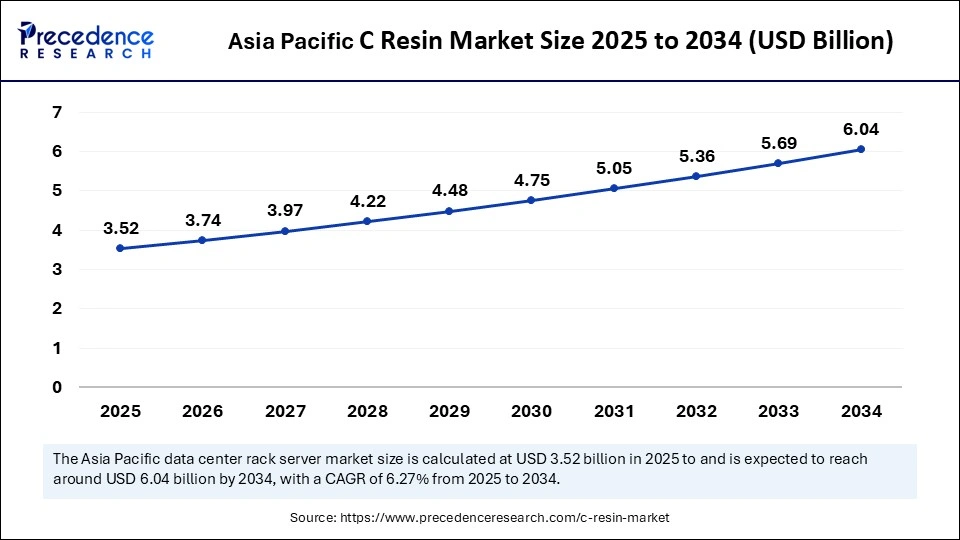

Asia Pacific C Resin Market Size and Growth 2025 to 2034

The Asia Pacific C resin market size is exhibited at USD 1.76 billion in 2025 and is projected to be worth around USD 3.05 billion by 2034, growing at a CAGR of 6.27% from 2025 to 2034.

How did Asia Pacific Dominate the C Resin Market in 2024?

Asia Pacific dominated the market and is expected to sustain growth during the forecast period. This is primarily due to a large manufacturing base, especially in China and India, supported by strong demand from sectors like automotive, construction, and packaging. Countries like China and India benefit from lower production costs, making the region an attractive location for resin manufacturing and consumption. Additionally, governments are pushing to diversify supply chains and strengthen domestic petrochemical industries. There is also a growing emphasis on sustainability, with industry efforts directed toward circular economies and innovation in biodegradable plastics for resin manufacturing.

India C Resin Market Trends

India plays a significant role in the C resin market, driven by robust industrialization in the construction, automotive, and packaging sectors. The country is enhancing its domestic production capabilities through initiatives like Make in India to reduce import reliance. However, it remains a net importer, depending on sources like Thailand, China, and South Korea, even as domestic manufacturers increase capacity to compete with global players.

China C Resin Market Trends

China is emerging as a leading manufacturer and exporter, playing a crucial role in the global supply chain. This growth is fostered by increasing domestic demand, particularly from booming industrial sectors such as chemicals, electronics, automotive, and construction. The rise is attributed to technological advancements and the escalating need for high-quality resins in advanced manufacturing. While China has a robust domestic production base with major players, it still imports certain specialized resins.

C Resin Market Companies

- Neville Chemical Company

- Kolon Industries, Inc.

- Arakawa Chemical Industries, Ltd.

- Cray Valley (TotalEnergies)

- Zibo Luhua Hongjin New Material Co., Ltd.

- Guangdong Komo Co., Ltd.

- Henan Anglxxon Chemical Co., Ltd.

- Lesco Chemical Limited

- Shanghai Jinsen Hydrocarbon Resins Co., Ltd.

- Foreverest Resources Ltd.

- Shandong Landun New Material Co., Ltd.

- Eastman Chemical Company (Indirect – Specialty Resins)

Leaders' Announcements

- In February 2025, Sumitomo Chemical acquired LCP technology from Syensqo, enhancing its capabilities in the liquid crystal polymer (LCP) business, particularly for ICT and mobility applications. LCPs are renowned for their excellent heat resistance and dimensional accuracy and are widely used in electronic components.(Source: https://www.sumitomo-chem.co.jp)

Recent Developments

- In March 2025, Westlake Epoxy launched new products at the European Coatings Show (ECS) in Germany. These innovations aim to enhance robustness, safety, and sustainability. The EpoVIVE™ portfolio introduces low-emission, bio-circular alternatives, including the new EPIKOTE™ Resins 901 and 902 for flooring, and AQUAREOUS™ epoxy systems for coatings, all designed to minimize environmental impact.(Source: https://www.westlake.com)

- In January 2024, Covestro developed Apec 2045, a high-heat copolycarbonate that significantly reduces production time and costs for molders and medical OEMs, enabling clients to improve production volumes through shorter cycle times.(Source: https://www.covestro.com)

Segments Covered in the Report

By Type

- Pure Indene-Coumarone Resin

- Modified Indene-Coumarone Resin

- Hydrogenated Indene-Coumarone Resin

By Application

- Paints and Coatings

- Adhesives and Sealants

- Rubber Compounding

- Printing Inks

- Varnishes

- Others

By End-Use Industry

- Construction and Infrastructure

- Automotive and Transportation

- Packaging and Printing

- Industrial Manufacturing

- Consumer Goods

By Function

- Tackifier

- Binder

- Modifier

- Film-Forming and Gloss Enhancer

- Chemical Resistance Agent

By Region

- Asia-Pacific

- Europe

- North America

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting