What is the Circulating Tumor Cells Market Size?

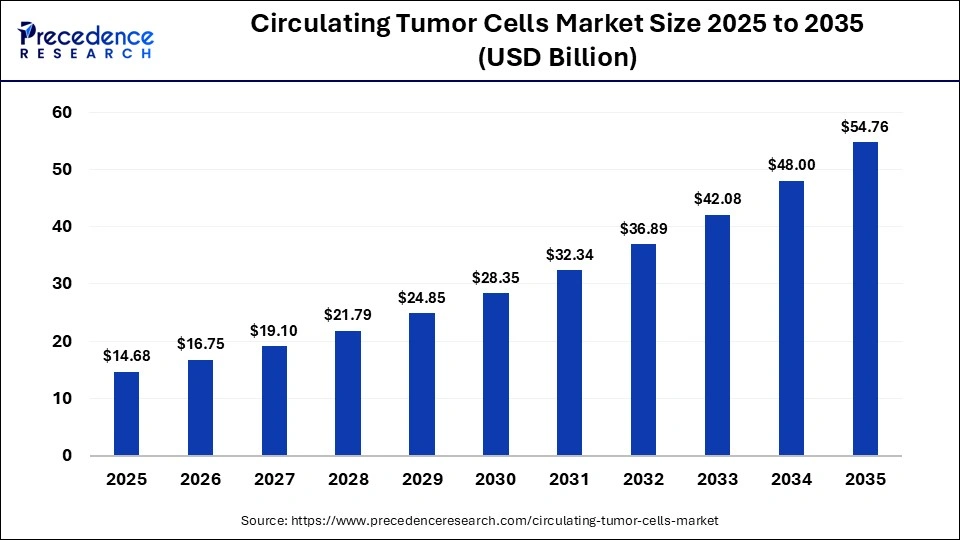

The global circulating tumor cells market size was calculated at USD 14.68 billion in 2025 and is predicted to increase from USD 16.75 billion in 2026 to approximately USD 54.76 billion by 2035, expanding at a CAGR of 14.07% from 2026 to 2035. The growing demand for liquid biopsy and non-invasive cancer testing is driving the adoption of circulating tumor cell technologies, supporting market expansion.

Market Highlights

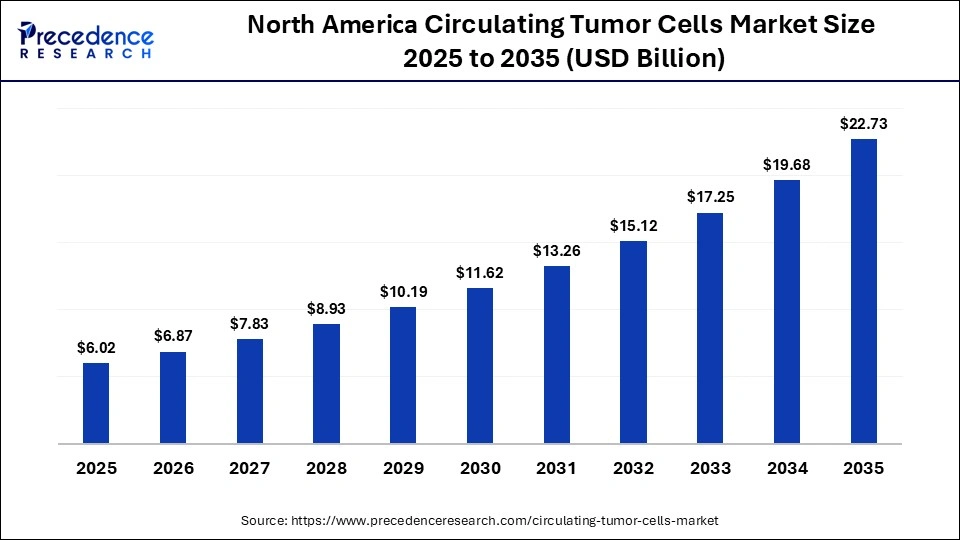

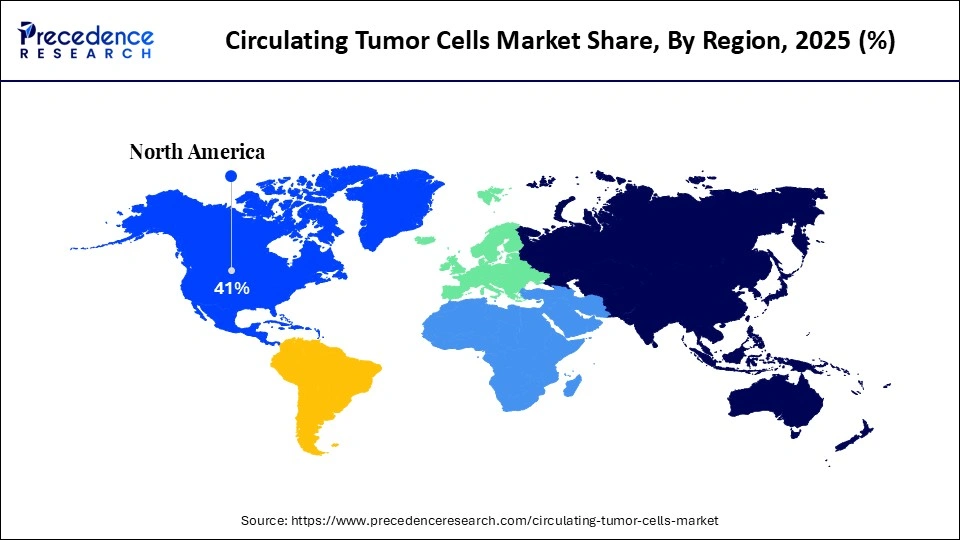

- North America dominated the circulating tumor cells market with the largest market share of 41% in 2025.

- Asia-Pacific is expected to be the fastest-growing region between 2026 and 2035.

- By technology, the CTC detection & enrichment methods segment held a dominant position in the market in 2025

- By technology, the CTC analysis is expected to grow at the fastest CAGR during the forecast period.

- By application, the research segment dominated the market in 2025.

- By application, the clinical/liquid biopsy segment is expected to show the fastest growth over the forecast period.

- By product, the kits & reagents segment led the global market in 2025.

- By product, the devices segment is expected to witness the fastest growth in the market over the forecast period.

- By specimen, the blood segment registered its dominance over the global market in 2025.

- By specimen, the bone marrow segment is expected to expand rapidly in the market in the coming years.

Market Overview

The circulating tumor cells market focuses on detecting, capturing, and analyzing these cells to support early cancer diagnosis, treatment monitoring, and personalized therapy planning. Circulating tumor cells (CTC) are cancer cells that break away from a primary tumor and travel through the bloodstream, which can lead to cancer spread. This market includes testing kits, detection instruments, reagents, microfluidic devices.

The rising global cancer prevalence, growing demand for liquid biopsy techniques, increasing focus on precision medicine, molecular diagnostics, and AI-based analytics are driving market growth. Additionally, expanding clinical research, growing adoption of non-invasive testing, and improved healthcare infrastructure are enhancing clinical acceptance while allowing faster, safer, and more accurate cancer diagnosis and monitoring.

How is AI Transforming the Circulating Tumor Cells Market?

Artificial intelligence (AI) is transforming the market by making cancer detection, analysis, and treatment monitoring faster, smarter, and more reliable. AI-powered systems can quickly scan thousands of cells and reduce human error, helping healthcare providers to make better decisions. These technologies improve image analysis, automate data processing, and enhance pattern recognition, allowing laboratories to detect changes in tumors that may indicate disease progression. AI also supports personalized medicine by analysing complex biological data to predict therapy outcomes. In research and development, AI accelerates biomarker discovery and optimizes clinical trial design, reducing time and cost.

Circulating Tumor Cells Market Trends

- Growing demand for liquid biopsy and non-invasive cancer testing is driving adoption of CTC technologies, as they offer safer, faster, and more comfortable alternatives to traditional tissue biopsies.

- Expanding adoption of CTC-based diagnostics is supporting better patient selection, therapy optimization, and improved clinical outcomes, especially in advanced and metastatic cancer.

- Increasing investments in cancer research, clinical trials, and biomarker discovery are accelerating innovation and expanding the application of CTC technologies across drug development.

- Growing healthcare infrastructure and awareness in enabling wider clinical access to CTC testing, supporting long-term market growth opportunities.

- Rapid advancements in microfluidics, single-cell analysis and AI-powered platforms are improving CTC capture efficiency, and accuracy for early diagnosis and personalized treatment.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 14.68 Billion |

| Market Size in 2026 | USD 16.75 Billion |

| Market Size by 2035 | USD 54.76 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 14.07% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Application, Product, Specimen, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Technology Insights

Which Technology Segment Dominated the Circulating Tumor Cells Market?

The CTC detection & enrichment methods segment held a major revenue share in the market in 2025, because CTCs are very rare and difficult to find among millions of normal blood cells. These techniques help isolate and concentrate tumor cells, allowing accurate detection. Common approaches include immunocapture methods using positive and negative selection, which rely on specific surface markers to either capture tumor cells or remove unwanted blood cells. Size-based separation and density-based separation methods use physical differences between tumor cells and normal cells for effective isolation. Combined methods, which integrate biological and physical techniques.

The CTC analysis is expected to grow at the fastest CAGR of % in the market between 2026 and 2035, because it provides detailed insights into tumor biology, treatment response, and disease progression. Advanced analytics, AI tools, and single-cell technologies enable more precise monitoring and early release detection. CTC direct detection methods like SERS, advanced microscopy, and imaging-based technologies enable label-free, real-time identification of tumor cells, making faster analysis, high sensitivity and improved clinical confidence in cancer diagnosis.

Application Insights

Which Application Segment Dominated the Circulating Tumor Cells Market?

The research segment held the largest revenue share in the market in 2025, due to the growing research activities, including cancer stem cell studies, tumor development research, and drug and therapy development. The rising investment in oncology research, increasing clinical trials, and demand for personalized treatments are accelerating the adoption of CTC technologies, enabling faster development of innovative cancer therapies.

The clinical/ liquid biopsy segment is expected to grow with the highest CAGR in the market during the studied years, because they are widely used for cancer risk assessment, early screening, and continuous treatment monitoring. These methods offer a safe, non-invasive, and repeatable alternative to tissue biopsies, making them highly practical for routine patient care. Hospitals and diagnostic laboratories increasingly rely on CTC-based liquid biopsies to track disease progression and support timely clinical decisions.

Product Insights

How the Kits & Reagents Segment Dominated the Circulating Tumor Cells Market?

The kits & reagents segment accounted for the highest revenue share in the market in 2025, because they are consumable products used in every test, leading to frequent repeat purchases and steady demand from hospitals, laboratories, and research centres. These include antibodies, buffers, staining agents, and assay kits essential for CTC capture, detection, and analysis. Kits & reagents are comparatively affordable, eliminating the need for researchers to purchase expensive equipment.

The devices segment is expected to expand rapidly in the market in the coming years, due to rapid technological advancements, automation, and integration of AI, which improve accuracy, speed, and workflow efficiency. Growing investments in advanced diagnostic infrastructure further support this growth. Additionally, specialized blood collection tubes play a critical role by preserving CTC integrity, preventing cell degradation, and extending sample stability during transport, ensuring reliable test results, and supporting smooth clinical and laboratory operations.

Specimen Insights

Why Did the Blood Segment Dominate the Circulating Tumor Cells Market?

The blood segment contributed the biggest revenue share in the market in 2025, because blood collection is simple, minimally invasive, widely accepted, and suitable for routine testing. Blood contains detectable levels of CTC, making it ideal for early diagnosis, treatment monitoring, and disease progression tracking. The easy handling, standardized collection methods, and compatibility with most CTC technologies of blood further strengthen its dominance.

By specimen type, the bone marrow segment is expected to show the fastest growth over the forecast period, because bone marrow is a rich source of CTCs. Advanced fluid collection techniques from bone marrow promote the segment's growth. CTCs from bone marrow allow for earlier detection of metastasis, monitoring of dormant cancer cells, and improved prognostic evaluation compared to peripheral blood alone.

Regional Insights

How Big is the North America Circulating Tumor Cells Market Size?

The North America circulating tumor cells market size is estimated at USD 6.02 billion in 2025 and is projected to reach approximately USD 22.73 billion by 2035, with a 14.21% CAGR from 2026 to 2035.

Which Factors Made North America the Dominant Region in the Market?

North America dominated the global circulating tumor cells market in 2025, driven by strong healthcare infrastructure, advanced diagnostic capabilities, and high awareness of early cancer detection. The region benefits from early adoption of innovative liquid biopsy technologies, advanced laboratory facilities, and strong investments in oncology research. The presence of leading biotechnology companies, research institutions, and academic centres supports continuous innovation in CTC detection, enrichment, and analysis platforms. Additionally, favorable reimbursement policies, widespread clinical adoption of precision medicine, and increasing cancer prevalence contribute to steady demand for CTC-based diagnostics.

What is the Size of the U.S. Circulating Tumor Cells Market?

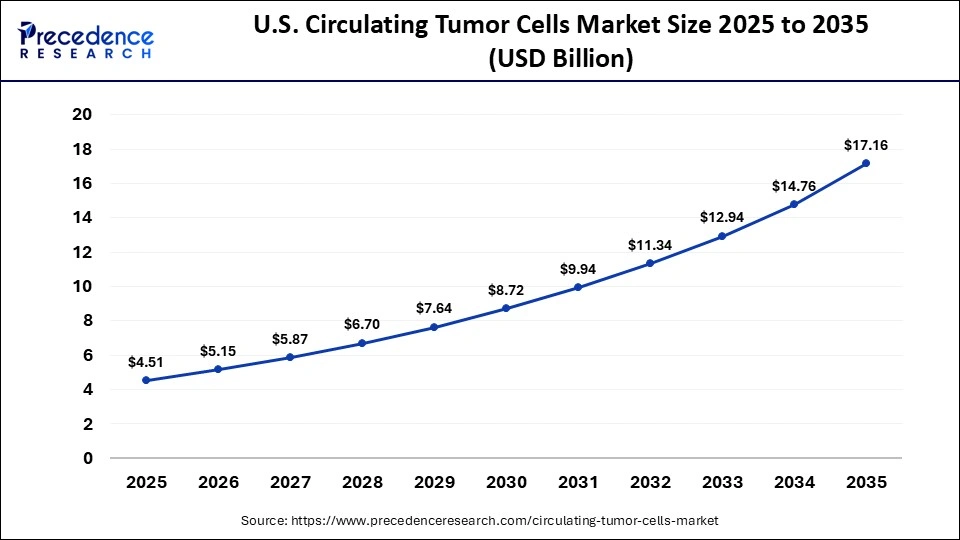

The U.S. circulating tumor cells market size is calculated at USD 4.51 billion in 2025 and is expected to reach nearly USD 17.16 billion in 2035, accelerating at a strong CAGR of 14.30% between 2026 and 2035.

U.S. Circulating Tumor Cells Market Trends

The U.S. holds the largest share within North America, supported by advanced cancer care facilities, high healthcare spending, and strong research funding. The growing burden of cancer, along with rising demand for non-invasive diagnostic solutions, is accelerating the adoption of liquid biopsy technologies, including CTC analysis. The U.S also leads in clinical trials, personalized medicine, and targeted therapy development, driving continuous demand for CTC platforms in oncology research and drug development. Growing patient awareness and physician preference for real-time disease monitoring further expand clinical adoption.

Which Factors Influence the Fastest Growth of Asia-Pacific?

Asia-Pacific is expected to grow at the fastest CAGR in the circulating tumor cells market during the forecast period, driven by rising cancer incidence, expanding healthcare infrastructure, and improving diagnostic access. Rapid urbanization, lifestyle changes, aging populations, and increased exposure to environmental risk factors have significantly increased cancer prevalence across countries like China, India, Japan, and South Korea. Governments across the region are increasing healthcare investments and launching national cancer screening programs, creating strong demand for cost-effective and minimally invasive diagnostic technologies. Growing awareness about early detection, rising adoption of liquid biopsy, and increasing clinical research activities further support market expansion.

India Circulating Tumor Cells Market Trends

India represents a high-growth market driven by rising cancer cases, improving healthcare infrastructure, and growing awareness of early cancer diagnosis. Increasing investments in hospital expansion, diagnostic laboratories, and oncology research centres are creating favorable conditions for CTC technology adoption. Government initiatives such as Ayushman Bharat and national cancer control programs are expanding patient access to advanced diagnostics. Additionally, the rapid growth of private healthcare providers and clinical research organizations is accelerating demand for liquid biopsy testing.

Which Factors Made Europe a Significantly Growing Region in the Market?

Europe represents a significant and steadily growing circulating tumor cells market for CTCs, supported by well-established healthcare systems, strong public health policies, and increasing investments in cancer research. Countries such as Germany, the U.K, France, and Italy are leading adopters of liquid biopsy technology due to high cancer screening rates and a strong focus on early diagnosis. European research institutions actively participate in biomarker discovery and clinical trials, accelerating CTC technology development.

Government-funded healthcare programs and strong regulatory regulation ensure high diagnostic quality and safety standards. Additionally, growing collaborations between research institutes, pharmaceutical companies, and diagnostic developers continue to strengthen the region's innovation ecosystem.

Circulating Tumor Cells MarketValue Chain Analysis

- R&D

Research and development in the market focuses on developing products that help in early detection, treatment, and prevention of cancer.

Key Players: RareCyte, Paragon Genomics, and STEMCELL Technologies, Inc.

- Clinical Trials and Regulatory Approvals

Clinical trials involve testing new CTC technologies in real patients to improve early cancer detection, treatment monitoring, safety, and effectiveness. Regulatory approvals ensure new CTC tests and devices meet safety, accuracy, and quality standards, building trust among doctors and patients.

Key Players: QIAGEN, Bio-Techne Corporation, IQVIA, and ICON plc.

- Formulation and Final Dosage Preparation

Formulation and final dosage preparation involve developing high-performance reagents, antibodies, therapeutic delivery vehicles design to capture CTCs in the bloodstream.

Key Players: Menarini Silicon Biosystems, Thermo Fisher Scientific, and ANGLE plc.

- Packaging and Sterilization

Packaging and sterilization in the market focus on securely sealing and sterilizing kits and tools to maintain cleanliness, sample safety, and accuracy.

Key Players: Guardant Health, Bio-Rad Laboratories, and Menarini Silicon Biosystems.

- Distribution to Hospitals, Pharmacies

Distribution to hospitals and pharmacies involves timely delivery, proper storage, and careful handling of testing kits and devices, ensuring easy availability.

- Patient Support and Services

Patient support and services focus on improving treatment experience through follow-up care, lifestyle guidance, and easy access to healthcare support.

Recent Developments

- In December 2025, Astrin Bioscience launched a blood-based early breast cancer detection test. Certitude supplemental screening test combines AI and proteomics and detects disease in the early stage and works in women with dense breast tissue. The company announced plans to deliver its test in the U.S. by early 2026.(Source: https://www.insideprecisionmedicine.com)

- In April 2025, OneCell Diagnostics launched Oncolncytes, a next-generation liquid biopsy platform that combines CTC analysis with ctDNA, RNA, and proteomics for high-precision cancer profiling. The company also rebranded itself as 1Cell.Ai to focus on combining its deep science expertise with advanced data science capabilities.(Source: https://www.prnewswire.com)

Who are the Major Players in the Global Circulating Tumor Cells Market?

The major players in the circulating tumor cells market include QIAGEN, Thermo Fisher Scientific, Merck & Co., BioCEP Ltd., BioFluidica, AVIVA Biosciences, Canopus Bioscience Ltd., Precision for Medicine, LungLife AI, Inc., Greiner Bio-One International GmbH, ScreenCell, Biolidics Limited, Bio-Techne, Menarini Silicon Biosystem, Miltenyi Biotec, Sysmex Corporation, Rarecells Diagnostics, Fluxion biosciences, LungLife AI, Agilent, Cell Microsystems, Ikonisys, Inc., STEMCELL technologies, and Immnocore.

Segments Covered in the Report

By Technology

- CTC Detection & Enrichment Methods

- Immunocapture (Label-based)

- Positive Selection

- Negative Selection

- Size-based Separation (Label-free)

- Membrane-based

- Microfluidic-based

- Density-based Separation (Label-free)

- Combined Methods

- CTC Direct Detection Methods

- SERS

- Microscopy

- Others

- CTC Analysis

By Application

- Clinical/ Liquid Biopsy

- Risk Assessment

- Screening and Monitoring

- Research

- Cancer Stem Cell & Tumorogenesis Research

- Drug/Therapy Development

By Product

- Kits & Reagents

- Blood Collection Tubes

- Devices or Systems

By Specimen

- Blood

- Bone Marrow

- Other Body Fluids

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content