What is the Commercial Pharmaceutical Analytics Market Size?

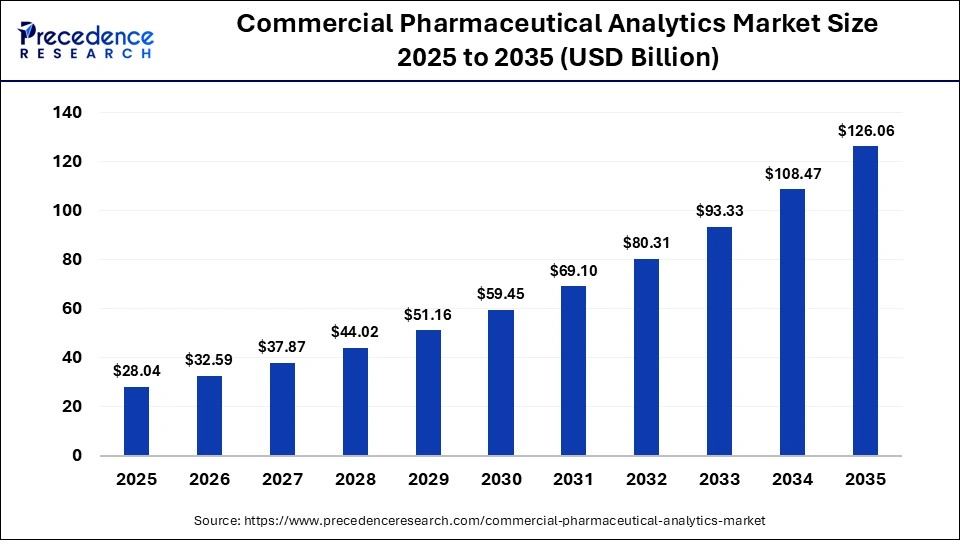

The global commercial pharmaceutical analytics market size was calculated at USD 28.04 billion in 2025 and is predicted to increase from USD 32.59 billion in 2026 to approximately USD 126.06 billion by 2035, expanding at a CAGR of 16.22% from 2026 to 2035. The commercial pharmaceutical analytics market is driven by the rising demand for data-driven sales optimization, market access improvement, and regulatory compliance.

Market Highlights

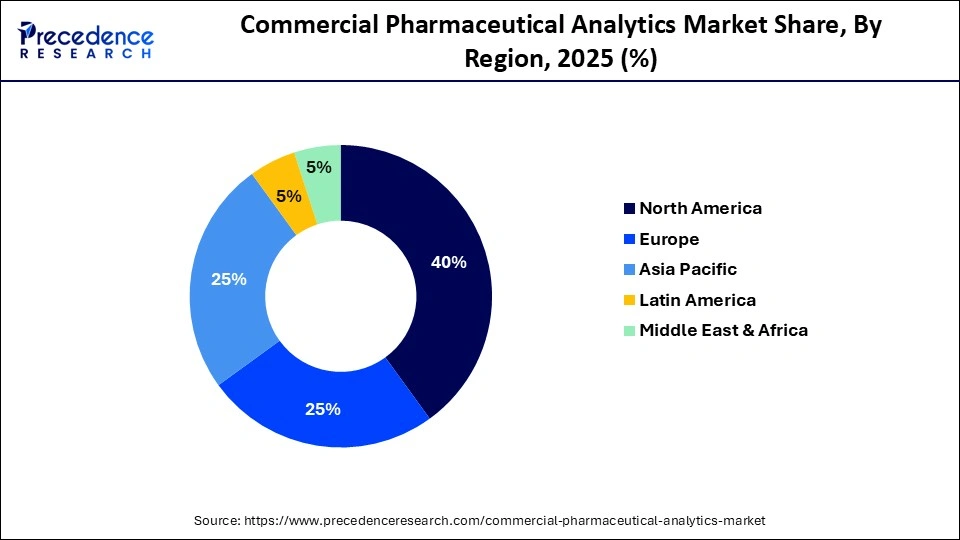

- North America dominated the market, holding the largest market share of 40% in 2025.

- The Asia Pacific is expected to be the fastest-growing region, with a CAGR of 16.8% in the period between 2026 and 2035.

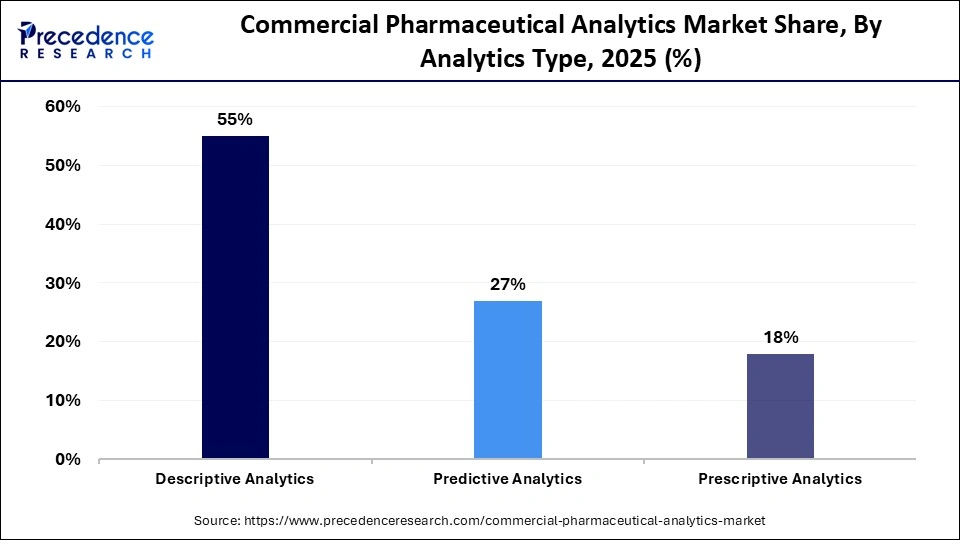

- By analytics type, the descriptive analytics segment held the largest market share of 55% in 2025.

- By analytics type, the predictive analytics segment is expected to reach a CAGR of 15.5% in the commercial pharmaceutical analytics market during the forecasted period.

- By deployment mode, the on-premises segment held the largest market share of 55% in 2025.

- By deployment mode, the cloud-based segment is expected to grow at the highest growth rate of 14.6% in the coming years.

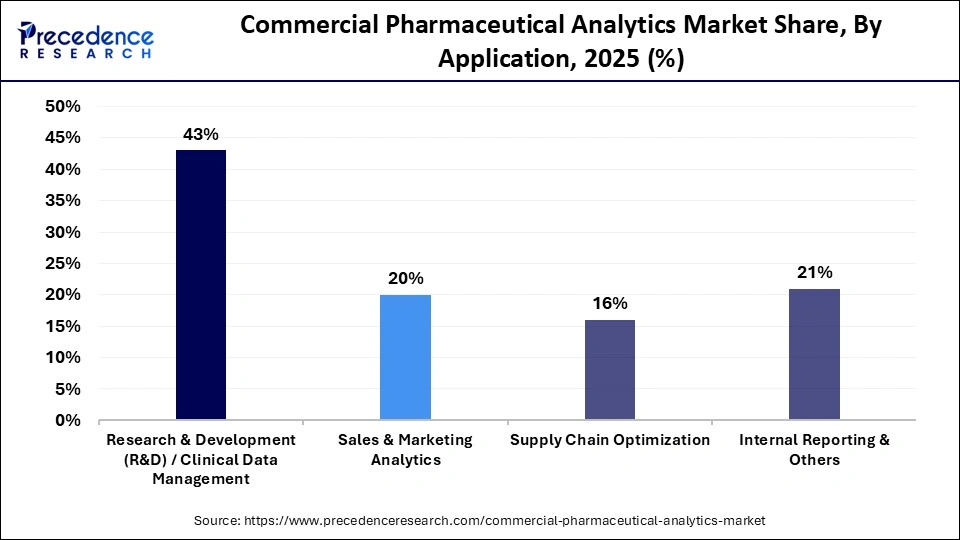

- By application, the research & development/clinical data management segment held the largest market share of 43% in 2025.

- By application, the sales & marketing analytics segment is set to grow at a 14.9% CAGR in the period between 2026 and 2035.

- By end user, the pharmaceutical companies segment held the largest share of 43% in the commercial pharmaceutical analytics market during 2025.

- By end user, the contract research organizations segment is expected to reach a growth rate of 15.2% in the coming years.

Optimizing Pharma Performance: How Innovation Is Revolutionizing Commercial Pharmaceutical Analytics

The commercial pharmaceutical analytics market covers the data analytics services and solutions to manage the clinical data, commercialization strategy, regulatory compliance, and market access strategies. Through descriptive, predictive, and prescriptive analytics, the pharmaceutical companies will be able to turn the complex clinical, operational, and market data into actionable intelligence, thus driving smarter decision-making in R&D, sales, and marketing departments.

The market is experiencing robust growth on the basis of the rising need for data-driven approaches to enhance operational efficiency, lower expenses, and become fast and efficient in taking new therapies to the market. The market growth is also supported by innovations in technology, such as cloud computing, artificial intelligence, machine learning, and software visualization, which help to track the business in real time, make predictions, and plan the business optimally.

Key AI Integration in the Commercial Pharmaceutical Analytics Market

The integration of artificial intelligence is transforming the commercial pharmaceutical analytics market, enabling organizations to convert bulk data of complex information into enterprise actionable outcomes. Machine learning models will enhance predicting the sales because they will better identify the demand trend, seasonal shift, and regional prescribing trend. Predictive analytics are employed to identify high-potential areas, serve the sales force, and reduce churn rates. In the market access and pricing, AI models are applied to evaluate or gauge the reimbursement trends and the payer behavior as a method of bargaining in a more assertive manner.

Commercial Pharmaceutical Analytics Market Trends

- The increased use of AI and machine learning to improve the accuracy of sales forecasting, customer targeting, demand planning, and real-time monitoring of performance in all commercial activities in the pharmaceutical sector.

- Scaling up the utilization of cloud-based analytics infrastructure to aid mass information control, faster generation of insights, cross-functional collaboration, and reduced infrastructure and maintenance costs.

- Higher investment in the state-of-the-art visualization and self-service analytics solutions to allow commercial departments to make decisions faster and have more strategic planning opportunities.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 28.04Billion |

| Market Size in 2026 | USD 32.59 Billion |

| Market Size by 2035 | USD 126.06Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 16.22% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Analytics Type, Deployment Mode, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Analytics Type Insights

Why Did the Descriptive Analytics Segment Hold a 55% Share in 2025?

In 2025, the descriptive analytics segment commanded a 55% market share in the commercial pharmaceutical analytics market because it was an essential part of summarizing the past data and offering practical solutions. Descriptive analytics can also allow pharmaceutical companies to observe performance, respectively, in sales, physician prescribing, and marketing campaign evaluation to aid informed decision-making in each area of commercial activity. Also, the growing need to have real-time dashboards, KPI tracking, and performance reporting tools in the pharmaceutical industry has enhanced the dominance of the segment. Descriptive analytics is the basis of more sophisticated techniques of analytics, such as predictive and prescriptive analytics, since it assists organizations in identifying trends, gaps, and opportunities.

The predictive analytics segment is set to grow at a 15.5% CAGR in in the forecasted period and proved to be the most dynamic segment. Predictive analytics will enable pharmaceutical businesses to understand the future physician demand, allocate their sales force efficiently, and improve healthcare provider targeting strategies. The segment enjoys a growing availability of data, including electronic medical records, prescription data, and market access insights, to predictive models, to make more accurate projections. Also, cutting-edge visualization software, cloud computing, and computer algorithms that apply artificial intelligence allow analyzing challenging data streams in real-time, making the process of decision-making more efficient. Predictive analytics is fast becoming an interactive and crucial component of commercial pharmaceutical analytics by offering the ability to model scenarios and authoritatively evaluate the risk and demand.

Deployment Mode Insights

Why Did the On-Premises Segment Hold a 55% Share in the Commercial Pharmaceutical Analytics Market During 2025?

The on-premises segment dominated the market with a 55% share in 2025 due to the increasing demand since the pharmaceutical companies are in need of more control over sensitive and proprietary information. On-premise solutions also enable the firms to take charge of the internal security measures, compliance with rigid regulatory systems, and tailor analytics solutions to the demands of the particular organization. Also, connectivity to existing systems, safe management of sensitive clinical and trade information, and less reliance on access to the internet are affecting adoption. There is growing awareness of hybrid strategies and investments in internal IT infrastructure, which are driving the growth in the commercial pharmaceutical analytics market.

The cloud-based segment is expected to grow at the fastest rate of 14.6% during the forecasted period due to its flexibility, scalability, and cost-efficiency. Clouds facilitate the central storage of data, real-time cooperation, and hassle-free integration of various sources of data, such as sales, marketing, and clinical information. The idea of cloud-based solutions is becoming more popular among pharmaceutical companies as a tool to enable them to work remotely, operate in multiple locations, and make decisions based on data, without investing heavily in IT infrastructure. Scalability of resources based on demand, automated updates, and secure and compliant environments add to its adoption.

Application Insights

Why Did Research & Development/Clinical Data Management Lead the Commercial Pharmaceutical Analytics Market in 2025?

The research & development/clinical data management segment dominated the commercial pharmaceutical analytics market, occupying 43% in 2025, due to the increased emphasis on data in drug discovery and development. R&D analytics can help companies to track the results of clinical trials, discover patient subpopulations, design trials, and remain regulatory compliant. Using real-time dashboards and predictive models and integrating AI enables researchers to analyze large datasets of trials, electronic medical records, and genomics research effectively. The use of superior commercial analytics in the R&D department makes it easy to make decisions regarding the allocation of resources, portfolio management, and market potential.

The sales and marketing analytics segment, with an expected growth rate of 14.9%, will grow significantly with the growing popularity of customized physician engagement and multichannel marketing shoots. The combination of AI, cloud computing, and real-time analytics helps the decision-making process to become quick and accurate. The increasing rivalry, growth of specialty medications, and focus on value-based medication are compelling pharmaceutical firms to spend excessively on sales and marketing data. The ability of the segment to provide operational knowledge to market strategy and leverage an increase in revenue generation makes it the quickest growing sector of application.

End User Insights

Why Did the Pharmaceutical Companies Segment Hold a 43% Share in the Commercial Pharmaceutical Analytics Market During 2025?

The pharmaceutical companies occupied a 43% share of the commercial pharmaceutical analytics market in 2025 due to the fact that they were globalized, had massive sales networks, and also had massive commercial strategies. Analytics can be applied to help these companies optimize the allocation of resources, monitor market access, evaluate physician engagement, and demand. Pharmaceutical companies can develop more effective decisions, enhance commercial effectiveness, and improve competitive positioning with the help of descriptive analytics and predictive analytics, cloud models, and AI integration possibilities. The pipelines of R&D and growing biologics portfolios increase the necessity to employ advanced analytics for primary marketing, sales, and clinical strategy.

The contract research organizations segment is set to have high growth because pharmaceutical companies are increasingly outsourcing their clinical trial, regulatory support service, and commercial analytics functions. Analytics also assists the CROs to handle data in the trial, creating a better study design, predicting, and offering insights on the market most effectively to the clients. The need to address both the increasing demand for specific, affordable, and scalable services promotes the growth of the use of analytics by CROs. The addition of cloud solutions, AI, and predictive models further increases the operational features, which makes CROs a rapidly expanding end-user demographic.

Region Insights

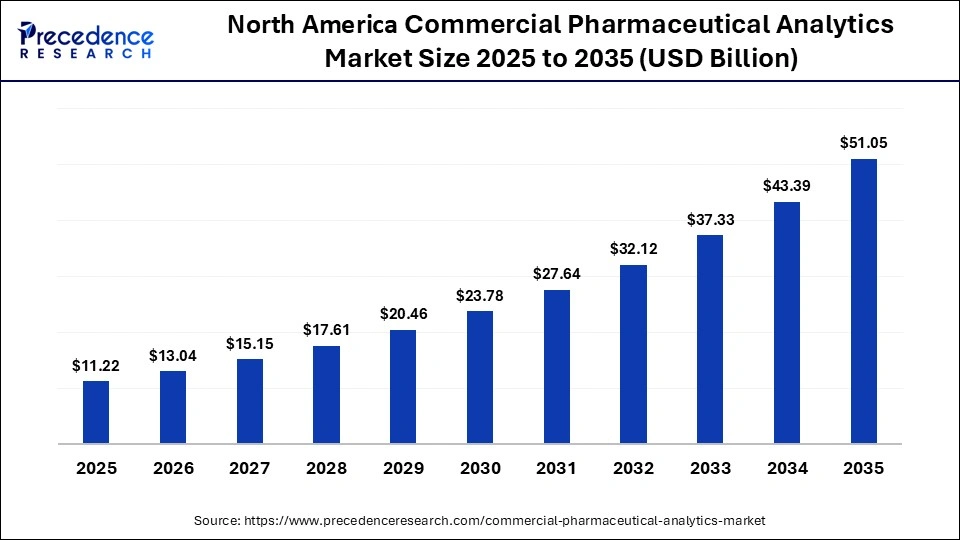

How Big is the North America Global Commercial Pharmaceutical Analytics Market Size?

The North America commercial pharmaceutical analytics market size is estimated at USD 11.22 billion in 2025 and is projected to reach approximately USD 51.05 billion by 2035, with a 16.36% CAGR from 2026 to 2035.

Why Did North America Lead the Global Commercial Pharmaceutical Analytics Market in 2025?

In 2025, North America was the largest market with a 40% share of the commercial pharmaceutical analytics market due to the highly developed healthcare infrastructure and the existence of giant pharmaceutical and biotechnological companies. The region has the benefits of the early adoption of digital technologies, including AI, big data, and cloud-based analytics platforms, which can be used to make commercial decisions faster and more accurately. Furthermore, tough regulatory requirements by the government agencies, such as the FDA, require the need to have robust data management, compliance surveillance, and reporting systems.

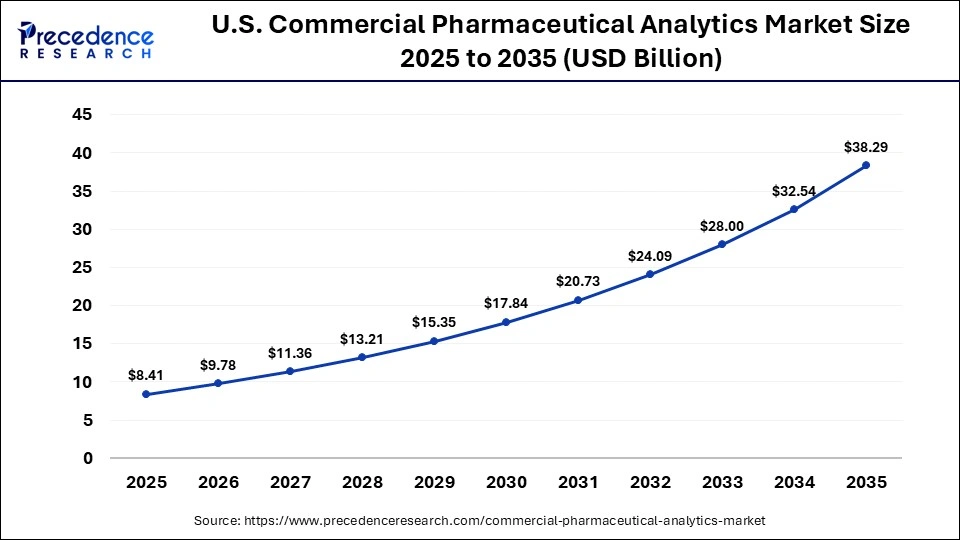

What is the Size of the U.S. Global Commercial Pharmaceutical Analytics Market?

The U.S. commercial pharmaceutical analytics market size is calculated at USD 8.41 billion in 2025 and is expected to reach nearly USD 38.29 billion in 2035, accelerating at a strong CAGR of 16.37% between 2026 and 2035.

U.S. Commercial Pharmaceutical AnalyticsMarket Analysis

The United States leads the market in the North America region in the commercial pharmaceutical analytics. The United States is the major contributor to the market in the region. The country's growth is supported by the increasing demand for 5G network connectivity, widespread adoption of smartphones, surging adoption of IoT platforms, and increasing focus on targeting niche markets (specific demographics). With the rapid rise of eSIM, 5G, IoT, and private LTE networks, MVNOs are increasingly focusing on expanding beyond consumer mobile into enterprise and industrial solutions, creating new MVNO opportunities in a country's highly competitive market. These collective factors are expected to drive the growth of the mobile virtual network operator market in the country during the forecast period.

Why Is Asia Pacific Undergoing the Fastest Growth in the Commercial Pharmaceutical Analytics Market?

The Asia Pacific region is experiencing the most rapid growth in the world's commercial pharmaceutical analytics market, which has a 25% market share, through the fast rate of pharmaceutical manufacturing and increasing investments in healthcare. Such nations as China, India, Japan, and South Korea have been experiencing the rising demand for sophisticated analytics to handle the growing product line and the intricate distribution channels. The governments are also advocating digital health projects and modernizing the healthcare IT, speeding up the use of technology. Increasing competition between local and international drug producers further aggravates the necessity of data-driven business analysis, which makes the Asia Pacific markets the highest growth.

Why Is the European Commercial Pharmaceutical Analytics Market Experiencing Notable Growth?

The European commercial pharmaceutical analytics market, with a 25% share, is experiencing notable growth with increased emphasis on a value-based approach to healthcare and regulatory transparency. The increased application of analytics by pharmaceutical companies in Germany, the UK, France, and other EU states is a new strategy of proving the efficiency of treatment, setting prices, and improving the outcomes of reimbursement. Furthermore, the pharmaceutical business in the area is emerging with more and more AI-based forecasts, client database segmentation, and multi-channel marketing statistics.

Who are the Major Players in the Global Commercial Pharmaceutical Analytics Market?

The major players in the commercial pharmaceutical analytics market include IQVIA, Optum/OptumInsight, McKesson, IBM / IBM Watson Health, Oracle Corporation, SAS Institute Inc., CitiusTech Inc., Scio Health Analytics, Take Solutions Ltd., Trinity Pharma Solutions, Wipro Limited, Statistical Analysis Syste, Veeva Systems, ZS Associates, Clarivate Analytics

Recent Developments

- In January 2026, Nvidia and Eli Lilly announced a 1 billion dollar co-innovation AI lab to speed up drug discovery and scale AI applications to pharmaceutical processes. The partnership aims at utilizing the AI platforms at Nvidia and clinical experience at Lilly to transform the research-to-market efficiency.(Source: https://investor.lilly.com)

- In December 2025, Bristol Myers Squibb and Accenture proposed Mosaic, a medical content hub founded on generative AI, in Mumbai to create customized educational material among doctors within a brief period of time. Enhanced commercial interaction and digital communication policy, which is going to be a benefit of the project, will be achieved through advanced analytics and AI-related insights.(Source: https://www.bms.com)

- In January 2025, IQVIA also partnered with NVIDIA to apply complex agent-based AI solutions to life sciences analytics to automate complex workflows via research and commercialization. The general aim of this collaboration is to facilitate the use of data-driven decisions and accelerate the commercialization process through the assistance of integrated AI and analytics.(Source: https://www.iqvia.com)

Market Segmentation

By Analytics Type

- Descriptive Analytics

- Predictive Analytics

- Prescriptive Analytics

By Deployment Mode

- Cloud-Based

- On-Premises

By Application

- Research & Development (R&D)/Clinical Data Management

- Sales & Marketing Analytics

- Supply Chain Optimization

- Internal Reporting & Others

By End User

- Pharmaceutical Companies

- Biotechnology Firms

- Contract Research Organizations (CROs)

- Healthcare Providers & Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content