Data Center Containment Market Size and Forecast 2025 to 2034

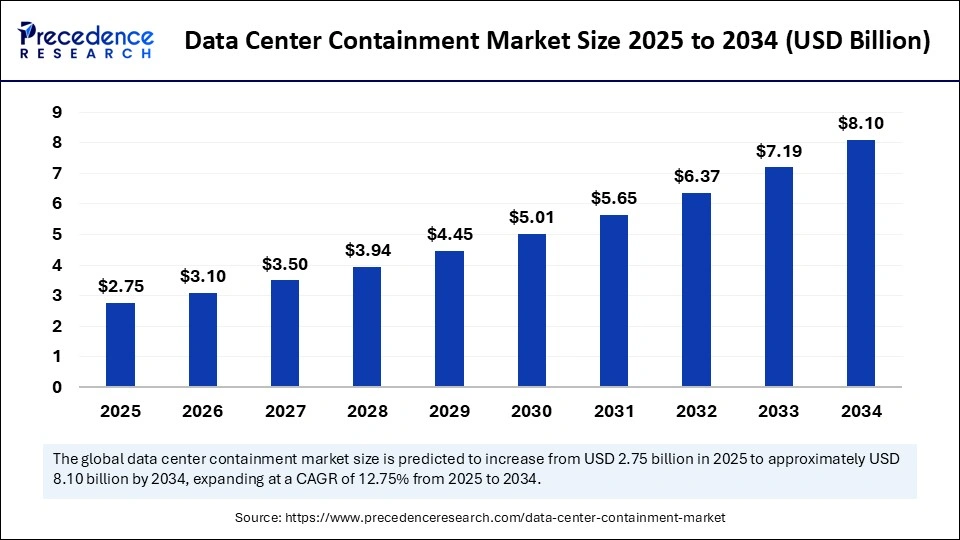

The global data center containment market size accounted for USD 2.44 billion in 2024 and is predicted to increase from USD 2.75 billion in 2025 to approximately USD 8.10 billion by 2034, expanding at a CAGR of 12.75% from 2025 to 2034. The data center containment market has experienced significant growth in recent years, reflecting the increasing reliance on digital platforms for freelance and gig-based work. As of 2024, the market size is estimated at USD 2.44 billion.

Data Center Containment Market Key Takeaways

- In terms of revenue, the global data center containment market was valued at USD 2.44 billion in 2024.

- It is projected to reach USD 8.10 billion by 2034.

- The market is expected to grow at a CAGR of 12.75% from 2025 to 2034.

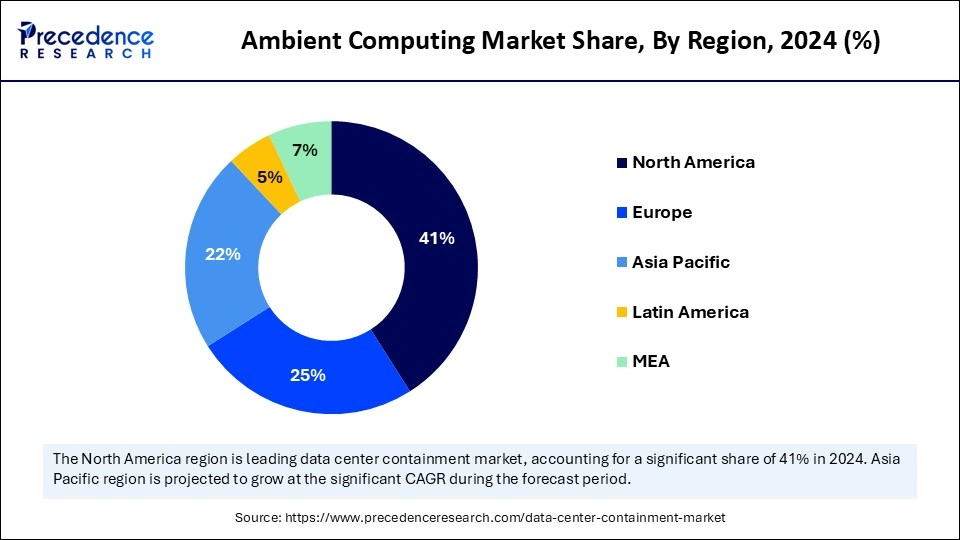

- North America dominated the data center containment market with the largest market share of 41% in 2024.

- By region, Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period.

- By containment type, the aisle containment segment led the market in 2024.

- By containment type, the modular/containerized containment segment is expected to grow at the fastest CAGR during the forecast period.

- By deployment/arrangement, the end-cap segment accounted for a considerable share in 2024.

- By deployment/arrangement, the in-row segment is projected to experience the highest growth CAGR between 2025 and 2034.

- By data center type, the hyperscale & colocation segment contributed the highest market share in 2024.

- By data-center type, the edge / micro data centers segment is set to experience the fastest CAGR from 2025 to 2034.

- By development stage type, the clinical supply segment captured the biggest market share in 2024.

- By development stage type, the IND/CTA enabling services for advanced modalities are the fastest growing from 2025 to 2034.

- By material & construction type, the Metal/hard-panel and engineered curtain systems segment generated the major market share in 2024.

- By material & construction type, the prefab modular pod materials for rapid deployment are the fastest-growing from 2025 to 2034.

- By scale/capacity/density served, the medium density segment held the maximum market share in 2024.

- By scale/capacity/density served, the high and ultra-high-density containment are the fastest growing from 2025 to 2034.

- By business/contract model, the product sale + turnkey install segment captured the maximum market share in 2024.

- By business/contract model, performance-based & capacity rental for modular/edge deployments are the fastest-growing segments from 2025 to 2034.

Securing Efficiency in Modern Data Centers

Systems and services that manage and isolate airflow, heat, and environmental zones inside data centers, including aisle containment (hot-aisle/cold-aisle), rack/chimney, curtains, hard-panel enclosures, and modular containerized solutions intended to improve cooling efficiency, reduce PUE, protect equipment, and enable higher rack densities across hyperscale, colocation, and enterprise facilities.

The data center containment market is experiencing steady growth as organizations strive to improve cooling efficiency and reduce energy costs. Containment solutions whether hot aisle or cold aisle help optimize airflow and maintain consistent temperatures, protecting critical IT equipment. With the increasing global demand for data, the need for scalable and energy-efficient data centers has intensified. Enterprises are increasingly adopting containment systems to extend the life of infrastructure and ensure sustainable operations. Cloud adoption and edge computing are adding further pressure on data centers to operate at peak efficiency. This creates a strong demand outlook for containment technologies as the backbone of modern digital infrastructure.

How AI is impacting the Intelligent Containment for Smarter Cooling?

Artificial intelligence is reshaping the data center containment market by enabling predictive cooling and real-time airflow optimization. AI-powered systems can analyze environmental variables to dynamically adjust cooling zones, ensuring maximum efficiency. This reduces operational costs while lowering the carbon footprint of facilities. Data centers are also leveraging AI to forecast demand spikes and adjust containment accordingly. By integrating AI-driven digital twins, operators can test and simulate containment strategies before implementation. Overall, AI is transforming containment from a passive design feature into an intelligent, adaptive system.

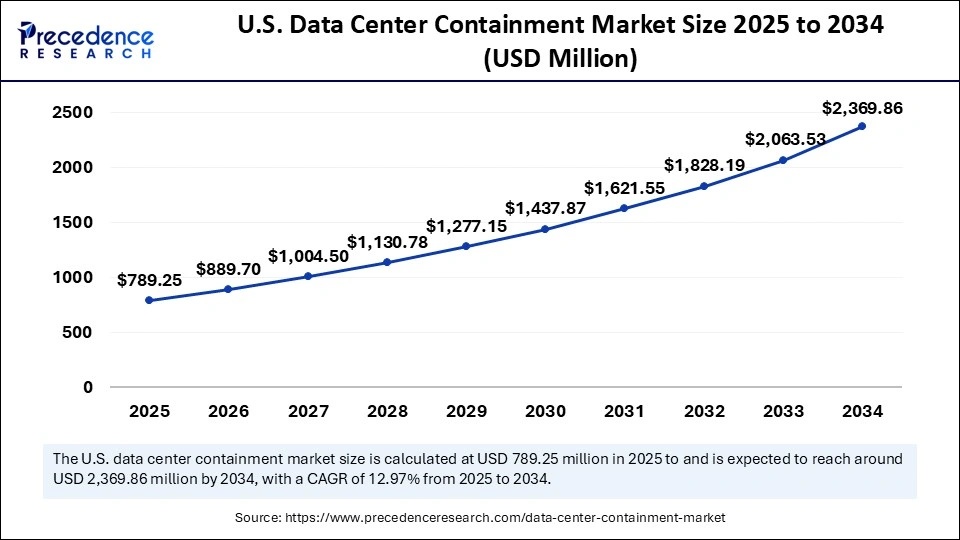

U.S. Data Center Containment Market Size and Growth 2025 to 2034

The U.S. data center containment market size was exhibited at USD 700.28 million in 2024 and is projected to be worth around USD 2,369.86 million by 2034, growing at a CAGR of 12.97% from 2025 to 2034.

How Is North America Pioneering Adoption and Technological Leadership?

North America dominates the data center containment market due to its extensive network of hyperscale facilities and cloud service providers. The region is home to major players like Amazon, Google, and Microsoft, all of which are investing heavily in cooling optimization. A strong regulatory focus on energy efficiency also drives the adoption of advanced containment strategies. Enterprises across finance, healthcare, and retail industries are prioritizing containment to reduce operational costs. Vendors in the region are at the forefront of integrating AI and automation into containment systems. Overall, North America's robust digital infrastructure cements its leadership in the market.

Its dominance is also fuelled by early adoption of modular and customizable containment solutions. Strong venture capital investment in green technologies has accelerated innovation across the region. Collaboration between universities, data centre operators, and technology vendors fosters a thriving ecosystem. The growing importance of 5G and edge computing is further boosting demand for smaller, efficient data centres. Continuous upgrades to existing facilities maintain high demand for containment. As a result, North America remains the benchmark for the adoption of containment worldwide.

What Makes Asia Pacific the Fastest-Growing Data Center Containment Market?

Asia-Pacific is the fastest-growing market for data center containment market, driven by rapid digitalization and cloud adoption. Countries like China, India, and Singapore are investing heavily in new data centres to support their expanding digital economies. The rise of e-commerce, fintech, and streaming services is intensifying the need for reliable, energy-efficient operations. Governments in the region are promoting sustainability initiatives that encourage containment solutions. Local players are increasingly collaborating with global vendors to introduce advanced technologies. This creates a dynamic and rapidly expanding growth environment for containment providers.

The region's growth is further supported by expanding internet penetration and surging data consumption among young populations. Investment in 5G rollout and smart city projects adds to the demand for edge and colocation data centres. Cost advantages in construction make APAC an attractive destination for global hyperscale expansions. Enterprises in the region are showing rising awareness of the long-term savings containment provides. Multinational companies are also setting up regional hubs, boosting containment needs across industries. Consequently, Asia-Pacific stands out as the fastest-growing region in the global market.

Key Trends: Modular, Green, and Software-Driven Solutions

- A major trend in the market is the shift toward modular containment systems that can be quickly deployed or reconfigured.

- Sustainability is another dominant theme, as enterprises prioritize green data centers with low power usage effectiveness (PUE).

- Software-driven monitoring and automation tools are being integrated with containment solutions for improved visibility.

- Vendors are also focusing on customizable designs that support both legacy and new facilities.

- The rise of hyperscale data centres is further accelerating large-scale containment deployments.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 8.10 Billion |

| Market Size in 2025 | USD 2.75 Billion |

| Market Size in 2024 | USD 2.44 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.75% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Containment Type, Deployment/Arrangement, Data Center Type, Material & Construction, Scale/Capacity / Density Served, Business/Contract Model, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Digital Growth Fueling Thermal Innovation

Explosive growth in cloud computing, big data analytics, and AI workloads is a key driver for the data center containment market. Rising energy costs are pushing organizations to adopt more efficient cooling solutions. Government and enterprises alike are under pressure to reduce carbon emissions, further boosting contamination adoption. The surge in hyperscale and colocation facilities demands consistent, scalable cooling strategies. Edge data centers are also fueling containment growth as smaller facilities seek to maximize limited space. Overall, rising digitalization is directly driving the need for containment technologies.

Restraint

Cost and Complexity Challenge Adoption

High upfront investment remains a significant barrier for small and medium-sized enterprises considering data center containment market solutions. Retrofitting existing facilities with containment systems can be complex and disruptive. Some organizations still perceive containment as an optional feature rather than a necessity. Inconsistent standards and a lack of awareness about long-term savings also slow adoption. Technical challenges such as airflow leaks and system integration further complicate deployment. Together, these factors create hurdles that restrain faster market penetration.

Opportunities

Edge and Sustainable Data Centers Lead the Way

The rapid rise of edge computing offers new opportunities for containment providers, as localized data centers require highly efficient cooling. Growing sustainability mandates open the door for eco-friendly containment designs that reduce energy waste. Partnerships between containment vendors and AI solution providers present opportunities to create next-generation smart systems. Emerging markets are also investing heavily in digital infrastructure, offering untapped potential for containment adoption. Demand for modular solutions tailored for scalable growth is expanding across multiple industries. These factors collectively highlight promising opportunities for the containment market in the coming years.

Containment Type Insights

Why Is Aisle Contamination Dominating the Data Center Containment Market?

Aisle contamination, encompassing both hot aisle and cold aisle designs, remains dominant in the data center containment market due to its proven ability to enhance cooling efficiency. Most hyperscale and enterprise data centers prefer aisle containment because it provides a balance of cost-effectiveness and performance. The design isolates hot and cold airflows, ensuring consistent rack temperatures and reducing strain on cooling systems. Adoption is particularly high in North America and Europe, where legacy facilities are being retrofitted with aisle containment systems. The solution is also attractive to operators due to its compatibility with existing rack arrangements. As a result, aisle containment remains the most widely deployed containment type in data centers worldwide.

The dominance of aisle containment is further reinforced by its scalability and adaptability across different data center sizes. Operators appreciate its relatively straightforward installation process compared to other configurations. Many vendors have developed standardized aisle containment products, driving down costs and increasing adoption. The ability to retrofit existing data centers with aisle systems makes them a flexible solution for enterprises aiming for incremental upgrades. In addition, aisle containment supports compliance with sustainability and energy efficiency goals, strengthening its appeal. This combination of practicality, affordability, and performance ensures aisle containment retains its dominant market share.

Modular containment solutions are the fastest-growing segment, driven by the need for flexible, quick-to-deploy systems in rapidly scaling data centers. Operators prefer modular solutions because they allow phased deployment without large upfront investments. These systems are highly adaptable, enabling data centers to reconfigure layouts as capacity needs evolve. The rise of colocation and edge facilities, which demand agile construction models, is further boosting adoption. Modular containment also reduces downtime during installation, making it attractive for dynamic business environments. This adaptability positions modular containment as the clear growth leader in the market.

The segment is also growing due to increasing demand for prefabricated solutions that can be shipped and assembled on-site with minimal disruption. Enterprises appreciate the ability to customize modular units to match specific airflow and density requirements. Vendors are increasingly innovating with modular kits that integrate sensors and monitoring systems for optimized performance. The approach aligns with global trends toward green data centers by reducing waste and improving energy efficiency. Modular containment also appeals to smaller operators looking to scale cost-effectively. With its flexibility and scalability, modular containment is on track to outpace traditional systems in growth.

Deployment Insights

Why Is End-Cap Dominating the Data Center Containment Market?

End-cap containment dominates the deployment segment due to its widespread use in large-scale and legacy data centres. It provides an effective solution for isolating hot or cold aisles by sealing both ends, ensuring efficient airflow management. The simplicity and proven performance of end-cap systems have made them the default choice for many operators. They are cost-efficient and relatively easy to implement, especially in facilities with standardized rack arrangements. Their adoption is further strengthened by compatibility with both retrofits and new builds. Overall, end-cap containment continues to anchor the market as the most common deployment method.

The success of end-cap containment also lies in its ability to significantly reduce energy consumption without requiring extensive structural changes. Enterprises appreciate the measurable ROI from lowered cooling costs and improved rack utilization. The design is well-suited for hyperscale facilities that require uniform cooling strategies across large numbers of racks. Vendors have standardized end-cap designs, which reduces installation time and cost. Regulatory compliance related to sustainability is also driving operators to choose reliable end-cap containment. As such, end-cap containment is expected to remain dominant in the foreseeable future.

In-row containment is the fastest-growing deployment method in the data center containment market, driven by demand for precision cooling in high-density environments. Unlike end-cap systems, in-row containment isolates airflow at the rack level, allowing targeted temperature management. This makes it ideal for edge data centres and smaller facilities with space constraints. The growth of AI, HPC, and other intensive workloads has further increased demand for in-row cooling precision. Data centres prioritizing maximum rack utilization and localized airflow efficiency are embracing this design. Its rising relevance in new-generation data centres makes it the fastest-growing deployment type.

In addition, in-row containment supports modular expansion, aligning well with dynamic IT environments. Its targeted approach also reduces overcooling, delivering cost savings and improving sustainability metrics. Vendors are developing advanced in-row systems integrated with monitoring software, making them more intelligent and adaptive. As more data centres move toward high-performance computing, the need for in-row precision solutions will accelerate. Edge computing facilities, which cannot rely on large-scale systems, are also fuelling demand. These advantages firmly position in-row containment as the fastest-growing deployment method.

Data Center Type Insights

Why Is Hyperscale & Colocation Dominating the Data Center Containment Market?

Hyperscale and colocation facilities dominate the data center containment market due to their massive scale and critical need for energy efficiency. These facilities house thousands of racks, making airflow optimization essential to reduce operational costs. Aisle containment and modular solutions are heavily deployed to achieve low PUE values. Colocation providers also adopt containment to attract enterprise clients demanding sustainability compliance. With the continued expansion of cloud services, hyperscale and colocation centers are rapidly scaling capacity. This makes them the primary revenue contributors for containment providers.

Large investments from cloud giants such as AWS, Microsoft, and Google reinforce the dominance of this segment. These players prioritize energy efficiency not only for cost savings but also for ESG commitments. Colocation providers adopt advanced containment systems as a competitive differentiator in crowded markets. Hyperscale operators are early adopters of AI-driven containment, further driving innovation. The need to optimize large-scale operations ensures hyperscale and colocation facilities remain the strongest demand centers. As global digital demand grows, these facilities will continue to dominate containment adoption.

Edge data centers are the fastest-growing type, reflecting the decentralization of digital infrastructure. As 5G, IoT, and AI applications proliferate, edge facilities are becoming essential for low-latency processing. These smaller data centers require compact and highly efficient containment solutions to manage limited cooling capacity. Modular and in-row containment are especially popular in edge deployments due to their flexibility. Edge data centers also drive demand for prefabricated solutions that can be deployed rapidly. This growth trajectory makes edge facilities the most dynamic segment for the adoption of containment.

Additionally, the cost-sensitive nature of edge operations increases reliance on efficient airflow management to maximize ROI. Containment solutions help edge facilities achieve enterprise-grade reliability despite their smaller size. Governments and telecom operators are investing heavily in edge infrastructure, further fueling adoption. Vendors are tailoring lightweight and customizable containment solutions specifically for edge use cases. With the global rollout of smart cities and 5G, demand for edge containment will only accelerate. This positions edge data centers as the fastest-growing type in the containment market.

Material & Construction Insights

Why Are Mental/Hard-Panel and Engineered Curtain Systems Dominating the Data Center Containment Market?

Hard-panel metal and engineered curtain systems dominate the containment market because of their durability and long lifespan. These systems provide robust physical barriers that effectively separate hot and cold airflows. Enterprises prefer hard panels for large facilities due to their structural strength and consistent performance. Engineered curtain systems are also widely used because they offer a balance between cost and adaptability. Vendors have standardized these materials, making them reliable and widely available. As a result, this category remains the most commonly used material in containment solutions.

The dominance of these materials is also tied to their ability to withstand the demands of hyperscale data centres. Operators value their longevity, which ensures stable performance over time with minimal maintenance. Hard panels are especially popular in facilities with high-density racks where stability is critical. Engineered curtains, on the other hand, provide flexibility for retrofits. Their compatibility with existing infrastructure makes them a default choice for many operators. Overall, metal and curtain systems continue to anchor the containment materials market.

Prefabricated modular pod materials are the fastest-growing category due to the surge in demand for rapid deployment solutions. These materials allow entire containment pods to be manufactured off-site and assembled quickly in data centers. This reduces installation time and minimizes operational disruption. Prefab pods are especially attractive to colocation and edge operators needing fast scalability. Their modularity supports phased investment, aligning with modern business needs. This makes prefab modular pod materials the leading growth driver in the materials segment.

Scale Insights

Why Is Medium Density Dominating the Data Center Containment Market?

Medium-density systems dominate the containment market because they represent the most common operational setup globally. Facilities with rack densities between 6 and 12 kilowatts strike a balance between cost efficiency and performance. Containment systems in medium-density environments deliver significant energy savings without requiring extreme infrastructure changes. Enterprises prefer medium density as it supports a wide range of workloads while maintaining manageable cooling needs. Vendors also target this density range with standardized containment products. As a result, medium-density facilities remain the largest user base for containment technologies.

High and ultra-high-density data centers are the fastest-growing segment due to increasing demand for AI, HPC, and big data workloads. These environments often exceed 20 kW per rack, requiring advanced containment to manage heat loads. Traditional cooling methods struggle in these setups, making containment indispensable. Hyperscale providers and research facilities are leading adopters of high-density containment solutions. The rise of GPU-heavy computing is accelerating this demand. This positions high and ultra-high density as the fastest-growing scale segment.

Businesses Insights

Why Product Sales and Turnkey Installation Dominate the Data Center Containment Market?

Product sales dominate the containment business model, as most enterprises prefer to purchase and own the equipment outright. Vendors traditionally focus on selling aisle doors, panels, curtains, and modular kits as standalone products. This model provides customers with complete control over installation and customization. It also allows vendors to benefit from large one-time revenue streams. Enterprises, especially hyperscale operators, prefer ownership to maintain long-term ROI. As a result, product sales remain the core revenue model for containment vendors.

Performance-based and capacity rental models are the fastest-growing business approaches in the containment market. Enterprises are increasingly adopting OPEX-driven models to avoid heavy upfront investments. Vendors offer containment as a service, linking fees to performance metrics such as energy savings. This aligns with the growing trend of as-a-service solutions in IT infrastructure. Smaller operators and colocation providers particularly benefit from this pay-as-you-go flexibility. As a result, performance-based and rental models are expanding rapidly.

Data Center Containment Market Companies

- Vertiv Group Corp.

- Rittal GmbH & Co. KG

- Eaton Corporation

- nVent / Schroff / Hoffman brands

- Schneider Electric

- Legrand

- Polargy, Inc.

- Chatsworth Products (CPI)

- Sealco

- Maysteel

- Upsite Technologies

- Subzero Engineering

- Tate

- Panduit

- STULZ/Rittal partners

Recent Developments

- In September 2025, Artificial intelligence data centers are projected to drive a substantial rise in global water consumption over the next few years, according to the report by Morgan Stanley. The report estimates that annual water use for cooling and electricity generation in AI data centres could reach around 1,068 billion liters by 2028, representing an 11-fold increase from 2024 levels. While direct water use for cooling in data centers is widely recognized, the report highlights that indirect consumption through electricity generation remains largely overlooked.(Source: https://economictimes.indiatimes.com)

Segment Covered in the Report

By Containment Type

- Aisle Containment (Cold-Aisle Containment, Hot-Aisle Containment)

- Rack/Chimney Containment (Rack-Level Ducts/Hoods)

- Curtain/Soft Containment (Flexible Curtains, Strip Doors)

- Hard-Panel/Gangway Containment (Rigid Panels, Sealed Aisles)

- Modular / Containerized Containment (Factory-Built Pods, Micro-Data Centers)

By Deployment/Arrangement

- In-Row / In-Rack Containment (Localized In-Row Panels & Doors)

- End-Cap Aisle Containment (Full Aisle End Walls + Doors)

- Room-Level Containment (Room Partitioning)

- Hybrid Containment (Mixed Soft/Hard Or Partial Aisles)

By Data Center Type (Customer/Demand Source)

- Hyperscale Cloud Data Centers

- Colocation & Multi-Tenant Data Centers

- Enterprise / On-Premises Data Centers

- Edge / Micro Data Centers (Telecom, CDN, Industrial)

By Material & Construction

- Steel/Aluminum Hard Panels & Frames

- Polycarbonate/Glass Panels

- Fabric/Curtain Systems (PVC, Fire-Retardant Fabrics)

- Modular Prefabricated Pods (Composite Panels)

By Scale/Capacity / Density Served

- Low Density (<5 kW/rack)

- Medium Density (5–15 kW/rack)

- High Density (>15 kW/rack)

- Ultra-High Density (Accelerator/GPU zones >30 kW/rack)

By Business/Contract Model

- Product Sale (Capex Purchase)

- Turnkey Project (Design + Install)

- Rental/Capacity Reservation (For Modular Pods)

- Performance-Based Contracts (Energy Savings Shared

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting