Data Center Logical Security Market Size?

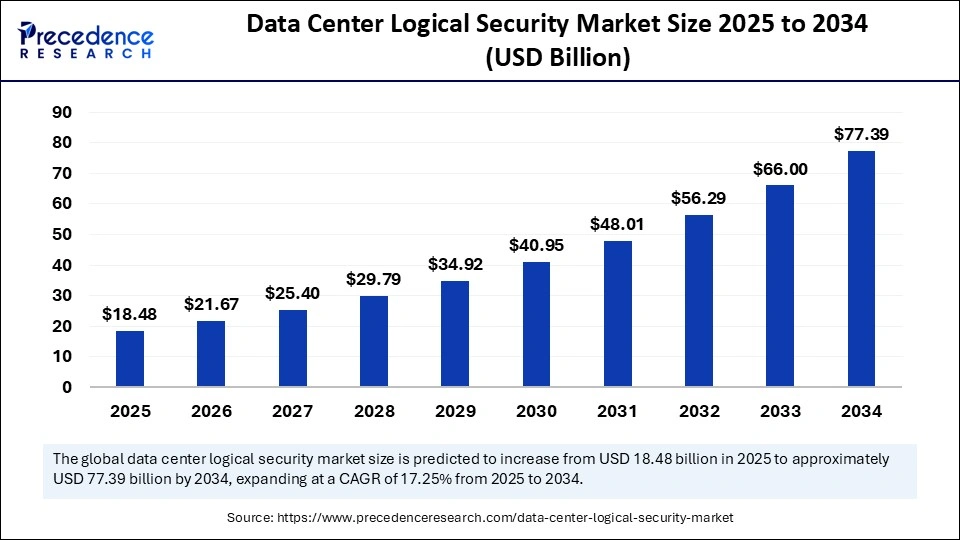

The global data center logical security market size is calculated at USD 18.48 billion in 2025 and is predicted to increase from USD 21.67 billion in 2026 to approximately USD 77.39 billion by 2034, expanding at a CAGR of 17.25% from 2025 to 2034. The market is driven by the rising need to safeguard critical data from cyber threats, ensure regulatory compliance, and support the rapid growth of cloud computing and digital transformation.

Market Highlights

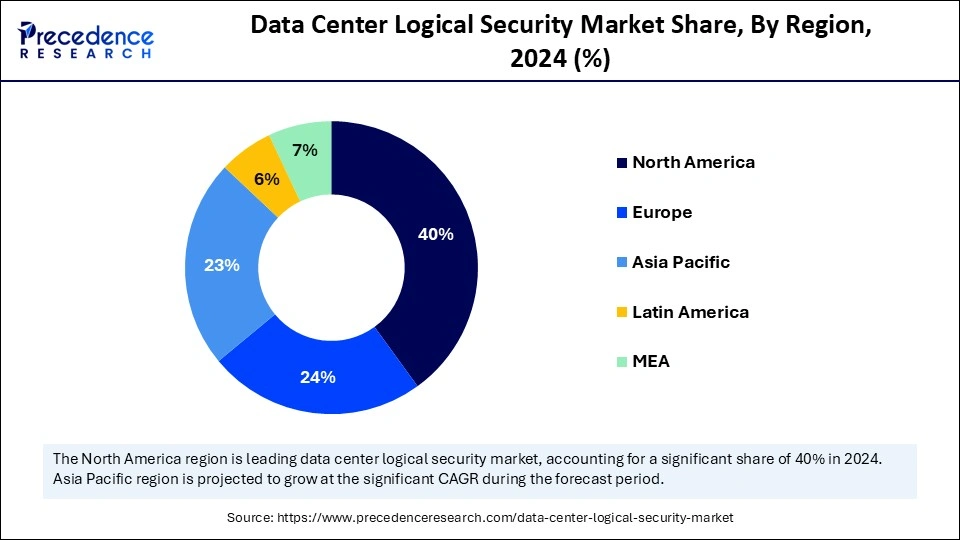

- North America dominated the global data center logical security market with the largest share of 40% in 2024.

- Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By security solutions segment, the access control systems segment captured the biggest market share of 32% in 2024.

- By security solutions, the endpoint security solutions segment is anticipated to show considerable growth over the forecast period.

- By deployment mode, the cloud-based deployment segment contributed the highest market share of 55% share in 2024.

- By deployment mode, the on-premise deployment segment is anticipated to show considerable growth over the forecast period.

- By end-user, the IT and cloud service providers segment generated the major market share of 38% in 2024.

- By end-user, the financial institutions segment is anticipated to show considerable growth over the forecast period.

Market Overview

The data center logical security market is a general term that denotes a wide spectrum of technologies and solutions that are used to protect the digital infrastructure of data centers against unauthorized access and cyber attacks, as well as against data breaches. The most common elements of logical security are firewalls, encryption, access controls, intrusion detection and prevention systems (IDPS), identity and access management (IAM), and advanced security monitoring tools. Data centers are nowadays the foundation of advanced digital processes worldwide, as cloud computing, Internet of Things (IoT), and analytics of large data volumes rapidly spread.

The rising data center logical security market is mainly fueled by the boom in cyber threats, regulatory demands, and the volumes of sensitive data that enterprises are processing. Regulatory authorities and governments around the world are enforcing data protection acts and regulations like GDPR, HIPAA, and CCPA, forcing organizations to adopt secure logical security structures. Such a regulatory environment is providing solution providers with advanced encryption, access management, and monitoring tools with significant opportunities. The increase in the number of data centers being built due to the use of the cloud, the digital transformation, and the growth of 5G networks is also increasing the pressure.

How is AI Integration Transforming the Data Center Logical Security Market?

With the assistance of Artificial Intelligence, the data center logical security market is taking a new shape to offer faster, smarter, and reliable protection against cyber threats. With predictive analytics, the AI will be capable of learning past and finding hidden patterns and predicting weaknesses, which will give the organizations a competitive edge in combating cyberattacks. It can handle routine monitoring, scan the network, and respond to incidents without relying on manual effort and which saves on errors and time. AI systems can also keep learning and evolving, and this makes them more capable of addressing emerging cyber threats. Using AI, which introduces resilience, efficiency, and capability to secure sensitive data in the digital-first world, is making data center security more resilient, more effective, and more efficient in detecting, preventing, and responding to threats.

What Factors Are Fueling the Rapid Expansion of the Data Center Logical Security Market?

- Increasing Cybersecurity Risks: The surge in cyberattacks, ransomware, and data breaches leveraging critical digital infrastructure is also fueling the demand for advanced data center logical security solutions. The market is growing as all over the world organizations spend heavily on encryption, intrusion detection, and access management to protect sensitive information, reduce downtime, and have a continuous flow of services.

- Regulatory Compliance Requirements: Tough data protection laws like GDPR, HIPAA, and CCPA are forcing organizations to embrace powerful logical security practices in data centers. The implementation of encryption, monitoring, and access control solutions is being used by businesses to keep up with the compliance requirements and to prevent penalties, and this has become a significant catalyst in the increasing market growth and adoption of solutions.

Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 18.48 Billion |

| Market Size in 2026 | USD 21.67 Billion |

| Market Size in 2034 | USD 77.39 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 17.25% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Security Solutions, Deployment Mode, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Data Traffic

The most powerful forces that have contributed to the rise of the data center logical security market are the increased data traffic across the globe. As smartphone use is quickly increasing, high-speed internet, video streaming systems, and web-based communication apps, data consumption increases at an unprecedented rate. This increasing reliance upon digital communication and entertainment service platforms requires data center infrastructures that are strong and scaled to bear heavy traffic loads safely. Firewalls, encryption, intrusion detection, and management of access among logical security solutions are critical in safeguarding the confidentiality, integrity, and availability of information. This trend of increasing data consumption across the globe is a direct stimulus to the need to establish efficient logical security solutions, and as such, it is a primary growth force in the market.

Growing Adoption of Cloud Computing and IoT

Corporations are shifting to cloud-based systems to increase scale, efficiency, and cost-effectiveness. At the same time, billions of IoT devices are being launched in industries, and clouds of data are being developed that must be safely processed and stored. To beat these risks, enterprises are investing in sophisticated logical security platforms such as identity and access management (IAM), security control, and artificial intelligence (AI)-based predictive threat management. These solutions ensure the safety of the data in both a hybrid and multi-cloud environment and protect applications based on IoT in other industries like healthcare, manufacturing, and smart cities. The growing popularity of cloud and IoT systems, the need to offer secure data management, is another influential factor that leads to the market development process throughout the world.

Restraint

Lack of Awareness about the Threats

One of the biggest inhibitors to the development of the data center logical security market is that most organizations are not aware of just how large and grave the cyber threats are. Though cyberattacks, such as ransomware and phishing, are the emerging threats with alarming rates, not all firms underestimate their possible consequences. With the expansion of data centers as a result of the rising digitalization and the adoption of clouds, the threat environment is expanding. The organizations lack adequate knowledge of logical security solutions, including intrusion detection, encryption, and identity management, which makes them susceptible. Such ignorance slows the development of the market, also predisposes the market to massive operational and financial losses, which makes the need to strengthen cybersecurity awareness and the proactive adoption of security measures in industries.

Opportunity

Growing Communication Infrastructure

The highly accelerated adoption of 5G networks in the world offers a big opportunity to the data center logical security market. With 5G, the speed of data transfer and connectivity can increase significantly, which enhances the autonomous driving industry, smart cities, IoT, and immersive entertainment. Data centers that are located geographically but are interconnected demand a strong logical security that would secure sensitive data and eliminate cyber-attacks. The implementation of 5G also spurred the need for sophisticated security systems, including the use of end-to-end encryption, real-time surveillance, and AI-controlled threat detection. 5G integration in data center infrastructure is likely to expand the market opportunities considerably, as it will stimulate an increase in the complexity of logical security constructs.

Segment Insights

Security Solution Insights

Why Did the Access Control Systems Segment Lead the Data Center Logical Security Market?

The access control systems segment led the market while holding a 32% share in 2024, driven by the increased demand of organizations to ensure the security of sensitive data and prevent unauthorised access in complex IT environments. The access control solutions include Role-based access control (RBAC), Identity and access management (IAM), and Multi-Factor authentication (MFA), which assist enterprises in strictly preventing the admission and denial of users and reducing the likelihood of an internal/external security breach. RBAC eases access control by granting permissions according to roles, making sure that an employee gains access. IAM solutions have centralized identification of user identities, authentication, and authorization across various systems, whereas MFA incorporates an additional tier of security by undertaking further verification measures. The increasing uptake of cloud applications, hybrid IT, and regulatory compliance needs is further fueling the need to have a strong access control system.

The endpoint security solutions segment is expected to grow at a significant CAGR over the forecast period. Antivirus Software and Advanced Threat Protection (ATP) are endpoint security solutions that protect against malware, ransomware, and other cybercrimes in laptops, desktops, servers, and mobile devices. Antivirus software offers real-time scanning, threat detection, and elimination of malicious files, whereas ATP offers better monitoring, behavioral analysis, and automated response to threats to counterattack in sophisticated forms. With the trend of remote working, the use of IoT, and cloud-based applications, endpoint security is now viewed as a central concern among organizations that have been keen on avoiding data breaches and maintaining continuity in their operations. The rise in the sophistication of cyber attacks, along with stringent data privacy regulations, is likely to stimulate the adoption of endpoint security solutions within industries.

Deployment Mode Insights

Why Did the Cloud-Based Deployment Segment Dominate the Data Center Logical Security Market?

The cloud-based deployment segment held a 55% share in the market in 2024. It is popular due to the flexibility, scalability, and cost-effectiveness that cloud solutions offer to contemporary enterprises. Public cloud implementations have become popular because they are easy to access, multi-tenant, and can dynamically scale their resources. The advantages of cloud solutions in terms of control, security, and privacy of data also provide greater control over cloud services, which makes them suitable in case of sensitive information in an organization. Hybrid deployments are also on the rise as they enable businesses to optimize workloads and provide coherent security policy enforcement. The increasing utilization of cloud applications, remote working, and digital transformation efforts only enhances the desirability of cloud-based security solutions. The cloud-based model offers agility, less operational complexity, and quicker implementation, and thus emerges as the leading deployment approach in the market.

The on-premise deployment segment is expected to grow substantially in the data center logical security market. Physical on-premise deployment enables companies to have an internal control of all security policies, network configuration, and access controls, which is especially important in the financial services sector, healthcare, and government. Businesses that have high compliance policies or those that deal with very sensitive data are more likely to favor on-premise solutions to reduce outside risks. Also, legacy systems and tailored security models are more easily integrated into on-premise environments so that businesses can be able to customize their security strategies to fit their operational requirements. As organizations become more data protection, resiliency, and operational reliability-aware, the appeal of on-premises logical security solutions will steadily increase.

End-User Insights

Why Did IT and Cloud Service Providers Lead the Data Center Logical Security Market?

The IT and cloud service providers segment held a 38% share in the market in 2024, motivated by the essential positions that these organizations are in charge of handling massive volumes of sensitive client and enterprise data. As cloud computing, virtualization, and hybrid infrastructures are being adopted, the IT and cloud providers have the role of protecting data over a distributed network and in a multi-tenant setup. Also, such providers should meet strict regulatory standards, such as GDPR and HIPAA, as well as the legislation on data protection on a regional level, which also stimulates investments in security solutions. Logical security solutions enable IT and cloud service providers to secure continued trust and continuity in their operations and ensure the safety of sensitive information in an ever-changing cyberspace by providing centralized management, real-time threat detection, and automated responses.

The financial institutions segment is expected to grow substantially in the data center logical security market. Banks, insurance companies, fintech companies, and payment service providers handle large quantities of personal and transactional, and corporate data, which is why they are the most sought-after victims of cyberattacks. Multi-factor authentication, encryption, AI-based monitoring, and predictive threat detection are examples of rational security that can help financial institutions to protect assets, prevent fraud, and stay in business. With the increasing adoption of digital banking, mobile apps, and cloud-based financial systems by more organizations in the financial sector, financial organizations are heavily investing in sophisticated security systems to maintain the integrity and confidentiality of data. The rising cyber threats, along with the rising complexity of IT infrastructures, make logical security a necessity for financial institutions.

Data Center Logical Security Market Outlook:

- Market Overview: The logical-security layer associated with data centers is experiencing enormous growth, as cybersecurity threats and virtualized infrastructures intermingle; this entails a shift in operator focus from perimeter defence to data and logic-based controls that continuously verify access.

- Global Expansion: As hyperscale and edge data-centers are established globally within North America, Asia-Pacific and the Middle East, logical-security solutions are required in new builds, which is the result of local compliance regimes and requirements imposed when upgrading or establishing the foundation of multinationals to engage cloud capability.

- Research & Development: AI, behavioral analytics and micro-segmentation developments are leading to new logical-security capabilities in data-centers enabling vendors to establish development and investment into proactive threat detection and zero-trust access frameworks as opposed to legacy models focused on firewall and reactive efforts.

- Technological Shift: The interaction of increased cloud workloads, data-residency requirements and the rise of new attack vectors is compelling enterprises and governments to priorities logical security controls, including IAM, encryption and continuous monitoring, within a data-center context.

Regional Insights

U.S. Data Center Logical Security Market Size and Growth 2025 to 2034

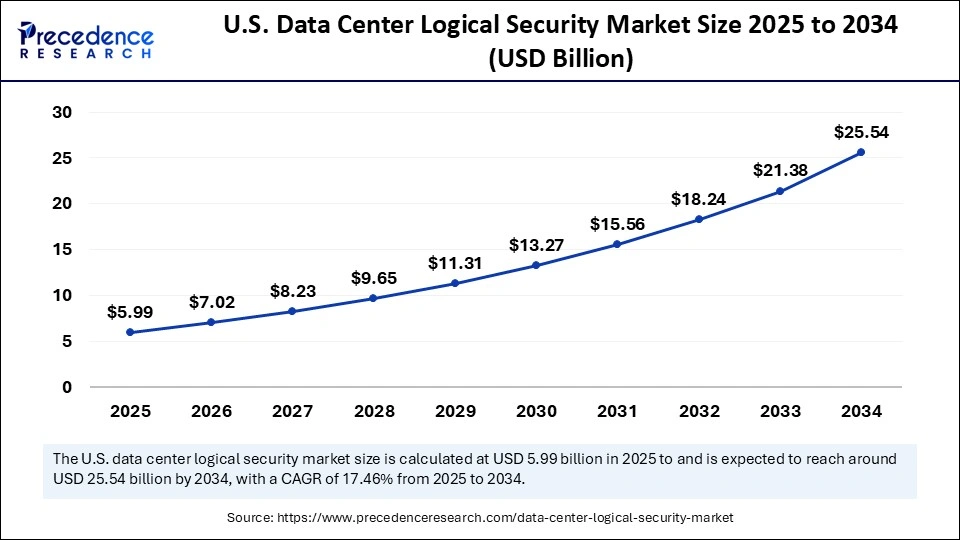

The U.S. data center logical security market size is evaluated at USD 5.99 billion in 2025 and is projected to be worth around USD 25.54 billion by 2034, growing at a CAGR of 17.46% from 2025 to 2034.

Why Did North America Lead the Global Data Center Logical Security Market in 2024?

North America led the global market with the highest market share of 40% in 2024. This security model is based on constant surveillance, identity authentication, rigorous access control, and least privilege to reduce risks. The high increase in cyber threats, coupled with the increase in the amount of data traffic due to cloud services, IoT, and big data analytics, has further enhanced the need for the region to have strong logical security systems. Also, the BFSI, healthcare, and telecommunications industries are massively investing in more advanced solutions to meet the strict regulatory measures and are becoming the main catalyst of overall growth in the market in North America.

The U.S. is the largest player in North America, where the country has a robust ecosystem of technology vendors, high levels of data usage, and government-backed programs. The focus of the U.S. government on cybersecurity structures and investment into the protection of critical infrastructure is strengthening the development of the market. The leadership in implementing 5G and edge computing technologies is enhancing even more the use of interdependent data centers that are secure. The U.S. will also be the engine that has North America continue to dominate the data center logical security market with increasing investment, regulatory compliance requirements, as well as technological innovation.

Why is Asia Pacific undergoing the Fastest Growth in the Data Center Logical Security Market?

Asia Pacific is estimated to grow at the fastest CAGR during the forecast period, as internet cloud computing is fast emerging in finance, healthcare, and e-commerce sectors. To prevent breaches and cyber threats to data information, cloud service providers are investing in higher logical security defenses, including encryption, multi-factor authentication (MFA), intrusion detection, and access control. The Asia Pacific is undergoing a fast rate of growth in data centers, which is due to the emergence of digital transformation initiatives combined with the robust governmental interest in cybersecurity and smart infrastructure.

Japan is also becoming a major player in the Asia Pacific data center logical security market. The effort of the country in reducing the emission of carbon and improving sustainability is transforming the data center industry in the region. In efforts to minimize their environmental impact and ensure their operations are safe, companies are adopting cooling systems that save energy, renewable energy, and green ecosystems. At the same time, the trend of accelerated digitalization of Japan and the growth of using cloud-based services are raising the need for efficient logical security measures. The BFSI, manufacturing, and healthcare industries are adopting the current technologies of real-time monitoring, AI-powered threat detectors, and zero-trust security design to safeguard sensitive information.

Data Center Logical Security Market Companies

- Cisco Systems Inc.

- Palo Alto Networks

- Fortinet Inc.

- Check Point Software Technologies Ltd.

- IBM Corporation

- McAfee Corp.

- FireEye Inc.

- Trend Micro Inc.

- Sophos Ltd.

- Barracuda Networks

- Juniper Networks

- RSA Security LLC

- Splunk Inc.

- CrowdStrike Inc.

- Akamai Technologies Inc.

- Imperva Inc.

- F5 Networks Inc.

- Citrix Systems Inc.

- Forcepoint LLC

- Digital Guardian

Recent Developments

- In February 2025, Varonis Systems launched a new data center in India to serve its expanding customer base and assist them in reducing the risk of cloud data. Varonis ' native Data Security Platform data centers are located in Mumbai and Pune. This emerges as the regulatory environment in India is in the process of transformation under the Digital Personal Data Protection Act. (Source: https://datacentrenews.in)

- In October 2024, IBM published the Guardium Data Security Center, a single product to manage data protection, data discovery, to remediation. It describes AI and quantum threats in terms of AI-based risk mitigation tools and quantum-safe encryption. It is capable of supporting on-premises and cloud environments, and enforcing compliance, protection, and logical security to modern digital infrastructures. (Source: https://newsroom.ibm.com)

- In February 2024, Cisco and NVIDIA launched Nexus HyperFabric AI Clusters, which is an integration of the AI software of NVIDIA and the security of Cisco networking. The solution allows the easy deployment of generative AI with robust data protection, end-to-end visibility, and cloud management. It is scalable and enhances operational efficiency and solid logical security support to grow AI-driven data center workloads.(Source: https://nvidianews.nvidia.com)

Segment Covered in the Report

By Security Solutions

- Access Control Systems

- Role-based Access Control (RBAC)

- Identity and Access Management (IAM)

- Multi-Factor Authentication (MFA)

- Firewalls

- Traditional Firewalls

- Next-Generation Firewalls (NGFW)

- Encryption Solutions

- Data-at-Rest Encryption

- Data-in-Transit Encryption

- Intrusion Detection and Prevention Systems (IDPS)

- Signature-based IDPS

- Anomaly-based IDPS

- Security Information and Event Management (SIEM)

- On-Premise SIEM

- Cloud-based SIEM

- Endpoint Security Solutions

- Antivirus Software

- Advanced Threat Protection (ATP)

- Virtualization Security Solutions

- Hypervisor Security

- Virtual Machine Security

By Deployment Mode

- Cloud-based Deployment

- Public Cloud

- Private Cloud

- Hybrid Cloud

- On-premise Deployment

By End-User

- Telecommunication Providers

- IT and Cloud Service Providers

- Financial Institutions

- Government & Defense

- Healthcare Providers

- Retailers

- Manufacturers

- Energy and Utilities

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting